Getty Realty Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Getty Realty Bundle

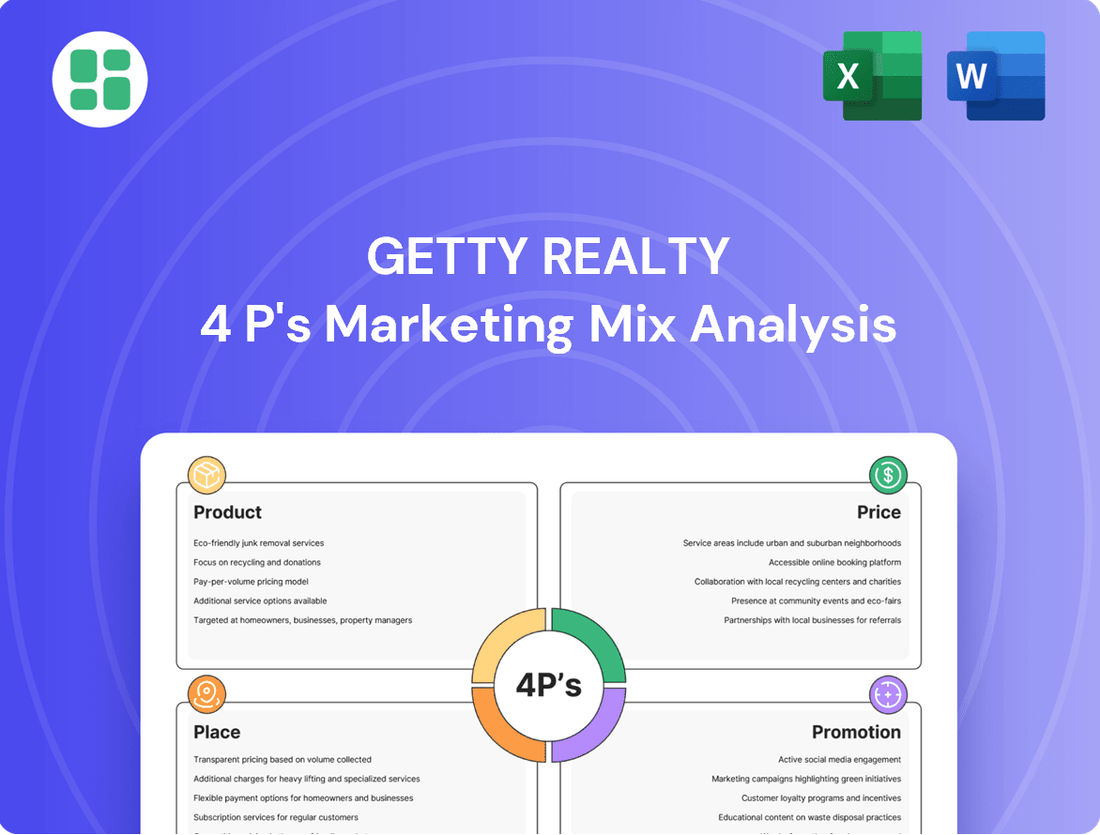

Discover how Getty Realty masterfully leverages its product offerings, strategic pricing, expansive distribution, and targeted promotions to dominate the real estate market. This analysis delves into the core of their marketing success, revealing the synergy between each P.

Go beyond this snapshot and unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Getty Realty. Perfect for business professionals, students, and consultants seeking actionable insights and strategic direction.

Product

Getty Realty's product is a specialized net lease real estate portfolio, heavily weighted towards convenience stores and gas stations. This focus provides essential, stable locations for their tenants' operations, generating consistent rental income for Getty. As of early 2024, the company's portfolio comprised over 1,000 properties, with a significant portion dedicated to these essential retail formats.

