General Electric Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

General Electric Bundle

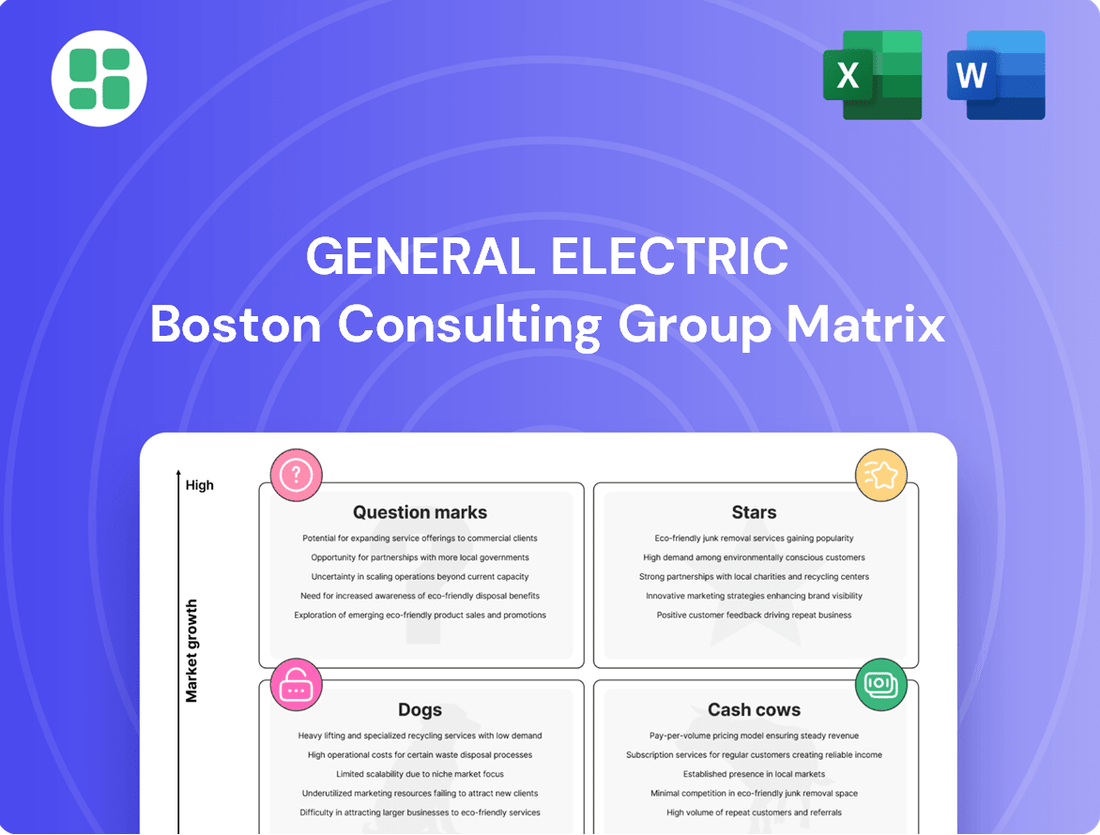

General Electric's strategic portfolio is a complex web of innovation and established dominance. Understanding where its diverse businesses fall within the BCG Matrix—Stars, Cash Cows, Dogs, or Question Marks—is crucial for informed decision-making. This preview offers a glimpse into that vital analysis.

Dive deeper into General Electric's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

GE Aerospace's new commercial aircraft engines, especially the CFM LEAP, are firmly positioned as Stars in the BCG Matrix. This is driven by their dominance in the rapidly expanding narrowbody aircraft market.

The LEAP engine's widespread adoption on aircraft like the Boeing 737 MAX and Airbus A320neo is a testament to its success. As of July 2024, the order backlog for these engines surpassed 10,000 units, reflecting a substantial market share in a segment experiencing robust growth.

GE Aerospace is strategically investing to meet this demand, aiming to boost production capacity. Projections indicate a significant increase in LEAP engine deliveries, with an estimated 15-20% rise anticipated for 2025, further solidifying its Star status.

GE Aerospace's military propulsion systems are a significant player in the market, buoyed by increased defense spending globally and ongoing geopolitical complexities. This segment is a strong performer within GE's portfolio.

