General Electric SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Electric Bundle

General Electric faces a dynamic market, balancing its established industrial might against evolving technological landscapes and intense competition. Understanding these internal strengths and external threats is crucial for any strategic player.

Want the full story behind GE's diversification, innovation potential, and the challenges it navigates? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

GE Aerospace commands a formidable market leadership in aviation, powering a significant portion of global commercial flights. With an installed base exceeding 45,000 engines, GE is a dominant force in the aerospace sector.

This vast installed base is a critical strength, translating into substantial, recurring revenue streams from aftermarket services. In 2023, these services represented roughly 70% of GE Aerospace's adjusted revenue, underscoring their importance to the company's profitability and financial stability.

The inherent long operational life of aircraft engines, often spanning three decades or more, solidifies GE's customer relationships. This extended lifecycle ensures a captive market for essential maintenance, repair, and overhaul (MRO) services, creating a predictable and enduring revenue pipeline.

Following its spin-off, GE Aerospace has showcased impressive financial resilience. In 2024, the company reported double-digit growth in orders and adjusted revenue, alongside substantial increases in operating profit and robust free cash flow generation. This performance has led to repeated upward revisions of its profit outlook for both 2024 and 2025.

The company's financial strength is further underscored by projections for continued expansion in operating profit and free cash flow extending through 2028. This solid financial foundation allows GE Aerospace to actively return capital to shareholders via dividends and share repurchases, thereby bolstering investor confidence and signaling a positive future trajectory.

General Electric's technological prowess is a significant strength, particularly within GE Aerospace. The company consistently invests heavily in research and development, with approximately $2.7 billion allocated in 2024. This dedication fuels innovation in critical areas such as Open Fan engine architecture, hybrid-electric propulsion, and advanced adaptive cycle engines.

This forward-thinking approach ensures GE remains at the forefront of aviation technology. Their commitment to developing more fuel-efficient and environmentally conscious solutions, exemplified by the LEAP engine and the CFM RISE program, directly addresses global sustainability demands and solidifies their leadership in shaping the future of flight.

Resilient Business Model with High Aftermarket Revenue

General Electric's business model demonstrates remarkable resilience, bolstered by its diversified presence across narrowbody, widebody, regional, and defense aircraft platforms. A substantial portion of its revenue originates from aftermarket services, which are crucial for maintaining stable and predictable cash flows. This service-based income stream creates a sticky customer base, as airlines typically commit to long-term engine service agreements.

The consistent demand for maintenance, repair, and spare parts, especially for the growing fleet of aging aircraft, significantly strengthens GE's competitive position. For instance, GE Aviation's services segment has historically been a strong performer, contributing significantly to overall profitability. In 2023, GE reported that its Aviation segment revenue grew by 15% to $30.5 billion, with services playing a key role in this expansion, reflecting the ongoing need for engine upkeep and upgrades.

- Diversified Platform Exposure: GE's presence across various aircraft types mitigates risks associated with any single market segment.

- Stable Aftermarket Revenue: Service contracts provide predictable and recurring revenue streams, enhancing financial stability.

- High Demand for Services: The need for maintenance and spare parts, particularly for the extensive global aircraft fleet, ensures sustained demand.

- Customer Lock-in: Once an engine supplier is chosen, airlines are generally committed to their service agreements, creating a loyal customer base.

Experienced Leadership and Operational Excellence

General Electric's strength lies in its experienced leadership, particularly with CEO Larry Culp at the helm of GE Aerospace, who has a proven track record of creating substantial shareholder value. This seasoned management team is instrumental in navigating complex market dynamics and driving strategic initiatives.

The company's operational excellence is anchored by its proprietary 'FLIGHT DECK' lean operating model. This systematic approach is designed to consistently improve safety, quality, delivery, and cost efficiency across its operations, directly impacting financial performance and customer satisfaction.

This commitment to continuous improvement and a customer-centric culture, reinforced by an unwavering focus on safety, provides a solid foundation for GE Aerospace. It instills confidence in their ability to consistently deliver value to both their customers and shareholders.

