Genmab PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genmab Bundle

Navigate the complex landscape of the biopharmaceutical industry with our comprehensive PESTLE analysis of Genmab. Understand how political shifts, economic volatility, and evolving social trends are directly impacting their innovative cancer therapies. Unlock actionable intelligence to inform your investment decisions and strategic planning. Download the full analysis now to gain a critical competitive advantage.

Political factors

Government policies on healthcare spending and drug pricing are a critical factor for Genmab. The Inflation Reduction Act (IRA) in the United States, enacted in 2022, is a prime example, introducing measures that aim to lower prescription drug costs. This legislation is already influencing pricing strategies and could impact Genmab's revenue streams for its innovative therapies.

Across Europe, a similar push for innovation coupled with cost containment is evident. This means Genmab faces increasing pressure to demonstrate the value of its treatments while navigating diverse national pricing and reimbursement systems. For instance, countries are increasingly scrutinizing the cost-effectiveness of new biologics, potentially affecting market access and uptake.

Shifts in political administrations, especially in major markets like the US and key European nations, can introduce new regulatory priorities or alter the landscape of pricing negotiations. A change in government could lead to revised healthcare spending plans or different approaches to drug price controls, directly influencing Genmab's profitability and its ability to secure market access for its pipeline and approved products.

The stringency and speed of drug approval processes by agencies like the FDA and EMA remain paramount for biopharmaceutical companies such as Genmab. In 2025, the FDA has continued to emphasize accelerated approval pathways, a move that could significantly benefit innovative antibody therapies in Genmab's pipeline, potentially shortening time-to-market.

Despite these positive trends, evolving regulatory landscapes present challenges. For instance, updated FDA guidelines in early 2025 have introduced increased scrutiny on clinical trial diversity and more robust post-market surveillance requirements, which could add complexity and extend approval timelines for new treatments.

Global trade policies and geopolitical shifts significantly impact Genmab's operations. For instance, ongoing trade disputes and the potential for increased tariffs on goods and services could raise costs for Genmab's supply chain and distribution networks, particularly affecting its global reach. The BIOSECURE Act, proposed in the US, specifically targets collaborations with certain Chinese biotech firms, potentially reshaping Genmab's partnership landscape and requiring careful navigation of international research and development agreements.

Intellectual Property Protection Policies

Government stances on intellectual property (IP) protection are critical for biotech firms like Genmab, whose success hinges on patents for novel therapies. Robust IP laws encourage significant investment in research and development, the lifeblood of the industry. Conversely, proposals to relax IP protections, often aimed at improving access to medicines in developing nations, pose a direct threat to Genmab's business model and future revenue streams.

The global landscape of IP protection is dynamic, with ongoing debates influencing policy. For instance, discussions surrounding the WIPO Treaty on Genetic Resources and Traditional Knowledge, which aims to establish a framework for benefit-sharing, underscore the evolving nature of IP rights in the life sciences sector. These international dialogues directly impact how companies like Genmab can safeguard their innovations.

In 2023, global R&D spending in the pharmaceutical and biotechnology sectors reached an estimated $250 billion, a figure heavily reliant on the assurance of patent protection to recoup these substantial investments.

- Patent Durability: Genmab's financial performance is directly tied to the strength and duration of its patent portfolio.

- R&D Incentives: Weakening IP laws could disincentivize the high-risk, high-reward research essential for developing new cancer treatments.

- Global Policy Shifts: International agreements and national legislation concerning IP rights require constant monitoring by Genmab to adapt its strategy.

Government Funding and R&D Incentives

Government funding and R&D incentives play a crucial role in shaping the biotechnology landscape where Genmab operates. The level of public investment in foundational research and the availability of tax credits for innovation directly influence the pace of discovery and the overall health of the sector. For instance, in 2024, many governments continued to prioritize life sciences, with significant budget allocations towards biomedical research, aiming to foster domestic innovation and attract private sector investment. These initiatives can de-risk early-stage research, making it more attractive for companies like Genmab to build upon.

Shifts in these governmental policies can significantly impact investment decisions and the speed at which new therapies are developed. For example, a change in R&D tax credit structures or the introduction of new grant programs can alter the financial calculus for companies pursuing novel drug development. In 2025, we are seeing a continued focus on precision medicine and advanced therapies, with governments increasingly offering targeted incentives to encourage breakthroughs in these areas. This creates a dynamic environment where strategic alignment with public funding priorities can accelerate Genmab's pipeline advancement.

