Getty Realty PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Getty Realty Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Getty Realty's strategic landscape. Our expert-crafted PESTLE analysis provides actionable intelligence to navigate market complexities and identify future opportunities. Gain a competitive edge by understanding these external forces. Download the full version now for immediate, in-depth insights.

Political factors

Getty Realty's business is heavily influenced by government regulations and zoning laws at federal, state, and local levels, particularly concerning convenience stores and gasoline stations. These rules dictate everything from property development and acquisition to the day-to-day operations of its tenants, impacting Getty's potential rental income and property valuations.

For instance, in 2024, many municipalities are reviewing or enacting stricter zoning ordinances related to the placement of new fuel stations and convenience stores, especially in urban areas. These changes can limit expansion opportunities and increase compliance costs for both Getty and its lessees. Furthermore, evolving environmental regulations, such as those concerning underground storage tanks or emissions standards, can necessitate costly upgrades to existing properties, directly affecting Getty's capital expenditure plans.

Government policies encouraging renewable energy and electric vehicles (EVs) present a dual-edged sword for Getty Realty. A swift move away from fossil fuels might decrease demand for conventional gas stations, but initiatives supporting EV charging infrastructure at current retail locations could unlock new income and investment avenues for the company.

The Biden administration's National Electric Vehicle Infrastructure (NEVI) Formula program, allocating $5 billion to address charging network deficiencies, could prove beneficial for Getty Realty's properties that can be adapted for EV charging. This program aims to establish a nationwide EV charging network, potentially creating new revenue streams for sites equipped with charging stations.

Changes in federal and state tax laws directly impact Getty Realty's financial health and how attractive it is to investors. For instance, the recent 'One Big Beautiful Bill Act' (OBBBA), enacted in July 2025, made the 20% deduction for qualified REIT dividends a permanent feature, a positive for those holding REIT shares.

Further bolstering REITs, the law also allows them to hold a greater value of taxable REIT subsidiary (TRS) securities. Starting with tax years after December 31, 2025, this limit will rise from 20% to 25%, potentially giving Getty Realty more room to maneuver its operations and investment strategies.

Infrastructure Spending

Government investment in infrastructure, like roads and transportation networks, directly impacts the strategic value and accessibility of Getty Realty's properties. For instance, the U.S. Department of Transportation's Federal Highway Administration allocated $66.4 billion for fiscal year 2024, a significant figure that can reshape traffic patterns and property desirability.

Improved infrastructure, such as new highway expansions or better road maintenance, can enhance visibility and accessibility for Getty Realty's convenience stores and gas stations, potentially driving increased customer traffic and tenant sales. This is particularly relevant as consumer spending in convenience stores continues to grow, with the National Association of Convenience Stores reporting over $900 billion in sales in 2023.

Conversely, infrastructure projects can also present challenges. Road closures or the creation of bypasses, while sometimes necessary for development, could negatively affect the performance of specific Getty Realty sites by diverting traffic away from them. Monitoring these shifts is crucial for property management and leasing strategies.

Key impacts of infrastructure spending include:

- Increased Property Accessibility: Enhanced road networks improve access to retail locations.

- Shifts in Traffic Flow: New construction or bypasses can alter customer access patterns.

- Boosted Tenant Sales: Better visibility and easier access often correlate with higher sales for tenants.

- Property Valuation: Proximity to well-maintained and improved infrastructure can increase property values.

Political Stability and Trade Policies

Political stability is a cornerstone for real estate investment, and the United States, where Getty Realty primarily operates, has maintained a generally stable political climate. This stability offers a predictable environment, crucial for long-term capital deployment in property development and management. For instance, the U.S. experienced a GDP growth of approximately 2.5% in 2024, indicating a healthy economic backdrop that supports real estate demand.

Trade policies, however, can introduce volatility. While specific impacts on Getty Realty are indirect, broad trade agreements or disputes influence material costs. For example, tariffs on steel or lumber, if implemented or increased, could raise construction expenses for new projects or renovations. The U.S. continued to engage in various trade negotiations throughout 2024, aiming to balance economic interests and supply chain resilience.

The broader economic climate, shaped by political decisions, directly impacts consumer confidence and spending, which in turn affects commercial and residential real estate demand. A stable political landscape, coupled with supportive economic policies, generally encourages investment and development. For example, government infrastructure spending initiatives announced in 2024 could indirectly benefit real estate markets by improving accessibility and desirability of certain locations.

- U.S. GDP growth projected around 2.5% for 2024, fostering a stable economic foundation for real estate.

- Ongoing trade policy discussions in 2024 highlight potential impacts on construction material costs.

- Government infrastructure projects can enhance property values and development opportunities.

Government regulations and zoning laws significantly shape Getty Realty's operational landscape, influencing property development and tenant operations. Evolving environmental standards and policies promoting electric vehicles also present both challenges and opportunities for the company's portfolio.