The company is actively investing in its manufacturing capabilities to support the production of new military engines, such as the T901 for the Black Hawk and Apache helicopters. This forward-looking investment positions GE Aerospace for future demand.

GE's defense business demonstrated robust growth, with revenues climbing 7% in the second quarter of 2025. This performance underscores the strength and demand for its military propulsion solutions.

GE Aerospace's investment in advanced engine technologies, exemplified by the CFM International RISE program, firmly places it in the Star category of the BCG matrix. This initiative focuses on developing next-generation sustainable aviation engines, targeting over 20% fuel consumption and CO2 emission reductions compared to current benchmarks.

The RISE program's commitment to revolutionary innovations, including open fan architecture and advanced lightweight materials, signifies its high growth potential within the burgeoning sustainable aviation market. This strategic focus aligns with global environmental goals and increasing demand for greener air travel solutions.

Hypersonic Propulsion Systems

GE Aerospace is heavily investing in hypersonic propulsion systems, signaling a strong commitment to this burgeoning sector. The company is expanding its testing capabilities for advanced engines like dual-mode ramjets, designed to reach speeds over Mach 10. This strategic focus positions GE Aerospace to capitalize on a market poised for significant growth and transformative innovation in both defense and commercial aviation.

The development of hypersonic technology represents a high-potential area for GE Aerospace. The company is actively working to establish a dominant presence in this emerging field, which promises to redefine speed and efficiency in air travel. For instance, in 2024, GE Aerospace announced plans to significantly increase its R&D spending on advanced propulsion, with a notable portion allocated to hypersonic research.

- Market Potential: Hypersonic travel is projected to be a multi-billion dollar market by the late 2030s, driven by defense applications and potential for high-speed civilian transport.

- Technological Advancement: GE's dual-mode ramjet technology is a key enabler, offering sustained flight at speeds exceeding Mach 5, with targets for Mach 10 and beyond.

- Investment Focus: Significant capital is being directed towards advanced materials and manufacturing processes essential for hypersonic engine durability and performance.

- Competitive Landscape: GE Aerospace is competing with other major aerospace firms and government-backed research initiatives in the race to achieve reliable and scalable hypersonic flight.

Additive Manufacturing for Aerospace

General Electric's (GE) investment in additive manufacturing for aerospace, particularly for its advanced jet engines, firmly places this segment as a Star in the BCG Matrix. This focus on innovative parts, often utilizing novel materials and sophisticated 3D printing techniques, directly fuels the high growth and market share characteristic of a Star.

GE's additive manufacturing capabilities are revolutionizing engine design and production. By drastically reducing the number of components needed for complex parts, GE is not only streamlining manufacturing but also enhancing engine performance. For instance, the LEAP engine, a significant product line for GE Aviation, utilizes 3D printed fuel nozzles that are 25% lighter and five times more durable than traditional ones. This innovation directly translates to improved fuel efficiency, a critical factor in the competitive aerospace market.

- Reduced Part Count: GE's additive manufacturing processes consolidate multiple traditional parts into single, complex components, simplifying assembly and reducing potential failure points.

- Enhanced Performance: 3D printed parts contribute to lighter, more durable engines, leading to significant improvements in fuel efficiency and overall operational lifespan. GE's commitment to this technology is evident in its substantial investments, with the company projecting significant revenue growth from additive manufacturing in the coming years.

- Design Freedom: Additive manufacturing allows for intricate geometries previously impossible with conventional methods, enabling engineers to optimize airflow and thermal management for peak engine performance.

- Scalability: GE is actively scaling its additive manufacturing operations, investing in new facilities and expanding its capacity to produce these innovative components for current and future engine programs, ensuring its continued leadership in the aerospace sector.

GE Aerospace's new commercial aircraft engines, especially the CFM LEAP, are firmly positioned as Stars in the BCG Matrix due to their dominance in the rapidly expanding narrowbody aircraft market.

The LEAP engine's widespread adoption on aircraft like the Boeing 737 MAX and Airbus A320neo is a testament to its success, with an order backlog exceeding 10,000 units as of July 2024.

