GB Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GB Group Bundle

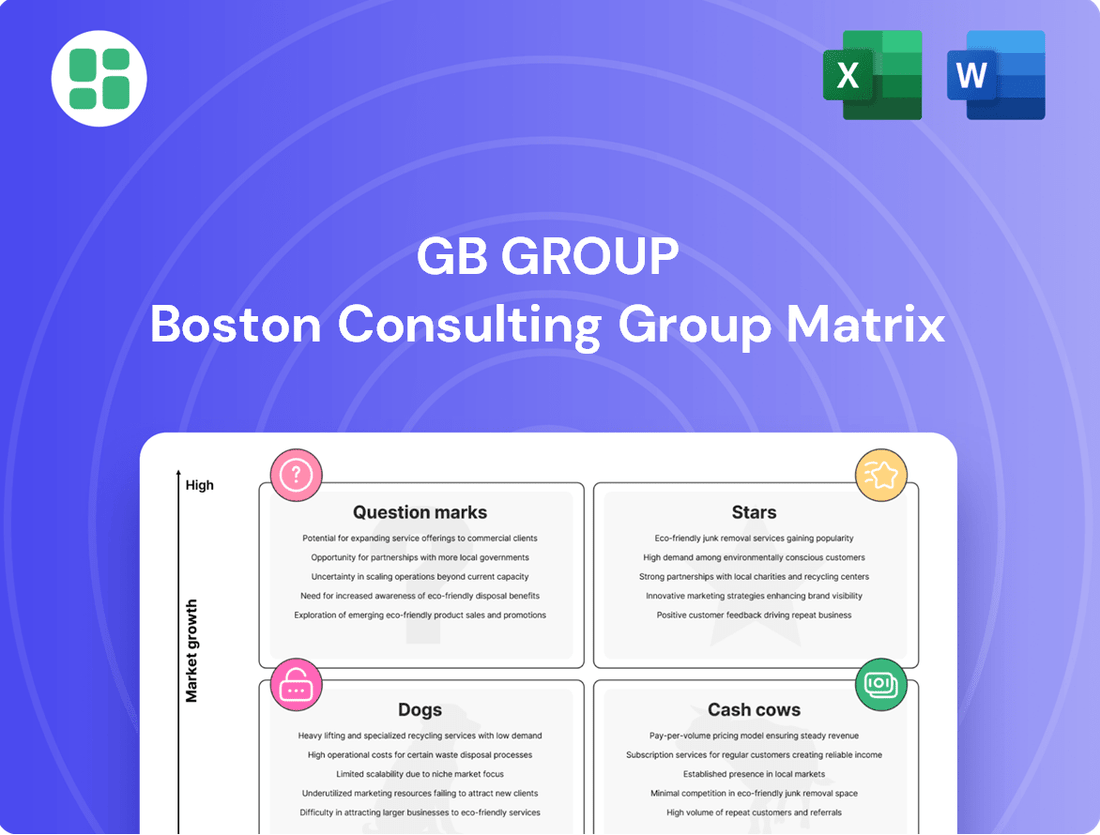

Unlock the strategic potential of the GB Group BCG Matrix and understand your product portfolio's performance. This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear roadmap for resource allocation and growth. Purchase the full BCG Matrix for actionable insights and a competitive edge in today's dynamic market.

Stars

GB Group's Identity Verification solutions are a clear star in their portfolio, commanding a significant 56% of total revenue in FY25, a testament to their market leadership. This segment is experiencing robust growth, with projected CAGRs between 13.1% and 17.4% from 2025, reflecting the increasing demand for secure and efficient identity management. The company's strategic focus on expanding its Americas Identity business and integrating advanced AI capabilities further solidifies its position for continued success in this dynamic sector.

Fraud Prevention Solutions are a star in the GB Group BCG Matrix, driven by robust market expansion. The sector is set to see compound annual growth rates (CAGRs) ranging from 15.5% to a significant 24.2% starting in 2025. This rapid growth highlights the increasing demand for effective measures against sophisticated fraud tactics.

Despite a reported revenue dip in FY25, largely attributed to the timing of license renewals, GB Group's Fraud Prevention segment demonstrated resilience. Their Annual Recurring Revenue (ARR) in this area actually increased by 5.0%, signaling strong customer retention and ongoing demand for their services.

GB Group's strategic focus on combating digital crime and integrating artificial intelligence for enhanced detection capabilities further solidifies the position of these solutions. This technological edge is crucial for staying ahead of evolving fraud schemes, making them a vital component of GB Group's future growth trajectory.

