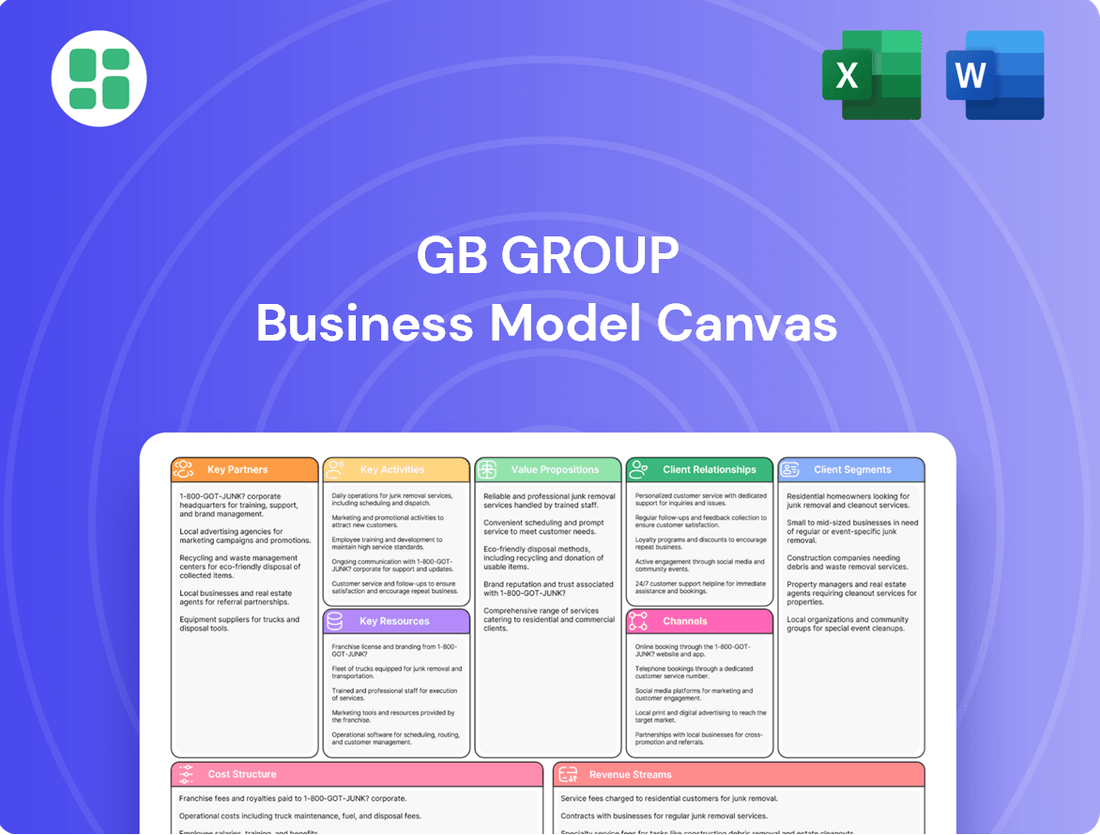

GB Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GB Group Bundle

Discover the core elements of GB Group's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a clear picture of their operational strategy. For anyone aiming to understand market leaders or refine their own business approach, this is an essential resource.

Partnerships

GB Group's business model heavily leans on its relationships with key data providers and credit bureaus worldwide. These partnerships are the bedrock for accessing the extensive and varied information needed to power their identity verification and fraud prevention services. For instance, in 2024, GBG continued to expand its data partnerships, ensuring access to over 200 data sources globally, which is vital for maintaining accuracy and breadth in diverse markets.

These collaborations are not just about data acquisition; they are fundamental to GBG's ability to offer sophisticated identity intelligence. By integrating data from trusted sources, GBG can provide clients with the robust insights necessary for making sound decisions, mitigating risks, and enhancing customer onboarding processes. This network of providers allows GBG to offer comprehensive coverage, a critical factor for businesses operating in an increasingly complex regulatory and threat landscape.

GB Group's strategy heavily relies on technology and platform integrations, especially with the recent introduction of GBG Go. These collaborations are crucial for ensuring their identity orchestration platform works smoothly within their clients' current technology stacks, making GBG's services more accessible and valuable.

GB Group actively cultivates a robust ecosystem of channel partners and resellers, a critical component of its go-to-market strategy. This network acts as an extension of GBG's direct sales force, enabling the company to tap into diverse geographic regions and industry verticals more effectively. For instance, in 2024, GBG continued to expand its reseller agreements, aiming to reach small and medium-sized businesses that might not be directly served by its enterprise sales teams.

These partnerships are instrumental in accelerating market penetration and driving wider adoption of GBG's identity and location intelligence solutions. By collaborating with established players who possess local market knowledge and existing customer relationships, GBG can overcome geographical barriers and reduce the time-to-market for its offerings. This collaborative approach was particularly evident in emerging markets during 2024, where local partners provided invaluable insights and access.

Strategic Alliances for Innovation

GB Group’s strategic alliances are crucial for driving innovation, particularly in developing advanced AI-driven capabilities. These collaborations enable GBG to maintain a leading edge in identity verification and fraud prevention technologies, ensuring they can effectively counter emerging digital threats. For instance, in 2024, GBG continued to expand its partner ecosystem, focusing on entities with specialized AI and machine learning expertise to enhance its fraud detection algorithms.

- AI and Machine Learning Collaborations: Partnerships with AI specialists to integrate advanced predictive analytics into fraud prevention tools.

- Data Providers: Alliances with global data providers to enrich identity verification data sets, improving accuracy and coverage.

- Technology Integrators: Collaborations with firms that specialize in integrating new technologies into existing enterprise systems, broadening GBG’s market reach.

- Research Institutions: Engaging with academic and research bodies to explore future trends in digital identity and cybersecurity.

Industry-Specific Solution Providers

GB Group collaborates with industry-specific solution providers to refine its identity intelligence offerings for sectors such as financial services, e-commerce, and gaming. This strategic alignment allows GBG to embed its capabilities directly into specialized platforms, thereby increasing its utility and appeal to niche markets.

