Gentherm SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentherm Bundle

Gentherm's innovative thermal management solutions position them strongly in the automotive sector, but they face intense competition and evolving industry trends. Understanding their unique strengths, potential weaknesses, market opportunities, and threats is crucial for any investor or strategist.

Want the full story behind Gentherm's competitive advantages, potential roadblocks, and future growth avenues? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Strengths

Gentherm commands a leading global position in thermal management and pneumatic comfort solutions, especially within the automotive sector. This strength is underscored by their consistent innovation and robust customer ties, highlighted by substantial new business wins, including securing approximately $1.4 billion in new awards in 2023, with a significant portion expected to commence in 2024 and 2025.

Gentherm's strength lies in its significantly diversified product portfolio, extending beyond its automotive roots into crucial medical and industrial applications. This strategic expansion, which includes patient temperature control systems and solutions for other temperature-sensitive industrial processes, effectively reduces the company's dependence on any single market. For instance, in 2024, the medical segment showed promising growth, contributing to overall revenue stability.

Gentherm’s commitment to innovation is a cornerstone of its strength, evident in its substantial and consistent investment in research and development. This focus has yielded groundbreaking solutions, such as the recognized ClimateSense® Technology, which is designed to deliver notable energy efficiency improvements.

The company strategically leverages its core technology platforms—Thermal Management, Air Moving Devices, Pneumatic Solutions, and Valve Systems—by actively expanding their application into emerging markets. This approach underscores Gentherm’s dedication to technological progress and sustained expansion, a strategy that has historically secured significant new business awards and reinforced its competitive position.

Robust Financial Performance and Business Awards

Gentherm's financial strength is evident in its recent business wins, securing $2.4 billion in new automotive awards in 2024 and an additional $1 billion year-to-date in 2025. This consistent influx of new contracts highlights robust customer trust and a strong pipeline for future revenue. The company's financial health is further underscored by its low net leverage, which offers significant flexibility for strategic initiatives and capital allocation.

This solid financial footing translates into tangible benefits, allowing Gentherm to pursue growth opportunities and return value to shareholders. The substantial new business awards not only confirm the company's competitive positioning but also provide a clear indicator of its sustained performance and market demand for its innovative solutions.

- Significant New Business Awards: $2.4 billion in 2024 and $1 billion year-to-date in 2025.

- Strong Financial Health: Characterized by low net leverage.

- Financial Flexibility: Enables strategic investments and share repurchases.

- Customer Confidence: Demonstrated by substantial new contract wins.

Global Presence and Operational Alignment

Gentherm boasts an impressive global presence, operating with over 14,000 employees spread across facilities in 13 countries. This extensive network allows for localized design, integration, and production, crucial for adapting to diverse customer needs and regional market dynamics. Their operational alignment with customer product strategies in key automotive hubs like North America, Europe, and Asia is a testament to their commitment to seamless service and market penetration.

This strategic global footprint directly supports Gentherm's ability to serve major automotive manufacturers worldwide. By having operations close to their clients, they can offer more responsive support and efficient supply chains. This also positions them well for expansion into new and emerging automotive markets, leveraging their established infrastructure and expertise.

Key aspects of their global strength include:

- Extensive Workforce: Over 14,000 employees globally, providing a robust human capital base.

- Geographic Reach: Facilities in 13 countries, enabling broad market access and localized operations.

- Customer-Centric Alignment: Operations strategically positioned to support customer product roadmaps in major automotive regions.

- Market Responsiveness: Capability for localized design and production enhances adaptability to regional demands and accelerates new market entry.

Gentherm's market leadership is solidified by its strong customer relationships and consistent innovation, evidenced by securing approximately $1.4 billion in new awards in 2023, with significant portions slated for 2024 and 2025. Their diversified product range, extending into medical and industrial sectors, provides a crucial buffer against automotive market fluctuations, as seen with positive growth in the medical segment during 2024.

The company’s financial health is robust, marked by low net leverage and substantial new business wins totaling $2.4 billion in 2024 and $1 billion year-to-date in 2025, demonstrating strong customer confidence and a healthy revenue pipeline. This financial stability grants Gentherm the flexibility to pursue strategic growth initiatives and enhance shareholder value.

Gentherm's expansive global footprint, with over 14,000 employees across 13 countries, enables localized design, production, and responsive customer support, crucial for adapting to regional automotive market demands and facilitating entry into new territories.