Key considerations regarding government funding and R&D incentives include:

- Increased public funding for early-stage, high-risk research

- Tax incentives for specific therapeutic areas, such as oncology and rare diseases

- Government-backed clinical trial support programs

- Regulatory streamlining initiatives to expedite drug approval processes

Government policies on healthcare spending and drug pricing remain a significant factor for Genmab. The Inflation Reduction Act (IRA) in the US, enacted in 2022, continues to influence pricing strategies for innovative therapies, potentially impacting Genmab's revenue. European nations are also increasingly scrutinizing the cost-effectiveness of biologics, affecting market access and reimbursement.

Political shifts in major markets can alter regulatory priorities and pricing negotiations. For instance, changes in government in 2025 could lead to revised healthcare spending plans or different approaches to drug price controls, directly influencing Genmab's profitability.

The speed and stringency of drug approval processes by agencies like the FDA and EMA are critical. In 2025, the FDA's continued emphasis on accelerated approval pathways offers potential benefits for Genmab's pipeline, though evolving guidelines on clinical trial diversity and post-market surveillance may introduce complexities.

Global trade policies and geopolitical shifts also affect Genmab's operations and supply chain. The BIOSECURE Act, proposed in the US, highlights the need for careful navigation of international research and development agreements, potentially reshaping partnership landscapes.

Government stances on intellectual property (IP) protection are vital for biotech firms like Genmab. Robust IP laws encourage R&D investment, while proposals to relax protections could threaten future revenue streams. International dialogues, such as those surrounding the WIPO Treaty on Genetic Resources, underscore the evolving nature of IP rights in the life sciences sector.

Government funding and R&D incentives are shaping the biotech landscape. In 2024, many governments prioritized life sciences with significant budget allocations for biomedical research, aiming to foster domestic innovation. In 2025, there's a continued focus on precision medicine and advanced therapies, with governments offering targeted incentives to encourage breakthroughs in these areas.

| Political Factor | Impact on Genmab | 2024/2025 Data/Trend |

|---|---|---|

| Drug Pricing Regulations | Affects revenue and market access | IRA in US continues to impact pricing; European countries scrutinize cost-effectiveness. |

| Regulatory Approval Processes | Determines time-to-market for new therapies | FDA's accelerated approval pathways remain; increased scrutiny on trial diversity and post-market surveillance in 2025. |

| Intellectual Property (IP) Protection | Safeguards R&D investments and revenue | Global IP landscape is dynamic; ongoing debates on benefit-sharing from genetic resources. |

| Government R&D Funding & Incentives | Supports early-stage research and innovation | Continued government prioritization of life sciences in 2024; focus on precision medicine and advanced therapies in 2025. |

