Getty Realty Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Getty Realty Bundle

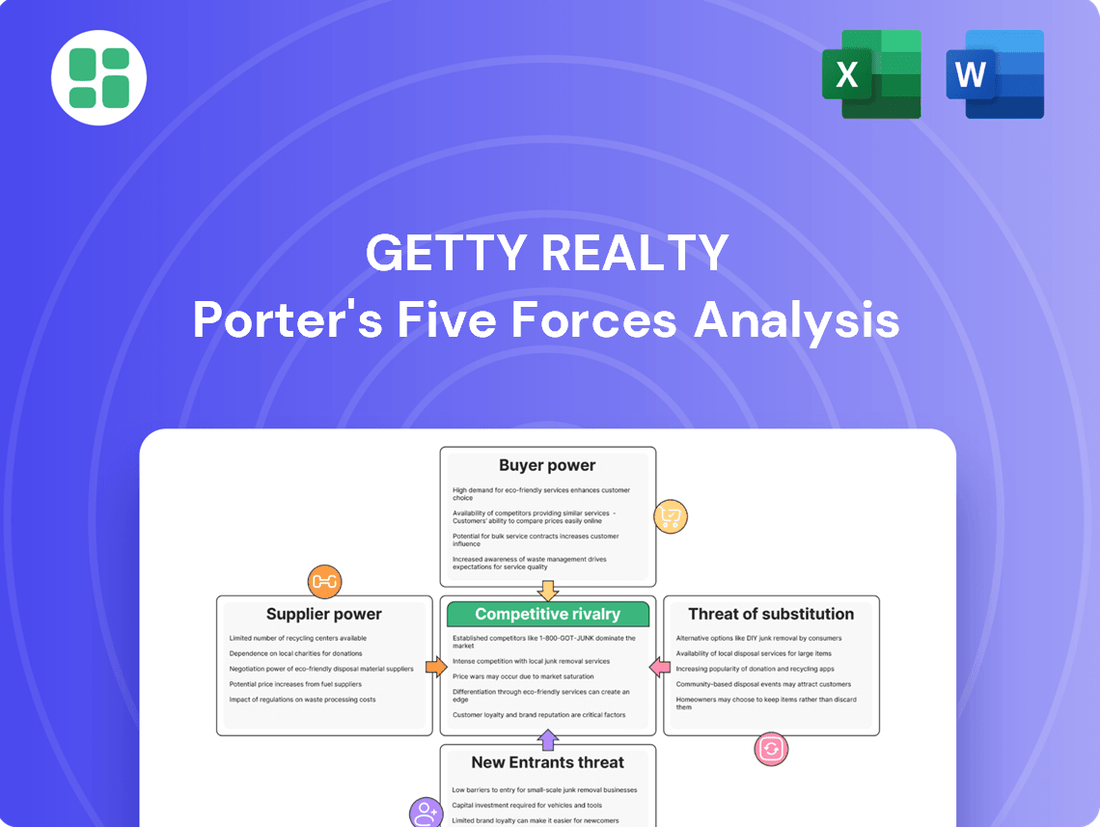

Getty Realty operates within a dynamic real estate landscape, where understanding the competitive forces is paramount. Our Porter's Five Forces analysis delves into the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Getty Realty’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Getty Realty's suppliers are largely individual property owners and developers of convenience stores and automotive retail locations. This fragmented ownership structure is a key advantage for Getty, as it prevents any single supplier from wielding significant influence over pricing or terms.

Because no single supplier can dictate terms, Getty enjoys considerable leverage in its negotiations. This dynamic allows Getty to effectively pursue and acquire a wide variety of properties across its targeted sectors, strengthening its portfolio.

The ease with which property owners can secure alternative funding directly influences their willingness to sell. When interest rates rise, as they have in recent periods, sale-leaseback arrangements, a core offering of Getty Realty, become a compelling strategy for businesses to generate cash. This allows them to free up capital tied in real estate without taking on new debt, potentially leading to a greater number of properties becoming available for acquisition by Getty.

