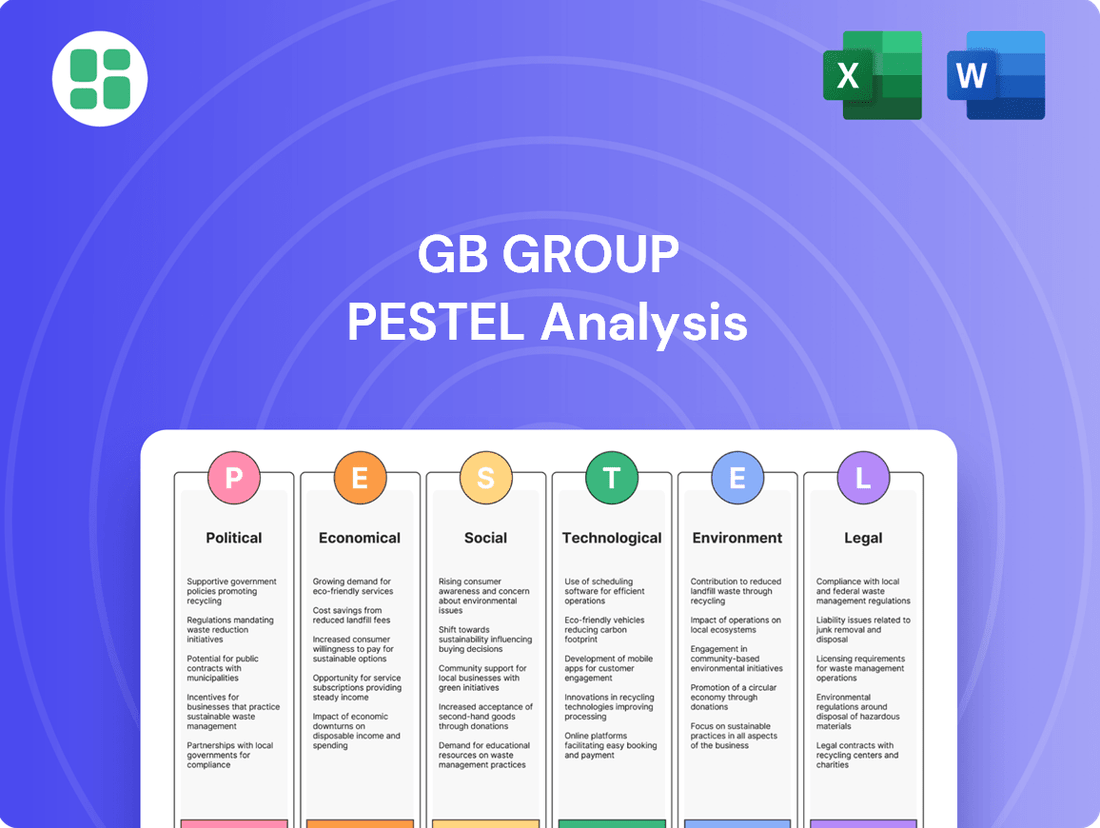

GB Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GB Group Bundle

Navigate the complex external landscape impacting GB Group with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping its trajectory and uncover critical insights to inform your own strategic decisions. Download the full version now for actionable intelligence and a competitive advantage.

Political factors

Governments worldwide are intensifying their focus on data protection and privacy. Regulations like the EU's General Data Protection Regulation (GDPR) and emerging regional equivalents compel companies like GB Group to constantly update their identity verification and fraud prevention services to ensure ongoing compliance. This regulatory landscape directly influences operational strategies and the development of new solutions.

The push for standardized digital identities is a significant political factor. Initiatives such as the UK's Office for Digital Identities and Attributes (OfDIA) are actively shaping the market for digital identity services. This governmental development creates both opportunities and challenges for GB Group, requiring strategic alignment with evolving national frameworks for digital identity management.

Governments worldwide are escalating their efforts to combat financial crime and fraud, a trend that directly benefits companies like GB Group. For instance, the UK's Payment Systems Regulator (PSR) has been instrumental in pushing for measures to protect fraud victims, which in turn drives demand for robust identity verification and fraud prevention services. In 2023 alone, reported fraud losses in the UK reached £485 million, highlighting the significant market need for solutions that GB Group provides.

