Gentherm Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentherm Bundle

Understanding Gentherm's competitive landscape is crucial, and Porter's Five Forces provides a powerful framework. This analysis reveals the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes impacting Gentherm's market position.

The complete report reveals the real forces shaping Gentherm’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Gentherm's reliance on suppliers for specialized components, especially for its automotive and medical thermal management systems, highlights a key area of supplier bargaining power. If there are only a handful of providers for critical, highly specialized parts, or if it's very costly for Gentherm to switch to a different supplier, those suppliers gain significant leverage. For instance, in 2023, the automotive industry faced ongoing supply chain disruptions for semiconductors, a specialized component, which led to increased costs for many manufacturers, including those in thermal management.

The components Gentherm relies on, like those for its Climate Control Seats (CCS®) and battery thermal management systems, are deeply integrated and crucial for the performance and unique selling points of Gentherm's offerings. For instance, specialized materials or advanced thermal management technologies, if proprietary to a supplier, significantly bolster their bargaining power. This critical nature can limit Gentherm's room to maneuver on pricing and contract terms for these vital inputs.

Suppliers might threaten Gentherm by integrating forward, essentially becoming direct competitors by producing thermal management systems themselves. This risk is amplified if a supplier holds proprietary technology or enjoys deep customer loyalty, though it's less likely for highly specialized parts.

For instance, if a key supplier of advanced thermoelectric materials were to develop its own integrated cooling solutions, it could directly challenge Gentherm's market position. Gentherm's robust supplier relationships and existing long-term agreements are crucial in deterring such backward integration, providing a layer of security against this potential threat.

Switching Costs for Gentherm

Gentherm faces significant supplier bargaining power due to high switching costs. These costs can include substantial investments in re-tooling manufacturing equipment, redesigning existing products to accommodate new components, and the lengthy, rigorous process of re-qualifying new suppliers to meet stringent automotive and medical industry safety and performance standards.

The complexity and critical nature of Gentherm's products mean that changing a supplier for key components isn't a simple swap. This inherent difficulty in transitioning to alternatives significantly limits Gentherm's leverage to negotiate more favorable terms with its current suppliers, as the cost and time involved in finding and integrating a new one are often prohibitive.

- High Switching Costs: Re-tooling, re-designing, and re-qualifying suppliers represent major financial and operational hurdles for Gentherm.

- Industry Standards: The automotive and medical sectors demand rigorous safety and performance validation, extending the time and expense of supplier changes.

- Reduced Negotiation Leverage: These high barriers make it difficult for Gentherm to switch suppliers, even when faced with unfavorable pricing or terms.

Supplier's Importance to Gentherm vs. Gentherm's Importance to Supplier

The bargaining power of suppliers for Gentherm is significantly influenced by how crucial Gentherm is as a customer to them. If Gentherm accounts for a minor share of a supplier's overall sales, that supplier likely holds more leverage. For instance, if a key component supplier generates 90% of its revenue from diverse automotive manufacturers and only 10% from Gentherm, they have less incentive to bend to Gentherm's demands.

Conversely, if Gentherm represents a substantial portion of a supplier's business, the supplier may be more amenable to negotiating favorable pricing and terms to secure Gentherm's continued patronage. Gentherm's global manufacturing footprint and considerable purchasing volume do provide some degree of counter-leverage, allowing them to negotiate from a stronger position when dealing with suppliers who rely heavily on their business.

- Customer Concentration: Suppliers who serve a broad automotive industry base, where Gentherm is one of many clients, possess greater bargaining power.

- Gentherm's Revenue Share: If Gentherm constitutes a small percentage of a supplier's total revenue, the supplier is less sensitive to losing Gentherm's business.

- Supplier Dependence: Suppliers heavily reliant on Gentherm for a significant portion of their income will have reduced bargaining power.

- Global Scale Advantage: Gentherm's substantial global presence and procurement scale enable it to negotiate more effectively with its supplier base.

