InterGlobe Aviation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InterGlobe Aviation Bundle

InterGlobe Aviation operates within a dynamic external environment, significantly shaped by political stability, economic growth, and evolving social attitudes towards travel. Understanding these forces is crucial for navigating the competitive aviation landscape. Gain an edge with our in-depth PESTEL Analysis—crafted specifically for InterGlobe Aviation. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

The Indian government's commitment to boosting aviation, exemplified by the UDAN scheme, directly fuels demand for carriers like IndiGo. This initiative aims to enhance regional air connectivity, making air travel more accessible and affordable for a wider population.

As of early 2024, the UDAN scheme has connected over 500 routes and 60 plus airports, a significant expansion that opens up new growth avenues for IndiGo. This policy support is instrumental in solidifying IndiGo's domestic market presence and driving passenger volume.

The Bharatiya Vayuyan Adhiniyam, 2024, which took effect on January 1, 2025, updates India's aviation regulations, replacing the Aircraft Act of 1934. This legislation is designed to simplify licensing, elevate safety, and improve the ease of doing business, potentially easing compliance for airlines like IndiGo and creating a more stable operating landscape.

Furthermore, the Protection of Interests in Aircraft Objects Bill, 2025, is set to harmonize aircraft leasing regulations with international norms. This alignment could lead to reduced leasing expenses for carriers, positively impacting their operational costs.

Ongoing geopolitical tensions, particularly in regions like the Middle East, can directly impact InterGlobe Aviation's operations. For instance, conflicts or political instability may lead to temporary or prolonged airspace closures. This forces airlines to reroute flights, significantly increasing fuel consumption and flight duration.

These rerouting necessities, driven by geopolitical events, disproportionately affect carriers like IndiGo, which rely on efficient, direct routes. In 2023, several airspace closures in the Middle East due to escalating tensions led to extended flight times for many airlines, including those operating to and from India, directly impacting operational costs and potentially passenger experience.

The financial implications are substantial; longer flight paths mean more fuel burned, higher crew costs, and potential delays, all of which erode profitability. For example, a reroute around restricted airspace can add hundreds of kilometers and an hour or more to a flight, translating to millions in additional fuel costs annually for a large carrier like InterGlobe Aviation.

Taxation and Fuel Subsidies

The taxation structure on Aviation Turbine Fuel (ATF) in India significantly impacts InterGlobe Aviation's operating costs, as fuel represents a substantial portion of expenses. Despite some fluctuations, ATF prices in 2024 and early 2025 have remained higher than pre-pandemic levels, exacerbated by ATF's exclusion from the Goods and Services Tax (GST). This exclusion places an additional cost burden on airlines like IndiGo.

Government decisions regarding fuel taxes or the potential introduction of subsidies directly influence IndiGo's ability to maintain competitive fares and impact its profit margins. For instance, in early 2024, several states continued to levy high VAT on ATF, contributing to the elevated operating expenses for domestic carriers.

- ATF's exclusion from GST continues to be a significant cost factor for Indian airlines.

- Elevated ATF prices in 2024 and early 2025 compared to pre-COVID levels persist.

- State-level Value Added Tax (VAT) on ATF remains a key determinant of fuel costs for airlines.

- Government policy on fuel taxation or subsidies directly affects IndiGo's fare competitiveness and profitability.

International Bilateral Air Service Agreements

International bilateral air service agreements are crucial for InterGlobe Aviation, commonly known as IndiGo, as they dictate market access and operational capacity on international routes. These agreements between India and other nations determine the number of flights and passenger capacity that airlines can operate, directly impacting IndiGo's ability to expand its global network.

IndiGo's strategic objectives, particularly its push into long-haul international markets, are significantly influenced by the terms and availability of these bilateral pacts. Favorable agreements can unlock opportunities for increased flight frequencies and entry into new, lucrative territories, thereby supporting the airline's growth ambitions.

- Market Access: Bilateral agreements define the number of flights and seats Indian carriers like IndiGo can deploy to partner countries.

- Route Expansion: IndiGo's planned expansion into new international routes, including long-haul destinations, is contingent on securing favorable bilateral rights.

- Government Influence: The Indian government's negotiation of these agreements directly shapes the competitive landscape and growth potential for IndiGo on the global stage.

- Capacity Constraints: Unfavorable or restrictive agreements can limit IndiGo's ability to scale operations and serve demand on key international corridors.

