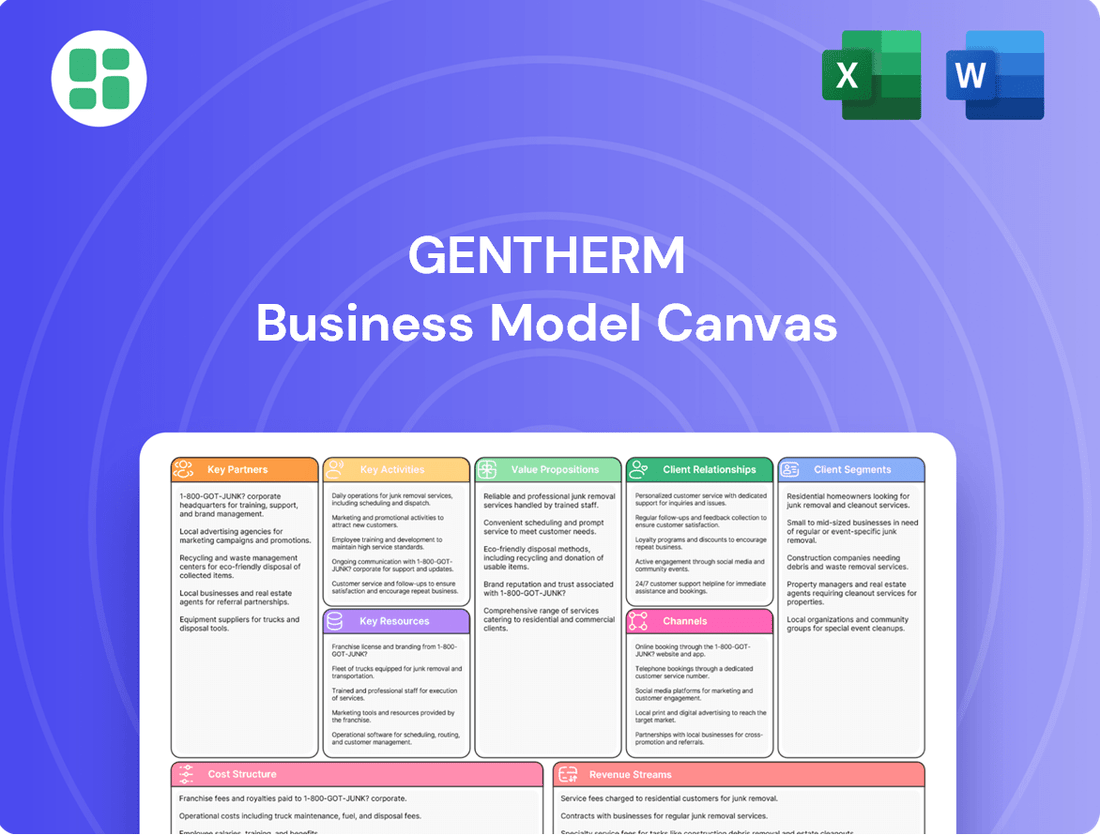

Gentherm Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentherm Bundle

Discover the strategic framework behind Gentherm's innovative approach to thermal management solutions. This comprehensive Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success.

Uncover the core components that drive Gentherm's market leadership, from their key resources and activities to their cost structure. This detailed canvas provides invaluable insights for anyone looking to understand and replicate their strategic advantages.

Ready to gain a competitive edge? Download the full Gentherm Business Model Canvas to access a professionally structured, actionable blueprint that can inform your own business strategy and unlock new growth opportunities.

Partnerships

Gentherm cultivates deep, enduring connections with leading automotive OEMs and Tier 1 suppliers, a cornerstone of its business model. These relationships are vital for embedding Gentherm's innovative thermal management technologies directly into the blueprints and manufacturing processes of new vehicles.

This strategic integration ensures Gentherm's solutions are designed in from the ground up, aligning with evolving vehicle architectures and securing substantial new contract wins. For instance, in 2024, Gentherm continued to solidify these partnerships, contributing to its robust order backlog which stood at $6.9 billion as of the first quarter of 2024.

Gentherm’s key partnerships in the medical sector are primarily with medical device manufacturers and specialized distributors. These alliances are crucial for extending the reach of Gentherm’s patient temperature management systems into healthcare facilities.

For instance, partnerships with distributors like DUOMED allow Gentherm to tap into localized market knowledge and existing networks. This strategy is vital for efficient product placement and adoption within hospitals and clinics, as seen in the growing demand for advanced thermal control solutions in critical care settings.

Gentherm actively partners with universities and research institutes to drive innovation in thermal management. These collaborations are crucial for developing next-generation technologies, enabling the company to explore new applications for its existing platforms and create entirely novel solutions.

In 2024, Gentherm continued to invest in R&D, with a significant portion of its innovation pipeline fueled by these external partnerships. This strategic approach allows Gentherm to leverage specialized expertise and accelerate the development of advanced thermal solutions for diverse markets.

Raw Material and Component Suppliers

Gentherm relies on a network of trusted suppliers for essential raw materials like aluminum and copper, as well as sophisticated electronic components. These partnerships are crucial for maintaining production efficiency and product quality.

In 2024, Gentherm continued to focus on diversifying its supplier base to mitigate risks and secure competitive pricing. For instance, the company actively sought out multiple sources for semiconductors, a critical input for its thermal management systems, ensuring resilience against potential shortages.

- Strategic Sourcing: Gentherm cultivates long-term relationships with key suppliers to ensure a consistent flow of high-quality materials.

- Cost Management: Partnerships enable negotiation of favorable terms, contributing to the cost-effectiveness of Gentherm's innovative solutions.

- Quality Assurance: Suppliers are vetted to meet stringent quality standards, directly impacting the reliability of Gentherm's products.

- Supply Chain Resilience: Diversification of suppliers, particularly for electronic components, is a priority to safeguard against disruptions.

Energy and Sustainability Partners

Gentherm actively collaborates with energy providers and sustainability consultants, a prime example being its partnership with Schneider Electric. These alliances are crucial for advancing Gentherm's environmental objectives, particularly in boosting its reliance on renewable energy sources.