Gentherm's suppliers wield considerable bargaining power, particularly when they provide highly specialized components essential for Gentherm's innovative thermal management solutions. High switching costs, stemming from the need for re-tooling, product redesign, and rigorous re-qualification processes in the automotive and medical sectors, significantly limit Gentherm's ability to change suppliers. This dependence is exacerbated if Gentherm represents a small fraction of a supplier's overall sales, giving the supplier more leverage in negotiations.

| Factor | Impact on Gentherm | Example/Data Point |

|---|---|---|

| Supplier Concentration | High | If a critical component supplier serves many automotive clients, their power over Gentherm increases. |

| Switching Costs | High | Re-tooling and re-qualification for specialized automotive parts can cost millions and take months. |

| Component Criticality | High | Proprietary materials for battery thermal management systems give suppliers significant leverage. |

| Customer Dependence (Supplier's View) | Variable | Suppliers with low Gentherm revenue share (e.g., <5%) have more power than those with high dependence (e.g., >20%). |

What is included in the product

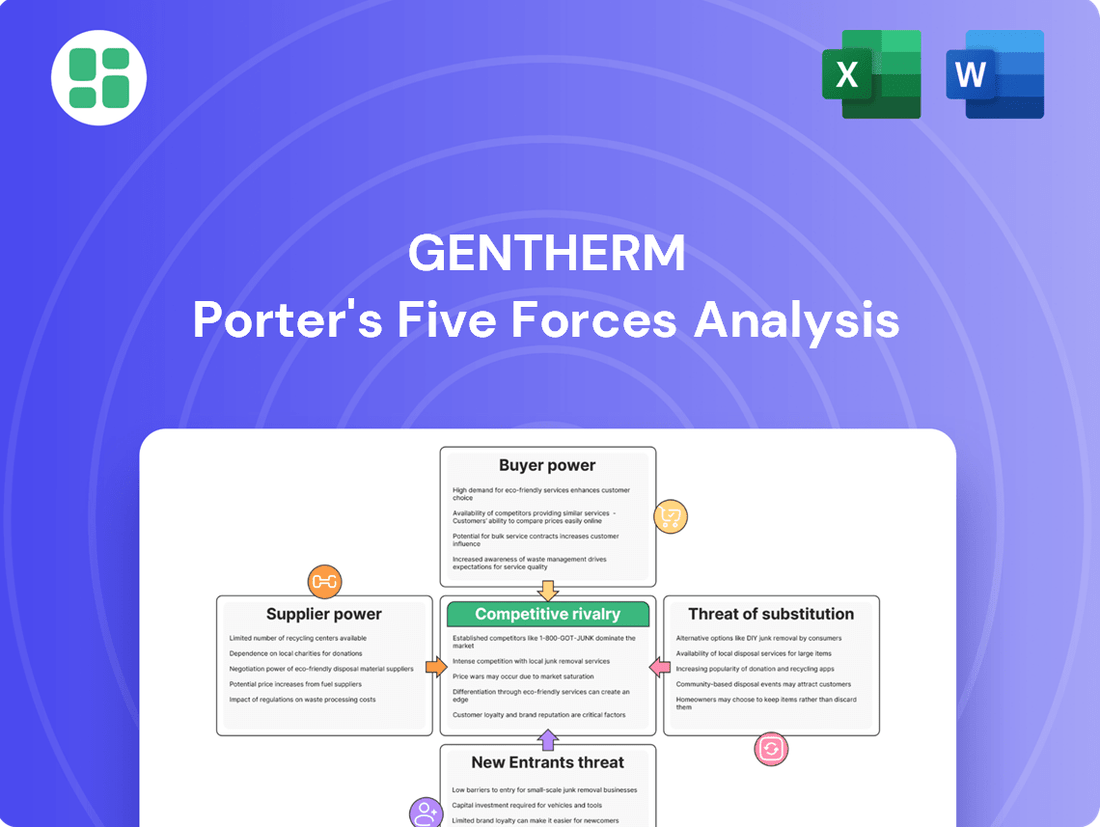

This analysis dissects Gentherm's competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly understand strategic pressure with a powerful spider/radar chart, simplifying complex competitive landscapes for Gentherm.

Customers Bargaining Power

Gentherm's customer base is heavily concentrated among a few major automotive original equipment manufacturers (OEMs). In 2024, these large OEMs accounted for a significant portion of Gentherm's sales, giving them considerable leverage. This concentration means that any single OEM's purchasing decisions can have a substantial impact on Gentherm's revenue.

