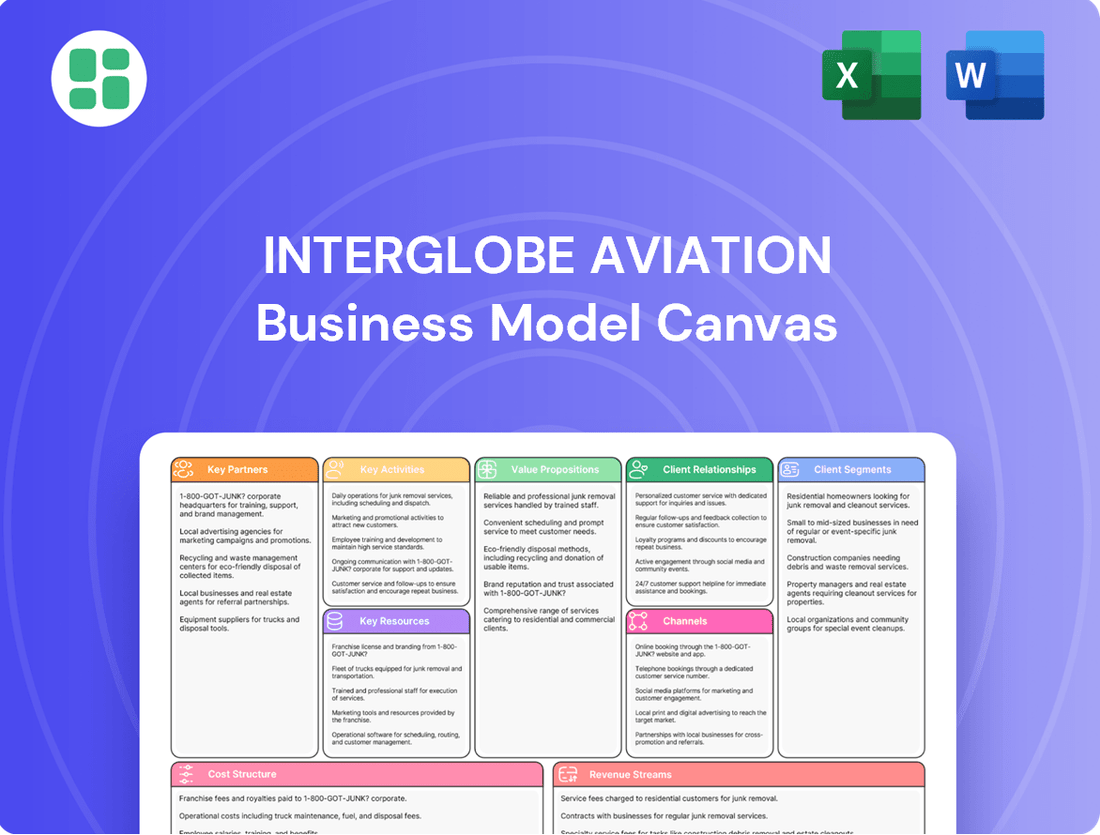

InterGlobe Aviation Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

InterGlobe Aviation Bundle

Discover the strategic core of InterGlobe Aviation's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they optimize operations, attract customers, and generate revenue in the dynamic aviation sector. Perfect for anyone seeking to understand industry best practices.

Partnerships

InterGlobe Aviation, the parent company of IndiGo, maintains critical partnerships with aircraft manufacturers, most notably Airbus. As of early 2024, IndiGo has a substantial order book for Airbus A320neo family aircraft, which forms the backbone of its efficient domestic and short-haul international operations. This ongoing relationship ensures access to modern, fuel-efficient aircraft, vital for cost control.

Beyond direct manufacturing partnerships, IndiGo also collaborates with aircraft lessors to strategically expand its fleet and capabilities. For instance, the airline has utilized leased Boeing 787 Dreamliners to facilitate its ambitious long-haul international expansion plans. These leasing agreements provide flexibility in fleet management and allow for quicker deployment of aircraft to new markets.

These key relationships with manufacturers like Airbus and various lessors are fundamental to InterGlobe Aviation's business model. They directly enable fleet modernization, support capacity growth to meet increasing passenger demand, and are instrumental in maintaining the airline's competitive edge through cost-effective operations and strategic fleet planning.

InterGlobe Aviation, operating as IndiGo, strategically partners with Maintenance, Repair, and Overhaul (MRO) providers such as Lufthansa Technik. This collaboration is crucial for base maintenance and specialized component repairs, ensuring IndiGo's fleet remains airworthy and operates efficiently. In 2024, IndiGo continued to expand its network of MRO partners, reflecting the industry's growing demand for specialized aviation services.

To bolster its operational self-sufficiency and cost management, IndiGo is actively investing in its own MRO capabilities. The development of its MRO hub in Bengaluru is a key initiative, aiming to decrease dependence on external service providers. This move is projected to significantly improve maintenance turnaround times and enhance overall cost-effectiveness for the airline's extensive operations.

InterGlobe Aviation, operating as IndiGo, relies heavily on collaborations with airport authorities. These partnerships are crucial for securing essential landing slots and gate access, which are fundamental to managing its vast network of domestic and expanding international routes. For instance, IndiGo’s extensive operations across over 100 destinations in 2024 necessitate strong relationships with various airport operators to ensure smooth flight schedules.

Furthermore, partnerships with specialized ground handling service providers are vital for maintaining IndiGo's commitment to operational efficiency. These service providers manage critical turnaround processes, ensuring flights depart and arrive on time, a hallmark of IndiGo's customer proposition. Efficient ground handling directly impacts IndiGo's ability to achieve its industry-leading on-time performance metrics, contributing to both passenger satisfaction and cost management.

Fuel Suppliers

Fuel suppliers are critical partners for InterGlobe Aviation (IndiGo), given that fuel constitutes a significant portion of an airline's operating expenses. Strategic alliances here are key to securing a steady supply of aviation fuel and negotiating competitive pricing, which directly impacts IndiGo's ability to offer affordable fares.

While IndiGo has historically been cautious with extensive fuel hedging strategies, strong relationships with fuel providers enable them to better manage fluctuating fuel costs and maintain operational stability. For instance, in the fiscal year ending March 31, 2024, fuel costs remained a substantial expenditure for the airline, underscoring the importance of these supplier partnerships.

