Genmab Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genmab Bundle

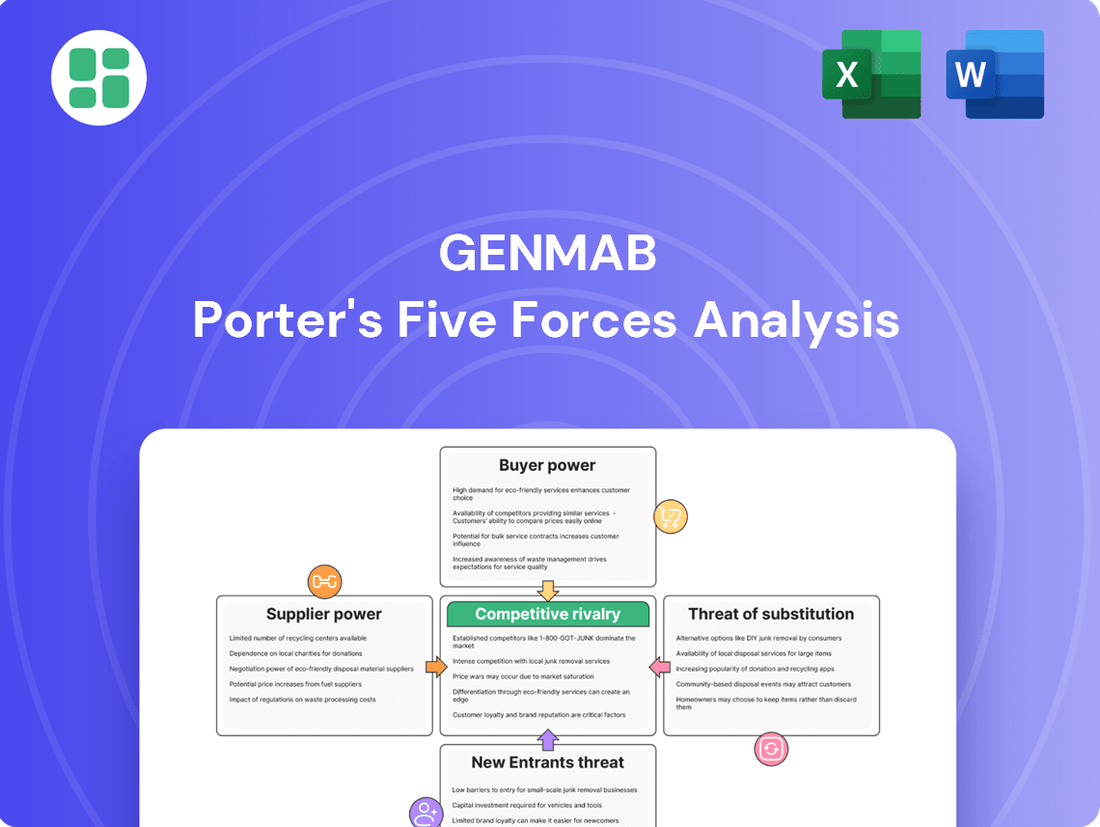

Genmab operates in a dynamic biotech landscape where the threat of new entrants is significant, yet high R&D costs and regulatory hurdles act as substantial barriers. Understanding the intense rivalry among established players and the bargaining power of both buyers (pharmaceutical companies) and suppliers (research institutions) is crucial for strategic positioning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Genmab’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Genmab's reliance on specialized raw materials and reagents for its antibody therapeutics means suppliers of these niche components can wield moderate bargaining power. The proprietary nature of some inputs, crucial for cutting-edge research and development, further strengthens this supplier position.

Genmab's reliance on Contract Development and Manufacturing Organizations (CDMOs) for its proprietary products means these specialized suppliers hold considerable bargaining power. The high capital expenditure and intricate technical demands of biologics manufacturing create a barrier to entry, concentrating expertise and capacity among a limited number of CDMOs. This dependence necessitates careful supplier relationship management to mitigate potential cost increases or supply disruptions.

Genmab's reliance on licensing complementary technologies, like its 2023 agreement with Scancell for anti-glycan monoclonal antibodies, highlights the bargaining power of these technology providers. These licensing deals often include substantial upfront payments, milestone achievements, and ongoing royalties, demonstrating the leverage held by the licensors of specialized intellectual property.