What is included in the product

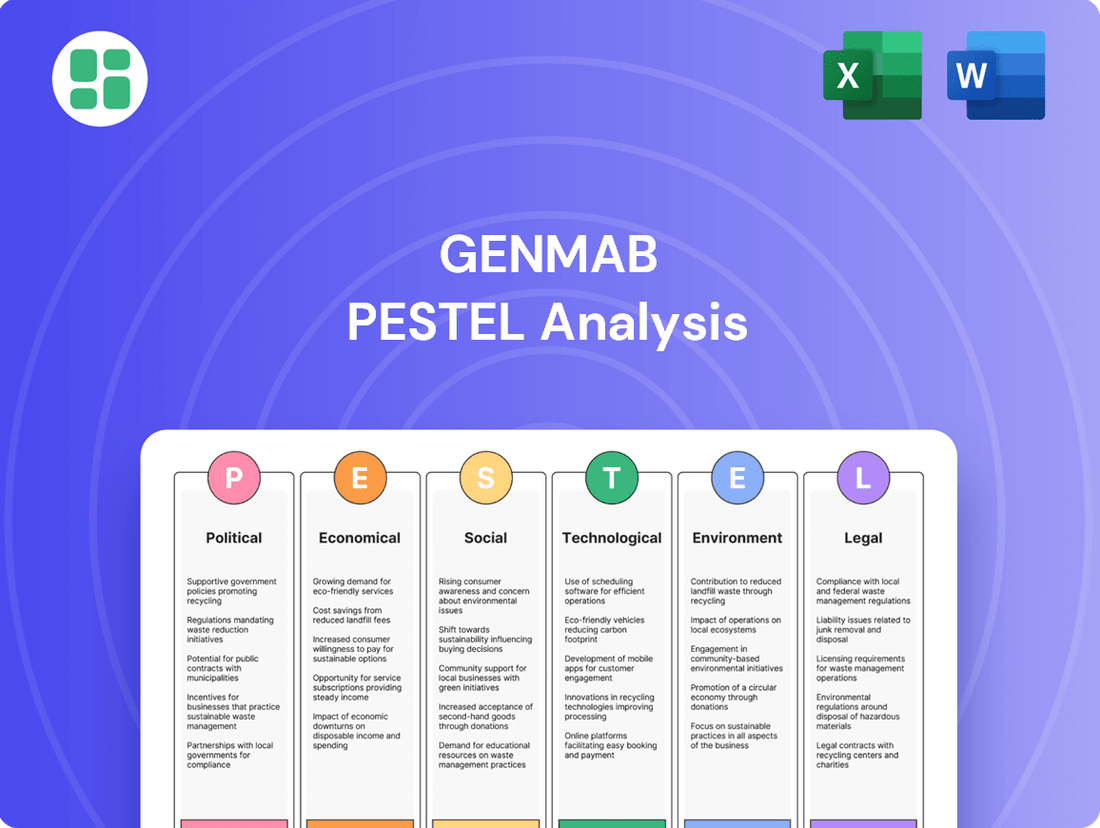

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting Genmab, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making, highlighting opportunities and threats within Genmab's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Genmab's strategic discussions.

Economic factors

Global healthcare spending is a crucial determinant of the market size for Genmab's antibody therapeutics. Projections for 2025 and beyond indicate a continued upward trend in medical costs. This is largely due to technological advancements, innovative pharmaceuticals, and a growing elderly population worldwide.

This sustained increase in healthcare expenditure, especially within the prescription drug segment, presents a positive market environment for Genmab's innovative treatments. For instance, global healthcare spending was estimated to reach $10 trillion in 2022, with continued growth anticipated.

Genmab's commitment to research and development is evident, with R&D accounting for a substantial 72% of its operating expenses in 2024. This internal investment highlights the company's focus on innovation, a critical factor in the competitive biotech landscape.

However, the broader economic environment significantly influences the R&D investment landscape. While Genmab maintains a robust cash position, the availability of external capital, such as venture capital funding and merger and acquisition activity, plays a vital role in fostering collaborations and securing funding for extensive pipeline development.

The biopharmaceutical sector is currently experiencing a period of macroeconomic uncertainty, leading to tighter capital access for many companies. This environment underscores the importance of efficient capital allocation for Genmab to continue its ambitious R&D pursuits and maintain its competitive edge.

Governments and insurers worldwide are intensifying efforts to curb healthcare spending, directly influencing drug pricing. In 2024, the US Inflation Reduction Act (IRA) continues to exert pressure by allowing Medicare to negotiate prices for certain high-cost drugs, a move that could impact future revenue streams for companies like Genmab. This trend extends globally, with many European countries implementing strict reimbursement policies and reference pricing to control drug costs, potentially limiting the profit margins on Genmab's innovative therapies.

These pricing pressures translate into challenges for reimbursement rates, affecting the accessibility and profitability of Genmab's products. For instance, the increasing scrutiny on the cost-effectiveness of novel treatments means that Genmab must provide robust data to justify pricing, especially for its antibody-drug conjugates. While Genmab's revenue model, particularly its royalty income from collaborations, offers some buffer, the overall economic climate and evolving reimbursement landscapes remain critical factors shaping its financial performance.

Global Economic Growth and Inflation

Global economic conditions significantly shape Genmab's operating environment. For instance, the International Monetary Fund (IMF) projected global GDP growth to be 3.2% in 2024, a figure that influences consumer spending and healthcare investment worldwide. Inflationary pressures, a key concern in recent years, directly impact Genmab's operational costs.

Rising inflation can escalate expenses for raw materials, clinical trial conduct, and manufacturing processes. For example, persistent inflation in the pharmaceutical supply chain throughout 2023 and into 2024 has put pressure on many biotech firms. This directly affects profit margins for companies like Genmab, which rely on efficient production and research pipelines.

A robust global economy generally correlates with increased healthcare spending and greater patient access to innovative treatments. Conversely, economic slowdowns or recessions can lead to tighter healthcare budgets and delayed adoption of new therapies. The economic outlook for 2025 will therefore be a critical factor for Genmab's revenue projections and market penetration strategies.

- Global GDP Growth: IMF projected 3.2% global GDP growth for 2024, indicating a generally stable economic backdrop.

- Inflationary Impact: Increased costs for raw materials and manufacturing due to inflation can compress profit margins for Genmab.

- Healthcare Demand: A strong economy typically boosts healthcare access and demand for advanced therapies, benefiting companies like Genmab.

- Economic Uncertainty: Potential economic downturns in key markets could temper demand for Genmab's products and R&D investments.

Currency Fluctuations

As a global biopharmaceutical company with significant operations in Denmark, the Netherlands, the United States, and Japan, Genmab is inherently exposed to currency fluctuations. Changes in exchange rates between the Danish Krone (DKK), US Dollar (USD), Euro (EUR), and Japanese Yen (JPY) can materially affect its reported financial results, including revenues, operating expenses, and overall profitability. For instance, Genmab reported a decrease in net financial income during the first half of 2025, partly attributed to unfavorable foreign exchange impacts. This highlights the constant need for robust currency risk management strategies.