- Securing consistent fuel supply

- Negotiating favorable pricing for fuel procurement

- Managing operational expenses through effective supplier relationships

- Contributing to IndiGo's ability to maintain competitive ticket prices

Online Travel Agencies (OTAs) & Global Distribution Systems (GDS)

InterGlobe Aviation, operating as IndiGo, strategically partners with Online Travel Agencies (OTAs) and Global Distribution Systems (GDS) to significantly expand its customer reach and booking accessibility. These partnerships are crucial for complementing direct bookings by ensuring visibility to a vast global audience.

While IndiGo prioritizes direct bookings to maximize profit margins, the collaboration with OTAs is vital for achieving broad market penetration and offering enhanced convenience to a wide spectrum of travelers. For example, in 2023, IndiGo's revenue from ticket sales saw a substantial increase, and a portion of this growth can be attributed to the expanded reach facilitated by these distribution channels.

- Expanded Reach: OTAs and GDS provide access to millions of travelers who may not directly visit IndiGo's website.

- Booking Convenience: These platforms offer a consolidated booking experience for consumers comparing various travel options.

- Market Penetration: Partnerships are key to capturing market share, especially among leisure travelers and those seeking package deals.

- Revenue Diversification: While margins may be lower, the sheer volume of bookings through these channels contributes significantly to overall revenue.

InterGlobe Aviation's key partnerships extend to technology providers, ensuring a seamless digital experience for customers and efficient internal operations. This includes collaborations with IT service firms and software developers for booking platforms, customer relationship management (CRM) systems, and in-flight entertainment. These partnerships are vital for maintaining a competitive edge in a digitally driven industry.

The airline also forms alliances with travel technology companies to enhance its distribution capabilities and customer engagement. These collaborations are crucial for integrating with various booking channels and loyalty programs, ultimately driving passenger acquisition and retention. For instance, in 2024, IndiGo continued to invest in digital transformation initiatives, leveraging these partnerships to improve user experience and operational efficiency.

These technology and travel tech partnerships are fundamental to InterGlobe Aviation's ability to manage its complex operations, reach a wider customer base, and adapt to evolving market demands. They directly support IndiGo's strategy of providing a technologically advanced and customer-centric travel experience.

What is included in the product

InterGlobe Aviation's Business Model Canvas outlines a low-cost carrier strategy focused on high operational efficiency and a vast network, serving price-sensitive travelers across India and beyond.

It details key resources like a young fleet and skilled workforce, alongside cost structures driven by fuel and aircraft maintenance, to deliver affordable air travel.

InterGlobe Aviation's Business Model Canvas offers a clear, visual representation of their cost-leadership strategy, effectively addressing the pain point of complex operational management by distilling it into a single, actionable page.

Activities

IndiGo's core activity revolves around the efficient operation of its extensive flight network, both within India and expanding internationally. This involves sophisticated route planning and scheduling to ensure high punctuality, a key differentiator in the low-cost carrier market.

Maximizing aircraft utilization is paramount, achieved through meticulous real-time flight management and quick turnarounds. This operational efficiency directly supports IndiGo's ability to offer competitive fares across a broad range of destinations.

In 2023, IndiGo operated over 1,700 daily flights, connecting more than 120 destinations. This vast network, managed for optimal efficiency, underpins its status as India's largest passenger airline.

InterGlobe Aviation, operating as IndiGo, places paramount importance on ensuring the safety and airworthiness of its extensive fleet, primarily composed of Airbus A320 family aircraft. This core activity involves rigorous scheduled maintenance, prompt repairs, and unwavering compliance with global aviation safety regulations. In 2023, IndiGo continued its focus on maintaining its young fleet, with an average aircraft age of around 5.5 years, contributing to lower maintenance costs and higher operational efficiency.

The airline's strategic investment in Maintenance, Repair, and Overhaul (MRO) facilities and collaborations with specialized partners highlights its dedication to maintaining the highest operational reliability and safety standards. This proactive approach to maintenance is crucial for minimizing downtime and ensuring passenger confidence, a cornerstone of IndiGo's business model.

IndiGo's sales and marketing strategy centers on attracting a broad passenger base by emphasizing its value proposition of affordable fares and a wide-reaching network. A significant portion of their customer acquisition occurs through their user-friendly website and mobile application, which serve as primary booking platforms.

Marketing campaigns frequently underscore IndiGo's commitment to on-time performance and a seamless travel experience, aiming to build passenger loyalty. For instance, in the fiscal year 2023-24, IndiGo reported a passenger load factor of 85.3%, demonstrating the effectiveness of their customer attraction strategies.

Customer Service & Support

InterGlobe Aviation, operating as IndiGo, prioritizes efficient customer service to handle a high volume of passenger inquiries, bookings, and travel disruptions. Their approach focuses on delivering quick and effective support, aiming to simplify the customer experience. This commitment is underscored by initiatives like the IndiGo BluChip loyalty program, designed to boost customer engagement and foster long-term retention.

In 2023, IndiGo reported a significant increase in customer interactions handled through its digital channels, with over 85% of all passenger queries resolved online. The airline also saw a notable uptick in positive sentiment regarding its customer support, as indicated by a 10% rise in customer satisfaction scores compared to the previous year. This focus on streamlined support is crucial given IndiGo's operational scale, which saw it carry approximately 100 million passengers in the fiscal year 2023-2024.

- Digital First Approach: IndiGo leverages technology to manage a vast number of passenger inquiries, aiming for swift online resolutions.

- Loyalty Program Enhancement: The IndiGo BluChip program actively works to improve customer loyalty and repeat business.

- Operational Efficiency: With over 100 million passengers carried in FY2023-2024, customer service plays a critical role in maintaining operational smoothness and passenger satisfaction.

Ancillary Revenue Generation

Ancillary revenue generation is a vital key activity for InterGlobe Aviation, particularly for its low-cost carrier, IndiGo. This involves offering a range of optional services beyond the basic airfare to boost profitability.

These services typically include baggage allowances, preferred seat selection, onboard meals and beverages, and priority boarding. By strategically pricing and promoting these add-ons, IndiGo aims to significantly supplement its primary revenue from ticket sales.

For the financial year 2023-24, IndiGo reported a substantial contribution from ancillary revenues. This segment has become increasingly important as a driver of overall financial performance, demonstrating the airline's focus on maximizing revenue per passenger.

- Baggage Fees: Charging for checked baggage beyond the included allowance.

