Genmab Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Genmab Bundle

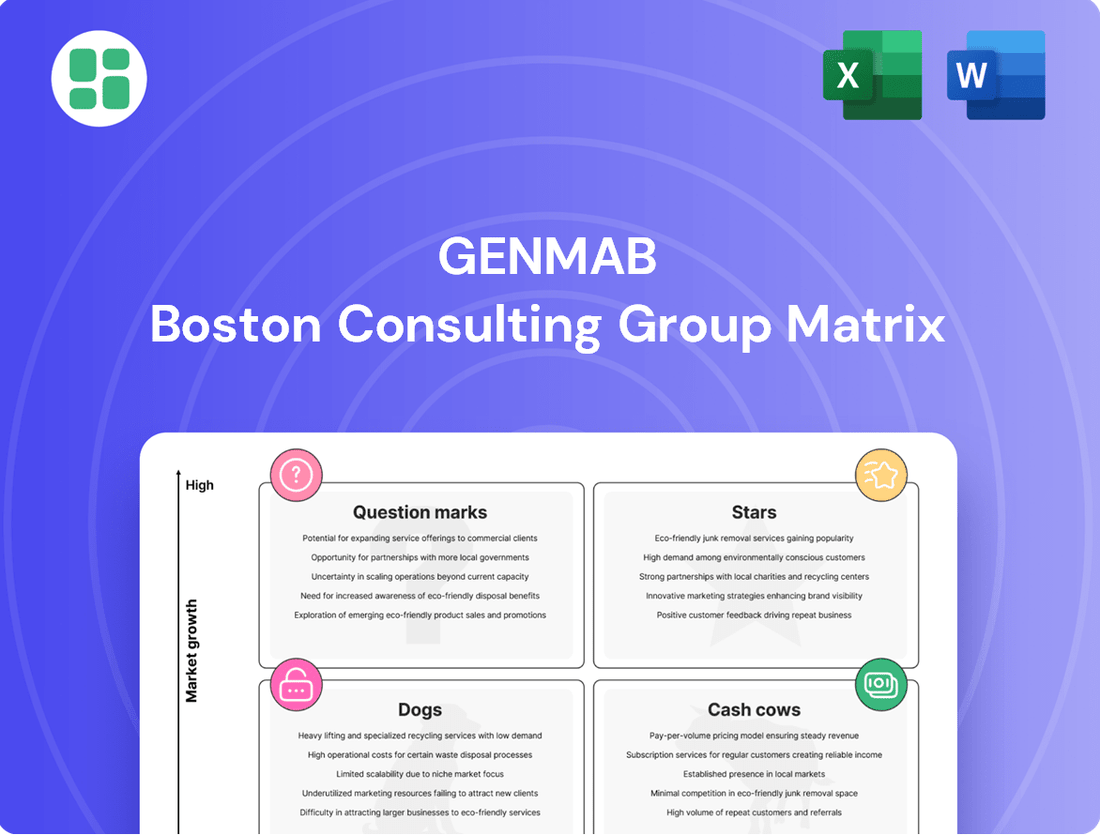

Curious about Genmab's strategic product portfolio? This glimpse into their BCG Matrix reveals the potential of their pipeline and the strength of their current offerings. Understand where Genmab's innovations are positioned as Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full strategic picture by purchasing the complete Genmab BCG Matrix. Gain detailed quadrant placements and data-driven insights to inform your investment decisions and anticipate market movements.

Don't miss out on the actionable intelligence within the full Genmab BCG Matrix. It's your shortcut to understanding their competitive landscape and planning for future growth.

Stars

EPKINLY, a collaboration with AbbVie, is a significant contributor to Genmab's growth trajectory. Its performance in the first half of 2025 was particularly strong, with sales jumping 74% year-over-year to $211 million.

Currently approved for diffuse large B-cell lymphoma (DLBCL) and follicular lymphoma (FL), EPKINLY is poised for further expansion. Positive Phase 3 results in second-line FL have earned it FDA priority review, with a decision anticipated in November 2025.