The volatility of major currency pairs directly influences Genmab's financial performance. A stronger USD relative to the DKK, for example, could boost the value of USD-denominated revenues when translated back into DKK, but conversely, it could increase the cost of DKK-denominated expenses incurred in Denmark. The opposite holds true for a weaker USD. This dynamic necessitates careful financial planning and hedging to mitigate potential negative impacts on earnings and cash flows.

- Impact on Revenue: Fluctuations in the USD/DKK and EUR/DKK exchange rates directly alter the DKK equivalent of sales generated in the US and Europe.

- Expense Translation: Costs incurred in foreign currencies, such as R&D expenses in the US or manufacturing costs in the Netherlands, are subject to translation risk.

- Net Financial Income: As observed in H1 2025, foreign exchange movements can significantly impact a company's net financial income or loss.

- Competitive Landscape: Currency shifts can also affect the relative pricing and competitiveness of Genmab's products against those of international rivals.

Global economic growth directly impacts healthcare spending, a key driver for Genmab's revenue. The IMF projected 3.2% global GDP growth for 2024, suggesting a supportive, albeit moderate, economic climate. However, persistent inflation, seen throughout 2023-2024, increases Genmab's operational costs for raw materials and R&D, potentially squeezing profit margins.

Government efforts to control healthcare costs, exemplified by the US Inflation Reduction Act's drug price negotiation provisions, are pressuring drug pricing and reimbursement rates. This necessitates Genmab to continually demonstrate the cost-effectiveness of its innovative therapies to secure favorable market access and maintain profitability.

Currency fluctuations also pose a significant risk, as seen with Genmab's H1 2025 results showing an impact on net financial income. Managing exchange rate volatility between the DKK, USD, EUR, and JPY is crucial for accurate financial reporting and profitability.

Same Document Delivered

Genmab PESTLE Analysis

The preview shown here is the exact Genmab PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis covers all key Political, Economic, Social, Technological, Legal, and Environmental factors impacting Genmab, delivered exactly as shown, no surprises.

The content and structure shown in this preview is the same Genmab PESTLE Analysis document you’ll download after payment, providing actionable insights for your strategic planning.

Sociological factors

The world's population is getting older, and this trend is a major plus for companies like Genmab. Why? Because age is a big factor when it comes to diseases like cancer, which is exactly what Genmab's treatments focus on. As more people reach older age groups, the potential patient pool for these life-saving therapies naturally expands, ensuring a steady demand for Genmab's innovative oncology solutions.

Consider this: by 2050, the United Nations projects that nearly one in six people globally will be over 65, a significant jump from the current ratio. This demographic shift directly translates into a larger market for advanced medical treatments. In 2024, cancer remains a leading cause of death worldwide, with organizations like the World Health Organization reporting millions of new cases annually, underscoring the persistent and growing need for effective therapies that Genmab provides.

The global cancer burden is significant, with the World Health Organization estimating 20 million new cancer cases in 2022, projected to rise to 35 million by 2050. This escalating incidence, coupled with widespread public health awareness campaigns and increasing patient advocacy, directly fuels demand for innovative and effective cancer therapies. Genmab's focus on antibody-based medicines aligns perfectly with this trend, positioning the company to benefit from the growing need for advanced treatment options.

Patient advocacy groups are increasingly influential, pushing for faster approval and broader access to new treatments. This societal pressure directly impacts how regulatory bodies like the FDA and EMA review and approve therapies, as seen in the expedited review pathways for many oncology drugs in 2024. Genmab, by developing novel cancer therapies, is at the forefront of this movement, but must also contend with growing demands for these advanced treatments to be affordable and accessible, a significant challenge given the high cost of biologics.

Lifestyle Changes and Disease Burden

Societal shifts towards more sedentary lifestyles and processed food consumption are contributing to a rising global disease burden, including certain cancers. Genmab's strategic focus on oncology means it must closely monitor these trends. For instance, the World Health Organization reported in 2024 that non-communicable diseases, largely driven by lifestyle factors, accounted for an estimated 74% of all deaths globally. This highlights a growing market for innovative cancer treatments.

Understanding these evolving epidemiological patterns is crucial for Genmab to identify unmet medical needs and align its research and development pipeline. By anticipating future public health challenges linked to lifestyle, Genmab can ensure its therapeutic innovations remain relevant to societal health demands. The increasing prevalence of obesity, a key risk factor for several cancers, is a prime example of such a trend that influences R&D priorities.

- Lifestyle-related diseases, including certain cancers, are a growing concern worldwide.