The company is actively expanding its product offering to include automotive retail, such as car washes and auto service centers. This strategic diversification aims to broaden the tenant base and reduce reliance on any single retail segment, enhancing portfolio resilience. By Q1 2024, Getty Realty reported that approximately 80% of its rental revenue came from convenience stores and gas stations, with automotive retail showing promising growth.

Getty Realty's sale-leaseback financing is a key product offering, allowing convenience and automotive retail operators to convert their owned real estate into immediate working capital. This strategy frees up significant funds, enabling businesses to invest in growth initiatives or operational improvements without diluting ownership. For instance, in 2024, many operators are seeking liquidity to navigate evolving consumer demands and invest in new technologies, making this a timely solution.

This financing structure, where Getty purchases a property and then leases it back to the original owner, is more than just a transaction; it's a strategic partnership. It strengthens Getty's tenant relationships by providing a vital financial tool, while simultaneously expanding Getty's portfolio of high-quality, income-generating properties. This approach directly supports Getty's property base expansion goals.

Getty Realty actively pursues both acquiring established properties and financing new construction within its specialized sectors. The company's strategy focuses on pinpointing prime locations and superior assets, such as drive-thru quick-service restaurants, express tunnel car washes, and auto service centers, that meet its rigorous investment standards.

In 2024, Getty Realty continued to allocate substantial capital towards portfolio expansion, reflecting its commitment to a dynamic product offering driven by strategic growth. This proactive approach ensures the company's assets remain competitive and aligned with evolving market demands in the quick-service retail and automotive service industries.

Long-Term, Triple Net Leases

Getty Realty's core product is its long-term, triple net lease (NNN) agreements, a cornerstone of its real estate offerings to tenants. This structure places the responsibility for property taxes, insurance, and maintenance squarely on the tenant's shoulders. This arrangement is key to generating a predictable and stable income stream for Getty Realty, minimizing its direct operational involvement with the physical assets and framing its product as a passive real estate investment.

The NNN lease model allows Getty Realty to focus on its investment strategy rather than day-to-day property management. This is particularly beneficial for a portfolio heavily weighted towards single-tenant retail properties, such as gas stations and convenience stores. As of the first quarter of 2024, Getty Realty reported that approximately 97% of its rental income was derived from NNN leases, highlighting the effectiveness of this product structure.

- Predictable Revenue: NNN leases create a stable and predictable income stream for Getty Realty, reducing revenue volatility.

- Reduced Operational Burden: Tenants cover property taxes, insurance, and maintenance, lessening Getty's operational responsibilities.

- Passive Investment Focus: The product is structured to be a passive investment for Getty, allowing management to concentrate on strategic growth and capital allocation.

- Portfolio Stability: The long-term nature of these leases, often with initial terms of 10-15 years and multiple renewal options, provides significant portfolio stability.

Strategic Redevelopment Initiatives

Getty Realty actively pursues strategic redevelopment initiatives to elevate the appeal and utility of its existing property portfolio. These projects focus on modernizing older retail assets, making them more attractive to contemporary tenants and consumers. For example, during 2024, Getty Realty reported completing several redevelopment projects, which contributed to a 3.5% increase in average rental rates across those specific properties compared to their pre-redevelopment state.

These redevelopment efforts are designed to unlock additional value by enabling Getty Realty to secure higher rental income and enhance the overall quality and competitiveness of its real estate holdings. This strategic product enhancement is crucial for maintaining long-term tenant relationships and attracting new, high-quality lessees, thereby supporting sustained rental income growth. By the end of Q1 2025, the company anticipates that its ongoing redevelopment pipeline will add an estimated $15 million in incremental annual rent.

- Portfolio Enhancement Redevelopments transform older assets into modern, high-demand retail spaces.

- Value Creation Higher rents are achieved on redeveloped properties, boosting portfolio value.

- Competitiveness Proactive upgrades ensure properties remain appealing to tenants and the market.

- Income Growth These initiatives directly support and drive long-term rental income expansion.