The Indian government's proactive stance on aviation growth, including initiatives like the UDAN scheme, provides a strong tailwind for InterGlobe Aviation. This policy framework is designed to bolster regional connectivity, making air travel more accessible and affordable, which directly translates to increased passenger volumes for carriers like IndiGo.

The Bharatiya Vayuyan Adhiniyam, 2024, effective January 1, 2025, modernizes India's aviation regulatory landscape, aiming for streamlined licensing and enhanced safety standards. This legislative update is expected to create a more conducive operating environment for airlines, potentially reducing compliance burdens and fostering stability.

Geopolitical instability, particularly in regions like the Middle East, poses a direct operational challenge. Airspace closures due to conflicts necessitate flight rerouting, significantly increasing fuel consumption and flight times, which directly impacts InterGlobe Aviation's operational efficiency and profitability.

The taxation of Aviation Turbine Fuel (ATF) remains a critical factor, with its exclusion from GST and varying state-level VAT rates contributing to elevated operating costs for IndiGo throughout 2024 and into early 2025.

What is included in the product

This InterGlobe Aviation PESTLE analysis delves into the critical external factors—Political, Economic, Social, Technological, Environmental, and Legal—that shape its operating landscape, offering a comprehensive view of potential challenges and strategic advantages.

A concise PESTLE analysis for InterGlobe Aviation that highlights key external factors impacting the airline, serving as a proactive tool to anticipate and mitigate potential challenges.

Economic factors

Fluctuations in Aviation Turbine Fuel (ATF) prices significantly impact InterGlobe Aviation, as ATF constitutes a substantial 30-40% of its operational expenses. This makes the airline particularly vulnerable to global crude oil price volatility and domestic tax policies.

Recent escalations in oil prices, driven by geopolitical instability, have intensified pressure on InterGlobe Aviation's profitability. Historically, the airline has faced challenges in fully transferring these elevated fuel costs to consumers via fare increases, directly affecting its financial outcomes.

India's burgeoning middle class, fueled by sustained economic growth, is a significant tailwind for airlines like IndiGo. As disposable incomes rise, so does the propensity for air travel, particularly for budget-conscious consumers seeking affordable domestic and international options. This trend is expected to continue as India's economy expands.

In 2023, India's GDP grew by an impressive 7.2%, indicating a strong economic environment that supports increased consumer spending on discretionary items like air travel. Projections for 2024 and 2025 suggest continued robust growth, further bolstering the purchasing power of Indian households and driving demand for air transportation services.

Exchange rate volatility significantly impacts InterGlobe Aviation (IndiGo) as a substantial portion of its operational costs, such as aircraft leases, fuel, and maintenance, are settled in foreign currencies, predominantly the US dollar.

For instance, in the fiscal year 2023-24, IndiGo reported that foreign currency-denominated expenses represented a significant portion of its total operating costs. A depreciating Indian Rupee against the US Dollar directly translates to higher expenses for the airline, directly affecting its bottom line.

While IndiGo does generate revenue from international operations, which offers some natural hedging, a consistently weaker rupee can still lead to increased costs. This was evident in the financial results for Q4 FY24, where foreign exchange losses contributed to the overall financial performance, underscoring the sensitivity of the airline's profitability to currency fluctuations.

Market Competition and Yield Pressure

The Indian aviation landscape is fiercely competitive. IndiGo, while a dominant player with a significant domestic market share, faces robust challenges from the consolidated Air India Group and other emerging carriers. This intense rivalry frequently translates into yield pressure, forcing airlines to lower fares to sustain passenger traffic, which can directly impact profitability. For instance, IndiGo's Q1 FY26 performance, despite benefiting from reduced fuel expenses, highlighted the ongoing impact of this competitive pricing environment on its financial outcomes.

Key competitive dynamics influencing IndiGo include:

- Dominant Domestic Share: IndiGo consistently commands a substantial portion of the Indian domestic air travel market.

- Air India Group Consolidation: The integration and growth of the Air India Group present a significant, well-capitalized competitor.

- Emerging Airline Growth: Other airlines are also expanding their operations, adding to the competitive intensity.

- Yield Pressure Impact: The need to maintain high load factors often leads to fare reductions, squeezing profit margins per passenger.

Infrastructure Development and Airport Capacity

India's commitment to infrastructure development, particularly in aviation, is a significant tailwind for airlines like InterGlobe Aviation (IndiGo). The government's ambitious target of operationalizing 200 airports by the end of 2025, up from 148 in early 2024, directly translates to increased capacity and route opportunities.

