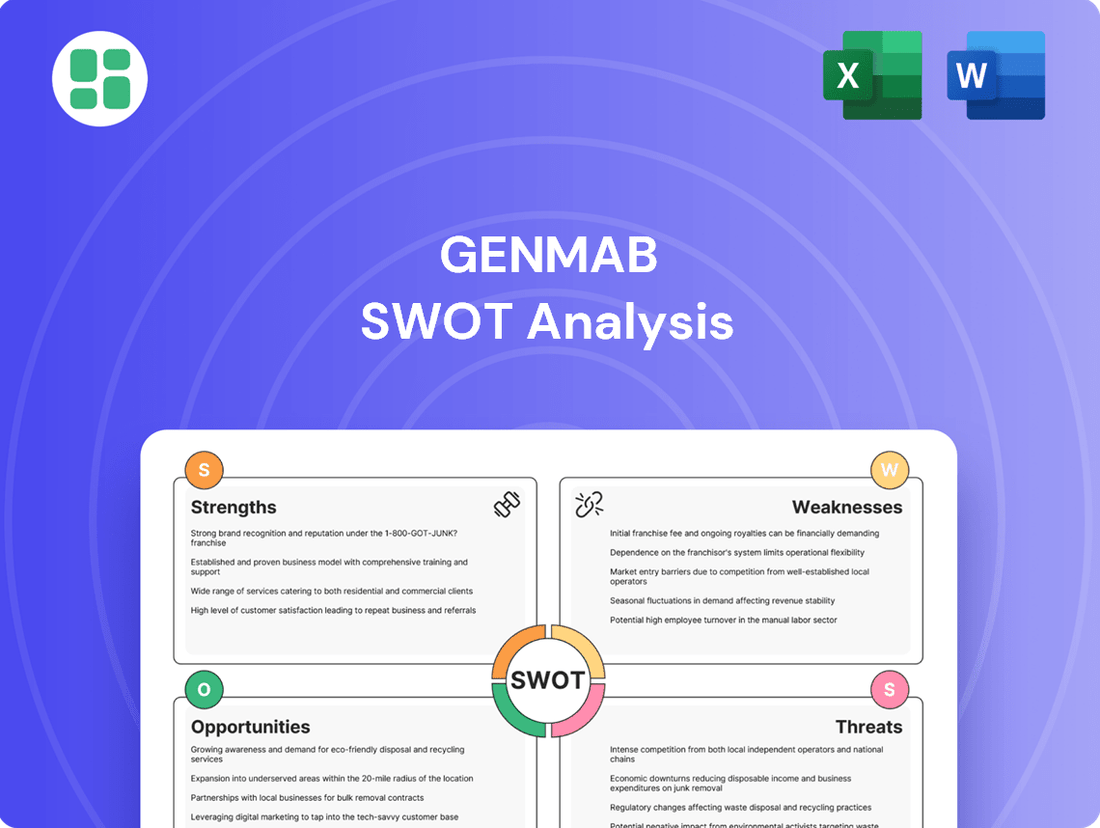

Genmab SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genmab Bundle

Genmab's innovative pipeline and strong market position in oncology are undeniable strengths, but understanding the full scope of their opportunities and threats requires a deeper dive.

Our comprehensive SWOT analysis reveals the critical factors shaping Genmab's future, from strategic partnerships to potential regulatory hurdles.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Genmab boasts a strong commercialized product portfolio, featuring eight approved antibody-based therapies. The blockbuster drug DARZALEX, a collaboration with Johnson & Johnson, was a significant contributor, achieving $11.67 billion in net sales in 2024. This robust offering provides a consistent revenue foundation.

Further strengthening its market position, Genmab's portfolio includes EPKINLY and Tivdak. Both of these therapies experienced notable sales increases and secured expanded regulatory approvals throughout 2024 and into 2025. This ongoing success underscores the effectiveness of Genmab's advanced antibody technologies.

Genmab's innovative proprietary technology platforms, including DuoBody and HexaBody, are central to its competitive edge. These advanced antibody technologies allow for the development of sophisticated therapeutics, particularly next-generation antibody-drug conjugates and bispecific T-cell engagers. This technological foundation underpins a robust pipeline of investigational medicines, solidifying Genmab's leadership in antibody-based therapies.

Genmab boasts a robust late-stage pipeline, featuring 12 products or candidates currently in 30 clinical trials. Seven of these are in Phase III, indicating a strong push towards market approval.

Key assets like EPKINLY, rinatabart sesutecan (Rina-S), and acasunlimab are strategically positioned to be significant revenue drivers by 2030. Genmab is channeling its investments into these high-potential programs.

