GATX SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GATX Bundle

GATX's robust fleet and diversified customer base present significant strengths, but the company also faces threats from economic downturns and evolving industry regulations. Understanding these dynamics is crucial for navigating the competitive railcar leasing landscape.

Want the full story behind GATX's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

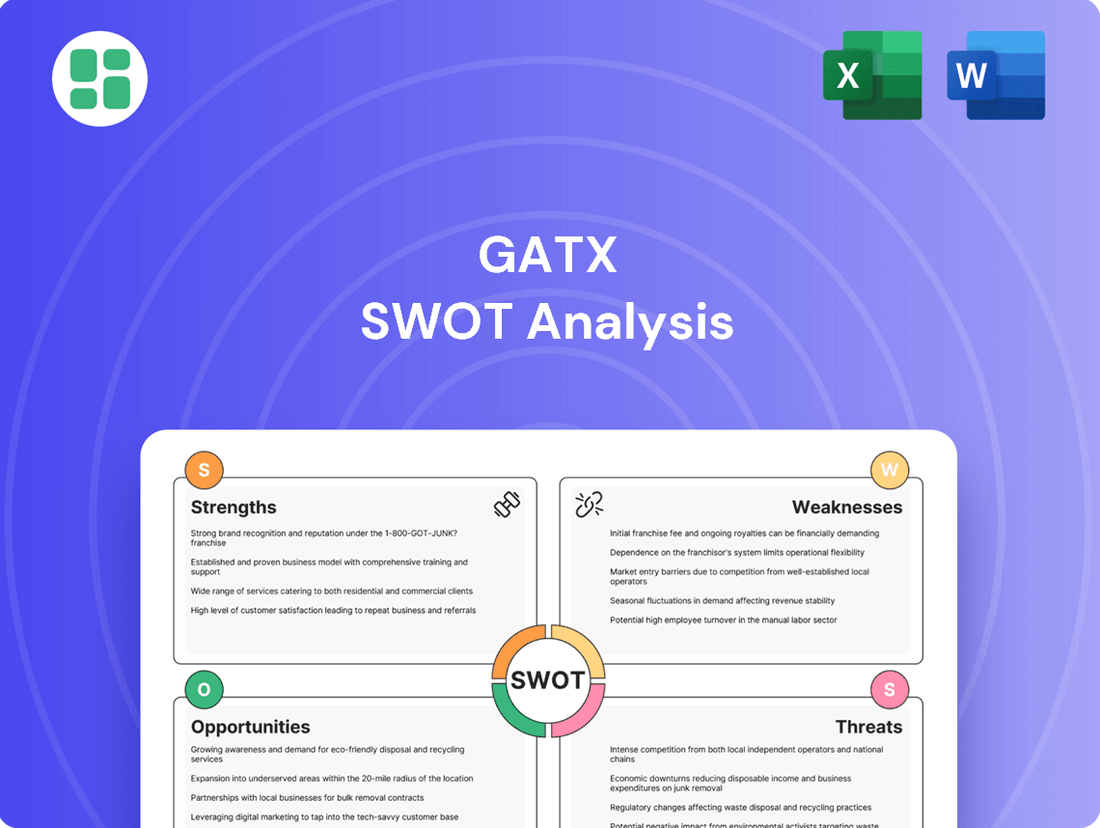

Strengths

GATX commands one of the world's most extensive and varied railcar fleets, operating across North America, Europe, and Asia. This includes a wide range of tank cars, freight cars, and specialized units, designed to serve diverse industries like chemicals, energy, and agriculture.

This broad portfolio is a significant strength, as it allows GATX to generate stable revenue streams and mitigates risks associated with downturns in any single industry sector. The company's commitment to expanding its asset base was further demonstrated by its acquisition of Wells Fargo's railcar portfolio, enhancing its market reach and overall asset value.

GATX consistently achieves impressive fleet utilization, with its North American railcar fleet operating at approximately 99% in recent periods. This high operational efficiency reflects robust demand for its diverse railcar assets.