This strategic move into earlier treatment lines for FL is expected to capture a substantial portion of a market estimated to be worth over $3 billion, solidifying EPKINLY's position as a star product for Genmab.

Tivdak, a collaboration between Genmab and Pfizer, is showing impressive growth, with net sales reaching $78 million in the first half of 2025, a significant 30% jump. This performance is bolstered by its recent introductions in Japan in May 2025 and Europe in March 2025, marking it as the first and only antibody-drug conjugate for recurrent or metastatic cervical cancer in these key markets.

The successful commercial rollout and its distinct position as a leading treatment for cervical cancer highlight Tivdak's potential to become a star product within Genmab's portfolio. Its rapid market penetration and strong sales trajectory indicate substantial future growth prospects.

EPKINLY's potential expansion into earlier lines of therapy for follicular lymphoma, backed by robust Phase 3 data, positions it as a high-growth asset. This move, expected to significantly increase its addressable market, is crucial for its future growth within Genmab's portfolio.

If approved for earlier treatment stages, EPKINLY could capture a larger share of the follicular lymphoma market, potentially reaching hundreds of millions in additional annual revenue by 2026. This strategic shift is designed to solidify its standing as a dominant bispecific antibody in the treatment of blood cancers.

Next-Generation Bispecific Antibodies

Genmab's next-generation bispecific antibodies, built on its DuoBody and HexaBody platforms, are poised to become significant Stars in its portfolio. These innovative therapies target multiple cancer pathways simultaneously, offering enhanced efficacy and patient outcomes. The company's commitment to developing first-in-class treatments fuels a robust pipeline of potential high-growth assets.

These bispecific antibodies represent a strategic investment in the future of oncology. For example, Genmab's ongoing clinical trials for several bispecific candidates demonstrate strong early-stage data. The company anticipates significant market penetration as these therapies move through development and towards commercialization.

- Pipeline Strength: Genmab's proprietary platforms are designed to create a continuous stream of novel bispecific antibodies.

- Market Potential: Targeting various cancers with innovative mechanisms, these candidates have the potential for substantial market share.

- First-in-Class Focus: The emphasis on developing therapies that are the first of their kind drives high growth expectations.

- Clinical Progress: Active clinical programs for several bispecific candidates indicate a promising development trajectory.

Strategic Co-development Programs

Genmab's strategic co-development programs with industry giants like AbbVie, Pfizer, and BioNTech are key to its growth. These collaborations focus on advancing novel antibody therapeutics in lucrative oncology markets, effectively sharing the substantial costs and risks associated with drug development. This approach grants Genmab access to wider commercial reach and leverages the partners' extensive clinical and regulatory expertise.

These vital partnerships are instrumental in speeding up the journey of groundbreaking therapies from the lab to patients. By pooling resources and knowledge, Genmab and its collaborators aim to bring innovative treatments to market faster, targeting areas with significant unmet medical needs and high commercial potential. This strategy firmly positions these co-developed assets as potential future stars in Genmab's portfolio.

- AbbVie Collaboration: Focuses on the development and commercialization of epcoritamab (DuoBody CD20xCD3), a bispecific antibody for B-cell malignancies. In 2023, AbbVie reported net sales of approximately $229 million for epcoritamab.

- Pfizer Partnership: Includes the co-development of several investigational antibody-drug conjugates (ADCs) and other novel antibody therapies for various cancer types.

- BioNTech Alliance: Centers on the discovery and development of novel mRNA-based therapeutics, including potential cancer vaccines and antibody treatments, leveraging BioNTech's mRNA platform.

EPKINLY's expansion into earlier lines of follicular lymphoma treatment, supported by strong Phase 3 data, positions it as a high-growth product. This strategic move aims to significantly broaden its market reach, potentially adding hundreds of millions in annual revenue by 2026, solidifying its status as a star product.