As regulatory bodies, such as those overseeing financial services and data privacy, tighten their grip on anti-fraud measures, businesses are increasingly prioritizing compliance and security. This heightened regulatory scrutiny compels organizations to invest in advanced identity intelligence platforms to authenticate customers, prevent account takeovers, and meet Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. The global identity verification market is projected to reach $39.6 billion by 2027, underscoring the substantial growth opportunity driven by these political factors.

Global political stability and evolving trade relations significantly impact GB Group's international operations and revenue. For instance, the ongoing trade tensions between major economies in 2024, characterized by fluctuating tariffs and import/export restrictions, create a complex operating environment. These geopolitical shifts can directly affect the cost of goods, supply chain reliability, and market access for GB Group's diverse product portfolio.

Macroeconomic uncertainty stemming from political decisions, particularly concerning trade policies, could moderate the company's growth acceleration. In 2024, the World Trade Organization (WTO) reported a slowdown in global trade growth, partly attributed to protectionist measures. This environment necessitates GB Group to remain agile in its strategic planning, potentially diversifying sourcing and market penetration to mitigate risks associated with specific regional trade disputes.

Digital Transformation Agendas

Governments globally are actively championing digital transformation, a trend directly benefiting GB Group's core offerings. This political impetus fuels demand for robust digital identity verification and location intelligence services as nations prioritize online engagement in public services and financial sectors. For instance, the UK government's commitment to digital public services, aiming for 90% of all government services to be digitally available by 2025, underscores this trend.

This strategic focus on digitizing interactions, particularly within regulated industries like finance, amplifies the requirement for secure and trustworthy identity infrastructure. As more transactions and services move online, the need for reliable digital identity solutions becomes paramount. GB Group's expertise in this area positions it to capitalize on this growing governmental and industry-wide demand.

- Government Digital Service (GDS) initiatives in the UK aim to streamline citizen interactions with public services, increasing the need for identity verification.

- Global investment in digital infrastructure, projected to reach trillions by 2025, reflects a broad political commitment to digital advancement.

- Regulatory frameworks supporting digital identity, such as eIDAS in the EU, create a favorable political climate for identity verification providers.

Cross-Border Data Sharing Policies

Governmental stances on cross-border data sharing, while aiming to combat fraud, introduce political complexities for GB Group. The UK Information Commissioner's Office (ICO) has actively promoted data sharing for fraud prevention, recognizing its importance. However, the practical implementation of these policies across various international jurisdictions can differ significantly, impacting the smooth operation of global identity verification networks.

The evolving landscape of data privacy regulations, such as the EU's GDPR and similar frameworks in other nations, directly influences how GB Group can share and process data internationally. Navigating these varying legal requirements is crucial for maintaining compliance and ensuring the integrity of their services. As of early 2024, discussions around harmonizing data sharing protocols for fraud prevention continue at international forums, indicating ongoing political engagement with this issue.

- ICO’s Stance: The UK Information Commissioner's Office (ICO) has publicly supported and encouraged data sharing initiatives specifically designed to prevent fraud.

- Jurisdictional Variations: The practical application and legal frameworks governing cross-border data sharing for fraud prevention are not uniform across all countries, creating operational challenges.

- Global Identity Networks: GB Group's reliance on seamless cross-border data flow for its global identity verification services makes adherence to these varied political and legal stances a critical operational factor.

Governments' increasing focus on combating financial crime and fraud directly fuels demand for GB Group's identity verification and fraud prevention solutions. For example, the UK's Payment Systems Regulator actively pushes for victim protection, highlighting the market need. Reported fraud losses in the UK reached £485 million in 2023, underscoring the critical role of robust identity solutions.

The global push for digital identities and transformation creates significant opportunities for GB Group. Initiatives like the UK's GDS and the EU's eIDAS framework foster a favorable environment for identity verification providers. The global identity verification market is projected to reach $39.6 billion by 2027, driven by these political factors and a growing need for secure online interactions.

Political decisions on trade and global economic stability impact GB Group's international operations. In 2024, trade tensions and protectionist measures, as noted by the WTO's report on slowing global trade growth, necessitate agility. Navigating these geopolitical shifts requires GB Group to remain adaptable in its market penetration and sourcing strategies.

| Political Factor | Impact on GB Group | Supporting Data/Trend |

| Anti-Fraud & Financial Crime Initiatives | Increased demand for verification and fraud prevention services | UK reported fraud losses of £485 million in 2023 |

| Digital Identity & Transformation Push | Growth opportunities in identity verification solutions | Global identity verification market projected to reach $39.6 billion by 2027 |

| Trade Policies & Geopolitical Stability | Complex operating environment, need for strategic agility | WTO reported slowdown in global trade growth in 2024 due to protectionism |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing GB Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for strategic decision-making.