This expansion is crucial for IndiGo's growth strategy. With plans to add more aircraft and expand its network, access to new and upgraded airports is essential for efficient operations and reaching underserved markets. The ongoing development of new greenfield airports and the expansion of existing ones are key enablers for these ambitions.

Specific initiatives include the development of new airports in cities like Dholera, Navi Mumbai, and Jewar, alongside upgrades to existing facilities. These projects are designed to handle increased air traffic and improve passenger experience, creating a more favorable operating environment for airlines.

- Airport Expansion: India aims for 200 operational airports by the end of 2025.

- Capacity Growth: New and expanded airports provide the necessary infrastructure for airline network growth.

- Connectivity Boost: Infrastructure development enhances both domestic and international connectivity for carriers like IndiGo.

- Future Outlook: Plans extend to developing over 1,000 airports in the next two decades, ensuring long-term infrastructure support.

The Indian economy's robust growth, projected to continue through 2024 and 2025, fuels consumer spending on air travel. India's GDP growth of 7.2% in 2023 underscores this positive economic climate, directly benefiting airlines like InterGlobe Aviation by increasing disposable incomes and travel demand.

Fluctuations in Aviation Turbine Fuel (ATF) prices, a significant operational cost for InterGlobe Aviation, directly impact profitability. Geopolitical instability has recently driven up oil prices, and the airline faces challenges in fully passing these costs onto consumers through fare hikes.

Exchange rate volatility, particularly the Indian Rupee's performance against the US Dollar, poses a considerable risk. A weaker rupee increases costs for foreign-denominated expenses like aircraft leases and maintenance, impacting InterGlobe Aviation's bottom line, as seen in Q4 FY24 foreign exchange losses.

The competitive landscape in Indian aviation remains intense, with IndiGo facing pressure from the consolidated Air India Group and other carriers. This rivalry often leads to yield pressure, forcing airlines to maintain lower fares, which can affect profit margins per passenger, as highlighted by Q1 FY26 performance data.