Tivdak's successful launch in Japan and Europe, coupled with its unique position in cervical cancer treatment, demonstrates a strong growth trajectory. This rapid market penetration and sales momentum indicate its potential to become a leading star product in Genmab's portfolio.

Genmab's next-generation bispecific antibodies, leveraging DuoBody and HexaBody platforms, are engineered for enhanced efficacy by targeting multiple cancer pathways. These first-in-class therapies are anticipated to drive substantial future growth, marking them as potential stars.

The company's strategic co-development partnerships with major players like AbbVie and Pfizer are crucial for advancing novel antibody therapeutics into lucrative oncology markets. These collaborations share development costs and risks, accelerating market entry and positioning these assets as future stars.

| Product | Collaboration Partner | H1 2025 Sales (Millions USD) | Growth (YoY) | Key Market Expansion |

| EPKINLY | AbbVie | $211 | 74% | FDA Priority Review for 2nd-line FL (Nov 2025 Decision) |

| Tivdak | Pfizer | $78 | 30% | Japan (May 2025), Europe (Mar 2025) |

What is included in the product

Genmab's BCG Matrix analyzes its product portfolio, guiding strategic decisions on investment, divestment, and resource allocation.

Genmab's BCG Matrix provides a clear, one-page overview of its business units, alleviating the pain of complex portfolio analysis.

Cash Cows

DARZALEX, developed in partnership with Johnson & Johnson, stands as Genmab's leading cash cow. This drug generated impressive royalty revenues of $11,670 million in 2024, underscoring its significant market impact.

The drug's position as a cornerstone treatment for multiple myeloma guarantees robust and consistent profit margins for Genmab. Its established market dominance and sustained high sales performance translate into a reliable and substantial cash flow.

Looking at the first half of 2025, DARZALEX continued its strong performance, contributing $6,776 million in royalty revenue. This ongoing success solidifies its status as a dependable source of significant cash generation for the company.

Kesimpta (ofatumab), partnered with Novartis, represents a robust royalty revenue stream for Genmab. This drug has demonstrated strong performance within the multiple sclerosis market, solidifying its position as a reliable asset with a high market share and a stable, albeit lower, growth trajectory.

DARZALEX and Kesimpta represent Genmab's established market leaders, firmly positioned as cash cows within its portfolio. Their mature market presence translates into significant market share, enabling Genmab to enjoy robust profit margins. This strong positioning means these products require comparatively low investments in promotion and placement to maintain their success.

These flagship products are characterized by their ability to generate substantial returns with minimal cash consumption. This financial efficiency allows Genmab to leverage their established success, providing a stable income stream that can be reinvested in other areas of the business or returned to shareholders.

Consistent Royalty Income

Genmab's business model thrives on a robust royalty income stream, largely derived from its established commercialized products. This high-margin engine generated over 80% of its total revenue in the first half of 2025, showcasing its significant contribution.

This predictable revenue is a key strength, providing financial stability and insulating Genmab from the immediate operational challenges associated with product manufacturing and market rollout.

- Consistent Royalty Income: Genmab's revenue is heavily reliant on royalties from successful products.

- High Margin Contribution: Over 80% of H1 2025 revenue stemmed from this royalty engine.

- Reduced Operational Risk: This income stream is insulated from direct manufacturing and commercialization risks.

Funding for R&D and Pipeline Expansion

Genmab's established products, functioning as cash cows, are the engine for its ambitious growth strategy. The substantial cash flow they generate is strategically reinvested into research and development, fueling the expansion of its promising late-stage pipeline. This financial strength also supports potential strategic acquisitions, allowing Genmab to explore innovative, albeit higher-risk, ventures that could define its future market position.

For instance, Genmab's commitment to R&D is evident in its significant investments. In 2023, the company reported R&D expenses of approximately DKK 8.4 billion (around $1.2 billion USD). This investment is crucial for advancing its pipeline, which includes several promising candidates in oncology and immunology, aiming to replicate the success of its current cash cows.