For example, GE Aerospace reported a significant increase in revenue for the first quarter of 2024, reaching $7.7 billion, a 13% increase year-over-year, demonstrating the tangible results of their operational focus and leadership.

GE Aerospace's market position is a significant strength, evidenced by its substantial installed base of over 45,000 engines powering a large portion of global commercial flights. This dominance translates into consistent, recurring revenue from aftermarket services, which represented approximately 70% of GE Aerospace's adjusted revenue in 2023.

The long lifecycle of aircraft engines, often exceeding three decades, fosters deep customer relationships and a captive market for essential maintenance, repair, and overhaul (MRO) services. This creates a predictable and enduring revenue stream for the company.

GE Aerospace demonstrated robust financial performance in 2024, with double-digit growth in orders and adjusted revenue, alongside strong increases in operating profit and free cash flow. The company has also seen repeated upward revisions to its profit outlook for both 2024 and 2025, projecting continued expansion through 2028.

General Electric's technological leadership, particularly in aviation, is a key strength. The company invests heavily in R&D, allocating around $2.7 billion in 2024 to drive innovation in areas like Open Fan architecture and hybrid-electric propulsion, ensuring it remains at the forefront of aviation advancements.

| Metric | 2023 (GE Aerospace) | 2024 (Projected) | 2025 (Projected) |

| Adjusted Revenue Growth | 15% | Double-digit | Double-digit |

| Aftermarket Services Revenue Share | ~70% | Expected to remain strong | Expected to remain strong |

| R&D Investment | N/A | ~$2.7 billion | N/A |

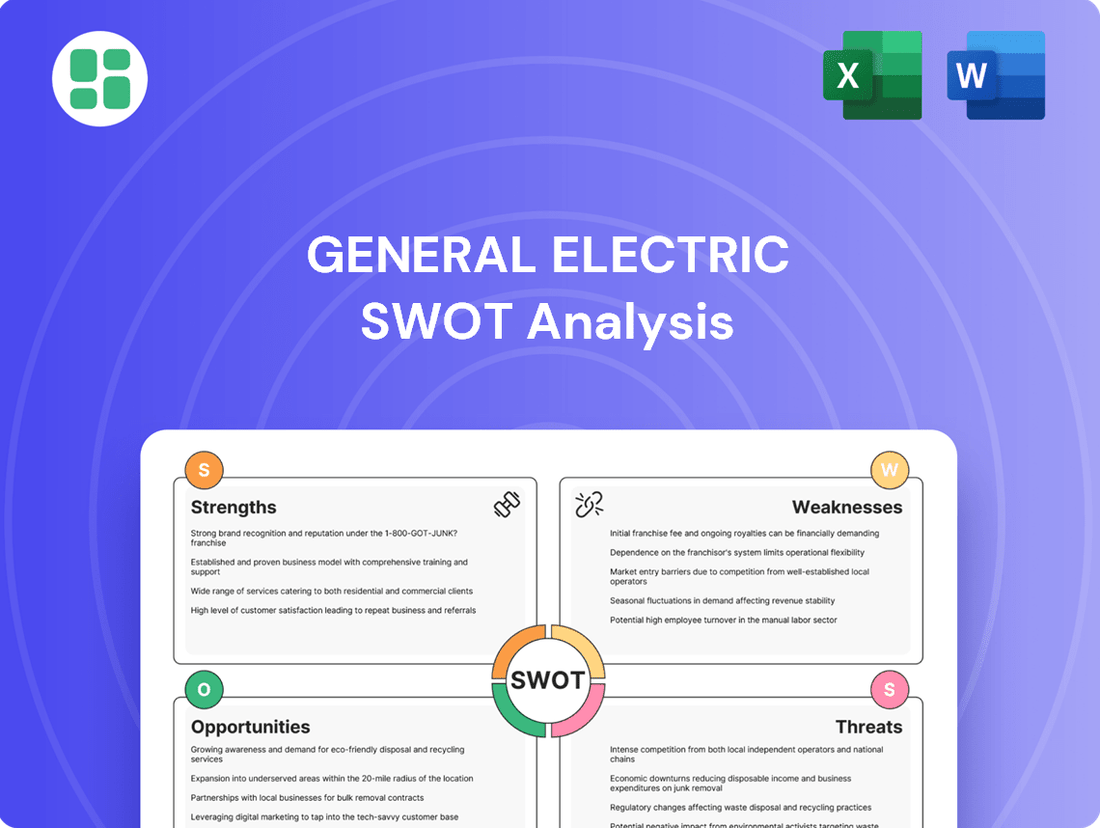

What is included in the product

Delivers a strategic overview of General Electric’s internal strengths and weaknesses, alongside external opportunities and threats.