Federal and state tax laws directly affect Getty Realty's financial health and investor appeal, with recent legislation in July 2025 making key REIT dividend deductions permanent and increasing limits on taxable REIT subsidiary holdings. Government investment in infrastructure, such as the $66.4 billion allocated by the Federal Highway Administration for fiscal year 2024, can enhance property accessibility and value.

The generally stable political climate in the U.S. provides a predictable environment for real estate investment, supported by a projected GDP growth of approximately 2.5% in 2024. However, trade policies and potential tariffs on construction materials in 2024 could impact development costs.

| Factor | 2024/2025 Impact | Getty Realty Relevance |

|---|---|---|

| Zoning & Environmental Regs | Stricter ordinances, evolving emissions standards | Limits expansion, increases compliance costs, necessitates property upgrades |

| EV Infrastructure Policies | NEVI program ($5B), EV charging network development | Potential new revenue streams for adapted properties |

| Tax Laws (REITs) | Permanent 20% dividend deduction, increased TRS limits (to 25% after 2025) | Enhances investor attractiveness, provides operational flexibility |

| Infrastructure Spending | $66.4B FHWA allocation (FY24), road improvements | Improves property accessibility, visibility, and potential tenant sales |

What is included in the product

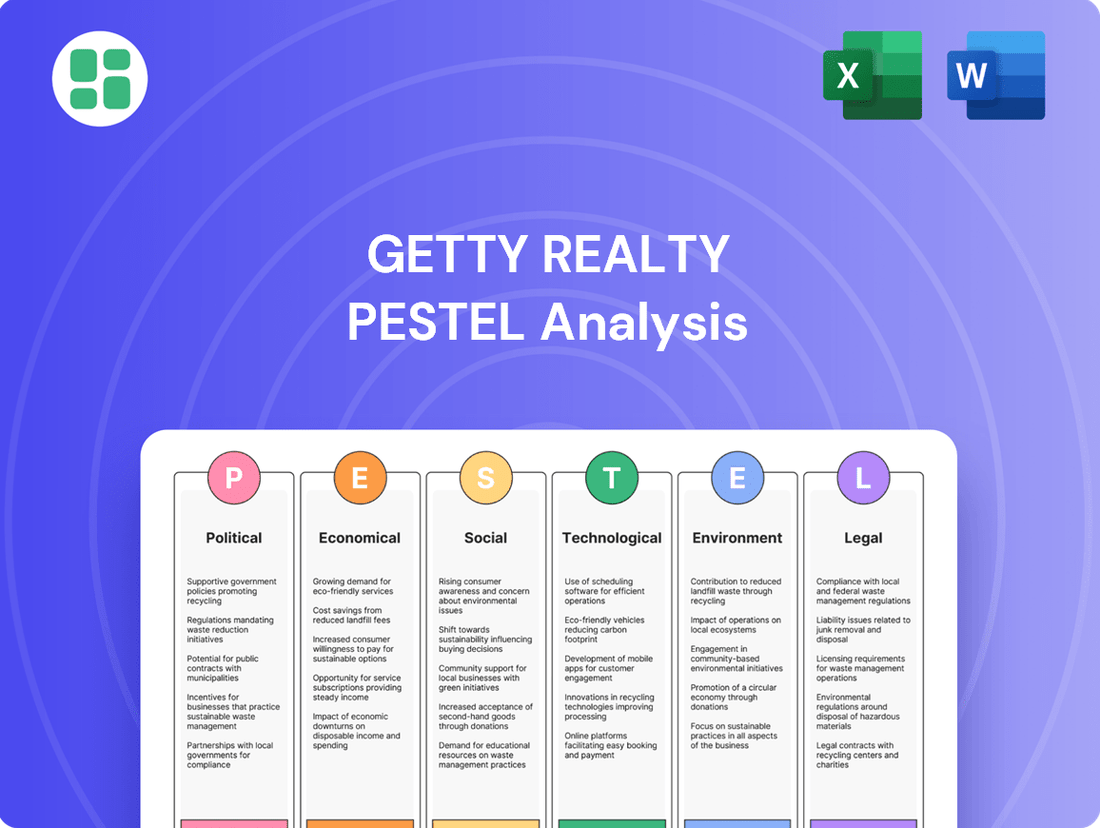

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Getty Realty, offering a comprehensive view of its operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear understanding of external factors impacting Getty Realty.

Helps support discussions on external risk and market positioning during planning sessions, enabling proactive strategy development for Getty Realty.

Economic factors

Interest rates are a major factor for Getty Realty, affecting how much it costs to borrow money and how much its properties are worth. As a Real Estate Investment Trust (REIT), Getty needs financing for buying and building, so rising interest rates can make borrowing more expensive, potentially squeezing profits and making sale-leaseback deals less appealing.