- R&D Investment: Genmab allocated approximately DKK 8.4 billion to R&D in 2023.

- Pipeline Advancement: Funds support late-stage clinical trials and early-stage discovery programs.

- Strategic Acquisitions: Cash flow enables the pursuit of external innovation and synergistic opportunities.

- Future Growth Drivers: Investment aims to cultivate future 'Stars' from high-potential projects.

Genmab's cash cows, primarily DARZALEX and Kesimpta, are the bedrock of its financial stability. These mature products command significant market share and generate substantial, consistent royalty revenues with minimal reinvestment needs. This allows Genmab to fund its ambitious research and development pipeline, ensuring future growth opportunities.

| Product | Partner | 2024 Royalty Revenue (USD millions) | H1 2025 Royalty Revenue (USD millions) |

|---|---|---|---|

| DARZALEX | Johnson & Johnson | 11,670 | 6,776 |

| Kesimpta | Novartis | N/A | N/A |

Delivered as Shown

Genmab BCG Matrix

The Genmab BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic clarity, will be delivered without any watermarks or demo content, ready for immediate professional use.

Dogs

Genmab's decision to terminate the GEN1047 program in November 2024 highlights the rigorous internal evaluation process for its pipeline assets. GEN1047, an early-stage bispecific antibody designed to target CD3 and B7-H4 for solid tumors, did not meet Genmab's stringent criteria for differentiation and therapeutic promise.

This discontinuation, impacting a program that was in the early stages of development, underscores Genmab's commitment to focusing resources on assets with the highest potential for success and significant clinical impact. The company's strategic pipeline management prioritizes programs that demonstrate a clear competitive advantage and a strong likelihood of delivering meaningful patient benefit.

Genmab's strategic decision in late 2024 to terminate the GEN3017 program, a bispecific antibody targeting CD3 and CD30, signals a clear shift in focus. This candidate was in Phase 1 development for lymphoma.

The discontinuation of GEN3017 underscores Genmab's commitment to prioritizing its late-stage assets. This move suggests that the company perceives limited future market potential for this specific bispecific antibody, aligning with a broader strategy to concentrate resources on more promising pipeline candidates.

Genmab's early-stage program GEN1056, a collaboration with BioNTech, was terminated in November 2024. This decision reflects Genmab's commitment to focusing on assets with high therapeutic and commercial potential.

The company indicated that GEN1056 did not meet its stringent criteria for a truly differentiated candidate, suggesting limited prospects for market share capture or significant growth. This strategic pruning is a common practice in the biopharmaceutical industry to optimize resource allocation.

Underperforming Early-Stage Assets

Genmab's early-stage assets, particularly those in pre-clinical or early clinical trials, that don't demonstrate strong efficacy, acceptable safety profiles, or a clear competitive advantage are prime candidates for divestment or discontinuation. These assets represent significant research and development expenditure with uncertain future returns, fitting the description of 'Dogs' in the BCG matrix.

For instance, if Genmab had several early-stage programs in areas like novel antibody-drug conjugates that showed disappointing early data in 2024, these would be flagged. Such assets drain R&D budgets without a clear path to becoming blockbuster drugs, impacting the overall efficiency of their pipeline management.

- Pipeline Pruning: Early-stage assets failing to meet rigorous efficacy and safety benchmarks are candidates for discontinuation.

- Resource Allocation: Continued investment in underperforming early-stage projects diverts capital from more promising ventures.

- Financial Impact: Discontinued programs reduce R&D expenses but also eliminate potential future revenue streams from those specific assets.

- Strategic Review: Regular evaluation of early-stage assets ensures resources are focused on candidates with the highest probability of success and market impact.

Legacy Research Initiatives

Genmab's legacy research initiatives, those platforms or early-stage projects that haven't yet delivered promising product candidates or have been surpassed by more advanced technologies, are categorized as dogs in the BCG matrix. These are typically areas where investment is being reduced or phased out to concentrate capital on more strategic, high-growth opportunities. For instance, if a particular antibody discovery platform showed initial promise but failed to yield a viable drug candidate by 2024, it might be reclassified as a dog.

