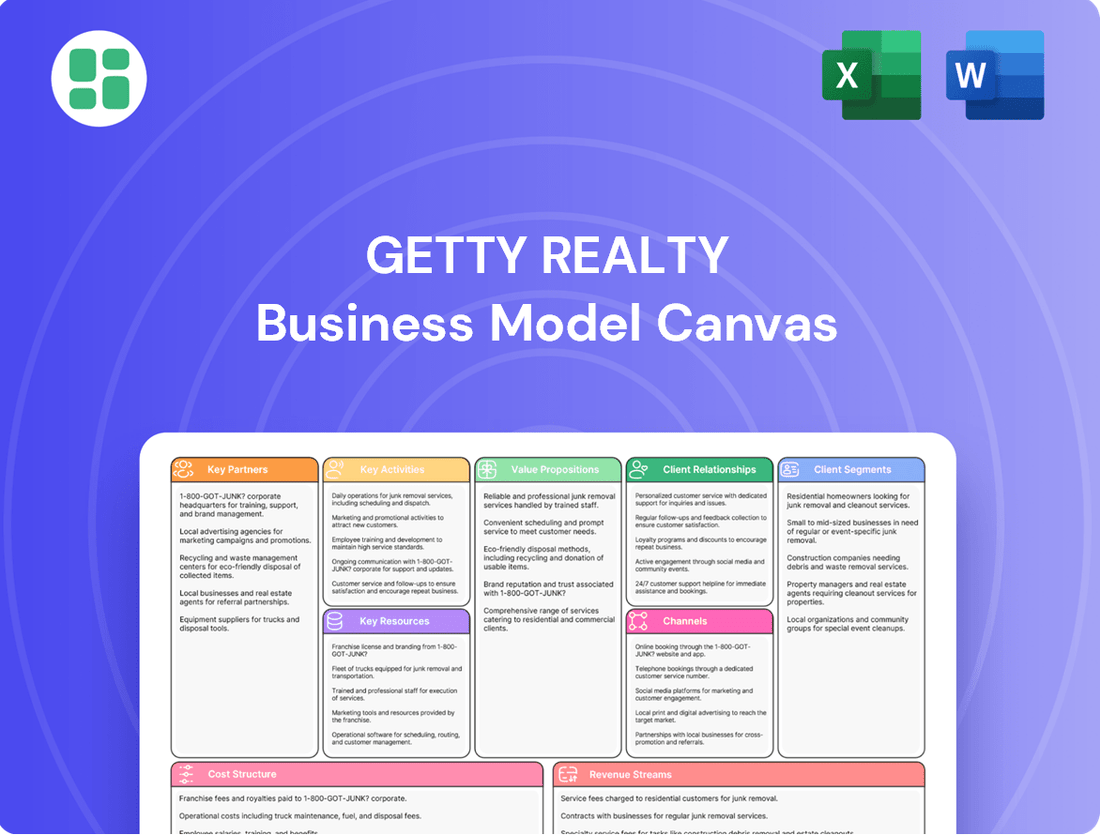

Getty Realty Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Getty Realty Bundle

Discover the core components of Getty Realty's thriving business with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a strategic roadmap for success. Download the full canvas to gain actionable insights for your own ventures.

Partnerships

Getty Realty actively cultivates relationships with property owners who are ready to divest their convenience store and gasoline station assets. A significant portion of these collaborations involve sale-leaseback arrangements, where Getty acquires the property and then leases it back to the original owner, securing a stable income stream. For instance, in 2024, Getty continued to leverage these transactions as a core strategy for portfolio growth.

Furthermore, Getty Realty collaborates with developers specializing in the convenience and automotive retail sectors. These partnerships are vital for identifying and executing new construction or redevelopment projects. This proactive approach ensures a consistent flow of attractive investment opportunities, allowing Getty to expand its real estate holdings strategically.

Getty Realty cultivates enduring relationships with national and regional convenience store and gas station operators, who serve as its core tenants. These partnerships are crucial for securing steady rental income and maintaining high occupancy, with Getty Realty actively working to offer competitive lease terms and financial support to solidify these vital connections.

Getty Realty actively cultivates partnerships with automotive service centers and express tunnel car wash operators. This strategic move diversifies their tenant base, lessening dependence on any single industry and bolstering their portfolio's resilience.

These collaborations are crucial for Getty's strategy, focusing on recession-resistant retail sectors. For instance, in 2023, Getty's net rental income grew by 7.1%, reaching $176.6 million, partly fueled by the stable demand in essential services like automotive care.

Financial Institutions and Capital Market Partners

Getty Realty actively partners with a diverse range of financial institutions to fuel its growth and operational needs. This includes securing crucial debt financing through arrangements like revolving credit facilities and unsecured notes, as well as raising capital via equity offerings such as common stock. These collaborations are fundamental to maintaining robust liquidity and supporting strategic acquisition and development projects.

These financial partnerships are critical for Getty's ability to execute its long-term strategy. For instance, in 2024, the company continued to leverage its strong banking relationships to manage its capital structure effectively, ensuring access to funds for opportunistic acquisitions and property enhancements. The strength of these relationships directly impacts Getty's capacity to pursue growth initiatives and maintain a healthy balance sheet.

- Debt Financing: Access to unsecured notes and revolving credit facilities from banks and financial intermediaries.

- Equity Financing: Capital raised through common stock offerings and potentially private placements with institutional investors.

- Liquidity Management: Partnerships ensure Getty maintains sufficient cash reserves for operations and unexpected needs.

- Growth Funding: Essential for financing new property acquisitions and capital improvement projects.