While the Federal Reserve is anticipated to lower the federal funds rate in 2025, longer-term interest rates, which have a more direct impact on real estate, have seen an upward trend. For instance, the 10-year Treasury yield, a benchmark for mortgage rates, hovered around 4.2% in early 2024, a notable increase from its lows in previous years, which directly influences Getty's financing costs and property valuations.

Inflation directly impacts Getty Realty by influencing the operating costs for its tenants, potentially limiting the company's ability to raise rents. Higher inflation can squeeze tenant margins, making it harder for them to absorb rent increases.

Consumer spending is a critical factor, as it directly ties into the sales performance of Getty's tenants, particularly convenience stores and gas stations. Trends in disposable income and the cost of fuel significantly shape how much consumers spend at these locations, affecting their capacity to meet rental obligations.

In 2024, while convenience store sales saw some dip compared to the previous year, the sector demonstrated resilience. Average unit prices increased by 4.1%, contributing to sustained profitability for these businesses, which bodes well for their rental payments to Getty.

The health of the commercial real estate market, especially for retail and automotive properties, significantly influences Getty Realty's strategic decisions regarding buying and selling assets. A robust market can support higher property values and more active transaction environments, aligning with the company's growth objectives.

Projections indicate the U.S. commercial real estate sector is poised for a recovery in 2025. This anticipated upturn is expected to be fueled by a soft economic landing, a closing gap between public and private property valuations, and a general increase in property sales activity.

Fuel Price Volatility

Fluctuations in fuel prices directly influence consumer spending habits and the operational profitability of Getty Realty's tenants, particularly those operating gasoline stations. While Getty, as a net-lease Real Estate Investment Trust (REIT), is generally shielded from direct operational risks, persistent high or unpredictable fuel costs can indirectly impact the financial stability of its lessees. For instance, data from the U.S. Energy Information Administration (EIA) in early 2024 indicated that average gasoline prices saw significant swings, impacting household budgets and discretionary spending. This consumer behavior is increasingly tied to fuel costs, with studies showing a pronounced positive correlation between gasoline price surges and increased customer traffic at convenience stores located at gas stations, suggesting a short-term boost but potential long-term strain on overall retail sales if prices remain elevated.

The impact of fuel price volatility on Getty Realty's tenant base can be multifaceted:

- Tenant Profitability: Higher fuel costs increase operating expenses for tenants, potentially reducing their net operating income and their ability to meet lease obligations.

- Consumer Behavior Shifts: Consumers may reduce non-essential travel or shift to more fuel-efficient vehicles, impacting the volume of fuel sold and, consequently, in-store purchases at convenience stores.

- Lease Renewals and Rent Adjustments: Prolonged periods of fuel price instability could lead to tenant requests for rent concessions or affect negotiations for lease renewals, impacting Getty's rental income.

Labor Market Conditions

Labor market conditions are a critical factor for Getty Realty's tenants, particularly convenience store and gasoline station operators. The availability and cost of labor directly influence their operational efficiency and profitability. A constricted labor market, characterized by high demand for workers and increasing wage pressures, can significantly elevate operating expenses for these businesses. This, in turn, may negatively impact their ability to cover rent payments, a key concern for Getty Realty.

Indeed, the challenge of hiring and retaining a necessary workforce was pinpointed as the foremost business obstacle for convenience stores in 2025. This persistent issue underscores the sensitivity of Getty Realty's tenant base to labor market dynamics. For instance, the U.S. Bureau of Labor Statistics reported that average hourly earnings for non-supervisory employees in the retail trade sector, which includes convenience stores, saw a notable increase through 2024 and into early 2025, adding to tenant cost structures.

- Labor Shortages: Many convenience store and gas station operators faced significant difficulties in finding and keeping staff throughout 2024 and into 2025, directly impacting service levels and operational hours.

- Wage Inflation: To attract and retain employees in a competitive environment, businesses were compelled to offer higher wages, increasing their overall labor costs. Average hourly wages for retail workers saw a steady climb.

- Operational Strain: The inability to adequately staff locations led to increased workload for existing employees, potential burnout, and a negative impact on customer experience, all of which can affect revenue.

- Rent Coverage Concerns: Rising labor expenses squeeze profit margins for tenants, potentially reducing their capacity to meet rent obligations to Getty Realty, especially if sales don't keep pace.

Interest rate trends are pivotal for Getty Realty, influencing borrowing costs and property valuations. While the Federal Reserve is expected to lower rates in 2025, longer-term yields, crucial for real estate, have risen, with the 10-year Treasury yield around 4.2% in early 2024, impacting financing expenses.