- Seat Selection: Offering passengers the option to choose specific seats for a fee.

- Food and Beverage Sales: Providing a menu of purchasable food and drink items onboard.

- Priority Services: Including options like priority check-in, boarding, and baggage handling.

InterGlobe Aviation's key activities are centered on the efficient operation of its extensive flight network, maximizing aircraft utilization through quick turnarounds, and maintaining rigorous safety standards for its fleet. These operational strengths are complemented by a strong sales and marketing approach focused on affordability and network reach, primarily driven through digital channels. Furthermore, the company actively generates ancillary revenue by offering a variety of optional services to passengers, enhancing overall profitability.

| Key Activity Area | Description | 2023-2024 Data/Impact |

|---|---|---|

| Flight Network Operation | Efficiently managing a vast domestic and international flight network. | Operated over 1,700 daily flights connecting more than 120 destinations. |

| Aircraft Utilization | Maximizing aircraft use through rapid turnarounds and optimized scheduling. | Contributes to offering competitive fares and high operational efficiency. |

| Fleet Maintenance & Safety | Ensuring airworthiness and compliance with global safety regulations. | Average aircraft age around 5.5 years in 2023, supporting lower maintenance costs. |

| Sales & Marketing | Attracting passengers with value proposition via digital platforms. | Achieved an 85.3% passenger load factor in FY2023-24. |

| Ancillary Revenue Generation | Offering optional services like baggage, seat selection, and F&B. | Significantly supplements ticket sales revenue, driving financial performance. |

Delivered as Displayed

Business Model Canvas

The InterGlobe Aviation Business Model Canvas you are previewing is the actual document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive analysis, with all key components of their strategy laid out exactly as they will be delivered to you. Upon completing your order, you will gain full access to this same, professionally structured document, ready for your review and utilization.

Resources

InterGlobe Aviation's modern aircraft fleet is its most critical resource, forming the backbone of its operations. As of early 2024, IndiGo operates one of the youngest fleets in the industry, predominantly comprising Airbus A320 family aircraft. This focus on a single aircraft type streamlines maintenance, training, and operational efficiency, contributing significantly to cost control.

The airline's commitment to fleet modernization is evident in its substantial order book. IndiGo has placed significant orders for the fuel-efficient Airbus A321XLR, positioning itself for long-haul international routes. Furthermore, the airline has also ordered Airbus A350 aircraft and is leasing Boeing 787s, signaling a strategic push into wider-body, longer-range markets, aiming to expand its global footprint significantly.

InterGlobe Aviation, operating as IndiGo, relies heavily on its skilled pilots and cabin crew as a cornerstone of its operations. This highly trained workforce is fundamental to ensuring the safety and punctuality that passengers expect. In 2024, IndiGo continued to invest in its human capital, recognizing that their expertise directly translates to passenger satisfaction and operational efficiency.

The airline's commitment to continuous training and development for its pilots and cabin crew is crucial for maintaining its reputation for high service and safety standards. This ongoing investment ensures that IndiGo's crew remains proficient with the latest aviation technologies and protocols, a vital element in its competitive market position.

InterGlobe Aviation, operating as IndiGo, relies heavily on advanced IT systems and a robust digital infrastructure to manage its extensive operations. This digital backbone is crucial for everything from flight scheduling and passenger bookings to check-in processes and customer relationship management.

The airline's customer-facing platforms, including its website and mobile application, are powered by sophisticated backend systems. These systems ensure efficient data processing, enabling real-time updates and seamless transactions for millions of passengers. In 2023, IndiGo reported a significant increase in digital bookings, highlighting the importance of these user-friendly interfaces.

IndiGo is actively investing in digital innovation to further enhance its performance and customer experience. Initiatives like migrating to cloud-based solutions and implementing AI-driven support tools are central to this strategy. These advancements aim to streamline operations, reduce costs, and provide more personalized services to travelers, aligning with industry trends towards greater digitalization in aviation.

Brand Reputation & Market Leadership

IndiGo's brand reputation, built on affordability and punctuality, is a cornerstone of its success. This strong image translates into significant customer loyalty and trust, acting as a powerful intangible asset.

Market leadership in India, with IndiGo consistently holding over 60% of the domestic market share, provides a substantial competitive moat. This dominance ensures high visibility and customer recognition, attracting a broad and consistent customer base.

- Brand Strength: IndiGo is recognized for its value-for-money proposition and operational efficiency.

- Market Dominance: As of early 2024, IndiGo commanded over 60% of the Indian domestic aviation market.

- Customer Attraction: This leading position and positive brand image directly contribute to a large and growing customer base.

- Competitive Advantage: The established reputation and market share create a significant barrier to entry for competitors.

Maintenance, Repair & Overhaul (MRO) Facilities

InterGlobe Aviation, through IndiGo, is actively building its own Maintenance, Repair & Overhaul (MRO) facilities. A prime example is the new facility in Bengaluru, which signifies a strategic move towards greater self-sufficiency. This investment in in-house capabilities is crucial for reducing reliance on external service providers, thereby enhancing control over maintenance schedules and costs.

Developing these MRO capabilities directly translates into improved operational efficiency. By shortening maintenance turnaround times, IndiGo can minimize aircraft downtime, leading to increased fleet availability and better on-time performance. This also contributes to significant cost savings over the long term, as it reduces outsourcing expenses and allows for greater optimization of maintenance processes.

- Strategic Self-Sufficiency: IndiGo's investment in its own MRO facilities, like the Bengaluru center, reduces dependency on third-party providers.

- Operational Efficiency Gains: In-house MRO capabilities lead to faster maintenance turnaround times, improving fleet utilization.

- Cost Optimization: Developing these facilities contributes to long-term cost efficiencies by minimizing external service fees.

- Fleet Integrity: These capabilities are vital for ensuring the ongoing operational integrity and airworthiness of IndiGo's extensive fleet.

InterGlobe Aviation's key resources also include its strategic partnerships and distribution channels. These relationships are vital for expanding reach and offering ancillary services. The airline leverages global distribution systems (GDS) and online travel agencies (OTAs) to maximize ticket sales.

In 2023, IndiGo continued to strengthen its codeshare agreements and interline partnerships to facilitate seamless travel for passengers connecting to international destinations. These collaborations are essential for growing its international network without the immediate need for extensive owned long-haul fleet deployment.