The acquisition of ProfoundBio brought rinatabart sesutecan into the fold, and it's demonstrating promising efficacy. This candidate is now progressing into Phase 3 trials for both ovarian and endometrial cancers, highlighting its potential impact.

Strategic Collaborations with Industry Leaders

Genmab’s strategic collaborations with major pharmaceutical companies like Johnson & Johnson, AbbVie, Pfizer, and Novartis are a significant strength. These partnerships are crucial for co-developing and commercializing its innovative therapies, significantly expanding their global market reach. For instance, the collaboration with AbbVie on epcoritamab (EPKINLY) has been instrumental in its market launch and ongoing development, demonstrating the power of these alliances in driving commercial success and reducing the financial risks associated with bringing new treatments to patients.

These alliances provide Genmab with vital access to extensive resources, including advanced research capabilities, regulatory expertise, and established distribution networks. This access accelerates product development timelines and enhances the potential for broad patient access. Furthermore, these partnerships often generate a steady stream of royalty income, contributing to Genmab's financial stability and enabling continued investment in its pipeline.

- Co-development and Commercialization: Partnerships with industry leaders like Johnson & Johnson, AbbVie, Pfizer, and Novartis enable shared development and global sales efforts.

- Reduced Financial Burden: Collaborations distribute the significant costs associated with late-stage clinical trials and commercial launches.

- Enhanced Market Access: Leveraging partners' established global infrastructure ensures broader and faster patient access to Genmab's therapies.

- Royalty Income Stream: These agreements provide predictable revenue, bolstering financial resilience and funding further innovation.

Strong Financial Position and Growth

Genmab boasts a remarkably strong financial position, underscored by its impressive 2024 performance. Revenue surged by 31% to DKK 21,526 million (approximately $3.1 billion USD), with operating profit climbing 26%. This robust growth trajectory is further solidified by the company’s substantial cash reserves, which stood at nearly $3 billion at the close of 2024.

Looking ahead, Genmab anticipates sustained momentum, projecting continued double-digit revenue growth for 2025. This financial strength provides a solid foundation for the company to aggressively invest in research and development and pursue strategic acquisitions, ensuring its competitive edge in the dynamic biotechnology sector.

- Robust 2024 Revenue Growth: 31% increase to DKK 21,526 million ($3.1 billion USD).

- Significant Operating Profit Increase: 26% growth in 2024.

- Healthy Cash Position: Nearly $3 billion in cash at the end of 2024.

- Positive 2025 Outlook: Projected continued double-digit revenue growth.

Genmab's commercial success is driven by a strong portfolio of approved therapies, notably DARZALEX, which generated $11.67 billion in net sales in 2024. The company also saw significant growth and expanded approvals for EPKINLY and Tivdak in 2024-2025, demonstrating the effectiveness of its antibody technology.

Its proprietary DuoBody and HexaBody platforms are key differentiators, enabling the development of advanced therapies like antibody-drug conjugates and bispecific T-cell engagers. This technological prowess fuels a robust pipeline of investigational medicines, positioning Genmab as a leader in antibody-based treatments.

Genmab's financial health is a significant strength, with 2024 revenue climbing 31% to DKK 21,526 million (approximately $3.1 billion USD) and operating profit increasing by 26%. The company maintained nearly $3 billion in cash reserves at the end of 2024 and projects continued double-digit revenue growth for 2025, providing ample resources for R&D and strategic initiatives.

What is included in the product

Delivers a strategic overview of Genmab’s internal and external business factors, highlighting its robust pipeline and market leadership alongside potential regulatory hurdles and competitive pressures.

Highlights Genmab's competitive advantages and potential threats for targeted strategic adjustments.

Weaknesses

Genmab's significant reliance on a single product, DARZALEX, presents a notable weakness. In 2024, approximately 65% of its $3 billion revenue stemmed from DARZALEX royalties. This concentration risk means that any downturn in DARZALEX sales or shifts in its market dominance could disproportionately impact Genmab's financial performance.

Genmab faces a significant weakness with the upcoming patent expiration for its core product, DARZALEX. Key patents in the United States are scheduled to expire by 2029, and in Europe by 2027. This expiration date creates a potential "patent cliff," which could lead to the introduction of biosimilar versions of the drug.

The anticipated entry of biosimilars poses a substantial risk to Genmab's revenue streams, as it could significantly diminish the royalty income generated from DARZALEX. In 2023, DARZALEX generated approximately $4.2 billion in net sales for Johnson & Johnson, Genmab's partner, highlighting the product's immense financial importance.