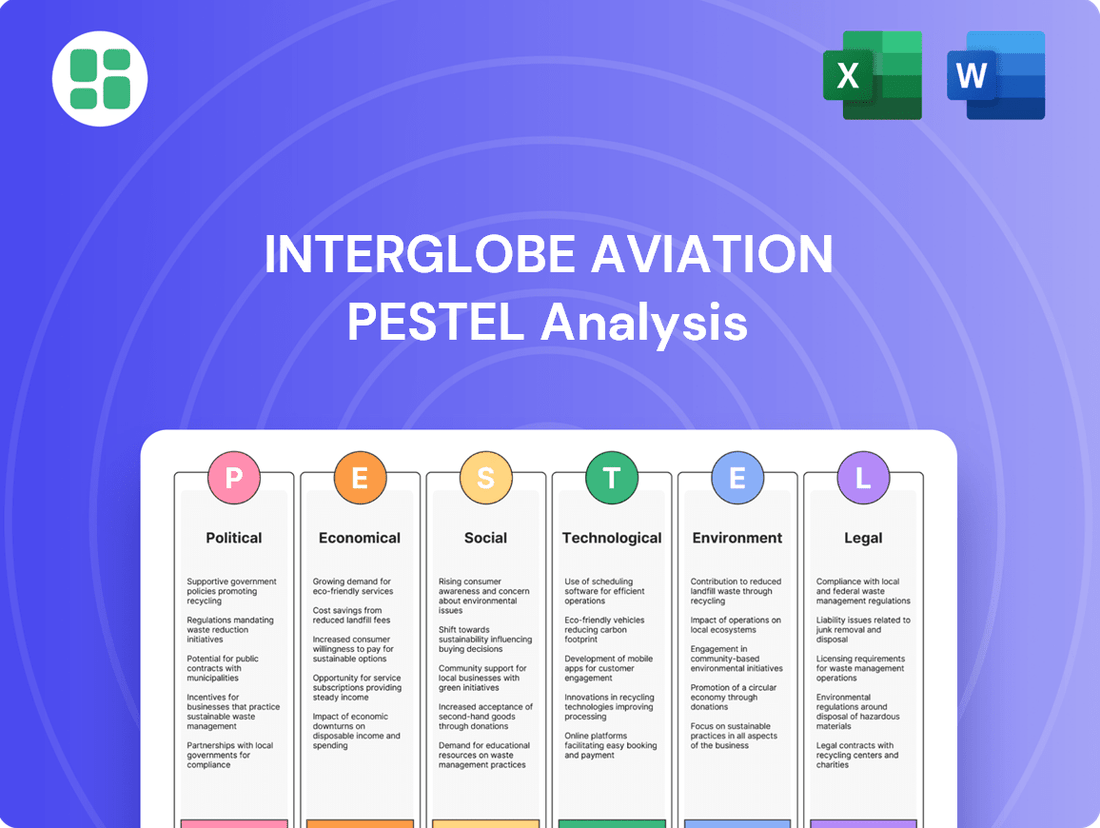

Preview the Actual Deliverable

InterGlobe Aviation PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing InterGlobe Aviation's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive look at the political, economic, social, technological, legal, and environmental factors impacting InterGlobe Aviation.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for InterGlobe Aviation.

Sociological factors

India's vast and expanding population, coupled with ongoing urbanization and a growing middle class, is a significant driver for air travel. This demographic trend translates into a sustained need for accessible and efficient air transport, a niche that IndiGo, InterGlobe Aviation's primary airline, expertly fills. Consequently, domestic passenger numbers have seen consistent upward movement.

The increasing disposable incomes of a larger segment of the population are making air travel a more viable option for both leisure and business. This economic uplift, particularly in Tier 2 and Tier 3 cities, is expanding the reach and frequency of air travel. India has already established itself as the world's fifth-largest market for air passengers, with projections indicating further substantial growth in the coming years.

IndiGo's success is deeply rooted in the strong preference for low-cost carriers among Indian travelers. This price sensitivity is a defining characteristic of a significant portion of the market, making IndiGo's value proposition highly appealing.

As of early 2024, IndiGo commands a dominant market share, often exceeding 55% of the domestic Indian aviation market, a testament to its effective low-cost model. This strategy, focusing on affordable fares, operational efficiency, and punctuality, resonates strongly with a vast number of consumers looking for economical travel options.

The airline's consistent growth trajectory, evidenced by its expanding fleet and network, directly correlates with this sustained consumer preference. IndiGo's ability to maintain competitive pricing while ensuring a reliable service continues to solidify its position as the preferred choice for many Indian travelers.

Following the pandemic, travel is booming again, with more people flying for both fun and work. In 2023, India's aviation sector saw over 150 million domestic passengers, a significant rise from previous years, signaling strong recovery and growth. This trend directly benefits airlines like IndiGo.

IndiGo is capitalizing on this by expanding its routes, including new international destinations. Their investment in aircraft like the A321XLR supports this, allowing them to offer longer flights and connect more travelers to global destinations. This strategic move aligns perfectly with the renewed appetite for international travel.

Perception of Safety and Reliability

Public perception of airline safety and reliability is absolutely crucial in the aviation sector. Even with IndiGo's strong operational track record, any negative news or incidents affecting the wider Indian aviation landscape can impact passenger trust. For instance, while IndiGo consistently aims for high on-time performance, a general dip in industry-wide safety perceptions could indirectly affect traveler choices.

IndiGo has built a significant part of its brand on being dependable. Their commitment to punctuality, with IndiGo often reporting some of the highest on-time performance figures in India, directly translates into a reputation for reliability among passengers. This focus is key to maintaining customer loyalty and attracting new travelers who prioritize a smooth travel experience.

The perception of safety is not just about a single airline but the entire ecosystem. For example, in 2023, the Directorate General of Civil Aviation (DGCA) reported a significant increase in the number of air safety violations across the Indian aviation sector compared to previous years, which, while not directly attributed to IndiGo, can collectively shape public sentiment regarding air travel safety.

IndiGo's consistent operational efficiency, often reflected in its punctuality rates which frequently exceed 80% for departures and arrivals, directly bolsters its image as a reliable carrier. This focus on operational excellence is a key factor in maintaining passenger confidence, especially in an environment where broader industry concerns can arise.

Urbanization and Tier-2/3 City Connectivity

India's rapid urbanization, with a significant portion of its population now residing in urban and semi-urban areas, is a key driver for the aviation sector. This demographic shift creates a larger pool of potential travelers. The government's push to enhance air connectivity to Tier-2 and Tier-3 cities, exemplified by the UDAN (Ude Desh Ka Aam Nagrik) scheme, directly benefits airlines like IndiGo by opening up new routes and markets.

The UDAN scheme, launched in 2016, has already seen several phases of bidding and route awarding. As of early 2024, the scheme has facilitated the operation of flights to over 450 routes, connecting more than 60 unserved and underserved airports. This expansion directly taps into a growing middle class in smaller cities, who are increasingly seeking air travel options previously only accessible from major hubs.