Because these customers buy in such large volumes, they possess significant bargaining power. They can use their substantial orders to negotiate for lower prices, more favorable payment terms, or demand specialized product development. This ability to influence pricing and terms directly affects Gentherm's profitability.

Automotive Original Equipment Manufacturers (OEMs) are acutely price-sensitive due to the intensely competitive nature of their industry. This sensitivity directly impacts component suppliers like Gentherm, as OEMs constantly seek cost reductions. For instance, in 2024, the global automotive market faced persistent economic pressures, leading OEMs to negotiate aggressively on component pricing to maintain their profit margins.

Automotive Original Equipment Manufacturers (OEMs) possess significant leverage due to their potential to bring thermal management component production in-house, a move known as backward integration. This capability puts pressure on Gentherm to consistently deliver value and cutting-edge solutions.

While Gentherm's proprietary technology acts as a barrier for some components, the underlying threat of OEMs developing their own capabilities remains. For instance, in 2024, the automotive industry saw continued investments in advanced manufacturing technologies, making in-house production of certain components more feasible for large players.

Availability of Alternative Suppliers (Gentherm's Competitors)

The bargaining power of customers, particularly Original Equipment Manufacturers (OEMs) in the automotive sector, is significantly influenced by the availability of alternative suppliers for thermal management solutions. Gentherm, while a leader, faces competition from numerous other companies offering similar technologies, providing OEMs with choices. This competitive environment necessitates continuous innovation from Gentherm to maintain its market position and customer loyalty.

The automotive thermal management market is populated by several established players besides Gentherm. These include companies like:

- Valeo: A major global automotive supplier with a strong presence in climate control systems.

- Mahle: Known for its expertise in powertrain and thermal management components.

- Denso: Another significant automotive component manufacturer offering a range of thermal systems.

The presence of these competitors means OEMs are not solely reliant on Gentherm, thereby increasing their leverage in price negotiations and product specifications. For instance, in 2024, the automotive industry continued to see intense competition among Tier 1 suppliers, with many offering advanced battery thermal management systems for electric vehicles, a key growth area for companies like Gentherm.

Product Differentiation and Switching Costs for Customers

Gentherm's ability to differentiate its products, such as its ClimateSense® technology, significantly impacts customer bargaining power. When these advanced, proprietary solutions are deeply integrated into a customer's vehicle architecture, the cost and complexity for an automaker to switch to a competitor increase substantially.

This integration creates a form of customer lock-in, thereby diminishing their leverage. For instance, if a major automotive OEM relies heavily on Gentherm's thermal management systems for their electric vehicle battery cooling or cabin comfort solutions, replacing these components would involve extensive re-engineering and validation processes.

- High Differentiation: Gentherm's ClimateSense® technology offers advanced, often patented, solutions that are not easily replicated by competitors, making it harder for customers to find direct substitutes.

- Integration into Vehicle Platforms: When Gentherm's systems are designed and built into the core structure of a vehicle, the effort and expense required for a customer to switch suppliers become considerable.

- Reduced Switching Costs for Gentherm: Conversely, if Gentherm can demonstrate unique value and seamless integration, the bargaining power of its customers is effectively lowered.

- Example: A recent trend in automotive development shows increased demand for sophisticated thermal management systems, a core area for Gentherm, especially with the rise of EVs. This suggests that customers seeking these advanced features are more likely to face higher switching costs if they are deeply embedded.

Gentherm's bargaining power with customers is significantly influenced by the concentration of its customer base, with a few major automotive OEMs accounting for a substantial portion of its 2024 sales. This concentration grants these large buyers considerable leverage. Their ability to negotiate lower prices and more favorable terms is amplified by their high-volume purchases and the intense price sensitivity inherent in the competitive automotive market.

