General Electric Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Electric Bundle

General Electric faces a complex competitive landscape, with significant bargaining power from both suppliers and buyers impacting its profitability. The threat of new entrants is moderate, while the intensity of rivalry among existing players, including competitors in aviation, healthcare, and energy, is high.

The full Porter's Five Forces Analysis reveals the real forces shaping General Electric’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

General Electric's Aerospace division faces substantial supplier bargaining power from specialized component manufacturers. These suppliers provide critical engine parts and advanced materials with unique specifications and rigorous quality demands, making switching costly and difficult for GE.

The proprietary nature of much of this technology further solidifies the suppliers' leverage. For instance, the aerospace industry often requires components manufactured to extremely precise tolerances, with materials developed through extensive research and development, creating high barriers to entry for new suppliers and reinforcing the power of existing ones.

Recent supply chain challenges have underscored this vulnerability. Disruptions in the availability of these specialized components can directly impact GE Aerospace's production schedules and profitability, demonstrating the significant influence these key suppliers wield in the market.

The cost and complexity involved in switching suppliers for certified aircraft engine components are extremely high for GE Aerospace. Re-tooling, re-certification, and the need to maintain consistent performance and safety standards create substantial barriers to changing suppliers, thereby strengthening supplier power. This makes GE more dependent on its existing supplier relationships, even if prices increase.

The aerospace industry's reliance on specialized, complex engine parts means its supply chain is often concentrated. A few key suppliers dominate the provision of niche components, giving them significant leverage.

This supplier concentration allows these dominant players to exert considerable influence over pricing, terms, and delivery timelines. For instance, in 2024, GE Aerospace, like other major engine manufacturers, faces a landscape where a limited number of advanced materials and component providers hold substantial market power.

To counter this, GE Aerospace strategically invests in its supplier partners, fostering their technological capabilities and capacity. This proactive approach aims to build more resilient relationships and mitigate the risks associated with a concentrated supplier base, ensuring more stable operations and favorable terms.

Impact of Raw Material Costs

Suppliers in the aerospace sector, particularly those providing specialized metals and composites crucial for engine production, are vulnerable to shifts in raw material prices. For instance, the price of titanium, a key component, experienced significant volatility in 2023, with some grades seeing increases of over 15% due to supply chain disruptions and increased demand from various industries. These cost escalations are frequently transferred to GE Aerospace, directly affecting its manufacturing expenses and profitability.

The extent to which suppliers can pass these increased costs onto GE Aerospace is a direct measure of their bargaining power. In early 2024, reports indicated that some key material suppliers for the aerospace industry were negotiating price increases of 5-10% for the upcoming year, citing energy costs and labor shortages as primary drivers. This ability to command higher prices without losing significant business underscores their leverage.

- Raw Material Price Volatility: Suppliers of specialized metals and composites face price fluctuations, impacting GE Aerospace's costs.

- Cost Pass-Through: Suppliers can often pass increased raw material expenses directly to GE Aerospace.

- Supplier Leverage: The ability to pass on costs is a key indicator of supplier bargaining power.

- 2023-2024 Trends: Witnessed price hikes in materials like titanium, with suppliers seeking further increases in 2024.

Proprietary Technology and Patents

Many suppliers possess proprietary technology and patents for critical aerospace components, creating a significant barrier for General Electric (GE) Aerospace to find alternative sources. This intellectual property grants these suppliers considerable bargaining power, especially when GE requires advanced materials or specialized sub-systems for its cutting-edge jet engines. For instance, in 2024, GE Aerospace continued to rely on a select group of suppliers for high-temperature alloys and advanced composite materials, where patent protection limits readily available substitutes.

This reliance on patented technology translates into leverage for suppliers during price negotiations. GE's internal research and development efforts are crucial in mitigating this supplier power by seeking to develop in-house capabilities or identify technologies that can reduce dependence on these proprietary sources. The ability to innovate and potentially replicate or find workarounds for patented components is a key strategy for GE to maintain its competitive edge and control costs.