IndiGo's strategic expansion into these emerging markets aligns with this trend. By establishing a presence in these developing urban centers, the airline can capture demand from a population base that is becoming more affluent and mobile. This allows IndiGo to diversify its revenue streams beyond the traditional metropolitan corridors, catering to a broader spectrum of Indian travelers.

- Urban Population Growth: India's urban population is projected to reach 600 million by 2030, creating a substantial base for air travel demand.

- UDAN Scheme Impact: Over 450 routes have been operationalized under UDAN, connecting more than 60 airports, thereby expanding air travel accessibility.

- Tier-2/3 City Potential: These cities represent a significant growth opportunity as disposable incomes rise and travel preferences evolve.

- IndiGo's Network Expansion: The airline's proactive approach in serving these markets allows it to build early market share and brand loyalty.

The increasing preference for low-cost carriers among Indian travelers is a dominant sociological factor. IndiGo's success is directly linked to its ability to cater to this price-sensitive market, making air travel accessible to a wider population. This trend is further amplified by rising disposable incomes, particularly in emerging urban centers.

Public perception of safety and reliability significantly influences travel choices. While IndiGo maintains a strong reputation for punctuality, broader industry safety concerns can impact overall passenger confidence. The airline's consistent operational efficiency, often exceeding 80% on-time performance, directly addresses this by building trust.

India's rapid urbanization is creating a larger pool of potential air travelers, especially in Tier 2 and Tier 3 cities. Schemes like UDAN have opened over 450 new routes, connecting more than 60 airports, thereby expanding air travel accessibility to these growing populations.

| Sociological Factor | Description | Impact on IndiGo | Supporting Data (2023-2024) |

| Preference for Low-Cost Carriers | Indian consumers are highly price-sensitive. | IndiGo's core business model thrives on this. | IndiGo holds over 55% domestic market share. |

| Perception of Safety & Reliability | Passenger trust is paramount. | IndiGo's punctuality builds confidence. | Consistent on-time performance often above 80%. |

| Urbanization & Tier-2/3 City Growth | Growing populations in smaller cities seek air travel. | IndiGo is expanding its network to these areas. | UDAN scheme operationalized over 450 routes. |

Technological factors

InterGlobe Aviation, operating IndiGo, is actively modernizing its fleet by introducing fuel-efficient aircraft such as the Airbus A321XLR. Deliveries for these are expected to commence in late 2025 or early fiscal year 2026. This strategic move is designed to enhance fuel savings and extend the operational range for international routes.

Further bolstering its long-haul capabilities, IndiGo plans to integrate Airbus A350-900 wide-body aircraft into its fleet by 2027. This expansion and modernization effort directly supports India's ambitious goal of possessing the youngest aircraft fleet globally by 2028, improving overall operational efficiency and competitiveness.

InterGlobe Aviation, operating as IndiGo, is heavily investing in digital transformation and artificial intelligence. Their AI-powered chatbot, '6Eskai,' is a prime example, handling a significant volume of customer queries and streamlining support processes. This focus on AI aims to improve efficiency across booking, operations, and customer service.

The company's strategic migration of key infrastructure to the cloud is another critical technological move. This not only enhances scalability and flexibility but also optimizes operational performance, allowing for more agile responses to market demands. These digital initiatives are designed to create a more seamless and cost-effective service experience for passengers.

InterGlobe Aviation is significantly enhancing its Maintenance, Repair, and Overhaul (MRO) capabilities by investing in its own infrastructure, notably a new facility in Bengaluru. This strategic move aims to bolster its operational scale and efficiency.

By bringing MRO in-house, the airline anticipates a substantial reduction in maintenance costs, projected between 8-10%. Furthermore, this development is expected to slash aircraft turnaround times by as much as 30%, thereby improving fleet availability and mitigating risks tied to external supply chain dependencies.

Advanced Air Traffic Management Systems

Improvements in India's air traffic management (ATM) systems are significantly enhancing safety and operational efficiency. The potential adoption of new pilot training systems, such as the Multi-Crew Pilot Licence (MPL), is a key part of this evolution, aiming to streamline pilot development and readiness.

Advanced ATM technologies are poised to optimize flight paths, leading to reduced delays and a smoother flow of air traffic. This directly benefits airlines like IndiGo by improving their on-time performance and boosting fuel efficiency, crucial factors in the competitive aviation market.

- Enhanced Safety: MPL programs focus on crew resource management from the outset, fostering better teamwork and decision-making in the cockpit.