- In 2024, non-communicable diseases, often linked to lifestyle, caused 74% of global deaths.

- Genmab's oncology focus requires adapting R&D to address emerging public health challenges driven by societal changes.

Ethical Considerations in Biotechnology

Societal views on biotechnology, particularly gene editing and the use of human biological materials, significantly shape regulatory landscapes and public trust in new medical treatments. Genmab's commitment to ethical practices and clear communication is paramount for fostering and maintaining this trust.

Public opinion surveys in 2024 indicated a growing, yet still divided, sentiment regarding genetic technologies, with a notable portion expressing concerns about unintended consequences. For instance, a 2024 Pew Research Center study found that while many see potential benefits in gene editing for disease treatment, a substantial percentage also voiced apprehension about its broader societal implications.

- Public Acceptance: Evolving ethical debates directly impact the speed of adoption for Genmab's innovative antibody therapies.

- Regulatory Influence: Societal concerns can lead to stricter governmental oversight, affecting research and development timelines and costs.

- Brand Reputation: Maintaining transparent and ethical operations is crucial; a perceived ethical lapse could severely damage Genmab's standing and market access.

- Investor Confidence: Demonstrating strong ethical governance reassures investors, particularly in a sector where public perception is so influential.

Societal trends, like an aging global population, directly benefit Genmab by expanding the potential patient base for its cancer therapies. The increasing prevalence of lifestyle-related diseases, as highlighted by the World Health Organization's 2024 report stating non-communicable diseases caused 74% of global deaths, also underscores the growing market for oncology solutions.

Public perception of biotechnology, particularly gene editing, influences regulatory approval and market acceptance of innovative treatments. Genmab must navigate these evolving societal views, ensuring ethical practices and transparent communication to maintain public trust and investor confidence in its advanced antibody therapies.

| Societal Factor | Impact on Genmab | Supporting Data/Trend |

|---|---|---|

| Aging Population | Increased demand for oncology treatments | UN projects 1 in 6 globally over 65 by 2050. |

| Lifestyle Diseases | Growing market for cancer therapies | WHO: 74% of global deaths in 2024 from NCDs (often lifestyle-linked). |

| Biotech Acceptance | Influences R&D, regulation, and market access | Pew Research (2024) shows divided public sentiment on gene editing. |

Technological factors

Genmab's foundation rests on its innovative antibody technologies, including DuoBody® and HexaBody®, underscoring the critical need for ongoing advancements in antibody engineering. The company's pipeline actively incorporates emerging formats such as bispecific antibodies and antibody-drug conjugates (ADCs), reflecting the dynamic nature of this scientific domain.

The biopharmaceutical landscape is witnessing significant technological progress, with new antibody formats offering enhanced therapeutic potential. For instance, bispecific antibodies, capable of binding to two different targets simultaneously, are gaining traction. In 2023, the global ADC market was valued at approximately $10 billion and is projected to grow substantially, highlighting the commercial importance of these advanced biologics.

The integration of AI in drug discovery is revolutionizing the pharmaceutical landscape, a trend Genmab is poised to capitalize on. AI and machine learning are accelerating antibody discovery and predicting protein structures, which directly benefits Genmab's core business. For instance, by mid-2024, AI platforms are demonstrating an ability to identify promising drug candidates up to 50% faster than traditional methods, potentially slashing R&D costs.

The increasing focus on personalized medicine, driven by technological leaps in diagnostics and genomics, presents a significant opportunity for companies like Genmab. This trend involves tailoring treatments to an individual's unique genetic makeup and disease characteristics.

Genmab's antibody therapeutics, particularly in the oncology space, can capitalize on this by developing companion diagnostics. These diagnostics identify patients who are most likely to respond to specific treatments, thereby enhancing treatment efficacy and strengthening Genmab's market position. For instance, the global personalized medicine market was valued at approximately $500 billion in 2023 and is projected to reach over $800 billion by 2028, indicating substantial growth potential.

Innovations in Biomanufacturing and Production Efficiency

Technological advancements are significantly reshaping biomanufacturing. Innovations like continuous bioprocessing and advanced cell culture media are boosting production yields and speed. For instance, the biopharmaceutical industry saw a significant increase in the adoption of single-use technologies, which can reduce turnaround times and contamination risks, contributing to operational efficiency.

Genmab's focus on scaling production for its key therapies, such as the antibody-drug conjugate (ADC) technology, directly benefits from these advancements. Improved bioprocessing materials and sustainable practices are not only lowering production costs but also strengthening supply chain resilience, a crucial factor in delivering life-saving treatments globally. The company's investment in expanding its manufacturing capabilities, as highlighted in its 2024 reports, underscores the importance of these technological integrations.