Inflation poses a challenge by increasing tenant operating costs, potentially limiting Getty's ability to raise rents and affecting tenant profitability. Consumer spending, tied to disposable income and fuel costs, directly impacts sales at Getty's tenant locations, with convenience store sales showing resilience in 2024, aided by a 4.1% average unit price increase.

The commercial real estate market is anticipated to recover in 2025, driven by a soft economic landing and increased property sales activity. Labor market tightness, with rising wages and hiring difficulties, remains a key concern for Getty's tenants, as evidenced by average hourly earnings increases for retail workers through 2024-2025.

| Economic Factor | Impact on Getty Realty | Relevant Data (2024-2025) |

|---|---|---|

| Interest Rates | Affects borrowing costs and property valuations. Higher rates increase financing expenses. | 10-year Treasury yield ~4.2% (early 2024). Fed expected to lower rates in 2025. |

| Inflation | Increases tenant operating costs, potentially limiting rent increases and impacting tenant profitability. | Inflationary pressures persist, affecting consumer purchasing power. |

| Consumer Spending | Directly impacts sales at Getty's tenant locations (convenience stores, gas stations). | Convenience store average unit prices increased 4.1% in 2024, showing sector resilience. |

| Labor Market | Tight labor market and wage inflation increase tenant operating expenses, potentially affecting rent payments. | Labor shortages and wage increases are key challenges for retail sector tenants. Average hourly earnings for retail workers rose through 2024-2025. |

Preview the Actual Deliverable

Getty Realty PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Getty Realty provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Getty Realty's market landscape, enabling informed strategic planning and risk mitigation.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis is designed to equip you with a thorough understanding of Getty Realty's operating environment.

Sociological factors

Consumer preferences are shifting away from just fuel and basic convenience items. There's a noticeable uptick in demand for healthier food choices, ready-to-eat meals, and a smoother, quicker shopping journey overall. This evolution is reshaping convenience stores into more appealing spots for quality, convenient food options.

The prepared food segment within convenience stores has seen substantial growth, reflecting this change. For instance, sales of prepared foods in U.S. convenience stores reached an estimated $25 billion in 2024, indicating a strong consumer appetite for these offerings. This trend highlights how these retailers are adapting to meet modern consumer needs for convenient, yet quality, meal solutions.

The accelerating consumer shift towards electric vehicles (EVs) signals a significant, long-term decline in demand for traditional gasoline. This societal trend directly impacts Getty Realty, as its properties, particularly those housing convenience stores or service stations, must adapt. Integrating EV charging infrastructure is becoming crucial for relevance and attracting a growing segment of eco-conscious consumers.

By 2024, EV sales in the United States were projected to reach over 1.5 million units, a substantial increase from previous years. This growing EV fleet creates a tangible need for charging solutions. Forward-thinking convenience store operators are already recognizing this, with many adding EV charging stations to draw in customers who prioritize sustainability and convenience, directly impacting foot traffic and revenue potential at Getty Realty's locations.

Consumers are increasingly prioritizing their health and wellness, driving demand for healthier options in convenience stores. This trend translates to a growing market for protein-rich snacks, fresh fruits and vegetables, and beverages fortified with beneficial ingredients. For instance, the global healthy snacks market was valued at approximately $117.2 billion in 2023 and is projected to grow significantly, indicating a substantial opportunity for retailers.

Getty Realty's tenants, particularly those operating convenience stores, will likely need to adapt their product assortments to align with these evolving consumer preferences. By stocking more "better-for-you" items, they can better capture in-store sales and cater to a health-conscious customer base. This strategic adjustment can enhance their competitive edge and overall profitability.

Demand for Convenience and Speed

The fundamental appeal of convenience stores, and by extension the properties leased by Getty Realty, hinges on speed and accessibility. Consumers increasingly prioritize quick, on-the-go transactions, driving demand for streamlined shopping journeys. This is evident in the growing adoption of self-checkout systems and the rise of mobile ordering platforms, aiming to minimize wait times.

Getty's leased properties must adapt to these evolving consumer expectations. Investments in technology and store layouts that facilitate faster customer throughput are crucial. For instance, the convenience store sector saw a significant boost in digital engagement, with mobile payment adoption rising. In 2024, it's projected that over 70% of convenience store transactions could involve some form of digital payment or loyalty program integration, directly impacting the operational efficiency of Getty's retail spaces.

- Speed as a Core Value: Consumers prioritize rapid transactions in convenience settings.

- Frictionless Experiences: Demand is high for self-checkout and mobile ordering options.

- Technological Adaptation: Getty's leased properties need to support these digital advancements.

- Digital Payment Growth: Projections indicate a significant increase in digital payment usage in 2024, impacting store functionality.