Offers a clear, actionable framework to address GE's complex challenges by identifying strategic opportunities and mitigating potential threats.

Weaknesses

General Electric, particularly its GE Aerospace division, is facing significant headwinds from persistent supply chain constraints. Despite robust demand for its jet engines, the company continues to struggle with shortages of critical materials and a lack of skilled labor. These ongoing issues directly affect its ability to ramp up production, impacting revenue forecasts and delivery schedules.

For 2024, GE Aerospace has already revised its LEAP engine production targets downward due to these supply chain bottlenecks. The expectation is that these challenges will extend well into 2025, creating further delays for airlines and aircraft manufacturers eager to expand their fleets. This situation underscores the difficulty in achieving supply chain stability amidst uneven improvements among suppliers and sustained demand for aftermarket services.

GE Aerospace's significant reliance on a few key airframers, primarily Boeing and Airbus, presents a notable weakness. For instance, Boeing's production challenges in 2024 have directly impacted GE's engine deliveries and revenue streams, highlighting the vulnerability of this concentrated customer base.

The commercial aviation market, a substantial portion of GE Aerospace's business, is inherently cyclical. Economic slowdowns, geopolitical instability, and unforeseen events like pandemics can drastically reduce air travel demand. This sensitivity means that a downturn in global travel, as experienced during past crises, can lead to a sharp decline in new aircraft orders and engine service demand, directly affecting GE's financial performance.

General Electric's commitment to innovation, particularly in areas like Open Fan and hybrid-electric propulsion, comes with substantial research and development (R&D) costs. These significant investments in cutting-edge aerospace technologies require considerable capital and extended timelines before generating returns.

The high fixed costs associated with engine development, coupled with potential regulatory delays for novel technologies, create financial pressure. GE's need to maintain its technological edge mandates ongoing, large-scale R&D expenditures, which can impact short-to-medium term profitability.

Legacy Issues and Transformation Risks

General Electric (GE) continues to grapple with the residual effects of its expansive conglomerate structure, even after significant divestitures. While the company has made strides in debt reduction, with total debt decreasing from approximately $110 billion at the end of 2018 to around $44 billion by the end of 2023, the legacy of past financial commitments still influences its operational capacity.

The recent spin-off of GE Aerospace, while a strategic move towards a more focused business, introduces inherent complexities. Optimizing operations within this newly independent entity requires meticulous attention to detail, ensuring that the separation fully unlocks efficiency gains and allows for agile adaptation to market dynamics. The success of this transformation hinges on GE Aerospace's ability to leverage its core strengths without being encumbered by the operational or financial overhangs of its former diversified structure.

Furthermore, the historical performance of GE's divested segments serves as a stark reminder of the critical need for stringent management discipline. The newly independent GE Aerospace must maintain a vigilant approach to capital allocation and strategic execution to avoid repeating past missteps and to solidify its position as a leading aviation technology provider.

- Legacy Debt Burden: GE's total debt has been reduced significantly, but the impact of prior financial leverage continues to shape its capital structure and investment capacity.

- Transformation Complexity: The full operational and financial optimization of GE Aerospace as a standalone entity presents ongoing challenges in adapting to a focused business model.

- Past Performance as a Precedent: Historical issues in other GE segments underscore the imperative for disciplined management and strategic oversight within the newly independent aerospace business.

Potential for Intense Competition

GE Aerospace operates in a highly competitive landscape. Key rivals like Pratt & Whitney, Rolls-Royce, and Safran are formidable players in both commercial and defense aviation. These competitors are also investing heavily in new engine technologies and seeking to capture market share.