Getty Realty's product is a specialized net lease real estate portfolio, primarily focused on convenience stores and gas stations, with an increasing emphasis on automotive retail like car washes. This strategic product mix, as of Q1 2024, saw approximately 80% of rental revenue from convenience and gas stations, with automotive retail showing strong growth potential. The company also offers sale-leaseback financing as a key product, providing liquidity to retail operators.

| Product Offering | Key Characteristics | 2024/2025 Data/Impact |

|---|---|---|

| Net Lease Real Estate Portfolio | Long-term triple net leases (NNN) | ~97% of rental income from NNN leases (Q1 2024) |

| Tenant Focus | Convenience stores, gas stations, automotive retail | ~80% revenue from convenience/gas stations (Q1 2024); automotive retail growing |

| Financing Solutions | Sale-leaseback financing | Enables operators to access working capital for growth/tech investment |

| Portfolio Expansion | Acquisition of established properties & financing new construction | Focus on prime locations, drive-thru QSRs, express car washes |

| Redevelopment Initiatives | Modernizing older retail assets | 3.5% average rent increase on redeveloped properties (2024); ~$15M incremental annual rent expected by Q1 2025 |

What is included in the product

This analysis provides a detailed examination of Getty Realty's marketing mix, dissecting its Product, Price, Place, and Promotion strategies with real-world examples.

It offers a comprehensive understanding of Getty Realty's market positioning, ideal for strategic planning and competitive benchmarking.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for quick decision-making.

Place

Getty Realty's national footprint is a cornerstone of its strategy, spanning 42 states and Washington D.C. This extensive reach, set to expand to 44 states by Q2 2025, is concentrated in densely populated metropolitan areas. Such a wide geographic distribution effectively mitigates concentration risk, offering a robust foundation for tenant acquisition and future growth opportunities.

Getty Realty actively cultivates direct relationships with its operators and tenants, a cornerstone of its marketing strategy. This direct engagement fosters loyalty and provides invaluable insights into evolving tenant needs and market shifts. For instance, in 2024, a significant portion of Getty's lease renewals were attributed to these established, direct connections, underscoring their importance in maintaining a stable and predictable revenue stream.

Getty Realty strategically employs targeted acquisition channels like direct negotiations and sale-leaseback transactions to secure properties aligning with its investment thesis. This focused approach, particularly within convenience and automotive retail, allows for efficient portfolio expansion. For instance, in 2023, Getty Realty completed acquisitions totaling $351.9 million, demonstrating the effectiveness of these targeted methods in deploying capital.

Investor Relations and Capital Markets

Getty Realty's 'place' in the capital markets is crucial for its investors, with shares traded on the New York Stock Exchange (NYSE) under the ticker symbol GTY. This public listing provides a readily accessible venue for investors to buy and sell ownership in the company, reflecting its market valuation. As of July 2025, Getty Realty's market capitalization is approximately $2.5 billion, demonstrating its significant presence in the real estate investment trust (REIT) sector.

The company actively engages with the financial community through participation in key investor conferences and maintaining a comprehensive investor relations website. This commitment to transparency ensures investors have timely access to financial reports, presentations, and corporate news, facilitating informed decision-making. For instance, their Q1 2025 earnings call highlighted a 5% year-over-year increase in net asset value, a key metric for REIT investors.

- NYSE Trading: Getty Realty (GTY) is listed on the New York Stock Exchange, offering liquidity and a regulated market for its shares.

- Investor Engagement: Active participation in industry conferences and a detailed IR website provide essential information for analysts and investors.

- Financial Transparency: Regular reporting and accessible data on performance metrics like FFO (Funds From Operations) are key components of their investor relations strategy.

- Market Perception: As of mid-2025, GTY's stock performance reflects investor confidence, with a beta of 0.95 indicating slightly lower volatility than the broader market.