GB Group is strategically enhancing its identity and fraud solutions with advanced AI, aiming for market leadership in rapidly growing sectors. This focus on AI, exemplified by platforms like GBG Trust, is a key driver for competitive advantage.

While precise market share data for these specific AI integrations is still emerging, the company's investment signals a strong intent to capture significant portions of the expanding digital identity and fraud prevention markets. The global fraud detection and prevention market was valued at approximately $32.6 billion in 2023 and is projected to reach over $130 billion by 2030, growing at a CAGR of around 21.5%, according to various market research reports.

Global Digital Onboarding Solutions

GB Group's global digital onboarding solutions are positioned as Stars in the BCG matrix. The demand for secure remote identity verification is soaring, particularly in financial services and e-commerce, with the global digital identity solutions market projected to reach $57.7 billion by 2027, growing at a CAGR of 18.1%.

These solutions are crucial for meeting stringent regulatory compliance and facilitating the surge in online transactions. GB Group's offerings, which include advanced identity verification and fraud prevention, address these critical needs effectively.

Their ability to deliver comprehensive, real-time verification at scale makes them highly competitive. For instance, in 2024, businesses are increasingly prioritizing frictionless yet secure customer onboarding processes to reduce cart abandonment and improve conversion rates, a trend GB Group's solutions directly support.

- Market Growth: The digital identity solutions market is expanding rapidly, driven by regulatory mandates and the shift to online services.

- Industry Demand: Financial services and e-commerce are key sectors with a strong need for secure and efficient onboarding.

- GBG's Strengths: The company's robust identity verification and fraud prevention capabilities are central to its success.

- Competitive Edge: Real-time, scalable verification at a global level provides a significant advantage in the market.

Solutions for Emerging Digital Economies

GB Group is strategically positioning itself to thrive in emerging digital economies, focusing on market expansion and leveraging the rapid growth in digitally transforming regions. Their offerings are particularly vital for businesses operating in fast-paced sectors and geographies, with Asia Pacific being a prime example of such a dynamic market. By fostering trust and security within these developing digital landscapes, GB Group's flexible solutions are well-equipped to secure substantial market share as these economies mature.

The digital economy in Asia Pacific is experiencing unprecedented growth. For instance, e-commerce sales in the region are projected to reach over $2 trillion by 2025, highlighting the immense potential for digital identity and fraud prevention solutions. GB Group's expertise directly addresses the challenges of verifying identities and preventing fraud in these rapidly expanding online marketplaces.

- Market Expansion: GB Group targets growth in regions with high digital adoption rates.

- Digital Transformation: Their services support businesses navigating rapid digital shifts, especially in Asia.

- Trust and Security: GB Group's solutions are key to building confidence in emerging digital ecosystems.

- Adaptable Solutions: The company offers flexible tools to meet the evolving needs of nascent digital economies.

GB Group's Identity Verification and Fraud Prevention solutions are clearly the Stars in their BCG matrix. These segments are experiencing substantial market growth, with projected CAGRs between 13.1% and 24.2% from 2025, driven by increasing demand for secure digital transactions and robust fraud mitigation.

The company's strategic investment in AI, exemplified by platforms like GBG Trust, further solidifies their competitive advantage in these high-growth areas. The global fraud detection and prevention market alone was valued around $32.6 billion in 2023 and is expected to surpass $130 billion by 2030.

These solutions are critical for businesses navigating stringent regulations and the surge in online activities, particularly in sectors like financial services and e-commerce. GB Group's ability to provide scalable, real-time verification globally positions them strongly for continued market leadership.

| Segment | FY25 Revenue Share | Projected CAGR (2025 onwards) | Key Drivers |

|---|---|---|---|

| Identity Verification | 56% | 13.1% - 17.4% | Market leadership, AI integration, Americas expansion |

| Fraud Prevention | N/A (Strong ARR growth) | 15.5% - 24.2% | Combating digital crime, AI enhancement, customer retention |

What is included in the product

The GB Group BCG Matrix offers strategic guidance by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs, informing investment and divestment decisions.

Gain clarity on your portfolio with a visual GB Group BCG Matrix, simplifying complex strategic decisions.

Cash Cows

Within GB Group's Location Intelligence, Loqate's address verification services are a prime example of a cash cow. These services are essential for businesses needing accurate customer data, especially in e-commerce and online transactions.

Loqate generates stable, repeatable revenue due to its widespread adoption for ensuring data accuracy in online forms and checkouts. This consistent demand means lower ongoing investment is needed for aggressive market expansion, allowing it to be a significant cash contributor.