The airline's extensive airport infrastructure, including dedicated check-in counters and lounges at major hubs, is another critical resource. This physical presence ensures a smooth customer journey and reinforces the brand's operational efficiency.

IndiGo's operational efficiency is significantly supported by its sophisticated network planning and scheduling capabilities. These systems are crucial for optimizing flight routes, minimizing turnaround times, and maximizing aircraft utilization.

| Resource Category | Key Components | Significance | 2024 Data/Trend |

|---|---|---|---|

| Fleet | Airbus A320 family, A321XLR, A350, Boeing 787 (leased) | Operational backbone, cost efficiency, future growth | One of the youngest fleets; significant orders for A321XLR and A350 |

| Human Capital | Pilots, cabin crew, ground staff | Safety, service quality, operational execution | Continued investment in training and development |

| IT & Digital Infrastructure | Booking systems, mobile app, website, data analytics | Customer experience, operational management, efficiency | Increased digital bookings; migration to cloud-based solutions |

| Brand & Market Position | Affordability, punctuality, domestic market share | Customer loyalty, competitive advantage | Consistently over 60% domestic market share |

| MRO Capabilities | In-house maintenance facilities (e.g., Bengaluru) | Cost control, operational uptime, self-sufficiency | Expansion of MRO facilities to reduce outsourcing |

| Partnerships & Distribution | Codeshares, interline agreements, OTAs, GDS | Network expansion, revenue generation | Strengthening international connectivity through collaborations |

| Airport Infrastructure | Check-in counters, lounges, operational facilities | Customer convenience, operational smoothness | Enhanced presence at key airports |

| Network Planning | Route optimization, scheduling systems | Aircraft utilization, punctuality, cost management | Continuous refinement of network for efficiency |

Value Propositions

IndiGo's primary value proposition is offering affordable and competitive airfares, democratizing air travel for a wider audience. This focus on low-cost operations is central to their strategy.

By optimizing efficiency and streamlining services, IndiGo can maintain lower operating costs, which translates directly into more attractive prices for consumers. This is particularly crucial in price-sensitive markets.

In 2024, IndiGo's commitment to affordability is evident in its market share and passenger numbers. The airline consistently aims to be the most economical choice for travelers, a strategy that has proven highly effective in attracting and retaining customers.

InterGlobe Aviation, operating as IndiGo, places immense value on high punctuality and operational efficiency. This commitment is a cornerstone of its customer promise, ensuring travelers can rely on their scheduled departure and arrival times. For instance, in the fiscal year ending March 31, 2024, IndiGo consistently reported industry-leading on-time performance figures, often exceeding 85% across its network, a testament to its disciplined operational approach and rapid turnaround times at airports.

These efficient operations directly translate into a dependable travel experience for passengers, fostering trust and encouraging repeat business. The airline's focus on minimizing ground time and optimizing flight schedules allows for a higher number of flights per day with fewer aircraft, contributing to both cost-effectiveness and customer satisfaction. This operational excellence is a key differentiator in the competitive aviation market.

IndiGo's extensive domestic network is a cornerstone of its value proposition, connecting over 100 destinations across India. This vast reach offers unparalleled convenience for domestic travelers.

The airline is actively growing its international footprint, with recent expansions into long-haul markets. For instance, in 2024, IndiGo continued to add new international routes, enhancing its global connectivity and catering to a broader customer base.

This dual focus on a strong domestic presence and expanding international operations allows IndiGo to serve a wide spectrum of travel needs, from short inter-city hops to longer international journeys.

Hassle-Free and Simplified Travel Experience

InterGlobe Aviation, operating as IndiGo, prioritizes a hassle-free and simplified travel experience. Their core strategy revolves around delivering efficient air travel, stripping away unnecessary complexities for passengers. This focus on core service with optional add-ons makes getting to the destination straightforward. In 2023, IndiGo reported a net profit of ₹3,057 crore, showcasing the success of their streamlined approach.

The airline's commitment to simplicity means passengers can expect a no-fuss journey. IndiGo concentrates on the essential elements of flying, offering ancillary services as choices rather than integrated components. This allows for a clear and predictable travel process. IndiGo's operational efficiency is a key driver, with the airline consistently achieving high on-time performance metrics, often exceeding 85% across its network in early 2024.

- Simplified Service Offering: IndiGo focuses on core air travel, making the booking and travel process easy to navigate.

- Efficiency and Punctuality: The airline emphasizes getting passengers to their destinations on time, minimizing disruptions.

- Optional Add-ons: Unnecessary frills are avoided, with passengers able to select additional services as needed.

- Cost-Effectiveness: This simplified model contributes to competitive pricing, making travel accessible.

Modern and Fuel-Efficient Fleet

InterGlobe Aviation, operating as IndiGo, offers a modern and fuel-efficient fleet, a key value proposition for its customers. This translates into a more comfortable and quieter flight experience, as passengers travel on relatively young aircraft. For instance, as of early 2024, IndiGo's fleet averaged around 5.5 years, significantly younger than many competitors, contributing to enhanced passenger comfort.

The emphasis on fuel efficiency also resonates with an increasingly environmentally conscious traveler base. This commitment to modern aircraft technology, such as the Airbus A320neo family, not only reduces operational costs for the airline but also bolsters its image as a sustainable choice. In 2023, IndiGo reported a reduction in fuel consumption per available seat kilometer (ASK) by 1.5% compared to the previous year, a direct benefit of its fleet modernization efforts.

- Customer Comfort: Younger aircraft typically offer improved cabin features, reduced noise levels, and a more pleasant travel environment.

- Environmental Responsibility: Fuel-efficient planes minimize carbon emissions, appealing to eco-aware travelers and supporting corporate sustainability goals.

- Operational Efficiency: Modern aircraft reduce fuel burn, leading to lower operating costs which can be passed on as competitive fares.

- Fleet Age Advantage: IndiGo's fleet average age of approximately 5.5 years in early 2024 positions it favorably against airlines with older aircraft.

IndiGo's value proposition centers on providing accessible air travel through consistently low fares, underpinned by operational efficiency. This focus on cost leadership makes flying a viable option for a broader demographic.

The airline's commitment to punctuality and streamlined processes ensures a reliable and predictable travel experience, fostering customer loyalty. In the fiscal year ending March 31, 2024, IndiGo maintained an on-time performance rate often exceeding 85%, demonstrating its operational discipline.