Strategic Market Focus

Getty Realty's place strategy centers on strategically positioning its properties within recession-resistant and internet-resistant retail segments. This means a deliberate focus on locations that benefit from consistent, high consumer demand, ensuring their physical presence remains vital. For instance, by concentrating on essential services like convenience stores and auto repair shops, Getty Realty cultivates a portfolio less susceptible to economic downturns or the shift towards online retail.

This approach is crucial for long-term asset stability. In 2024, the retail real estate market continued to see a bifurcation, with essential services and necessity-based retail demonstrating resilience. Getty Realty's focus aligns with this trend, aiming to maintain property relevance and profitability irrespective of broader economic fluctuations.

- Targeted Sectors: Convenience stores, quick-service restaurants, and auto service centers are key components of Getty Realty's portfolio, chosen for their consistent demand.

- Location Emphasis: Properties are situated in markets with robust and stable consumer traffic, minimizing exposure to economic volatility.

- Resilience Strategy: By focusing on "internet-resistant" businesses, Getty Realty mitigates the impact of e-commerce growth on its physical asset values.

- 2024 Market Alignment: This strategy reflects a keen understanding of 2024 retail real estate trends, where necessity-driven retail outperformed many other segments.

Getty Realty's place strategy is defined by its expansive geographic footprint, covering 44 states by mid-2025, with a strong emphasis on densely populated metropolitan areas. This broad reach, coupled with direct tenant relationships cultivated through active engagement and targeted acquisitions, ensures portfolio stability and growth potential. Their strategic focus on recession-resistant and internet-resistant retail sectors, such as convenience stores and auto service centers, further solidifies the value and resilience of their physical asset locations.

| Metric | Value | As Of |

|---|---|---|

| States Covered | 44 | Q2 2025 (Projected) |

| Key Tenant Segments | Convenience Stores, Auto Service Centers | Ongoing |

| NYSE Ticker | GTY | Ongoing |

| Market Capitalization | ~$2.5 Billion | July 2025 |

Full Version Awaits

Getty Realty 4P's Marketing Mix Analysis

The preview you see here is the exact same comprehensive Getty Realty 4P's Marketing Mix Analysis that you will receive immediately after purchase. This means you are viewing the final, complete document with no surprises or missing sections. You can be confident that the insights and strategies presented are precisely what you'll be working with.

Promotion

Getty Realty prioritizes clear and consistent investor communications, utilizing quarterly earnings calls, press releases, and detailed financial reports to share its business and financial performance. This proactive approach ensures the investment community stays informed about strategic moves, financial outcomes, and future growth potential, fostering trust among a wide range of financially savvy individuals.

Getty Realty's leadership actively participates in significant industry gatherings like Nareit's REITweek. This engagement is crucial for showcasing the company's strategic vision, fostering vital connections with prospective collaborators, and interacting with the wider real estate investment ecosystem.

These conferences function as a powerful promotional channel, allowing Getty Realty to effectively communicate its core strengths, competitive market standing, and future expansion prospects to a select audience of financial experts and investors. For instance, during 2024, REITweek events provided direct access to key decision-makers in the net lease sector.

Getty Realty's digital presence, particularly its investor portal, serves as a crucial element of its marketing mix. This online hub offers a wealth of information including SEC filings, investor presentations, and recent news releases, ensuring stakeholders have timely access to company data. This commitment to transparency is vital for fostering trust and engagement with a diverse investor base.

Public Relations and News Coverage

Getty Realty leverages public relations and news coverage to disseminate key business developments, such as property acquisitions and financial performance. By distributing press releases through major newswire services and securing coverage in financial news outlets, the company effectively communicates its progress and reinforces its standing as a prominent net lease REIT.

This strategic media engagement significantly boosts brand visibility and strengthens its reputation. For instance, in the first quarter of 2024, Getty Realty announced the acquisition of a retail property for $5.2 million, a transaction that garnered attention from industry publications. Such positive coverage is crucial for attracting new investors and maintaining the confidence of its existing shareholder base.

- Enhanced Brand Visibility: Broad media outreach through press releases and financial news coverage amplifies Getty Realty's presence in the market.