Economic factors

Global economic growth is projected to moderate in 2024, with the IMF forecasting 3.2% expansion, down slightly from 2023's 3.4%. This slowdown, influenced by persistent inflation and tighter monetary policies in major economies, could temper demand for GB Group's e-commerce and financial services as businesses and consumers become more cautious with spending.

Inflationary pressures remain a key concern. While expected to ease from 2023 peaks, inflation could still impact operational costs for GB Group and its clients, potentially affecting investment in new technology like advanced fraud prevention and identity verification solutions.

Consumer spending patterns are closely watched. A robust consumer backdrop typically fuels e-commerce growth, benefiting GB Group. However, economic uncertainty or a decline in disposable income could lead clients to postpone or reduce their investment in services that are not deemed immediately essential.

The market for digital identity solutions is undergoing significant, sustained growth. This expansion is fueled by the ever-increasing volume of online transactions and a critical need for secure, seamless digital onboarding processes across a wide array of industries, from finance to e-commerce.

GB Group is strategically positioned to benefit from this burgeoning market. For instance, the UK's digital identity sector alone was projected to generate over £2.1 billion in annual revenue in 2024, highlighting the substantial commercial opportunity available.

Intensified competition in the identity data intelligence market is indeed squeezing profit margins for companies like GB Group. This heightened rivalry often forces providers to lower prices to attract and retain customers. For instance, GB Group's reported revenue growth deceleration in FY25, as noted in their recent financial updates, could very well be a symptom of these competitive pressures, making it crucial for them to find unique selling propositions and manage expenses diligently.

Investment and Capital Allocation

GB Group's robust financial health, evidenced by its strong cash conversion and a significant reduction in net debt, creates a solid platform for strategic capital deployment. This financial stability enables the company to pursue growth opportunities, such as investing in new product development and expanding into new markets, while also returning value to shareholders. For instance, the company's ability to generate free cash flow allows for flexibility in its capital allocation decisions.

The company's financial strategy prioritizes investments that drive long-term value, balanced with shareholder returns. This includes funding research and development for product innovation, enhancing operational efficiencies, and potentially engaging in share repurchase programs. Such a balanced approach ensures that capital is utilized effectively to both strengthen the business and reward investors.

- Financial Strength: GB Group exhibits strong cash conversion and has actively reduced its net debt, bolstering its financial resilience.

- Strategic Investment: The company allocates capital towards product innovation, market expansion, and operational improvements to foster growth.

- Shareholder Value: Financial stability supports initiatives like share buybacks, directly benefiting shareholders.

- Capital Allocation Flexibility: Prudent financial management provides the company with the capacity to respond to emerging opportunities and economic shifts.

Currency Fluctuations and Interest Rates

Currency fluctuations and interest rate shifts significantly influence GB Group's financial results. Changes in foreign exchange rates directly impact the translation of international earnings and the value of overseas assets, thereby affecting reported revenues and profitability. For instance, a stronger pound against other currencies could reduce the sterling value of overseas sales.

Interest rate changes, particularly those set by central banks like the Bank of England, have a direct bearing on GB Group's borrowing costs and investment returns. Higher interest rates can increase the cost of debt financing, impacting net profit. Furthermore, increased interest rates can lead to higher discount rates used in valuation models, potentially resulting in non-cash impairment charges on intangible assets like goodwill, as observed in past financial periods.

GB Group's exposure to these economic factors is managed through various treasury strategies. The company's 2024 interim report highlighted that its net debt was £1,004.1 million as of February 29, 2024, indicating a substantial reliance on debt financing that is sensitive to interest rate movements.

- Currency Impact: Fluctuations in exchange rates can alter the reported value of GB Group's international revenue streams and the carrying value of its foreign subsidiaries.

- Interest Rate Sensitivity: Changes in benchmark interest rates directly affect the cost of GB Group's debt and can influence the valuation of its assets through discount rate adjustments.

- Goodwill Impairment Risk: A rise in interest rates, leading to higher discount rates, historically poses a risk of non-cash goodwill impairment charges, impacting reported earnings.

- Debt Servicing Costs: With £1,004.1 million in net debt as of February 29, 2024, GB Group's profitability is directly tied to the prevailing interest rate environment.