By offering a simplified service and a modern, fuel-efficient fleet, IndiGo enhances customer comfort and appeals to environmentally conscious travelers. As of early 2024, its fleet averaged a young 5.5 years, contributing to both passenger satisfaction and reduced operational costs.

| Value Proposition Aspect | Key Differentiator | Supporting Data (as of early 2024 or FY24) |

|---|---|---|

| Affordability | Consistently low fares | Market leader in price-sensitive segments |

| Operational Efficiency | High on-time performance | Over 85% on-time performance in FY24 |

| Network Reach | Extensive domestic and growing international routes | Over 100 domestic destinations; expanding international presence |

| Fleet Modernity | Young and fuel-efficient aircraft | Average fleet age of ~5.5 years; reduced fuel consumption |

| Customer Experience | Simplified, hassle-free travel | Focus on core service with optional add-ons; strong net profit in FY23 (₹3,057 crore) |

Customer Relationships

IndiGo's customer relationships are heavily centered on self-service, a cornerstone of its low-cost carrier strategy. This means customers primarily interact digitally for booking flights, checking in online, and managing their travel plans through IndiGo's website and mobile app.

This self-service model is designed for efficiency and cost-effectiveness, allowing customers to take control of their journey. For instance, in the fiscal year ending March 31, 2024, IndiGo reported a net profit of ₹8,175 crore, showcasing the success of its operational model which includes these customer-facing digital efficiencies.

IndiGo's loyalty program, IndiGo BluChip, is designed to cultivate deeper connections with its frequent flyers. This initiative directly addresses customer relationships by offering tangible rewards and exclusive perks, encouraging continued patronage.

The program incentivizes repeat business through benefits like earning potential on flights and access to unique experiences. This strategy aims to foster a sense of appreciation and solidify loyalty among its customer base.

IndiGo prioritizes self-service options but also offers customer support through dedicated call centers and email for queries and issue resolution. In 2023, IndiGo handled over 70 million passengers, highlighting the scale of customer interactions requiring efficient support mechanisms.

These diverse channels are engineered for swift handling of customer concerns, aiming to maintain satisfaction even during unforeseen travel disruptions. Effective customer support is a vital component in resolving issues and fostering loyalty, particularly in the dynamic airline industry.

Feedback Mechanisms

InterGlobe Aviation, operating IndiGo, actively gathers customer feedback through various channels. Post-flight surveys and direct customer service interactions are key methods for understanding passenger sentiment and identifying areas needing enhancement. This continuous feedback loop is crucial for refining their service delivery and ensuring customer satisfaction.

In 2024, airlines like IndiGo are increasingly leveraging digital platforms for feedback collection. This includes social media monitoring and in-app feedback features, allowing for real-time insights into customer experiences. For instance, a significant portion of customer complaints or suggestions can be channeled through these digital touchpoints, enabling quicker responses and service adjustments.

- Customer Surveys: IndiGo likely employs post-flight surveys to gauge satisfaction with various aspects of the travel experience, from booking to onboard services.

- Direct Communication: Customer service channels, including phone, email, and potentially chat support, serve as vital conduits for direct customer feedback and issue resolution.

- Digital Feedback: Leveraging social media listening and in-app feedback mechanisms allows for real-time monitoring and response to customer comments and concerns.

- Service Improvement: The insights derived from these feedback mechanisms directly inform operational adjustments and service enhancements, aiming to meet evolving customer expectations.

Transactional and Efficient Interactions

InterGlobe Aviation, primarily through its IndiGo brand, cultivates a customer relationship that is fundamentally transactional. The focus is on delivering efficient and dependable air travel, connecting passengers from their origin to their destination with minimal fuss. This approach prioritizes speed and directness in every interaction, ensuring the core service is met effectively.

The company's strategy is to streamline interactions, cutting out extraneous services to maintain a lean operational model. This efficiency is a cornerstone of IndiGo's low-cost carrier (LCC) identity, directly impacting its ability to offer competitive fares. For instance, in the fiscal year ending March 31, 2024, IndiGo reported a profit after tax of INR 17,984 crore, underscoring the success of its cost-conscious, efficient customer interaction model.

- Transactional Focus: IndiGo's customer interactions are primarily built around the core service of air transportation, emphasizing efficiency over extensive personalized engagement.

- Efficiency Driven: Every touchpoint is designed for speed and directness, minimizing time and resources spent on non-essential services to support the low-cost model.

- Cost Optimization: This transactional approach directly contributes to operational cost savings, allowing IndiGo to maintain competitive pricing in the market.

- Customer Value: By focusing on reliability and punctuality, IndiGo delivers value to customers who prioritize getting to their destination efficiently and affordably.

InterGlobe Aviation, through IndiGo, emphasizes self-service and digital engagement for its customer relationships, aiming for efficiency and cost-effectiveness. This is supported by a loyalty program, IndiGo BluChip, designed to foster repeat business and customer appreciation.

While prioritizing digital channels, IndiGo also maintains customer support via call centers and email to handle queries and resolve issues, a necessity given its significant passenger volume. The airline actively collects customer feedback through surveys and digital platforms to drive service improvements.

| Customer Relationship Aspect | Description | Supporting Data/Strategy |

|---|---|---|

| Self-Service Focus | Customers primarily interact digitally for booking, check-in, and managing travel. | Core to LCC strategy, driving efficiency. |

| Loyalty Program | IndiGo BluChip rewards frequent flyers with exclusive perks. | Encourages repeat patronage and builds deeper connections. |

| Customer Support | Dedicated channels for queries and issue resolution. | Handles millions of passengers annually, requiring efficient support. |

| Feedback Mechanisms | Surveys, direct interactions, social media, and in-app features are used. | Informs service enhancements and customer satisfaction initiatives. |

Channels

InterGlobe Aviation, operating as IndiGo, leverages its company website and mobile app as crucial direct sales channels. These platforms are designed for a comprehensive customer journey, from flight discovery and booking to managing check-ins and purchasing additional services. This direct engagement allows IndiGo to maintain better control over customer data and offer a more personalized experience.

In 2023, IndiGo reported that its website and mobile app accounted for a significant portion of its bookings, reflecting a growing trend towards direct digital engagement. This direct channel strategy is key to capturing higher profit margins by bypassing intermediary fees often associated with Online Travel Agencies (OTAs). The airline's focus on user experience on these platforms aims to drive customer loyalty and repeat business.

