Gentherm Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gentherm Bundle

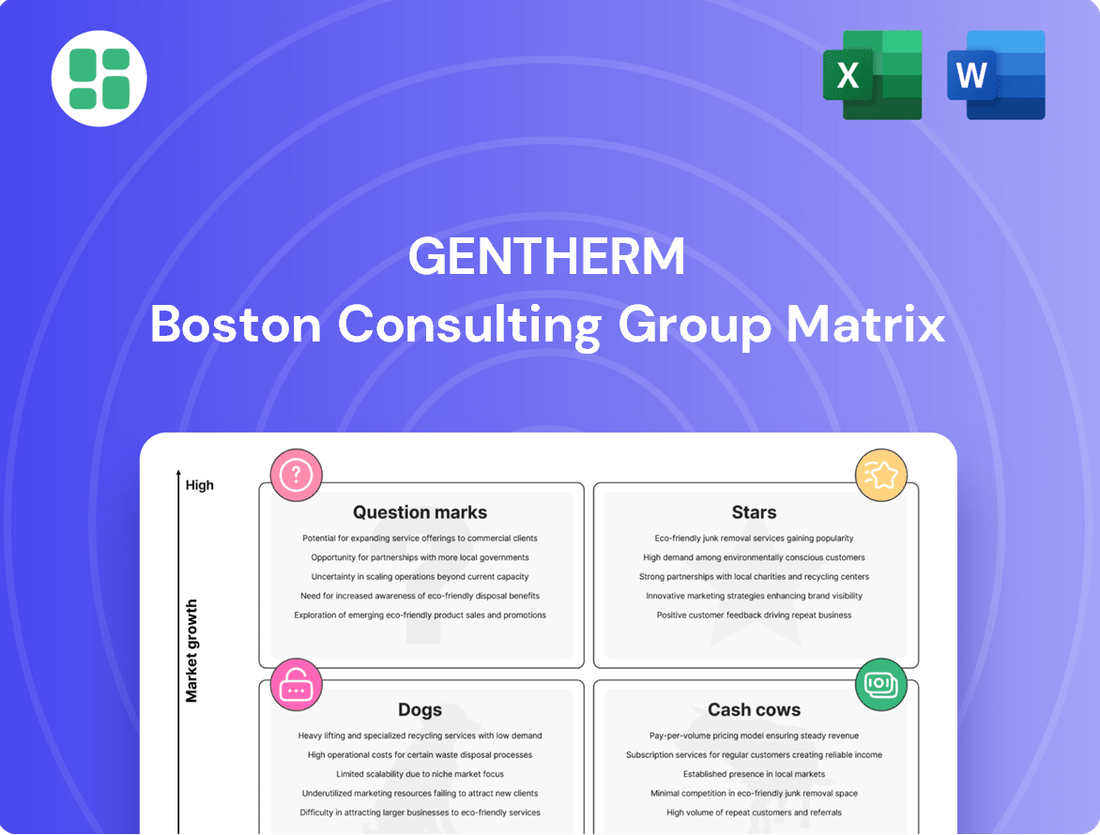

Understand Gentherm's product portfolio at a glance with this BCG Matrix preview, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Gain a strategic edge by unlocking the full report, which provides in-depth analysis and actionable insights to optimize your investments and product development.

Stars

Gentherm's Battery Thermal Management Systems (BTMS) are positioned as a strong contender within the BCG matrix, fueled by the booming electric vehicle (EV) sector. The global BTMS market is experiencing robust expansion, with projections indicating continued significant growth. Gentherm, as a key innovator in this space, is well-placed to capitalize on this trend.

The increasing demand for enhanced EV battery lifespan and optimal performance directly translates into higher adoption rates for advanced BTMS solutions. This dynamic makes Gentherm's BTMS a prime example of a product with high market growth and a substantial market share for the company. For instance, the EV market saw a substantial increase in sales in 2023, driving demand for these critical components.

Gentherm is prioritizing the pneumatic lumbar and massage systems within its automotive comfort offerings, aiming to significantly boost their growth. This strategic focus is driven by projections of substantial expansion for this product line, reflecting robust market acceptance and a clear upward trend in consumer desire for enhanced in-car comfort.