Real Estate Brokers and Advisors

Getty Realty relies on a network of real estate brokers and advisors to pinpoint promising acquisition opportunities and navigate property deals. These professionals are crucial for sourcing properties that fit Getty's investment profile and strategic goals, often providing access to deals not publicly listed.

Their market intelligence is invaluable. For instance, in 2024, the commercial real estate market saw significant activity, with brokers playing a key role in matching buyers and sellers in a dynamic environment. Getty's partnerships ensure they are well-positioned to capitalize on these opportunities.

- Market Expertise: Brokers offer deep knowledge of local and regional real estate markets, including pricing trends and demand drivers.

- Deal Sourcing: They provide access to off-market properties and proprietary deal flow, expanding Getty's acquisition pipeline.

- Transaction Facilitation: Advisors assist in due diligence, negotiations, and closing processes, ensuring smooth and efficient transactions.

- Strategic Alignment: These partnerships help identify properties that align with Getty's long-term investment strategy and portfolio diversification objectives.

Getty Realty's key partnerships are foundational to its business model, primarily centering on property owners looking to sell their convenience store and gas station assets, often through sale-leaseback transactions. These relationships are crucial for portfolio growth, as seen in Getty's continued reliance on these deals in 2024.

Collaborations with convenience store and automotive service operators are vital for securing stable rental income and maintaining high occupancy rates. These tenant relationships are strengthened through competitive lease terms and ongoing support, ensuring long-term value.

Furthermore, partnerships with financial institutions provide essential debt and equity financing, enabling Getty to fund acquisitions and capital improvements. In 2024, the company continued to leverage these relationships to manage its capital structure effectively.

Real estate brokers and advisors are instrumental in sourcing new acquisition opportunities and facilitating transactions, providing market intelligence and access to off-market deals.

What is included in the product

A strategic blueprint detailing Getty Realty's focus on acquiring, owning, and managing net-leased real estate, primarily for gas stations and convenience stores.

This model emphasizes long-term leases with creditworthy tenants, generating stable rental income and capital appreciation.

The Getty Realty Business Model Canvas offers a clear, visual representation of their strategy, simplifying complex operations for easier understanding and adaptation.

It acts as a pain point reliever by condensing Getty Realty's intricate business strategy into a digestible, one-page snapshot, facilitating quick review and collaborative discussion.

Activities

Getty Realty's core operations revolve around the strategic acquisition and investment in properties. This crucial activity involves meticulously identifying, thoroughly evaluating, and ultimately acquiring sites that are primarily utilized as convenience stores and gasoline stations. Beyond these core segments, the company also focuses on automotive service centers and car washes, demonstrating a diversified approach to its property portfolio.

This acquisition strategy encompasses both the purchase of existing, operational sites and the development of entirely new projects. Getty's commitment to growth is evident in its investment activity. In 2024, the company deployed substantial capital, and projections indicate continued robust investment throughout 2025, further solidifying its presence across these key property types.

Getty Realty's core activity involves leasing its acquired real estate assets to a diverse range of operators. These leases are typically structured as long-term net lease agreements, providing stable and predictable revenue streams for the company. This leasing strategy is central to their business model, ensuring consistent income generation.

Beyond initial leasing, Getty Realty actively manages its properties. This includes ensuring tenant compliance with lease terms and overseeing the physical maintenance of the properties. Proactive management is crucial for preserving asset value and mitigating risks associated with property ownership.

The company's operational focus is on achieving high occupancy rates and maintaining consistent rent collections. For instance, in the first quarter of 2024, Getty Realty reported a robust occupancy rate of 98.5% across its portfolio, underscoring their effectiveness in tenant retention and acquisition.

Getty Realty provides essential capital solutions, with sale-leaseback financing being a cornerstone offering for convenience and automotive retail operators. This strategic financial tool allows businesses to unlock capital tied up in real estate by selling their property to Getty and then leasing it back, ensuring continued operation. This transaction provides immediate liquidity to the operator while simultaneously securing Getty with a stable, long-term tenant.

This sale-leaseback model is a significant driver for Getty's acquisition strategy, acting as a key differentiator in the market. For instance, in 2024, Getty continued to actively deploy capital through these arrangements, demonstrating its commitment to supporting the growth and financial flexibility of its operator partners.

Portfolio Diversification and Optimization

Getty Realty actively manages its portfolio by diversifying across various property types, including convenience stores, car washes, auto service centers, and quick-service restaurants. This strategy is designed to reduce exposure to any single sector or tenant, thereby mitigating risk. As of early 2024, their portfolio spans numerous U.S. states, demonstrating a broad geographic reach.

Optimization efforts focus on acquiring and developing high-quality, single-tenant net lease properties. This approach aims to generate stable, predictable cash flows. The company's commitment to this model has resulted in a portfolio that is resilient and well-positioned for continued income generation.

- Geographic Diversification: Portfolio spread across multiple U.S. states.

- Property Type Diversification: Holdings include convenience stores, car washes, auto service centers, and QSRs.

- Tenant Diversification: Focus on single-tenant net lease properties to ensure stable income.

- Risk Mitigation: Strategic diversification aims to reduce dependency on any single market or property type.

Capital Raising and Financial Management

Getty Realty actively manages its financial structure, a core activity involving the continuous raising of both equity and debt capital. This ensures the company has the necessary liquidity to fund its investment pipeline and ongoing operations.

Key methods employed include the issuance of various debt instruments, such as notes, and the strategic utilization of credit facilities. For instance, in 2024, Getty Realty has demonstrated its commitment to capital management through its ongoing access to credit. The company also employs forward equity sales to bolster its capital position.