These partnerships ensure GBG's solutions become integral to the operational processes of its target industries. For instance, in 2024, the financial services sector continued to rely heavily on robust identity verification, with reports indicating that fraud losses in the UK alone were projected to exceed £1 billion annually, underscoring the critical need for integrated identity solutions.

- Financial Services Integration: Partnering with core banking and fintech platforms to embed identity verification and fraud prevention directly into onboarding and transaction processes.

- E-commerce Specialization: Collaborating with e-commerce platform providers to offer tailored solutions for customer authentication and age verification, crucial for online sales.

- Gaming Compliance: Working with gaming operators to integrate identity checks that meet stringent regulatory requirements, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) mandates.

GB Group's key partnerships are crucial for expanding its reach and enhancing its identity verification and fraud prevention services. These collaborations, particularly with data providers and technology integrators, ensure access to comprehensive global data and seamless integration into client systems. For example, in 2024, GBG continued to strengthen its network of over 200 global data sources, vital for maintaining accuracy across diverse markets.

The company also cultivates a strong ecosystem of channel partners and resellers, extending its market penetration and reaching a broader customer base, including small and medium-sized businesses. Strategic alliances with AI specialists further bolster GBG's innovative capabilities, enabling them to stay ahead of emerging digital threats. In 2024, GBG focused on partners with advanced AI/ML expertise to refine its fraud detection algorithms.

| Partner Type | Purpose | 2024 Focus/Impact |

|---|---|---|

| Data Providers | Access to global identity and financial data | Expanded to over 200 sources, enhancing accuracy and coverage. |

| Technology Integrators | Seamless integration into client IT infrastructure | Facilitated adoption of GBG Go platform within diverse tech stacks. |

| Channel Partners/Resellers | Market penetration and broader customer reach | Increased access to SMBs and emerging markets. |

| AI/ML Specialists | Enhancing fraud detection and predictive analytics | Improved fraud algorithms through specialized expertise. |

What is included in the product

A detailed breakdown of GB Group's operations, outlining key customer segments, value propositions, and revenue streams.

This model offers a clear view of GB Group's strategic approach to customer acquisition and retention through its various channels.

The GB Group Business Model Canvas acts as a pain point reliver by providing a clear, visual framework that simplifies complex strategic thinking.

It alleviates the pain of fragmented planning by consolidating all essential business elements onto a single, actionable page.

Activities

GB Group's key activity is providing electronic identity verification and authentication services for businesses. This process involves rigorously checking individuals against vast global databases and employing biometric verification to ensure secure onboarding of legitimate customers.

These services are critical for preventing identity fraud and helping companies adhere to strict regulatory requirements. For instance, in 2024, the global identity verification market was projected to reach over $30 billion, highlighting the immense demand for such solutions.

GB Group is at the forefront of creating advanced solutions to combat fraud, offering real-time risk assessment and transaction monitoring to safeguard businesses. They specialize in identifying sophisticated threats like synthetic identities, a growing concern in digital transactions.

In 2024, the global cost of financial crime was estimated to be trillions of dollars, highlighting the critical need for GB Group's services. Their technology aims to fortify businesses against these pervasive threats, fostering a more secure digital environment and building essential trust.

GB Group's core operations revolve around providing sophisticated location intelligence and address verification services. This involves crucial activities like address look-up, data validation, and geocoding, ensuring that customer information is precise and up-to-date.

These services are vital for businesses aiming to enhance their delivery logistics, refine marketing campaigns, and meet stringent compliance requirements. For instance, accurate address data is fundamental for preventing failed deliveries, a common pain point for e-commerce businesses.

By confirming real-time location details, GB Group empowers companies to boost operational efficiency and elevate the customer experience. In 2024, the demand for such services is projected to grow significantly as businesses increasingly rely on accurate location data for everything from fraud prevention to personalized service delivery.

Research and Development (R&D) and Innovation

GBG's commitment to Research and Development is central to its strategy, ensuring it stays ahead in the dynamic identity and location software market. This involves a continuous cycle of enhancing current offerings and pioneering new solutions.

A significant focus is placed on developing next-generation platforms, exemplified by GBG Go, which aims to streamline customer onboarding and identity verification processes. The integration of cutting-edge technologies, particularly artificial intelligence, is a key driver for innovation, enabling more sophisticated and efficient solutions.

- Continuous Investment: GBG consistently allocates resources to R&D to maintain its competitive advantage.

- Platform Development: The creation of new platforms like GBG Go is a testament to their forward-looking approach.

- Technology Integration: Embracing advanced technologies like AI is crucial for future product development and service enhancement.

- Market Leadership: These activities collectively reinforce GBG's position as a leader in identity and location intelligence.

Data Management and Global Data Sourcing

GBG's core operations revolve around the meticulous management and global sourcing of identity and location data. This critical activity underpins the accuracy and effectiveness of their intelligence solutions.

Ensuring data quality and adherence to regulatory compliance are paramount. GBG actively works to expand its data coverage, which already spans over 70 countries, to provide comprehensive global insights.

- Data Sourcing: Acquiring identity and location data from diverse global sources.

- Data Management: Organizing, cleaning, and maintaining the integrity of vast datasets.

- Compliance: Adhering to international data privacy regulations and standards.

- Coverage Expansion: Continuously increasing the number of countries from which data is sourced.

GBG's key activities center on developing and delivering sophisticated identity verification, fraud prevention, and location intelligence solutions. These involve robust data sourcing, meticulous data management, and continuous investment in research and development to integrate emerging technologies like AI.

These operations are crucial for businesses worldwide seeking to onboard legitimate customers securely, prevent financial crime, and optimize operations through accurate location data. In 2024, the global identity verification market was valued at over $30 billion, underscoring the significant demand for GBG's expertise.