The company's strategy to mitigate this revenue impact hinges on the successful launch and adoption of its newer pipeline products. However, the ability of these new therapies to fully compensate for the potential loss of DARZALEX revenue remains a considerable uncertainty and a key area of risk for Genmab's future financial performance.

Developing innovative antibody therapeutics is a capital-intensive endeavor, with Genmab investing a significant portion of its operating expenses into R&D. In 2024, over 70% of Genmab's operating expenses were driven by R&D, reflecting its focus on late-stage priority programs.

While necessary for growth, these substantial R&D expenditures can impact profitability, especially if clinical development faces setbacks or delays. The company must consistently achieve successful clinical outcomes to validate these significant investments.

Clinical Trial Risks and Pipeline Attrition

The inherent risks in biotechnology clinical trials can lead to significant pipeline attrition. Genmab, like many in the sector, faces the possibility of programs failing due to safety concerns or a lack of efficacy, resulting in substantial lost investment. This is a normal, albeit costly, part of drug development that can affect future financial outlooks.

Genmab's recent decision to terminate several early-stage clinical programs, including GEN1047, GEN3017, GEN1056, and GEN1078, highlights this weakness. These programs were discontinued because they did not meet internal differentiation standards or presented toxicity concerns. Such setbacks represent capital deployed without a return and can impact the company's projected revenue streams.

- Clinical Trial Failure: The possibility of trials not meeting primary endpoints or encountering safety issues remains a persistent risk.

- Pipeline Attrition: Recent terminations of early-stage programs (GEN1047, GEN3017, GEN1056, GEN1078) demonstrate the ongoing challenge of advancing drug candidates.

- Investment Loss: Each terminated program signifies a loss of invested capital, potentially impacting future research and development budgets.

- Efficacy and Safety Concerns: Issues with drug efficacy or unforeseen toxicity are primary drivers for program discontinuation in the biotech industry.

Intense Competitive Landscape

Genmab operates within an intensely competitive oncology market. It faces significant rivalry from numerous biotechnology and pharmaceutical firms actively developing similar antibody therapeutics and antibody-drug conjugates (ADCs). This crowded field necessitates continuous innovation and market differentiation.

Competitors have launched successful products that directly challenge Genmab's market position. For instance, Roche's Polivy and AbbVie's Elahere are established therapies in similar treatment areas. Genmab must consistently prove its pipeline candidates offer superior efficacy, safety profiles, or novel mechanisms of action to gain market traction.

The pressure to stand out in this crowded landscape translates into increased demands on research and development investment and commercialization strategies. For example, the global oncology drug market was valued at approximately $218 billion in 2023 and is projected to reach over $300 billion by 2028, highlighting the scale of competition and the investment required to capture market share.

- High R&D Spend: Competitors' advancements necessitate substantial ongoing investment in Genmab's own R&D pipeline to maintain a competitive edge.

- Market Access Challenges: Differentiating products in a crowded market can make securing favorable reimbursement and market access more difficult.

- Pricing Pressures: The presence of multiple treatment options can lead to increased pricing pressures, impacting Genmab's revenue potential.

Genmab's heavy reliance on DARZALEX, which accounted for about 65% of its $3 billion revenue in 2024, represents a significant concentration risk. The impending patent expiration of DARZALEX in the US by 2029 and Europe by 2027 poses a substantial threat, potentially leading to biosimilar competition and a significant decline in royalty income.

The company's strategy to offset this risk relies on the successful adoption of its newer pipeline products, but their ability to fully compensate for the potential loss of DARZALEX revenue remains uncertain. Furthermore, Genmab's substantial R&D investments, exceeding 70% of operating expenses in 2024, carry inherent risks of clinical trial failures and pipeline attrition, as seen with the recent discontinuation of several early-stage programs like GEN1047 and GEN3017.

The competitive oncology market, valued at approximately $218 billion in 2023, presents another weakness, with established therapies from competitors like Roche and AbbVie demanding continuous innovation and market differentiation from Genmab to secure market access and manage pricing pressures.

Full Version Awaits

Genmab SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Genmab's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Genmab's strategic position.

Opportunities

Genmab has a significant runway for growth by seeking expanded indications for its existing therapies. For example, EPKINLY, already approved for diffuse large B-cell lymphoma, received additional approvals in Japan and Europe for follicular lymphoma during 2024, opening up new patient segments.

Furthermore, the company can leverage its approved products in new geographic markets. Tivdak's launch in Japan in 2024 represents a key opportunity to tap into a major pharmaceutical market, driving substantial revenue growth beyond its current territories.

