InterGlobe Aviation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InterGlobe Aviation Bundle

InterGlobe Aviation, the parent company of IndiGo, operates in a dynamic aviation market. Understanding its product portfolio through the BCG Matrix reveals crucial insights into its competitive standing. Are its services Stars poised for growth, Cash Cows generating steady revenue, Dogs lagging behind, or Question Marks requiring strategic evaluation?

This preview offers a glimpse into InterGlobe Aviation's strategic positioning. To truly grasp the nuances of its market performance and unlock actionable strategies for investment and resource allocation, dive deeper with the complete BCG Matrix report. Purchase it today for a comprehensive breakdown and a clear roadmap to informed decision-making.

Stars

InterGlobe Aviation's IndiGo is aggressively pursuing international expansion, a strategy that positions it as a potential Star in the BCG Matrix. The airline is deploying new aircraft, including Airbus A321XLRs and leased Boeing 787 Dreamliners, to bolster its long-haul capabilities. This ambitious move is designed to significantly increase its international capacity share, targeting a rise from 28% to 40% by fiscal year 2030.

This expansion includes launching direct flights to key European cities such as London, Amsterdam, Manchester, Copenhagen, and Athens. Such a high-growth, high-investment approach in new international markets signals IndiGo's intent to capture substantial market share and establish a strong global presence.

InterGlobe Aviation's (IndiGo) fleet modernization, including the induction of wide-body aircraft like the Airbus A321XLR from FY26 and A350-900s from 2027, marks a significant strategic push. This investment is designed to unlock new, long-haul international routes that were previously beyond the airline's reach, allowing it to enter new market segments and expand its global footprint.

With nearly 950 aircraft on order as of 2025, IndiGo is making a substantial commitment to future capacity and market leadership. This aggressive expansion strategy, particularly with the introduction of long-range capabilities, positions the airline to challenge established players on international routes and solidify its dominance in the Indian aviation market.

IndiGo's cargo division, IndiGo CarGo, is aiming for robust growth, targeting double-digit increases in both revenue and tonnage. This expansion is fueled by a strategic push into international markets and a concerted effort to boost aircraft utilization.

Key to this strategy is the planned entry into new territories like Saudi Arabia and the Maldives. Furthermore, the upcoming introduction of wide-body A350 aircraft will substantially enhance cargo capacity, positioning this segment as a high-growth area with significant revenue potential.

IndiGoStretch (Business Class) Offering

IndiGo's introduction of IndiGoStretch, a business class offering, signifies a strategic pivot towards higher-yield passenger segments. This new product is being rolled out on their Airbus A321neo aircraft and leased Boeing 787-9 Dreamliners.

Initially deployed on select domestic routes, IndiGoStretch is quickly broadening its reach to short-haul international destinations, including popular routes like Dubai and Singapore. This expansion is designed to attract a different customer demographic and boost revenue per passenger.

- Strategic Expansion: IndiGoStretch targets premium travelers, a segment previously underserved by the airline.

- Fleet Integration: The business class product is being integrated into both owned Airbus A321neo and leased Boeing 787-9 Dreamliner fleets.

- Route Development: Initial domestic routes are being complemented by international expansions to key hubs like Dubai and Singapore.

- Revenue Enhancement: The move aims to increase average revenue per passenger by catering to a higher-paying customer base.

Digital Transformation and Operational Technology

IndiGo's strategic embrace of digital transformation, exemplified by the deployment of AI-powered customer support like '6Eskai' and migrating critical infrastructure to the cloud, underscores a significant investment in operational efficiency and future scalability. These advancements are vital for the airline to not only maintain its market leadership but also to fuel its aggressive growth trajectory.

These technological investments are directly linked to enhanced performance metrics. For instance, in Q4 FY24, IndiGo reported a net profit of ₹4,177 crore, a substantial increase from ₹919 crore in the same period last year, partly attributable to improved operational efficiencies driven by such digital initiatives. The airline's continued focus on optimizing processes through technology positions it to capitalize on sustained high growth by refining its operations and elevating the overall customer journey.