These strategic relationships enable Gentherm to implement key initiatives, such as securing Power Purchase Agreements (PPAs). For instance, in 2023, Gentherm continued to explore and execute PPAs to increase its renewable energy procurement, aiming to significantly lower its overall carbon footprint.

The company's commitment to sustainability is further solidified through these partnerships, which provide the expertise and resources necessary to navigate the complexities of the energy transition. This focus on renewable energy sourcing is a core component of Gentherm's strategy to operate more sustainably.

- Energy Provider Collaborations: Partnerships with companies like Schneider Electric facilitate the integration of renewable energy into Gentherm's operations.

- Sustainability Consulting: Expert guidance from consultants helps in developing and executing strategies for carbon footprint reduction.

- Power Purchase Agreements (PPAs): Securing PPAs is a key tactic to increase the proportion of renewable energy used by Gentherm, contributing to its environmental goals.

- Carbon Footprint Reduction: These partnerships directly support Gentherm's efforts to decrease its environmental impact through tangible energy initiatives.

Gentherm's key partnerships are critical for innovation, market access, and operational efficiency. These alliances span automotive OEMs, medical device manufacturers, research institutions, and suppliers, ensuring the integration of advanced thermal technologies and a resilient supply chain.

In 2024, the company's $6.9 billion order backlog, as of Q1, underscores the success of its OEM partnerships in embedding solutions into new vehicle designs. Furthermore, collaborations with energy providers like Schneider Electric are driving sustainability initiatives, with a focus on renewable energy procurement through PPAs to reduce its carbon footprint.

| Partner Type | Key Collaborators | Strategic Importance | 2024 Impact/Data |

|---|---|---|---|

| Automotive OEMs | Major Vehicle Manufacturers | New product integration, securing contracts | $6.9B order backlog (Q1 2024) |

| Medical Device Manufacturers | Specialized Healthcare Companies | Market access for patient temperature management | Growing demand in critical care |

| Research Institutions | Universities, R&D Centers | Next-generation technology development | Fueled innovation pipeline |

| Suppliers | Raw Material & Component Providers | Quality, efficiency, supply chain resilience | Diversification of semiconductor sources |

| Energy Providers | Schneider Electric | Renewable energy integration, sustainability | Focus on Power Purchase Agreements (PPAs) |

What is included in the product

This Gentherm Business Model Canvas provides a structured overview of their thermal management solutions, detailing customer segments like automotive OEMs and HVAC manufacturers, and their value proposition of enhanced comfort and efficiency.

It outlines Gentherm's key resources and activities, revenue streams from product sales and services, and cost structure, offering a comprehensive view for strategic planning and stakeholder communication.

Gentherm's Business Model Canvas acts as a pain point reliver by providing a clear, one-page snapshot of their operations, making complex strategies easily digestible and actionable for teams.

Activities

Gentherm's commitment to Research and Development is a cornerstone of its business. In 2024, the company continued to pour resources into innovating its thermal management and pneumatic comfort solutions, aiming to stay ahead in a rapidly evolving automotive landscape. This focus drives the creation of next-generation products and the exploration of new market opportunities.

The R&D efforts are strategically directed towards enhancing existing product applications within core automotive markets. Simultaneously, Gentherm is actively working to leverage its established platforms to penetrate new sectors, such as the growing commercial vehicle and powersports industries. This dual approach ensures both the refinement of current offerings and the expansion of its technological reach.

Gentherm's core activity revolves around the global manufacturing and production of its innovative product lines, encompassing climate control seats, heated interior systems, and patient temperature management solutions. This intricate process demands careful management of worldwide operations and strategic optimization of its manufacturing presence.

In 2024, the company continued to expand its operational footprint, with significant investments in new manufacturing facilities. For example, the establishment of new plants in Mexico and Morocco highlights Gentherm's commitment to optimizing its production capabilities and supply chain efficiency across key global markets.

Gentherm's key activities revolve around direct sales to automotive original equipment manufacturers (OEMs) and medical device companies, supported by a robust global sales force. In 2024, the company continued to emphasize building and maintaining strong customer relationships through direct engagement and technical consultation. This approach is crucial for securing new business awards and gaining insights into evolving market needs.

Active participation in industry events is another cornerstone of Gentherm's strategy, allowing for direct interaction with potential clients and showcasing their innovative thermal management solutions. For instance, their presence at major automotive and medical technology trade shows in 2024 provided platforms to demonstrate advancements in areas like battery thermal management for electric vehicles and patient warming systems.

Supply Chain and Logistics Management

Gentherm's supply chain and logistics management is a core function, encompassing everything from acquiring raw materials to getting finished goods to customers. This critical activity involves smart sourcing of components and materials, making sure transportation and warehousing are as efficient as possible, and adhering to all customer specifications and growing sustainability mandates. For instance, in 2023, Gentherm reported that its cost of sales, which includes significant supply chain expenses, was $1.58 billion, highlighting the scale of these operations.

Key activities within this segment include:

- Strategic Sourcing: Identifying and partnering with reliable suppliers globally to secure high-quality materials and components at competitive prices.

- Logistics Optimization: Managing the movement and storage of goods across its international network, focusing on cost reduction and timely delivery.

- Compliance and Sustainability: Ensuring all supply chain activities meet regulatory standards, customer requirements, and the company's commitment to environmental and social responsibility.

Quality Assurance and Product Reliability

Gentherm's commitment to quality assurance and product reliability is central to its operations, especially since its thermal management solutions are often used in safety-critical automotive and medical devices. This focus ensures that their products consistently perform as expected, building trust with customers who rely on these systems for essential functions.

The company employs rigorous testing protocols throughout the product development lifecycle. This includes extensive validation and verification processes to identify and rectify potential issues before products reach the market, minimizing failures and enhancing customer satisfaction. For example, in 2024, Gentherm continued to invest in advanced testing equipment and methodologies to meet evolving industry demands.

- Rigorous Testing: Implementing comprehensive testing at various stages, from component level to full system integration, to ensure optimal performance and durability.

- Industry Standards Adherence: Complying with stringent automotive (e.g., IATF 16949) and medical (e.g., ISO 13485) quality management standards.

- Continuous Improvement: Utilizing feedback loops from production and field data to refine processes and enhance product reliability over time.