The threat of backward integration, where OEMs might develop thermal management components in-house, also empowers customers. This potential, coupled with the availability of alternative suppliers like Valeo, Mahle, and Denso in 2024, means OEMs have choices, further strengthening their negotiating position. However, Gentherm's proprietary technologies, such as ClimateSense®, can mitigate this by increasing switching costs for customers deeply integrating these advanced solutions.

| Factor | Impact on Gentherm's Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Customer Concentration | High | Major OEMs drive significant sales, increasing their leverage. |

| Purchase Volume | High | Large orders allow customers to negotiate for better pricing and terms. |

| Price Sensitivity | High | OEMs' need to control costs pressures suppliers like Gentherm. |

| Threat of Backward Integration | Moderate to High | Feasibility of in-house production increases customer leverage. |

| Availability of Alternatives | Moderate to High | Presence of competitors like Valeo, Mahle, Denso provides customer choice. |

| Product Differentiation & Integration | Low to Moderate | Proprietary tech (ClimateSense®) can reduce customer power by raising switching costs. |

Preview the Actual Deliverable

Gentherm Porter's Five Forces Analysis

This preview showcases the complete Gentherm Porter's Five Forces Analysis, providing a comprehensive examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency. You can confidently download and utilize this detailed analysis without any surprises or missing sections.

Rivalry Among Competitors

The automotive thermal management market, while boosted by electric vehicle adoption, exhibits maturity in traditional segments. This maturity often translates to heightened competitive rivalry as companies vie for market share. Gentherm is strategically addressing this by expanding into higher-growth areas like medical and industrial applications, alongside developing advanced automotive solutions such as battery thermal management.

Gentherm faces a competitive landscape populated by numerous players, including significant automotive HVAC suppliers such as Denso and Hanon Systems. This market's diversity, encompassing both broad-spectrum suppliers and highly specialized firms, fuels a robust competitive environment.

In 2024, the automotive thermal management sector continues to see intense competition as companies vie for market share. For instance, Denso, a global leader, reported approximately $47.2 billion in net sales for the fiscal year ending March 31, 2024, highlighting the scale of operations for major competitors.

Gentherm's strategy to stand out involves a dedicated focus on cutting-edge thermal management and advanced comfort solutions, differentiating it from competitors with broader product portfolios.

Competitive rivalry in the automotive thermal management sector is intense, particularly when products are similar, forcing companies into price wars. Gentherm actively combats this by focusing on product differentiation through advanced technologies. For instance, their ClimateSense® and Puls.A™ innovations offer unique solutions that move beyond basic functionality, aiming to command premium pricing and reduce reliance on cost alone.

Gentherm's commitment to research and development is a key strategy to stay ahead of rivals. In 2023, the company reported R&D expenses of $107.9 million, a significant investment reflecting its dedication to innovation. This continuous pursuit of new technologies is vital for securing future business awards and maintaining a competitive advantage in a market where technological advancements quickly become standard.

Exit Barriers

High exit barriers, such as substantial fixed assets and specialized equipment, can trap even unprofitable companies within the automotive thermal management sector, thereby increasing competitive pressure. Gentherm's extensive global manufacturing presence, including specialized facilities for its core technologies, represents significant capital investments that make exiting the market difficult.

These barriers mean that firms might continue operating at reduced profitability rather than incurring substantial losses from asset disposal. For instance, the specialized nature of tooling and production lines for climate control seats or battery thermal management systems means they have limited alternative uses, increasing the cost of departure.

- Significant Fixed Assets: Gentherm's substantial investments in manufacturing plants and specialized machinery create a high cost of exit.

- Specialized Equipment: The unique nature of their thermal management technology means equipment has limited resale value or alternative applications.

- Long-Term Contracts: Commitments with Original Equipment Manufacturers (OEMs) can bind companies to production for extended periods, even if operations become less profitable.

- Brand Reputation and Relationships: The established relationships and brand loyalty within the automotive supply chain can also act as a disincentive to exit prematurely.

Industry Structure and Strategic Alliances

The automotive thermal management industry, where Gentherm operates, is characterized by a concentrated structure with a few dominant global suppliers catering to original equipment manufacturers (OEMs). This setup naturally intensifies competition among these key players.

Strategic alliances are crucial for navigating this landscape. For instance, Gentherm's collaboration with DUOMED to expand into the medical sector exemplifies how such partnerships can carve out new market niches and mitigate direct confrontation with rivals in established automotive segments. These alliances can also provide access to new technologies and customer bases.