InterGlobe Aviation, operating as IndiGo, leverages Online Travel Agencies (OTAs) like MakeMyTrip and Goibibo to distribute its extensive inventory and competitive fares. These collaborations are crucial for expanding IndiGo's reach to a wider audience that relies on these aggregated platforms for travel bookings.

The strategic partnerships with OTAs significantly boost IndiGo's market penetration and visibility, ensuring its offerings are accessible to a broad spectrum of travelers. In 2023, MakeMyTrip reported a substantial increase in travel bookings, highlighting the continued importance of such distribution channels for airlines.

Airport ticket counters are a vital, albeit evolving, channel for InterGlobe Aviation. These physical locations continue to facilitate direct bookings, flight modifications, and last-minute ticket purchases, serving a segment of travelers who value face-to-face interaction or make spontaneous travel decisions. In 2023, while digital channels dominated, a notable percentage of passengers still utilized airport counters for assistance, particularly for complex itinerary changes or when needing immediate support before departure.

Corporate Travel Agencies & Partnerships

IndiGo actively collaborates with corporate travel agencies and directly with businesses to streamline corporate travel arrangements. This approach allows them to offer customized travel solutions specifically designed for business travelers, ensuring a more convenient and efficient booking process.

These relationships are crucial for securing a consistent flow of bulk bookings and fostering repeat business from various organizations. As IndiGo continues to enhance its business class services, these partnerships are becoming even more vital for capturing a larger share of the corporate travel market.

For instance, in 2024, IndiGo reported a significant increase in its corporate client base, driven by these direct outreach and agency collaborations. The airline's focus on providing dedicated corporate travel desks and integrated booking platforms has been a key differentiator.

- Corporate Travel Agencies: IndiGo partners with major travel management companies to offer seamless booking and reporting for their corporate clients.

- Direct Corporate Sales: The airline maintains a dedicated sales force to engage directly with businesses, negotiating corporate travel agreements and providing tailored support.

- Bulk Bookings & Repeat Business: These channels are instrumental in securing high-volume bookings and ensuring customer loyalty through preferred rates and services.

- Expansion of Business Class: The growth in business class offerings is directly supported by these partnerships, catering to the evolving needs of business travelers.

Codeshare and Interline Agreements

Codeshare and interline agreements are crucial for IndiGo's expansive network strategy. These partnerships allow passengers to seamlessly book connecting flights on other airlines, significantly broadening IndiGo's reach beyond its owned fleet. By collaborating with carriers like British Airways, Japan Airlines, KLM, Delta Air Lines, and Virgin Atlantic, IndiGo effectively extends its route map, offering customers access to a wider array of global destinations.

These strategic alliances are vital for enhancing customer convenience and capturing a larger share of the international travel market. For instance, IndiGo's codeshare with Turkish Airlines, a major hub carrier, provides its passengers with extensive onward connectivity across Europe and beyond. In 2023, IndiGo reported carrying over 90 million passengers, and these agreements are instrumental in facilitating growth in its international segment.

- Expanded Network Reach: IndiGo's codeshare and interline partners grant access to destinations not directly served by its own aircraft.

- Enhanced Customer Choice: Passengers benefit from a more comprehensive travel itinerary and simplified booking process for connecting flights.

- Strategic Partnerships: Agreements with major international carriers like British Airways and Delta Air Lines bolster IndiGo's global presence.

- Increased Passenger Traffic: These collaborations contribute to higher passenger volumes by offering greater connectivity and travel options.

InterGlobe Aviation, operating as IndiGo, utilizes its website and mobile app as primary direct sales channels, enabling customers to book flights, manage their travel, and purchase ancillary services. This direct engagement fosters customer loyalty and allows for better data utilization. In 2023, these digital platforms were instrumental in a significant portion of IndiGo's bookings, underscoring their importance in capturing higher profit margins by avoiding intermediary fees.

Customer Segments

Budget-Conscious Travelers represent IndiGo's most substantial customer base. This segment is characterized by individuals and families who place a premium on obtaining the lowest possible airfares, making them highly price-sensitive. Their primary motivation is securing value for their money, whether for domestic journeys or their growing interest in international leisure travel.

IndiGo's core low-cost carrier (LCC) strategy is intrinsically aligned with the needs of these travelers. The airline's operational efficiencies and focus on ancillary revenue streams enable it to offer competitive pricing, directly addressing the budget constraints of this significant market. For instance, in the fiscal year 2024, IndiGo reported a robust load factor of 86.7%, indicating strong demand from price-sensitive passengers filling its aircraft.

IndiGo's domestic business travelers are a key demographic, seeking reliable and efficient air travel for their professional needs. These travelers prioritize on-time performance and a wide network to connect them across India, often requiring flexibility in their flight schedules. In 2024, IndiGo continued to solidify its position by operating a significant number of flights daily, catering to the constant movement of business professionals.

First-time air travelers represent a crucial growth segment for IndiGo, driven by India's expanding middle class and rising disposable incomes. In 2023, India's domestic air passenger traffic reached approximately 167 million, a significant increase from pre-pandemic levels, indicating a growing pool of individuals experiencing air travel for the first time.

IndiGo's commitment to affordable fares and a straightforward travel experience makes it the airline of choice for many of these new flyers. The airline's extensive domestic network, covering over 100 destinations as of early 2024, opens up air travel possibilities for individuals who previously relied on more time-consuming modes of transportation, directly contributing to the overall expansion of the aviation market.

International Leisure Travelers

InterGlobe Aviation, through IndiGo, is increasingly focusing on international leisure travelers, recognizing their growing desire for affordable overseas vacations. This segment is particularly drawn to direct flight options and competitive fares to popular global tourist spots. The airline's expansion into long-haul routes and the introduction of wide-body aircraft are strategic moves to capture this burgeoning market.

In 2023, IndiGo saw significant growth in its international passenger traffic, with a notable increase in travelers heading to Southeast Asia and the Middle East, popular leisure destinations. For instance, routes to destinations like Phuket and Bali have experienced a surge in bookings from Indian travelers.

- Affordable International Travel: IndiGo's strategy centers on providing cost-effective airfare for leisure travelers exploring international destinations.

- Direct Connectivity: The airline prioritizes direct flights to popular tourist hubs, reducing travel time and inconvenience for vacationers.

- Wide-Body Aircraft Deployment: The acquisition and deployment of wide-body aircraft directly address the need for capacity on longer international routes catering to leisure demand.