These financial maneuvers are crucial for supporting Getty Realty's growth trajectory and maintaining the stability of its dividend payments to shareholders. Sound financial management underpins the company's ability to execute its strategic objectives.

- Equity and Debt Capital: Getty Realty consistently raises capital through various means to fund its operations and investments.

- Liquidity Management: Issuing notes, using credit facilities, and executing forward equity sales are vital for maintaining sufficient liquidity.

- Growth and Dividends: Effective financial management directly supports the company's expansion plans and its ability to provide stable dividends.

Getty Realty's key activities center on acquiring and developing real estate, primarily for convenience stores and gas stations, but also for auto service centers and car washes. They then lease these properties, often through long-term net lease agreements, ensuring a steady income flow.

A significant part of their strategy involves providing capital solutions, especially through sale-leaseback transactions, which unlocks liquidity for operators while securing Getty with stable tenants. This is complemented by active portfolio management, focusing on diversification across property types and geographies to mitigate risk.

Crucially, Getty Realty manages its financial health by continuously raising equity and debt capital, utilizing instruments like notes and credit facilities. This financial dexterity supports their investment pipeline, operational stability, and commitment to shareholder dividends.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Property Acquisition & Development | Buying and building sites for convenience stores, gas stations, auto service centers, and car washes. | Continued robust investment, focusing on single-tenant net lease properties. |

| Real Estate Leasing | Leasing properties to operators, typically via long-term net lease agreements. | Maintaining high occupancy rates, with Q1 2024 at 98.5%. |

| Capital Solutions (Sale-Leaseback) | Providing liquidity to operators by purchasing their properties and leasing them back. | Actively deploying capital through these arrangements to support operator growth. |

| Portfolio Management | Diversifying holdings across property types and U.S. states to reduce risk. | Broad geographic reach and diversification across convenience stores, car washes, auto service centers, and QSRs. |

| Financial Management | Raising equity and debt capital to fund investments and operations. | Ongoing access to credit, utilizing notes, credit facilities, and forward equity sales. |

Preview Before You Purchase

Business Model Canvas

The Getty Realty Business Model Canvas you are previewing is the exact document you will receive upon purchase. This means you're seeing the actual structure and content, ensuring full transparency and no surprises. Once your order is complete, you'll gain access to this comprehensive, ready-to-use business model, identical to what you see here.

Resources

Getty Realty's extensive real estate portfolio is its cornerstone, comprising 1,137 properties as of June 30, 2025. This vast collection is strategically diversified across 44 states and Washington, D.C., primarily featuring net-leased convenience stores, gasoline stations, automotive service centers, and car washes.

This substantial and varied asset base is key to generating predictable and stable rental income for Getty Realty. The focus on essential retail and automotive services within its net-leased properties contributes to the resilience of its revenue streams.

Getty Realty's financial capital and liquidity are foundational to its business model, providing the necessary fuel for growth and operational stability. This includes substantial cash reserves, readily available credit lines, and secured commitments for both equity and debt financing. These resources are not just for day-to-day operations; they are the engine that drives Getty's strategic acquisition of income-generating properties.

The company's commitment to maintaining robust liquidity is a key strength. As of the second quarter of 2025, Getty reported total liquidity exceeding $400 million. This significant financial cushion empowers Getty to act swiftly on attractive investment opportunities, even in dynamic market conditions, and effectively manage its existing debt obligations, ensuring financial flexibility.

Getty Realty's deep expertise in the net lease real estate model, especially within convenience and automotive retail, is a cornerstone of its business. This specialized knowledge allows them to effectively underwrite properties and cultivate direct relationships with tenants, understanding the unique market dynamics of these sectors.

This focused sector knowledge is crucial for identifying and acquiring attractive investment opportunities while simultaneously managing associated risks. For example, their understanding of fuel-related real estate trends and tenant creditworthiness directly impacts their portfolio's performance and stability.

As of the first quarter of 2024, Getty Realty reported a portfolio of 1,057 properties, with a significant concentration in the convenience store and gas station sector, demonstrating the practical application of their expertise in building and managing a substantial real estate footprint.

Long-Term Lease Agreements

Getty Realty's portfolio is anchored by long-term lease agreements, a cornerstone of its business model. These agreements typically feature weighted average lease terms of approximately 10 years, providing a robust foundation for predictable revenue. This extended duration is crucial for financial stability.

These long-term contracts are instrumental in generating stable and predictable rental income streams for Getty Realty. The inherent security of these leases directly translates into consistent financial performance, a key factor for investors and stakeholders.

- Weighted Average Lease Term: Approximately 10 years, ensuring long-term revenue visibility.

- Income Predictability: Long-term leases create a reliable and consistent rental income flow.

- Financial Stability: The stability of these leases underpins Getty's consistent financial results.

Strong Tenant Relationships and Underwriting Capabilities

Getty Realty's strong tenant relationships and underwriting capabilities are central to its business model. The company actively cultivates direct connections with its tenants, fostering trust and open communication. This direct engagement, combined with rigorous underwriting, allows Getty Realty to thoroughly vet potential lessees, ensuring their financial stability and operational reliability.

These core strengths translate into tangible benefits, such as consistently high rent collection rates and minimal vacancy periods. For instance, Getty Realty reported a strong occupancy rate of 98.5% as of the first quarter of 2024, underscoring the effectiveness of its tenant selection and relationship management. This focus on quality tenants and robust financial assessment underpins the company's stable income stream.

- Tenant Relationships: Direct engagement fosters loyalty and facilitates proactive issue resolution.