- Bioprocessing Efficiency: Innovations such as perfusion bioreactors and intensified cell culture are enabling higher cell densities and product titers, potentially reducing the physical footprint and operational costs of manufacturing facilities.

- Sustainable Materials: The development and adoption of biodegradable or recyclable materials for single-use bioprocessing components are gaining traction, aligning with environmental, social, and governance (ESG) goals while also offering potential cost benefits through reduced waste disposal.

- Supply Chain Resilience: Technologies like advanced process analytical technology (PAT) and digital twins are enhancing real-time monitoring and control of manufacturing processes, leading to more predictable outcomes and a more robust supply chain, crucial for companies like Genmab with global distribution needs.

Data Analytics and Digital Health Solutions

The increasing volume and sophistication of data analytics, including real-world evidence and clinical trial data, are transforming pharmaceutical development. Genmab can leverage these insights to refine its product pipeline and understand treatment efficacy more deeply. For instance, the global healthcare analytics market was projected to reach $108.7 billion by 2027, indicating significant investment and adoption in this area.

Digital health solutions, encompassing telemedicine, wearable devices, and AI-powered diagnostics, present further avenues for Genmab to enhance patient monitoring and market access. These technologies facilitate continuous data collection, offering a more comprehensive view of patient outcomes post-market. By 2025, the digital health market is expected to exceed $660 billion globally, underscoring its rapid expansion and potential impact.

- Data-driven clinical optimization: Genmab can utilize advanced analytics to identify patient subgroups most likely to respond to its therapies, thereby improving clinical trial success rates and reducing development timelines.

- Enhanced patient monitoring: Digital health tools allow for real-time tracking of patient responses and side effects, providing invaluable data for post-market surveillance and product lifecycle management.

- Improved market access strategies: By demonstrating the real-world value and effectiveness of its treatments through robust data analytics, Genmab can strengthen its negotiations with payers and healthcare providers.

- Personalized medicine advancements: The integration of data analytics and digital health solutions supports the development of more personalized treatment approaches, aligning with Genmab's focus on innovative oncology therapies.

Genmab's technological edge hinges on its proprietary antibody platforms like DuoBody® and HexaBody®, driving innovation in areas such as bispecific antibodies and antibody-drug conjugates (ADCs). The accelerating adoption of AI in drug discovery, with platforms in mid-2024 showing up to 50% faster candidate identification, directly enhances Genmab's research and development efficiency.

The company's strategic alignment with personalized medicine, a market valued at approximately $500 billion in 2023 and projected to exceed $800 billion by 2028, is bolstered by technological advancements in diagnostics and genomics. This synergy allows for the development of companion diagnostics to optimize treatment efficacy for specific patient populations.

Technological progress in biomanufacturing, including continuous bioprocessing and advanced cell culture, directly supports Genmab's scaling efforts for therapies like ADCs. These improvements enhance production yields and operational efficiency, a critical factor for global supply chain resilience.

The increasing sophistication of data analytics and digital health solutions, with the latter market expected to surpass $660 billion globally by 2025, offers Genmab opportunities to refine its pipeline, improve patient monitoring, and strengthen market access through evidence-based strategies.

Legal factors

Genmab navigates a complex web of global drug approval regulations, including those set by the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and Japan's Pharmaceuticals and Medical Devices Agency (PMDA). Compliance with these evolving guidelines for clinical trials, manufacturing processes, and ongoing post-market surveillance is absolutely critical for the company's success.

Recent regulatory shifts, such as the FDA's 2025 transparency initiatives for complete response letters and its ongoing evaluation of accelerated approval pathways, directly impact Genmab's product development timelines and its ability to bring innovative therapies to market efficiently. For instance, the FDA's increased focus on data integrity in accelerated approvals could necessitate more robust real-world evidence generation, potentially extending timelines if not proactively addressed.

Genmab's success hinges on safeguarding its significant portfolio of antibody technologies and drug candidates through patents. The intricate global landscape of biotechnology intellectual property, particularly defining novel genetic sequences and navigating diverse international patent regulations, necessitates strong legal approaches to deter infringement and preserve market exclusivity.

The World Intellectual Property Organization's (WIPO) recent treaty introduces new disclosure obligations, adding another layer of complexity to Genmab's IP strategy. This means meticulous documentation and transparent sharing of certain information are now critical components of patent protection, impacting how Genmab secures and maintains its competitive edge in the biopharmaceutical market.

Regulations surrounding clinical trials are constantly being updated, affecting everything from how patients are recruited and data is gathered to ensuring diversity in trial participation. For instance, as of early 2024, the FDA continues to emphasize diversity in clinical trials, with initiatives aimed at increasing representation of underrepresented populations to ensure findings are broadly applicable.