Gentherm's key activities center on the design, development, manufacturing, and sale of innovative thermal management and pneumatic comfort solutions. This includes a strong emphasis on research and development to create next-generation products for the automotive and medical sectors. The company also focuses on global manufacturing and supply chain optimization to ensure efficient production and delivery of its diverse product portfolio.

In 2024, Gentherm continued to invest heavily in R&D, aiming to enhance its offerings in areas like electric vehicle battery thermal management and advanced patient temperature control. Their manufacturing operations expanded with new facilities, underscoring a commitment to global production efficiency. Direct sales to automotive OEMs and medical device companies, supported by strong customer relationships and industry event participation, are crucial for market penetration and growth.

The company's supply chain management is vital, involving strategic sourcing, logistics optimization, and adherence to sustainability standards. For instance, in 2023, Gentherm's cost of sales, reflecting these extensive operations, was $1.58 billion. Quality assurance and product reliability are paramount, with rigorous testing protocols and compliance with industry standards like IATF 16949 and ISO 13485 ensuring customer trust.

| Key Activity | Description | 2024 Focus/Data |

| Research & Development | Innovating thermal management and pneumatic comfort solutions. | Continued investment in EV battery thermal management and patient temperature systems. |

| Manufacturing & Production | Global production of climate control seats, interior systems, etc. | Expansion of operational footprint with new facilities in Mexico and Morocco. |

| Sales & Customer Relations | Direct sales to OEMs and medical device companies. | Emphasis on building strong customer relationships and technical consultation. |

| Supply Chain & Logistics | Managing raw materials to finished goods delivery. | Focus on efficient sourcing, transportation, and sustainability mandates. |

| Quality Assurance | Ensuring product reliability and performance. | Rigorous testing and adherence to automotive and medical quality standards. |

Full Version Awaits

Business Model Canvas

The Gentherm Business Model Canvas you are previewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this same comprehensive analysis, allowing you to immediately leverage its insights for your strategic planning.

Resources

Gentherm's robust intellectual property portfolio, particularly its patents and proprietary thermal management and pneumatic technologies, is a cornerstone of its business model. This IP is not just a collection of legal protections; it's the engine driving its innovation and market differentiation.

This deep well of patented technology provides Gentherm with a substantial competitive moat, allowing it to offer unique solutions in demanding sectors like automotive and medical. For instance, their advancements in battery thermal management systems are crucial for the burgeoning electric vehicle market, a sector that saw significant growth and investment throughout 2024.

The company's commitment to R&D, reflected in its significant patent filings, directly translates into market leadership. In 2024, Gentherm continued to invest heavily in developing next-generation thermal solutions, ensuring its proprietary technologies remain at the forefront of industry advancements and customer needs.

Gentherm's core strength lies in its highly skilled human capital, especially its engineers and scientists. These experts are the engine behind the company's innovative product development and its ability to maintain operational efficiency in complex automotive thermal management systems.

The company actively invests in its workforce, offering robust talent development programs and continuous training to keep its technical teams at the forefront of the industry. This focus on skill enhancement is crucial for driving advancements in areas like battery thermal management for electric vehicles.

As of the first quarter of 2024, Gentherm reported a significant portion of its workforce comprises technical professionals, underscoring the importance of this resource. Their expertise directly translates into the advanced solutions Gentherm provides to global automotive manufacturers.

Gentherm operates a robust global manufacturing network spanning 13 countries, equipped with specialized machinery. This extensive footprint is critical for efficient production and supports localized design and integration, allowing them to tailor solutions for diverse customer needs worldwide.

In 2024, Gentherm's manufacturing capabilities are central to their ability to scale operations and respond to market demands. Their strategically located facilities ensure they can effectively serve a global customer base, a key asset in the competitive automotive and industrial sectors.

Financial Capital and Strong Balance Sheet

Gentherm's robust financial capital and strong balance sheet are cornerstones of its business model, enabling significant investments in research and development. This financial health provides the necessary liquidity and flexibility to pursue strategic growth opportunities and optimize operational efficiency, ultimately supporting long-term value creation for stakeholders.

The company's financial strength is evident in its ability to manage its resources effectively. For instance, as of the first quarter of 2024, Gentherm reported total assets of approximately $2.3 billion, with a significant portion allocated to property, plant, and equipment, reflecting ongoing investments in its manufacturing capabilities and technological advancements.

- Financial Flexibility: Gentherm's strong balance sheet offers the capacity to secure favorable financing terms for acquisitions or capital expenditures.

- Investment Capacity: Robust financial capital allows for sustained investment in innovation, crucial for maintaining a competitive edge in the automotive technology sector.

- Operational Resilience: A healthy financial position enhances the company's ability to navigate economic downturns and supply chain disruptions.

- Shareholder Value: Financial strength underpins Gentherm's capacity for dividends and share repurchases, contributing to shareholder returns.

Brand Reputation and Customer Relationships

Gentherm's brand reputation, forged through years of delivering innovative, high-quality, and reliable thermal management solutions, serves as a cornerstone of its business model. This established trust with major Original Equipment Manufacturers (OEMs) is a critical intangible asset that underpins its market position.

These enduring customer relationships are not just about past successes; they are vital for securing future business and driving sustained growth. The deep partnerships allow Gentherm to collaborate closely on new product development and anticipate evolving industry needs.

- Brand Strength: Gentherm is recognized for its technological leadership in automotive thermal management, fostering a perception of quality and innovation among its OEM partners.

- OEM Partnerships: The company has cultivated long-standing relationships with leading global automakers, a testament to its consistent performance and product development capabilities.

- Customer Loyalty: These strong ties translate into a high degree of customer loyalty, providing a stable revenue base and a competitive advantage in securing new contracts.

Gentherm's key resources are its intellectual property, skilled workforce, global manufacturing network, financial capital, and strong brand reputation. These elements collectively enable the company to innovate, produce, and deliver advanced thermal management solutions to its customers.

The company's extensive patent portfolio, particularly in thermal and pneumatic technologies, provides a significant competitive advantage. This IP is the foundation for its market leadership in sectors like automotive, where advancements in battery thermal management for electric vehicles were a major focus in 2024.

Gentherm's human capital, comprising highly skilled engineers and scientists, is crucial for its product development and operational excellence. As of Q1 2024, a substantial portion of its workforce was technical, highlighting the importance of this resource for driving innovation.