The intensity of this competition means GE Aerospace must continually innovate and manage costs effectively. For instance, Pratt & Whitney's geared turbofan engine is a significant competitor in the narrow-body market. Rolls-Royce is also making strides with its UltraFan technology. Staying ahead requires substantial R&D investment and efficient production processes to maintain its leading position and secure lucrative long-term contracts.

- Pratt & Whitney: A major competitor, particularly in the narrow-body commercial aircraft engine market with its Geared Turbofan (GTF) technology.

- Rolls-Royce: A key player in wide-body aircraft engines and a direct competitor across various segments, developing advanced technologies like UltraFan.

- Safran: Another significant competitor, often partnering with GE in joint ventures but also competing independently in engine components and systems.

- Market Share Pressure: Intense rivalry puts constant pressure on GE Aerospace to win new engine orders and aftermarket service contracts, impacting revenue and profitability.

GE Aerospace faces significant challenges due to ongoing supply chain disruptions, impacting its ability to meet demand for its jet engines. These constraints, including shortages of critical materials and skilled labor, have led to revised production targets for 2024 and are expected to persist into 2025, affecting delivery schedules and revenue. The company's reliance on a few major customers, like Boeing, further amplifies its vulnerability to production issues within its customer base.

Full Version Awaits

General Electric SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for General Electric. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after checkout. This ensures you receive the full, professionally structured report you expect.

Opportunities

The International Air Transport Association (IATA) anticipates a strong 5.8% growth in global air passenger traffic for 2025 compared to 2024. This expanding market directly fuels demand for new aircraft and engines, a core offering of GE Aerospace.

This surge in travel necessitates increased production and maintenance for existing aircraft fleets, creating substantial opportunities for GE's aftermarket services. The industry's current record-high order backlog for new aircraft further solidifies this positive outlook for GE Aerospace.

The persistent production delays from major aircraft manufacturers like Boeing and Airbus are directly benefiting GE Aerospace by extending the operational life of existing aircraft fleets. This scenario naturally boosts the demand for maintenance, repair, and overhaul (MRO) services, presenting a significant growth avenue.

Given that aftermarket services already represent a substantial portion, around 70%, of GE Aerospace's total revenue, this extended aircraft lifespan translates into a robust opportunity. The company can capitalize on increased sales of spare parts and a higher volume of internal shop visits, securing a resilient and growing revenue stream even as new aircraft deliveries face headwinds.

The increasing global demand for reduced carbon emissions in aviation presents a significant opportunity for GE Aerospace. By investing in technologies such as Open Fan engine architecture and hybrid-electric propulsion, GE is positioning itself to meet the future market need for environmentally friendly flight solutions. The company's focus on developing engines compatible with Sustainable Aviation Fuel (SAF) further strengthens this advantage.

Collaborations with key industry players like NASA and Airbus are crucial for accelerating the development and adoption of these sustainable aviation technologies. These partnerships can lead to faster innovation cycles and wider market penetration for GE's greener flight offerings, potentially capturing a larger share of the evolving aerospace market in the coming years.

Growth in Defense and Military Programs

General Electric Aerospace is a major player in the defense sector, supplying engines and essential systems for military aircraft. The company's Defense & Propulsion Technologies segment is a substantial revenue driver. This robust performance is bolstered by increasing global defense spending, projected to reach $2.29 trillion in 2024, according to the International Institute for Strategic Studies. This trend fuels demand for advanced military platforms, offering GE significant opportunities for new contracts and market expansion. Continued investment in cutting-edge defense technologies further solidifies GE's competitive edge in this vital industry.

Key opportunities within defense and military programs include:

- Securing new contracts: The rising global defense budgets present a fertile ground for GE Aerospace to win new business in aircraft engines and propulsion systems.

- Expansion in next-generation platforms: Demand for advanced military aircraft and rotorcraft provides avenues for GE to integrate its technologies into future defense assets.

- Strengthening strategic partnerships: Collaborations with defense ministries and prime contractors globally can enhance GE's position in this strategically critical sector.

- Leveraging R&D investments: Ongoing investment in advanced defense technologies allows GE to maintain its technological leadership and offer state-of-the-art solutions.