Key digital transformation initiatives include:

- AI-driven customer support: Implementation of '6Eskai' to handle customer queries, aiming to reduce response times and improve service quality.

- Cloud migration: Moving core IT infrastructure to cloud platforms to enhance flexibility, reliability, and cost-effectiveness.

- Data analytics: Leveraging data to optimize flight schedules, fuel consumption, and maintenance, leading to significant cost savings and improved punctuality.

- Digital customer engagement: Enhancing the digital interface for booking, check-in, and in-flight services to create a seamless customer experience.

IndiGo's aggressive international expansion, including the introduction of wide-body aircraft and new long-haul routes, positions it as a Star in the BCG Matrix. The airline's significant fleet orders, nearly 950 aircraft by 2025, and strategic entry into markets like Saudi Arabia and the Maldives underscore its high-growth, high-investment approach. This focus on expanding global reach and capacity, particularly with the new IndiGoStretch business class offering, aims to capture new market segments and increase revenue per passenger.

| Initiative | Description | BCG Matrix Category | Key Metrics/Data |

| International Expansion | Launching new long-haul routes and increasing international capacity share. | Star | Targeting 40% international capacity share by FY2030; adding Airbus A321XLR and Boeing 787 Dreamliners. |

| IndiGoStretch | Introducing a business class product on A321neo and B787-9 aircraft. | Star | Deployed on domestic and short-haul international routes like Dubai and Singapore; aims to boost revenue per passenger. |

| Digital Transformation | AI customer support ('6Eskai') and cloud migration. | Star | Contributed to a net profit of ₹4,177 crore in Q4 FY24; enhances operational efficiency and customer experience. |