Gentherm's core technology platforms, including Thermal Management and Pneumatic Solutions, are consistently expanded into emerging markets, reinforcing their commitment to technological advancement and sustained growth, which has historically led to significant new business awards.

| Key Strength | Description | Supporting Data/Examples |

| Market Leadership & Innovation | Dominant position in thermal management and pneumatic comfort, driven by continuous R&D. | Secured ~$1.4 billion in new awards (2023), with significant portions for 2024/2025. Recognized ClimateSense® Technology for energy efficiency. |

| Product Diversification | Broad product portfolio extending beyond automotive into medical and industrial applications. | Medical segment showed promising growth in 2024, contributing to revenue stability. |

| Financial Strength & Flexibility | Strong financial health with low net leverage, enabling strategic investments. | $2.4 billion in new automotive awards (2024), $1 billion year-to-date (2025). |

| Global Presence & Operations | Extensive global network for localized support and market responsiveness. | Over 14,000 employees in 13 countries, enabling localized design and production. |

What is included in the product

Delivers a strategic overview of Gentherm’s internal and external business factors, highlighting its technological leadership and market expansion opportunities while acknowledging potential competitive pressures and supply chain vulnerabilities.

Offers a clear, actionable framework to identify and address Gentherm's key strategic challenges and opportunities.

Weaknesses

Gentherm's significant reliance on the automotive sector, which generates the bulk of its revenue, presents a notable weakness. For instance, in the first quarter of 2024, automotive sales represented over 90% of the company's total revenue. This concentration exposes Gentherm to substantial risks associated with the cyclical nature of vehicle production and demand.

The company's financial performance is therefore highly susceptible to downturns in the global automotive market. A slowdown in light vehicle production, as observed in certain regions during late 2023 and early 2024, directly translates to reduced demand for Gentherm's thermal management solutions, impacting its top and bottom lines.

Gentherm faces a significant weakness in its vulnerability to rising material and labor costs. The company's Q2 2025 earnings report highlighted that these increased expenses directly impacted its gross margin, demonstrating a clear challenge in absorbing these inflationary pressures.

Even with stable or growing revenues, these cost escalations can substantially erode Gentherm's profitability. Effectively managing and mitigating these ongoing cost increases remains a critical operational hurdle that directly influences the company's financial performance.

Gentherm's global footprint means its financial results are susceptible to foreign currency fluctuations. For instance, in the first quarter of 2024, the company reported net unrealized foreign currency losses, which directly impacted its net income. This exposure can inject unpredictability into earnings, complicating financial planning and forecasting for investors and management alike.

Potential for Intense Competition

The thermal management market, especially in the automotive sector, is becoming increasingly crowded. This includes not only established players but also newer, non-traditional companies entering the space, all vying for market share. This intense competition can put significant pressure on pricing, potentially impacting Gentherm's profit margins.

While Gentherm holds a strong leadership position, this competitive landscape means the company must constantly invest in research and development to stay ahead. Failing to innovate could lead to a decline in market share as competitors catch up or surpass Gentherm's technological offerings. For instance, the global automotive thermal management market was valued at approximately USD 30 billion in 2023 and is projected to grow, indicating a dynamic and attractive market for new entrants.

Maintaining technological superiority is not just an advantage; it's a necessity. This means continuous investment in R&D is crucial to develop next-generation thermal solutions that meet evolving automotive demands, such as those for electric vehicles (EVs). The rapid advancement in EV battery technology, for example, requires sophisticated thermal management systems, creating opportunities but also intensifying the need for innovation.

- Intensifying Competition: The thermal management market faces pressure from both traditional and non-traditional competitors.

- Pricing Pressure: Increased competition can lead to downward pressure on pricing, impacting profitability.

- Market Share Risk: Failure to innovate could result in a loss of market share to more agile competitors.

- R&D Investment: Sustained investment in research and development is critical to maintain a competitive edge and technological leadership, especially with the growth in EV thermal management needs.

Integration Challenges with New Facilities and Acquisitions

Gentherm faces integration challenges when bringing new facilities online, such as its plants in Monterrey, Mexico, and Tangier, Morocco. These expansions, while strategically important for global reach, can lead to initial costs associated with setting up new operations and realigning its overall footprint. This can temporarily affect gross margins as these facilities ramp up production and achieve full efficiency.

Integrating acquired businesses, like the 2023 acquisition of Alfmeier, presents another hurdle. The process requires meticulous planning and execution to ensure that anticipated synergies are realized and to prevent any operational disruptions that could hinder performance. Restructuring expenses were specifically noted in Gentherm's 2024 financial reporting, underscoring the costs associated with these integration efforts.