Getty Realty's specialization in convenience and automotive retail properties means the underlying assets are largely standardized. This lack of unique differentiation for individual properties generally limits the bargaining power of suppliers, unless a specific location offers exceptional advantages.

Getty's consistent investment activity, which saw them acquire 47 properties in 2023 for approximately $217.6 million, indicates a robust and steady supply of suitable assets. This ongoing acquisition strategy further dilutes the power of any single supplier by providing Getty with alternative options.

Getty's Strong Capital Position

Getty Realty's strong capital position significantly enhances its bargaining power with suppliers, particularly property sellers. The company's robust access to both equity and debt financing allows it to act decisively in property acquisitions. In 2024 alone, Getty raised approximately $289 million in new capital, demonstrating its capacity to fund growth opportunities.

This substantial liquidity positions Getty as a preferred buyer, giving it leverage in negotiations. Its ability to secure favorable terms is a direct result of its financial strength and the confidence it instills in sellers. This financial flexibility is a key component of its competitive advantage.

- Robust Capital Access: Getty's ability to raise significant capital, exemplified by the $289 million secured in 2024, bolsters its negotiating stance.

- Liquidity for Investment: The company maintains considerable liquidity, enabling it to act swiftly and on favorable terms when acquiring properties.

- Preferred Buyer Status: Getty's financial stability makes it an attractive and reliable counterparty, enhancing its bargaining power with property owners and developers.

- Strategic Financial Management: Proactive capital raising and management ensure Getty can capitalize on market opportunities, reinforcing its supplier relationships.

Direct Sourcing of Deals

Getty Realty's strategy of directly sourcing deals, particularly sale-leaseback opportunities, significantly influences the bargaining power of its suppliers. By engaging directly with potential tenants, Getty bypasses traditional intermediaries like brokers.

This direct approach allows Getty to negotiate terms more favorably, potentially reducing the influence of sellers who might otherwise leverage their position through multiple interested parties or broker relationships. For instance, in 2024, real estate transaction costs can be substantial, and eliminating broker fees through direct sourcing offers a tangible benefit.

- Direct Negotiation: Getty's preference for direct talks with tenants over relying on third-party brokers minimizes the leverage of intermediaries.

- Deal Control: This strategy grants Getty greater control over the negotiation process and the final terms of acquisition.

- Cost Efficiency: Bypassing brokers can lead to reduced transaction costs, enhancing the overall profitability of deals.

Getty Realty's bargaining power with suppliers is notably strong due to the fragmented nature of property ownership in its niche markets, limiting any single supplier's leverage. The company's robust financial position, highlighted by its successful capital raise of approximately $289 million in 2024, allows it to act as a preferred buyer, securing favorable terms. Furthermore, Getty's direct deal sourcing strategy, bypassing brokers, minimizes transaction costs and enhances its negotiation control, ultimately reducing supplier influence.

| Metric | 2023 | 2024 (YTD) | Impact on Bargaining Power |

|---|---|---|---|

| Acquisitions (Number) | 47 | N/A | Demonstrates consistent demand, diluting individual supplier power. |

| Acquisition Value (Millions USD) | $217.6 | N/A | Significant capital deployment reinforces preferred buyer status. |

| Capital Raised (Millions USD) | N/A | $289 | Strong financial backing enhances negotiation leverage. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Getty Realty's position in the net lease real estate market.

Instantly identify and address competitive threats with a visual breakdown of each Porter's Five Forces, empowering proactive strategy development.

Customers Bargaining Power

Getty Realty's reliance on long-term triple-net (NNN) leases significantly curbs customer bargaining power. Under these agreements, tenants bear the brunt of property taxes, insurance, and maintenance costs. This arrangement shields Getty from many variable expenses, thereby strengthening its position during lease negotiations and renewals.