- Supplier Patents: Suppliers hold patents on essential aerospace materials and sub-systems, limiting GE's sourcing options.

- Negotiating Leverage: Proprietary technology gives suppliers increased power in pricing and contract terms.

- GE's Mitigation: GE Aerospace invests in R&D to reduce reliance on single-source, patented technologies.

- 2024 Impact: Continued dependence on specialized suppliers for advanced materials in 2024 highlighted this ongoing challenge.

General Electric's Aerospace division grapples with significant supplier bargaining power, particularly from those providing specialized, high-specification components and advanced materials. This leverage stems from the proprietary nature of many technologies and the high costs associated with switching suppliers, creating dependencies that can influence pricing and terms. For example, in 2024, the aerospace industry continued to see a concentration of suppliers for critical engine parts, allowing them to command higher prices and favorable contract conditions.

| Key Factor | Impact on GE Aerospace | 2024 Trend/Example |

| Supplier Concentration | Limited sourcing options increase supplier leverage. | Few dominant suppliers for advanced alloys and composites. |

| Proprietary Technology | High switching costs and reliance on patented components. | GE's continued dependence on specific suppliers for critical sub-systems. |

| Raw Material Volatility | Suppliers pass on increased costs for materials like titanium. | Price increases for key aerospace metals, impacting GE's manufacturing expenses. |

| Cost Pass-Through Ability | Suppliers can effectively transfer cost escalations to GE. | Negotiated price hikes of 5-10% by material suppliers in early 2024. |