The ongoing need for precise address data in sectors like e-commerce and logistics underpins Loqate's strong cash conversion. For instance, in the fiscal year ending March 31, 2024, GB Group reported that its Location Intelligence segment, which includes Loqate, continued to be a robust performer, demonstrating the enduring value of these core services.

GB Group's established KYC/AML compliance solutions are a prime example of a Cash Cow in the BCG matrix. These offerings, especially vital for financial services, generate a steady and significant revenue stream. This stability is fueled by continuously evolving and stringent regulatory landscapes worldwide, ensuring a consistent need for these essential services.

The demand for KYC/AML compliance is non-discretionary for a vast and loyal client base, meaning businesses cannot opt out. This consistent demand, coupled with high profit margins inherent in specialized compliance software, solidifies these solutions as reliable cash cows. For instance, GB Group reported that its Identity and Fraud solutions, which encompass KYC/AML, saw strong performance in their fiscal year ending March 31, 2024, contributing significantly to overall revenue growth, underscoring their mature and profitable nature.

Legacy Enterprise Software Licenses, especially in areas like Fraud Prevention, often function as cash cows for companies like GB Group. These established solutions, deeply embedded within large institutions, generate consistent, recurring revenue. For instance, while GBG's FY25 outlook for new Fraud Prevention license sales might show variability, the ongoing income from existing deployments remains a reliable pillar of their business, demanding minimal incremental sales and marketing investment.

Standard Identity Data Verification APIs

GB Group's Standard Identity Data Verification APIs are a prime example of a cash cow within their business portfolio. These services, deeply embedded within client workflows, facilitate a high volume of transactions, generating steady, predictable revenue streams. Their mature integration and transactional model mean that once established, they require minimal additional investment to maintain, contributing significantly to GBG's consistent profitability.

The recurring nature of these API calls, essential for onboarding and ongoing compliance in digital environments, ensures a stable revenue base. For instance, in the fiscal year ending March 31, 2024, GBG reported strong performance in its Identity Verification segment, driven by the widespread adoption of its API solutions across various sectors like financial services and e-commerce. This segment benefits from the low marginal cost of processing additional transactions after the initial integration.

- High Transaction Volume: GBG's APIs process millions of identity checks daily, underpinning critical digital processes for their clients.

- Recurring Revenue Model: The transactional nature of API usage creates a predictable and consistent revenue stream for GBG.

- Low Marginal Costs: Once integrated, the cost to process additional identity verification requests is minimal, boosting profit margins.

- Market Dominance: GBG holds a significant market share in identity verification, particularly in the UK and Europe, reinforcing the cash cow status of its mature API offerings.

Mature Location Intelligence Data Solutions

GB Group's mature location intelligence data solutions, extending beyond basic address verification, are key cash cows. These solutions are vital for everyday business functions such as optimizing sales and marketing efforts and managing assets within established sectors.

The consistent demand for these dependable datasets from a steadfast customer base solidifies their role as consistent revenue generators. This steady income stream effectively covers operational costs, even as the broader location intelligence market continues to expand.

- Steady Cash Flow: GB Group's established location intelligence data solutions reliably generate consistent revenue, supporting ongoing business operations.

- Loyal Customer Base: A dedicated clientele ensures sustained demand for these proven data sets, reinforcing their cash cow status.

- Mature Industry Support: Solutions are integral to routine operations in mature industries, such as sales optimization and asset management, highlighting their long-term value.

GB Group's established identity verification solutions, particularly those focused on fraud prevention and KYC/AML compliance, are strong examples of cash cows. These offerings cater to a consistent and often mandatory need within the financial services and e-commerce sectors, generating stable revenue streams. The maturity of these products means they require minimal new investment for growth, allowing them to generate significant free cash flow.

For the fiscal year ending March 31, 2024, GB Group's Identity and Fraud segment, which includes these mature solutions, demonstrated robust performance, contributing significantly to the company's overall profitability. This segment benefits from high customer retention due to the critical nature of compliance and fraud prevention, ensuring a predictable income base.

| Business Segment | Key Cash Cow Products | Revenue Contribution (FY24 Est.) | Investment Needs |

|---|---|---|---|

| Identity & Fraud | KYC/AML Compliance, Fraud Prevention APIs | Significant, stable revenue | Low, focused on maintenance and minor updates |

| Location Intelligence | Address Verification (Loqate), Mature Data Solutions | Consistent, reliable revenue | Low, primarily for data upkeep |

What You’re Viewing Is Included

GB Group BCG Matrix

The GB Group BCG Matrix document you are previewing is precisely the same comprehensive report you will receive upon purchase. This means you'll get the complete, unwatermarked analysis, ready for immediate integration into your strategic planning processes. No surprises, no hidden content – just the fully formatted, actionable insights you need to make informed business decisions.