Gentherm's success in securing substantial new business awards, such as the significant wins announced in early 2024 totaling over $600 million in new revenue, underscores its competitive prowess. These awards demonstrate the company's ability to win contracts against established competitors by offering compelling technological solutions and value propositions.

- Industry Structure: Dominated by a few large global suppliers serving major automotive OEMs.

- Strategic Alliances: Partnerships like the one with DUOMED in the medical field help diversify and strengthen market position.

- Competitive Strength: Demonstrated by securing significant new business awards, reflecting strong technological and commercial capabilities.

Competitive rivalry in the automotive thermal management market is fierce, driven by a mature industry structure and the presence of large, established global suppliers. Gentherm faces significant competition from players like Denso and Hanon Systems, who command substantial market share and revenue, as evidenced by Denso's approximately $47.2 billion in net sales for fiscal year 2024. This intense competition necessitates a strong focus on product differentiation and innovation to avoid price wars.

| Competitor | Approximate FY2024 Net Sales (USD billions) | Key Focus Areas |

|---|---|---|

| Denso | 47.2 | Automotive components, including thermal systems |

| Hanon Systems | N/A (Competitor data varies, but significant player) | Thermal management solutions for automotive |

| Gentherm | N/A (Focus on specific segment performance) | Advanced thermal management, comfort solutions, diversification |

SSubstitutes Threaten

The threat of substitutes for Gentherm's thermal management solutions comes from alternative methods customers can employ to achieve comfort and energy efficiency. These can range from simpler, less technologically advanced options to entirely different approaches to climate control.

For example, traditional passive insulation in vehicles offers a lower-cost substitute, though it significantly compromises on personalized comfort and the precise energy savings that Gentherm's active systems provide. In 2024, the automotive industry continued to see demand for cost-effective solutions, making these less sophisticated alternatives a persistent consideration for some market segments.

Gentherm's ClimateSense technology, which focuses on intelligent, personalized climate control, directly contrasts with these simpler substitutes by offering superior energy efficiency. While specific comparative data for 2024 is proprietary, the trend towards electrification and demand for extended EV range underscore the value proposition of such advanced, energy-saving thermal management.

Customer propensity to substitute is a key factor in understanding competitive pressure. It hinges on how aware customers are of alternatives, the value they perceive in those alternatives, and their openness to switching. For Gentherm, this means their advanced thermal management solutions must consistently prove their worth against potential replacements.

In the automotive sector, the adoption of new technologies is heavily influenced by what original equipment manufacturers (OEMs) offer and what consumers are demanding, particularly regarding comfort and efficiency. For instance, the increasing consumer interest in electric vehicles (EVs) drives demand for sophisticated battery thermal management systems, an area where Gentherm operates. Gentherm's ability to highlight the unique benefits and cost-effectiveness of its patented technologies is crucial to mitigating the threat of substitutes.

Technological progress in areas like advanced passive insulation materials or novel alternative energy sources for vehicle climate control presents a significant threat from substitutes. For instance, breakthroughs in thermoelectric cooling or advanced phase-change materials could offer competitive solutions that bypass traditional heating and cooling systems. Gentherm is actively addressing this by dedicating substantial resources to research and development, aiming to continuously innovate and expand its own technological capabilities to maintain a competitive edge.

Indirect Substitutes for Comfort and Efficiency

Broader vehicle design choices can act as indirect substitutes, lessening the demand for active thermal management systems. For instance, enhanced aerodynamics and advanced window tinting can reduce the reliance on internal heating and cooling, potentially shrinking the market for specialized solutions. In 2024, the automotive industry continued to emphasize aerodynamic efficiency, with many new models showcasing designs aimed at improving fuel economy and reducing drag, which indirectly impacts the need for robust climate control systems.

These indirect substitutes, while not direct competitors to Gentherm's core thermal technologies, can still influence the overall market size for such solutions. As automakers prioritize energy efficiency across the board, features that inherently reduce the load on climate control systems become more attractive. This trend suggests a need for thermal management providers to integrate their offerings more seamlessly with overall vehicle design and energy management strategies.