- Expansion Costs: Opening new plants in Monterrey and Tangier incurs initial setup and realignment expenses that can pressure gross margins.

- Acquisition Integration: Successfully integrating acquisitions, such as Alfmeier, is critical to achieving expected synergies and avoiding operational setbacks.

- Restructuring Expenses: Gentherm reported restructuring expenses in 2024, highlighting the financial impact of integrating new operations and entities.

Gentherm's heavy reliance on the automotive sector, accounting for over 90% of its revenue in Q1 2024, makes it highly vulnerable to industry downturns and production slowdowns, as seen in late 2023 and early 2024.

The company is also susceptible to rising material and labor costs, which directly impacted its gross margin in Q2 2025, demonstrating a challenge in absorbing inflationary pressures.

Foreign currency fluctuations, evidenced by net unrealized losses in Q1 2024, introduce unpredictability into Gentherm's financial results.

Intensifying competition in the thermal management market, valued at approximately USD 30 billion in 2023, puts pressure on pricing and necessitates continuous R&D investment to maintain market share, especially with the growing demand for EV thermal solutions.

What You See Is What You Get

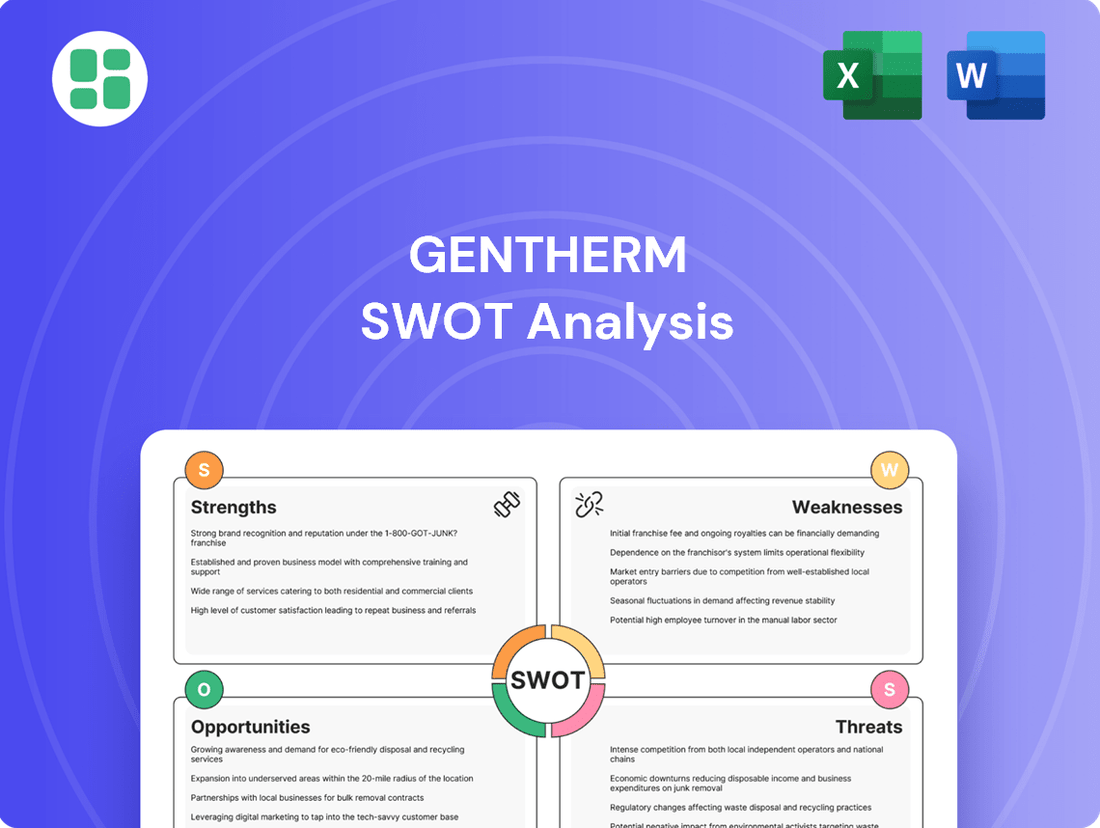

Gentherm SWOT Analysis

The preview you see is the same Gentherm SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This allows you to assess the depth and structure of the analysis before committing. You'll gain immediate access to the full, detailed report after completing your purchase.

Opportunities

The accelerating global transition to electric vehicles represents a substantial growth avenue for Gentherm. EVs necessitate advanced thermal management systems for critical components like batteries, cabins, and power electronics, areas where Gentherm possesses deep expertise.