What is included in the product

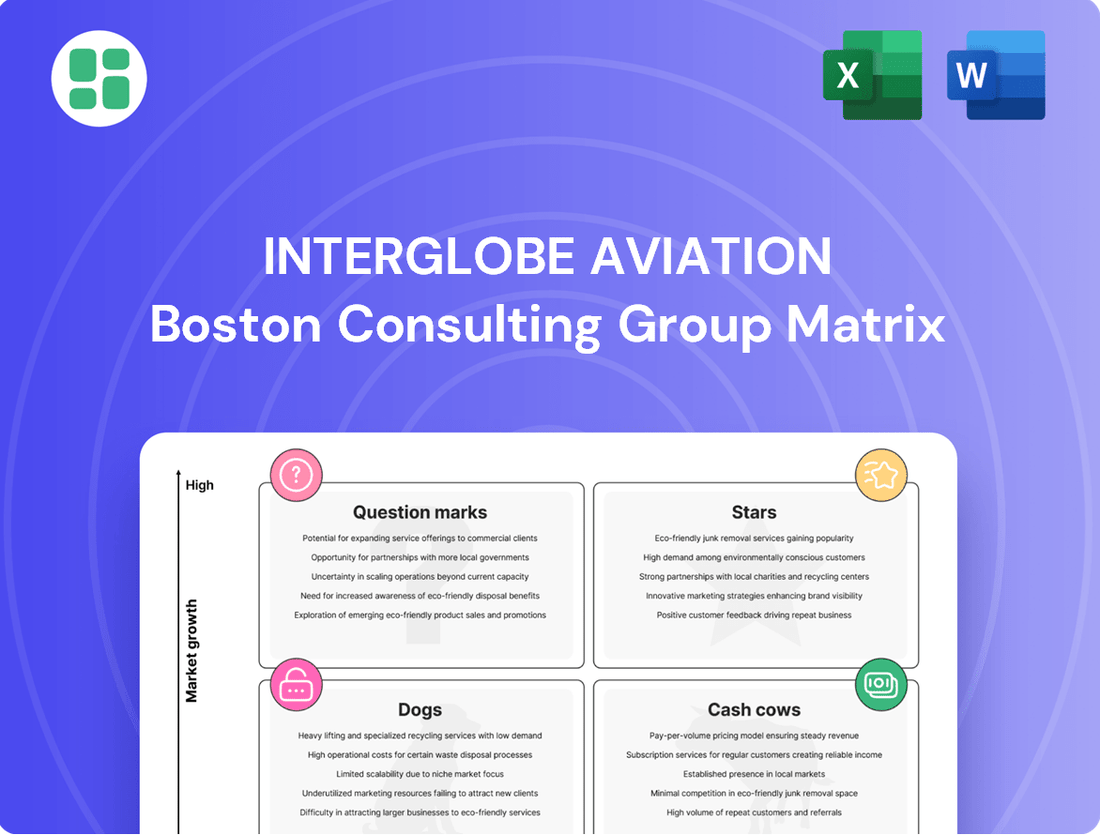

InterGlobe Aviation's BCG Matrix analysis reveals strategic insights into its airline operations, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This framework helps identify which business units to invest in, hold, or divest for optimal resource allocation.

A clear BCG Matrix visualizes InterGlobe Aviation's portfolio, alleviating the pain of strategic uncertainty by highlighting growth opportunities and underperforming assets.

Cash Cows

IndiGo's dominance in the Indian domestic aviation market is a key strength, evidenced by its approximately 64.5% market share as of June 2025. This commanding position fuels consistent and substantial cash flow, a hallmark of a cash cow.

The airline's expansive network, reaching both major metropolitan hubs and smaller Tier-2/3 cities, underpins its stable revenue generation. This broad reach ensures a steady stream of passengers, contributing significantly to its cash cow status.

IndiGo's operational blueprint is a masterclass in efficiency, focusing on punctuality and a streamlined service. This strategy translates directly into competitive pricing and robust profit margins, solidifying its position as a cash cow.

The airline's commitment to cost control is evident in its standardized fleet, predominantly comprising the Airbus A320 family. This standardization simplifies maintenance and operations, significantly boosting cash generation.

Further underscoring its efficiency, IndiGo boasts one of the youngest fleets in the industry, with an average age of just 4.9 years as of early 2024. This low average age contributes to lower fuel consumption and reduced maintenance costs, enhancing its cash-generating prowess.

Established ancillary revenue streams, like baggage fees and seat selection, are a mature and significant contributor to IndiGo's overall profitability. These revenue streams typically boast high-profit margins because their incremental costs are quite low. In the first quarter of fiscal year 2025, ancillary revenues saw a healthy increase of 13.9% compared to the same period in the previous year, underscoring their continued importance as a stable cash generator for the airline.

Strong Brand Recognition and Customer Loyalty

InterGlobe Aviation’s IndiGo, as India's largest and most preferred airline, enjoys significant brand recognition and a deeply loyal customer base. This strong market position translates into consistent passenger volumes and impressive load factors, even amidst intense competition. For instance, in the fiscal year 2024, IndiGo reported an average passenger load factor of approximately 85-90% across its network, underscoring its ability to fill seats reliably.

The airline's unwavering commitment to on-time performance and a seamless travel experience further solidifies customer preference. This focus on operational excellence not only drives repeat business but also ensures a predictable and steady inflow of cash, a hallmark of a cash cow. IndiGo's operational efficiency, often highlighted by its industry-leading on-time departure statistics, contributes directly to its financial stability.

- Brand Strength: IndiGo is consistently ranked as one of the most trusted airline brands in India.

- Customer Loyalty: High repeat customer rates are a key indicator of IndiGo's strong customer loyalty.

- Load Factors: Maintaining load factors in the high 80s to low 90s demonstrates consistent demand.

- Operational Efficiency: A focus on on-time performance directly supports consistent revenue generation.

Strategic Partnerships and Codeshare Agreements

InterGlobe Aviation, through its IndiGo brand, leverages strategic partnerships and codeshare agreements as key components of its Cash Cow strategy. These alliances, including collaborations with Air France-KLM, Virgin Atlantic, and Jetstar, significantly extend IndiGo's network reach. This expansion is achieved without the need for substantial capital investment, effectively allowing the airline to capitalize on existing passenger demand for connecting flights.

These international collaborations are instrumental in enhancing IndiGo's global connectivity. For instance, the codeshare with Turkish Airlines, initiated in 2023, provides IndiGo passengers access to 33 European destinations. Such agreements not only bolster passenger traffic on established routes but also contribute to a stable and predictable revenue stream, characteristic of a Cash Cow business unit.