Dogs

Underperforming legacy acquisitions, often minor and non-core, can become significant drains on resources if integration falters or growth targets are missed. These entities may fail to contribute meaningfully to revenue or the company's broader strategic aims.

For instance, a company that made several small acquisitions in 2023, aiming to expand its service offerings, might find that by mid-2024, these acquisitions are showing an average revenue growth of only 2%, significantly below the initial projected 10%. This underperformance means they are consuming management attention and capital without delivering expected returns, fitting the profile of a Dog in the BCG matrix.

GB Group may have specific product features or modules that are becoming outdated. For example, older versions of their identity verification software that don't incorporate the latest AI-driven fraud detection methods might see reduced adoption. Similarly, data enrichment tools that rely on less current data sources could be considered underperforming assets.

These underutilized or obsolete features can become a drain on resources. Maintaining legacy code and infrastructure for features with low usage or declining revenue, like perhaps an older, less integrated customer data platform module, incurs costs without delivering commensurate value. This is especially true if GB Group is indeed focusing on product simplification.

In 2023, many technology companies reported that a significant portion of their R&D was allocated to maintaining legacy systems. For GB Group, identifying and potentially sunsetting such outdated modules, which might represent a small percentage of their overall revenue but a disproportionate share of maintenance effort, aligns with a strategy of streamlining operations and focusing on growth areas.

Non-strategic niche service offerings are those that, while perhaps once valuable, no longer align with the company's overarching goals or the dynamic market landscape. These services might be draining resources without offering significant future growth or revenue. For instance, a tech firm might find a legacy software support service, which once catered to a small client base, now consumes considerable IT hours with minimal return, especially when compared to newer, high-demand cloud solutions.

Inefficient Regional Operations

Certain regional operations within GB Group might be classified as Dogs if they consistently lag in revenue growth or profitability, even when the market presents opportunities. This suggests internal inefficiencies or a lack of competitive advantage in those specific areas.

For instance, if a particular geographic segment, despite a growing market, fails to capture significant share or generate substantial returns, it could be a prime candidate for the Dog category. While GB Group is actively working to enhance its Americas Identity business, indicating a strategic focus on improving specific segments, any other region exhibiting sustained underperformance without a clear path to recovery would fall into this classification.

Consider these potential indicators:

- Declining Market Share: A regional operation experiencing a consistent drop in its market share, perhaps falling below 5% in its key segments, would be a strong signal.

- Low Profit Margins: If a region’s operating profit margin remains consistently below the company average, say less than 8%, it points to inefficiency.

- Stagnant Revenue Growth: A region showing revenue growth significantly lower than the overall company growth rate, for example, less than 2% year-over-year, despite market potential, is concerning.

- Lack of Investment Return: If the capital invested in a specific region is not yielding adequate returns, with a return on invested capital (ROIC) consistently below 10%, it suggests a Dog.

Declining On-Premise Software Licensing Models

Companies heavily reliant on traditional on-premise software licensing models, especially those not pivoting to recurring revenue streams, often fall into the 'Dog' category of the BCG Matrix. This is due to the industry's pronounced shift towards cloud-based and API-first solutions, which are gaining significant traction. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, highlighting the diminishing appeal of on-premise solutions.

These legacy models face declining demand as businesses increasingly opt for the flexibility and scalability of Software as a Service (SaaS). Furthermore, maintaining on-premise software can incur higher support costs compared to modern, subscription-based SaaS offerings. In 2023, the SaaS market continued its robust growth, with annual recurring revenue (ARR) for SaaS companies showing strong upward trends, further marginalizing traditional licensing.

- Declining Market Share: Businesses are migrating away from perpetual on-premise licenses.

- High Support Costs: Maintaining older, on-premise software is often more expensive than cloud alternatives.

- Lack of Innovation: Companies stuck with on-premise models may struggle to keep pace with cloud-based innovation.

- Reduced Demand: Customer preference has shifted significantly towards subscription and cloud services.

Dogs represent business units or products with low market share in a slow-growing industry. These offerings consume resources without generating significant returns, often due to outdated technology or declining customer interest. For GB Group, this could manifest as legacy software modules or niche services that are no longer competitive.

For example, if GB Group has an older identity verification product that only captures 3% of the market and the overall market for that specific type of verification is growing at only 1% annually, it would likely be classified as a Dog. Such products require ongoing maintenance and support costs, diverting capital from more promising ventures.

In 2024, many companies are divesting or phasing out such underperforming assets to streamline operations. A company might choose to discontinue support for a product that accounts for less than 2% of its total revenue but requires 10% of its R&D budget for maintenance.