Gentherm's established capabilities in heating and cooling technologies are well-suited to address the unique thermal challenges of EVs. By developing innovative solutions, they can enhance EV battery performance, optimize driving range, and improve passenger comfort, thereby capitalizing on the rapid expansion of this market segment. Battery performance solutions are already a key offering within their portfolio, demonstrating their readiness to meet this demand.

Gentherm is strategically expanding its reach beyond traditional automotive seating. The company is actively exploring opportunities in commercial vehicles and powersports, leveraging its thermal management expertise in these growing segments. This diversification aims to tap into new revenue streams and reduce reliance on a single market.

The company's core technology platforms are also being adapted for non-automotive applications. Significant growth is anticipated in the medical sector, where thermal solutions are critical. Gentherm is also investigating potential new industrial applications, broadening its market footprint and capitalizing on its established technological capabilities.

Gentherm's strategic partnerships, like the extended deal with DUOMED for European medical product distribution, highlight a proactive approach to market expansion. Acquisitions, such as the integration of Alfmeier, have bolstered their technological capabilities and product range. These moves are crucial for accelerating market entry and diversifying their tech base, especially as they forge new alliances with rapidly growing original equipment manufacturers (OEMs).

Increasing Adoption of Advanced Comfort and Wellness Features in Vehicles

The automotive industry is seeing a significant surge in demand for advanced comfort and wellness features. This trend is driving the adoption of sophisticated climate control solutions, extending their reach into more vehicle applications and global markets. For instance, high-content offerings like climate-controlled seats, lumbar support, and massage functions are increasingly sought after by both original equipment manufacturers (OEMs) and Tier 1 suppliers.

Gentherm's innovative Puls.A™ solution exemplifies this market shift, showcasing the growing consumer and manufacturer appetite for enhanced in-cabin experiences. This increasing adoption represents a substantial opportunity for companies positioned to deliver these advanced technologies, tapping into a market driven by a desire for greater passenger comfort and well-being.

- Growing Demand for Climate Control Seats: The market for advanced seating solutions, including heating, ventilation, and massage, is expanding rapidly as consumers prioritize comfort.

- Expansion into New Vehicle Segments: These features are no longer exclusive to luxury vehicles but are becoming standard in mid-range and even some entry-level models.

- OEM and Tier 1 Customer Interest: Automotive manufacturers and their suppliers are actively seeking innovative comfort solutions to differentiate their offerings.

- Gentherm's Puls.A™ as a Key Offering: The company's advanced thermal comfort technology is well-positioned to capitalize on this trend, meeting the evolving needs of the automotive sector.

Leveraging Sustainability Initiatives for Market Advantage

Gentherm's dedication to sustainability, including increasing its renewable energy usage and actively working to lower its carbon footprint, resonates with the escalating demand from consumers and investors for eco-friendly companies. This strategic alignment not only bolsters brand image but also attracts a growing segment of environmentally aware customers and investors. Furthermore, their commitment to long-term emissions targets, with a goal to achieve net-zero emissions by 2050, positions them favorably in a market increasingly prioritizing ESG (Environmental, Social, and Governance) factors.

This focus on sustainability can translate into tangible operational advantages. By prioritizing energy management and efficiency, Gentherm can unlock cost savings and streamline operations. For instance, in 2023, Gentherm reported a 10% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to their 2022 baseline, demonstrating concrete progress toward their environmental objectives.

- Enhanced Brand Reputation: Strong sustainability practices improve public perception and brand loyalty.

- Attracting ESG Investors: Companies with robust environmental strategies are increasingly favored by investment funds focused on sustainability.

- Customer Acquisition: Environmentally conscious consumers are more likely to choose brands demonstrating a commitment to sustainability.

- Operational Efficiencies: Investments in renewable energy and carbon reduction often lead to long-term cost savings.

The accelerating shift towards electric vehicles (EVs) presents a significant opportunity for Gentherm. EVs require sophisticated thermal management for batteries, cabins, and power electronics, aligning perfectly with Gentherm's core competencies. Their established expertise in heating and cooling technologies allows them to enhance EV battery performance, extend driving range, and improve passenger comfort, directly addressing the growing demands of this burgeoning market.

Threats

The automotive sector's inherent cyclicality makes it vulnerable to economic downturns, directly impacting light vehicle production and, consequently, demand for Gentherm's thermal management solutions. S&P Global anticipates flat to slightly declining global light vehicle production in 2025, with specific regional contractions, particularly in North America, presenting a significant headwind for revenue expansion.