- Network Expansion: Partnerships with airlines like Air France-KLM and Virgin Atlantic allow IndiGo to tap into new international markets.

- Cost Efficiency: Codeshare agreements reduce the need for IndiGo to operate its own aircraft on long-haul routes, saving capital expenditure.

- Revenue Generation: These alliances facilitate passenger flow onto existing routes, generating consistent revenue from established demand.

- Market Presence: By offering a wider network, IndiGo strengthens its competitive position and brand recognition internationally.

IndiGo's dominant market share, consistently around 64.5% as of June 2025, fuels its cash cow status by ensuring high passenger volumes and stable revenue. Its operational efficiency, marked by a young fleet averaging 4.9 years old in early 2024 and a focus on punctuality, drives profitability and cost control. Mature ancillary revenue streams, which grew 13.9% in Q1 FY25, further contribute to its robust cash generation.

| Metric | Value (as of latest available data) | Impact on Cash Cow Status |

| Domestic Market Share | ~64.5% (June 2025) | Ensures consistent passenger flow and revenue stability. |

| Average Fleet Age | 4.9 years (Early 2024) | Reduces maintenance and fuel costs, boosting cash generation. |

| Ancillary Revenue Growth | 13.9% (Q1 FY25) | Adds high-margin revenue, enhancing overall cash flow. |

| Load Factor | 85-90% (FY24) | Indicates high aircraft utilization and revenue per flight. |

Full Transparency, Always

InterGlobe Aviation BCG Matrix

The InterGlobe Aviation BCG Matrix preview you are viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive analysis, detailing InterGlobe Aviation's product portfolio within the BCG framework, is ready for immediate strategic application without any watermarks or demo content. You can confidently expect to download this professionally designed document, which has been meticulously prepared for clarity and actionable insights into the company's market position.

Dogs

Certain international routes, particularly those in highly competitive or less-demand markets where IndiGo has a low market share, could be classified as dogs within the BCG matrix. These routes might struggle to achieve profitability due to intense competition from full-service carriers or other low-cost airlines. For instance, routes with consistently low passenger load factors, perhaps below 70% in 2024, would signal underperformance.

These underperforming routes might break even or, worse, consume more cash than they generate, making them prime candidates for review or potential divestment. In 2024, IndiGo's operational data likely showed some international sectors with negative contribution margins after accounting for all direct and indirect costs, indicating a need for strategic re-evaluation.

InterGlobe Aviation's legacy Airbus A320-200 aircraft, while historically significant, are increasingly being categorized as 'dogs' within its BCG matrix. These older models are being systematically phased out to make way for the more fuel-efficient A320neo family. As of early 2024, IndiGo continues this transition, aiming to retire older aircraft to reduce operational costs and environmental impact.

InterGlobe Aviation's (IndiGo) "Dogs" in the BCG Matrix likely represent routes characterized by persistently low yields and intense price competition. On these routes, IndiGo finds it challenging to stand out or capture substantial market share, often leading to a struggle for profitability.

These segments may demand significant marketing and operational investments that fail to yield sustainable profits. For instance, in 2024, certain domestic routes might have seen average yields below 5 INR per passenger kilometer, while simultaneously experiencing load factors that, despite being high, couldn't offset the low revenue per seat due to aggressive pricing by competitors.

Such routes are often maintained not for their direct profitability but to ensure overall network connectivity, supporting feeder traffic to more lucrative destinations. This strategic retention highlights a trade-off between immediate financial returns and the long-term benefits of a comprehensive route network.

Unsuccessful Ancillary Product Launches

Unsuccessful ancillary product launches for InterGlobe Aviation, specifically within the context of a BCG Matrix analysis, would fall under the 'Dogs' category. These are offerings that have failed to capture customer interest or generate meaningful revenue, potentially becoming a drain on resources. While IndiGo's primary ancillary income streams are robust, newer, untested services that don't align with its low-cost carrier model or its customers' expectations could be classified here.