GE Aerospace's investment in advanced engine technologies, exemplified by the CFM International RISE program, further solidifies its Star status by focusing on next-generation sustainable aviation engines.

The company's commitment to hypersonic propulsion systems, including significant R&D spending in 2024 and expansion of testing capabilities for dual-mode ramjets, positions it to capitalize on a market poised for substantial growth.

GE's investment in additive manufacturing for aerospace, particularly for its advanced jet engines, also firmly places this segment as a Star, revolutionizing engine design and production with innovative, 3D printed components.

What is included in the product

This BCG Matrix overview highlights General Electric's product portfolio, identifying units for investment, divestment, or maintenance.

A clear BCG Matrix visualizes GE's portfolio, easing the pain of resource allocation by highlighting Stars for growth and Dogs for divestment.

Cash Cows

GE Aerospace's commercial engine aftermarket services, encompassing maintenance, repair, and overhaul (MRO), represent a powerful Cash Cow within the company's portfolio. This segment consistently contributes a significant majority of GE Aerospace's revenue, with parts and services alone reportedly accounting for over 70% of the total.

The sustained demand for these services is further bolstered by the current industry trend of operators extending the service life of older aircraft, largely driven by ongoing delivery delays for new aircraft. This situation creates a predictable and robust revenue stream for GE Aerospace's MRO operations.

The inherent characteristics of MRO contracts, which are typically recurring and high-margin, solidify this segment's position as a stable and reliable cash generator for GE Aerospace.

General Electric's existing fleet support contracts are a prime example of a Cash Cow. These long-term service agreements and support contracts for its substantial installed base of approximately 45,000 commercial and 25,000 military aircraft engines generate consistent, high-profit cash flow. This steady revenue stream comes from mature products operating in a stable, low-growth market, underscoring their Cash Cow status.

General Electric's mature commercial engine product lines, like the CFM56, are true cash cows. These established engines, even with their lower growth rates, are still incredibly profitable. Think of them as reliable workhorses that keep churning out cash through ongoing maintenance and the sale of spare parts.

The CFM56, a predecessor to the highly successful LEAP engine, exemplifies this. Its widespread adoption and proven reliability in the market mean a steady stream of revenue. This consistent cash generation is vital for GE, funding new innovations and supporting other business segments.

Spare Parts Sales for Mature Fleets

Spare parts sales for GE Aerospace's mature fleets represent a classic cash cow. This segment leverages the sheer volume of its installed base of commercial and military engines, which are known for their long operational lifespans.

The continuous demand for replacement parts, driven by the ongoing need for aircraft maintenance and operational readiness, creates a stable and predictable revenue stream. This business model requires minimal new investment to maintain its market share, as the demand is inherent to the existing product lifecycle.

- Significant Cash Flow Contribution: GE Aerospace's aftermarket services, including spare parts, generated over $10 billion in revenue in 2023, underscoring its importance to the company's overall financial health.

- Low Investment, High Returns: The mature fleet segment typically sees high margins with limited incremental capital expenditure needed for growth, allowing it to generate substantial free cash flow.

- Longevity and Reliability: Aircraft engines often remain in service for decades, ensuring a sustained demand for spare parts throughout their operational life.

- Market Stability: Unlike new engine sales, which can be cyclical, the spare parts market for existing fleets offers a more consistent and less volatile revenue profile.

Proprietary Lean Operating Model (FLIGHT DECK)

GE Aerospace's FLIGHT DECK, a proprietary lean operating model, functions as a significant Cash Cow within General Electric's BCG Matrix. This internal system is designed to streamline operations, leading to enhanced efficiency and reduced costs across the board. By optimizing supply chain management and production processes, FLIGHT DECK directly contributes to increased profitability from GE Aerospace's established business lines.

The model's success is evident in its ability to boost output and expedite delivery schedules, which in turn generates more cash. For instance, improvements in shop visit turnaround times directly translate to quicker servicing of aircraft engines, maximizing asset utilization for customers and increasing revenue streams for GE Aerospace. This focus on operational excellence ensures that existing assets generate maximum returns.