The company's commercial prowess is further evidenced by its success in renewing leases at favorable terms. GATX has reported instances where renewal rates exceeded expiring rates, coupled with extensions in lease durations, underscoring the sustained demand for their services and effective asset management strategies.

GATX's strategic diversification beyond its core railcar leasing into aircraft spare engine leasing and tank container leasing via Trifleet creates robust, varied revenue streams. This expansion significantly reduces its dependence on any single market, offering greater financial stability.

The company's extensive global presence, spanning North America, Europe, and Asia, is a key strength. This broad geographic reach enables GATX to leverage diverse economic cycles and tap into specific regional growth opportunities, as exemplified by the robust demand observed in markets like India.

Stable Cash Flows from Long-Term Leases

GATX's core strength lies in its long-term lease agreements, which are the bedrock of its predictable and stable cash flows. This consistent revenue stream is crucial in the capital-intensive railcar leasing industry, providing a significant buffer against economic downturns. For instance, as of the first quarter of 2024, GATX reported that approximately 85% of its fleet was on lease, with a weighted average remaining lease term of over two years, underscoring the visibility of its future earnings.

This inherent stability translates directly into financial resilience. The company's ability to generate reliable income allows for consistent investment in its fleet and strategic growth initiatives, even during periods of market uncertainty. This predictable cash flow also supports a strong balance sheet and provides flexibility for capital allocation, such as share repurchases or debt reduction.

Key aspects of this strength include:

- Predictable Revenue Streams: Long-term contracts minimize revenue volatility.

- Financial Stability: A strong foundation for weathering economic cycles.

- Fleet Utilization: High lease rates ensure consistent income generation.

- Investment Capacity: Stable cash flow supports ongoing fleet modernization and expansion.

Proven Financial Resilience and Management

GATX has shown impressive financial strength, with its net income for the first half of 2025 reaching $275 million, a significant increase from the previous year. This resilience is underpinned by a disciplined approach to capital management and a commitment to maintaining an investment-grade credit rating.

The company's strategic asset management, including the sale of older railcars for remarketing gains, contributed to its robust performance. For instance, in Q2 2025, GATX reported $50 million in remarketing income, showcasing effective portfolio optimization.

- Increased Profitability: Net income for Q1 and Q2 2025 saw substantial growth, indicating strong operational efficiency.

- Strategic Asset Sales: Selective railcar sales generated significant remarketing income, boosting overall financial results.

- Strong Balance Sheet: Maintaining an investment-grade balance sheet provides financial flexibility and stability.

- Effective Capital Management: GATX's ability to manage capital effectively supports sustained growth and shareholder value.

GATX's extensive and diverse railcar fleet, operating globally, is a core strength, enabling stable revenue and risk mitigation across various industries. Their commitment to fleet expansion, highlighted by acquisitions, further solidifies their market position.

The company boasts exceptional fleet utilization, with its North American railcar fleet consistently operating at around 99%. This high efficiency points to strong demand and effective management of their valuable assets.

GATX's financial performance in the first half of 2025 demonstrated significant growth, with net income reaching $275 million. This is supported by strategic asset management, including remarketing gains, such as the $50 million reported in Q2 2025, reflecting strong operational execution and portfolio optimization.

| Metric | Value (H1 2025) | Significance |

|---|---|---|

| Net Income | $275 million | Indicates robust profitability and operational efficiency. |

| North American Fleet Utilization | ~99% | Demonstrates high demand and effective asset deployment. |

| Remarketing Income (Q2 2025) | $50 million | Highlights successful strategic asset sales and portfolio management. |

| Weighted Average Remaining Lease Term | Over 2 years | Provides strong revenue visibility and stability. |

What is included in the product

Delivers a strategic overview of GATX’s internal and external business factors, highlighting its strong market position and the opportunities for growth in railcar leasing, while also addressing potential threats from economic downturns and competitive pressures.