The strategic rationale for managing these 'dog' initiatives involves reallocating financial and human resources. By discontinuing or significantly scaling back investment in underperforming legacy research, Genmab can free up capital. This allows for increased funding in areas with a higher probability of success, such as their ongoing development of next-generation antibody therapies. This strategic shift is crucial for maintaining a competitive edge and maximizing return on investment in the dynamic biotechnology sector.

- Resource Reallocation: Phasing out legacy research allows for the redirection of funds from underperforming projects to more promising pipeline candidates.

- Focus on High-Potential Areas: This strategic move enables Genmab to concentrate its R&D efforts on areas with a greater likelihood of commercial success and market impact.

- Efficiency Gains: Reducing investment in 'dog' initiatives improves overall R&D efficiency by eliminating expenditure on projects with low probability of return.

- Portfolio Optimization: Regularly assessing and managing the 'dog' category is essential for maintaining a lean and effective research portfolio, ensuring capital is deployed where it can generate the most value.

Genmab's early-stage pipeline assets that fail to demonstrate significant therapeutic promise or a clear competitive advantage are considered 'Dogs' within the BCG matrix framework. These are projects that consume resources without a clear path to market success, such as GEN1047 and GEN1056, which were terminated in late 2024 due to not meeting stringent criteria. The discontinuation of these programs, which involved early-stage bispecific antibodies targeting conditions like solid tumors and lymphoma, reflects Genmab's strategic pruning to optimize R&D investment.

The strategic rationale for managing these 'dog' initiatives involves reallocating financial and human resources. By discontinuing or significantly scaling back investment in underperforming legacy research, Genmab can free up capital. This allows for increased funding in areas with a higher probability of success, such as their ongoing development of next-generation antibody therapies. This strategic shift is crucial for maintaining a competitive edge and maximizing return on investment in the dynamic biotechnology sector.

For example, Genmab's 2024 pipeline updates indicated a focused approach, with resources being channeled towards late-stage assets like epcoritamab and Tivdak. Early-stage projects that do not show compelling differentiation or a robust development path, often characterized by limited clinical data or challenging competitive landscapes, are prime candidates for being classified as dogs. These assets, while representing past investment, are re-evaluated to ensure capital is deployed efficiently toward higher-potential opportunities.

Genmab's commitment to pipeline optimization means that early-stage candidates not showing strong efficacy, acceptable safety, or a clear differentiator are prime candidates for discontinuation. This strategic pruning, as seen with the termination of GEN1047 and GEN1056 in 2024, ensures resources are concentrated on assets with the highest probability of success and market impact, thereby improving overall R&D efficiency.

| Asset Name | Development Stage (as of late 2024) | Target Indication | BCG Category (Implied) | Rationale for Classification |

|---|---|---|---|---|

| GEN1047 | Early-stage | Solid Tumors | Dog | Terminated due to not meeting criteria for differentiation and therapeutic promise. |

| GEN3017 | Phase 1 | Lymphoma | Dog | Terminated, signaling limited future market potential and focus on late-stage assets. |

| GEN1056 | Early-stage | N/A (Collaboration w/ BioNTech) | Dog | Terminated for not meeting criteria for a differentiated candidate. |

Question Marks

Rinatabart sesutecan (Rina-S), a key asset from Genmab's April 2024 acquisition of ProfoundBio, is positioned as a 'Question Mark' in the company's BCG Matrix. This antibody-drug conjugate is currently in Phase 3 trials for endometrial cancer, showing promising anti-tumor activity in ovarian cancer as well.

With a potential launch as early as 2027, Rina-S exhibits high growth potential in the oncology market. However, as it currently holds no market share, it necessitates significant investment to capture market presence and achieve its full commercialization potential.

Acasunlimab, now solely under Genmab's development since late 2024, is positioned as a Question Mark within the BCG Matrix. It's currently in a Phase 2 trial, indicating its early stage of market penetration.