What is included in the product

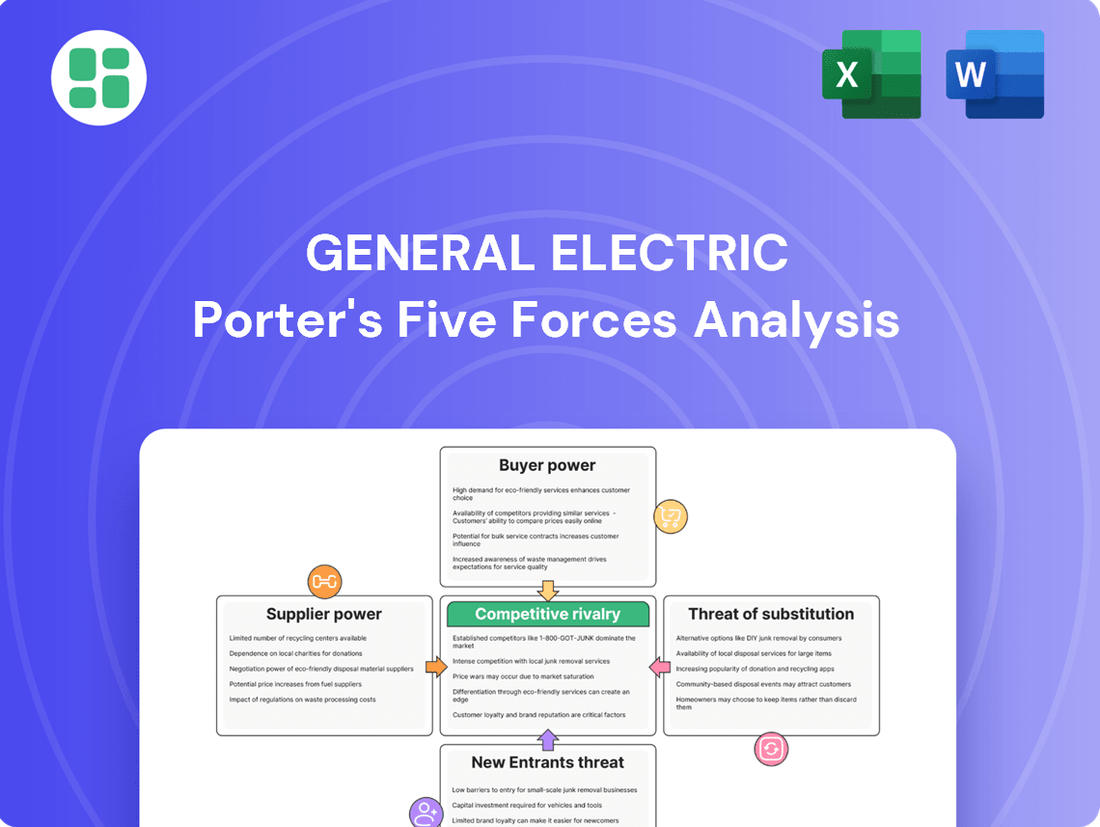

Tailored exclusively for General Electric, analyzing its position within its competitive landscape by examining the intensity of rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitutes.

Instantly visualize GE's competitive landscape, identifying key threats and opportunities with a dynamic, interactive five forces dashboard.

Customers Bargaining Power

General Electric Aerospace faces significant bargaining power from its customers due to a consolidated customer base. Its primary clients include major airlines, defense departments, and aircraft manufacturers such as Boeing and Airbus.

The sheer volume of purchases made by these large entities, especially in the commercial engine sector, grants them considerable leverage. This means individual customers, particularly the largest ones, can negotiate prices and contract terms effectively, impacting GE's profitability.

Long-term service agreements (LTSAs) are a cornerstone of GE Aerospace's revenue, particularly for engine maintenance, repair, and overhaul (MRO). These contracts, while ensuring predictable income, also empower customers. For instance, in 2023, GE Aerospace reported that its Services segment, heavily reliant on LTSAs, generated substantial revenue. This reliance means customers have leverage, especially when negotiating terms or during renewal periods, as they consider the total cost of ownership for their GE engines.

Airlines are incredibly sensitive to aircraft engine prices and maintenance costs. In 2024, the average operating cost per available seat mile for a major US airline was around $0.12, with fuel and maintenance being significant components. This means even small fluctuations in engine pricing can heavily impact their bottom line, giving them considerable leverage when negotiating with suppliers like General Electric.

The sheer cost of acquiring and maintaining an aircraft fleet means airlines are constantly looking for ways to reduce capital expenditure and operating expenses. For instance, the list price for a new Boeing 737 MAX can range from $100 million to over $130 million, with engines representing a substantial portion of that cost. This financial pressure allows airlines to demand competitive pricing and favorable long-term service agreements, directly impacting GE Aviation's pricing power.

Standardization and Interchangeability

While aircraft engines are incredibly sophisticated, a degree of standardization and the potential for interchangeability between manufacturers like GE and Rolls-Royce for specific aircraft models can empower customers. This ability to switch, even with significant switching costs, provides a foundation for negotiation, as customers can leverage the availability of alternatives.

For instance, airlines operating fleets that can accommodate engines from multiple suppliers may use this flexibility to secure more favorable terms. The existence of these options, even if not always exercised, influences pricing and contract negotiations.

- Interchangeability: The ability for an airline to select engines from different manufacturers for the same aircraft type.

- Negotiation Leverage: Customers can use the presence of alternative suppliers to bargain for better pricing, service agreements, or delivery schedules.

- Switching Costs: While engines are complex, the underlying airframe compatibility can reduce the perceived barrier to switching, impacting bargaining power.

Customer Knowledge and Transparency

Sophisticated customers, particularly major airlines, wield significant bargaining power due to their deep understanding of engine performance, fuel efficiency, and lifecycle maintenance costs across various manufacturers. This heightened customer knowledge, amplified by industry benchmarks and competitive bidding processes, enables them to negotiate more favorable terms and services from GE Aerospace.

For instance, in 2024, airlines continue to scrutinize total cost of ownership, pushing engine manufacturers for greater transparency in pricing and maintenance agreements. The availability of detailed performance data allows these buyers to effectively compare offerings and exert pressure for better value, impacting GE Aerospace's pricing strategies and service level agreements.