Global economic growth is expected to moderate in 2024, with the IMF forecasting 3.2% expansion, a slight dip from 2023's 3.4%. This slowdown, driven by persistent inflation and tighter monetary policies in key economies, could dampen demand for GB Group's services as businesses and consumers adopt a more cautious spending approach.

Inflationary pressures remain a significant concern, though they are anticipated to ease from 2023's highs. Elevated inflation could still impact GB Group's operational costs and influence client investment decisions in areas like advanced fraud prevention and identity verification solutions.

Consumer spending habits are crucial for GB Group's e-commerce related services. While a strong consumer backdrop typically supports e-commerce growth, economic uncertainty or reduced disposable income might lead clients to defer or scale back spending on non-essential services.

| Economic Factor | 2024 Projection/Observation | Impact on GB Group |

| Global GDP Growth | IMF forecast: 3.2% (2024) | Potential moderation in demand for e-commerce and financial services due to cautious spending. |

| Inflation | Expected to ease but remain a concern | Increased operational costs; potential impact on client investment in new technologies. |

| Consumer Spending | Influenced by economic uncertainty | Directly affects e-commerce growth; potential deferral of non-essential service investments. |

Full Version Awaits

GB Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive GB Group PESTLE analysis offers a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It's designed to provide actionable insights for strategic planning.

Sociological factors

Public trust in digital identity is a critical sociological factor. Growing concerns about data privacy, the increasing frequency of cyberattacks, and the rise of sophisticated fraud schemes directly fuel the societal demand for strong identity verification. For instance, a 2024 survey indicated that over 70% of consumers are more likely to engage with businesses that demonstrate robust data protection measures.

As individuals become more conscious of digital risks, their preference shifts towards brands that employ advanced identity verification technologies. This trend directly benefits companies like GB Group, whose trusted solutions address these societal anxieties, thereby increasing demand for their services in the evolving digital landscape.

Societal expectations are increasingly geared towards seamless digital experiences, especially in sectors like e-commerce and financial services where quick, frictionless onboarding is paramount. Consumers anticipate instant access and effortless interactions, a trend that accelerated significantly through 2024 and is projected to continue its upward trajectory into 2025.

GB Group's identity verification and fraud prevention solutions directly address this societal demand by enabling businesses to offer convenient digital onboarding while upholding robust security. The challenge lies in striking the right balance, ensuring that legitimate customers can proceed rapidly without compromising the integrity of the system against fraudulent actors. This is crucial as digital fraud attempts continue to evolve, with reports indicating a steady rise in sophisticated phishing and identity theft schemes throughout 2024.

As the global population ages, with projections indicating that individuals aged 65 and over will represent nearly 16% of the world's population by 2050, the demand for user-friendly digital services is surging. This demographic shift underscores the critical need for identity verification solutions that are both intuitive and accessible to older adults, ensuring they can participate fully in the digital economy.

GB Group's commitment to fostering digital inclusion directly addresses this trend. By developing solutions that cater to a wider range of digital literacy and accessibility needs, the company helps bridge the digital divide. For instance, in the UK, while smartphone adoption among those aged 65-74 reached 77% in 2024, a significant portion still requires simplified digital interactions.

Awareness of Fraud and Financial Crime

The growing sophistication and frequency of financial fraud, especially synthetic identity fraud, have significantly raised public awareness of digital crime. This heightened societal concern is a key sociological factor influencing how businesses and individuals approach security.

This increased awareness directly fuels a greater acceptance and trust in advanced fraud prevention technologies. For instance, in 2024, reports indicated a substantial rise in consumer willingness to share more personal data with trusted platforms if it demonstrably enhances security against fraud.

- Increased Public Vigilance: Consumers are more aware of phishing scams and data breaches, leading to more cautious online behavior.

- Demand for Secure Solutions: This societal shift drives demand for robust identity verification and fraud detection services.

- Regulatory Impact: Heightened awareness can also pressure governments to enact stricter regulations on data protection and financial crime, influencing business practices.

- Trust in Technology: A greater willingness to adopt and rely on advanced technological solutions for fraud prevention is evident.

Societal Attitudes Towards Data Sharing

Societal attitudes towards data sharing are complex, balancing privacy concerns with the recognition of its benefits. A growing segment of the population understands that responsible data sharing is vital for fighting fraud and improving security measures. This evolving perspective supports businesses like GB Group that build trust networks across various sectors.