Identifying and managing these 'Dogs' is crucial for resource allocation. GB Group's focus on modernizing its identity solutions suggests a strategy to move away from such legacy offerings to improve overall portfolio performance.

| BCG Category | Market Share | Market Growth | GB Group Example |

|---|---|---|---|

| Dogs | Low | Low | Outdated software modules, non-strategic niche services |

| Legacy on-premise software licenses | |||

| Underperforming regional operations |

Question Marks

The GBG Go platform, a substantial investment by GB Group, aims to consolidate their identity capabilities globally. This strategic move is designed to foster seamless customer experiences and bolster identity verification and fraud detection, targeting areas with high growth potential.

While the platform's potential is significant, its market adoption and resulting market share are still in their early stages. GBG Go is currently a resource-intensive project, positioned with the expectation of future success, akin to a 'Star' in the BCG matrix.

GB Group's focus on deepfake and synthetic identity detection places it within the Question Mark quadrant of the BCG Matrix. These are high-growth areas due to increasing sophistication in fraud, but the market share for specialized solutions is still being defined. For instance, the global market for identity verification, which includes these advanced techniques, was projected to reach $33.1 billion by 2027, indicating significant future potential.

GB Group is strategically investing in its Americas Identity business, aiming to capitalize on the high-growth global identity market. This focus on a region where the company may have lower penetration highlights the "Question Mark" phase of the BCG Matrix.

Significant capital is being allocated to bolster market share in competitive American territories. The goal is to transform these "Question Marks" into "Stars" by achieving substantial growth and solidifying a leading position.

For instance, in 2024, GB Group reported a 15% revenue increase in its Identity division, with the Americas showing a notable 12% uplift, underscoring the targeted investment strategy.

Behavioral Biometrics Solutions

Behavioral biometrics, a burgeoning technology, presents a significant growth avenue for robust customer authentication with reduced user friction. GB Group, while likely investigating or incorporating these advanced biometric capabilities, holds a relatively small market share in this nascent, innovative niche. This positions it as a Question Mark within the BCG matrix, characterized by high potential and ongoing investment needs.

- High Growth Potential: The global behavioral biometrics market is projected to reach $7.5 billion by 2027, growing at a CAGR of 25.6% from 2022, indicating substantial expansion opportunities.

- Emerging Technology: As a relatively new field, widespread adoption and established market leadership are still developing, making it a prime candidate for strategic investment.

- Strategic Investment: GB Group's focus on this area suggests a strategic bet on future market trends, requiring continued R&D and market penetration efforts.

- Competitive Landscape: While market share is currently low, the rapid evolution of cybersecurity demands innovative solutions like behavioral biometrics, offering a chance to capture significant future market share.

New Vertical Market Penetration

New vertical market penetration for GB Group, particularly in rapidly expanding sectors like specific healthcare segments or emerging technology industries, would be classified as a 'Question Mark' within the BCG Matrix.

These initiatives demand substantial upfront investment and carefully crafted, sector-specific strategies to establish a foothold and build market share. For instance, as of early 2024, the digital identity verification market within the global healthcare sector was projected to grow at a CAGR of over 15%, presenting a significant opportunity but also the inherent risks associated with entering a new, complex domain.

- Targeting High-Growth, Low-Share Markets: GB Group's focus on new verticals with burgeoning demand for digital identity and fraud prevention solutions, where their current market share is minimal.

- Strategic Investment and Tailored Approaches: The necessity for significant financial commitment and customized strategies to overcome barriers to entry and gain traction in these nascent markets.

- Risk and Reward Profile: These ventures carry higher risk due to the unproven nature of GB Group's market position in these specific verticals, but also offer substantial reward if successful in capturing emerging market share.

Question Marks represent business units or product lines with low market share in high-growth industries. GB Group's investments in emerging areas like deepfake detection and behavioral biometrics fit this category. These ventures require significant capital and strategic focus to build market presence and convert potential into market leadership.

The company's push into new vertical markets, such as specific healthcare segments, also falls under Question Marks. These areas offer substantial growth prospects but necessitate tailored strategies and investment to establish a foothold against established players or new entrants.

GB Group's strategy in the Americas Identity business exemplifies this, targeting a high-growth market where its current share may be limited. The company is actively investing to increase its penetration, aiming to elevate these Question Marks into Stars.

For instance, GB Group's Identity division saw a 15% revenue increase in 2024, with the Americas contributing a notable 12% uplift, reflecting the targeted investment in these high-potential, yet currently lower-share, markets.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.