- Operational Efficiency: Advanced ATM, including technologies like satellite-based navigation and digital communication, allows for more direct routing and reduced separation between aircraft.

- Reduced Delays: By optimizing airspace usage and flow, these systems can significantly cut down on flight delays, improving passenger experience and airline scheduling.

- Fuel Savings: More efficient flight paths and reduced holding patterns directly translate to lower fuel consumption, a major cost driver for airlines.

Sustainable Aviation Fuel (SAF) Technology

The push for Sustainable Aviation Fuel (SAF) is a major technological shift impacting aviation. While India is still ramping up, the government has set a target of 1% SAF blending by 2027, signaling a significant future requirement. The establishment of the India SAF Alliance further underscores this trend, suggesting that airlines like InterGlobe Aviation (IndiGo) will need to prepare for increased SAF usage, potentially involving investments in aircraft that can utilize it or securing reliable SAF supply chains.

The development of SAF technologies, such as those converting waste oils, agricultural residues, or even captured carbon into jet fuel, is crucial for reducing aviation's carbon footprint. As these technologies mature and become more cost-effective, their adoption will become increasingly important for regulatory compliance and market competitiveness. For InterGlobe Aviation, this means staying abreast of SAF production advancements and understanding how these fuels will integrate with existing and future aircraft fleets.

- SAF Blending Target: India aims for 1% SAF blending by 2027.

- Industry Collaboration: The India SAF Alliance promotes SAF development and adoption.

- Technological Evolution: SAF production methods are diversifying, converting waste streams and CO2 into usable fuel.

- Fleet Adaptation: Airlines may need to invest in SAF-compatible aircraft or upgrade existing ones.

InterGlobe Aviation is actively modernizing its fleet, with deliveries of fuel-efficient Airbus A321XLRs expected by late 2025, enhancing range and fuel savings. The airline also plans to integrate Airbus A350-900 wide-body aircraft by 2027, aligning with India's goal for the youngest global fleet by 2028.

Significant investment in digital transformation, including an AI chatbot '6Eskai' and cloud migration, aims to boost efficiency in customer service and operations. The company is also enhancing its MRO capabilities with a new Bengaluru facility, projecting an 8-10% reduction in maintenance costs and a 30% cut in turnaround times.

Technological advancements in Air Traffic Management (ATM) are improving flight path optimization and reducing delays, directly benefiting IndiGo's on-time performance and fuel efficiency. Furthermore, India's target of 1% Sustainable Aviation Fuel (SAF) blending by 2027, supported by initiatives like the India SAF Alliance, necessitates adaptation to new fuel technologies.

Legal factors

IndiGo operates under the stringent regulatory oversight of India's Directorate General of Civil Aviation (DGCA), which dictates safety, licensing, and operational standards. This framework is crucial for maintaining passenger trust and operational integrity. The recent Bharatiya Vayuyan Adhiniyam, 2024, has amplified these requirements, introducing more severe penalties for non-compliance and aiming to simplify regulatory procedures.

Ensuring strict adherence to these updated regulations is paramount for IndiGo to mitigate the risk of substantial fines and potential operational disruptions. For instance, the DGCA's safety audits and compliance checks directly impact IndiGo's ability to maintain its flight permits and expand its network.

New aviation legislation requires airlines to provide advance fare notifications, giving passengers more clarity. This also grants the Central Government the authority to implement economic regulations, fostering fare transparency and safeguarding travelers against price gouging. In 2023, Indian domestic air passenger traffic reached over 150 million, highlighting the significance of these consumer protections.

While IndiGo's cost-effective approach aligns well with consumer interests, these regulatory mandates can influence its ability to adjust prices dynamically. The airline's market share, often exceeding 55% in the Indian domestic market, means these regulations have a broad impact on passenger experience and airline strategy.

InterGlobe Aviation, operating as IndiGo, navigates a complex web of Indian labor laws. These regulations cover everything from minimum wages and working hours to employee benefits and dispute resolution, directly influencing operational expenses and staffing models. For instance, recent discussions around potential revisions to the Code on Wages Act, 2019, could impact salary structures across the aviation sector.

Changes in employment regulations, such as those pertaining to contract labor or retrenchment, can significantly affect IndiGo's ability to manage its workforce flexibly. The company must remain agile in adapting to evolving legal frameworks to maintain operational efficiency and manage potential industrial relations challenges, which are critical in a labor-intensive industry like aviation.