- Efficiency Gains: FLIGHT DECK has demonstrably improved operational efficiency within GE Aerospace.

- Cost Reduction: The lean principles embedded in the model contribute to significant cost savings.

- Increased Output: By optimizing processes, the model allows for higher production volumes.

- Faster Turnaround: Improvements in shop visit times enhance customer service and revenue generation.

GE Aerospace's aftermarket services, including maintenance, repair, and overhaul (MRO), are a significant Cash Cow. These services, which encompass spare parts and labor, consistently generate substantial revenue. In 2023, GE Aerospace's aftermarket segment alone brought in over $10 billion in revenue, highlighting its critical role in the company's financial performance. This segment benefits from a stable demand due to the long operational life of aircraft engines.

The mature commercial engine product lines, such as the CFM56, also function as Cash Cows. Despite lower growth rates, these engines remain highly profitable through ongoing maintenance and spare parts sales. The installed base of approximately 45,000 commercial and 25,000 military aircraft engines ensures a consistent cash flow from these established products operating in a mature market.

GE's FLIGHT DECK, an operational efficiency model, acts as a Cash Cow by optimizing processes and reducing costs. This lean operating model enhances profitability from existing business lines by improving turnaround times and streamlining supply chains. For example, faster shop visit times for engines directly boost revenue by maximizing asset utilization for customers.

| Segment | 2023 Revenue (approx.) | Key Characteristics | BCG Matrix Status |

| Commercial Engine Aftermarket Services (MRO & Spare Parts) | >$10 billion | High recurring revenue, stable demand, low incremental investment | Cash Cow |

| Mature Engine Product Lines (e.g., CFM56) | Significant contribution from installed base | Proven reliability, steady demand for maintenance and parts, mature market | Cash Cow |

| FLIGHT DECK (Operational Efficiency Model) | N/A (Internal System) | Drives cost reduction, improves efficiency, increases asset utilization | Supports Cash Cow status |

What You See Is What You Get

General Electric BCG Matrix

The General Electric BCG Matrix preview you're viewing is the identical, fully developed document you'll receive immediately after purchase. This means no watermarks, no placeholder text, and no missing sections – just the complete strategic analysis ready for your immediate use. You'll gain access to a professionally formatted report that breaks down GE's diverse business portfolio according to market attractiveness and business unit strength, enabling informed decision-making. This is the exact, uncompromised strategic tool you need to understand GE's competitive landscape.

Dogs

Residual non-core businesses for General Electric, post the spin-offs of GE HealthCare and GE Vernova, would represent any remaining minor assets or units not directly supporting the core aviation focus. These are likely to be legacy operations with limited strategic alignment.

Given GE's pivot to a pure-play aviation company, these residual businesses would typically exhibit low market share and low growth prospects, fitting the characteristics of Dogs in the BCG Matrix. For instance, any remaining niche industrial services or smaller manufacturing units that were not part of the major spin-offs would fall into this category.

General Electric's older manufacturing facilities, particularly those not slated for the significant $1 billion investment planned for U.S. factories and supply chains in 2025, could be categorized as Dogs. These assets often exhibit low productivity and a diminishing market share when compared to more advanced, modern capabilities.

Such facilities consume valuable resources, including capital and labor, without generating substantial returns, thereby dragging down overall efficiency. Their continued operation represents a drain on GE's resources, potentially hindering growth in more promising areas of the business.

Underperforming niche aviation segments, characterized by GE Aerospace's low market share and stagnant market growth, would fall into the Dogs category of the BCG matrix. These are areas where the company lacks a strong competitive position, and further investment is unlikely to generate substantial returns. For instance, certain specialized component suppliers within the broader aerospace market might represent such segments if GE Aerospace has not secured significant contracts or developed proprietary technology in those specific niches.

Legacy Digital Solutions Not Integrated with Aviation Core

Legacy digital solutions within GE Digital, particularly those not integrated into GE Aviation's core operations, would likely be classified as Dogs in the BCG Matrix. These might include older software platforms or services that haven't kept pace with industry demands or haven't found a significant foothold in the competitive aerospace digital landscape. For instance, if a particular digital maintenance tracking system developed by GE Digital struggled to gain adoption among airlines or MROs, it would represent a Dog. This is because it would possess a low market share and face limited growth prospects in a sector that prioritizes highly specialized and proven solutions.