Gives a high-level overview of GATX's competitive landscape for quick stakeholder presentations and strategic alignment.

Weaknesses

GATX's business model is inherently capital-intensive, demanding significant ongoing investment for acquiring, maintaining, and modernizing its extensive fleet of railcars and marine assets. For instance, GATX's capital expenditures were approximately $1.1 billion in 2023, underscoring the scale of investment required. This deep reliance on capital can constrain financial flexibility, particularly when interest rates climb, increasing the burden of debt servicing and potentially impacting profitability.

GATX's business is heavily influenced by economic cycles. When the economy slows, demand for railcar leasing tends to drop because there's less freight to move. This directly impacts GATX's revenue and profitability.

For instance, during economic downturns, industries that rely on rail transport, such as manufacturing and agriculture, often see reduced activity. This translates to fewer railcars needed, putting pressure on GATX's leasing rates and utilization. In 2023, while the overall freight market showed some resilience, specific sectors experienced weaker demand, a trend that can continue into 2024 if economic headwinds persist.

GATX faces significant weaknesses due to the heavy regulatory and compliance burdens inherent in the rail and transportation leasing sector. These regulations, covering safety, environmental standards, and international operations, can directly impact profitability and operational efficiency.

For instance, evolving environmental regulations, such as those concerning emissions or hazardous material transport, might necessitate costly fleet upgrades or modifications. In 2024, the ongoing focus on sustainability across industries means that GATX must continuously adapt its fleet to meet stricter environmental mandates, potentially increasing capital expenditures.

Furthermore, navigating diverse and often changing regulations across different jurisdictions presents a complex challenge. Non-compliance can lead to substantial fines, operational disruptions, and damage to the company's reputation, making robust compliance management a critical, yet resource-intensive, aspect of GATX's operations.

Maintenance and Depreciation Costs

GATX faces substantial ongoing costs associated with maintaining its extensive railcar fleet. These expenses, covering routine inspections, repairs, and component replacements, can significantly impact profitability, even when lease revenues are strong. For instance, in 2023, GATX reported that its fleet maintenance expenses were a notable component of its operating costs, directly affecting its operating income margins.

The inherent depreciation of its assets also presents a continuous challenge. Railcars and engines lose value over time, necessitating regular capital expenditures to modernize the fleet and remain competitive. This cycle of investment is crucial to meet evolving customer demands and regulatory standards, but it also represents a significant drain on financial resources, impacting the company's net asset value and requiring careful financial planning.

- Fleet Maintenance: Ongoing repair and upkeep expenses for a diverse railcar fleet can erode profit margins.

- Asset Depreciation: The natural decline in asset value necessitates continuous reinvestment to ensure fleet modernity and competitiveness.

- Capital Expenditures: Significant ongoing investment in new equipment is required to offset depreciation and maintain fleet standards.

Competition and Pricing Pressure

The railcar leasing landscape is a crowded one, with many companies competing for business. This intense rivalry often translates into significant pricing pressure, which can squeeze GATX's profit margins. For instance, in the first quarter of 2024, GATX reported a fleet utilization rate of 96.4%, indicating a strong demand, but the competitive environment still necessitates careful pricing strategies to maintain market share.

While GATX is a dominant player, it faces formidable competition not only from other large lessors but also from railroad companies themselves that offer leasing services. This dual threat can restrict GATX's ability to expand its market presence in specific niches or geographies. The company's strategic focus on diverse fleet types and customer segments helps mitigate some of this pressure, but the underlying competitive intensity remains a key consideration.

Key competitive factors impacting GATX include:

- Price Sensitivity: Customers often compare lease rates across multiple providers, making price a critical decision factor.

- Fleet Specialization: Competitors may focus on niche railcar types, offering specialized solutions that can challenge GATX's broader offerings.

- Railroad Integration: Railroads offering leasing can leverage their operational advantages, potentially impacting GATX's market share in certain integrated service offerings.