Aircraft Leasing and Financing Laws

The Protection of Interests in Aircraft Objects Bill, 2025, is set to significantly reshape India's aviation leasing landscape by aligning it with the Cape Town Convention. This move is particularly beneficial for IndiGo, a major player heavily reliant on leased aircraft, as it promises to streamline international financing and aircraft acquisition processes. Such legislative harmonization is expected to lower leasing costs and enhance the airline's ability to expand its fleet efficiently, a critical factor given IndiGo's aggressive growth strategy.

This alignment with global standards is anticipated to boost investor confidence in India's aviation sector. For IndiGo, this could translate into more favorable terms on lease agreements and easier access to capital markets for purchasing new aircraft. The bill's passage is a positive development for airlines seeking to modernize and expand their fleets in a cost-effective manner.

- Legislative Alignment: India's adoption of the Cape Town Convention through the Protection of Interests in Aircraft Objects Bill, 2025, brings its legal framework in line with international norms.

- Cost Reduction: IndiGo can expect reduced aircraft leasing costs due to increased competition and greater confidence among international lessors.

- Financing Access: The bill facilitates easier access to global financing for aircraft acquisition, crucial for IndiGo's fleet expansion plans.

- Investor Confidence: Harmonized laws are likely to attract more foreign investment into India's aviation leasing market.

Competition Law and Market Dominance

InterGlobe Aviation, operating as IndiGo, faces significant oversight from India's Competition Commission (CCI) due to its substantial market share. As of early 2024, IndiGo consistently holds over 50% of the domestic air passenger market, making it a key focus for competition law enforcement. This dominance means any perceived anti-competitive practices, such as predatory pricing or exclusionary conduct, could trigger investigations and potential penalties.

Regulatory scrutiny directly impacts IndiGo's operational flexibility. For instance, the CCI's ongoing monitoring of the aviation sector means that strategic decisions regarding fleet expansion, route development, or pricing strategies must be carefully evaluated to ensure compliance with fair competition principles. Failure to adhere to these regulations could lead to fines or mandated changes in business practices, affecting profitability and growth trajectories.

- Market Share: IndiGo's domestic market share hovered around 55-58% in late 2023 and early 2024.

- Regulatory Body: The Competition Commission of India (CCI) is the primary authority overseeing competition law.

- Potential Impacts: Investigations can lead to significant fines, operational restrictions, or forced divestitures.

- Compliance Focus: IndiGo must ensure pricing, capacity deployment, and partnerships do not stifle competition.

InterGlobe Aviation's operations are heavily influenced by aviation-specific legislation, including the Bharatiya Vayuyan Adhiniyam, 2024, which enhances safety oversight and consumer protection measures. The Protection of Interests in Aircraft Objects Bill, 2025, is set to align India's aircraft leasing framework with international standards like the Cape Town Convention, potentially lowering leasing costs for IndiGo. Furthermore, the airline's dominant market share, often exceeding 55% domestically in late 2023 and early 2024, places it under scrutiny from the Competition Commission of India (CCI) regarding fair competition practices.

Environmental factors

India's commitment to achieving net-zero emissions by 2070, alongside specific targets for Sustainable Aviation Fuel (SAF) blending, creates a significant environmental factor for InterGlobe Aviation (IndiGo). This global and national drive towards decarbonization directly impacts the airline's operational and strategic planning.

IndiGo, known for its fuel-efficient fleet, will need to accelerate efforts in operational efficiencies, fleet modernization, and SAF integration to comply with these escalating regulatory demands and reduce its carbon footprint.

The Indian government's push for Sustainable Aviation Fuel (SAF) adoption, with a proposed mandate of 1% blending by 2027 and escalating to 5% by 2030, directly impacts InterGlobe Aviation (IndiGo). This policy presents a dual challenge and opportunity for the airline.

While SAF offers a significant reduction in aviation's lifecycle carbon emissions, its current higher cost compared to conventional jet fuel and limited domestic production capacity are immediate concerns for IndiGo. Successfully navigating these constraints will be crucial for the airline's environmental goals and long-term operational sustainability.

As urban sprawl encroaches on airport vicinities, noise pollution regulations are tightening, especially for older aircraft. This trend directly impacts airlines' operational costs and fleet modernization strategies.

InterGlobe Aviation, operating as IndiGo, benefits significantly from its commitment to a modern, young fleet. For instance, as of early 2024, IndiGo boasts one of the youngest average fleet ages in the industry, with its Airbus A320neo family aircraft being substantially quieter than previous generations. This proactive approach aids in compliance with evolving noise standards, fostering better community relations and potentially reducing future noise-related penalties.