- Informed Decision-Making: Airlines leverage comprehensive data on engine reliability and fuel consumption to negotiate pricing and service contracts.

- Competitive Benchmarking: Industry-wide comparisons of engine performance and maintenance expenses empower customers to demand competitive offerings.

- Cost-Conscious Procurement: The focus on total cost of ownership in 2024 procurement cycles means customers are more adept at identifying and demanding cost efficiencies from suppliers like GE Aerospace.

General Electric Aerospace's customers, primarily large airlines and defense entities, possess substantial bargaining power. Their significant purchase volumes and sensitivity to operating costs, such as the average operating cost per available seat mile for US airlines in 2024 being around $0.12, allow them to negotiate favorable pricing and contract terms. The high cost of aircraft, with a Boeing 737 MAX costing upwards of $130 million, further amplifies this leverage as airlines seek to minimize total cost of ownership.

| Customer Segment | Key Bargaining Factors | Impact on GE Aerospace |

|---|---|---|

| Major Airlines | High purchase volume, sensitivity to operating costs (e.g., maintenance, fuel efficiency), long-term service agreements (LTSAs) | Ability to negotiate pricing, service terms, and potentially influence product development; LTSAs provide predictable revenue but also customer leverage during renewals. |

| Defense Departments | Large, long-term contracts, specific performance requirements, potential for sole-sourcing or competitive bidding | Can dictate terms on specialized engine development and support; government procurement processes can be lengthy and price-sensitive. |

| Aircraft Manufacturers (e.g., Boeing, Airbus) | Integration of engines into airframes, volume commitments, potential for alternative supplier selection | Negotiate engine pricing and delivery schedules as part of broader aircraft sales packages; influence engine design for compatibility. |

Same Document Delivered

General Electric Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of General Electric, detailing the competitive landscape and strategic implications. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights without any placeholders or generic content. You are looking at the actual document, ensuring you get a complete and ready-to-use analysis of GE's industry environment upon completing your transaction.

Rivalry Among Competitors

The global aircraft engine market is a tight race with only a few major contenders: GE Aerospace, Rolls-Royce, and Pratt & Whitney, which is part of RTX. This limited number of dominant companies creates a highly competitive environment.

This oligopolistic setup means these giants are constantly battling for new engine contracts and the lucrative aftermarket services that follow. It’s a high-stakes game in an industry that demands massive upfront investment, making market share a critical objective for each player.

For instance, GE Aerospace reported approximately $32.3 billion in revenue for 2023, showcasing the scale of operations these companies manage. The intense rivalry drives innovation and strategic maneuvering as they vie for dominance in this capital-intensive sector.

General Electric's aircraft engine division faces intense rivalry, partly due to the immense fixed costs involved in R&D and manufacturing. For instance, developing a new jet engine can cost billions of dollars, a significant barrier to entry and a commitment that necessitates continuous operation.

These high upfront investments, coupled with the lengthy product lifecycles of aircraft engines, create substantial exit barriers for GE. Companies are essentially locked into the industry, compelling them to maintain competitive pricing and innovation even when market demand softens, as seen in the post-pandemic recovery where order backlogs remain crucial.

Competitive rivalry in the aerospace sector is intensely fueled by relentless technological innovation. This innovation is particularly focused on enhancing fuel efficiency, minimizing emissions, and improving engine durability, critical factors for airlines and defense contractors.

Companies like GE Aerospace are making substantial investments in research and development to stay ahead. For instance, their commitment to programs like the CFM RISE (Revolutionary Innovation for Sustainable Engines) program and the development of the GE9X engine, the world's most powerful commercial aircraft engine, demonstrates this drive. These advancements are crucial for offering superior products that provide a distinct competitive edge and are key to securing lucrative, long-term contracts in a market where performance and efficiency are paramount.