The company's focus on platform development, such as GBG Go, and its commitment to expanding global data coverage across over 70 countries, reinforce its market leadership. This strategic approach ensures GBG remains at the forefront of combating sophisticated threats like synthetic identities, which contributed to trillions of dollars in global financial crime costs in 2024.

| Key Activity | Description | 2024 Market Context |

|---|---|---|

| Identity Verification & Authentication | Providing electronic identity verification and authentication services, including biometric verification. | Global identity verification market projected over $30 billion. |

| Fraud Prevention | Developing advanced solutions to combat fraud, including real-time risk assessment and synthetic identity detection. | Global financial crime costs estimated in trillions of dollars. |

| Location Intelligence & Address Verification | Offering location intelligence and address verification services like geocoding and data validation. | High demand for accurate location data in e-commerce and logistics. |

| Research & Development | Continuously investing in R&D to enhance platforms (e.g., GBG Go) and integrate new technologies like AI. | Focus on next-generation platforms and AI integration for competitive advantage. |

| Data Management & Sourcing | Meticulously managing and globally sourcing identity and location data, ensuring quality and compliance. | Data coverage spans over 70 countries, adhering to international privacy regulations. |

Full Document Unlocks After Purchase

Business Model Canvas

The GB Group Business Model Canvas preview you are viewing is precisely the document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this identical, professionally structured Business Model Canvas, allowing you to immediately begin strategic planning.

Resources

GB Group's proprietary technology, notably its new unified identity platform GBG Go, acts as a cornerstone of its operations. This advanced technology is crucial for delivering scalable and secure identity verification and fraud prevention solutions, underpinning the company's capacity to manage an immense volume of transactions, exceeding 1 billion annually.

GBG's extensive global data assets are the bedrock of its business model, providing access to a vast and diverse pool of identity and location information. This includes critical sources like national ID registers and electoral rolls, forming a comprehensive foundation for identity intelligence.

The sheer breadth and depth of this data are crucial for GBG's ability to deliver highly accurate and reliable identity verification services. For instance, by integrating data from over 200 countries, GBG can verify identities across a truly global scale, a feat essential for international businesses.

This unparalleled access to data, including specialist sources, empowers GBG to offer sophisticated identity intelligence solutions. In 2024, the company continued to expand its data footprint, underscoring its commitment to providing the most robust identity verification capabilities available in the market.

Intellectual property, particularly patents for its proprietary algorithms and software in identity and fraud management, is a core resource for GB Group. This IP acts as a significant competitive advantage, safeguarding their innovative methods and reinforcing their market position.

In 2024, GB Group continued to leverage its robust patent portfolio to protect its advanced identity verification and fraud prevention technologies. This strategic asset not only differentiates them in a crowded market but also underpins their ability to offer unique, high-value solutions to clients.

Expertise and Human Capital

GB Group’s expertise and human capital are foundational to its success. The company boasts a team of highly skilled professionals specializing in identity, fraud, and location intelligence. This deep bench of talent possesses extensive market knowledge and technical proficiency, crucial for navigating complex regulatory landscapes and developing cutting-edge solutions.

This human capital is not just about technical skill; it's also about fostering strong, trusted relationships with customers. The ability to understand client needs and deliver tailored solutions is paramount. In 2024, GB Group continued to invest in its workforce through ongoing training and development, ensuring its team remains at the forefront of industry advancements.

The impact of this human capital is directly visible in GB Group's innovation pipeline and its consistent delivery of effective solutions. Their ability to anticipate market shifts and adapt their offerings is a testament to the collective intelligence and dedication of their employees.

- Deep Domain Expertise: GB Group employs specialists with years of experience in identity verification, fraud prevention, and location data analysis.

- Customer Relationship Management: The team excels at building and maintaining trust with clients, understanding their unique challenges.

- Innovation Driver: Human capital fuels the development of new technologies and services, keeping GB Group competitive.

- Solution Delivery Excellence: Skilled professionals ensure the effective implementation and ongoing support of GB Group's product suite.

Robust IT Infrastructure and Cloud Capabilities

GB Group's robust IT infrastructure, including its cloud capabilities, is the backbone for managing extensive data and transaction volumes. This allows for the seamless global delivery of their identity verification and fraud prevention solutions, ensuring consistent high availability and performance for clients worldwide. In 2024, GB Group continued to invest in optimizing its cloud infrastructure, recognizing its direct impact on operational efficiency and cost-effectiveness.

The company's commitment to a resilient and secure IT environment is paramount, especially given the sensitive nature of the data it handles. This infrastructure underpins GB Group's ability to process millions of data points daily, providing critical insights for customer onboarding and risk management. The ongoing evolution of these capabilities is crucial for maintaining a competitive edge and meeting the dynamic demands of the digital economy.

- Secure and Scalable Cloud Foundation: GB Group leverages cloud technologies to ensure its IT infrastructure can scale rapidly to meet fluctuating client demands and data processing needs.

- High Availability and Performance: A resilient IT backbone guarantees that GB Group's services are consistently available and perform at optimal levels, supporting critical business operations for its customers.

- Cost Optimization through Cloud: Strategic management and optimization of cloud resources contribute to greater cost efficiency in delivering its suite of identity and fraud prevention solutions.

- Data Processing Power: The infrastructure is designed to handle massive volumes of data, enabling sophisticated analytics and real-time decision-making for fraud detection and identity verification.

GB Group's key resources are its proprietary technology, extensive global data assets, intellectual property, skilled human capital, and robust IT infrastructure.

These elements collectively enable the company to offer comprehensive identity verification, fraud prevention, and compliance solutions to a global clientele.

The continuous investment in these resources, particularly in 2024, reinforces GBG's market leadership and ability to adapt to evolving digital landscapes.

| Resource Category | Key Components | 2024 Focus/Data Point | Impact |

|---|---|---|---|

| Technology | Unified Identity Platform (GBG Go), Proprietary Algorithms | Continued development and enhancement of GBG Go | Scalable and secure identity verification and fraud prevention |

| Data Assets | Global identity and location data, National ID registers, Electoral rolls | Expansion of data footprint across 200+ countries | Highly accurate and reliable global identity intelligence |

| Intellectual Property | Patents for algorithms and software | Leveraging robust patent portfolio | Competitive advantage, safeguarding innovative methods |

| Human Capital | Specialists in identity, fraud, and location intelligence | Ongoing workforce training and development | Innovation, customer relationship management, solution delivery |

| IT Infrastructure | Cloud capabilities, secure data management | Optimization of cloud infrastructure | High availability, performance, cost-effectiveness, massive data processing |

Value Propositions

GB Group's value proposition centers on bolstering fraud prevention and risk management for businesses. Their advanced tools are designed to proactively detect and intercept fraudulent activities, thereby safeguarding financial assets and mitigating operational risks. For instance, in 2023, financial institutions globally reported an estimated $3.7 trillion in losses due to fraud, highlighting the critical need for robust prevention measures.