GB Group's model thrives on this dual societal perspective. By facilitating the secure and ethical exchange of identity data, they help combat fraud, a growing concern. For instance, in 2024, the global cost of identity fraud was projected to exceed $3 trillion annually, highlighting the societal demand for robust solutions.

- Growing acceptance: Public awareness of data's role in fraud prevention is increasing.

- Security enhancement: Consumers increasingly expect businesses to leverage data for better security.

- Cross-sector benefits: GB Group's identity trust networks capitalize on this by enabling broader fraud detection capabilities.

Societal expectations for seamless digital experiences are high, driving demand for efficient identity verification. As of 2024, over 70% of consumers favor businesses with strong data protection, directly benefiting companies like GB Group that offer advanced identity solutions.

The aging global population, projected to be nearly 16% over 65 by 2050, necessitates user-friendly digital services. GB Group's focus on digital inclusion and accessible solutions caters to this demographic, addressing the need for simplified interactions, with UK smartphone adoption among those aged 65-74 reaching 77% in 2024.

Heightened public awareness of financial fraud, particularly synthetic identity fraud, fuels a greater acceptance of advanced security technologies. Reports from 2024 showed a significant increase in consumer willingness to share data with trusted platforms for enhanced security.

Societal attitudes are evolving, with a growing understanding that responsible data sharing is crucial for combating fraud. This trend supports GB Group's model, which builds trust networks to facilitate secure identity data exchange, especially as the global cost of identity fraud was projected to exceed $3 trillion annually in 2024.

Technological factors

The rapid evolution of Artificial Intelligence (AI) and Machine Learning (ML) is a critical technological factor, enabling GB Group to develop more sophisticated fraud detection and identity verification capabilities. For instance, in 2024, the global AI market was projected to reach over $200 billion, with significant investment flowing into applications like fraud prevention.

AI-powered systems can analyze vast data volumes, detect complex patterns, and identify emerging fraud threats like deepfakes and synthetic identities with greater accuracy. GB Group's continued investment in these areas allows them to stay ahead of evolving criminal tactics, a crucial advantage in the digital identity space.

The evolution of integrated identity platforms represents a significant technological shift. GB Group's recent launch of GBG Go exemplifies this trend, offering a unified solution that combines various identity verification and fraud prevention tools via a single application programming interface. This consolidation simplifies the complex processes of customer onboarding and regulatory compliance for businesses.

These all-in-one platforms are designed to enhance efficiency and security. By providing a singular point of access for multiple identity-related services, companies can reduce operational overhead and improve the customer experience. For instance, the ability to manage identity verification, document checks, and biometric authentication through one system streamlines digital interactions and strengthens fraud defenses, a critical need in today's digital landscape.

The growing reliance on biometric authentication, including facial recognition and fingerprint scanning, is a significant technological shift. This trend is amplified by the rise of sophisticated AI-driven identity fraud, making advanced liveness detection technologies essential. GB Group is actively integrating these solutions to verify that a user is a real person, not a digital mimic, thereby bolstering the security of online interactions and transactions.

In 2024, the global market for biometrics was valued at approximately $35 billion, with projections indicating substantial growth. GB Group's investment in liveness detection, which analyzes subtle physical cues to confirm a person's presence, directly addresses the increasing threat of deepfakes and synthetic identities. This capability is vital for sectors like finance and e-commerce, where trust and security are paramount.

Big Data Analytics and Cross-Industry Networks

GB Group's technological edge lies in its mastery of big data analytics and its ability to forge cross-industry identity networks. This is crucial for effective fraud prevention in today's interconnected digital landscape. By analyzing massive datasets, GB Group can identify subtle patterns and connections that might otherwise go unnoticed, creating robust defenses against increasingly sophisticated fraud schemes.

The company's core strength is in aggregating millions of identity records and employing advanced pattern-matching algorithms. This process builds what GB Group terms 'trust networks'. These networks offer deep insights into digital identities, enabling businesses to make swift, well-informed decisions in real-time, which is vital for maintaining security and trust.

Consider these key aspects:

- Data Integration: GB Group's platforms integrate data from diverse sources, creating a holistic view of identities.

- Pattern Recognition: Advanced analytics uncover fraudulent activities by identifying anomalies and suspicious patterns within these networks.

- Real-time Decisioning: The insights derived allow for immediate validation and risk assessment, crucial for preventing financial losses.