These types of offerings typically require substantial investment to maintain but generate minimal returns. Their lack of integration means they don't benefit from the synergies within GE Aviation's core product lines, further hindering their potential.

- Low Market Share: Unintegrated legacy digital solutions often struggle to capture significant market share in the highly specialized aerospace sector, where adoption cycles can be long and demanding.

- Limited Growth Potential: Without strong integration into core aviation offerings and demonstrable market traction, these solutions face constrained growth opportunities.

- High Maintenance Costs: Maintaining older, unintegrated digital platforms can be costly, diverting resources from more promising ventures.

Highly Specialized, Low-Volume Military Programs Approaching End-of-Life

Certain highly specialized military engine programs, characterized by their low production volumes and approaching end-of-life cycles, can be categorized as Dogs within the General Electric BCG Matrix. These programs, while potentially requiring continued support, are generating diminishing returns. For instance, GE Aviation's legacy engine programs, like those for older fighter jets, face declining demand as newer, more advanced platforms are fielded.

These programs present limited future growth prospects as newer technologies emerge, making investment in their enhancement less attractive. By 2024, the global defense spending on legacy systems continues to shift towards modernization, impacting the long-term viability of such programs. GE's focus is increasingly on next-generation propulsion systems, which further sidelines these older, low-volume contracts.

- Low Production Volume: Programs with consistently low unit sales, such as specialized engine components for retired aircraft, exemplify this category.

- End-of-Life Cycle: Engines designed for platforms being phased out of active service, like certain older helicopter models, fall into this segment.

- Diminishing Returns: The cost of maintaining and supporting these aging programs often outweighs the revenue generated from their limited production or service contracts.

- Limited Growth Prospects: With the advent of more advanced military technologies, the market for these older engine types is contracting, offering little opportunity for expansion.

Residual, non-core businesses within General Electric, particularly those not aligned with its core aviation focus, would be classified as Dogs. These are typically legacy operations with low market share and limited growth prospects.

Examples include older manufacturing facilities not slated for modernization or underperforming niche digital solutions within GE Digital that lack integration into core aviation operations. These segments consume resources without generating substantial returns, hindering overall efficiency.

Specialized military engine programs nearing the end of their life cycles, with low production volumes and diminishing returns, also fit the Dog category. Global defense spending shifts towards modernization in 2024, further impacting the viability of these older programs.

These businesses often require high maintenance costs while yielding minimal revenue, representing a drain on GE's resources and diverting capital from more promising ventures.

Question Marks

GE Aerospace's focus on developing engines compatible with 100% Sustainable Aviation Fuel (SAF) positions them in a high-growth, strategically important sector aligned with aviation's net-zero ambitions. This initiative is crucial for future industry sustainability.

However, SAF's current market penetration remains very low, accounting for less than 1% of global jet fuel consumption as of early 2024. The higher cost of SAF compared to traditional jet fuel also presents a significant hurdle for widespread adoption, making GE's current market share in SAF production or related infrastructure still nascent.

General Electric's investments in hybrid-electric and hydrogen propulsion systems are positioned as potential future stars within its portfolio. These innovative technologies, exemplified by the CFM RISE program, target a rapidly evolving aerospace market with significant growth prospects. However, they currently represent a small slice of GE Aviation's overall market share.

These advanced propulsion systems demand substantial research and development funding, placing them in a high-investment category. While the long-term potential is considerable, the timelines for commercialization and widespread market adoption remain uncertain, characteristic of 'question marks' in a BCG matrix analysis. For instance, GE Aviation's commitment to sustainability initiatives underscores the strategic importance of these ventures, even with the inherent risks.

GE Aerospace's advanced digital services for predictive maintenance, leveraging AI, represent a burgeoning area with significant future potential. While the broader digital aviation services market is expanding, these specific AI-powered offerings are still gaining traction, placing them in the question mark category of the BCG matrix.