These underperforming ancillary products require careful review. The airline needs to assess whether these offerings can be revitalized or if they should be phased out to prevent further resource depletion. For example, if a new in-flight entertainment system or a premium baggage service failed to attract the projected uptake, it would be a prime candidate for this classification.

- Underperforming Ancillary Services: Any ancillary product or service that has not achieved sufficient customer adoption or revenue generation.

- Potential Cash Traps: Experimental offerings that do not resonate with IndiGo's low-cost model or its customer base, risking resource drain.

- Strategic Re-evaluation Needed: These 'dog' products necessitate a review for potential discontinuation or significant modification to avoid continued financial strain.

Impact of Geopolitical Headwinds on Specific Markets

Geopolitical headwinds can significantly impact airline operations, potentially turning previously profitable routes into underperforming assets, or dogs, within a business portfolio like InterGlobe Aviation's. For example, if tensions escalate in a key region, leading to airspace closures or travel advisories, IndiGo might face substantial disruptions. This could result in reduced passenger traffic and increased operational costs on affected routes, making them economically unviable.

Consider a scenario where a conflict erupts in a region crucial for IndiGo's international connectivity. This could force the airline to reroute flights, incurring higher fuel expenses and longer flight times. If these disruptions persist, routes that were once cash cows might become dogs. For instance, if a major route relies on transit through a politically unstable airspace, a sudden closure could render the entire route unprofitable. While IndiGo is known for its efficient operations, such external shocks are difficult to fully mitigate.

- Geopolitical Instability: Disruptions like airspace closures or conflict in transit regions can directly impact flight schedules and profitability.

- Regulatory Challenges: Evolving international regulations or sanctions against specific countries can impose operational restrictions and increase compliance costs.

- Reduced Traffic: Travel advisories or a general sense of insecurity can lead to a sharp decline in passenger demand for affected routes.

- Unprofitable Routes: The combination of increased costs and decreased revenue can push routes into a dog category, requiring strategic review.

InterGlobe Aviation's 'Dogs' primarily encompass underperforming international routes with low market share and intense competition, alongside older aircraft models being phased out. These segments often struggle for profitability, potentially consuming more cash than they generate, necessitating strategic review or divestment.

Additionally, unsuccessful ancillary product launches and routes impacted by geopolitical instability or regulatory challenges can also be classified as dogs. These areas demand careful assessment to determine if they can be revitalized or should be discontinued to prevent further resource drain.

| BCG Category | Example for IndiGo | Key Characteristics | 2024 Financial Indicator Example |

|---|---|---|---|

| Dogs | Specific underperforming international routes | Low market share, high competition, low yields | Load factor below 70%, negative contribution margin |

| Dogs | Older Airbus A320-200 aircraft | Lower fuel efficiency, higher maintenance costs | Higher cost per available seat kilometer (CASK) compared to A320neo |

| Dogs | Unsuccessful ancillary product launches | Low customer adoption, minimal revenue generation | Low uptake rate for new services, negative ROI on development |

| Dogs | Routes affected by geopolitical instability | Disruptions, increased operational costs, reduced demand | Significant increase in fuel burn due to rerouting, sharp drop in passenger numbers |

Question Marks

InterGlobe Aviation's expansion into new long-haul international routes like London Heathrow, Amsterdam, and Manchester places these ventures firmly in the question mark category of the BCG matrix. These routes offer significant growth prospects, but IndiGo faces the challenge of entering markets dominated by established full-service airlines.

The success of these new international routes hinges on substantial investments in wide-body aircraft and aggressive marketing to build brand recognition and capture market share. For instance, by the end of fiscal year 2024, IndiGo had placed significant orders for wide-body aircraft, signaling its commitment to this long-haul strategy.

InterGlobe Aviation's (IndiGo) push into Tier-3 cities and underserved regions, often supported by schemes like the Regional Connectivity Scheme (RCS), represents a strategic gamble. While these markets offer vast untapped potential, the immediate profitability and long-term viability of these routes remain a key question mark.