Strategic Partnerships and Acquisitions

General Electric's (GE) strategy of focused mergers, acquisitions, and strategic partnerships, particularly within GE Aerospace, is a key opportunity for sustained growth. This approach prioritizes clear synergies, ensuring that any deals align with the company's capital allocation framework. For instance, the enduring success of the CFM International joint venture with Safran, a leader in aircraft engines, demonstrates the power of shared development costs and expanded market access. By continuing to leverage these existing collaborations and actively seeking new ones, GE can significantly enhance its technological prowess, diversify its product offerings, and solidify its competitive standing in the aerospace sector.

Opportunities in this area include:

- Targeted M&A: GE Aerospace's capital allocation framework emphasizes disciplined M&A to unlock strategic, operational, and financial synergies, driving growth through carefully selected acquisitions.

- Strengthening Joint Ventures: The CFM International partnership with Safran exemplifies a successful model for cost-sharing and market expansion in engine development, providing a blueprint for future collaborations.

- Expanding Technological Capabilities: By forging new strategic alliances, GE can gain access to innovative technologies and accelerate its own research and development efforts, staying ahead in a competitive market.

- Broadening Product Portfolios: Partnerships and acquisitions allow GE to offer a more comprehensive range of products and services, catering to a wider customer base and increasing revenue streams.

The global aviation industry is experiencing a robust recovery, with the International Air Transport Association (IATA) forecasting a strong 5.8% growth in global air passenger traffic for 2025 compared to 2024. This expansion directly translates into increased demand for new aircraft and engines, a core strength of GE Aerospace. Furthermore, the industry's substantial order backlog for new aircraft, coupled with persistent production delays from major manufacturers, creates a sustained need for maintenance, repair, and overhaul (MRO) services, which already constitute about 70% of GE Aerospace's revenue.

GE Aerospace is well-positioned to capitalize on the growing demand for sustainable aviation solutions, investing in technologies like Open Fan engine architecture and hybrid-electric propulsion. The company's focus on engines compatible with Sustainable Aviation Fuel (SAF) and strategic partnerships with entities like NASA and Airbus are key to accelerating the development and adoption of these environmentally friendly flight options. In the defense sector, rising global defense spending, projected to reach $2.29 trillion in 2024, presents significant opportunities for GE to secure new contracts and expand its market share with advanced military propulsion systems.

The company's strategy of targeted mergers, acquisitions, and strengthening joint ventures, such as the successful CFM International partnership with Safran, offers a clear path for sustained growth. These collaborations enhance technological capabilities, broaden product portfolios, and provide expanded market access. GE Aerospace's disciplined approach to capital allocation ensures that these strategic moves unlock synergies and drive value.

| Opportunity Area | Key Driver | GE Aerospace Relevance | 2024/2025 Data Point |

|---|---|---|---|

| Aviation Market Growth | Increased passenger traffic | Higher demand for new engines and aftermarket services | 5.8% projected global air passenger traffic growth (2025 vs 2024) |

| Aftermarket Services | Extended aircraft lifespans due to production delays | Increased demand for MRO and spare parts | Aftermarket services represent ~70% of GE Aerospace revenue |

| Sustainable Aviation | Global push for reduced emissions | Investment in SAF-compatible engines and new propulsion tech | Partnerships with NASA and Airbus accelerating development |

| Defense Sector Expansion | Rising global defense budgets | Opportunities for military aircraft engine contracts | Global defense spending projected at $2.29 trillion in 2024 |

| Strategic Partnerships & M&A | Synergies and market access | Leveraging joint ventures like CFM International | Successful CFM JV with Safran |

Threats

Persistent global supply chain disruptions, marked by shortages of critical materials and labor, present a substantial threat to GE Aerospace's production capacity and its ability to fulfill market demand. These ongoing issues can drive up manufacturing expenses, postpone engine deliveries, and extend maintenance schedules for operational aircraft, ultimately affecting financial results and customer contentment. Analysts anticipate these challenging conditions to persist at least through 2025, with some sectors experiencing extended lead times for key components.