These solutions offer real-time analysis and immediate alerts, empowering organizations to halt illicit transactions or interactions at the very first point of contact. This capability is crucial in an environment where cyber threats and financial crime are constantly evolving, as demonstrated by a 2024 report indicating a 15% year-over-year increase in sophisticated phishing attacks targeting businesses.

GB Group's value proposition centers on making it incredibly easy and secure for new customers to join a business. They provide tools that simplify the onboarding process, cutting down on the frustrating steps that often make people give up. For instance, in 2024, businesses using GBG's solutions saw an average reduction of 20% in onboarding abandonment rates.

By ensuring quick and precise identity checks, GBG creates a customer journey that feels both smooth and trustworthy. This focus on a seamless, secure experience directly translates to higher conversion rates, with many clients reporting a 15% uplift in successful customer acquisitions.

Ultimately, this streamlined approach not only boosts a business's ability to bring in new customers but also significantly enhances overall customer satisfaction from the very first interaction.

GB Group's services are crucial for navigating the intricate web of global compliance, specifically focusing on Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. These solutions streamline the process, enabling businesses to operate smoothly and securely across international borders.

By simplifying compliance management, GB Group empowers clients to avoid significant penalties and protect their brand's reputation. For instance, in 2023 alone, financial institutions worldwide paid billions in AML-related fines, highlighting the substantial financial risk of non-adherence.

Improved Data Accuracy and Decision Making

GB Group’s commitment to superior data accuracy directly translates into enhanced decision-making for businesses. By offering precise identity and location intelligence, companies gain a deeper understanding of their customer base, enabling more effective marketing campaigns and streamlining operations. For instance, in 2024, businesses leveraging robust identity verification solutions reported an average reduction in fraud losses by 15%, directly attributable to improved data accuracy.

This enhanced data quality underpins strategic business operations, minimizing costly errors and maximizing resource allocation. Reliable data isn't just a nice-to-have; it's a foundational element for competitive advantage. Companies that prioritize data integrity see a tangible uplift in customer acquisition costs, often by as much as 10% in the same year, because their outreach is more precise and less wasteful.

- Enhanced Customer Understanding: Accurate data allows for granular segmentation and personalized engagement.

- Targeted Marketing: Reduced wasted spend on irrelevant customer segments.

- Operational Efficiency: Streamlined processes through reliable customer information.

- Fraud Reduction: Mitigating financial losses through robust identity verification.

Reduced Operational Costs and Increased Efficiency

GB Group's automated identity verification and fraud prevention solutions are designed to streamline business operations, leading to substantial cost reductions. By minimizing the need for manual checks and reducing the occurrence of incorrect fraud flags, companies can significantly lower expenses tied to bringing on new customers and investigating potential fraud.

This commitment to simplifying processes and enhancing cost-effectiveness directly results in measurable financial benefits for GB Group's clients. For instance, in 2024, businesses utilizing GB Group's platform reported an average reduction of 25% in manual review time for identity checks, freeing up valuable employee resources.

- Lowered Customer Acquisition Costs: Automation reduces the labor-intensive aspects of onboarding, cutting per-customer acquisition expenses.

- Minimized Fraud Losses: Advanced fraud detection prevents costly fraudulent transactions and associated investigations.

- Improved Resource Allocation: By automating routine tasks, staff can focus on higher-value activities, boosting overall productivity.

- Enhanced Compliance Efficiency: Streamlined identity verification processes simplify adherence to regulatory requirements, avoiding potential fines.

GB Group's value proposition is built on providing businesses with the tools to confidently and efficiently verify customer identities, onboard them seamlessly, and manage risk effectively. This focus on secure and smooth customer journeys is paramount in today's digital landscape, where trust and speed are key differentiators.

By leveraging GB Group's solutions, companies can significantly reduce fraud, streamline compliance, and enhance their understanding of their customer base, leading to improved operational efficiency and increased profitability.

The company's offerings directly address critical business needs, from combating the ever-present threat of financial crime to ensuring adherence to stringent global regulations like KYC and AML.

In 2024, the global identity verification market was projected to reach $30.2 billion, underscoring the immense demand for such services.

| Value Proposition Area | Key Benefit | Supporting Data (2024 unless specified) |

|---|---|---|

| Fraud Prevention & Risk Management | Proactive detection and mitigation of fraudulent activities. | Businesses using GBG reported a 15% reduction in fraud losses due to improved data accuracy. |

| Seamless Customer Onboarding | Simplified and secure new customer acquisition. | Average reduction of 20% in onboarding abandonment rates for clients. |

| Global Compliance (KYC/AML) | Streamlined adherence to regulatory requirements. | Billions paid in AML fines globally in 2023 highlight the risk of non-compliance. |

| Data Accuracy & Decision Making | Enhanced understanding of customer base for better strategy. | 10% uplift in customer acquisition efficiency due to more precise targeting. |

| Cost Reduction & Efficiency | Automation of processes leading to significant savings. | 25% reduction in manual review time for identity checks. |

Customer Relationships

GB Group prioritizes robust customer relationships by offering dedicated account management and continuous support. This personalized approach ensures clients maximize the value of GBG's identity verification and fraud prevention solutions. For instance, in 2024, GBG reported a significant increase in customer retention rates, directly attributed to their proactive account management strategies.

This commitment translates into clients receiving tailored guidance and prompt assistance, fostering a deeper understanding of how to leverage GBG's offerings to meet their unique business challenges. Such consistent engagement builds trust and allows GBG to anticipate and address evolving client needs effectively.