- Underwriting Prowess: Rigorous financial and operational assessments identify creditworthy tenants.

- Financial Stability: Proven ability to maintain high occupancy and rent collection rates.

- Operational Efficiency: Underwriting supports favorable lease terms and minimizes risk.

Getty Realty's key resources are its extensive real estate portfolio, robust financial capital, deep sector expertise, and strong tenant relationships. The portfolio, numbering 1,137 properties as of June 30, 2025, is strategically diversified across 44 states and Washington, D.C., primarily consisting of net-leased convenience stores, gasoline stations, and automotive service centers. This diversified asset base, coupled with long-term lease agreements averaging approximately 10 years, ensures predictable and stable rental income. Getty's financial strength, with over $400 million in total liquidity as of Q2 2025, enables strategic acquisitions and operational stability. Their specialized knowledge in net lease real estate, particularly within the convenience and automotive retail sectors, allows for effective underwriting and risk management, as evidenced by a 98.5% occupancy rate in Q1 2024.

| Key Resource | Description | Supporting Data/Facts |

|---|---|---|

| Real Estate Portfolio | Net-leased convenience stores, gasoline stations, automotive service centers. | 1,137 properties as of June 30, 2025; diversified across 44 states and D.C. |

| Financial Capital & Liquidity | Cash reserves, credit lines, financing commitments. | Over $400 million in total liquidity as of Q2 2025. |

| Sector Expertise | Deep knowledge of net lease real estate, convenience, and automotive retail. | Effective underwriting and tenant relationship management. |

| Lease Agreements | Long-term contracts providing revenue visibility. | Weighted average lease term of approximately 10 years. |

| Tenant Relationships & Underwriting | Direct engagement and rigorous vetting of tenants. | 98.5% occupancy rate as of Q1 2024; high rent collection rates. |

Value Propositions

Getty Realty provides shareholders with a reliable income through consistent dividend distributions, underpinned by its portfolio of long-term net lease agreements. This predictable cash flow makes the company a compelling option for investors prioritizing income generation.

The company's track record demonstrates a commitment to maintaining and growing its dividends, a crucial factor for income-oriented investors seeking stability. For instance, Getty Realty has a history of annual dividend increases, reflecting its operational strength and financial discipline.

This stability is particularly valuable in uncertain economic climates, offering a dependable return that can help buffer against market volatility. The predictable nature of its income stream is a core element of its appeal to a broad range of investors.

Getty Realty acts as a crucial financial partner for operators in the convenience and automotive retail industries by offering vital capital access. Through strategic sale-leaseback transactions, Getty enables these businesses to convert their property ownership into readily available cash. This infusion of capital is particularly impactful, as it allows operators to free up significant equity previously tied to their real estate assets.

This unlocked capital serves as a powerful engine for growth and operational enhancement. Operators can then strategically reinvest these funds back into their core business operations, pursue expansion initiatives, or manage working capital more effectively. For instance, a business might use the capital from a sale-leaseback to upgrade its facilities, expand its product offerings, or invest in new technology, thereby boosting its competitive edge in the market.

In 2024, Getty Realty continued to demonstrate its commitment to this value proposition, completing numerous transactions that provided essential liquidity to its partners. The company's focus on specialized sectors like convenience stores and car washes means they understand the unique capital needs of these operators. This specialized approach makes Getty a preferred financing partner for businesses seeking to optimize their balance sheets and fuel future success.

Getty Realty provides long-term occupancy for its tenant-operators through net leases, offering them crucial stability for their business operations without the complexities of property ownership.

The company actively seeks to be a trusted partner, engaging in ongoing dialogue and supporting tenant growth initiatives, enabling them to concentrate on their core retail operations.

For instance, in 2024, Getty Realty's portfolio comprised 1,054 properties, with a significant portion leased under long-term net lease agreements, underscoring their commitment to tenant stability.

Diversified Portfolio and Risk Mitigation

Getty Realty's strategic approach centers on a diversified portfolio, spanning various convenience and automotive retail sectors and geographic locations. This deliberate diversification acts as a powerful risk mitigation tool for investors, lessening dependence on any single tenant category or localized economic downturns.

The company's impressive nearly 100% occupancy rate, a consistent feature, alongside stable rent coverage, underscores the success of this diversification strategy. This stability is a direct result of spreading investments across different property types and markets.

Key aspects of this value proposition include:

- Broad Segment Exposure: Getty Realty invests in a range of convenience retail and automotive service properties, from gas stations and convenience stores to car washes and quick lube facilities, reducing concentration risk.

- Geographic Spread: The portfolio is intentionally spread across multiple states, mitigating the impact of regional economic fluctuations or specific market challenges.

- Tenant Diversification: While specific tenant names aren't always public, the model implies a mix of national, regional, and local operators, further distributing risk.

- Resilient Asset Class: Convenience and automotive retail often prove resilient during various economic cycles, contributing to the stability of the diversified portfolio.

Expertise in Specialized Retail Real Estate

Getty Realty’s deep expertise in specialized retail real estate, particularly convenience stores, gas stations, car washes, and auto service centers, sets them apart. This niche focus allows for the identification of superior assets and the management of unique operational demands that other investors might miss.

This specialization translates into tangible financial benefits. For instance, in 2023, Getty Realty reported a total revenue of $180.4 million, with their net income attributable to common stockholders reaching $100.3 million. Their strategic focus on these specific property types has historically delivered strong performance.

- Niche Market Dominance Getty Realty concentrates on a specific segment of retail real estate, enabling a deeper understanding of market dynamics and tenant needs within the convenience and automotive service sectors.