Talent and Scientific Expertise

The biotechnology industry, including companies like Genmab, is fundamentally driven by specialized knowledge. This means that highly skilled scientists and researchers are a crucial, albeit intangible, supplier. Their expertise is the engine of innovation and product development, giving them significant leverage.

Genmab's strategic moves, such as expanding its U.S. headquarters and creating new positions, underscore the intense competition for this talent. For instance, in 2024, the U.S. biotechnology sector continued to see robust demand for experienced researchers, with job postings for roles like 'Senior Scientist' often attracting numerous highly qualified applicants, driving up compensation expectations.

- Human Capital as a Key Supplier: The scarcity of specialized scientific and research talent in biotech directly translates to increased bargaining power for these individuals.

- Genmab's Talent Acquisition Strategy: Genmab's investment in its U.S. headquarters expansion and job creation highlights its proactive approach to securing this vital expertise in a competitive market.

- Impact of Scarcity: The limited availability of top-tier scientific minds allows them to command higher salaries and more favorable working conditions, influencing Genmab's operational costs.

Strategic Collaboration Partners

Genmab’s reliance on strategic collaboration partners for co-development and commercialization significantly influences supplier bargaining power. These major pharmaceutical companies, including Johnson & Johnson, Novartis, AbbVie, Pfizer, and Amgen, are not just collaborators but also critical suppliers of market access and distribution networks. Their substantial existing infrastructure and extensive market reach grant them considerable leverage in negotiating terms for shared development costs and commercialization efforts.

The bargaining power of these strategic partners is amplified by their ability to contribute substantial capital and expertise, reducing Genmab’s financial burden and accelerating product development timelines. For instance, a successful co-development deal can significantly de-risk the financial outlay for Genmab, allowing it to focus on its core research and development capabilities. The partners’ established regulatory and sales forces are essential for navigating complex global markets, making their participation a critical success factor.

- Key Collaborators: Johnson & Johnson, Novartis, AbbVie, Pfizer, Amgen.

- Supplier Role: Provide market access, distribution, and shared development costs.

- Leverage Factors: Established infrastructure, market reach, capital contribution, and expertise.

Genmab's reliance on specialized raw materials and CDMOs for its antibody therapeutics means these suppliers hold moderate to considerable bargaining power. The proprietary nature of some inputs and the high technical demands of biologics manufacturing create barriers to entry, concentrating expertise among a limited number of providers. This dependence necessitates careful management to mitigate cost increases or supply disruptions.

Genmab's partnerships with major pharmaceutical companies like Johnson & Johnson and Pfizer for co-development and commercialization also grant these entities significant leverage. Their established infrastructure, market reach, and capital contributions are critical for market access and distribution, influencing negotiation terms for shared costs and commercialization efforts.

| Supplier Type | Bargaining Power | Key Factors |

|---|---|---|

| Specialized Raw Material Providers | Moderate | Proprietary nature of inputs, niche market |

| CDMOs (Biologics Manufacturing) | Considerable | High capital expenditure, intricate technical demands, limited capacity |

| Technology Licensors | Considerable | Proprietary intellectual property, upfront payments, milestones, royalties |

| Strategic Collaboration Partners (e.g., J&J, Pfizer) | Considerable | Market access, distribution networks, capital contribution, expertise |

| Skilled Scientific Talent | Significant | Scarcity of specialized expertise, engine of innovation |

What is included in the product

This analysis delves into the competitive forces shaping Genmab's market, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Quickly identify and mitigate threats from competitors and suppliers with a visual breakdown of Genmab's competitive landscape.

Customers Bargaining Power

Genmab's reliance on major pharmaceutical partners like Johnson & Johnson and Novartis for its key products, such as Darzalex and Kesimpta, significantly influences customer bargaining power. These giants leverage their vast market presence and commercialization expertise, directly impacting Genmab's royalty streams.

The substantial market reach and established distribution networks of these partners grant them considerable leverage in negotiating terms and royalty rates. This dynamic is a critical factor in Genmab's revenue structure, as evidenced by the substantial contributions of these collaborations to its overall financial performance.

As Genmab increasingly handles its own commercialization, healthcare systems and payers emerge as key customers. These large entities, including hospitals and government programs, hold significant sway due to their substantial purchasing volumes and their crucial role in deciding which drugs are covered and at what price. This dynamic intensifies when considering the high cost of antibody therapies, which naturally leads to strong pressure for demonstrating value and negotiating prices.