Long Product Lifecycles and Aftermarket Focus

Aircraft engines boast exceptionally long operational lives, often spanning decades. This longevity shifts the competitive battlefield beyond the initial sale, with aftermarket services like maintenance, repair, and overhaul (MRO), along with spare parts, becoming crucial revenue and profit drivers for manufacturers such as General Electric (GE) Aerospace. The ongoing rivalry centers on securing these lucrative, long-term service contracts.

GE Aerospace, for instance, generated approximately 50% of its revenue from services in 2023, highlighting the critical importance of the aftermarket. This focus means competition is not just about selling new engines, but about building and maintaining strong relationships through reliable and cost-effective support throughout the engine's lifecycle. The aftermarket segment is characterized by intense competition among major players aiming to capture a larger share of the ongoing service revenue.

- Long Product Lifecycles: Aircraft engines are designed for decades of service, extending the competitive arena beyond initial purchase.

- Aftermarket Dominance: Revenue from MRO and spare parts constitutes a substantial portion of a manufacturer's lifetime profit.

- Service Contract Rivalry: Competition intensifies as companies vie for long-term service agreements, ensuring sustained customer engagement.

- GE Aerospace Example: Services accounted for roughly 50% of GE Aerospace's revenue in 2023, underscoring the aftermarket's financial significance.

Strategic Partnerships and Joint Ventures

Competitors frequently form strategic partnerships to share development expenses and mitigate risks, a strategy exemplified by GE's CFM International joint venture with Safran. This collaboration, a cornerstone of GE's aerospace engine business, has been instrumental in developing and marketing successful engine models, contributing significantly to GE Aerospace's revenue. For instance, CFM International's LEAP engine family, a product of this partnership, was a leading engine choice for new narrow-body aircraft deliveries in 2024, underscoring the venture's market impact.

While such alliances can lessen direct rivalry in specific product categories, they simultaneously introduce intricate competitive dynamics across the wider industry landscape. These partnerships can lead to concentrated market power in certain segments, influencing pricing and innovation strategies for other market participants. The success of CFM International highlights how joint ventures can create formidable competitive advantages, shaping the overall competitive intensity within the aerospace manufacturing sector.

- GE's CFM International joint venture with Safran is a prime example of strategic partnerships aimed at cost and risk sharing in the aerospace sector.

- CFM International's LEAP engine family, a product of this partnership, was a dominant engine choice for new narrow-body aircraft in 2024, demonstrating the venture's commercial success.

- These partnerships can **reduce direct competition in specific segments** but also foster complex competitive dynamics throughout the broader market.

- The success of such ventures can **influence pricing, innovation, and market concentration** for other players in the industry.

The competitive rivalry in the aircraft engine market is exceptionally high, driven by a limited number of major players like GE Aerospace, Rolls-Royce, and Pratt & Whitney. This oligopoly forces intense competition for contracts and aftermarket services, with billions invested in R&D and manufacturing. The long lifecycles of engines mean aftermarket services, such as maintenance and repair, are crucial revenue streams, with GE Aerospace deriving about 50% of its 2023 revenue from services.

Strategic partnerships, like GE's CFM International joint venture with Safran, are common to share costs and risks. This venture's LEAP engine family was a leading choice for new narrow-body aircraft in 2024. While these alliances can reduce direct competition in specific areas, they also create complex dynamics and can lead to concentrated market power, impacting pricing and innovation for others in the sector.

| Company | 2023 Revenue (Approx.) | Key Product Focus | Aftermarket Revenue Share (Approx.) |

|---|---|---|---|

| GE Aerospace | $32.3 billion | Commercial & Military Engines | 50% |

| Rolls-Royce | £16.47 billion (2023) | Commercial & Defense Engines | Not Publicly Disclosed Separately |

| Pratt & Whitney (RTX) | Part of RTX's Collins Aerospace Segment | Commercial & Military Engines | Not Publicly Disclosed Separately |

SSubstitutes Threaten

While GE Aerospace's current dominance in jet engines for large aircraft is clear, the long-term threat of substitutes is significant. Emerging technologies like electric, hybrid-electric, and hydrogen propulsion are in early development but could fundamentally alter the aerospace landscape. For instance, by 2024, numerous startups and established players are investing billions in electric and hybrid-electric aviation, with some aiming for regional aircraft certification in the coming years.