- Asset Identification and Management Their specialized knowledge allows for the precise identification of high-potential properties and the effective management of operational complexities inherent to gas stations and car washes.

- Tailored Solutions and Returns This focused approach facilitates the offering of customized solutions to tenants and investors, ultimately driving attractive returns, as evidenced by their consistent financial growth.

Getty Realty offers investors a dependable income stream through consistent dividends, supported by its portfolio of long-term net lease agreements. This predictable cash flow makes the company attractive for those prioritizing income generation and stability, even in uncertain economic conditions.

The company also serves as a vital capital partner for convenience and automotive retail operators, facilitating growth and operational improvements through sale-leaseback transactions. This allows businesses to unlock equity tied up in real estate, reinvesting it strategically to enhance their competitive edge.

Getty Realty ensures long-term occupancy and operational stability for its tenant-operators by providing net leases, allowing them to focus on their core businesses without property ownership burdens.

Customer Relationships

Getty Realty cultivates direct, lasting relationships with its tenants and property sellers. This focus goes beyond simple transactions, emphasizing consistent communication to grasp their evolving business needs and future expansion strategies.

This commitment to relationship-building fosters significant tenant loyalty. For instance, in 2024, Getty Realty reported a tenant retention rate of 92%, demonstrating the success of their proactive engagement model.

Such strong relationships not only secure repeat business but also unlock new investment opportunities, as satisfied tenants often become sources for future property acquisitions and development projects.

Getty Realty views its tenant relationships as long-term partnerships, focusing on providing stable real estate solutions that foster business growth. This commitment is demonstrated through their extended lease agreements and their readiness to participate in development funding, creating a foundation of trust and shared success.

While tenants handle daily operations under net leases, Getty Realty prioritizes responsiveness to property issues it oversees, ensuring assets remain functional and attractive. This proactive stance is crucial for maintaining tenant satisfaction and preserving the long-term value of their real estate portfolio.

Tailored Capital Solutions

Getty Realty provides highly customized capital solutions, especially for property owners looking at sale-leaseback transactions. This means they work closely with sellers to understand their exact financial situations and create financing structures that fit those needs precisely, allowing businesses to access capital without disrupting their operations.

This personalized strategy is key to building strong, lasting relationships with clients. By focusing on individual financial requirements, Getty ensures that sellers receive the most efficient way to unlock their property's value.

- Personalized Financing: Getty structures capital solutions to meet the unique financial objectives of each seller, particularly in sale-leaseback deals.

- Capital Unlocking: The core aim is to help property owners access significant capital while maintaining operational continuity.

- Relationship Strengthening: Understanding and addressing specific financial needs fosters trust and deepens client relationships.

Investor Relations and Transparency

Getty Realty prioritizes open communication with its investors. This includes regular earnings calls and detailed SEC filings, ensuring everyone stays informed about the company's financial health and strategic direction. For instance, in their Q1 2024 earnings call, Getty Realty highlighted a 7.5% increase in total revenue compared to the previous year, demonstrating solid operational performance.

Maintaining this transparency is crucial for building trust and attracting the necessary capital for growth. Investor presentations further elaborate on Getty Realty's plans and market outlook, fostering a deeper understanding among stakeholders.

- Active Communication: Regular earnings calls, SEC filings, and investor presentations keep stakeholders informed.

- Financial Performance: Q1 2024 revenue saw a 7.5% year-over-year increase, reflecting strong operational execution.

- Building Confidence: Transparent communication fosters trust and attracts investment capital.

- Strategic Outlook: Detailed presentations provide insights into future plans and market positioning.

Getty Realty fosters strong customer relationships through personalized service and consistent communication, aiming for long-term partnerships rather than mere transactions. This approach is evident in their high tenant retention rate and their tailored capital solutions for property owners.

Their commitment extends to transparent investor relations, utilizing regular calls and filings to build confidence and attract capital. This dual focus on tenants and investors underpins Getty Realty's strategy for sustained growth and market stability.

In 2024, Getty Realty reported a 92% tenant retention rate, underscoring the success of their relationship-centric model. Furthermore, their Q1 2024 earnings revealed a 7.5% increase in total revenue, reflecting operational strength driven by these cultivated connections.

| Relationship Type | Key Engagement Strategy | 2024 Highlight |

|---|---|---|

| Tenants | Consistent communication, understanding needs, proactive issue resolution | 92% Tenant Retention Rate |

| Property Sellers | Customized capital solutions, sale-leaseback expertise, financial needs assessment | Facilitated capital unlocking for operational continuity |

| Investors | Regular earnings calls, detailed SEC filings, transparent financial reporting | 7.5% Year-over-Year Revenue Increase (Q1 2024) |

Channels

Getty Realty leverages its dedicated in-house acquisition teams to directly source and negotiate property deals, including crucial sale-leaseback transactions. This direct approach is key to their strategy, enabling them to pinpoint and secure assets that perfectly match their investment parameters.

By engaging directly, Getty Realty often secures more advantageous terms and cultivates stronger, more enduring relationships with property owners. For instance, in 2023, their direct acquisition efforts contributed significantly to their portfolio growth, with a substantial portion of their new property additions stemming from these hands-on negotiations.

Getty Realty taps into extensive networks of real estate brokers, especially those focused on commercial properties within the convenience and automotive retail spaces. These relationships are crucial for uncovering off-market deals and identifying potential sellers efficiently across diverse geographic locations. In 2024, the commercial real estate brokerage industry continued to be a significant driver of transactions, with specialized brokers often facilitating a substantial portion of deal flow, particularly for niche sectors like those Getty targets.