Physicians and other healthcare professionals are crucial indirect customers for Genmab, wielding significant power by influencing treatment choices and product uptake. Their decisions are primarily driven by a product's efficacy, safety profile, and ultimately, the positive outcomes for their patients. This clinical expertise makes them gatekeepers to accessing therapies.

Genmab's strategy to mitigate this power hinges on showcasing superior clinical data. For instance, demonstrating a compelling efficacy and safety profile for a product like Rina-S, especially when benchmarked against existing treatments, can directly impact prescribing patterns. In 2024, clinical trial data continues to be the most persuasive factor for physician adoption.

Patient Advocacy Groups and Patient Needs

Patient advocacy groups wield significant influence by amplifying patient needs, particularly in critical areas like oncology. Their collective voice can sway treatment access and shape demand for innovative therapies, directly impacting companies like Genmab. These groups advocate for improved patient outcomes, such as therapies with better tolerability or enhanced efficacy, which can guide market trends and regulatory considerations.

Genmab's stated mission to transform patient lives resonates with the core objectives of these advocacy organizations. For instance, in 2024, patient advocacy groups played a crucial role in discussions surrounding accelerated approval pathways for novel cancer treatments, highlighting their impact on market entry and patient access. Their focus on unmet medical needs ensures that companies developing new treatments are keenly aware of the patient perspective.

- Patient advocacy groups can significantly influence demand for therapies, especially for life-threatening conditions.

- Their collective voice impacts treatment access and shapes market preferences for more effective or tolerable options.

- Genmab's patient-centric approach aligns with the influence of these groups in driving innovation.

- In 2024, advocacy for improved cancer treatment access demonstrated the tangible impact of these organizations.

Competitive Alternatives and Treatment Options

The bargaining power of customers in the pharmaceutical sector, particularly for advanced therapies like those developed by Genmab, is significantly influenced by the availability of competitive alternatives. The presence of other antibody therapies, alongside small molecule drugs and conventional treatments, provides patients and healthcare providers with choices. This directly amplifies customer bargaining power, as they can opt for treatments that present superior value, enhanced efficacy, or more favorable side effect profiles.

Genmab, therefore, faces a dynamic landscape where its ability to retain customers and pricing power hinges on continuous innovation. The company must actively differentiate its product offerings to maintain a competitive edge. Failure to do so allows customers to exert greater leverage by switching to alternatives that better meet their needs or offer a more attractive cost-benefit ratio.

- Availability of Alternatives: The market features diverse treatment modalities including other biologics, chemotherapy, radiation, and targeted small molecules, offering patients multiple pathways.

- Value Proposition: Customers, including payers and patients, evaluate treatments based on efficacy, safety, convenience, and cost-effectiveness, driving demand for superior value.

- Genmab's Response: Genmab's strategy involves ongoing R&D to develop novel antibodies and combination therapies, aiming to create unique clinical benefits that reduce the substitutability of its products.

- Market Dynamics (2024): In 2024, the oncology market saw continued growth in immunotherapy and targeted therapies, with significant investment in novel drug development, underscoring the competitive pressure and the importance of product differentiation.

Genmab's bargaining power with customers is significantly shaped by its major pharmaceutical partners, who leverage their market dominance to negotiate favorable terms. As Genmab expands its own commercialization efforts, healthcare systems and payers become key customers with substantial purchasing power, especially given the high cost of antibody therapies. Physicians and patient advocacy groups also exert considerable influence by guiding treatment choices and advocating for patient needs, making clinical data and patient-centric approaches crucial for Genmab.

The availability of alternative treatments, ranging from other biologics to conventional therapies, directly empowers customers by providing choices based on efficacy, safety, and cost-effectiveness. Genmab's strategy to counter this involves continuous innovation and differentiation of its product portfolio to maintain a competitive edge and reduce product substitutability. In 2024, the competitive landscape in oncology, particularly with advancements in immunotherapy, further emphasized the need for Genmab to highlight unique clinical benefits.