For long-haul passenger and cargo transport, the threat of substitutes for air travel is very low. Modes like rail or sea simply cannot compete on speed or reach, meaning GE Aerospace's engine business faces minimal direct substitution risk in this core segment. This lack of viable alternatives reinforces the strong market position for aviation engines.

However, for shorter, regional routes, high-speed rail presents a marginal substitute. While not a direct replacement for air travel, increased investment in and adoption of high-speed rail networks, particularly in Europe and Asia, could indirectly impact demand for smaller aircraft engines used on these routes. For instance, Germany's ICE network continues to expand, offering competitive travel times between major cities that might otherwise be served by short-haul flights.

A significant threat of substitution for General Electric's (GE) new engine sales comes from the option for airlines to overhaul and repair their existing engines. Instead of purchasing brand-new, often more fuel-efficient models, carriers can opt for extensive maintenance and refurbishment of their current fleet. This can significantly extend the operational life of an engine, delaying or even negating the need for a new acquisition.

GE Aerospace’s robust Maintenance, Repair, and Overhaul (MRO) capabilities play a crucial role in managing this substitution threat. By offering attractive and cost-effective overhaul services, GE can make extending the life of older engines a more appealing proposition than outright replacement. However, this strategy inherently competes with their own new engine sales, as a well-maintained older engine might still be considered sufficient for an airline's needs for a longer period.

The economic climate heavily influences this substitution dynamic. During periods of economic uncertainty or high operating costs, airlines are more likely to prioritize MRO services over capital expenditures for new engines. For instance, in 2024, many airlines continued to focus on fleet optimization and cost management, which often translates to increased investment in engine overhauls rather than new aircraft purchases, directly impacting GE's new engine order book.

Advancements in Existing Engine Technology

Continuous advancements in existing engine technologies, like General Electric's LEAP engine, directly reduce the threat of substitutes. For instance, the LEAP-1B engine, powering the Boeing 737 MAX, offers a 15% improvement in fuel efficiency compared to its predecessor, making it a more compelling option than exploring entirely new propulsion systems for many airlines. These incremental yet significant upgrades within the current turbofan framework diminish the urgency for airlines to seek out radically different or unproven alternatives.

The focus on enhancing current-generation engines, such as extending their time-on-wing and improving reliability, also serves as a powerful deterrent to substitutes. For example, GE Aviation's commitment to improving the durability and service intervals of its engines means airlines can operate their existing fleets more cost-effectively and with less disruption. This internal evolution within the established engine ecosystem effectively counters the appeal of disruptive substitute technologies by making the status quo increasingly competitive.

- Enhanced Fuel Efficiency: GE's LEAP engine family has seen continuous upgrades, contributing to significant fuel savings for operators.

- Extended Time-on-Wing: Improvements in engine design and materials allow for longer operational periods between overhauls, reducing maintenance costs and downtime.

- Reliability Improvements: Ongoing development focuses on increasing the overall reliability of current engine models, making them a more dependable choice.

- Cost-Effectiveness: The combination of fuel efficiency, reliability, and extended service life makes existing GE engine technologies a more attractive and cost-effective solution compared to the perceived risks of adopting novel substitute technologies.

Regulatory and Environmental Pressures

Increasing regulatory pressure for lower emissions and greater fuel efficiency is a significant threat of substitutes for GE Aerospace. For instance, the European Union's "Fit for 55" package aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, impacting aviation fuel standards and engine performance requirements.

The aviation industry's ambitious commitment to achieving net-zero carbon emissions by 2050 directly fuels investment in alternative propulsion systems and sustainable aviation fuels (SAF). This push for sustainability could accelerate the adoption of electric or hydrogen-powered aircraft, posing a substantial future threat if GE Aerospace doesn't maintain a leading position in these emerging technologies.