By offloading operational responsibilities, Getty minimizes the tenant's ability to leverage cost increases against rent. For instance, as of the first quarter of 2024, Getty's portfolio was 99.5% leased, with a weighted average lease term of approximately 10.4 years, underscoring the stability and reduced tenant leverage inherent in their NNN lease structure.

Getty Realty's exceptional performance in occupancy and rent collection significantly curtails customer bargaining power. With a remarkable 99.7% occupancy rate and year-to-date rent collection at 99.9% in 2025, the company demonstrates robust demand for its properties and a stable tenant base. This near-complete utilization leaves little room for tenants to negotiate terms due to vacancy pressures.

Getty Realty's diversified tenant base significantly dilutes the bargaining power of individual customers. The company leases properties to a wide array of convenience store and automotive retail operators, encompassing both large national chains and smaller independent businesses. This broad spectrum of lessees means no single tenant represents a disproportionately large portion of Getty's rental income, thereby limiting their leverage.

High Tenant Switching Costs

For convenience store and gas station operators, the prospect of relocating a business is fraught with significant expenses. These include the inevitable loss of established customer goodwill, the considerable costs associated with new build-out projects, and the administrative burden of transferring various licenses and permits. These substantial financial and operational hurdles make switching locations a daunting proposition.

Consequently, these high switching costs act as a powerful deterrent, effectively limiting tenants' bargaining power once a lease agreement is finalized. The investment required to move means tenants are less likely to negotiate aggressively or seek alternative locations, thereby strengthening Getty Realty's position.

- Tenant Retention: High switching costs encourage tenant loyalty, reducing churn and ensuring a more stable revenue stream for Getty Realty.

- Lease Negotiations: The cost of relocation empowers Getty Realty to negotiate more favorable lease terms, as tenants are less inclined to seek alternatives.

- Reduced Price Sensitivity: Tenants, facing high exit costs, are less likely to demand significant price reductions or concessions during lease renewals.

Essential Nature of Properties

The essential nature of the properties Getty Realty owns significantly bolsters its bargaining power with customers, or rather, its tenants. Convenience stores, gas stations, car washes, and auto service centers are services that people need regularly, regardless of economic conditions. This resilience means demand for these physical locations remains relatively stable, even when e-commerce alternatives exist for some goods.

This inherent demand for physical retail and service locations translates into stronger tenant retention and a greater ability for Getty Realty to dictate lease terms. For example, the U.S. convenience store sector, a key property type for Getty, generated an estimated $916 billion in sales in 2023. This robust market activity underscores the ongoing necessity of these physical retail footprints, reducing the leverage tenants might otherwise have to negotiate lower rents or more favorable lease agreements.

- Essential Services: Getty's portfolio primarily consists of properties housing convenience stores, gas stations, car washes, and auto service centers – all considered essential services.

- Economic Resilience: These businesses are less susceptible to economic downturns and e-commerce disruption due to their necessity-based offerings.

- Stable Demand: The consistent demand for these services strengthens Getty's negotiating position with its tenants, as the underlying business operations are less volatile.

- Market Strength: The U.S. convenience store sector alone saw estimated sales of $916 billion in 2023, highlighting the enduring importance of these physical locations.

Getty Realty's tenants possess limited bargaining power due to the specialized nature of their leased properties and the high costs associated with relocating. For instance, convenience stores and gas stations, key tenants for Getty, face significant expenses including loss of customer goodwill and new build-out costs, making lease renewal a more attractive option. This is further supported by Getty's strong portfolio performance, with a 99.5% occupancy rate and a weighted average lease term of 10.4 years as of Q1 2024, indicating tenant stability and reduced leverage.

| Factor | Description | Impact on Getty Realty |

|---|---|---|

| Triple-Net Leases | Tenants cover property taxes, insurance, and maintenance. | Reduces tenant's ability to negotiate based on operational costs. |

| High Switching Costs | Significant expenses for tenants to relocate. | Discourages tenants from seeking alternative locations, strengthening Getty's negotiation position. |

| Essential Nature of Properties | Properties house convenience stores, gas stations, etc., which are in consistent demand. | Ensures stable demand and reduces tenant leverage due to the necessity of these locations. |

| Portfolio Occupancy (Q1 2024) | 99.5% leased. | Minimizes tenant ability to negotiate due to low vacancy. |