| Customer Segment | Influence Factor | Genmab's Mitigation Strategy | 2024 Relevance |

|---|---|---|---|

| Major Pharma Partners (e.g., J&J, Novartis) | Market reach, commercialization expertise | Strong collaboration, data sharing | Continued reliance on established partnerships for key products |

| Healthcare Systems & Payers | Purchasing volume, formulary decisions | Demonstrating value, cost-effectiveness data | Increased scrutiny on drug pricing and reimbursement |

| Physicians | Treatment decisions, product uptake | Superior clinical trial data, efficacy and safety profiles | Clinical trial results remain paramount for adoption |

| Patient Advocacy Groups | Patient needs, treatment access | Patient-centric approach, aligning with patient outcomes | Active role in shaping access to novel therapies, especially in oncology |

| Availability of Alternatives | Treatment choices, cost-benefit analysis | Product differentiation, novel therapies, combination treatments | Intensified competition in the oncology market |

Preview Before You Purchase

Genmab Porter's Five Forces Analysis

This preview shows the exact Genmab Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the biopharmaceutical industry. This document is fully formatted and ready for your immediate use, providing a detailed strategic overview.

Rivalry Among Competitors

The oncology and antibody therapeutics sector is a battleground, with both large pharmaceutical companies and nimble biotech firms fiercely competing. Genmab operates in an environment where numerous players are constantly pushing for innovation and market dominance, making it a highly fragmented but intensely contested space.

This intense rivalry means companies like Genmab must continuously invest in research and development to stay ahead. For instance, the global oncology drug market was valued at approximately $200 billion in 2023 and is projected to grow significantly, fueled by advancements in areas like antibody-drug conjugates and immunotherapies, all of which are areas of intense competition.

Genmab faces intense competition from a wide array of players, including major pharmaceutical giants such as Roche, Amgen, Novartis, AbbVie, Johnson & Johnson, and Pfizer. These established companies possess significant resources for research and development, extensive marketing capabilities, and broad product portfolios. For instance, in 2023, Roche reported sales of CHF 63.3 billion, demonstrating its substantial market presence and ability to invest heavily in new therapies.

The competitive landscape also includes numerous specialized biotechnology firms, each focusing on specific therapeutic areas or innovative technology platforms, like bispecific antibodies or antibody-drug conjugates. This diversity means Genmab must contend with rivals who may have distinct advantages in particular niches or technological approaches. The ongoing advancements in areas like CAR-T therapy and gene editing further intensify this rivalry, pushing all companies to innovate rapidly to maintain a competitive edge.

Competitive rivalry in the antibody therapy sector, including for companies like Genmab, is fiercely driven by innovation and the continuous expansion of product pipelines. This intense competition necessitates substantial investments in research and development (R&D) to discover and advance novel therapies. Companies are actively pursuing cutting-edge technologies and cultivating specialized scientific talent to create differentiated treatments that can effectively address significant unmet medical needs.

Genmab's strategic emphasis on R&D is a cornerstone of its competitive strategy. The company is actively progressing a robust pipeline, with 12 products currently undergoing clinical trials. This commitment to a broad and deep pipeline is crucial for maintaining its position and driving future growth in a rapidly evolving market.

Product-Specific Competition and Differentiation

Competitive rivalry in the biopharmaceutical sector, particularly for companies like Genmab, is intensely focused on the product level. New therapies frequently contend with established standards of care or other novel treatments targeting the same diseases. This necessitates a clear demonstration of clinical superiority and unique patient benefits.

Genmab's Rina-S exemplifies this, entering the market to compete with AbbVie's Elahere for ovarian and endometrial cancers. Success hinges on robust clinical trial data that showcases a differentiated profile, whether through efficacy, safety, or mechanism of action, to capture market share.

- Product Differentiation: Genmab's Rina-S aims to offer a distinct advantage over Elahere in specific cancer indications.

- Clinical Data is Key: Strong efficacy and safety data are crucial for market adoption and physician prescribing habits.

- Competition for Indications: The fight for patient populations within specific cancer types is a primary battleground.

Strategic Collaborations and Acquisitions

The competitive landscape is dynamic, with companies frequently engaging in strategic collaborations, partnerships, and mergers and acquisitions (M&A). These moves are aimed at bolstering product pipelines, widening market access, and speeding up drug development.

Genmab's own strategic alliances and its recent acquisition of ProfoundBio for approximately $1.8 billion in April 2024 exemplify this trend. This acquisition, in particular, is expected to significantly enhance Genmab's competitive position by adding ProfoundBio's promising ADC pipeline.

- Strategic Collaborations: Partnering to share R&D costs and leverage complementary expertise.