Community and Local Sourcing Preferences

Consumers increasingly favor businesses that actively contribute to their local economies and feature products sourced from nearby suppliers. This trend is particularly evident in the convenience store sector, where integrating local goods can build significant customer loyalty and a stronger community connection. For instance, a 2024 survey indicated that 65% of consumers are more likely to shop at a store that supports local producers.

This preference for local sourcing isn't just about community goodwill; it often aligns with growing environmental consciousness. Consumers are recognizing that shorter supply chains reduce carbon footprints. Getty Realty can capitalize on this by encouraging its tenants to explore partnerships with local farmers and artisans, a strategy that resonated with 72% of respondents in a 2025 consumer sentiment study regarding sustainability.

- Growing Consumer Demand: 65% of consumers in 2024 expressed a preference for businesses supporting local economies.

- Community Connection: Local sourcing fosters trust and a sense of belonging, potentially boosting foot traffic.

- Sustainability Alignment: Shorter supply chains appeal to environmentally conscious consumers, with 72% favoring this in 2025.

Societal shifts towards healthier lifestyles are significantly impacting convenience store offerings, pushing demand for fresh, nutritious options. Consumers are also increasingly conscious of environmental impact, favoring businesses that demonstrate sustainability and community support. This evolving consumer mindset necessitates that Getty Realty's leased properties adapt to offer more than just basic convenience.

The growing preference for local sourcing, with 65% of consumers in a 2024 survey indicating they're more likely to shop at stores supporting local producers, highlights a key sociological trend. This aligns with environmental concerns, as shorter supply chains reduce carbon footprints, a factor noted by 72% of consumers in a 2025 study on sustainability. Getty Realty's tenants need to integrate these values to attract and retain customers.

| Sociological Factor | Consumer Behavior Impact | Implication for Getty Realty Tenants |

|---|---|---|

| Health & Wellness Focus | Increased demand for fresh, healthy, and prepared foods. | Adapt product assortments to include "better-for-you" options. |

| Environmental Consciousness | Preference for businesses with sustainable practices and local sourcing. | Encourage tenants to partner with local suppliers and reduce supply chain footprints. |

| Demand for Speed & Convenience | Prioritization of quick, frictionless transactions and digital integration. | Invest in technology (e.g., self-checkout, mobile ordering) to enhance customer throughput. |

Technological factors

The accelerating adoption of electric vehicles (EVs) necessitates the integration of EV charging infrastructure into Getty Realty's retail properties. As of early 2025, EV sales continue to climb, with projections indicating they could represent over 30% of new vehicle sales in key markets by 2030, according to industry analysts.

This technological shift presents both a challenge and an opportunity for Getty Realty. While traditional fuel sales remain vital, failing to offer EV charging solutions could alienate a growing segment of consumers and impact property desirability. For instance, a recent survey found that 60% of EV owners consider charging availability a primary factor when choosing where to stop.

Technology is rapidly transforming convenience store operations for companies like Getty Realty. We're seeing a significant uptake in self-checkout kiosks, AI for managing inventory, and a wider array of digital payment options. These advancements are not just about modernizing; they directly impact efficiency and the customer experience.

For instance, the implementation of AI-powered inventory management can lead to more accurate stock levels, reducing waste and ensuring popular items are always available. This also opens doors for dynamic pricing strategies, allowing businesses to adjust prices based on demand or time of day, potentially boosting revenue. By 2024, the global retail automation market was projected to reach over $30 billion, highlighting the significant investment and adoption in these areas.

Data analytics is increasingly vital for convenience store and real estate operations, offering a competitive edge. Advanced analytics can pinpoint optimal locations for new Getty Realty sites, refine inventory levels to reduce waste, and create targeted loyalty programs that boost customer retention for tenants.

These data-driven insights also bolster loss prevention strategies, a critical area for convenience store profitability. For instance, by analyzing transaction data and security footage, Getty's tenants can identify patterns indicative of internal theft or shoplifting, leading to proactive measures that protect their bottom line.

The adoption of AI and machine learning in analytics is accelerating this trend. In 2024, a significant portion of retail businesses reported using AI for inventory forecasting and personalized marketing, with projections indicating further growth in the adoption of these technologies by 2025 to enhance operational efficiency and strategic planning.

Mobile Commerce and Loyalty Programs

Mobile commerce and sophisticated loyalty programs are increasingly vital for convenience stores to capture and keep customers. These digital tools provide personalized promotions and seamless reward management, directly boosting customer interaction. For instance, by late 2024, it's projected that mobile payment transactions will continue their upward trajectory, with a significant portion of consumers expecting loyalty program integration within their preferred retail apps.

These technologies foster deeper customer relationships by offering tailored discounts and making it effortless to track rewards, which in turn encourages more frequent visits. The convenience store sector saw mobile ordering and payment adoption accelerate significantly in recent years, with many chains reporting substantial increases in customer lifetime value for those engaging with their mobile platforms. By early 2025, the trend is expected to solidify, with an estimated 70% of convenience store shoppers preferring brands that offer a robust mobile loyalty experience.