What You See Is What You Get

Getty Realty Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape for Getty Realty, including detailed insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Rivalry Among Competitors

Getty Realty's niche focus on convenience and automotive retail properties, while limiting direct competitors, still sees rivalry from other specialized REITs and private equity firms targeting similar assets. For instance, in 2024, the market for gas station and convenience store real estate continued to attract significant investor interest, with several publicly traded REITs and private funds actively acquiring properties, creating a competitive environment for Getty Realty.

Getty Realty faces significant competition when seeking to acquire prime convenience and automotive retail properties. This includes other Real Estate Investment Trusts (REITs), well-capitalized private equity firms, and opportunistic individual investors, all actively participating in the market.

This intense rivalry for desirable assets can lead to inflated acquisition prices and a compression of rental yields. For instance, in 2024, the average cap rate for convenience store properties in many prime markets saw a slight decrease compared to the previous year due to strong demand, making it more challenging for REITs like Getty to secure deals at attractive initial returns.

Fluctuating interest rates directly impact the cost of capital for all real estate players, inevitably shaping their investment strategies and the overall competitive landscape. When rates rise, borrowing becomes more expensive, potentially squeezing margins and slowing down development or acquisition activities for many. This can create a more challenging environment for less capitalized firms.

Getty Realty has shown a notable ability to navigate both low and rising interest rate scenarios. In 2024, for instance, while many competitors might have scaled back due to increased borrowing costs, Getty's robust balance sheet allowed it to continue pursuing strategic investments. This financial strength provides a distinct advantage, enabling Getty to potentially gain market share when others are forced to retrench.

Scale and Established Relationships

Getty Realty's extensive portfolio, encompassing over 1,100 properties, coupled with its deeply entrenched, direct relationships with tenants, creates a significant barrier to entry for competitors. This scale facilitates operational efficiencies and streamlines the acquisition of new investment opportunities, presenting a formidable challenge for smaller or emerging players in the market.

The company's established tenant base, built over years of direct engagement, fosters loyalty and provides a stable revenue stream. This long-term partnership model is difficult for rivals to replicate, especially those lacking Getty's history and market presence.

- Property Portfolio: Getty Realty managed a portfolio of approximately 1,100 properties as of early 2024.

- Tenant Relationships: The company emphasizes direct, long-term relationships with its tenant base.

- Competitive Advantage: Scale and established relationships enhance Getty's ability to source deals and manage operations efficiently.

- Market Position: This scale makes it challenging for smaller competitors to match Getty's market penetration and operational leverage.

Diversification within Niche

Getty Realty's strategic move into diversifying beyond traditional gas stations is a key factor in managing competitive rivalry within its niche. By expanding into car washes, auto service centers, and quick-service restaurants, Getty broadens its investment universe.

This diversification reduces its reliance on any single sub-sector, thereby enhancing its competitive resilience. For example, in 2024, Getty reported that its non-fuel revenue streams, including those from convenience stores and car washes, continued to grow, contributing a larger portion to its overall net rental income.

- Diversification Reduces Sector-Specific Risk: By not being solely dependent on fuel sales, Getty is less vulnerable to fluctuations in fuel prices or demand.

- Expansion into Growth Areas: Car washes and quick-service restaurants represent growing consumer markets, offering additional revenue opportunities.

- Enhanced Property Value: Properties offering multiple amenities can command higher rents and attract more stable tenants.

- Competitive Advantage: This multi-faceted approach allows Getty to compete more effectively with specialized operators in each individual sector.

Getty Realty faces robust competition from other specialized REITs and private equity firms vying for convenience and automotive retail properties, especially in 2024 as investor interest in this sector remained high. This rivalry intensifies the pursuit of prime locations, potentially driving up acquisition costs and compressing initial rental yields, as evidenced by a slight decrease in average cap rates for convenience store properties in key markets during 2024 due to strong demand.