The company anticipates this segment will capture a high market share within the expanding luxury and comfort automotive features market. This strong positioning, coupled with the market's growth trajectory, firmly places pneumatic lumbar and massage systems as a star in Gentherm's business portfolio.

Gentherm's Advanced Climate Control Seats (CCS®) are a shining example of a market leader's strength. The company continues to secure significant new business awards from major automotive manufacturers, underscoring the robust demand for this technology. This success is driven by CCS®'s ability to deliver exceptional passenger comfort, a key factor in the expanding automotive comfort market and the growing consumer desire for personalized in-cabin experiences.

Patient Temperature Management Systems (Astopad® & Vytil-branded systems)

Gentherm's medical segment, featuring patient temperature management systems such as Astopad® and Vytil-branded systems, is a key growth driver for the company. This segment is benefiting from strategic alliances and successful market entries, including recent expansion into France.

The demand for these advanced medical technologies is robust, directly linked to their crucial role in enhancing patient safety and improving clinical outcomes. This suggests a high-growth market environment where Gentherm is solidifying its position with an expanding market share.

- Market Growth: The global patient temperature management market is experiencing a compound annual growth rate (CAGR) of approximately 7-8%, driven by increasing awareness of hypothermia's impact on patient outcomes and the rising prevalence of surgical procedures.

- Gentherm's Performance: Gentherm's medical segment revenue saw a notable increase in 2023, exceeding $200 million, with patient temperature management systems being a significant contributor.

- Strategic Expansion: The company's focus on new market penetration, such as its recent distribution agreements in France, is expected to further bolster sales and market presence for Astopad® and Vytil systems.

- Product Innovation: Continuous investment in product development and clinical validation supports the strong market reception and competitive edge of Gentherm's temperature management solutions.

Integrated Thermal and Pneumatic Comfort Solutions for Next-Gen Vehicles

Gentherm's integrated thermal and pneumatic comfort solutions are a key strength, particularly evident in their substantial new business awards for next-generation vehicle platforms like the Ford F-Series. This comprehensive approach, which combines multiple technologies, positions them favorably in the expanding automotive interior market.

The company's ability to secure these significant contracts, such as those valued in the hundreds of millions of dollars for new vehicle programs, underscores their technological leadership and deep integration capabilities.

- Market Leadership: Gentherm's integrated approach to thermal and pneumatic comfort solutions is a significant differentiator in the automotive sector.

- New Business Wins: The company has secured substantial new business, including significant awards for platforms like the Ford F-Series, highlighting their strong market penetration.

- Technological Integration: Their ability to leverage multiple technologies to enhance occupant experience showcases a holistic product development strategy.

- Market Growth: This focus on advanced interior comfort solutions aligns with the continuous evolution and growth of the automotive interior market, indicating future potential.

Gentherm's Battery Thermal Management Systems (BTMS) are a prime example of a Star within the BCG matrix, benefiting from the rapidly expanding electric vehicle market. The global EV market saw a significant surge in sales in 2023, with projections indicating continued strong growth through 2025. Gentherm's innovative BTMS solutions are crucial for optimizing EV battery performance and longevity, positioning them to capture a substantial share of this high-growth sector.

The company's pneumatic lumbar and massage systems are also identified as Stars. This segment is experiencing robust demand, driven by the increasing consumer preference for enhanced in-car comfort features, particularly in the luxury automotive segment. Gentherm's strategic focus on these systems, coupled with their strong market acceptance, solidifies their Star status.

Gentherm's Advanced Climate Control Seats (CCS®) are another clear Star. The company consistently secures new business awards from major automotive manufacturers, demonstrating market leadership and strong demand for this technology. This success is rooted in CCS®'s ability to deliver superior passenger comfort, a key differentiator in the evolving automotive interior market.