- Enhanced Customer Engagement: Mobile apps allow for direct communication and personalized offers, increasing the likelihood of repeat business.

- Streamlined Loyalty Tracking: Customers can easily monitor their rewards and progress, removing friction from the loyalty process.

- Convenient Payment Options: Integration of mobile payment solutions within loyalty programs simplifies transactions and improves the overall customer experience.

- Data-Driven Personalization: Insights gained from app usage enable retailers to refine offers and marketing strategies for maximum impact.

Smart Store Solutions and IoT

Smart store solutions powered by the Internet of Things (IoT) are transforming convenience retail operations. These technologies enable real-time monitoring of critical aspects like temperature control for perishable goods, energy consumption, and inventory management. For a company like Getty Realty, which owns and manages retail properties, this means enhanced operational efficiency for its tenants.

The benefits are tangible. By proactively identifying potential equipment malfunctions or inefficiencies, operating costs can be significantly reduced. For instance, smart sensors can alert operators to deviations in refrigeration temperatures, preventing spoilage and associated financial losses. This also translates to improved energy efficiency, a key consideration for property owners aiming to lower utility expenses and enhance sustainability.

Looking ahead, the adoption of IoT in retail is expected to accelerate. Industry reports suggest the global IoT in retail market is projected to reach over $50 billion by 2025, indicating a strong trend towards these smart solutions. Specifically, smart store technologies are anticipated to see substantial growth, with investments in areas such as AI-powered inventory tracking and predictive maintenance becoming more prevalent.

- Real-time monitoring: IoT devices provide instant data on store conditions, from temperature to energy usage.

- Cost reduction: Proactive issue detection minimizes spoilage and optimizes energy consumption, lowering operating expenses.

- Enhanced efficiency: Streamlined inventory management and predictive maintenance improve overall store performance.

- Market growth: The IoT in retail sector is experiencing significant expansion, with smart store solutions at its forefront.

The integration of Electric Vehicle (EV) charging stations is becoming a necessity for retail properties like those owned by Getty Realty, driven by the rapid growth in EV adoption. By early 2025, EV sales continue to surge, with industry analysts projecting they could account for over 30% of new vehicle sales in major markets by 2030, underscoring the need for charging infrastructure to attract and retain customers.

Technological advancements are also revolutionizing convenience store operations, with AI for inventory management and self-checkout kiosks becoming more common. These innovations boost efficiency and customer experience, with the global retail automation market projected to exceed $30 billion by 2024, reflecting significant investment in these areas.

Data analytics, particularly powered by AI and machine learning, is crucial for strategic decision-making in real estate and retail. By 2025, a substantial number of retail businesses are expected to leverage AI for inventory forecasting and personalized marketing, enhancing operational efficiency and strategic planning.

Mobile commerce and integrated loyalty programs are key to customer engagement and retention. By late 2024, mobile payment transactions are expected to rise, with many consumers anticipating loyalty program integration within retail apps, as an estimated 70% of convenience store shoppers prefer brands with robust mobile loyalty experiences by early 2025.

| Technology Trend | Impact on Getty Realty | Adoption Rate/Projection (2024-2025) |

|---|---|---|

| EV Charging Infrastructure | Attracts EV-driving consumers, enhances property appeal. | EVs projected to be >30% of new sales by 2030; 60% of EV owners consider charging availability crucial. |

| AI & Automation in Retail | Improves operational efficiency for tenants, reduces waste. | Global retail automation market >$30 billion (2024); AI adoption for inventory forecasting and marketing growing. |

| Data Analytics & AI | Optimizes site selection, inventory, and customer loyalty programs. | Significant portion of retailers using AI for forecasting and personalization (2024); continued growth expected. |

| Mobile Commerce & Loyalty | Boosts customer interaction and lifetime value. | Mobile payment transactions rising; 70% of shoppers prefer brands with strong mobile loyalty (early 2025 projection). |

Legal factors

Getty Realty's portfolio, especially those properties with gasoline stations, navigates a complex web of environmental regulations. Key among these are rules governing underground storage tanks (USTs) and fuel emissions, which necessitate ongoing monitoring and potential infrastructure upgrades. Failure to comply can result in significant penalties and jeopardized operating permits.

The financial implications of these regulations are substantial. For instance, in 2024, the EPA continued its robust enforcement of UST compliance, with states also implementing their own stringent standards. Getty Realty must factor in the costs associated with tenant compliance, which could involve tenant-funded upgrades or increased lease rates to offset Getty's indirect expenses related to environmental stewardship.