For these services to ascend to Star status, GE Aerospace must aggressively capture a larger share of this nascent market. The global market for AI in aviation is projected to reach approximately $1.5 billion by 2025, indicating substantial growth, yet GE's current penetration in these advanced predictive maintenance solutions needs to accelerate significantly.

Small Engines for Unmanned Aerial Systems (UAS)

GE Aerospace is actively developing small engines for unmanned aerial systems (UAS), a sector poised for significant expansion. This represents a potential star in GE's portfolio, characterized by substantial investment in research and development to pioneer new propulsion technologies for the burgeoning drone market.

While the exact current market share for GE in this niche segment isn't publicly detailed, the overall UAS market is experiencing rapid growth. For instance, the global drone market size was valued at approximately USD 31.2 billion in 2023 and is projected to reach USD 100.8 billion by 2030, growing at a compound annual growth rate (CAGR) of 18.2% during the forecast period (2024-2030). This indicates a fertile ground for GE's innovative engine solutions.

- High Growth Potential: The UAS propulsion market is expanding rapidly, driven by increasing adoption across various industries.

- R&D Investment: GE Aerospace is dedicating resources to advance small engine technology for drones.

- Emerging Market: This segment is relatively new, offering opportunities for market leadership with early innovation.

- Strategic Importance: Capturing a significant share of this market could position GE Aerospace for future dominance in aerospace propulsion.

Next-Generation Adaptive Cycle Engines for Military Applications

General Electric's next-generation adaptive cycle engines for military applications currently represent a Question Mark in the BCG Matrix. These advanced engines, designed for enhanced performance and adaptability across various flight regimes, are in the early stages of research, development, and limited deployment. Their high cost and the extensive investment required for their maturation place them in this category.

GE is investing significantly in these programs to secure future military contracts and establish a dominant market position. For instance, the Adaptive Engine Transition Program (AETP) involves substantial R&D funding, with the U.S. Air Force awarding contracts in the hundreds of millions of dollars. This focus on innovation is crucial for future defense capabilities.

- Low Market Share: Adaptive cycle engines are not yet widely adopted, reflecting their nascent stage of development and integration into existing military fleets.

- High Investment Needs: Continued substantial R&D funding is essential to refine the technology and meet stringent military specifications, positioning these as high-potential but high-cost ventures.

- Future Market Dominance: Successful development and deployment are key to capturing future military engine contracts, especially as nations upgrade their air power.

- Strategic Importance: These engines are critical for maintaining technological superiority in air combat, making them a strategic priority for GE and defense ministries globally.

GE Aerospace's initiatives in Sustainable Aviation Fuel (SAF) compatible engines and advanced propulsion systems like hybrid-electric and hydrogen are prime examples of Question Marks. These ventures operate in high-growth potential markets, aligning with aviation's sustainability goals, but currently hold low market share due to high R&D costs and nascent adoption rates. For instance, SAF usage was less than 1% of global jet fuel in early 2024, and while the UAS market is projected to reach $100.8 billion by 2030, GE's specific market penetration in drone engines is still developing.

| GE Business Unit | BCG Category | Key Characteristics | Growth Potential | Market Share | Strategic Imperative |

|---|---|---|---|---|---|

| Aerospace - SAF Engines | Question Mark | High investment, low current adoption, critical for net-zero goals. | Very High | Very Low (<1% of jet fuel in early 2024) | Increase SAF production and integration. |

| Aerospace - Advanced Propulsion (Hybrid-Electric, Hydrogen) | Question Mark | Significant R&D, uncertain commercialization timelines, targets evolving market. | Very High | Nascent | Accelerate development and secure early market wins. |

| Aerospace - AI Digital Services (Predictive Maintenance) | Question Mark | Expanding market, requires aggressive capture, AI integration is key. | High | Growing, but needs acceleration | Dominate niche AI applications in aviation services. |

| Aerospace - UAS Engines | Question Mark | Rapidly growing market ($31.2B in 2023), requires pioneering technology. | Very High | Emerging | Establish leadership in a key future aerospace segment. |

| Aerospace - Adaptive Cycle Engines (Military) | Question Mark | High R&D investment, low current market share, crucial for defense tech. | High | Low | Secure future military contracts through technological superiority. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.