The company's global manufacturing footprint, spanning 13 countries with specialized machinery, ensures efficient production and localized solutions. This network was vital in 2024 for scaling operations and meeting global market demands.

Financially, Gentherm's robust capital and strong balance sheet, with total assets around $2.3 billion in Q1 2024, allow for continuous investment in R&D and operational resilience.

Its brand reputation, built on delivering reliable thermal management solutions, fosters strong, long-standing relationships with leading global automakers, ensuring customer loyalty and a stable revenue base.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Intellectual Property | Patents and proprietary thermal/pneumatic technologies | Drove innovation in EV battery thermal management; significant patent filings in 2024. |

| Human Capital | Skilled engineers and scientists | Engine behind product development; substantial technical workforce in Q1 2024. |

| Manufacturing Network | Global facilities in 13 countries with specialized machinery | Enabled scaling and localized solutions for global customers in 2024. |

| Financial Capital | Strong balance sheet and liquidity | Supported R&D investment; total assets ~ $2.3 billion (Q1 2024). |

| Brand Reputation | High-quality, reliable thermal management solutions | Fostered strong OEM partnerships and customer loyalty. |

Value Propositions

Gentherm's thermal solutions, like climate-controlled seats and heated steering wheels, offer automotive passengers a noticeably more comfortable and healthier ride. These innovations directly address passenger well-being by providing personalized thermal environments, reducing fatigue and enhancing the overall in-car experience.

In 2024, the demand for premium interior features that contribute to passenger comfort and wellness continues to grow. Gentherm's advanced climate control systems are key differentiators for automakers looking to elevate their vehicle offerings, directly impacting customer satisfaction and brand perception.

Gentherm’s medical solutions are pivotal in enhancing patient thermal management, directly contributing to improved health outcomes. These systems offer precise temperature control, crucial for patient safety during surgical procedures and critical care. For instance, in 2024, the demand for advanced patient warming and cooling systems is projected to grow significantly, driven by increased awareness of hypothermia's negative impact on recovery and the rising number of complex medical interventions.

Gentherm’s thermal management systems significantly boost energy efficiency by precisely controlling heating and cooling, reducing wasted energy in automotive and other applications. For instance, their advanced battery thermal management solutions are crucial for the growing electric vehicle market, where efficiency directly translates to range and performance. This focus on optimization directly addresses the increasing consumer and regulatory demand for greener transportation.

Beyond product efficiency, Gentherm is committed to sustainable operational practices. This includes efforts to reduce waste and emissions throughout their manufacturing processes. By aligning their business with environmental responsibility, Gentherm not only meets current market expectations but also positions itself favorably for future growth in a world increasingly prioritizing sustainability.

Customized and Integrated Thermal Solutions

Gentherm excels at creating thermal management systems precisely engineered for each client's unique requirements. This deep customization ensures optimal performance and integration, setting them apart in the market.

Their strength lies in seamlessly incorporating these sophisticated thermal solutions into a wide array of vehicle platforms and industrial equipment. This integration capability is a key differentiator, providing significant added value to their customers.

- Tailored Engineering: Development of bespoke thermal systems for specific OEM and industrial applications.

- System Integration: Expertise in embedding complex thermal solutions into diverse product architectures.

- Performance Optimization: Ensuring enhanced functionality and efficiency through integrated design.

- Market Differentiation: Offering unique, high-value solutions that address specific client needs.

Reliability and High-Performance Technology

Gentherm's value proposition centers on its proven reliability and high-performance thermal and pneumatic technologies. These are absolutely essential for the rigorous demands of the automotive and medical industries, where failure is not an option. The company's engineering focus on durability ensures consistent performance, building significant trust with its worldwide clientele.

This commitment to quality translates directly into tangible benefits for customers. For instance, in the automotive sector, Gentherm's climate control solutions contribute to enhanced passenger comfort and vehicle efficiency, directly impacting brand perception and customer satisfaction. Their medical applications, such as patient warming systems, rely on this same dependable technology to ensure patient safety and optimal therapeutic outcomes.

- Proven Durability: Gentherm's technologies are engineered to withstand harsh operating conditions, minimizing downtime and maintenance needs for clients.

- Consistent Performance: Customers can depend on the predictable and stable operation of Gentherm's thermal and pneumatic systems, crucial for critical applications.

- Global Trust: A broad and loyal customer base across automotive and medical sectors underscores the reliability and high-performance reputation of Gentherm's offerings.

- Technological Edge: Continuous investment in advanced engineering ensures Gentherm remains at the forefront of thermal and pneumatic solutions.

Gentherm's core value lies in delivering superior thermal comfort and wellness solutions, enhancing the user experience in automotive and medical settings. Their technology provides personalized climate control, contributing to improved passenger well-being and patient outcomes. This focus on comfort and health is a significant differentiator in markets increasingly prioritizing these aspects.

The company's commitment to energy efficiency is a key value proposition, particularly relevant in the automotive sector. By optimizing thermal management, Gentherm helps reduce energy consumption, directly benefiting electric vehicle range and overall operational costs. This aligns with global trends towards sustainability and resource conservation.

Gentherm's expertise in tailored engineering and seamless system integration allows them to create bespoke thermal solutions that precisely meet client needs. This capability ensures optimal performance and compatibility across diverse applications, from advanced automotive interiors to critical medical equipment. Their ability to customize and integrate complex systems adds substantial value for their partners.

Reliability and high performance are foundational to Gentherm's value. Their thermal and pneumatic technologies are engineered for durability, ensuring consistent operation in demanding environments. This proven track record builds trust and positions Gentherm as a dependable partner for critical applications in the automotive and medical industries.

Customer Relationships

Gentherm's longevity in the automotive sector is largely built on its robust, long-term OEM partnerships. These aren't just supplier relationships; they are strategic alliances where Gentherm often co-develops innovative thermal management solutions for upcoming vehicle generations.

These deep collaborations are founded on mutual trust and a shared commitment to pushing technological boundaries. For instance, in 2024, Gentherm continued to work closely with major automakers on next-generation battery thermal management systems for electric vehicles, a testament to the enduring nature of these partnerships and their role in shaping future automotive technology.