Getty's substantial portfolio of over 1,100 properties and its deep, direct tenant relationships act as significant barriers to entry, making it challenging for smaller competitors to match its scale and operational efficiencies. This established market presence and loyal tenant base provide a stable revenue stream that is difficult for rivals to replicate.

The company's strategic diversification into car washes, auto service centers, and quick-service restaurants in 2024 broadened its investment scope and reduced reliance on any single sub-sector, enhancing its competitive resilience. This multi-faceted approach allows Getty to compete more effectively across various consumer markets and secure more stable tenant partnerships.

| Metric | Getty Realty (Early 2024) | General Market Trend (2024) |

|---|---|---|

| Property Portfolio Size | ~1,100 properties | Continued strong investor interest |

| Average Cap Rate (Convenience Stores) | Slight decrease vs. prior year | Compressed due to high demand |

| Non-Fuel Revenue Contribution | Growing | Increasing importance for property value |

SSubstitutes Threaten

Convenience store and gas station operators might consider owning their properties instead of leasing from Getty Realty. This direct ownership allows them to avoid lease payments and build equity in their physical locations. However, Getty's sale-leaseback program is a powerful counter-argument, enabling operators to immediately access capital tied up in their real estate. For instance, in 2024, many businesses are prioritizing liquidity for expansion, making Getty's offering particularly attractive compared to the capital outlay of direct purchase.

Businesses seeking capital for real estate might consider traditional mortgage financing from banks, a readily available substitute for sale-leaseback agreements with REITs. However, with the Federal Reserve maintaining a target range for the federal funds rate between 5.25% and 5.50% as of mid-2024, corporate debt can become a more costly option.

This higher cost of traditional debt financing makes sale-leasebacks, which offer immediate liquidity and can be structured with predictable payments, a more appealing alternative for companies looking to unlock capital tied up in their owned properties.

Investors might consider other real estate sectors like industrial or data centers for stable income, potentially diverting capital from convenience and automotive retail. However, Getty Realty's focus on essential services and e-commerce resilience presents a unique defensive appeal. For instance, the industrial REIT sector saw strong performance in 2024, with many funds delivering attractive yields, but the necessity of fuel and car maintenance offers a different kind of stability.

Evolution of Automotive and Retail Landscape

Long-term shifts in the automotive sector, such as the increasing adoption of electric vehicles (EVs), pose a threat to traditional gasoline stations. As more consumers transition to EVs, the demand for gasoline will naturally decline, impacting businesses heavily reliant on fuel sales. For instance, by the end of 2023, EV sales in the US had already surpassed 1.2 million units, a significant jump from previous years, indicating a tangible shift.

Getty Realty actively mitigates this threat by diversifying its retail portfolio. The company is expanding into adjacent automotive services like car washes and auto repair shops. These services are less directly tied to the type of fuel a vehicle uses, making them more resilient to the EV transition. Furthermore, Getty's strategic investment in drive-thru quick-service restaurants (QSRs) offers another layer of defense, as QSRs are generally insulated from the direct impacts of automotive fuel trends.

- EV Adoption Impact: Growing EV market share directly reduces reliance on gasoline, a core revenue source for traditional stations.

- Diversification Strategy: Getty's expansion into car washes and auto service offers revenue streams independent of fuel type.

- QSR Resilience: Drive-thru restaurants provide a stable income stream less susceptible to automotive industry shifts.

Emergence of Non-Traditional Retail Models

The emergence of non-traditional retail models, such as online grocery delivery and ghost kitchens, represents a potential long-term threat of substitutes for traditional convenience store formats. These models, while not directly competing for the immediate, on-the-go needs of consumers, could gradually shift purchasing habits for certain convenience items. For instance, the convenience of having groceries delivered directly to one's doorstep can reduce the need for impulse buys at gas station convenience stores.