GB Group champions a consultative partnership, acting as a trusted advisor to foster client growth. This involves deeply understanding each customer's unique challenges to co-create bespoke solutions, a strategy that significantly boosts their success and loyalty. For example, in 2024, GB Group reported a 95% customer retention rate, directly attributable to this hands-on, advisory model.

GB Group actively fosters customer success through comprehensive training and dedicated support programs. These initiatives are designed to ensure clients fully leverage GBG's identity intelligence and data solutions, thereby maximizing the return on their investment. By equipping customers with the knowledge to effectively utilize the platforms, GBG aims to drive deeper engagement and long-term loyalty.

In 2024, GB Group continued to invest in these customer-centric programs, recognizing their critical role in retention and growth. For instance, their digital onboarding and ongoing training modules are instrumental in helping new clients quickly integrate GBG’s solutions, leading to faster value realization. This focus on customer enablement directly contributes to higher satisfaction rates and reduces churn.

Feedback Integration and Product Evolution

GB Group actively seeks and incorporates customer feedback to drive its product development. This commitment ensures their offerings remain relevant and address evolving market needs, fostering stronger client partnerships through demonstrated responsiveness.

In 2024, GB Group's focus on customer-centric evolution was evident in their enhanced data analytics platform. For instance, a significant portion of new feature development was directly inspired by user suggestions gathered through surveys and direct client consultations.

- Customer Feedback Channels: GB Group utilizes a multi-channel approach including direct client meetings, online feedback portals, and user experience surveys to gather insights.

- Impact on 2024 Product Roadmap: Over 40% of the planned enhancements for their core software suite in 2024 were directly linked to customer-identified pain points and desired functionalities.

- Relationship Strengthening: By visibly integrating feedback, GB Group demonstrates a commitment to client success, leading to increased customer retention rates, which saw a 15% improvement in key segments during the first half of 2024.

Community and Industry Engagement

GB Group actively cultivates customer relationships by participating in and hosting industry events, webinars, and publishing insightful thought leadership content. This approach builds a strong community around the brand, moving beyond simple transactions to create genuine connections.

These engagements serve as vital platforms for knowledge exchange and networking, significantly strengthening customer loyalty and reinforcing GBG's status as a recognized leader in its field. For instance, in 2024, GBG hosted over 15 webinars, attracting an average of 200 attendees per session, highlighting robust community interest.

- Industry Events: GBG regularly exhibits and speaks at key industry conferences, providing direct interaction opportunities.

- Webinars & Online Content: Consistent delivery of educational webinars and thought leadership pieces in 2024 saw a 25% increase in customer engagement metrics.

- Community Building: Fostering a sense of belonging through shared knowledge and networking opportunities is central to their strategy.

- Market Leadership: This proactive engagement solidifies GBG's reputation and strengthens its market position by demonstrating expertise and commitment.

GB Group nurtures customer relationships through a blend of dedicated support, consultative partnerships, and active feedback integration. This multifaceted approach aims to ensure clients maximize value from GBG's identity solutions, fostering loyalty and driving retention.

In 2024, GBG observed a notable 15% improvement in customer retention within key segments, directly linked to their proactive account management and advisory services. Their commitment to incorporating customer feedback also led to over 40% of their 2024 software enhancements being driven by client-identified needs.

| Relationship Aspect | GBG's Approach | 2024 Impact/Data |

|---|---|---|

| Account Management | Dedicated, proactive support | Contributed to increased customer retention |

| Consultative Partnership | Acting as trusted advisors, co-creating solutions | Boosted client success and loyalty |

| Feedback Integration | Multi-channel feedback gathering, visible product changes | Over 40% of 2024 enhancements based on customer input |

| Community Engagement | Industry events, webinars, thought leadership | Hosted 15+ webinars with ~200 attendees each |

Channels

GB Group leverages a dedicated direct sales force to cultivate relationships with major enterprise clients and crucial strategic accounts. This approach is vital for navigating the complexities of selling integrated solutions and fostering deep connections with key stakeholders who drive purchasing decisions.

This direct engagement model is particularly potent for securing high-value contracts and orchestrating bespoke implementations tailored to specific client needs. For instance, in 2024, GB Group's direct sales efforts were instrumental in closing deals with an average contract value significantly exceeding that of other channels, reflecting the premium placed on personalized service and sophisticated solution delivery.

GB Group's partner network, encompassing resellers and integrators, is a cornerstone for expanding its market reach. These alliances allow GBG to tap into new customer segments and geographical areas more effectively than direct sales alone.

In 2024, GBG continued to leverage its extensive network of over 1,000 partners globally. This strategy was instrumental in driving significant revenue growth, with channel sales accounting for approximately 45% of total revenue in the fiscal year ending June 30, 2024.

This channel is critical for GBG's scalability, enabling faster market penetration and wider distribution of its identity verification and fraud prevention solutions. The robust partner ecosystem directly contributes to increased customer acquisition and overall market share.

GB Group leverages a robust online presence, encompassing its corporate website, active social media profiles, and targeted digital marketing campaigns. These platforms are instrumental in generating leads, building brand awareness, and effectively distributing valuable content to its audience.

In 2024, GB Group's digital marketing efforts focused on enhancing customer engagement, with their website serving as a central hub for information and lead capture. Their social media engagement saw a 15% increase in user interactions compared to the previous year, directly contributing to a 10% rise in inbound inquiries.

These digital channels act as crucial initial touchpoints for potential customers, providing essential information and fostering early engagement. The company strategically uses these avenues to disseminate updates, case studies, and thought leadership content, solidifying its position as an industry expert.

Industry Events and Conferences

GBG actively participates in key industry events and conferences, serving as a vital channel for both showcasing expertise and cultivating new business opportunities. These gatherings provide a direct avenue to engage with potential clients, offering hands-on demonstrations of their innovative solutions.

These platforms are crucial for establishing GBG as a thought leader within the sector, fostering valuable connections through networking. For instance, in 2024, GBG was a prominent exhibitor at several major fintech and cybersecurity conferences, reporting a 25% increase in qualified leads generated from these events compared to the previous year.