Gentherm's strategic response, such as its ClimateSense® integrated solutions, aims to counter this by focusing on optimizing overall energy usage within the vehicle. This approach acknowledges that the future of automotive comfort lies not just in powerful heating and cooling, but in intelligent systems that manage thermal needs efficiently. By making their solutions part of a holistic energy optimization strategy, companies like Gentherm can maintain relevance and capture value even as other design elements reduce the baseline demand for active thermal management.

- Indirect Substitutes: Improved vehicle aerodynamics and advanced window tinting reduce the need for active heating and cooling.

- Market Impact: These design choices can shrink the overall market size for dedicated thermal management systems.

- Gentherm's Strategy: Focus on integrated solutions like ClimateSense® to optimize total vehicle energy usage.

- Industry Trend: 2024 saw continued emphasis on aerodynamic efficiency in new vehicle designs, impacting thermal system demand.

Cross-Industry Substitution (e.g., Medical vs. Automotive)

The threat of substitutes for Gentherm extends beyond direct competitors within the automotive or medical sectors. Solutions developed for one industry can often find application in another, posing a substitution risk. For instance, general patient warming technologies originating from non-automotive medical device manufacturers could be viewed as substitutes for Gentherm's specialized patient temperature management systems in the medical field.

Gentherm's strategic diversification across multiple industries, including automotive and medical, serves as a crucial mitigating factor against this cross-industry substitution threat. By not being solely reliant on a single market, the company can better absorb potential impacts if a substitute technology gains traction in one area.

- Cross-Industry Adaptation: Technologies proven in one sector, like general patient warming from medical device firms, can be adapted for use in other markets, potentially impacting Gentherm's medical segment.

- Diversification as a Buffer: Gentherm's presence in both automotive and medical industries helps spread risk, making it less vulnerable if a substitute emerges in just one of those markets.

- Technological Convergence: As technology advances, innovations in areas like thermal management for electronics or personal comfort could offer alternative solutions to Gentherm's core offerings.

The threat of substitutes for Gentherm's thermal management solutions is moderate, stemming from alternative methods like passive insulation and advancements in areas like thermoelectric cooling. While these substitutes may offer lower initial costs, they often fall short in delivering the precise comfort and energy efficiency that Gentherm's active systems provide. In 2024, the automotive industry's continued focus on aerodynamic efficiency and advanced window tinting indirectly reduced the demand for robust climate control systems, highlighting the need for integrated thermal management strategies.

Gentherm's strategic response involves developing advanced solutions like ClimateSense®, which optimize overall vehicle energy usage and offer superior performance compared to simpler alternatives. The company's diversification across automotive and medical sectors also mitigates risks from cross-industry substitution. Despite these efforts, the potential for breakthroughs in alternative thermal technologies remains a key consideration.

| Factor | Impact on Gentherm | Mitigation Strategy |

|---|---|---|

| Passive Insulation | Lower cost, reduced comfort/efficiency | Highlighting superior performance of active systems |

| Aerodynamics & Window Tinting | Reduced demand for active climate control | Integrated thermal management solutions |

| Thermoelectric Cooling | Potential for alternative solutions | Continued R&D and innovation |

| Cross-Industry Tech | Risk to specific market segments | Industry diversification |

Entrants Threaten

Entering Gentherm's thermal management technology sector demands significant upfront capital. This includes substantial investments in research and development to create advanced solutions, building state-of-the-art manufacturing facilities, and establishing robust global distribution channels. For instance, establishing a competitive presence in the automotive sector alone can easily run into hundreds of millions of dollars.

Gentherm benefits from considerable economies of scale, a key barrier to entry. With operations spanning 13 countries and employing over 14,000 individuals, the company leverages its vast scale to reduce per-unit production costs. This global infrastructure and operational efficiency make it exceedingly challenging for new players to match Gentherm's cost competitiveness, especially in high-volume markets.

Gentherm's formidable portfolio of proprietary technologies, including ClimateSense® and Puls.A™, acts as a significant deterrent to new market entrants. These innovations, protected by a substantial number of patents, necessitate considerable upfront investment in research and development for any competitor aiming to replicate their capabilities. For instance, in 2023, Gentherm reported spending $169.8 million on R&D, a clear indicator of the capital required to maintain such technological leadership.