The growing demand for SAF, which is projected to reach 10% of global jet fuel consumption by 2030 according to some industry forecasts, incentivizes airlines to explore aircraft designs optimized for these fuels. GE Aerospace's ability to adapt its engine technology to effectively utilize SAF and develop new, more efficient engine architectures will be crucial in mitigating this threat.

- Regulatory Push: EU's "Fit for 55" targets emissions reduction, influencing engine efficiency and fuel standards.

- Net-Zero Ambition: The 2050 net-zero goal drives significant investment in SAF and novel propulsion.

- SAF Growth: Projections indicate a substantial increase in SAF usage, necessitating engine compatibility.

- Technological Shift: The rise of electric and hydrogen power presents a long-term substitution risk for traditional jet engines.

The threat of substitutes for GE Aerospace's core jet engine business is multifaceted. While direct replacements for large aircraft engines are scarce, alternative propulsion systems like electric and hydrogen power are gaining traction. By 2024, significant investment is flowing into these nascent technologies, with some aiming for regional aircraft certification within the next few years, signaling a potential long-term shift.

For shorter routes, high-speed rail offers a competitive alternative to air travel, potentially impacting demand for smaller aircraft engines. For instance, Germany's ICE network expansion illustrates the growing viability of rail for intercity travel, directly competing with short-haul flights.

A more immediate substitution threat comes from airlines opting to overhaul and repair existing engines rather than purchasing new ones. This strategy is amplified during economic downturns, as seen in 2024, where many airlines prioritized cost management and fleet optimization through MRO services, delaying new engine acquisitions.

| Substitute Type | Impact on GE Aerospace | Key Drivers | 2024 Relevance |

|---|---|---|---|

| Alternative Propulsion (Electric/Hydrogen) | Long-term, potentially disruptive | Environmental regulations, technological advancements | Increased R&D investment by competitors, early-stage development |

| High-Speed Rail | Marginal, primarily for short-haul | Infrastructure investment, travel time competitiveness | Continued network expansion in key regions |

| Engine Overhaul & Repair (MRO) | Immediate, impacts new engine sales | Economic conditions, cost-consciousness of airlines | Airline focus on fleet efficiency and cost reduction |

Entrants Threaten

The sheer scale of investment needed to even begin competing in aircraft engine manufacturing is a massive deterrent. We're talking about billions of dollars for research, development, and setting up state-of-the-art production facilities. For instance, developing a new engine platform can easily cost upwards of $10 billion, making it incredibly difficult for any new player to enter this arena.

Beyond the initial R&D and manufacturing setup, the costs for rigorous testing and obtaining crucial certifications from aviation authorities are substantial. Add to this the necessity of building a robust, global supply chain for specialized components, and the financial hurdles become almost insurmountable for newcomers. GE Aviation itself has invested billions over decades to reach its current market position.

The aerospace sector presents formidable barriers to entry due to its highly regulated nature. Agencies like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA) impose stringent safety standards and lengthy certification processes. For instance, obtaining type certification for a new aircraft can take years and cost hundreds of millions, if not billions, of dollars, significantly deterring potential new competitors.

General Electric Aerospace, for instance, holds a significant number of patents, with a robust R&D investment. In 2023, GE Aerospace's R&D spending was substantial, contributing to its vast intellectual property portfolio. This deep well of proprietary technology and accumulated expertise makes it exceptionally challenging for newcomers to replicate GE's advanced engine designs and manufacturing processes, effectively raising the barrier to entry.

Economies of Scale and Experience Curve

General Electric's aerospace division, GE Aerospace, benefits immensely from established economies of scale. This means GE can produce its complex jet engines more cheaply per unit than a smaller, newer competitor could. For instance, in 2024, GE Aerospace continued to be a dominant force, delivering a substantial portion of the world's commercial aircraft engines, a volume that allows for significant cost efficiencies in manufacturing and supply chain management.