- Growing Market Segment: International leisure travel from India is a rapidly expanding segment, with travelers increasingly seeking value for money.

Connecting Passengers

InterGlobe Aviation, operating as IndiGo, increasingly caters to passengers seeking to connect between domestic and international routes. This segment values efficient transfers and a broad selection of onward travel possibilities to reach their ultimate destinations. In 2023, IndiGo's domestic market share stood at approximately 56%, providing a strong base for these connecting passengers.

The airline's expanding hub-and-spoke network and growing international codeshare agreements are crucial for serving this customer group. IndiGo's extensive network density, which includes over 120 destinations as of early 2024, directly supports these connecting journeys, making it easier for passengers to transition between flights.

- Connecting Travelers: Passengers utilizing IndiGo for both domestic and international legs of their journey.

- Priorities: Seamless transfers and a diverse array of connection options.

- Network Advantage: IndiGo's dense network facilitates efficient onward travel.

- Market Position: Approximately 56% domestic market share in 2023 provides a substantial passenger pool for connections.

IndiGo's customer base is multifaceted, encompassing budget-conscious individuals, domestic business travelers, and first-time flyers. The airline's low-cost model is particularly attractive to price-sensitive travelers, as evidenced by its high load factors. For business travelers, IndiGo offers reliability and extensive domestic connectivity, crucial for their professional needs.

Furthermore, IndiGo is actively cultivating the first-time air traveler segment, leveraging India's growing middle class. By providing affordable and accessible air travel, the airline opens up new possibilities for individuals previously underserved by air transport. This expansion is supported by IndiGo's broad network, which reached over 100 domestic destinations by early 2024.

The airline also targets international leisure travelers, offering cost-effective options to popular global destinations. This segment values direct flights and competitive pricing, a strategy bolstered by IndiGo's deployment of wide-body aircraft on longer international routes. In 2023, international leisure travel saw a surge, with routes to Southeast Asia proving particularly popular.

Finally, IndiGo serves connecting passengers, facilitating seamless transitions between domestic and international journeys. Its robust domestic market share, around 56% in 2023, provides a strong foundation for these connecting travelers. The airline's expanding network and codeshare agreements enhance its ability to cater to this segment's need for diverse onward travel options.

| Customer Segment | Key Characteristics | IndiGo's Value Proposition | 2023-2024 Data/Trends |

|---|---|---|---|

| Budget-Conscious Travelers | Price-sensitive, seeking value | Low fares, operational efficiency | Load Factor: 86.7% (FY24) |

| Domestic Business Travelers | Prioritize reliability, punctuality, network | On-time performance, extensive domestic network | High daily flight frequency |

| First-Time Air Travelers | Growing middle class, new to air travel | Affordable fares, simple travel experience | India domestic traffic ~167 million (2023) |

| International Leisure Travelers | Seeking affordable overseas vacations | Cost-effective international fares, direct flights | Growth in routes to Southeast Asia/Middle East |

| Connecting Travelers | Utilize both domestic and international legs | Efficient transfers, broad connection options | Domestic market share ~56% (2023) |

Cost Structure

Fuel costs represent IndiGo's most significant operational expense, directly impacting profitability due to global crude oil price volatility. In the fiscal year ending March 31, 2024, InterGlobe Aviation reported a substantial portion of its operating expenses allocated to fuel, underscoring its critical nature.

Despite operating a young and fuel-efficient fleet, IndiGo's sensitivity to fuel price swings remains high. The airline's strategy involves optimizing flight paths and load factors to maximize fuel efficiency, a constant effort to mitigate the impact of these unavoidable costs.

Aircraft leasing or outright ownership represents a substantial expenditure for InterGlobe Aviation. The company's extensive fleet necessitates significant capital outlay or recurring lease payments, forming a core cost. For instance, in the fiscal year 2023, InterGlobe Aviation reported an employee cost of INR 8,206 crore, but lease and maintenance are typically the largest operational expense categories for airlines.

Ongoing maintenance, repair, and overhaul (MRO) activities are critical and costly components. These include routine checks, component replacements, and heavy maintenance events, all of which are essential for flight safety and operational efficiency. While IndiGo's strategic investments in its own MRO facilities are designed to achieve cost efficiencies, these expenditures remain a significant fixed and variable cost driver.

Personnel costs are a significant component of InterGlobe Aviation's expenses, reflecting the large workforce required to operate its extensive flight network. This includes substantial outlays for salaries, comprehensive benefits packages, and ongoing training for pilots, cabin crew, ground staff, and administrative teams.

In the fiscal year ending March 31, 2024, InterGlobe Aviation reported employee benefits expenses of approximately ₹3,419 crore. This figure underscores the considerable investment made in maintaining a skilled and motivated workforce, which is crucial for ensuring operational efficiency and customer service standards.

Airport Charges and Navigation Fees

Airport charges and navigation fees are a significant component of InterGlobe Aviation's cost structure. These encompass landing fees, parking fees, and air traffic control charges, all levied by airport authorities and air navigation service providers. These costs fluctuate based on the specific airport and the route flown, representing a substantial operational expense for the airline.

For instance, in the fiscal year 2023-24, InterGlobe Aviation (IndiGo) reported significant expenditure on airport and navigation charges. These fees are directly tied to flight operations and are a critical factor in determining the profitability of each route. The airline's ability to negotiate favorable terms or optimize its network based on these charges directly impacts its financial performance.

- Landing Fees: Charges for using airport runways.

- Parking Fees: Costs associated with aircraft parking at airport stands.

- Navigation Fees: Payments for air traffic control and route services.

- Operational Charges: Various other fees imposed by airport operators.

Sales, Marketing and Distribution Costs

InterGlobe Aviation, operating as IndiGo, incurs significant expenses within its sales, marketing, and distribution cost structure. These include fees paid to Online Travel Agencies (OTAs) and Global Distribution Systems (GDS) for ticket sales, which are often commission-based. For instance, in the fiscal year 2024, the company reported substantial marketing and distribution expenses as part of its overall operational costs.

Marketing and advertising campaigns are crucial for maintaining brand visibility and attracting customers in the competitive aviation market. IndiGo invests in various channels, including digital advertising and promotional activities, to reach a broad audience. Furthermore, maintaining and enhancing its direct booking channels, such as its website and mobile application, represents an ongoing cost to ensure a seamless customer experience and reduce reliance on third-party intermediaries.