Gentherm's customer relationships are primarily built on direct B2B sales, fostering close partnerships with automotive, medical, and industrial clients. This direct channel is crucial for understanding and addressing the intricate needs of these sectors.

Through this direct engagement, Gentherm provides specialized technical support, enabling collaborative development of customized solutions. For instance, in 2024, the company continued to work closely with major automotive manufacturers on advanced thermal management systems, highlighting the necessity of this hands-on approach.

Gentherm actively engages in co-development with key automotive clients, embedding its thermal management expertise from the initial design phases of new vehicle platforms. This collaborative approach ensures their innovative solutions are perfectly integrated, enhancing both product performance and customer satisfaction.

After-Sales Service and Maintenance Support

Gentherm's commitment to after-sales service and maintenance support is paramount, particularly for its medical and industrial segments where operational continuity is non-negotiable. This focus directly translates to enhanced customer retention and reinforces the enduring value proposition of their thermal management systems. For example, in 2024, Gentherm continued to invest in its global service network, aiming to minimize downtime for critical applications.

This robust support infrastructure ensures that customers, especially those in demanding fields like healthcare and heavy industry, can rely on the consistent performance of Gentherm's products. The company understands that the long-term success of its solutions is intrinsically linked to the reliability and ongoing maintenance provided. This dedication fosters strong, lasting relationships built on trust and dependable service.

- Enhanced Uptime: Providing timely and effective maintenance minimizes operational disruptions for critical medical and industrial equipment.

- Customer Loyalty: Superior after-sales support directly contributes to higher customer satisfaction and repeat business.

- Long-Term Value: Demonstrating a commitment to ongoing service reinforces the perceived long-term value of Gentherm's technological solutions.

- Global Service Network: Maintaining and expanding a worldwide service presence ensures support is available where and when it's needed most.

Supplier of Choice Recognition

Gentherm actively cultivates its position as a preferred supplier, striving for 'Supplier of the Year' accolades from its major clients. This ambition underscores a commitment to fostering trust through consistent delivery of innovative solutions and high-quality products.

Achieving such recognition, like the Supplier of the Year award from General Motors in 2023, validates Gentherm's strategic focus on customer satisfaction and operational excellence. This strengthens its standing as a key partner in the automotive supply chain.

- Supplier Recognition: Gentherm targets 'Supplier of the Year' awards, signifying deep customer trust and partnership.

- Key Performance Indicators: This recognition is a direct result of sustained innovation, superior product quality, and dependable performance.

- Customer Validation: Awards from major automotive manufacturers, such as General Motors, serve as concrete proof of Gentherm's value proposition.

- Strategic Importance: Being a recognized 'Supplier of the Year' reinforces Gentherm's status as a preferred and essential partner for its clientele.

Gentherm's customer relationships are primarily built on direct B2B sales, fostering close partnerships with automotive, medical, and industrial clients. This direct channel is crucial for understanding and addressing the intricate needs of these sectors, often leading to co-development of customized solutions. For instance, in 2024, the company continued to work closely with major automotive manufacturers on advanced thermal management systems, highlighting the necessity of this hands-on approach.

These deep collaborations are founded on mutual trust and a shared commitment to pushing technological boundaries. Gentherm actively engages in co-development with key automotive clients, embedding its thermal management expertise from the initial design phases of new vehicle platforms. In 2024, Gentherm continued to work closely with major automakers on next-generation battery thermal management systems for electric vehicles, a testament to the enduring nature of these partnerships.

Gentherm's commitment to after-sales service and maintenance support is paramount, particularly for its medical and industrial segments where operational continuity is non-negotiable. This focus directly translates to enhanced customer retention and reinforces the enduring value proposition of their thermal management systems. For example, in 2024, Gentherm continued to invest in its global service network, aiming to minimize downtime for critical applications.

Gentherm actively cultivates its position as a preferred supplier, striving for 'Supplier of the Year' accolades from its major clients. Achieving such recognition, like the Supplier of the Year award from General Motors in 2023, validates Gentherm's strategic focus on customer satisfaction and operational excellence, strengthening its standing as a key partner.

Channels

Gentherm's direct sales force is crucial for building strong relationships with automotive OEMs globally. This direct engagement allows for close collaboration throughout the OEM's product development, ensuring Gentherm's thermal management solutions are seamlessly integrated. For instance, in 2023, Gentherm reported significant revenue growth, underscoring the effectiveness of these direct OEM partnerships in securing large-scale contracts and driving innovation.

Gentherm's direct sales channel to medical device manufacturers is crucial for its medical products. This approach allows for the transfer of specialized knowledge and direct technical consultation, ensuring seamless integration of patient thermal management systems into various medical equipment.

This direct engagement is vital for complex medical device integration, where understanding specific product requirements and providing tailored technical support is paramount. For instance, in 2024, Gentherm's focus on this channel likely supported its efforts in areas like advanced patient warming and cooling solutions for surgical and critical care settings.

Gentherm's strategic distribution partnerships, exemplified by its collaboration with DUOMED, are crucial for expanding its presence, especially within the medical technology market. These alliances allow Gentherm to tap into established networks for localized sales and marketing efforts. For instance, DUOMED's expertise in the European healthcare landscape helps Gentherm navigate regulatory environments and reach key medical institutions more effectively.

Global Manufacturing and Logistics Network

Gentherm's global manufacturing and logistics network is a vital channel, ensuring products reach customers efficiently in key markets like North America, Europe, and Asia. This widespread operational footprint allows for localized support, which is crucial for meeting customer demands and providing prompt service.

This network is designed for agility, enabling Gentherm to adapt to regional market needs and supply chain fluctuations. By having manufacturing and distribution centers strategically placed, the company minimizes lead times and transportation costs, directly benefiting its customer base.

- Global Footprint: Operates manufacturing facilities and logistics hubs across North America, Europe, and Asia.

- Customer Proximity: Localized presence facilitates timely delivery and responsive customer service.

- Efficiency Gains: Strategic placement reduces transportation costs and lead times, enhancing supply chain performance.

- Market Responsiveness: Enables adaptation to regional market demands and supply chain dynamics.