Zoning and land use laws are critical for Getty Realty, directly impacting where it can operate and grow. Local ordinances dictate the placement and expansion of convenience stores and gas stations, influencing Getty's ability to acquire new sites or redevelop existing ones. For instance, in 2024, many municipalities are reviewing or enacting stricter zoning for new gas station developments, particularly in urban areas, which could limit portfolio expansion opportunities.

Changes in these regulations, especially those aimed at reducing fossil fuel infrastructure, present a significant challenge. As of early 2025, several states are considering or have implemented policies that restrict the approval of new gas stations or mandate specific environmental standards for existing ones, potentially affecting Getty's long-term strategy and the value of its current holdings.

Getty Realty, as a Real Estate Investment Trust (REIT), navigates a complex web of specific tax laws. To maintain its beneficial REIT status, it must consistently meet stringent requirements related to income sources, asset holdings, and dividend distributions, as outlined by the Internal Revenue Code.

Recent legislative actions have significantly influenced Getty's financial landscape. For instance, the permanent 199A deduction for qualified REIT dividends, enacted through the Tax Cuts and Jobs Act of 2017, offers a tax advantage to shareholders, potentially boosting investor appeal. Furthermore, an increase in the asset test limit for taxable REIT subsidiaries provides Getty with greater flexibility in structuring its operations and subsidiaries, impacting its overall financial strategy and growth potential.

Lease Contract Laws and Tenant Bankruptcy

The legal landscape for commercial leases significantly shapes Getty Realty's operations. Understanding landlord-tenant statutes, lease enforceability, and the intricacies of tenant bankruptcy proceedings is crucial. For instance, Getty Realty's Adjusted Funds From Operations (AFFO) guidance for the first quarter of 2025 was revised downward, directly reflecting the potential financial repercussions of a recent tenant's bankruptcy filing, underscoring the materialization of this legal risk.

Key legal considerations for Getty Realty include:

- Lease Enforcement Mechanisms: Getty Realty must navigate state-specific laws governing lease defaults, eviction processes, and the recovery of unpaid rent.

- Tenant Bankruptcy Impact: The Bankruptcy Code dictates how leases are treated in bankruptcy, potentially allowing tenants to reject leases or assume them, impacting Getty's rental income and property occupancy.

- Regulatory Compliance: Adherence to zoning laws, building codes, and environmental regulations is paramount to maintaining property value and operational legality.

- Contractual Protections: Getty Realty's lease agreements are designed to protect its interests, but their effectiveness is often tested by unforeseen tenant financial distress and legal challenges.

Consumer Protection and Data Privacy Laws

Consumer protection and data privacy are critical for Getty Realty's tenants, as convenience stores manage substantial consumer data. Compliance with regulations like the California Consumer Privacy Act (CCPA) and other state-specific privacy laws is paramount for tenant business continuity and reputation. For instance, in 2024, data breaches continued to be a significant concern, with the Identity Theft Resource Center reporting thousands of data compromises affecting millions of individuals. While Getty Realty doesn't directly handle this data, its tenants' adherence to these laws directly impacts their operational stability and brand image, which can indirectly influence Getty's relationship with its tenants.

Getty Realty's operations are heavily influenced by evolving environmental regulations, particularly concerning gasoline stations and underground storage tanks, with ongoing enforcement in 2024 and potential stricter standards by early 2025 impacting compliance costs and property value.

Zoning and land use laws critically dictate Getty's expansion and redevelopment opportunities, as many municipalities in 2024 reviewed or implemented stricter zoning for new gas stations, potentially limiting portfolio growth.

As a REIT, Getty Realty must adhere to specific tax laws, with recent legislation like the 199A deduction and increased asset test limits for taxable REIT subsidiaries in 2024 providing both advantages and flexibility.

Lease enforceability and tenant financial stability are key legal risks, as demonstrated by Getty Realty's revised AFFO guidance in Q1 2025 due to a tenant's bankruptcy, highlighting the impact of tenant default and bankruptcy proceedings.

Environmental factors

Growing governmental and societal pressure to combat climate change is driving stricter regulations on carbon emissions and energy use for commercial real estate. For instance, by the end of 2024, many major cities are expected to have updated or implemented new building performance standards requiring significant reductions in energy consumption and greenhouse gas emissions.

Getty Realty might encounter increased operational costs or capital expenditure requirements to meet these evolving standards, potentially necessitating investments in energy-efficient retrofits or on-site renewable energy generation. As of early 2025, the average cost for commercial building energy efficiency upgrades can range from $5 to $20 per square foot, depending on the scope of work.

Consumer pressure is significantly shaping sustainability in retail, with a growing number of shoppers favoring businesses with strong environmental commitments. For instance, a 2024 Nielsen study indicated that 60% of consumers are willing to pay more for products from sustainable brands. This trend is pushing retailers, including those in the convenience store sector, to adopt practices like biodegradable packaging and waste reduction.