- Mergers & Acquisitions: Consolidating market share and acquiring innovative technologies.

- Portfolio Enhancement: Companies like Genmab actively seek to strengthen their therapeutic offerings through external means.

- Market Access Expansion: M&A and partnerships can unlock new geographic regions or patient populations.

Competitive rivalry in the oncology and antibody therapeutics sector is characterized by intense innovation and a constant drive for market share among numerous players. Genmab faces competition from both large pharmaceutical companies with vast resources and specialized biotech firms focusing on niche technologies.

The need for continuous R&D investment is paramount, as evidenced by the global oncology drug market's valuation of approximately $200 billion in 2023. Companies like Genmab must differentiate their products through superior clinical data to gain traction against established treatments and emerging therapies.

Strategic moves such as collaborations and acquisitions are common, as seen with Genmab's April 2024 acquisition of ProfoundBio for about $1.8 billion to bolster its antibody-drug conjugate pipeline.

| Competitor | 2023 Sales (approx.) | Key Focus Area |

| Roche | CHF 63.3 billion | Broad Oncology Portfolio, Diagnostics |

| Amgen | $24.3 billion | Biologics, Oncology, Cardiovascular |

| Novartis | $45.4 billion | Oncology, Immunology, Neuroscience |

SSubstitutes Threaten

Traditional cancer treatments like chemotherapy, radiation, and surgery are strong substitutes for antibody therapies. These methods are often the initial go-to options or used alongside new treatments. Their established presence and long history mean Genmab’s antibody treatments need to clearly show they offer better results or substantial advantages.

Beyond monoclonal antibodies, other advanced biologic therapies, including cell therapies like CAR-T and gene therapies, are emerging as significant substitutes. These innovative treatments offer different mechanisms to combat diseases, potentially drawing patients away from Genmab's antibody-based products if they demonstrate superior efficacy or safety profiles. The market for cell and gene therapies is experiencing rapid growth, with significant investment and clinical advancements being made.

Conventional small molecule drugs, often synthesized chemically and simpler to produce and administer, represent a significant threat of substitutes for antibody therapeutics. These molecules can target similar biological pathways, offering alternative treatment avenues for patients and physicians, even if they lack the same level of specificity as antibodies.

For instance, in oncology, while Genmab focuses on antibody-based therapies, numerous small molecule inhibitors are readily available and widely used, providing a cost-effective and accessible alternative for many cancer types. The global small molecule drug market was valued at approximately $1.3 trillion in 2023, demonstrating its substantial presence and competitive pressure.

Biosimilars

The rise of biosimilars presents a significant threat to established antibody drug manufacturers like Genmab. As patents for high-value monoclonal antibodies expire, biosimilar versions enter the market, offering comparable efficacy at substantially lower price points. This can erode the market share and pricing power of originator biologics.

For instance, by the end of 2024, the global biosimilars market was projected to reach over $40 billion, demonstrating a rapid expansion driven by patent expiries and increased regulatory approvals. This trend directly impacts the competitive landscape for antibody-based therapies.

- Market Entry: Biosimilars, approved by regulatory bodies like the FDA and EMA, are entering markets for widely used antibody drugs, providing direct competition.

- Price Erosion: The availability of lower-cost biosimilars can force price reductions across the entire class of monoclonal antibodies, affecting even innovative therapies.

- Innovation Pressure: Genmab's focus on novel antibody development means that while not directly competing with existing biosimilars, the overall market pricing pressure can indirectly impact the perceived value and reimbursement of its next-generation treatments.

Preventative Measures and Lifestyle Changes

While Genmab focuses on advanced therapies, the threat of substitutes, though indirect, exists. Preventative measures and lifestyle changes can reduce the need for treatments. For instance, advancements in early cancer detection, like improved mammography screening which saw a 1.5% increase in screening rates in the US in 2023 according to CDC data, can catch diseases earlier, potentially requiring less aggressive, and thus less costly, interventions down the line. Similarly, public health initiatives promoting healthier lifestyles can mitigate the incidence of chronic diseases, indirectly impacting the demand for late-stage therapeutic solutions.

These preventative strategies act as a long-term, albeit less direct, substitute for antibody therapeutics. Consider the growing emphasis on personalized nutrition and exercise plans, which are projected to be a significant market by 2028, with global spending expected to reach over $100 billion. Such widespread adoption could lead to a healthier population, thereby reducing the overall patient pool requiring complex treatments like those developed by Genmab.