Industry Trade Shows and Conferences

Industry trade shows and conferences are crucial channels for Gentherm. By participating in key automotive, medical, and industrial events, the company effectively showcases its innovative technologies. For instance, in 2023, Gentherm actively exhibited at events like CES, highlighting advancements in thermal management solutions for electric vehicles.

These platforms are vital for networking with potential clients and forging new business relationships. The ability to directly engage with industry leaders and decision-makers at these gatherings allows Gentherm to gauge market needs and present tailored solutions. This direct interaction is invaluable for lead generation and understanding emerging trends.

- Showcasing Innovation: Gentherm leverages these events to demonstrate cutting-edge products, such as their advanced climate control systems.

- Client Engagement: Direct interaction at shows facilitates relationship building with both existing and prospective customers.

- Brand Reinforcement: Consistent presence reinforces Gentherm's position as a leader in thermal technology across multiple sectors.

- Market Intelligence: Participation provides insights into competitor activities and evolving industry demands, informing future product development.

Gentherm's channels are diverse, encompassing direct sales to automotive OEMs and medical device manufacturers, strategic distribution partnerships, a global logistics network, and industry trade shows. These channels are designed to foster strong relationships, facilitate technical collaboration, ensure efficient product delivery, and showcase innovation across its key markets.

The company's direct sales approach with automotive OEMs is critical for integrating its thermal management solutions early in vehicle development, as evidenced by its significant revenue growth in 2023. Similarly, direct engagement with medical device manufacturers is vital for specialized applications, supporting advancements in patient thermal management in 2024.

Distribution partnerships, like the one with DUOMED in the European healthcare market, expand Gentherm's reach and navigate regional complexities. Furthermore, its global manufacturing and logistics network, with facilities in North America, Europe, and Asia, ensures efficient delivery and responsiveness to customer needs.

Participation in industry trade shows, such as CES in 2023, serves as a key channel for showcasing new technologies, building client relationships, and gathering market intelligence.

| Channel | Target Audience | Key Function | Example/Data Point |

|---|---|---|---|

| Direct Sales (Automotive OEMs) | Automotive Manufacturers | Deep collaboration, integration of solutions | Revenue growth in 2023 linked to OEM partnerships |

| Direct Sales (Medical Device Manufacturers) | Medical Equipment Companies | Technical consultation, tailored solutions | Focus on advanced patient warming/cooling in 2024 |

| Distribution Partnerships | Medical Technology Market | Market penetration, localized sales | Collaboration with DUOMED in Europe |

| Global Manufacturing & Logistics | All Customers | Efficient delivery, regional support | Facilities in North America, Europe, Asia |

| Industry Trade Shows | Industry Stakeholders | Showcasing innovation, lead generation | Presence at CES 2023 |

Customer Segments

Global Automotive Original Equipment Manufacturers (OEMs) represent Gentherm's core and most substantial customer base. These are the major car companies operating worldwide, from North America and Europe to Asia.

These OEMs are actively looking for advanced solutions that enhance thermal comfort for drivers and passengers while also improving the energy efficiency of their vehicle lineups. This demand spans all vehicle segments, from high-end luxury cars to everyday mass-market models.

In 2024, the automotive industry continued its focus on electrification and advanced features, with OEMs like General Motors and Volkswagen investing billions in new EV platforms, directly impacting the demand for innovative thermal management systems that Gentherm provides.

Gentherm's Tier 1 automotive supplier customers are critical partners who integrate Gentherm's thermal management solutions into more complex automotive systems. These suppliers, like Magna or Valeo, demand components that are not only high-performing but also exceptionally reliable, as any failure can impact their own reputation and the final vehicle's quality. For instance, in 2024, the automotive industry continued its push for advanced driver-assistance systems (ADAS) and electrification, requiring suppliers to source components that meet rigorous automotive safety integrity levels (ASIL).

These Tier 1 customers rely on Gentherm for components that seamlessly fit into their manufacturing processes and meet the exacting specifications set by Original Equipment Manufacturers (OEMs). They need assurance of consistent quality and on-time delivery to maintain their own production schedules. The global automotive supplier market was valued at over $3 trillion in 2024, highlighting the immense scale and demanding nature of these relationships.

Gentherm serves medical device manufacturers and healthcare providers, including hospitals and clinics. These entities need highly accurate patient temperature management solutions for critical medical procedures.

For instance, in 2024, the global medical device market was projected to reach over $600 billion, highlighting the significant demand for specialized equipment like advanced temperature control systems. Patient safety and ensuring optimal clinical outcomes are paramount for these customers.

Commercial Vehicle and Powersports Manufacturers

Gentherm is strategically broadening its customer base to include manufacturers of commercial vehicles and powersports equipment. This expansion leverages their established thermal and pneumatic technologies for innovative applications beyond the passenger car segment.

These new market segments are actively integrating Gentherm’s solutions to enhance driver and rider comfort and safety. For instance, in the commercial vehicle sector, improved cabin climate control is crucial for driver well-being during long hauls. In powersports, heated and cooled seating contributes significantly to rider experience in diverse weather conditions.

The demand for advanced thermal management in these areas is growing. In 2024, the global commercial vehicle market, encompassing trucks and buses, was projected to reach hundreds of billions of dollars, indicating a substantial opportunity for Gentherm. Similarly, the powersports industry, including motorcycles and ATVs, continues to show robust sales figures, creating a fertile ground for technology adoption.

- Expanded Market Reach: Targeting commercial vehicle and powersports manufacturers.

- Technology Adaptation: Applying existing thermal and pneumatic solutions to new applications.

- Key Drivers: Enhanced comfort and safety are paramount for these customer segments.

- Market Potential: Significant growth opportunities within these expanding industries.

Industrial Equipment Manufacturers

Gentherm's expertise extends beyond automotive and medical, reaching into the industrial equipment sector. This segment focuses on manufacturers needing highly accurate temperature control for their specialized machinery.

These solutions are critical for ensuring optimal performance and energy efficiency in demanding industrial environments. For instance, in 2024, the global industrial automation market was projected to reach over $200 billion, highlighting the significant demand for advanced equipment and the underlying control systems.

- Specialized Equipment Needs: Manufacturers of construction machinery, agricultural equipment, and heavy-duty vehicles often require robust thermal management to maintain operational integrity in extreme conditions.