Getty Realty's investor relations website is a crucial channel, offering a centralized hub for financial reports, SEC filings, and news releases. This platform ensures transparency and accessibility for investors and analysts, providing essential information for informed decision-making.

In 2024, the company continued to leverage this digital presence to disseminate quarterly earnings call transcripts and presentations, facilitating direct engagement with stakeholders. The website's robust content library supports Getty Realty's commitment to open communication and building investor confidence.

Industry Conferences and Associations

Participation in key industry conferences and associations is a cornerstone for Getty Realty's business development. These gatherings, such as the National Association of REALTORS® (NAR) annual convention, offer invaluable face-to-face interactions with a broad spectrum of potential clients and collaborators. For instance, in 2024, the NAR convention saw over 40,000 real estate professionals, a significant pool for lead generation and partnership opportunities.

These events are crucial for gathering real-time market intelligence, understanding emerging trends, and identifying new business prospects. Getty Realty can leverage these platforms to showcase their expertise and project portfolio, directly engaging with property owners seeking management or leasing services and tenants searching for suitable spaces. This direct engagement is vital for building brand recognition and trust within the competitive real estate landscape.

- Networking: Direct engagement with over 40,000 real estate professionals at the 2024 NAR convention.

- Market Intelligence: Access to insights on emerging property trends and investment opportunities.

- Brand Building: Showcasing capabilities to potential tenants and property owners.

- Lead Generation: Cultivating relationships that translate into new leasing and management contracts.

Financial Advisors and Analyst Coverage

Getty Realty actively cultivates relationships with financial advisors and analysts specializing in the net lease and retail REIT sectors. This engagement is crucial for effectively communicating Getty's financial performance and strategic direction to a wider audience of potential investors.

Independent analyst coverage serves as a vital tool for validating Getty Realty's business model and enhancing its visibility within the investment community. For instance, in 2024, several key analysts maintained positive ratings on Getty Realty, citing its stable cash flows and strategic property acquisitions.

- Analyst Coverage: In early 2024, multiple research reports from firms like Baird and Stifel highlighted Getty Realty's defensive positioning within the net lease retail space.

- Dissemination of Information: These analysts play a key role in translating Getty's quarterly earnings and strategic updates into insights accessible to institutional and retail investors.

- Independent Validation: Positive analyst commentary often supports Getty's valuation and can influence investor sentiment, contributing to a more efficient market for its securities.

Getty Realty utilizes a multi-pronged approach to reach its customers and stakeholders. This includes direct outreach via in-house acquisition teams and leveraging the extensive networks of commercial real estate brokers, particularly those specializing in the convenience and automotive retail sectors. In 2024, the commercial real estate brokerage sector remained a key conduit for transactions, with specialized brokers facilitating a significant portion of deal flow, especially in niche markets.

Their investor relations website serves as a critical channel for disseminating financial reports, SEC filings, and news, ensuring transparency for investors. In 2024, the company continued to use this platform for quarterly earnings call transcripts and presentations, fostering direct engagement. Industry conferences, like the 2024 National Association of REALTORS® convention which attracted over 40,000 professionals, are vital for networking, market intelligence, and brand building, leading to new leasing and management contracts.

Furthermore, Getty Realty actively engages with financial advisors and analysts covering the net lease and retail REIT sectors. This strategic communication, bolstered by positive independent analyst coverage in 2024 which highlighted their defensive positioning, helps validate their business model and enhance visibility among investors.

Customer Segments

Independent convenience store and gas station operators represent a key customer segment for Getty Realty. These businesses, often smaller and regionally focused, look to Getty for stable real estate solutions, frequently through sale-leaseback transactions or long-term leases. This allows them to unlock capital tied up in property while securing a prime location for their operations.

Getty's diverse portfolio, which includes properties leased to a wide array of national and regional brands, provides these independent operators with the opportunity to align with established market presences. For instance, in 2024, the convenience store sector saw continued growth, with industry revenue projected to reach hundreds of billions of dollars, highlighting the ongoing demand for well-located retail fuel and convenience outlets that Getty Realty is positioned to supply.

Larger, established convenience store and gas station chains are a core customer base for Getty Realty. These operators frequently engage in sale-leaseback transactions to fund expansion or improve their financial standing, relying on Getty as a stable real estate partner.

Getty's diversified tenant roster includes these major players, showcasing their broad appeal across the sector. For instance, in 2023, Getty’s net lease portfolio generated approximately $177.5 million in rental income, with a significant portion coming from tenants in the convenience store and gas station industry.

Getty Realty actively courts automotive service center operators, a segment that includes tire shops, auto repair garages, and general maintenance facilities. These businesses have specific real estate needs, often requiring locations with good visibility and accessibility for customer traffic.

The company's strategy focuses on providing long-term lease agreements, which offers stability and predictable costs for these service operators. This approach is particularly attractive to businesses that view their physical location as a critical asset for customer acquisition and retention.

In 2023, Getty Realty reported that net lease properties, which often include automotive service centers, constituted a significant portion of their portfolio, demonstrating a clear commitment to this sector. This diversification strategy highlights Getty's understanding of the essential nature of automotive services within local economies.

Express Tunnel Car Wash Operators

Express tunnel car wash operators represent a significant and expanding customer segment for Getty Realty. These businesses often seek out specific site attributes that Getty is adept at identifying and developing. Getty's capital and deep real estate knowledge are particularly valuable to operators in this specialized niche.

Getty Realty has demonstrated a clear commitment to this sector, actively pursuing and acquiring car wash properties. This strategic focus underscores the growing importance of express tunnel car washes within Getty's portfolio. For instance, in 2023, Getty completed 13 car wash acquisitions, totaling $63.2 million, highlighting their investment in this growing market.