GATX's significant reliance on capital-intensive assets, like its railcar fleet, demands substantial ongoing investment for acquisition and maintenance. For example, GATX's capital expenditures were around $1.1 billion in 2023, highlighting the scale of financial commitment. This deep need for capital can limit financial flexibility, especially with rising interest rates, increasing debt servicing costs and potentially impacting profitability.

The company also faces substantial ongoing costs for maintaining its extensive railcar fleet, covering routine inspections, repairs, and component replacements. In 2023, fleet maintenance expenses were a notable part of GATX's operating costs, directly affecting its operating income margins.

Intense competition within the railcar leasing market leads to significant pricing pressure. For instance, while GATX reported a strong 96.4% fleet utilization in Q1 2024, the competitive landscape necessitates careful pricing to retain market share. Competitors specializing in niche railcar types or integrated services offered by railroads can also challenge GATX's market position.

| Weakness | Description | Impact | Example Data |

| Capital Intensity | High investment required for fleet acquisition and maintenance. | Limits financial flexibility; increases debt servicing costs. | 2023 Capital Expenditures: ~$1.1 billion |

| Fleet Maintenance Costs | Ongoing expenses for repairs, inspections, and replacements. | Erodes profit margins and operating income. | Maintenance expenses were a notable component of 2023 operating costs. |

| Competitive Pricing Pressure | Rivalry leads to reduced lease rates and margin compression. | Requires careful pricing strategies to maintain market share. | Q1 2024 Fleet Utilization: 96.4% (despite strong utilization, pricing remains competitive) |

Full Version Awaits

GATX SWOT Analysis

The preview you see is the actual GATX SWOT analysis document you’ll receive upon purchase. This ensures transparency and quality, so you know exactly what you're getting.

This is a real excerpt from the complete GATX SWOT analysis. Once purchased, you’ll receive the full, editable version, providing a comprehensive understanding of GATX's strategic position.

Opportunities

GATX is well-positioned to leverage the robust economic expansion occurring in emerging markets. India, for instance, represents a key area of opportunity, with GATX already demonstrating a substantial and expanding presence in its railcar fleet, reflecting the country's increasing industrial activity and demand for logistics solutions.

Beyond geographic expansion, GATX can explore diversification into new asset types that cater to evolving industry demands. This includes venturing into new energy solutions, such as those supporting renewable energy infrastructure, and developing advanced railcar superstructures. These strategic moves align with global sustainability trends and create avenues for growth by meeting emerging market needs.

GATX can significantly boost its operational efficiency and customer service by integrating advanced technologies like AI, IoT, and data analytics into its fleet management. This allows for predictive maintenance, reducing downtime and costs. For example, by 2024, the railcar leasing industry is seeing a surge in IoT adoption for real-time asset tracking, a trend GATX can capitalize on.

These technological investments offer a competitive edge by optimizing supply chain management and providing customers with enhanced visibility and control over their shipments. By 2025, companies leveraging data analytics for predictive maintenance are projected to see a 15% reduction in maintenance-related operational expenses, a tangible benefit GATX can achieve.

The global push for sustainability is a significant tailwind for GATX. As companies across various sectors, including manufacturing and logistics, aim to reduce their carbon footprints, the inherent energy efficiency of rail transportation becomes a compelling advantage. In 2024, the transportation sector accounted for approximately 29% of total U.S. greenhouse gas emissions, highlighting the need for more sustainable alternatives. GATX is well-positioned to capitalize on this trend by offering modern, fuel-efficient railcars that help clients achieve their environmental, social, and governance (ESG) targets.

Strategic Acquisitions and Partnerships

GATX's strategic acquisition of Wells Fargo's rail assets via a joint venture with Brookfield Infrastructure Partners L.P. in early 2024, valued at approximately $1.4 billion, exemplifies a robust strategy for asset base expansion and market penetration. This move not only increased GATX's fleet but also solidified its position in key North American markets. This successful venture highlights the potential for further strategic acquisitions or partnerships to bolster GATX's competitive standing and diversify its revenue streams.