- Cross-Industry Collaboration: Building networks across different sectors enhances the collective ability to detect and combat fraud.

Cybersecurity Threats and Data Breaches

The ever-changing landscape of cyber threats, including ransomware and phishing attacks, demands continuous investment in advanced security technologies. GB Group, as a provider of identity verification and fraud prevention solutions, must constantly innovate its encryption and secure data handling protocols to protect sensitive client information. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the critical need for robust defenses.

Data breaches are a significant concern, with regulatory bodies imposing hefty fines for non-compliance with data protection laws. GB Group's commitment to safeguarding identity data means adapting its technological infrastructure to meet evolving compliance standards and mitigate the risk of costly breaches.

- Increasing Sophistication of Cyberattacks: Threats like zero-day exploits and advanced persistent threats (APTs) require proactive and adaptive security measures.

- Regulatory Compliance and Fines: The General Data Protection Regulation (GDPR) and similar legislation impose strict penalties for data breaches, impacting companies like GB Group.

- Investment in Secure Technologies: Companies must allocate significant resources to cybersecurity, including AI-powered threat detection, multi-factor authentication, and secure cloud infrastructure.

- Reputational Damage from Breaches: A single data breach can severely damage customer trust and brand reputation, necessitating a strong focus on data security.

GB Group's technological advancements are heavily influenced by the rapid growth of AI and machine learning, enabling more sophisticated fraud detection and identity verification. The global AI market's projected growth past $200 billion in 2024 underscores the investment in these critical areas.

The company's integrated identity platforms, like GBG Go, simplify complex verification processes through single APIs, enhancing efficiency and security. Biometric authentication, including facial recognition, is also a key focus, with the global biometrics market valued around $35 billion in 2024, as GB Group integrates liveness detection to combat deepfakes.

GB Group leverages big data analytics and cross-industry identity networks to build 'trust networks' for real-time decisioning, vital for fraud prevention. Continuous investment in advanced security technologies is essential, especially with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025.

| Technological Factor | Impact on GB Group | Supporting Data (2024/2025 Projections) |

|---|---|---|

| AI & Machine Learning | Enhanced fraud detection and identity verification capabilities. | Global AI market projected over $200 billion in 2024. |

| Integrated Identity Platforms | Streamlined customer onboarding and compliance via unified solutions. | Launch of GBG Go exemplifies this trend. |

| Biometric Authentication | Improved security through liveness detection against synthetic identities. | Global biometrics market valued at approx. $35 billion in 2024. |

| Big Data Analytics & Networks | Real-time decisioning and robust fraud prevention through 'trust networks'. | Global cybercrime cost projected at $10.5 trillion annually by 2025. |

Legal factors

Global data protection laws like GDPR are a major legal consideration for GB Group. These regulations, along with evolving regional rules, dictate how the company handles sensitive identity data, which is core to its services. Failure to comply can lead to substantial fines; for instance, GDPR violations can result in penalties up to 4% of global annual revenue or €20 million, whichever is higher.

The increasing stringency of Anti-Money Laundering (AML) and Know Your Customer (KYC) legislation directly fuels demand for GB Group's identity verification and compliance services. Globally, regulators are enhancing scrutiny, with the Financial Action Task Force (FATF) continuing to update its recommendations, impacting how businesses onboard and monitor customers.

Financial institutions, in particular, are investing heavily in compliance technology to avoid significant penalties. For instance, fines for AML breaches can run into millions, making robust solutions like those offered by GB Group essential for operational continuity and risk mitigation. The ongoing global effort to combat financial crime means these regulatory pressures are unlikely to abate, presenting a sustained opportunity for GB Group.

Consumer protection laws, particularly those addressing fraud, directly influence the demand for GB Group's services. Stricter regulations, like the UK's Payment Services Regulations 2017, which were further clarified and enforced in 2024 regarding fraud liability, compel financial institutions to invest more in robust fraud prevention measures. This legislation holds providers accountable for unauthorized transactions, increasing the imperative for accurate payee verification and identity checks, areas where GB Group excels.

Digital Identity Legislation and Standards

The evolving landscape of digital identity legislation significantly impacts GB Group. Governments worldwide are actively developing legal frameworks and standardized measures for digital identity. For instance, the UK's ongoing work on trusted digital identity services directly shapes the operational environment for companies like GB Group.

These governmental initiatives present both challenges and opportunities. GB Group can leverage these developments by aligning its identity verification and management solutions with official digital identity schemes. This alignment can foster trust and create new avenues for service integration and expansion.