Getty Realty's portfolio, which includes numerous retail properties, will likely face increasing demand from tenants to support these eco-friendly transitions. This could involve property upgrades to facilitate energy efficiency, waste management systems, or even providing space for locally sourced product displays, directly impacting operational and capital expenditure planning.

Environmental regulations concerning waste management and recycling are tightening globally, directly impacting commercial real estate. Getty Realty's portfolio, like others, must comply with these evolving standards, which often necessitate investments in specialized waste disposal infrastructure and recycling programs for tenants. For instance, in 2024, many municipalities are increasing landfill tipping fees, making robust recycling programs more economically viable for property owners.

These stricter rules can translate into operational costs for Getty Realty and its tenants, potentially influencing lease agreements and property operating expenses. The growing tenant demand for sustainable practices, exemplified by convenience stores trialing zero-waste sections, puts pressure on landlords to provide compliant and appealing facilities. Failure to adapt could affect property desirability and occupancy rates.

Water Usage and Conservation

Getty Realty's portfolio, which includes convenience stores, is directly affected by water usage and conservation. These facilities, particularly those with car washes or significant landscaping, face potential impacts from evolving water conservation regulations. For instance, in regions experiencing drought, stricter water use mandates could necessitate changes in operational practices.

Implementing water-efficient technologies is a key strategy for managing these environmental factors. This could involve installing low-flow fixtures in restrooms and kitchens, or adopting smart irrigation systems for any landscaping. Such measures not only help comply with regulations but also offer tangible cost savings on utility bills.

Significant water consumption in convenience stores stems from several areas:

- Restrooms: High-traffic restrooms are a primary source of water use.

- Kitchens: Food preparation and cleaning in any associated food service areas contribute to consumption.

- Landscaping Irrigation: Maintaining outdoor spaces, especially in drier climates, can be water-intensive.

By proactively addressing water usage, Getty Realty can mitigate operational risks and enhance its environmental, social, and governance (ESG) profile. For example, the average American household uses about 300 gallons of water per day, and optimizing usage in commercial properties can lead to substantial reductions. Companies that demonstrate strong water stewardship are increasingly favored by investors and consumers alike.

Impact of Extreme Weather Events

The escalating frequency and severity of extreme weather events, a direct consequence of climate change, present significant physical risks to Getty Realty's portfolio. Events like floods, wildfires, and intense storms can lead to substantial property damage, operational disruptions, and a marked increase in insurance premiums. This directly impacts the value and ongoing functionality of the company's real estate assets.

For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $145 billion in damages. This trend underscores the growing financial burden and operational challenges that such events pose to property owners.

- Increased Property Damage: Extreme weather can cause structural damage, requiring costly repairs and potentially rendering properties unusable for extended periods.

- Operational Disruptions: Flooding, power outages, and transportation disruptions can halt business operations, leading to lost revenue and increased expenses for tenants and Getty Realty.

- Rising Insurance Costs: As climate-related risks escalate, insurance providers are increasing premiums and, in some cases, withdrawing coverage from high-risk areas, impacting Getty Realty's operating costs and risk management strategies.

- Asset Devaluation: Properties located in areas prone to frequent extreme weather may experience a decline in market value due to perceived risk and potential for future damage.

Getty Realty faces increasing regulatory pressure and societal demand for environmental sustainability, particularly concerning carbon emissions and energy efficiency in its commercial properties. By early 2025, many cities are implementing stricter building performance standards, potentially increasing operational costs for upgrades, which can range from $5 to $20 per square foot.

Consumer preference for eco-friendly businesses is also growing, with studies in 2024 showing a significant portion of consumers willing to pay more for sustainable brands, influencing tenant demands for greener facilities.

Extreme weather events, a consequence of climate change, pose a growing physical risk to Getty Realty's portfolio, leading to increased property damage, operational disruptions, and higher insurance premiums. In 2023 alone, the U.S. experienced 28 billion-dollar weather disasters, costing over $145 billion.

| Environmental Factor | Impact on Getty Realty | Example/Data (2023-2025) |

| Climate Change & Emissions | Stricter building codes, increased operational costs for retrofits. | Building performance standards by end of 2024; upgrade costs $5-$20/sq ft (early 2025). |

| Consumer Sustainability Demand | Tenant demand for eco-friendly practices, influencing property upgrades. | 60% of consumers willing to pay more for sustainable brands (2024 study). |

| Extreme Weather Events | Property damage, operational disruption, rising insurance costs. | 28 billion-dollar weather disasters in U.S. in 2023, costing $145 billion. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Getty Realty is grounded in data from reputable sources including government agencies, real estate industry reports, and economic forecasting firms. We incorporate insights from regulatory bodies, market research, and demographic studies to ensure a comprehensive view.