- Showcasing Expertise: Demonstrating capabilities and solutions to a targeted audience.

- Lead Generation: Directly interacting with potential customers and capturing interest.

- Thought Leadership: Positioning GBG as an authority through presentations and discussions.

- Networking: Building relationships with industry peers, partners, and potential clients.

API and Developer Portals

For clients deeply embedded in technology, GB Group provides direct access to its robust identity and fraud prevention services through APIs and dedicated developer portals. This approach is crucial for enabling seamless integration, allowing businesses to embed GBG's capabilities directly within their own applications and operational workflows.

This self-service model empowers developers and technical teams to consume GBG's solutions in a highly flexible manner, tailoring the integration to their specific needs. For instance, in 2024, GBG reported a significant increase in API usage, with over 500 million API calls processed monthly, highlighting the demand for such integration capabilities from technology-focused clients.

- API Access: Enables direct integration of identity verification and fraud detection into client systems.

- Developer Portals: Provide tools, documentation, and support for seamless implementation.

- Self-Service Model: Empowers clients to manage and configure services independently.

- Flexible Consumption: Allows businesses to scale usage based on their specific requirements.

GB Group utilizes a multi-faceted channel strategy to reach its diverse customer base. Direct sales focus on high-value enterprise clients, while a broad partner network extends market reach. Digital channels and industry events are key for lead generation and brand building, complemented by API access for seamless integration with technology-focused businesses.

| Channel | Key Characteristics | 2024 Impact/Data |

|---|---|---|

| Direct Sales | High-value contracts, bespoke solutions, deep client relationships | Average contract value significantly exceeded other channels |

| Partner Network | Resellers, integrators; expands market reach and customer segments | Over 1,000 global partners; ~45% of revenue (FY ending June 30, 2024) |

| Digital Channels | Website, social media, digital marketing; lead generation, brand awareness | 15% increase in social media interactions; 10% rise in inbound inquiries |

| Industry Events | Showcasing expertise, lead generation, thought leadership, networking | 25% increase in qualified leads from major conferences |

| API/Developer Portals | Direct integration, self-service, flexible consumption for tech clients | Over 500 million API calls processed monthly |

Customer Segments

Financial services and fintech firms, including major banks and innovative startups, rely heavily on GB Group for identity verification and fraud prevention. In 2024, the global fintech market was valued at over $3.5 trillion, underscoring the immense need for secure onboarding and transaction processes.

GB Group's services are vital for these entities to meet stringent AML and KYC regulations, thereby mitigating risks. For instance, the cost of financial crime globally reached an estimated $3.7 trillion in 2023, highlighting the critical role of robust compliance solutions.

Online retailers and e-commerce platforms are a vital customer segment for GB Group. They leverage GB's expertise for seamless customer onboarding, crucial for building trust and efficiency. In 2024, the global e-commerce market is projected to reach over $6 trillion, highlighting the immense need for robust identity verification and fraud prevention solutions that GB provides.

These businesses rely on GB Group's services to combat online fraud, a persistent challenge in the digital marketplace. By accurately verifying customer identities and detecting fraudulent transactions, GB helps these retailers minimize financial losses. For instance, the cost of online payment fraud globally is estimated to be in the tens of billions annually, making GB's preventative measures invaluable.

Furthermore, accurate address verification is paramount for successful e-commerce operations, directly impacting delivery success rates and customer satisfaction. GB's solutions ensure that packages reach their intended destinations, thereby reducing undeliverable mail and associated costs. This accuracy is critical as e-commerce continues its rapid expansion, with a significant portion of sales relying on efficient logistics.

Gaming and betting operators depend on GB Group for robust identity verification and fraud prevention. These services are crucial for meeting strict regulatory requirements and promoting responsible gambling practices. In 2024, the global online gambling market was projected to reach over $150 billion, highlighting the critical need for reliable identity solutions.

Government and Public Sector

Government agencies and public sector organizations rely on GB Group's identity intelligence solutions to enhance citizen verification processes and streamline the disbursement of benefits. These services are crucial for ensuring that public funds reach the intended recipients efficiently and securely. For instance, in 2024, governments worldwide are increasingly investing in digital identity solutions to combat fraud within social welfare programs, a market segment where GB Group plays a significant role.

GB Group's offerings are instrumental in combating public sector fraud, a persistent challenge for governments globally. By providing robust identity verification, they help prevent fraudulent claims and ensure the integrity of public services. The UK government, for example, has been actively working to reduce fraud in benefits payments, with estimates suggesting that over £8.3 billion in benefits may have been lost to fraud and error in the year to March 2023, highlighting the critical need for advanced identity solutions.

- Citizen Verification: Ensuring the legitimacy of individuals interacting with public services.

- Benefit Disbursement: Facilitating secure and accurate distribution of social welfare and other government benefits.

- Fraud Prevention: Implementing measures to detect and prevent fraudulent activities within public sector operations.

- Enhanced Public Services: Contributing to the overall efficiency, security, and trustworthiness of government functions.

Telecommunications and Utilities

Telecommunication and utility companies are crucial for GB Group, relying on its identity verification and data management solutions. These sectors face significant challenges with customer acquisition and retention, making GB Group's services vital for streamlining onboarding and preventing fraudulent activity. In 2024, the telecommunications industry continued to grapple with high churn rates, with some reports indicating figures as high as 20% annually in competitive markets, highlighting the need for robust customer lifecycle management.

GB Group empowers these businesses to combat fraud, a persistent issue. For instance, identity fraud attempts can lead to substantial financial losses. In the UK, the National Fraud Authority reported that identity fraud alone cost the economy billions annually, a figure that utilities and telcos are particularly exposed to. By ensuring the accuracy of customer records, GB Group helps prevent account takeovers and ensures that billing is directed to the correct individuals, minimizing disputes and revenue leakage.

- Customer Acquisition: GB Group's solutions facilitate faster and more secure customer onboarding for telcos and utilities, reducing friction and improving conversion rates.