- Reputation Reinforcement: Consistent positive news coverage solidifies its image as a leading net lease REIT.

- Investor Attraction: Positive media attention aids in drawing new investment capital to the company.

- Shareholder Confidence: Transparent communication of business updates helps maintain and grow existing shareholder trust.

Corporate Responsibility Reporting

Getty Realty actively communicates its dedication to sustainable and ethical operations through its Corporate Responsibility Report. This report details the company's Environmental, Social, and Governance (ESG) efforts, resonating with the increasing number of investors focused on socially conscious investments. For instance, in their 2023 report, Getty Realty highlighted a 15% reduction in energy consumption across their portfolio compared to 2022, demonstrating tangible progress in their environmental stewardship.

This promotional strategy underscores Getty Realty's forward-thinking approach and commitment to operating within a robust ethical framework. By transparently sharing their ESG performance, they aim to build trust and attract stakeholders who value corporate accountability. This aligns with broader market trends, where ESG factors are becoming increasingly critical in investment decisions, with global sustainable investment assets projected to exceed $50 trillion by 2025.

The Corporate Responsibility Report serves as a key element in Getty Realty's marketing mix, specifically within the promotion aspect. It effectively communicates value beyond financial returns, appealing to a conscious consumer and investor base. Key highlights typically include:

- Environmental Initiatives: Details on energy efficiency improvements, waste reduction programs, and sustainable building practices.

- Social Impact: Information on community engagement, employee well-being, diversity and inclusion efforts, and ethical supply chain management.

- Governance Standards: Transparency regarding board structure, executive compensation, shareholder rights, and business ethics.

- ESG Performance Metrics: Quantifiable data and progress reports on key environmental, social, and governance targets.

Getty Realty's promotional strategy is multifaceted, focusing on clear investor communications through earnings calls and press releases. Participation in industry events like REITweek in 2024 allows direct engagement with key financial players, enhancing brand visibility and fostering crucial industry connections.

The company's investor portal acts as a central hub for essential data, reinforcing transparency and stakeholder trust. Public relations efforts, including announcements of acquisitions like the $5.2 million retail property purchase in Q1 2024, are vital for attracting new capital and solidifying its market position.

Furthermore, Getty Realty's commitment to ESG is highlighted in its Corporate Responsibility Report, showcasing tangible progress such as a 15% energy consumption reduction in 2023. This appeals to a growing segment of investors prioritizing socially responsible investments, aligning with the projected growth of global sustainable investment assets to over $50 trillion by 2025.

| Promotional Activity | Key Objective | Recent Example/Data Point |

|---|---|---|

| Investor Communications | Inform stakeholders, build trust | Quarterly earnings calls, press releases |

| Industry Event Participation | Networking, strategic positioning | Nareit REITweek 2024 attendance |

| Digital Investor Portal | Provide easy access to information | SEC filings, investor presentations available |

| Public Relations | Enhance visibility, attract capital | $5.2M retail property acquisition announcement (Q1 2024) |

| Corporate Responsibility Report | Attract ESG-focused investors | 15% energy reduction (2023 vs. 2022) |

Price

Getty Realty utilizes a triple net lease (NNN) structure for its properties. This means tenants are responsible for property taxes, insurance, and maintenance, in addition to rent. This approach allows Getty to offer attractive base rents while securing a stable and predictable income stream, minimizing its exposure to variable property operating costs.

Getty Realty carefully considers the initial cash yield when evaluating new property acquisitions and developments. This metric is key to ensuring they achieve strong returns on the capital they deploy.

For instance, in 2024, Getty Realty committed around $209 million to investments that generated an 8.3% initial cash yield. Following this, in the second quarter of 2025, the company invested an additional $66.1 million, securing an 8.1% initial cash yield on those transactions.

This focus on initial cash yield directly impacts the ongoing profitability of their portfolio and the long-term rental income they can expect from their properties, making it a critical factor in their investment decisions.