This volatility necessitates close monitoring of customer demand schedules, as any slowdown in vehicle manufacturing directly translates to fewer component orders for Gentherm. The potential for reduced consumer spending during economic contractions further exacerbates this threat by dampening new vehicle sales.

The thermal management market is a hotbed of activity, with established players and new, innovative companies constantly vying for market share. Gentherm faces the challenge of staying ahead in this dynamic environment, where a competitor's breakthrough could quickly shift the landscape.

Rapid technological advancements are a significant threat. For instance, the increasing sophistication of battery thermal management systems for electric vehicles (EVs) means that companies not investing heavily in R&D could find their current offerings quickly becoming obsolete. Gentherm's ability to maintain its technological edge is paramount to fending off these disruptive forces.

To counter this, continuous and substantial investment in research and development is crucial. Without it, Gentherm risks losing its competitive advantage as rivals introduce more efficient or cost-effective thermal solutions, potentially impacting its market position and profitability.

Gentherm faces significant threats from supply chain disruptions and fluctuating raw material prices. For instance, the company's gross margin was impacted by rising material and labor expenses in recent periods, highlighting its sensitivity to these cost pressures. Geopolitical instability, evolving trade agreements, and unforeseen natural events can further disrupt operations, potentially causing production delays and escalating costs.

Regulatory Changes and Compliance Costs

Gentherm faces the ongoing threat of evolving regulations, especially within the automotive and medical sectors. These changes often focus on critical areas like safety, environmental impact, and energy efficiency. For instance, stricter emissions standards or new safety protocols could necessitate costly product modifications or even entirely new development cycles, impacting operational expenses and product roadmaps.

Furthermore, shifts in global tax policies present another significant challenge. As of early 2024, ongoing discussions and potential adjustments to corporate tax rates in key markets could directly influence Gentherm's net income and overall financial performance. Adapting to these varying tax landscapes requires constant vigilance and strategic financial planning to mitigate any negative consequences.

- Increased Compliance Burden: Evolving safety and environmental regulations in the automotive sector, such as those related to EV battery thermal management or emissions controls, could lead to higher research and development costs.

- Tax Reform Impact: Changes in international tax laws, like potential adjustments to global minimum tax rates or country-specific corporate tax reforms, could affect Gentherm's effective tax rate and profitability.

- Product Redesign Necessity: New energy efficiency standards for climate control systems might require substantial investment in redesigning existing products to meet updated performance benchmarks.

Foreign Exchange Rate Volatility and Geopolitical Risks

Gentherm's global footprint, spanning operations in 13 countries, inherently exposes the company to significant foreign exchange rate volatility. These fluctuations can directly impact the translation of foreign revenues and profits into U.S. dollars, potentially distorting reported financial performance. For instance, a strengthening U.S. dollar against currencies where Gentherm generates substantial sales could lead to lower reported revenues and net income.

Geopolitical risks and trade conflicts present another substantial threat. Disruptions in key operating regions or to critical supply chains, particularly for components sourced internationally, could impede production and delivery. Such tensions can also dampen consumer demand in affected markets, impacting Gentherm's sales outlook. The company has previously acknowledged experiencing unrealized currency losses, underscoring the tangible impact of these currency movements.

- Exposure to 13 operating countries amplifies foreign exchange rate risk.

- Geopolitical tensions can disrupt supply chains and market demand.

- Unrealized currency losses highlight the financial impact of exchange rate volatility.

Intense competition within the thermal management sector poses a significant threat, as both established players and emerging innovators continuously introduce new solutions. Gentherm must maintain its technological edge and adapt quickly to prevent market share erosion from competitors' advancements.

Rapid technological shifts, particularly in EV battery thermal management, demand substantial R&D investment to avoid product obsolescence. Failure to innovate could render current offerings uncompetitive and impact future profitability.

Supply chain vulnerabilities and raw material price fluctuations are ongoing concerns, as demonstrated by past impacts on gross margins from rising material and labor costs. Geopolitical instability and trade policy shifts can further exacerbate these cost pressures and operational disruptions.

Evolving regulatory landscapes in automotive and medical sectors, focusing on safety, environment, and efficiency, may necessitate costly product redesigns and development cycles. Additionally, changes in global tax policies require constant strategic financial planning to mitigate adverse effects on net income.

SWOT Analysis Data Sources

This Gentherm SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary. These sources provide the reliable, data-driven insights necessary for a robust strategic assessment.