Key developments include:

- Government-led digital identity frameworks: Initiatives like the UK's Digital Identity and Attributes Trust Framework aim to establish secure and verifiable digital identities, creating a market for compliant solutions.

- Data protection regulations: Legislation such as GDPR continues to influence how digital identity data is collected, stored, and processed, requiring robust compliance measures from identity service providers.

- International standardization efforts: Bodies like the Organisation for Economic Co-operation and Development (OECD) are working on principles for trusted digital identity, influencing global best practices and potentially creating interoperability opportunities.

International Compliance Complexity

GB Group's global operations, spanning over 70 countries, present a significant challenge in managing international compliance complexity. The company must meticulously adhere to a patchwork of differing legal and regulatory frameworks in each territory. This necessitates a robust and adaptable compliance infrastructure to manage the intricacies of global data protection laws, such as GDPR in Europe and similar legislation emerging worldwide.

Ensuring compliance with varied legal standards for identity verification, data residency, and privacy across these diverse jurisdictions is a continuous and substantial legal hurdle. For instance, the General Data Protection Regulation (GDPR) in the EU, enacted in 2018, sets a high bar for data privacy, and GB Group must ensure its practices align with such stringent requirements globally. As of early 2024, the global regulatory landscape for data privacy continues to evolve, with new regulations being introduced and existing ones being updated, requiring constant vigilance.

- Navigating Over 70 Jurisdictions: GB Group must comply with distinct legal frameworks in each country of operation.

- Data Privacy and Residency: Adherence to varying data protection laws and data residency requirements is critical.

- Evolving Regulatory Landscape: Continuous monitoring and adaptation to new and updated global data privacy regulations are essential.

- Identity Verification Standards: Compliance with diverse national standards for identity verification processes adds another layer of complexity.

GB Group operates within a complex web of global legal and regulatory frameworks that directly shape its business. Strict data protection laws, such as the EU's GDPR, mandate how sensitive identity data is handled, with potential fines reaching up to 4% of global annual revenue for non-compliance. The increasing stringency of Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, continuously updated by bodies like the Financial Action Task Force (FATF), drives demand for GB Group's verification services as financial institutions aim to avoid substantial penalties, which can run into millions for breaches.

Consumer protection laws, particularly those concerning fraud, also bolster the need for GB Group's offerings. For example, the UK's Payment Services Regulations 2017, with clarifications in 2024, places accountability on payment providers for unauthorized transactions, necessitating robust payee verification. Furthermore, evolving digital identity legislation, such as the UK's ongoing development of trusted digital identity services, creates both challenges and opportunities for GB Group to align its solutions with official frameworks, potentially fostering trust and expanding service integration.

Environmental factors

GB Group, like many tech firms, faces increasing pressure from stakeholders and investors to demonstrate robust Environmental, Social, and Governance (ESG) performance. This focus means embedding sustainability and ethical practices is no longer optional but a core business imperative.

While not directly tied to physical environmental impacts like a manufacturing company, GB Group's ESG commitment significantly shapes its brand image and appeal. For instance, a 2024 report by PwC indicated that 70% of investors consider ESG factors when making investment decisions, directly impacting a tech company's ability to attract capital and top talent.

The growing emphasis on CSR means GB Group must align its operations with societal expectations. This includes responsible data handling, fair labor practices, and contributing positively to the communities it serves, all of which are critical for long-term business resilience and reputation management in the current market landscape.

GB Group, while not a heavy manufacturing firm, faces increasing expectations to embed sustainable business practices throughout its operations. This includes a focus on responsible resource consumption and effective waste management, particularly within its office spaces and data centers. The company is actively working to reduce its carbon footprint, aiming for greener operational efficiency.

In 2024, many companies like GB Group are setting ambitious targets for emissions reduction. For instance, a significant portion of FTSE 100 companies have committed to Net Zero by 2050, with interim targets for 2030. GB Group's efforts to promote environmental awareness internally are crucial for fostering a culture of sustainability, encouraging employees to adopt eco-friendly habits in their daily work.

The environmental dimension of ethical technology development is increasingly critical. Concerns around the significant energy consumption of large-scale data processing and the burgeoning field of artificial intelligence are paramount. For instance, the training of advanced AI models can consume vast amounts of electricity, raising questions about their carbon footprint.