Economic downturns pose a significant threat to General Electric, particularly through its aviation segment. A projected global economic slowdown in 2024-2025 could curtail consumer and business travel, directly impacting airline profitability and their capacity to purchase new aircraft. This reduced demand for new planes, like GE Aerospace's LEAP engines, can lead to fewer orders and slower revenue growth.

Geopolitical instability, including ongoing trade disputes and regional conflicts, further exacerbates these risks. Disruptions to global supply chains, a critical element for GE's manufacturing operations, can lead to increased costs and production delays. For instance, the ongoing tensions in Eastern Europe have already demonstrated the vulnerability of international logistics, potentially increasing raw material costs and impacting delivery timelines for GE's diverse product lines.

General Electric Aerospace faces significant threats from intensifying competition. Rivals such as Pratt & Whitney and Rolls-Royce are formidable, especially in the lucrative commercial engine market. This rivalry directly translates into pricing pressure on both new engine sales and crucial aftermarket services, potentially squeezing GE's profit margins.

Furthermore, competitors' technological breakthroughs or aggressive market tactics could chip away at GE Aerospace's established market share. For instance, in 2024, the aerospace industry continues to see substantial R&D investments from all major players, aiming for greater fuel efficiency and reduced emissions, which could rapidly shift competitive dynamics.

Regulatory and Environmental Policy Changes

Changes in aviation regulations, especially concerning environmental emissions and aircraft safety, pose a significant ongoing threat to General Electric. GE Aerospace's substantial investments in sustainable technologies might still fall short of rapidly evolving, stringent new standards, potentially necessitating expensive research and development and manufacturing overhauls.

Increased regulatory oversight on major airframers, such as Boeing, can create ripple effects, directly impacting GE's production timelines and delivery schedules for collaborative programs. For instance, the ongoing scrutiny of the Boeing 737 MAX program has previously influenced GE's engine output and financial projections.

- Evolving Emission Standards: New international and national targets for aviation carbon emissions, potentially introduced in 2024 or 2025, could require accelerated development of more fuel-efficient engines, impacting GE's existing product roadmaps.

- Safety Mandates: Stricter airworthiness directives or certification requirements for new aircraft models could lead to costly redesigns or delays in engine deliveries, affecting GE's revenue streams.

- Supply Chain Scrutiny: Broader regulatory attention on the aerospace supply chain, including component manufacturing and testing, could impose additional compliance burdens and costs on GE's operations.

Technological Obsolescence and Cybersecurity Risks

GE Aerospace faces a significant threat from technological obsolescence. The relentless pace of innovation in aerospace engineering means that current engine technologies could quickly become outdated, necessitating substantial and continuous investment in research and development to maintain a competitive edge. For instance, the push for more sustainable aviation fuels and electric propulsion systems requires ongoing adaptation.

Cybersecurity risks are another major concern. As GE Aerospace increasingly integrates digital systems and relies on interconnected supply chains, its exposure to cyber threats escalates. These risks include potential data breaches that could compromise sensitive intellectual property or operational disruptions that could halt critical production lines, impacting delivery schedules and revenue. In 2023, the aerospace and defense sector experienced a notable increase in cyberattacks, highlighting the pervasive nature of this threat.

- Technological Obsolescence: Continuous R&D investment is crucial to prevent existing engine technologies from becoming obsolete due to rapid advancements in aerospace engineering.

- Cybersecurity Vulnerabilities: Increased reliance on digital systems and interconnected supply chains exposes GE Aerospace to data breaches and operational disruptions.

- R&D Expenditure: Staying ahead in engine technology requires significant capital allocation towards research and development, impacting profitability if not managed efficiently.

- Supply Chain Resilience: Ensuring the security and integrity of digital components within the supply chain is vital to mitigate operational risks.

Intensified competition from rivals like Pratt & Whitney and Rolls-Royce poses a significant threat, particularly in the commercial engine market, leading to pricing pressures on both new sales and aftermarket services. Evolving emission standards and safety mandates, potentially introduced in 2024-2025, could necessitate costly redesigns and impact GE's existing product roadmaps, while cybersecurity risks and technological obsolescence demand continuous, substantial R&D investment to maintain market position.

SWOT Analysis Data Sources

This General Electric SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to provide a robust and actionable assessment.