For instance, during fiscal year 2024, IndiGo significantly increased its presence on regional routes. The airline's network expansion saw it connecting more smaller cities, aiming to capture nascent demand. However, the success of these ventures hinges on sustained passenger growth and the development of supporting infrastructure in these areas, which can lead to substantial initial investment with uncertain near-term returns.

InterGlobe Aviation's ambition to establish a dedicated MRO hub in Bengaluru, alongside exploring new ventures within the aircraft maintenance sector, positions these initiatives as question marks within its BCG matrix. This strategic move into MRO services represents a significant diversification, demanding substantial capital outlay and specialized knowledge to navigate a competitive landscape.

While the development of MRO capabilities can bolster operational efficiency and cater to growing demand for aviation services, the ultimate profitability and market penetration of these new MRO operations remain uncertain. For example, the global MRO market was valued at approximately $80 billion in 2023 and is projected to grow, but establishing a strong foothold requires overcoming significant barriers to entry and demonstrating competitive service offerings. InterGlobe Aviation's success here will hinge on its ability to attract skilled technicians and secure lucrative maintenance contracts.

New Loyalty Programs and Customer Experience Innovations

InterGlobe Aviation's introduction of the BluChip loyalty program and other customer experience enhancements represents a strategic move to bolster customer engagement and capture new market segments. These initiatives are viewed as crucial investments aimed at securing future growth and fostering long-term customer loyalty.

While these programs are designed to attract and retain passengers, their immediate effect on market share and profitability remains to be seen. The ultimate success hinges on how effectively these innovations are implemented and how well they resonate with customers.

- BluChip Loyalty Program: Designed to reward frequent flyers and encourage repeat business.

- Customer Experience Innovations: Focus on improving overall passenger journey, from booking to post-flight.

- Investment in Future Growth: Initiatives are strategic bets on increasing customer lifetime value and market penetration.

- Uncertainty of Immediate Impact: Success metrics like market share and profitability gains will become clearer over time.

Potential for Sustainable Aviation Fuel (SAF) Adoption and Green Initiatives

While IndiGo, operated by InterGlobe Aviation, already boasts a low CO2-emitting profile, the airline's significant investment in Sustainable Aviation Fuel (SAF) and other green initiatives presents a potential question mark within its BCG Matrix positioning. These areas are characterized by high upfront costs and uncertain short-term market returns, despite their long-term environmental benefits.

The aviation sector is undeniably shifting towards greater sustainability, yet the commercial viability of widespread SAF adoption remains a developing aspect. For instance, in 2023, the global SAF production was still a fraction of total jet fuel consumption, with estimates suggesting it accounted for less than 0.5% of the total. This highlights the nascent stage of the market and the associated financial risks for early adopters.

- High Cost of SAF: SAF can be two to eight times more expensive than conventional jet fuel, impacting operational costs.

- Limited Production Capacity: Global SAF production in 2023 was around 1.5 million tons, a small fraction of the over 300 million tons of jet fuel used annually.

- Uncertain Market Returns: The long-term profitability of significant SAF investments is still being established as supply chains and demand mature.

- Industry Trend: Despite challenges, major airlines and manufacturers are setting ambitious SAF usage targets, indicating a strong future industry direction.

InterGlobe Aviation's strategic expansion into new international long-haul routes and its push into smaller Tier-3 cities represent significant question marks. These ventures demand substantial investment in aircraft and marketing, with uncertain near-term profitability due to intense competition and underdeveloped infrastructure.

The airline's ambition to establish a dedicated MRO hub and its investments in customer loyalty programs like BluChip also fall into this category. While these initiatives aim to enhance operational efficiency and customer engagement, their ultimate impact on market share and financial returns remains to be seen.

Similarly, InterGlobe Aviation's commitment to Sustainable Aviation Fuel (SAF) and other green initiatives, while environmentally crucial, presents a financial question mark. The high cost and limited production capacity of SAF, with global production in 2023 being less than 0.5% of total jet fuel consumption, highlight the financial risks involved in these early-stage investments.

BCG Matrix Data Sources

Our InterGlobe Aviation BCG Matrix is informed by official company filings, industry growth forecasts, and competitive market analysis to provide a clear strategic overview.