With a projected market opportunity of around $1 billion, acasunlimab shows significant growth potential. However, its current low market share, coupled with its ongoing development, necessitates substantial investment to capture this future market.

Genmab's pipeline extends beyond its established products to include a robust array of early-to-mid stage proprietary candidates. This diverse group features various bispecific T-cell engagers, antibody-drug conjugates (ADCs), and next-generation immune checkpoint modulators, targeting a range of hematological malignancies and solid tumors.

These emerging programs are positioned within rapidly expanding therapeutic markets, yet they are in the crucial phases of clinical development where significant R&D investment is essential to demonstrate efficacy and secure market positioning. For instance, the development of novel ADCs often involves complex manufacturing and extensive clinical trials, with costs easily running into hundreds of millions of dollars per candidate.

Novel Antibody-Drug Conjugate (ADC) Technology Platforms

Genmab's acquisition of ProfoundBio introduced novel antibody-drug conjugate (ADC) technology platforms, significantly expanding its capabilities beyond the Rina-S asset. These platforms are positioned as question marks within the BCG matrix due to their high growth potential in the rapidly evolving ADC market.

The success of these platforms is intrinsically linked to the successful development and commercialization of new products derived from them. While the ADC market is projected for substantial growth, with some estimates suggesting it could reach over $10 billion by 2028, the inherent risks in drug development mean these platforms are not yet established cash cows.

- High Growth Potential: The novel ADC technology platforms offer Genmab entry into a burgeoning sector of cancer therapy.

- Development Dependency: Their progression depends on translating these platforms into commercially viable drug candidates.

- Market Dynamics: The competitive landscape and regulatory hurdles in the ADC space represent significant challenges.

- Investment Requirement: Continued investment in research and development is crucial for realizing the full value of these platforms.

New Targets and Therapeutic Areas

Genmab is actively broadening its research scope beyond its established oncology expertise. This strategic expansion involves venturing into new therapeutic areas like immunology and inflammation, often facilitated through strategic collaborations. These new frontiers represent a significant investment, demanding substantial R&D resources.

These exploratory efforts are characterized by their high-risk, high-reward nature. By pursuing these avenues, Genmab aims to tap into potentially lucrative new markets, diversifying its pipeline and future revenue streams.

- Expanding Therapeutic Horizons: Genmab is moving into immunology and inflammation research.

- Collaborative Growth: Partnerships are key to entering these new areas.

- R&D Investment: Significant resources are allocated to these high-risk, high-reward ventures.

- Market Potential: The goal is to establish a presence in new, high-growth markets.

Genmab's 'Question Mark' assets, like Rinatabart sesutecan (Rina-S) and Acasunlimab, represent significant future growth opportunities but currently require substantial investment due to their nascent market presence. These candidates are in crucial development stages, with Rina-S in Phase 3 and Acasunlimab in Phase 2 trials, highlighting their high-risk, high-reward profile. The company's strategic expansion into new therapeutic areas like immunology and inflammation, often through collaborations, also falls into this category, demanding considerable R&D resources to tap into potentially lucrative new markets.

| Asset/Platform | Stage | Market Potential | Investment Need | Genmab's Role |

|---|---|---|---|---|

| Rinatabart sesutecan (Rina-S) | Phase 3 | High (Endometrial, Ovarian Cancer) | High (Commercialization) | Post-acquisition development |

| Acasunlimab | Phase 2 | ~$1 Billion | High (Development & Market Capture) | Sole development |

| Novel ADC Platforms | Early-stage | High (>$10 Billion by 2028 for ADC market) | High (R&D, Product Translation) | Acquired technology |

| Immunology/Inflammation Research | Exploratory | High (New Markets) | High (R&D) | Strategic expansion |

BCG Matrix Data Sources

Our Genmab BCG Matrix is built on comprehensive data, including internal financial reports, clinical trial outcomes, and market share analysis, to accurately assess product performance and potential.