Newcomers face significant hurdles in accessing established distribution channels and cultivating strong customer relationships within the automotive and medical device sectors. These industries are characterized by long qualification periods, demanding quality standards, and deeply entrenched supply chains, making it difficult for new entrants to break in. Gentherm's success, evidenced by its 'Supplier of the Year' award from General Motors in 2023, underscores the value of these hard-won, long-standing partnerships.

Government Policy and Regulations

Government policy and regulations significantly impact the threat of new entrants for companies like Gentherm. Strict safety standards and certification processes in the automotive and medical sectors, where Gentherm operates, create substantial hurdles for newcomers. For instance, obtaining necessary approvals for automotive components can take years and involve rigorous testing, deterring many potential competitors.

New entrants must invest heavily in understanding and complying with a complex web of international and national regulations. This includes everything from environmental standards to product safety mandates. For example, in 2024, the automotive industry continued to see evolving regulations around electric vehicle components and battery safety, requiring significant upfront investment and expertise for any new player.

- High Compliance Costs: Navigating complex certifications and testing procedures requires substantial financial and time investment, acting as a barrier.

- Established Infrastructure Advantage: Gentherm's existing compliance framework and experience provide a distinct competitive edge over new entrants.

- Evolving Regulatory Landscape: Changes in regulations, such as those for EV components in 2024, necessitate continuous adaptation and investment, further challenging new market entrants.

Brand Identity and Switching Costs for Customers

Gentherm's strength lies not in consumer brand recognition but in its deep-seated reputation and trust with Original Equipment Manufacturer (OEM) clients and medical industry partners. This established relationship acts as a significant barrier to entry for newcomers, making it challenging for them to gain traction.

The switching costs for Gentherm's OEM and medical partners are substantial. These include the intricate processes of re-designing components, undergoing rigorous re-validation procedures, and the potential for disruptive impacts on their existing supply chains. These hurdles effectively deter partners from easily transitioning to unproven new entrants, thereby reinforcing Gentherm's market position.

- Established OEM Relationships: Gentherm's long-standing partnerships with major automotive manufacturers are a key deterrent to new entrants.

- High Re-validation Costs: For automotive components, re-validating new suppliers can cost millions and delay product launches significantly.

- Supply Chain Integration: Gentherm's integrated supply chain solutions reduce complexity for OEMs, making it costly and disruptive to switch.

- Proprietary Technology: Certain Gentherm technologies may require specialized knowledge and integration, further increasing switching costs.

The threat of new entrants in Gentherm's thermal management sector is generally low due to substantial capital requirements for R&D, manufacturing, and distribution, often reaching hundreds of millions for automotive entry alone. Furthermore, Gentherm's significant economies of scale, achieved through operations in 13 countries with over 14,000 employees, create a cost advantage that is difficult for newcomers to match. Proprietary technologies, protected by numerous patents, and the high switching costs for established customers, including extensive re-validation processes, further solidify Gentherm's market position and deter new competition.

| Barrier to Entry | Description | Impact on New Entrants | Gentherm's Advantage |

|---|---|---|---|

| Capital Requirements | High upfront investment in R&D, manufacturing, and distribution. | Deters potential entrants lacking significant funding. | Established infrastructure and operational scale. |

| Economies of Scale | Lower per-unit costs due to high-volume production. | New entrants struggle to compete on price. | Global operational footprint and efficiency. |

| Proprietary Technology | Patented innovations requiring substantial R&D investment to replicate. | Requires significant investment to match technological capabilities. | Extensive patent portfolio and ongoing R&D spending (e.g., $169.8 million in 2023). |

| Customer Relationships & Switching Costs | Long qualification periods, high re-validation costs, and supply chain integration. | Makes it difficult and costly for customers to switch to new suppliers. | Strong OEM partnerships (e.g., GM Supplier of the Year 2023) and integrated solutions. |

Porter's Five Forces Analysis Data Sources

Our Gentherm Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, SEC filings, and industry-specific market research from firms like IHS Markit and Frost & Sullivan.