The experience curve also plays a crucial role. Over decades, GE has accumulated invaluable knowledge in designing, testing, and servicing its engines. This deep operational expertise, built through years of production and innovation, creates a steep learning curve for any potential new entrant. This accumulated know-how translates into higher quality, greater reliability, and more efficient operations, all difficult for newcomers to replicate quickly.

- Economies of Scale: GE Aerospace's massive production volumes in 2024 allow for lower per-unit costs in manufacturing, procurement of raw materials, and the operation of its extensive global service network.

- Experience Curve Advantages: Decades of accumulated engineering, manufacturing, and maintenance expertise provide GE with a significant learning curve advantage, making it difficult for new entrants to match operational efficiency and product development speed.

- High Entry Barriers: The combination of scale and experience creates substantial barriers to entry, as new companies would need vast capital investment and years to develop comparable capabilities in designing, producing, and servicing complex aerospace engines.

Established Customer Relationships and Trust

Established customer relationships and trust present a significant barrier for new entrants in the aerospace and defense sector, particularly for engine manufacturers like General Electric (GE). Airlines and defense organizations prioritize proven reliability and have deep-seated relationships with incumbent suppliers. Securing initial contracts with major airframers and operators requires demonstrating an exceptional track record, a feat that takes years, if not decades, to achieve.

For instance, the long lifecycle of aircraft and defense systems means that customer loyalty is exceptionally strong. A new engine entrant would need to overcome not just the technical validation but also the extensive qualification processes and the inherent risk aversion of these critical industries. GE, having supplied engines for commercial aviation for decades, benefits from this ingrained trust and established partnerships, making it difficult for newcomers to gain a foothold.

- High Switching Costs: Airlines face substantial costs and operational disruptions when switching engine suppliers, including retraining maintenance crews, retooling facilities, and recertifying aircraft.

- Safety and Reliability Imperative: The paramount importance of safety in aviation means customers are reluctant to adopt new, unproven technologies or suppliers, favoring those with extensive operational histories.

- Long-Term Contracts: Major airframers often enter into multi-year, multi-aircraft engine supply agreements, locking in established players and limiting opportunities for new entrants.

- Brand Reputation: GE's brand is synonymous with aerospace engine innovation and dependability, a reputation built over many years and a significant competitive advantage against unknown entities.

The threat of new entrants for General Electric Aerospace is exceptionally low, primarily due to the colossal capital requirements and the extensive time needed to establish credibility. The aerospace engine market demands billions in initial investment for research, development, and manufacturing infrastructure. For example, developing a new engine platform can easily surpass $10 billion, a sum that deters most potential competitors.

Furthermore, the aerospace industry is heavily regulated, with agencies like the FAA and EASA enforcing stringent safety standards and lengthy certification processes. Obtaining type certification for a new engine can take years and cost hundreds of millions of dollars. GE Aerospace's substantial patent portfolio and ongoing R&D investments, which saw significant expenditure in 2023, further solidify its technological lead, making it incredibly difficult for newcomers to replicate its advanced designs and manufacturing capabilities.

Established players like GE Aerospace benefit from significant economies of scale, as evidenced by their dominant market share in 2024, which allows for lower per-unit production costs. The experience curve, built over decades of innovation and operational expertise, provides GE with a learning curve advantage that new entrants cannot quickly overcome. This deep operational know-how translates into higher quality, greater reliability, and more efficient operations, all of which are difficult for newcomers to match.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions of dollars needed for R&D, manufacturing, and testing. | Extremely High |

| Regulatory Hurdles | Lengthy and costly certification processes by aviation authorities. | Very High |

| Intellectual Property & Expertise | Extensive patents and accumulated know-how from decades of operation. | Very High |

| Economies of Scale | Lower per-unit costs due to high production volumes. | High |

| Customer Loyalty & Switching Costs | Strong relationships, safety concerns, and high costs to change suppliers. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for General Electric leverages data from GE's annual reports, investor presentations, and SEC filings. We also incorporate industry-specific market research reports and news from reputable business publications to assess competitive dynamics.