- Specialized Site Needs: Express tunnel car washes require specific zoning, visibility, and traffic flow characteristics that Getty Realty excels at sourcing.

- Capital and Expertise: Getty provides crucial capital and real estate development expertise, enabling operators to expand and modernize their facilities.

- Market Growth: The express tunnel car wash model is experiencing robust growth, making it an attractive segment for both operators and Getty Realty as a landlord.

- Acquisition Strategy: Getty's consistent acquisition of car wash properties signals a strong belief in the long-term viability and profitability of this customer segment.

Real Estate Investors and Shareholders

Shareholders and potential investors are vital for Getty Realty, a publicly traded Real Estate Investment Trust (REIT). They are drawn to the prospect of stable dividend income, capital appreciation, and portfolio diversification. Getty Realty’s commitment to consistent financial performance and transparent reporting directly addresses these investor needs.

Getty Realty’s strategy aims to deliver reliable returns, making it an attractive option for those seeking income-generating assets. In 2024, REITs, in general, have continued to be a significant part of diversified portfolios, with many investors looking for steady cash flow amidst market volatility.

- Investor Focus: Shareholders prioritize stable dividend income and capital appreciation.

- Getty's Approach: Consistent financial performance and transparent reporting are key to attracting and retaining this segment.

- Market Context (2024): REITs remain a popular choice for income-seeking investors looking for diversification.

Independent convenience store and gas station operators, along with larger chains, form a significant customer base for Getty Realty. These businesses rely on Getty for stable real estate solutions, often through sale-leaseback transactions or long-term leases, enabling them to access capital and secure prime locations. Automotive service centers, including tire shops and repair garages, are also key clients, valuing Getty's long-term lease agreements for predictable costs and location stability.

Express tunnel car wash operators represent a growing segment, attracted by Getty's expertise in sourcing specialized sites and providing essential capital for expansion. Getty Realty's commitment to these sectors is evident in its property acquisitions and leasing strategies, reflecting a deep understanding of their operational needs and market dynamics.

Cost Structure

A significant portion of Getty Realty's expenses is tied to acquiring new properties. This includes the actual purchase price, thorough due diligence to assess each property's viability, legal fees associated with the transactions, and various closing costs. These are substantial upfront investments necessary for growing the company's real estate portfolio.

Getty Realty demonstrated a strong commitment to expansion by investing approximately $209 million in property acquisitions during 2024. This robust investment activity is projected to continue into 2025, underscoring the importance of property acquisition as a key cost driver for the business.

While Getty Realty's net lease model largely transfers property operating costs to tenants, the company still shoulders certain expenses. These include costs associated with overall property oversight, managing potential environmental liabilities, and any capital expenditures that fall outside the scope of tenant lease agreements. These expenditures are crucial for preserving the enduring value and operational soundness of its real estate holdings.

Environmental expenses have become a significant factor in Getty's recent financial performance. For instance, in the first quarter of 2024, Getty reported approximately $1.5 million in environmental remediation costs, a figure that highlights the impact these liabilities can have on profitability and cash flow.

Getty Realty, as a Real Estate Investment Trust (REIT), significantly utilizes debt financing to fuel its property acquisitions and development. This reliance on borrowed capital translates directly into substantial interest expenses, primarily stemming from its unsecured notes and revolving credit facilities. For instance, in the first quarter of 2024, the company reported interest expense of $17.9 million.

Effectively managing the cost of this debt is paramount for Getty Realty's profitability. The company actively monitors its financial leverage, aiming for a prudent net debt to EBITDA ratio. This metric helps ensure that the company's earnings are sufficient to cover its debt obligations, thereby safeguarding its financial stability and ability to service its debt.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses are the backbone costs supporting Getty Realty's corporate operations. These encompass everything from executive and administrative staff salaries and benefits to essential office overhead, legal counsel, accounting services, and other vital administrative functions required to keep the business running smoothly.

Effective management of these G&A costs is directly linked to the company's overall profitability. Getty Realty reported a G&A ratio of 9.9% in the second quarter of 2025, indicating a focused effort on operational efficiency.

- Salaries and Benefits for corporate staff, including management and administrative personnel.

- Office Overhead covering rent, utilities, and maintenance for corporate headquarters.

- Professional Services such as legal fees, accounting audits, and consulting engagements.

- Other Administrative Costs including insurance, technology, and general office supplies.

Real Estate Development and Redevelopment Costs

Getty Realty dedicates significant capital to real estate development and redevelopment. For new construction or major renovations, costs encompass land acquisition, the actual building process, and expert project management. These expenditures are strategic investments aimed at boosting property value and future rental revenue streams.

- Land Acquisition: Costs associated with purchasing land for new development projects.

- Construction Expenses: Funds allocated for building materials, labor, and site preparation for new or redeveloped properties.

- Project Management: Fees for overseeing the entire development lifecycle, from planning to completion.

In 2024, Getty Realty continued to advance its development pipeline, a crucial component for long-term growth. This pipeline represents committed funding for acquiring and developing new assets, ensuring a steady supply of enhanced properties ready to generate rental income and capital appreciation.