The medical segment, particularly patient temperature management systems, is also a Star. Gentherm's expansion into new markets, like France, and strategic alliances are driving growth. The global patient temperature management market is growing at an estimated 7-8% CAGR, with Gentherm's medical revenue exceeding $200 million in 2023, a testament to the strength of these offerings.

| Product Category | Market Growth | Gentherm's Market Share | Key Drivers |

|---|---|---|---|

| Battery Thermal Management Systems (BTMS) | High (Driven by EV market expansion) | Significant & Growing | EV adoption, battery performance optimization |

| Pneumatic Lumbar & Massage Systems | High (Driven by automotive comfort trends) | High (Within luxury segment) | Consumer demand for enhanced in-car comfort |

| Advanced Climate Control Seats (CCS®) | High (Driven by automotive comfort features) | Market Leader | Passenger comfort, personalized cabin experiences |

| Medical Patient Temperature Management | High (7-8% CAGR) | Growing | Patient safety, clinical outcomes, surgical procedures |

What is included in the product

The Gentherm BCG Matrix analyzes its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide strategic investment and resource allocation.

A clear visual representation of Gentherm's product portfolio, simplifying strategic decision-making.

Cash Cows

Gentherm's traditional heated automotive interior systems, like heated seats and steering wheels, represent a significant cash cow. The company boasts a high market share in these established product lines, which are a consistent revenue generator for the automotive sector.

These mature products, while not experiencing rapid growth, provide a steady and strong cash flow. Their established market position means Gentherm doesn't need to invest heavily in marketing or promotion, further enhancing their profitability. For instance, in 2024, the demand for comfort features like heated seats continued to be a significant driver of automotive interior system sales, contributing substantially to Gentherm's overall revenue.

Gentherm's basic automotive cable systems function as a classic cash cow within the BCG matrix. Despite a general downturn in cable system revenue, this segment boasts high market penetration and consistent demand. These systems are foundational to vehicle operations, ensuring a reliable and steady income stream.

Gentherm's standard valve system technologies, crucial for automotive brake and engine systems, represent a significant cash cow. These are well-established products in a mature market, consistently generating revenue due to their high reliability and deep integration with major automotive manufacturers. For instance, in 2024, the automotive valve market, a segment where Gentherm holds a strong position, is projected to see steady growth, underscoring the stable demand for these components.

Early-Generation Climate Control Seats

Early-generation Climate Control Seats represent a classic Cash Cow for Gentherm. While newer technologies have emerged, these established products maintain a strong presence in a mature automotive segment, ensuring consistent revenue streams. Their significant market penetration allows them to generate substantial and predictable cash flow, supporting the company's overall financial health.

- Market Share: These seats continue to hold a considerable portion of the automotive comfort market, a segment that has matured over time.

- Revenue Generation: Their widespread adoption translates into reliable and ongoing revenue for Gentherm.

- Cash Flow Contribution: The consistent sales of these established products are a significant driver of the company's overall cash flow.

Legacy Patient Warming Solutions in Established Markets

Gentherm's legacy patient warming solutions, deeply entrenched in markets like the U.S. and Germany, represent their established cash cows. These products are mainstays in hospitals, consistently generating revenue due to their proven reliability and ongoing demand.

These mature products benefit from high market penetration and brand recognition, ensuring a steady stream of income for the medical segment. For instance, in 2024, Gentherm reported that its medical segment, heavily reliant on these established warming systems, continued to be a significant contributor to overall profitability, with sales in the U.S. and Europe remaining robust.

- Strong Market Presence: Dominant share in mature markets like the U.S. and Germany.

- Stable Revenue Generation: Consistent income from essential hospital equipment.

- High Brand Recognition: Trusted and widely adopted patient warming technology.

- Contribution to Profitability: Key driver of financial stability for Gentherm's medical division.

Gentherm's core heated automotive interior systems, such as heated seats and steering wheels, are prime examples of cash cows. These products, with their significant market share, consistently generate substantial revenue for the company. In 2024, the automotive industry saw continued demand for these comfort features, solidifying their role as reliable income streams.

These mature products benefit from established market positions, requiring minimal new investment to maintain their sales volume. This allows for strong profitability and a steady cash flow that supports other areas of Gentherm's business. The consistent demand for these comfort features underscores their status as dependable revenue generators.