Getty Realty's lease rates are designed to grow over time, with contractual rent increases often linked to inflation or predetermined fixed escalators. This ensures a steady, predictable increase in rental income, supporting the company's financial stability and growth objectives.

While precise lease rates are confidential, Getty Realty's pricing strategy is clearly influenced by market demand, the quality of its properties, and the financial strength of its tenants. This approach allows them to remain competitive in the market while also benefiting from any appreciation in their real estate assets.

For instance, as of the first quarter of 2024, Getty Realty reported a weighted average lease term of approximately 7.5 years, indicating a stable tenant base and long-term revenue streams. This stability is crucial for supporting their market-driven lease rate adjustments.

Capital Solutions and Financing Terms

Getty Realty's capital solutions and financing terms are structured to be competitive, aiming to align with current capital market conditions for convenience and automotive retail operators. The 'price' element in this context refers to the interest rates and repayment structures Getty offers, designed to balance the capital needs of its partners with attractive returns for Getty. For instance, in 2024, Getty Realty's weighted average interest rate on its financing portfolio remained competitive, reflecting market dynamics and its strategy to facilitate growth.

These financial arrangements are specifically tailored to support the expansion of its partners' businesses through sale-leaseback transactions and development financing. Getty's approach prioritizes creating mutually beneficial terms that enable operators to access necessary capital while simultaneously allowing Getty to grow its real estate asset base.

- Competitive Interest Rates: Getty Realty aims to offer interest rates that are in line with prevailing capital market conditions for similar transactions in 2024 and early 2025.

- Flexible Repayment Schedules: Financing terms are customized to match the cash flow patterns and operational needs of convenience and automotive retail businesses.

- Facilitating Growth: The pricing and terms are set to encourage expansion, supporting Getty's partners in acquiring new locations or redeveloping existing ones.

- Asset Base Expansion: Getty's financial structuring is designed to secure attractive returns on its investments while growing its portfolio of owned real estate assets.

Dividend Payouts and Shareholder Returns

For investors, Getty Realty's dividend payout is a crucial part of their return, signaling the company's financial strength and profitability. The company has demonstrated a commitment to its shareholders by consistently increasing its dividend for eight consecutive years, a significant factor in attracting and retaining investment.

This sustained dividend growth is directly tied to Getty Realty's operational success, particularly its reliable rental income streams and adept capital management strategies. As of early 2024, Getty Realty's dividend yield was approximately 4.5%, reflecting a solid return for shareholders.

- Consistent Dividend Growth: Eight consecutive years of dividend increases.

- Shareholder Value: Dividends represent a key return on investment.

- Financial Health Indicator: Payouts reflect profitability and effective capital management.

- Yield Performance: Approximately 4.5% dividend yield in early 2024.

Getty Realty's pricing strategy is anchored by its triple net lease (NNN) model, ensuring tenants cover taxes, insurance, and maintenance, which allows for competitive base rents and stable income. The company prioritizes an initial cash yield on acquisitions, demonstrating this with $209 million invested in 2024 at an 8.3% yield and $66.1 million in Q2 2025 at an 8.1% yield. Lease rates are designed for growth through inflation-linked or fixed escalators, supported by a weighted average lease term of approximately 7.5 years as of Q1 2024.

| Metric | 2024 Data | Q2 2025 Data |

|---|---|---|

| Investment Commitments | ~$209 million | $66.1 million |

| Initial Cash Yield | 8.3% | 8.1% |

| Weighted Average Lease Term (as of Q1 2024) | ~7.5 years | N/A |

4P's Marketing Mix Analysis Data Sources

Our Getty Realty 4P's Marketing Mix Analysis is meticulously crafted using a blend of primary and secondary data sources. We leverage official company disclosures, including SEC filings and investor presentations, alongside publicly available information on their real estate portfolio, lease agreements, and operational strategies.