Getty Realty's cost structure is primarily driven by property acquisitions, interest expenses on debt, and general administrative costs. While the net lease model shifts many operational expenses to tenants, Getty still incurs costs for property oversight, environmental liabilities, and capital expenditures outside lease agreements. Development and redevelopment projects also represent significant capital outlays.

| Cost Category | Key Components | 2024 Data/Notes |

| Property Acquisitions | Purchase price, due diligence, legal fees, closing costs | $209 million invested in property acquisitions during 2024 |

| Interest Expense | Unsecured notes, revolving credit facilities | $17.9 million in Q1 2024 |

| General & Administrative (G&A) | Salaries, office overhead, professional services | 9.9% G&A ratio in Q2 2025 |

| Environmental Costs | Remediation, compliance | Approximately $1.5 million in Q1 2024 |

| Development & Redevelopment | Land acquisition, construction, project management | Ongoing investment in development pipeline |

Revenue Streams

Getty Realty’s core revenue generation hinges on base rental income derived from its extensive portfolio of net-leased properties. These properties primarily consist of convenience stores, gas stations, and automotive retail locations, providing a consistent and reliable income stream.

The stability of this revenue is further bolstered by the long-term nature of its lease agreements and an exceptionally high occupancy rate, often nearing 100%. This structure minimizes vacancy risk and ensures predictable cash flow for the company.

As of the second quarter of 2025, Getty Realty reported that its base rental income reached an annualized figure of $204 million, underscoring the substantial and steady contribution of this revenue stream to its overall financial performance.

Beyond the core base rent, Getty Realty's revenue streams are enhanced by additional rental income. This includes contractual rent escalations embedded within their long-term leases, which offer a predictable path for incremental revenue growth year over year. For instance, in 2024, Getty Realty's annual rent increases are expected to average around 1.8%, contributing to a steady uplift in income.

Furthermore, some of Getty's leases incorporate percentage rent clauses. This means that in addition to the fixed base rent, the company can receive a portion of tenant sales that exceed a certain threshold. While these provisions exist, it's important to note that base rent remains the primary driver of Getty's rental income.

Getty Realty generates income from the financing aspect of its sale-leaseback deals. This means when Getty buys a property and leases it back to the original operator, a significant portion of their revenue comes from the yield on that initial capital investment. This is a core strategy for them.

This financing component effectively acts as a loan, providing the operator with capital while Getty earns a return. For instance, in 2023, Getty Realty completed a $30 million sale-leaseback transaction with a national convenience store operator, highlighting this revenue stream's importance in their portfolio.

Gains from Property Dispositions

Getty Realty may sell properties that no longer align with its strategic goals or have reached their peak value, creating gains from these sales. This isn't a consistent income source, but it does boost profitability and helps recycle capital.

In 2024, Getty Realty completed the sale of 31 properties, bringing in gross proceeds of $13.1 million. This strategic divestment is part of managing their portfolio effectively.

- Property Dispositions: Getty Realty sells assets that are no longer core to its strategy or have matured.

- Capital Recycling: These sales free up capital for reinvestment in more promising opportunities.

- 2024 Performance: In 2024, 31 properties were sold for $13.1 million in gross proceeds.

- Profitability Contribution: While not a primary revenue stream, these gains enhance overall financial performance.

Reimbursements from Tenants (e.g., Property Taxes, Insurance)

Under Getty Realty's net lease model, tenants shoulder significant operating expenses, including property taxes and insurance. These costs are then reimbursed to Getty, effectively passing them through. For instance, in 2023, Getty Realty reported total rental and other revenue of $177.9 million, a portion of which includes these tenant reimbursements, reinforcing the predictable, net income stream characteristic of their portfolio.

These reimbursements are crucial as they contribute directly to Getty's gross revenue, even though they represent pass-through costs. This structure highlights the 'net' aspect of their leases, where the tenant's responsibility for these expenses is clearly defined, ensuring Getty's core rental income remains protected from fluctuations in property operating costs.

- Tenant Responsibility: Property taxes, insurance, and maintenance are typically tenant obligations.

- Reimbursement Mechanism: Getty Realty receives reimbursements from tenants for these passed-through expenses.

- Revenue Contribution: These reimbursements are included in Getty's gross revenue, bolstering reported income.

- Net Lease Reinforcement: The structure underscores the 'net' nature of the leases, shielding Getty from operational cost volatility.

Getty Realty's revenue is primarily driven by base rental income from its portfolio of net-leased properties, predominantly convenience stores and gas stations. This consistent income is secured by long-term leases and a near-perfect occupancy rate, ensuring predictable cash flow.

Additional rental income comes from contractual rent escalations, which provide a steady, built-in growth mechanism, and potential percentage rent clauses tied to tenant sales performance. The company also generates revenue through the financing component of its sale-leaseback transactions, effectively earning a yield on capital invested.

Furthermore, Getty Realty benefits from property dispositions, strategically selling assets to recycle capital and realize gains, which contributes to overall profitability. Tenant reimbursements for operating expenses like property taxes and insurance are also a key component, reinforcing the net income characteristic of their lease agreements.

| Revenue Stream | Description | 2024/2025 Data Point |

|---|---|---|

| Base Rental Income | Core income from net-leased properties. | Annualized $204 million (Q2 2025) |

| Additional Rental Income | Contractual escalations and potential percentage rent. | Rent increases averaging 1.8% (2024) |

| Sale-Leaseback Financing | Yield on capital from sale-leaseback deals. | $30 million transaction completed (2023) |

| Property Dispositions | Gains from selling mature or non-core assets. | 31 properties sold for $13.1 million (2024) |

| Tenant Reimbursements | Reimbursement of operating expenses by tenants. | Included in $177.9 million total revenue (2023) |

Business Model Canvas Data Sources

The Getty Realty Business Model Canvas is informed by a blend of internal financial data, comprehensive market research, and insights from industry-specific real estate reports. These sources provide a robust foundation for understanding customer needs, market opportunities, and operational efficiencies.