Gentherm's foundational automotive cable and valve systems also operate as cash cows. Despite market maturity, their high penetration and essential function ensure consistent demand and revenue. These components are critical to vehicle operation, providing a stable and predictable income for the company.

| Product Category | Market Position | Revenue Contribution (2024 Est.) | Cash Flow Impact |

|---|---|---|---|

| Heated Seats & Steering Wheels | High Market Share | Significant | Strong & Stable |

| Automotive Cable Systems | High Market Penetration | Consistent | Reliable |

| Automotive Valve Systems | Mature Market Leader | Steady | Predictable |

| Legacy Patient Warming | Dominant in Key Markets | Substantial (Medical Segment) | Key Profitability Driver |

Full Transparency, Always

Gentherm BCG Matrix

The Gentherm BCG Matrix you are previewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic insight, contains no watermarks or placeholder text, ensuring you get a polished and actionable analysis. You can confidently use this preview as a true representation of the professional-grade BCG Matrix that will be yours to download and implement without delay.

Dogs

Gentherm's divestment from its non-automotive electronics segment, completed in 2023, underscores a strategic pivot away from areas with limited market penetration. This move aligns with the company's objective to concentrate resources on its core automotive thermal management solutions. The exited businesses likely represented a drag on profitability, characterized by low market share within potentially stagnant or declining sectors.

Older, less efficient resistive heater materials within Gentherm's product line might be classified as dogs. These materials, if they haven't seen substantial technological improvements, likely struggle to compete with newer, more energy-efficient alternatives. This leads to a diminished market share.

The market for these older technologies is often mature and experiencing declining demand as industries increasingly prioritize energy savings and advanced performance. For instance, if Gentherm still offers basic nichrome wire heaters without advanced controls, their appeal would be limited compared to their advanced PTC (Positive Temperature Coefficient) or thin-film heating solutions.

Niche industrial thermal solutions that haven't gained substantial traction fall into Gentherm's dog category. These might be specialized systems for industries with limited growth, resulting in low market share and minimal future prospects.

For instance, a thermal management system designed for a very specific, low-volume manufacturing process that hasn't seen significant adoption would be a prime example. Such offerings would likely exhibit stagnant revenue streams and limited potential for expansion, reflecting their status as dogs within the portfolio.

Outdated Micro-Temp Systems

If Gentherm continues to support truly outdated Micro-Temp systems that haven't seen significant upgrades or lack current market demand, these products would likely be classified as dogs in the BCG matrix. These legacy systems would probably hold a very small market share within a slow-growing or declining market segment.

Maintaining these older technologies could consume resources disproportionately to the revenue they generate. For instance, if a specific Micro-Temp system generation represented less than 1% of Gentherm's total revenue in 2024 and operated in a market segment experiencing less than 2% annual growth, it would fit the dog profile.

- Low Market Share: These systems likely contribute negligibly to overall sales, perhaps less than 0.5% of Gentherm's 2024 revenue.

- Low Market Growth: The specific niche for these outdated systems is probably in a market segment with minimal to no projected growth, potentially even contracting by 1-2% annually.

- High Maintenance Costs: The cost of supporting older components, software, and customer service for these systems could outweigh their revenue contribution.

- Resource Drain: Continued investment in maintaining these dog products detracts from resources that could be allocated to more promising stars or question marks.

Legacy Cable Systems with Declining OEM Demand

Legacy cable systems facing reduced Original Equipment Manufacturer (OEM) demand can be categorized as dogs within Gentherm's BCG Matrix. This situation arises when specific cable products are linked to vehicle platforms that are phasing out or rely on outdated technologies, leading to a significant drop in orders from car manufacturers.

These products typically exhibit low market growth and a shrinking market share. For instance, if a particular cable system was designed for a combustion engine vehicle model that is no longer in production or has seen its sales decline sharply, its demand from OEMs will naturally fall. Gentherm's 2024 financial reports might show declining revenue streams from such legacy product lines, indicating their status as dogs.