- Reduced Disease Incidence: Lifestyle changes and preventative medicine can lower the overall prevalence of diseases treatable by antibody therapies.

- Early Diagnosis as a Substitute: More effective early detection methods can lead to less invasive and potentially less expensive treatments, substituting the need for advanced therapies in some cases.

- Long-Term Indirect Threat: While not a direct competitor, a healthier global population due to preventative efforts represents a gradual, indirect reduction in the market for late-stage treatments.

The threat of substitutes for Genmab's antibody therapies is multifaceted, encompassing traditional treatments, emerging biologics, and even preventative measures. Established therapies like chemotherapy and radiation remain significant alternatives, often being the first line of defense or used concurrently. Furthermore, innovative cell and gene therapies are gaining traction, offering distinct mechanisms of action that could draw patients away from antibody-based treatments if they prove more effective or safer.

Conventional small molecule drugs, which are generally simpler to produce and administer, also pose a competitive threat. These drugs can target similar biological pathways, providing an alternative for patients and physicians, even if they lack the high specificity of antibodies. For instance, the global small molecule drug market was valued at approximately $1.3 trillion in 2023, highlighting its substantial market presence.

The increasing prevalence of biosimilars represents a direct challenge. As patents expire on high-value monoclonal antibodies, biosimilar versions enter the market at lower price points, potentially eroding market share and pricing power. By the end of 2024, the global biosimilars market was projected to exceed $40 billion, underscoring this growing competitive pressure.

Preventative strategies and early detection methods also act as indirect substitutes by reducing the overall need for advanced treatments. For example, improvements in cancer screening, such as the 1.5% increase in mammography screening rates in the US in 2023, can lead to earlier, less aggressive interventions. Similarly, public health initiatives promoting healthier lifestyles can decrease the incidence of chronic diseases, thereby shrinking the patient pool for late-stage therapies.

| Substitute Category | Examples | Market Size/Growth Indicator (2023/2024 Data) | Impact on Genmab |

|---|---|---|---|

| Traditional Therapies | Chemotherapy, Radiation, Surgery | Established, widely accessible | Need for clear demonstration of superior efficacy/safety |

| Emerging Biologics | CAR-T therapy, Gene therapy | Rapidly growing market | Potential patient diversion if superior |

| Small Molecule Drugs | Targeting similar pathways | Global market ~$1.3 trillion (2023) | Cost-effective, accessible alternatives |

| Biosimilars | Generic versions of antibody drugs | Projected >$40 billion (end of 2024) | Price erosion, market share loss for originator biologics |

| Preventative Measures | Early detection, lifestyle changes | Personalized nutrition market >$100 billion by 2028 | Indirect reduction in patient pool for late-stage treatments |

Entrants Threaten

The biotechnology sector, especially for advanced antibody therapies like those Genmab develops, demands massive upfront capital. This includes funding for rigorous research, preclinical testing, and multi-phase clinical trials, often reaching hundreds of millions or even billions of dollars. These immense financial requirements serve as a significant deterrent, presenting a substantial hurdle for any new entity aiming to enter and challenge established players.

New entrants in the biotechnology sector, particularly those developing novel biologic drugs like Genmab, confront a formidable barrier to entry due to rigorous and lengthy regulatory approval processes. Agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and Japan's Ministry of Health, Labour and Welfare (MHLW) mandate extensive clinical trials and data submissions.

These trials, spanning multiple phases, are designed to meticulously assess a drug's safety and efficacy. The entire process, from initial research to final approval, can easily span a decade and require hundreds of millions of dollars in investment. For instance, the average cost for developing a new drug was estimated to be over $2 billion in 2023, with a significant portion attributed to clinical trials and regulatory affairs. This substantial financial and temporal commitment acts as a significant deterrent for many potential new competitors.

Developing advanced antibody therapeutics, like those Genmab focuses on, requires deep scientific knowledge in fields such as immunology, molecular biology, and protein engineering. This specialized expertise is not easily acquired, and building a team with this caliber of talent is a significant hurdle.

The scarcity of individuals possessing these niche scientific skills, coupled with the lengthy process of cultivating experienced research and development teams, acts as a substantial barrier for new entrants. Companies lacking a pre-existing, robust scientific foundation will find it exceptionally difficult to compete in this arena.