Furthermore, stringent data privacy laws like the General Data Protection Regulation (GDPR) in Europe and the Health Insurance Portability and Accountability Act (HIPAA) in the United States significantly shape how patient data is managed throughout the research and commercialization phases. Non-compliance with these regulations, which are increasingly enforced, can lead to substantial legal penalties and damage a company's reputation, impacting its ability to conduct vital research and bring therapies to market.

Anti-Trust and Competition Laws

As a major biotechnology company, Genmab must carefully adhere to anti-trust and competition laws. These regulations are designed to ensure fair play in the market, preventing any single company from gaining too much control. This is particularly important for Genmab, given its significant role in the development and commercialization of innovative therapies.

The company's strategic alliances, including mergers, acquisitions, and co-development deals, face rigorous review by regulatory bodies. For instance, the European Commission's Directorate-General for Competition and the U.S. Federal Trade Commission (FTC) actively monitor such transactions. Their oversight aims to prevent anti-competitive practices and safeguard consumer interests.

These legal frameworks directly impact Genmab's partnership strategies and its approach to market expansion. For example, a proposed acquisition or collaboration might be approved with conditions to maintain competitive dynamics. In 2024, the FTC continued its aggressive stance on pharmaceutical mergers, scrutinizing deals that could potentially reduce competition in critical drug markets.

- Regulatory Scrutiny: Genmab's partnerships and acquisitions are subject to review by competition authorities like the FTC and European Commission.

- Market Impact: Anti-trust laws aim to prevent monopolistic behavior, influencing Genmab's strategies for growth and market consolidation.

- 2024 Trends: Increased regulatory focus on pharmaceutical mergers by agencies such as the FTC highlights the evolving landscape for competitive practices.

Product Liability and Safety Regulations

Genmab operates under stringent product liability laws, requiring rigorous adherence to safety and efficacy standards for its antibody therapeutics. Failure to meet these benchmarks can result in substantial legal penalties and financial losses, impacting market standing and investor confidence.

The company must maintain robust quality control and pharmacovigilance systems to proactively identify and address any potential adverse events. For instance, in 2024, the pharmaceutical industry saw increased scrutiny on drug safety, with regulatory bodies like the FDA issuing new guidelines for post-market surveillance, a trend Genmab must actively navigate.

- Product Recalls: A significant product recall could lead to millions in lost revenue and substantial legal settlements, as seen with other biopharmaceutical companies facing similar challenges.

- Adverse Event Reporting: Timely and accurate reporting of adverse events is crucial to maintain regulatory compliance and patient trust.

- Regulatory Fines: Non-compliance with safety regulations can result in hefty fines, potentially impacting profitability. For example, in 2023, several pharmaceutical giants faced multi-million dollar fines for manufacturing quality issues.

- Litigation Costs: Product liability lawsuits are costly, encompassing legal fees, damages, and reputational repair.

Genmab's operations are heavily influenced by evolving global regulatory frameworks, particularly concerning drug approvals and clinical trials. The company must meticulously adhere to guidelines from bodies like the FDA and EMA, with recent initiatives in 2024 and 2025 focusing on transparency and data integrity, especially for accelerated approvals.

Intellectual property protection is paramount, with Genmab needing to navigate complex international patent laws to safeguard its antibody technologies. The World Intellectual Property Organization's (WIPO) updated treaty in 2024 mandates new disclosure obligations, adding a layer of complexity to IP strategy.

Data privacy laws, such as GDPR and HIPAA, significantly impact how Genmab handles patient data. Non-compliance can lead to severe penalties, underscoring the need for robust data management practices as these regulations continue to be rigorously enforced.

Antitrust and competition laws, along with regulatory review of partnerships and acquisitions by agencies like the FTC and European Commission, shape Genmab's market strategies. The FTC's aggressive stance on pharmaceutical mergers in 2024 emphasizes the ongoing scrutiny of competitive practices.

Product liability laws demand strict adherence to safety and efficacy standards. In 2024, regulatory bodies increased oversight on drug safety and post-market surveillance, a trend Genmab must actively manage to avoid penalties and maintain trust.

Environmental factors

The biotechnology sector, including companies like Genmab, is under growing scrutiny to implement greener manufacturing processes. This involves a concerted effort to shrink the environmental impact stemming from operations, a key focus for Genmab's sustainability goals. Efforts include optimizing energy usage and cutting down waste in both research laboratories and production sites.

Genmab's dedication to corporate social responsibility is evident in its drive to minimize its environmental footprint. For instance, the company aims to reduce energy consumption across its facilities. In 2023, Genmab reported a 5% decrease in its Scope 1 and 2 greenhouse gas emissions compared to its 2022 baseline, demonstrating tangible progress in its operational sustainability efforts.