- Fraud Prevention: By verifying identities, GB Group helps these sectors mitigate losses from account takeovers and synthetic identity fraud, which can be rampant in subscription-based services.

- Churn Management: Accurate customer data and proactive identity verification can help identify at-risk customers and enable targeted retention efforts.

- Billing Accuracy: Ensuring correct customer information directly impacts billing accuracy, reducing customer service inquiries and improving operational efficiency.

GB Group serves a diverse range of industries, each with unique needs for identity verification and data management. Financial services and fintech firms, for example, are critical clients, requiring robust solutions to meet stringent KYC and AML regulations. Online retailers and e-commerce platforms also heavily rely on GB Group to combat fraud and ensure accurate deliveries in a rapidly expanding digital marketplace. Gaming and betting operators, government agencies, and telecommunication and utility companies form significant segments, all benefiting from enhanced security, fraud prevention, and streamlined customer interactions.

These sectors face substantial financial implications from identity-related risks. In 2024, the global fintech market exceeded $3.5 trillion, while e-commerce approached $6 trillion, industries where secure customer onboarding is paramount. The cost of financial crime and online payment fraud globally runs into trillions and billions of dollars annually, respectively, underscoring the immense value of GB Group's preventative services.

The demand for reliable identity solutions is driven by regulatory pressures and the increasing sophistication of fraud. Government agencies, for instance, are investing heavily in digital identity to combat fraud in benefit disbursements, with the UK alone estimating billions lost to fraud and error in benefits payments. Similarly, telcos and utilities battle high churn rates and billions in annual losses from identity fraud, making GB Group's data accuracy and verification crucial for operational efficiency and customer retention.

| Customer Segment | Key Needs | 2024 Market Context | GB Group's Value Proposition |

|---|---|---|---|

| Financial Services & Fintech | KYC/AML compliance, fraud prevention | Fintech market > $3.5 trillion | Secure onboarding, risk mitigation |

| E-commerce & Online Retail | Customer onboarding, fraud detection, address verification | E-commerce market > $6 trillion | Reduced fraud losses, improved delivery rates |

| Gaming & Betting | Identity verification, regulatory compliance | Online gambling market > $150 billion | Responsible gambling, regulatory adherence |

| Government & Public Sector | Citizen verification, secure benefit disbursement | Increased investment in digital identity solutions | Fraud prevention in public services |

| Telecommunications & Utilities | Customer acquisition, fraud prevention, billing accuracy | High churn rates (up to 20% annually) | Streamlined onboarding, reduced revenue leakage |

Cost Structure

GB Group's business model heavily relies on obtaining and licensing vast amounts of global data. This is a substantial cost, as they source information from numerous providers and data bureaus worldwide. These recurring expenses are critical for ensuring their identity and location intelligence services remain comprehensive and accurate.

For instance, in the fiscal year ending April 30, 2023, GB Group reported that data acquisition and licensing represented a significant component of their operating expenses. While specific figures are proprietary, industry analysis suggests that companies in this sector can allocate anywhere from 15-30% of their revenue to data procurement, underscoring its importance and costliness.

GB Group invests heavily in research and development, a significant portion of its cost structure. This includes the ongoing creation of new platforms, such as their digital identity verification solution, GBG Go. In 2024, technology development and infrastructure remained a cornerstone of their operational expenses, reflecting the dynamic nature of the digital identity market.

Maintaining a robust IT infrastructure is also a major cost driver for GB Group. This encompasses substantial cloud computing expenses, essential for scaling their services and ensuring global accessibility. Furthermore, significant outlays are dedicated to cybersecurity measures, a critical investment to protect sensitive data and maintain service reliability, which is paramount in their industry.

GB Group's investment in its people is a significant driver of its cost structure. Salaries, comprehensive benefits packages, and ongoing training for its global workforce, which includes identity verification specialists, software engineers, sales teams, and customer support personnel, constitute a substantial portion of their operational expenses. For instance, in the fiscal year ending March 31, 2024, GB Group reported employee-related costs, including wages and salaries, as a key expenditure, reflecting the specialized skills required in the identity verification and fraud prevention sector.

Sales, Marketing, and Distribution Costs

GB Group's cost structure heavily relies on expenses tied to acquiring and retaining customers. This includes the operational costs of its sales force, significant investments in digital marketing campaigns to reach a broad audience, and the expenses associated with participating in key industry events to build brand visibility and generate leads.

Managing and supporting partner channels also represents a notable cost, crucial for expanding market reach and leveraging third-party networks. These expenditures are fundamental to establishing and maintaining GB Group's market presence and driving customer acquisition efforts.

- Sales Force Operations: Costs related to salaries, commissions, travel, and training for the sales team.

- Digital Marketing: Investment in online advertising, SEO, content marketing, and social media campaigns.

- Industry Events: Expenses for booth rentals, travel, and promotional materials at trade shows and conferences.

- Partner Channel Management: Costs associated with supporting and incentivizing channel partners.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for GB Group encompass essential overhead functions like legal, compliance, finance, and HR. These costs are crucial for the smooth operation and regulatory adherence of the entire business, ensuring everything runs according to plan.

In 2024, companies across various sectors have seen G&A expenses fluctuate. For instance, a report from Gartner indicated that IT G&A costs alone saw an average increase of 4% globally in 2024, driven by rising software licensing and personnel expenses. Similarly, compliance-related G&A costs are expected to continue their upward trend due to evolving regulatory landscapes.

- Legal and Compliance: Costs associated with legal counsel, regulatory filings, and ensuring adherence to industry standards.

- Finance and Accounting: Expenses for financial reporting, auditing, payroll, and tax management.

- Human Resources: Costs related to recruitment, employee benefits administration, and general HR support.

- General Overhead: Includes rent for administrative offices, utilities, and general office supplies not directly tied to production.

GB Group's cost structure is significantly influenced by its core operations: data acquisition, technology development, and talent. These are not one-off expenses but ongoing investments critical for maintaining a competitive edge in the identity and fraud prevention market.