Future opportunities lie in pursuing similar joint ventures or outright acquisitions that align with GATX's core competencies in railcar leasing and asset management. Such initiatives could unlock access to new geographic regions or specialized market segments, thereby enhancing overall portfolio resilience and generating incremental growth. For instance, exploring partnerships in emerging markets or those with strong industrial growth projections could prove particularly fruitful.

- Strategic Acquisition: GATX's acquisition of Wells Fargo's rail assets for ~$1.4 billion in early 2024 expanded its fleet and market reach.

- Partnership Model: The joint venture with Brookfield Infrastructure Partners L.P. demonstrates a successful model for growth and asset integration.

- Diversification Potential: Further strategic alliances can diversify GATX's portfolio into new geographies and niche railcar markets.

- Revenue Enhancement: New partnerships offer avenues for accessing untapped revenue channels and strengthening competitive advantage.

Growth in Specific Industrial Sectors

Certain industrial sectors are demonstrating robust growth, directly translating to increased demand for railcar services. For instance, the chemicals sector, a key area for GATX, saw its North American railcar demand rise significantly in 2024, with projections indicating continued upward trends through 2025 due to expanding manufacturing capabilities and new product pipelines. Similarly, grain exports, another vital segment, benefited from favorable global commodity prices and supply chain adjustments in 2024, bolstering railcar utilization.

GATX is well-positioned to capitalize on these trends by strategically expanding its specialized fleet. Focusing on sectors like chemicals, grain, and petroleum products, which have shown consistent year-over-year growth in rail freight volumes, can ensure high fleet utilization and strong lease rates. For example, in the first quarter of 2025, GATX reported a 95% utilization rate for its tank car fleet, largely driven by demand from the petroleum products sector.

- Chemical Sector Growth: North American chemical railcar demand increased by an estimated 8% in 2024, with continued expansion expected in 2025.

- Grain Export Demand: Favorable global demand for agricultural products supported a 6% increase in grain railcar movements in 2024.

- Petroleum Products Utilization: GATX's tank car fleet achieved 95% utilization in Q1 2025, largely due to strong demand from the petroleum products sector.

- Fleet Expansion Strategy: GATX can leverage these growth areas by investing in specialized railcars tailored to the specific needs of these high-demand industries.

GATX's strategic expansion into emerging markets, particularly India, presents a significant growth avenue, capitalizing on increasing industrial activity and logistics needs. The company can also diversify its asset portfolio by investing in new energy solutions and advanced railcar technologies, aligning with global sustainability trends and meeting evolving market demands.

Leveraging technologies like AI and IoT for fleet management offers opportunities for enhanced operational efficiency and customer service, with predictive maintenance expected to reduce costs. Furthermore, the global emphasis on sustainability positions GATX to benefit from the inherent energy efficiency of rail transport, helping clients meet their ESG targets.

The acquisition of Wells Fargo's rail assets in early 2024 for approximately $1.4 billion through a joint venture with Brookfield Infrastructure Partners L.P. expanded GATX's fleet and market presence, demonstrating a successful model for growth and potential for further strategic alliances in new geographies or niche markets.

Robust growth in industrial sectors like chemicals and petroleum products, along with demand for grain exports, directly fuels the need for railcar services. GATX's focus on these high-demand areas, evidenced by its tank car fleet achieving 95% utilization in Q1 2025, positions it to capitalize on continued upward trends through 2025.