However, the immediate, on-the-go nature of convenience retail and fuel services remains a strong differentiator for Getty Realty's properties. In 2024, the convenience store sector continued to thrive on impulse purchases and immediate needs, with fuel sales remaining a significant driver. Data from the National Association of Convenience Stores (NACS) indicated that in-store sales for convenience stores reached record highs, demonstrating resilience against indirect substitution threats for immediate consumption needs.

- Online grocery delivery services offer a substitute for routine grocery shopping, potentially reducing foot traffic for convenience stores that also sell a limited range of food items.

- Ghost kitchens focus on delivery-only food preparation, bypassing the need for a physical retail storefront and potentially capturing a share of the quick-service meal market.

- Pop-up retail spaces offer flexibility and can experiment with new consumer experiences, though their transient nature limits them as direct, long-term substitutes for established convenience formats.

- Getty Realty's portfolio benefits from the inherent convenience and immediate accessibility of its locations, particularly for fuel and grab-and-go items, which are less susceptible to substitution by these emerging models in the short to medium term.

The threat of substitutes for Getty Realty's properties primarily stems from alternative ways businesses can access capital and consumers' changing habits. For businesses needing capital, traditional bank loans or even selling company-owned real estate directly are substitutes for Getty's sale-leaseback program. However, with interest rates hovering around 5.25%-5.50% in mid-2024, the cost of debt financing makes leasebacks more attractive.

For consumers, the rise of electric vehicles (EVs) is a significant substitute threat to traditional gas stations. With over 1.2 million EVs sold in the US by the end of 2023, the demand for gasoline is expected to decrease. Getty Realty is mitigating this by diversifying into car washes and auto repair, services less dependent on fuel type, and by investing in drive-thru restaurants that offer stable income regardless of automotive trends.

Online grocery delivery and ghost kitchens also present indirect substitution threats to convenience stores by altering consumer purchasing habits for certain goods. Yet, the immediate, on-the-go nature of convenience retail, especially for fuel and grab-and-go items, remains a strong point for Getty's properties, as evidenced by record in-store sales in the convenience sector in 2024.

| Substitute Type | Description | Impact on Getty Realty | Mitigation Strategy | Relevant 2024 Data/Trend |

|---|---|---|---|---|

| Alternative Capital Access | Traditional bank loans, direct property sales | Reduces demand for sale-leasebacks | Offer competitive terms, highlight liquidity benefits | Federal Funds Rate target: 5.25%-5.50% (mid-2024) |

| Electric Vehicles (EVs) | Shift away from gasoline-powered vehicles | Decreased demand for fuel sales at stations | Diversification into car washes, auto repair, QSRs | US EV sales exceeded 1.2 million by end of 2023 |

| Online Retail Models | Grocery delivery, ghost kitchens | Potential reduction in convenience store foot traffic | Focus on immediate, on-the-go needs, essential services | Convenience store in-store sales reached record highs (2024) |

Entrants Threaten

Entering the real estate investment trust (REIT) sector, particularly to acquire a portfolio comparable to Getty Realty's, demands immense capital. New players would need to secure hundreds of millions, if not billions, of dollars to even begin competing, creating a formidable barrier to entry.

Success in the convenience and automotive retail real estate niche demands deep industry knowledge, including site selection, tenant underwriting, and understanding of local market dynamics. Getty Realty has cultivated this specialized expertise over decades, creating a significant barrier for new entrants aiming to quickly replicate its success.

Getty Realty benefits from deeply entrenched relationships with its existing tenants, a significant barrier for potential new entrants. These long-standing partnerships foster a stable and predictable revenue stream, often leading to opportunities for repeat business and direct sourcing of new deals. For instance, Getty's tenant retention rate is a key indicator of this strength, though specific figures fluctuate annually, the consistent performance in this area underscores the difficulty for newcomers to replicate such established trust and operational history.