- Process Optimization: Precise temperature control is vital for manufacturing processes that rely on specific material properties or chemical reactions, directly impacting product quality and yield.

- Energy Efficiency Mandates: With increasing global focus on sustainability, industrial clients are seeking solutions that reduce energy consumption, making Gentherm's efficient thermal systems a key differentiator.

Gentherm's primary customer segment consists of global automotive Original Equipment Manufacturers (OEMs) who require advanced thermal management solutions for both comfort and efficiency. These OEMs are increasingly focused on vehicle electrification, driving demand for innovative systems. In 2024, major OEMs continued significant investments in new EV platforms, underscoring this trend.

Another key group is Tier 1 automotive suppliers, who integrate Gentherm's components into larger vehicle systems. Reliability and seamless integration are paramount for these partners, who operate within a vast global supplier market exceeding $3 trillion in 2024. They need assurance of consistent quality and timely delivery to meet OEM specifications and production schedules.

Gentherm also caters to medical device manufacturers and healthcare providers, supplying precise patient temperature management solutions crucial for critical procedures. The global medical device market's projected growth past $600 billion in 2024 highlights the demand for such specialized, high-accuracy equipment where patient safety is the top priority.

Furthermore, Gentherm is expanding into commercial vehicles and powersports, leveraging its thermal and pneumatic technologies. These sectors seek enhanced driver/rider comfort and safety, with the commercial vehicle market alone representing a multi-billion dollar opportunity in 2024. Growth in powersports also presents fertile ground for technology adoption.

The industrial equipment sector also relies on Gentherm for accurate temperature control in specialized machinery, ensuring optimal performance and efficiency. With the industrial automation market projected to exceed $200 billion in 2024, there's substantial demand for advanced equipment and the control systems that manage their operational integrity, especially with increasing energy efficiency mandates.

| Customer Segment | Key Needs | 2024 Market Context/Data |

| Global Automotive OEMs | Thermal comfort, energy efficiency, electrification integration | Billions invested in EV platforms by major OEMs (e.g., GM, VW) |

| Tier 1 Automotive Suppliers | Reliability, seamless integration, consistent quality, on-time delivery | Global automotive supplier market > $3 trillion |

| Medical Device Manufacturers / Healthcare Providers | Precise patient temperature management, patient safety, clinical outcomes | Global medical device market projected > $600 billion |

| Commercial Vehicle & Powersports Manufacturers | Driver/rider comfort and safety, leveraging existing technologies | Commercial vehicle market in hundreds of billions; robust powersports sales |

| Industrial Equipment Manufacturers | Accurate temperature control for machinery, process optimization, energy efficiency | Industrial automation market projected > $200 billion |

Cost Structure

Gentherm allocates a substantial portion of its resources to Research and Development (R&D), fueling the creation of advanced thermal management solutions. This investment is critical for developing innovative technologies and expanding their application across various industries.

In 2023, Gentherm reported R&D expenses of $131.7 million. This figure underscores their commitment to staying at the forefront of thermal technology, encompassing investments in skilled engineering teams, state-of-the-art laboratory facilities, and the development of functional prototypes.

Manufacturing and production costs are a significant component of Gentherm's business model, covering everything from the raw materials used in their thermal and pneumatic systems to the direct labor involved in assembly and the overhead costs of their global manufacturing facilities. These expenses are directly tied to the physical production of their innovative climate control solutions.

Fluctuations in product mix, meaning the proportion of different types of systems they produce, can significantly influence these costs. For instance, producing more complex or higher-volume items might alter the per-unit cost. Additionally, freight expenses for moving materials and finished goods around the world, as well as the capital investment and operational costs associated with opening new plants, all play a crucial role in impacting Gentherm's gross margins.

For the first quarter of 2024, Gentherm reported cost of goods sold of $268.5 million. This figure directly reflects the substantial investment in raw materials, labor, and manufacturing overhead necessary to deliver their automotive climate solutions to a global market.

Gentherm’s Sales, General, and Administrative (SG&A) expenses encompass a broad range of costs, including those tied to its sales and marketing efforts, the management of its global administrative functions, and overall corporate overhead. These are the everyday costs of running the business beyond the direct cost of making their products.

The company actively pursues operational efficiency and implements 'Fit-for-Growth' initiatives. These strategies are designed to ensure that SG&A expenses grow at a slower pace than revenue, thereby improving profitability. For instance, in the first quarter of 2024, Gentherm reported SG&A expenses of $73.4 million, a slight increase from $71.9 million in the same period of 2023, indicating a focus on managing these costs strategically.

Capital Expenditures (CapEx)

Gentherm's capital expenditures are crucial for maintaining and growing its operational capabilities. These investments primarily focus on enhancing manufacturing facilities, upgrading essential equipment, and improving overall infrastructure to support increased production and technological innovation.

In 2023, Gentherm reported capital expenditures of $135.2 million, a slight increase from $133.6 million in 2022. This consistent investment underscores their commitment to expanding production capacity and integrating advanced technologies into their operations, ensuring they remain competitive in the automotive thermal management sector.

- Manufacturing Facility Enhancements: Investments in building new plants and expanding existing ones to meet growing global demand for climate comfort solutions.

- Equipment Upgrades: Allocating funds for state-of-the-art machinery and technology to improve production efficiency, quality, and the development of new product features.

- Infrastructure Improvements: Spending on necessary upgrades to support advanced manufacturing processes and ensure operational reliability.

Supply Chain and Logistics Costs

Gentherm's cost structure is significantly influenced by its intricate global supply chain and logistics operations. These costs encompass everything from sourcing raw materials and components to managing inventory levels and handling the physical movement of goods across continents. In 2024, companies like Gentherm often face substantial expenses in these areas, with procurement and freight being major components.

The management of a complex, worldwide supply chain is a significant cost driver for Gentherm. This includes the expenses related to procuring necessary materials and components, maintaining optimal inventory levels to meet demand without excessive holding costs, and the considerable freight charges associated with transporting products globally. These operational necessities represent a core part of the company's outlays.

Fluctuations in the cost of raw materials, such as plastics and metals, and the dynamic nature of global logistics expenses, including shipping rates and fuel surcharges, can directly impact Gentherm's profitability. For instance, a surge in container shipping costs, which saw significant increases in 2023 and continued volatility into early 2024, can erode margins if not effectively managed through pricing strategies or cost-saving initiatives.