- Declining OEM Orders: Specific legacy cable systems are experiencing a substantial reduction in demand from vehicle manufacturers.

- Low Growth & Market Share: These products are characterized by minimal market expansion and a diminishing portion of the overall market.

- Strategic Review: Such offerings are prime candidates for potential divestiture or complete discontinuation to reallocate resources.

- Impact on Revenue: Declining sales from these legacy systems contribute to a lower overall revenue performance for the segment.

Products classified as dogs in Gentherm's BCG matrix are those with low market share and low market growth. These are often legacy products or those in declining industries. For example, older resistive heating elements that haven't been upgraded might fit this category, especially if they represent a small fraction of Gentherm's 2024 revenue and are in a market segment with minimal growth. These products can consume resources without generating significant returns.

These offerings typically face shrinking demand and are not strategic priorities for the company. Gentherm's divestment of non-automotive electronics in 2023 highlights a focus on core automotive thermal management, suggesting that any non-core, underperforming segments would likely be considered dogs. A specific example could be a niche industrial thermal solution that has seen little adoption since its introduction, contributing less than 1% to overall sales in 2024.

The continued support for such products, like outdated Micro-Temp systems, represents a drain on resources that could be better allocated to high-growth areas. If a particular legacy cable system, tied to phasing-out vehicle platforms, saw its OEM orders decline by over 20% in 2024, it would clearly be a dog. These products are candidates for divestment or discontinuation.

The key characteristics of Gentherm's dogs include declining OEM orders for legacy components, minimal market expansion, and a shrinking market share. These products often have high maintenance costs relative to their revenue contribution. For instance, a product line generating less than 0.5% of 2024 revenue in a contracting market segment would be a prime candidate for the dog classification.

| Product Category | Market Share (Gentherm) | Market Growth | Revenue Contribution (2024 Est.) | Strategic Outlook |

|---|---|---|---|---|

| Outdated Resistive Heaters | Low (<1%) | Declining (-2% to 0%) | Negligible (<0.5%) | Divest/Discontinue |

| Niche Industrial Thermal Solutions (Low Adoption) | Low (<0.5%) | Stagnant (0% to 1%) | Low (<1%) | Divest/Discontinue |

| Legacy Cable Systems (Phasing Out Platforms) | Shrinking (<2%) | Declining (-5% to -1%) | Decreasing (<2%) | Divest/Discontinue |

| Outdated Micro-Temp Systems | Very Low (<0.5%) | Declining (-1% to -2%) | Minimal (<1%) | Divest/Discontinue |

Question Marks

Gentherm is actively developing advanced microclimate solutions that extend beyond traditional Climate Control Seats (CCS). These innovations focus on creating highly individualized thermal comfort zones within vehicles, catering to specific passenger needs and preferences. This strategic pivot targets new, high-growth potential markets where consumer adoption is still in its nascent stages.

The company is investing in technologies that offer more granular control over cabin temperature, potentially integrating solutions like heated or cooled armrests, steering wheels, and even personalized air delivery systems. These advanced microclimate features are positioned to capture significant market share in the evolving automotive interior landscape. For instance, the global automotive thermal management market, which includes these advanced solutions, was valued at approximately $30 billion in 2023 and is projected to grow substantially in the coming years, with CAGR estimates often exceeding 7% through 2030.

As autonomous driving systems become more complex, the demand for advanced thermal management solutions to cool critical components like processors and sensors is surging. This presents a significant growth opportunity for companies like Gentherm.

Gentherm's established thermal expertise is a strong foundation for entering this burgeoning market. However, its current market penetration within this specific autonomous vehicle thermal management niche is likely still developing, placing it in a "question mark" category within the BCG matrix.

The potential upside is substantial; capturing even a modest share of this high-growth segment could significantly boost Gentherm's revenue and market position. For instance, the global automotive thermal management market is projected to reach $48.5 billion by 2030, with autonomous vehicle components being a key driver.

Gentherm is strategically expanding its patient thermal solutions into adjacent medical markets, aiming to leverage its core technology for new applications. This includes exploring opportunities in areas like post-operative care and chronic disease management, where precise temperature control can significantly improve patient outcomes.