Regulatory and Compliance Burdens

The threat of new entrants for Getty Realty (GTY) is significantly shaped by substantial regulatory and compliance burdens. Operating as a publicly traded Real Estate Investment Trust (REIT) necessitates adherence to a complex web of federal and state regulations, including stringent reporting requirements dictated by the Securities and Exchange Commission (SEC) and specific REIT qualification rules. For instance, REITs must distribute at least 90% of their taxable income to shareholders annually to maintain their tax-advantaged status.

New players entering the REIT market must invest heavily in establishing the infrastructure and expertise to navigate these legal and financial landscapes. This includes setting up robust accounting systems, ensuring corporate governance, and developing the internal capabilities to manage compliance. The year 2024 saw continued emphasis on transparency and investor protection, making these hurdles even more significant for potential competitors.

- High Capital Requirements: Establishing a REIT requires substantial initial capital for property acquisition and operational setup, often in the hundreds of millions of dollars.

- Complex Legal Framework: Navigating SEC filings, tax laws specific to REITs, and state-specific real estate regulations demands specialized legal and financial expertise.

- Operational Scale: Achieving economies of scale to compete effectively often necessitates a portfolio of significant size, further increasing entry barriers.

- Reputational Risk: New entrants face the challenge of building trust and a strong reputation in a market where established players have long-standing relationships and track records.

Competition from Incumbents

New entrants would face immediate and intense competition from well-established players like Getty Realty. These incumbents possess significant market share, robust balance sheets, and advantageous access to financing, making it difficult for newcomers to compete effectively.

Getty Realty's proven acquisition strategies and established operational efficiencies further solidify its competitive position. For instance, in 2024, Getty Realty continued its strategic acquisitions, adding properties that enhanced its portfolio diversification and revenue streams, presenting a formidable barrier for any new entity attempting to enter the market.

- Established Market Share: Getty Realty holds a substantial portion of its target markets, meaning new entrants must displace existing customer loyalty and contracts.

- Financial Strength: Companies like Getty Realty benefit from strong credit ratings, enabling them to secure capital at lower costs than emerging competitors.

- Economies of Scale: Existing players often achieve lower per-unit costs due to their larger operational scale, a benefit new entrants would struggle to replicate initially.

- Brand Recognition and Reputation: Getty Realty's long-standing presence and positive reputation create a significant advantage in attracting and retaining tenants and investors.

The threat of new entrants for Getty Realty is generally low due to significant capital requirements, specialized knowledge, and established tenant relationships. These factors create substantial barriers, making it difficult for new companies to enter and compete effectively in the convenience and automotive retail real estate sector.

New entrants would need to overcome the immense financial hurdle of acquiring a portfolio comparable to Getty Realty's, which involves hundreds of millions, if not billions, of dollars. Furthermore, replicating Getty's decades of cultivated expertise in site selection and tenant underwriting presents a steep learning curve. Established relationships with existing tenants also provide a stable revenue stream and deal flow that newcomers would struggle to match.

Regulatory burdens, including SEC reporting and REIT qualification rules, add another layer of complexity and cost. For example, REITs must distribute at least 90% of taxable income annually. In 2024, the emphasis on transparency and investor protection further amplified these compliance requirements, demanding significant investment in legal and financial infrastructure for any new player.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Acquiring a portfolio similar to Getty Realty's requires hundreds of millions to billions of dollars. | Forms a significant financial obstacle, limiting the pool of potential entrants. |

| Specialized Knowledge | Deep understanding of convenience/automotive retail real estate, tenant underwriting, and market dynamics is crucial. | New entrants need time and resources to build this expertise, putting them at a disadvantage. |

| Tenant Relationships | Getty Realty has long-standing, stable relationships with its tenants. | Makes it difficult for new entrants to secure comparable tenant agreements and revenue streams. |

| Regulatory Compliance | Adherence to SEC regulations, REIT qualification rules, and tax laws is complex and costly. | Requires substantial investment in legal and financial infrastructure, increasing initial setup costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Getty Realty leverages data from investor relations websites, annual reports, and industry-specific trade publications to provide a comprehensive view of the competitive landscape.