- Procurement Expenses: Costs associated with sourcing raw materials and components globally.

- Inventory Management: Expenses related to holding and managing stock levels.

- Freight and Logistics: Costs for transporting finished goods and components worldwide.

- Material Cost Volatility: The impact of changing prices for key inputs on overall expenses.

Gentherm's cost structure is built upon significant investments in Research and Development, manufacturing, and operational overhead. These pillars ensure their position as a leader in thermal management solutions.

The company's commitment to innovation is evident in its R&D spending, with $131.7 million allocated in 2023 to develop cutting-edge technologies. Manufacturing and supply chain costs, including procurement and logistics, are substantial, reflecting the global nature of their operations and material sourcing.

Sales, General, and Administrative (SG&A) expenses, reported at $73.4 million for Q1 2024, are managed through efficiency initiatives. Capital expenditures, amounting to $135.2 million in 2023, support facility and equipment upgrades to drive growth and maintain competitiveness.

| Cost Category | 2023 Actuals/Q1 2024 | Significance |

| Research & Development (R&D) | $131.7 million (2023) | Drives innovation and technological advancement. |

| Cost of Goods Sold (COGS) | $268.5 million (Q1 2024) | Represents direct costs of manufacturing products. |

| Sales, General & Administrative (SG&A) | $73.4 million (Q1 2024) | Covers operational and administrative expenses. |

| Capital Expenditures (CapEx) | $135.2 million (2023) | Investments in facilities, equipment, and infrastructure. |

| Supply Chain & Logistics | Ongoing significant costs | Crucial for global material sourcing and product distribution. |

Revenue Streams

Gentherm's core revenue generation hinges on selling its advanced automotive climate and comfort solutions. This includes a range of products like climate-controlled seats, heated steering wheels, and sophisticated lumbar and massage systems, all designed to enhance the in-car experience.

These sales are primarily directed towards major global Original Equipment Manufacturers (OEMs), forming the backbone of the company's financial performance. For instance, in 2023, Gentherm reported net sales of $2.05 billion, with a significant portion attributable to these automotive interior thermal management systems.

Gentherm's medical segment is a key revenue driver, primarily through the sale of patient temperature management systems. These systems, including both resistive and convective warming technologies, are crucial for maintaining patient safety and comfort during medical procedures.

The company has experienced consistent growth in this area. For instance, in 2023, Gentherm reported a notable increase in its Medical segment revenue, highlighting the strong demand for its temperature management solutions in healthcare settings.

Gentherm's revenue from Battery Performance Solutions is experiencing robust growth, fueled by the accelerating adoption of electric vehicles (EVs). These solutions are critical for maintaining optimal battery temperature, which directly impacts EV range, charging speed, and overall battery lifespan. For instance, in 2024, the automotive segment, which heavily features these solutions, saw significant contributions, with the company reporting substantial increases in demand for thermal management systems designed specifically for EV batteries.

Sales of Industrial Thermal Management Solutions

Gentherm's industrial thermal management solutions represent a growing revenue stream, leveraging their core competency beyond automotive and medical sectors. This segment focuses on applying advanced thermal technologies to various industrial equipment and specialized applications, broadening market penetration.

While a smaller portion of overall revenue, this diversification is strategic. For instance, in 2023, Gentherm reported total revenue of $1.31 billion, with their Industrial segment contributing a notable portion, demonstrating its increasing significance. This expansion into industrial markets taps into new growth opportunities.

- Industrial Equipment Cooling: Providing thermal management for heavy machinery, data centers, and other industrial hardware to ensure optimal performance and longevity.

- Specialized Application Solutions: Developing custom thermal solutions for niche markets such as aerospace, defense, and advanced manufacturing processes.

- Energy Efficiency Focus: Offering solutions that reduce energy consumption in industrial settings through precise temperature control.

New Business Awards and Program Launches

Securing new business awards, particularly long-term contracts with automotive original equipment manufacturers (OEMs), serves as a critical predictor of Gentherm's future revenue. These awarded contracts directly fuel sustained revenue streams as new vehicle programs transition from development to production phases.

For instance, in 2024, Gentherm announced several significant wins, including new thermal management systems for upcoming electric vehicle (EV) platforms with major global automakers. These awards are projected to contribute substantially to revenue growth over the next five to seven years, reflecting the long-term nature of automotive supply agreements.

- New Business Awards: Indicate future revenue by securing long-term contracts with automotive OEMs.

- Program Launches: Translate awarded business into sustained revenue as new vehicle programs enter production.

- EV Focus: Recent 2024 awards highlight a strategic shift towards thermal solutions for electric vehicles, a growing market segment.

- Long-Term Impact: These contracts are expected to provide predictable revenue streams for several years, underpinning financial stability.

Gentherm's revenue streams are diversified across automotive, medical, and industrial sectors, with a strong emphasis on thermal management solutions. The automotive segment, driven by climate-controlled seats and battery thermal management for EVs, represented the largest portion of its 2023 net sales of $2.05 billion. The medical segment, focused on patient temperature control, also showed consistent growth in 2023.

The company's Battery Performance Solutions are a key growth area, directly benefiting from the increasing adoption of electric vehicles. New business awards, particularly long-term contracts with automotive OEMs announced in 2024 for upcoming EV platforms, are crucial for future revenue, projecting substantial growth over the next five to seven years.

| Revenue Segment | Primary Products/Services | Key Drivers | 2023 Performance Indicator |

| Automotive | Climate-controlled seats, heated steering wheels, battery thermal management | OEM contracts, EV adoption | Largest portion of $2.05 billion net sales |

| Medical | Patient temperature management systems | Healthcare demand | Notable revenue increase |

| Industrial | Industrial equipment cooling, specialized applications | Market diversification | Growing contribution to revenue |

| New Business Awards | Long-term contracts with OEMs | Program launches, EV focus | Projected substantial growth (2024 announcements) |

Business Model Canvas Data Sources

The Gentherm Business Model Canvas is built upon a foundation of internal financial data, comprehensive market research, and strategic insights derived from industry analysis. These diverse data sources ensure each component of the canvas accurately reflects Gentherm's current operations and future strategic direction.