Waste Management and Recycling Initiatives

Airlines face growing pressure regarding their waste output. IndiGo is actively addressing this through various sustainability efforts.

IndiGo's commitment extends to waste recycling at airports and supporting environmental causes like tree planting via its IndiGoReach program, showcasing a comprehensive strategy to mitigate its environmental footprint.

- Waste Reduction: IndiGo has implemented programs to reduce single-use plastics onboard, aiming for a significant decrease in cabin waste by 2025.

- Recycling Efforts: The airline partners with airport authorities to enhance recycling infrastructure, diverting a substantial portion of operational waste from landfills.

- Carbon Offsetting: Beyond waste, IndiGo's IndiGoReach initiative includes tree-planting drives, contributing to carbon sequestration and broader environmental stewardship.

Climate Change Impact on Operations

Long-term climate change effects, such as more frequent and intense extreme weather events, pose a significant risk to InterGlobe Aviation's operations. These events can lead to flight disruptions, increased turbulence, and reduced fuel efficiency, directly impacting operational costs and passenger experience. For instance, the summer of 2024 saw numerous flight delays and cancellations across India due to unseasonal heavy rainfall and thunderstorms, a trend expected to persist.

Adapting to these changing climatic conditions is crucial for IndiGo's operational resilience and long-term planning. This includes investing in more robust weather forecasting systems and potentially adjusting flight schedules or routes to mitigate risks. The airline's commitment to fuel efficiency, a key operational metric, will be further challenged by the need to navigate more unpredictable weather patterns.

The financial implications of climate change are also substantial. Increased fuel consumption due to flying through adverse weather or rerouting can significantly impact profitability. IndiGo, as a low-cost carrier, relies heavily on operational efficiency, making climate-related disruptions a direct threat to its business model. For example, a 1% increase in fuel burn can translate to millions of dollars in additional operating costs annually.

- Increased operational costs: Extreme weather can lead to higher fuel consumption and maintenance expenses.

- Flight disruptions: Delays and cancellations impact customer satisfaction and revenue.

- Strategic planning: Long-term adaptation to climate change is vital for sustained operational capability.

- Fuel efficiency challenges: Navigating adverse weather can negate efficiency gains from newer aircraft.

India's commitment to net-zero by 2070 and mandated Sustainable Aviation Fuel (SAF) blending, starting with 1% in 2027, directly pressures InterGlobe Aviation (IndiGo) to enhance its environmental strategy. While IndiGo's young fleet, averaging under 6 years old as of early 2024, aids in noise reduction and fuel efficiency, the airline must further invest in SAF integration and operational adjustments to meet these evolving regulatory landscapes and reduce its carbon footprint.

The increasing focus on waste reduction and recycling is another key environmental factor. IndiGo's initiatives to cut single-use plastics and enhance airport recycling, alongside its IndiGoReach program's tree-planting efforts, demonstrate a proactive approach to mitigating its environmental impact. These efforts are crucial as consumer and regulatory scrutiny on corporate environmental responsibility intensifies.

Long-term climate change, manifesting as more extreme weather events, poses significant operational risks. For instance, unseasonal heavy rains in mid-2024 caused widespread flight disruptions across India, leading to delays and increased fuel burn. IndiGo's reliance on operational efficiency means that adapting to these unpredictable weather patterns, potentially through enhanced forecasting and route adjustments, is vital for maintaining profitability and customer satisfaction.

| Environmental Factor | Impact on IndiGo | 2024/2025 Relevance |

|---|---|---|

| Net-Zero & SAF Mandates | Increased operational costs for SAF, need for fleet modernization and efficiency improvements. | SAF blending target of 1% by 2027 necessitates immediate planning and investment. |

| Noise Pollution | Compliance with stricter regulations, potential penalties for non-compliance. | IndiGo's young fleet (average < 6 years in early 2024) provides a competitive advantage. |

| Waste Management | Reputational risk, potential fines, opportunities for cost savings through efficiency. | Growing consumer demand for sustainable practices and regulatory oversight on waste. |

| Extreme Weather Events | Flight disruptions, increased fuel consumption, higher maintenance costs. | Increased frequency and intensity of events in 2024 impacting operational reliability and costs. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for InterGlobe Aviation is grounded in data from reputable aviation industry bodies, economic forecasting agencies, and government regulatory updates. We draw upon market research reports, financial disclosures, and environmental impact assessments to provide a comprehensive view.