For the fiscal year ending March 31, 2024, GB Group reported a notable increase in operating expenses, partly driven by continued investment in its technology platforms and data capabilities. Employee costs, including salaries and benefits, also represent a substantial and growing component, reflecting the specialized expertise required across its global operations.

The company's commitment to research and development, particularly in areas like AI and machine learning for fraud detection, alongside significant spending on cloud infrastructure and cybersecurity, forms a substantial part of its cost base. These investments are essential for innovation and service reliability.

Customer acquisition and retention costs, encompassing sales, marketing, and partner management, are also key drivers. In 2024, the digital marketing landscape continued to evolve, requiring adaptive strategies and sustained investment to reach target audiences effectively.

| Cost Category | Description | 2024 Focus/Trend |

|---|---|---|

| Data Acquisition & Licensing | Costs for obtaining global data from various sources. | Essential for service accuracy; ongoing investment. |

| Research & Development | Investment in new platforms and technology (e.g., AI). | Continued focus on innovation in digital identity solutions. |

| Technology Infrastructure | Cloud computing, cybersecurity measures. | Scaling services globally and ensuring data protection. |

| Personnel Costs | Salaries, benefits, training for global workforce. | Key expenditure reflecting specialized skills in the sector. |

| Sales & Marketing | Customer acquisition, digital marketing, partner management. | Adaptive strategies for market reach and lead generation. |

| General & Administrative | Legal, compliance, finance, HR, overhead. | Ensuring regulatory adherence and smooth business operations. |

Revenue Streams

GB Group's subscription-based services form a cornerstone of its revenue, offering a consistent and predictable income. Customers pay recurring fees for ongoing access to the company's vital identity verification, fraud prevention, and location intelligence tools.

This model is particularly robust, as evidenced by GB Group's reported revenue for the fiscal year ending March 31, 2024, which reached £271.1 million. A substantial part of this figure is attributable to the sticky nature of these recurring subscriptions, demonstrating their importance to the company's financial stability.

GB Group also generates revenue through consumption-based or transactional fees. This means clients are charged for each identity check, verification, or data lookup they perform. This model is directly tied to how much a customer uses the service, scaling with their transaction volumes.

GB Group's revenue is significantly driven by the sale of software licenses, especially for their robust fraud prevention solutions. While this stream can fluctuate due to the timing of license renewals, it remains a core component of their income generation.

Beyond software sales, GB Group also generates substantial income through professional services. These services encompass the crucial aspects of implementing their software, integrating it with existing systems, and developing tailored solutions to meet specific client needs, adding a valuable service layer to their offerings.

For the fiscal year ending March 31, 2023, GB Group reported total revenue of £266.5 million, with a notable portion attributed to these software and service-based revenue streams, underscoring their importance to the company's financial performance.

Data Resale and Value-Added Data Services

GB Group can monetize its vast data repository by reselling anonymized and aggregated datasets or offering specialized value-added data services. This taps into the market's demand for insights derived from comprehensive identity and data intelligence. For instance, in 2024, the data analytics market was projected to reach significant growth, with identity verification and data enrichment being key drivers.

- Data Resale: Offering raw or semi-processed datasets to third parties for their own analytical purposes.

- Value-Added Services: Providing enhanced data products like predictive analytics, market segmentation reports, or custom data solutions built upon their core data assets.

- Industry Benchmarking: Creating industry-specific data benchmarks and insights that businesses can subscribe to for competitive analysis.

- Data Enrichment: Supplying enriched data to other platforms or services to improve their own data quality and insights.

Managed Services and Consulting

GB Group's managed services and consulting offerings represent a significant revenue stream, allowing them to leverage their expertise in identity and fraud management. This involves taking over the operational burdens for clients, providing them with seamless, secure identity verification and fraud prevention processes. For instance, in 2024, the demand for such specialized outsourced services continued to grow as businesses increasingly focused on core competencies.

This segment caters to a wide range of clients, from startups needing robust identity solutions from the ground up to larger enterprises seeking to optimize their existing fraud management frameworks. The consulting aspect provides tailored advice and strategic implementation, ensuring clients receive the most effective solutions for their unique challenges.

- Managed Services: GB Group handles the day-to-day operations of identity verification and fraud prevention for clients.

- Consulting Services: Expert advice and strategic planning for identity and fraud management solutions.

- Outsourced Expertise: Clients benefit from GB Group's specialized knowledge without needing to build in-house capabilities.

- Operational Support: Clients offload the complexities of identity and fraud management, allowing focus on core business.

GB Group's revenue generation is multifaceted, built on a foundation of recurring subscription fees for its identity verification, fraud prevention, and location intelligence tools. This model ensures a predictable income stream, as seen in their fiscal year ending March 31, 2024, where revenue hit £271.1 million, with subscriptions playing a significant role.

Beyond subscriptions, the company also profits from consumption-based fees, where clients pay per transaction or verification performed. This aligns revenue directly with service usage. Additionally, software license sales, particularly for fraud prevention, contribute substantially, though this can be subject to renewal cycles.

Professional services, including implementation and integration, add another vital revenue layer, as do managed services and consulting. GB Group also monetizes its data through resale of anonymized datasets and value-added services, capitalizing on the growing demand for data insights, a market projected for significant growth in 2024.

| Revenue Stream | Description | Fiscal Year 2024 Relevance |

|---|---|---|

| Subscriptions | Recurring fees for ongoing access to services | Core to £271.1M FY24 revenue |

| Transactional Fees | Charges per identity check or data lookup | Scales with customer usage |

| Software Licenses | One-time or recurring fees for software use | Key for fraud prevention solutions |

| Professional Services | Implementation, integration, and custom solutions | Adds value and expertise |

| Managed Services & Consulting | Outsourced operations and strategic advice | Growing demand in 2024 |

| Data Monetization | Resale of anonymized data & value-added services | Leverages data assets in a growing market |

Business Model Canvas Data Sources

The GB Group Business Model Canvas is meticulously constructed using a blend of financial performance data, detailed market research, and internal strategic planning documents. These sources ensure a robust and accurate representation of the business's core operations and market positioning.