Genmab's late-stage pipeline, featuring Rina-S and acasunlimab, is poised for significant growth as both assets advance into pivotal Phase 3 trials. This progression represents a substantial opportunity for future revenue generation, particularly as these candidates target large markets like ovarian cancer with Rina-S.

Positive outcomes from these late-stage studies could pave the way for multi-billion dollar market opportunities. Successful commercialization of these promising assets is absolutely critical for Genmab's long-term growth trajectory and for diversifying its revenue streams beyond the established success of DARZALEX.

Genmab's robust financial position, boasting nearly $3 billion in cash as of early 2025, offers substantial capacity for strategic acquisitions and in-licensing. This financial strength allows the company to pursue opportunities that can rapidly enhance its pipeline and technological base.

The 2024 acquisition of ProfoundBio, which integrated the promising Rina-S asset, serves as a prime example of Genmab leveraging its capital for inorganic growth. This move not only accelerates development in critical therapeutic areas but also demonstrates a clear strategy for pipeline expansion and capability enhancement.

Leveraging Advanced Antibody Technologies for New Targets

Genmab's advanced antibody technologies, like DuoBody and HexaBody, present a significant opportunity to expand beyond their current oncology focus. These platforms enable the discovery and development of novel antibody therapeutics targeting a wider array of diseases. By exploring new targets and mechanisms, Genmab can address significant unmet medical needs in areas such as autoimmune disorders or infectious diseases, potentially opening up substantial new market segments.

The continued innovation in antibody discovery and engineering is key to unlocking these new therapeutic avenues. For example, the successful application of these technologies in oncology, demonstrated by their pipeline, suggests strong potential for efficacy in other complex disease areas. This strategic diversification could lead to entirely new revenue streams and solidify Genmab's position as a leader in next-generation antibody therapies.

- Broader Disease Indication: Leveraging DuoBody and HexaBody for non-oncology indications like autoimmune diseases or rare genetic disorders.

- New Target Identification: Expanding research to identify and validate novel protein targets in these new therapeutic areas.

- Market Expansion: Accessing new patient populations and market segments beyond the oncology space.

- Pipeline Diversification: Reducing reliance on oncology by building a robust pipeline across multiple therapeutic categories.

Increased Commercialization Independence

Genmab's strategic pivot towards a fully integrated biotech model signifies a significant opportunity for increased commercialization independence. By developing its own commercial infrastructure, the company aims to move beyond its current royalty-dependent revenue streams.

This transition allows Genmab to capture a larger portion of its product revenues, fostering greater long-term profitability. For example, as Genmab builds out its capabilities, it can directly benefit from sales growth, rather than sharing profits with partners. This enhances strategic autonomy and the ability to directly execute market strategies.

- Direct Revenue Capture: Genmab can retain a greater share of sales revenue by managing its own commercialization efforts.

- Enhanced Market Control: Full integration provides direct control over pricing, promotion, and distribution strategies.

- Improved Profitability: Reducing reliance on partners for commercialization can lead to higher profit margins on successful products.

- Strategic Flexibility: Greater independence allows for more agile decision-making regarding product launches and market expansion.

Genmab's robust financial health, with nearly $3 billion in cash as of early 2025, fuels strategic acquisitions and in-licensing opportunities to bolster its pipeline and technological capabilities.

The company's advanced antibody technologies, DuoBody and HexaBody, offer a significant avenue for expansion beyond oncology into areas like autoimmune diseases or rare genetic disorders, diversifying revenue streams and addressing unmet medical needs.

Genmab's strategic move towards a fully integrated biotech model presents a clear opportunity to capture a larger share of product revenues and gain greater independence in commercialization, enhancing long-term profitability and strategic flexibility.

Expanding indications for existing therapies like EPKINLY and exploring new geographic markets for Tivdak, as seen with its Japan launch in 2024, are critical growth drivers. Genmab's late-stage pipeline, including Rina-S and acasunlimab, also holds the potential for multi-billion dollar market opportunities upon successful development and commercialization.

Threats

Genmab faces a significant threat from the impending patent expirations of its key drug, DARZALEX. With patents set to expire in the EU in 2027 and the US in 2029, the market is bracing for the introduction of biosimilars. These biosimilars are expected to drive down prices and erode Genmab's substantial royalty revenues, impacting its financial performance.

The oncology landscape is exceptionally dynamic, characterized by the rapid advancement of novel therapeutic approaches. Genmab's portfolio, including its innovative bispecific antibodies, faces direct competition from emerging treatments like CAR-T therapies. This constant influx of new technologies and treatments creates a challenging environment where market share and pricing power can be quickly challenged, potentially leading to a reduction in revenue streams.