GB Group's commitment to developing efficient, data-driven solutions directly addresses these environmental considerations. By optimizing resource utilization within its verification processes, the company can contribute to more sustainable digital ecosystems. This focus on efficiency helps mitigate the environmental impact often associated with data-intensive operations, aligning with broader sustainability goals within the tech sector.

Supply Chain Sustainability

GB Group, like many businesses in 2024 and 2025, faces growing pressure to demonstrate robust supply chain sustainability. This means not only looking at its own operations but also scrutinizing the environmental practices of its vendors and partners. For a data-centric company, this extends to how data is sourced and processed, ensuring these activities align with environmental considerations.

The drive for greener supply chains is accelerating. For instance, by 2025, many companies are expected to have at least 50% of their key suppliers reporting on their environmental impact. This trend is fueled by consumer demand and regulatory shifts, pushing businesses to adopt more transparent and eco-conscious sourcing strategies.

- Vendor Audits: GB Group may need to implement stricter environmental audits for its suppliers, assessing their carbon footprint, waste management, and resource efficiency.

- Data Ethics and Environment: Scrutinizing data sourcing and processing for environmental alignment could involve evaluating the energy consumption of data centers used by partners or the sustainability of data collection methods.

- Circular Economy Principles: Encouraging partners to adopt circular economy principles, such as reducing waste and promoting reuse or recycling of materials, will become increasingly important.

- Reporting Standards: Adherence to evolving environmental reporting standards, like those from the Task Force on Climate-related Financial Disclosures (TCFD), will likely be a key expectation for GB Group's supply chain partners.

Reporting and Transparency on Environmental Impact

There's a significant and accelerating push for businesses to openly share details about their environmental footprint and sustainability efforts. This isn't just a trend; it's becoming a core expectation from investors, regulators, and the public alike.

GB Group's proactive engagement with Environmental, Social, and Governance (ESG) reporting and its dedication to a comprehensive sustainability strategy are vital for satisfying these growing demands. Stakeholders are increasingly using this information to guide their investment and partnership decisions.

For instance, a 2024 report by PwC indicated that 80% of investors consider ESG factors when making investment decisions. This underscores the critical need for companies like GB Group to provide clear, verifiable data on their environmental impact.

- Investor Scrutiny: Investors are increasingly demanding detailed ESG data, with many using it as a key criterion for capital allocation.

- Regulatory Landscape: Evolving regulations globally are mandating greater transparency in environmental reporting, pushing companies towards more robust disclosure practices.

- Brand Reputation: Companies demonstrating strong environmental stewardship and transparent reporting often enjoy enhanced brand loyalty and a more positive public image.

- Operational Efficiency: The process of reporting often highlights areas for operational improvement, leading to cost savings and increased resource efficiency.

GB Group faces increasing pressure to integrate sustainable practices, impacting its brand and investor appeal, as evidenced by a 2024 PwC report showing 70% of investors consider ESG factors. The company is actively working to reduce its carbon footprint, aiming for greener operational efficiency and setting ambitious emissions reduction targets, aligning with broader sustainability goals within the tech sector.

The company must also ensure its supply chain partners adhere to environmental standards, with many businesses aiming for at least 50% of key suppliers to report on environmental impact by 2025. This includes scrutinizing data sourcing and processing for environmental alignment, such as the energy consumption of partner data centers.

GB Group's commitment to transparent environmental reporting is crucial, as an 80% of investors consider ESG factors in 2024, according to PwC. This focus on sustainability is driven by investor scrutiny, evolving regulations, and the need to enhance brand reputation.

| Environmental Factor | GB Group's Focus/Challenge | Industry Trend/Data (2024-2025) |

|---|---|---|

| Carbon Footprint Reduction | Aiming for greener operational efficiency, reducing emissions from data centers and offices. | FTSE 100 companies targeting Net Zero by 2050, with interim 2030 goals. |

| Supply Chain Sustainability | Scrutinizing vendor practices, including data sourcing and processing energy consumption. | By 2025, 50% of key suppliers expected to report environmental impact. |

| Data Center Energy Efficiency | Optimizing resource utilization in data-intensive operations. | Growing concern over AI model training energy consumption. |

| Environmental Reporting & Transparency | Providing clear, verifiable data on environmental impact to stakeholders. | 80% of investors consider ESG factors; regulatory mandates for disclosure increasing. |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, reputable financial news outlets, and leading industry research firms. We meticulously gather insights on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to provide a comprehensive view.