Biopharmaceutical production, like Genmab's, inevitably creates distinct waste streams, encompassing biological materials and chemical byproducts. Proper handling and disposal are paramount for regulatory adherence and fulfilling sustainability pledges, a growing concern for the industry.

Genmab's commitment to environmental stewardship necessitates robust waste management protocols. For instance, in 2024, the biopharmaceutical sector globally saw increased scrutiny on waste disposal, with regulations tightening around hazardous biological materials and chemical residues, impacting operational costs and requiring advanced treatment technologies.

The drive towards greener manufacturing offers solutions. Innovations in sustainable bioprocessing, such as the use of biodegradable materials or more efficient purification techniques, can significantly mitigate the volume and toxicity of waste generated, aligning with Genmab's long-term environmental goals and potentially reducing disposal expenses.

Genmab's research and development facilities and manufacturing operations are inherently energy-intensive, contributing to its overall carbon footprint. In 2024, the company actively engaged in initiatives like sponsoring tree planting, demonstrating a commitment to mitigating its environmental impact. This aligns with a significant industry-wide push towards achieving carbon neutrality and the increasing adoption of renewable energy sources across the biopharmaceutical sector.

Supply Chain Environmental Impact

Genmab's global supply chain, encompassing everything from sourcing raw materials to delivering finished products, faces increasing scrutiny regarding its environmental footprint. This includes the carbon emissions generated by transportation and the waste produced by packaging materials.

Mitigating these environmental risks is a key component of Genmab's broader sustainability strategy. The company is actively exploring ways to reduce its impact across all stages of its operations.

- Transportation Emissions: Genmab is likely evaluating options for lower-emission transport, such as optimizing shipping routes and potentially exploring alternative fuel sources for its logistics partners.

- Packaging Waste: Efforts are underway to implement 'green' packaging solutions, aiming to reduce the volume of waste generated and increase the use of recyclable or biodegradable materials.

- Process Streamlining: Beyond packaging, Genmab is likely focusing on streamlining its overall supply chain processes to enhance efficiency and minimize resource consumption.

Climate Change and Health Implications

Climate change poses a significant long-term risk to global health, potentially shifting disease prevalence and increasing the incidence of various conditions. For Genmab, a company dedicated to tackling serious illnesses like cancer, this necessitates an adaptive approach to research and development, staying ahead of health challenges influenced by environmental changes.

The World Health Organization (WHO) projects that between 2030 and 2050, climate change could cause approximately 250,000 additional deaths per year from malnutrition, malaria, diarrhoea and heat stress. This underscores the need for biopharmaceutical companies to consider the broader public health landscape shaped by environmental factors.

Genmab's pipeline, focused on oncology and immunology, could see indirect impacts as altered environmental conditions might affect patient populations or disease presentation. Staying attuned to these evolving health dynamics is crucial for maintaining the relevance and efficacy of their therapeutic innovations.

- Global Health Shifts: Climate change can alter disease vectors and geographical distribution of illnesses.

- R&D Adaptability: Genmab must ensure its research addresses potential future health challenges influenced by environmental factors.

- Patient Population Impact: Evolving health landscapes may affect the demographics and specific needs of patient populations.

Genmab's environmental strategy focuses on reducing emissions and optimizing resource use across its operations. The company reported a 5% reduction in Scope 1 and 2 greenhouse gas emissions in 2023 compared to 2022, demonstrating tangible progress. This aligns with the biopharmaceutical sector's broader trend towards carbon neutrality and increased adoption of renewable energy.

Waste management is a critical environmental consideration for Genmab, given the nature of biopharmaceutical production. In 2024, the industry faced heightened scrutiny on hazardous waste disposal, necessitating advanced treatment technologies and impacting operational costs. Genmab is actively implementing robust protocols to manage biological materials and chemical byproducts responsibly.

The company is also addressing its supply chain's environmental footprint, particularly transportation emissions and packaging waste. Genmab is exploring greener logistics and sustainable packaging solutions to minimize its impact. These efforts are part of a comprehensive strategy to enhance operational efficiency and reduce resource consumption throughout its value chain.

Climate change presents long-term risks, potentially altering disease prevalence, which Genmab must adapt to in its research and development. The WHO projects significant increases in climate-related deaths by 2050, highlighting the need for biopharma to consider these evolving public health dynamics. Genmab's focus on oncology and immunology may see indirect impacts as altered environmental conditions affect patient populations and disease presentation.

PESTLE Analysis Data Sources

Our Genmab PESTLE Analysis is constructed using a blend of publicly available data from regulatory bodies, financial markets, and scientific journals. We also incorporate insights from industry-specific publications and market research reports to ensure a comprehensive understanding of the macro-environment impacting Genmab.