The path of drug development is fraught with uncertainty, and even late-stage clinical trials can falter due to unforeseen safety issues or a lack of efficacy, potentially derailing years of work and significant investment. Genmab has experienced this firsthand, having previously discontinued early-stage programs due to toxicity concerns or a failure to demonstrate sufficient differentiation from existing treatments.

Navigating the complex and rigorous approval processes of regulatory agencies such as the FDA and EMA presents another substantial threat. Delays in obtaining marketing authorization, or even outright rejections, can severely impact a drug's time-to-market and consequently, its projected revenue streams. This regulatory scrutiny is a constant challenge for any biopharmaceutical company aiming to bring novel therapies to patients.

Genmab's significant reliance on strategic collaborations, particularly with Johnson & Johnson for the commercialization of its blockbuster drug DARZALEX, presents a notable threat. This dependence means that any friction or underperformance within these partnerships directly impacts Genmab's revenue streams and market reach.

Past disputes, such as arbitration cases concerning royalty payments with Johnson & Johnson, highlight the financial risks associated with these collaborations. Furthermore, shifts in a partner's strategic priorities or their commercial and regulatory execution capabilities can significantly hinder the success and financial returns of jointly developed products.

Intellectual Property Litigation and Patent Challenges

Genmab's reliance on its robust intellectual property portfolio makes it susceptible to patent litigation and challenges. These legal battles, which can target infringement claims or the validity of existing patents, pose a significant threat to its revenue streams and operational costs. The company's past experience with legal disputes, such as the arbitration with Johnson & Johnson concerning DARZALEX royalties, highlights the potential financial impact of adverse rulings. For instance, while specific 2024 or 2025 litigation costs aren't publicly detailed, the ongoing nature of patent defense underscores the significant resources allocated to this area.

Defending its extensive patent estate is a continuous and resource-intensive endeavor for Genmab. The uncertainty inherent in patent law means that even strong patents can face challenges, potentially leading to costly legal proceedings and the risk of losing exclusivity for key products. This ongoing need for legal defense diverts capital and management focus that could otherwise be directed towards research and development or commercial expansion.

- Patent Challenges: Genmab's core business model is built upon its innovative therapies, making its patent portfolio a critical asset.

- Litigation Risks: Lawsuits alleging patent infringement or challenging patent validity can result in substantial financial penalties and loss of market exclusivity.

- Historical Precedent: The arbitration with J&J over DARZALEX royalties serves as a stark reminder of the financial implications of patent disputes.

- Cost of Defense: Maintaining and vigorously defending its intellectual property requires significant ongoing investment in legal expertise and resources.

Global Economic and Healthcare Policy Shifts

Changes in global economic conditions, such as rising inflation or the potential for recession, can directly impact healthcare spending by governments and individuals, potentially limiting patient access to costly biologic therapies like those developed by Genmab. For instance, persistent inflation in 2024 and 2025 could squeeze household budgets, making it harder for patients to afford co-pays or for healthcare systems to absorb the full cost of innovative treatments.

Furthermore, evolving healthcare policies, particularly around drug pricing and reimbursement in major markets like the United States and Europe, pose a significant threat. New regulations or intensified negotiations could exert downward pressure on drug prices, directly affecting Genmab's profitability and revenue streams. The ongoing debate surrounding drug price controls in the US, for example, could set precedents impacting global pricing strategies.

These external factors, largely beyond Genmab's direct control, represent significant risks to its commercial outlook. The company's reliance on the successful market access and reimbursement of its high-value therapies means that shifts in these policy and economic landscapes can have a material impact on its financial performance and growth trajectory.

- Inflationary Pressures: Persistent inflation in 2024-2025 could reduce discretionary healthcare spending and impact reimbursement levels.

- Drug Pricing Regulations: Increased government scrutiny and potential price controls in key markets could limit Genmab's revenue potential for its biologic therapies.

- Reimbursement Landscape Changes: Shifts in how healthcare systems pay for innovative treatments can affect market access and uptake for Genmab's products.

Genmab faces the significant threat of patent expirations, particularly for its key drug DARZALEX, with EU patents expiring in 2027 and US patents in 2029, paving the way for biosimilar competition and potential revenue erosion. The dynamic oncology market also presents a constant challenge, with emerging therapies like CAR-T potentially impacting Genmab's market share and pricing power.

SWOT Analysis Data Sources

This Genmab SWOT analysis is built upon a foundation of robust data, drawing from official company financial reports, comprehensive market research, and expert industry analysis. These sources ensure a well-informed and accurate assessment of Genmab's strategic position.