Strong Intellectual Property and Patent Landscape

Genmab's strong intellectual property, including its DuoBody and HexaBody platforms, acts as a significant barrier to new entrants. These proprietary technologies, coupled with patents on its existing and developing drug candidates, make it challenging for newcomers to compete without infringing on existing rights. For instance, Genmab's pipeline, as of early 2024, features numerous antibody-based therapies, each protected by a complex web of patents.

New companies entering the antibody therapeutics space would need to invest heavily in developing novel technologies or navigate costly licensing agreements. The threat of litigation for patent infringement is a substantial deterrent, requiring potential entrants to conduct extensive freedom-to-operate analyses. This legal and technological hurdle effectively limits the number of viable new competitors.

The high cost and time associated with developing and patenting new therapeutic modalities further solidify the position of established players like Genmab. Successfully challenging Genmab's patent landscape would require substantial scientific innovation and significant financial resources, making the threat of new entrants in this specific segment relatively low.

- Proprietary Platforms: DuoBody and HexaBody technologies offer unique advantages in antibody engineering.

- Patent Portfolio: Extensive patent coverage on approved and pipeline products provides a strong competitive moat.

- Barriers to Entry: High R&D costs and the risk of patent infringement litigation deter new market participants.

Established Commercialization and Distribution Networks

For a company like Genmab, the threat of new entrants is significantly mitigated by the sheer cost and complexity of building out commercialization and distribution networks. Successfully bringing a biopharmaceutical product to market demands more than just regulatory approval; it requires a robust sales force, skilled market access teams, and deep-seated relationships with healthcare providers and payers. These elements are not easily replicated.

Establishing these critical infrastructures is a massive undertaking, both in terms of capital investment and the time required to cultivate them. New players often struggle to gain traction without pre-existing partnerships or substantial financial backing, creating a formidable barrier to entry. For instance, in 2024, the average cost for a pharmaceutical company to launch a new drug, including sales force deployment and marketing, can easily run into the hundreds of millions of dollars.

- High Capital Investment: Building a dedicated sales force and market access infrastructure can cost upwards of $100 million for a single product launch.

- Time-Intensive Network Development: Cultivating relationships with key opinion leaders, payers, and healthcare systems typically takes several years.

- Regulatory and Compliance Hurdles: Navigating complex distribution and sales regulations adds further layers of difficulty and cost for new entrants.

- Established Player Advantage: Companies with existing, proven commercial and distribution channels, like Genmab, possess a significant competitive advantage, making it harder for newcomers to compete effectively.

The threat of new entrants for Genmab is considerably low due to the substantial capital required for research and development, often exceeding billions of dollars. This high financial barrier, coupled with the lengthy and complex regulatory approval processes managed by agencies like the FDA and EMA, deters potential competitors. For example, the average cost to bring a new drug to market in 2023 was estimated at over $2 billion, a significant hurdle for newcomers.

Furthermore, the need for specialized scientific expertise in areas like immunology and molecular biology, along with the protection afforded by Genmab's proprietary platforms and extensive patent portfolio, creates significant entry barriers. Developing novel antibody therapies requires a deep scientific foundation and robust intellectual property, which new entrants often lack, making it difficult to compete without infringing on existing rights.

The immense cost and time associated with establishing commercialization and distribution networks also limit new entrants. Building a sales force and cultivating relationships within the healthcare system can cost hundreds of millions of dollars, a significant investment that established players like Genmab already possess, thereby solidifying their competitive advantage.

| Barrier Type | Description | Estimated Cost/Time (Illustrative) |

| Capital Investment (R&D) | Funding for research, preclinical, and clinical trials | $2 billion+ per drug (2023 estimate) |

| Regulatory Approval | Lengthy process for safety and efficacy validation | Up to 10 years |

| Scientific Expertise | Need for specialized knowledge in biotechnology | Years to build experienced teams |

| Intellectual Property | Patents on proprietary platforms and drug candidates | Significant legal and development costs for challengers |

| Commercialization & Distribution | Building sales force, market access, and healthcare relationships | $100 million+ for single product launch (2024 estimate) |

Porter's Five Forces Analysis Data Sources

Our Genmab Porter's Five Forces analysis is built upon a foundation of robust data, including Genmab's annual reports, SEC filings, and industry-specific market research from reputable firms.