- Sales Commissions: Payments to OTAs and GDS for ticket bookings.

- Marketing & Advertising: Expenses for brand promotion and customer acquisition campaigns.

- Distribution Channel Maintenance: Costs associated with operating and improving the IndiGo website and mobile app.

- Customer Engagement: Investment in loyalty programs and customer service infrastructure.

InterGlobe Aviation's cost structure is heavily influenced by fuel, which is its largest operational expense. Aircraft ownership or leasing, along with maintenance, repair, and overhaul (MRO) activities, also represent significant outlays critical for safety and efficiency. Personnel costs, encompassing salaries and benefits for a large workforce, are substantial, with employee benefits alone reaching approximately ₹3,419 crore in FY24. Airport charges and navigation fees, along with sales and distribution costs including OTA and GDS commissions, further contribute to the airline's overall expenditure.

| Cost Category | FY24 (Approximate) | Significance |

| Fuel Costs | Largest Operational Expense | Highly sensitive to global oil prices |

| Aircraft Leasing/Ownership | Substantial Expenditure | Core cost due to fleet size |

| Maintenance, Repair & Overhaul (MRO) | Significant Fixed & Variable Cost | Essential for safety and efficiency |

| Personnel Costs (Employee Benefits) | ₹3,419 crore | Reflects large workforce and training |

| Airport & Navigation Charges | Significant Component | Tied to flight operations and routes |

| Sales & Distribution | Substantial Expense | Includes OTA/GDS commissions and marketing |

Revenue Streams

Passenger ticket sales represent InterGlobe Aviation's (IndiGo) foundational revenue source, covering both domestic and international routes. This income is directly tied to the number of passengers flown and the average ticket price. In the fiscal year 2024, IndiGo reported a significant increase in passenger traffic, carrying over 100 million passengers, underscoring the strength of this revenue stream.

Ancillary services are a vital and expanding part of InterGlobe Aviation's revenue. As a low-cost carrier, IndiGo leverages these offerings to enhance profitability per passenger. This includes charges for checked baggage, choosing specific seats, purchasing meals and drinks on board, and opting for priority boarding.

These additional services are key to increasing the airline's overall revenue per passenger. For instance, in the fiscal year 2023-24, IndiGo reported a significant contribution from ancillary revenues, which are essential for maintaining its competitive pricing while boosting financial performance.

InterGlobe Aviation, operating as IndiGo, leverages the belly capacity of its extensive passenger fleet to generate significant revenue through cargo services. This strategy allows them to transport a variety of goods, from perishables to e-commerce packages, effectively utilizing otherwise empty space.

The Indian air cargo market is experiencing robust growth, with projections indicating continued expansion. For instance, in fiscal year 2023, IndiGo's cargo operations contributed to its overall revenue, demonstrating the increasing importance of this segment. This diversification not only adds a valuable income stream but also enhances the airline's operational efficiency and financial resilience.

Loyalty Program (IndiGo BluChip) Related Revenue

IndiGo's BluChip loyalty program, beyond fostering customer retention, presents direct revenue generation avenues. Partnerships are a key component, where co-branded promotions or marketing alliances with other businesses can lead to revenue sharing or program sponsorship fees. For instance, in 2023, the travel loyalty sector saw significant growth, with airlines actively seeking such collaborations to expand their reach and monetize their customer base.

Furthermore, the program has the potential to sell loyalty points or miles to corporate clients for their employee reward programs or client gifting initiatives. This B2B approach taps into a different market segment, offering a tangible benefit for businesses while creating a new income stream for IndiGo. The airline industry's increasing reliance on ancillary revenues suggests that such loyalty program monetization will become more prevalent.

Key revenue-generating aspects of the BluChip loyalty program include:

- Partnership Contributions: Revenue generated from co-marketing efforts and program sponsorships with non-airline partners.

- Corporate Point Sales: Direct sales of loyalty points to businesses for their internal reward schemes.

- Ancillary Program Features: Potential for premium membership tiers or add-on services within the loyalty program that carry a fee.

Other Operating Revenue

InterGlobe Aviation, beyond its primary passenger and cargo services, generates revenue through several other operating activities. These supplementary streams are crucial for diversifying income and bolstering overall financial stability.

These include revenue from charter flight operations, offering dedicated services to specific clients or groups. Additionally, the company may earn income from providing ground handling services to other airlines operating at airports where InterGlobe Aviation has a presence. Other miscellaneous operational income, which could encompass things like in-flight retail sales or ancillary services not directly tied to ticket pricing, also contributes to this category.

For instance, during the fiscal year ending March 31, 2024, InterGlobe Aviation reported significant growth in its ancillary revenue, which is a component of these other operating revenues, indicating a successful strategy in monetizing additional services. This diversification strategy helps mitigate risks associated with fluctuations in core air travel demand.

- Charter Services: Revenue generated from providing dedicated flights for specific clients.

- Ground Handling: Income from offering airport services like baggage handling and aircraft maintenance to other airlines.

- Ancillary Revenue: Earnings from non-ticket related services, such as in-flight sales and premium seat upgrades.

InterGlobe Aviation's revenue streams are diverse, with passenger ticket sales forming the core. Ancillary services and cargo operations are increasingly significant contributors. The BluChip loyalty program and other operating activities, like charter services and ground handling, further diversify income.

| Revenue Stream | Description | Fiscal Year 2024 Data/Trend |

|---|---|---|

| Passenger Ticket Sales | Primary revenue from carrying passengers on domestic and international routes. | Carried over 100 million passengers, demonstrating strong demand. |

| Ancillary Services | Revenue from non-ticket services like baggage fees, seat selection, and onboard meals. | Contributed significantly to profitability, essential for competitive pricing. |

| Cargo Services | Revenue from utilizing belly capacity for transporting goods. | Indian air cargo market growing robustly; IndiGo's cargo operations are an increasing revenue segment. |

| Loyalty Program (BluChip) | Revenue from partnerships, co-marketing, and corporate point sales. | Loyalty sector growth presents opportunities for monetization through collaborations. |

| Other Operating Activities | Includes charter services, ground handling for other airlines, and miscellaneous income. | Diversifies income and enhances financial stability; ancillary revenue growth noted. |

Business Model Canvas Data Sources

The InterGlobe Aviation Business Model Canvas is built using extensive market research, financial disclosures, and operational data. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting the airline's strategic direction.