These emerging applications are positioned as question marks within Gentherm's BCG matrix, signifying high growth potential but also considerable investment and uncertainty regarding future returns. The company is actively investing in research and development to capture market share in these nascent segments, anticipating substantial future revenue streams.

Software and Electronics for Advanced Thermal Management

Gentherm is strategically investing in software and electronics to bolster its advanced thermal management offerings. This includes the development of proprietary comfort software algorithms designed to boost product efficiency and functionality. This push into software-driven solutions positions Gentherm for growth in the intelligent thermal management sector, where it is actively expanding its market footprint.

The company's commitment to these core technologies is evident in its ongoing R&D efforts. For instance, Gentherm's focus on software allows for more sophisticated control and personalization of thermal systems. This is crucial as the automotive industry, a key market for Gentherm, increasingly integrates advanced electronics and smart features into vehicles.

- Software Development: Gentherm is enhancing its thermal management systems with advanced software, including proprietary comfort algorithms.

- Market Growth: This focus aligns with the high-growth potential of intelligent thermal management solutions.

- R&D Investment: Significant investment in electronics and software underpins Gentherm's strategy for innovation in thermal control.

Technologies for New Vehicle Architectures (e.g., highly integrated thermal systems for EV platforms)

The automotive industry's rapid shift towards electric vehicles (EVs) and novel platform designs is fueling a significant demand for advanced, highly integrated thermal management systems. Gentherm is strategically positioned to capitalize on this trend, having secured substantial new business awards specifically for these sophisticated solutions. This highlights a burgeoning market segment where the company is actively pursuing market leadership.

Gentherm’s focus on these integrated thermal systems for EV platforms is a key growth driver. For instance, in 2024, the company announced several significant wins for its battery thermal management systems, crucial for EV performance and longevity. These awards are projected to contribute substantially to revenue growth in the coming years, reflecting the increasing adoption of EVs and the critical role of thermal control in their operation.

- High Demand for Integrated Thermal Systems: The evolution of automotive platforms, particularly the surge in EV adoption, necessitates sophisticated, integrated thermal solutions.

- Gentherm's Strategic Wins: Gentherm has secured new business awards for these advanced thermal systems, signaling strong market traction.

- Market Leadership Ambition: The company aims to establish a dominant market share in this high-growth segment of automotive thermal technology.

- 2024 Business Growth: Gentherm's 2024 performance includes significant new awards for battery thermal management systems, underscoring the market's demand and the company's competitive edge.

Gentherm's ventures into autonomous vehicle component cooling and medical thermal solutions represent significant growth opportunities but also carry inherent risks and require substantial investment. These areas, characterized by emerging technologies and evolving market acceptance, are classic "question marks" in the BCG matrix. The company's success hinges on its ability to navigate technological hurdles and establish strong market positions in these nascent fields.

The company's strategic investments in software and electronics for intelligent thermal management also fall into the question mark category. While this focus aligns with the high-growth potential of smart automotive features, the market is competitive, and the return on investment for these software-driven solutions is yet to be fully realized. Gentherm's ability to differentiate its offerings and gain traction will be crucial.

Gentherm's expansion into adjacent medical markets, leveraging its thermal expertise, is another strategic initiative classified as a question mark. The medical device sector has stringent regulatory requirements and a different sales cycle compared to automotive. While the potential for improved patient outcomes is high, the path to profitability in these new segments requires careful execution and significant R&D.

These question mark areas, including advanced microclimate solutions beyond traditional seats and thermal management for autonomous vehicle components, are critical for Gentherm's future growth. The company's substantial investments in 2024, particularly in securing new business for EV battery thermal management systems, highlight its commitment to these high-potential but uncertain markets. The global automotive thermal management market was valued at approximately $30 billion in 2023, with projections indicating strong growth driven by EVs and advanced vehicle technologies.

BCG Matrix Data Sources

Our Gentherm BCG Matrix is constructed using a blend of internal financial disclosures, comprehensive market research reports, and industry-specific growth forecasts to provide a robust strategic overview.