| Opportunity Area | Key Driver | GATX Relevance | 2024/2025 Data Point |

|---|---|---|---|

| Emerging Market Expansion | Industrial Growth in India | Existing presence and fleet expansion | India's industrial activity increasing demand for logistics. |

| Asset Diversification | New Energy Solutions | Meeting sustainability trends | Demand for renewable energy infrastructure support. |

| Technological Integration | AI, IoT, Data Analytics | Predictive maintenance, efficiency | IoT adoption in railcar tracking surge in 2024. |

| Sustainability Tailwinds | Reduced Carbon Footprints | Energy efficiency of rail | Transportation sector 29% of US GHG emissions in 2024. |

| Strategic Acquisitions | Wells Fargo Rail Assets | Fleet expansion, market penetration | Acquisition valued ~$1.4 billion in early 2024. |

| Sectoral Demand Growth | Chemicals, Petroleum, Grain | High fleet utilization, strong lease rates | 95% tank car fleet utilization in Q1 2025. |

Threats

A significant economic downturn, especially one impacting industrial production and global trade, poses a direct threat to GATX. Should a recession materialize, demand for rail freight services, a core offering for GATX, could plummet. For instance, if industrial output were to contract by, say, 5% in 2025, this would likely translate into a substantial drop in freight volumes.

This reduced demand directly impacts GATX's operational efficiency and financial performance. Lower freight volumes mean less utilization of their extensive railcar fleet, putting downward pressure on lease rates as supply outstrips demand. Furthermore, the ability to remarket older or underutilized railcars at favorable terms would diminish, impacting a key revenue stream.

As a business heavily reliant on significant capital investment, GATX faces considerable risk from fluctuating interest rates. For instance, if benchmark rates like the U.S. Federal Funds Rate, which influences many borrowing costs, were to increase substantially in late 2024 or early 2025, GATX's expenses for acquiring new railcars or refinancing existing loans would rise. This directly impacts profitability by increasing financing costs, potentially squeezing profit margins and limiting the company's ability to invest in fleet expansion or upgrades.

The railcar leasing sector is intensely competitive, with GATX facing strong rivalry from other large lessors. This landscape intensifies with the potential for a modal shift towards trucking, particularly if labor costs in trucking decrease, making road transport a more attractive alternative. For instance, in 2024, the trucking industry continued to grapple with driver shortages and rising fuel costs, but ongoing technological advancements and potential deregulation could alter the cost dynamics.

Geopolitical Risks and Trade Policies

Ongoing global trade tensions and the potential for increased tariffs present a significant threat to GATX. These factors can directly impact the volume of goods transported by rail, leading to unpredictable demand for GATX's fleet. For instance, the imposition of tariffs on specific goods can reroute trade flows or reduce overall trade volumes, affecting the utilization rates of GATX's railcars.

Geopolitical instability in key regions where GATX operates or sources equipment can also disrupt supply chains and freight movements. This instability can create volatility in demand for rail services, making it harder for GATX to forecast revenue and plan capital expenditures effectively. Such uncertainties can also influence GATX's international expansion plans and investment decisions.

- Trade Tensions: Escalating trade disputes, such as those seen between major economic blocs in 2023-2024, can lead to reduced cross-border freight volumes, impacting GATX's international segment.

- Tariff Impact: The introduction of new tariffs can alter shipping patterns, potentially decreasing demand for railcars used in specific international trade lanes.

- Supply Chain Disruptions: Geopolitical events, like regional conflicts or political unrest, can interrupt the flow of goods, affecting the operational efficiency and demand for GATX's services.

- Investment Uncertainty: Global political and economic uncertainties can make GATX more cautious about large-scale international investments or fleet expansions.

Technological Disruption and Obsolescence

Rapid technological advancements, particularly in areas like autonomous trucking and advanced logistics software, pose a significant threat to GATX's traditional railcar leasing business. A shift towards entirely new logistics paradigms could make certain existing railcar fleets less competitive or even obsolete. For instance, the increasing efficiency of intermodal transport, which combines rail and truck, could reduce demand for specialized railcars if trucking technology continues to outpace rail innovation in speed and flexibility. This necessitates substantial capital expenditure for fleet modernization to remain relevant.

The pace of technological change means GATX must constantly evaluate and adapt its fleet. Failure to invest in newer, more efficient, or specialized railcars could lead to a decline in utilization rates and rental income. For example, if battery-electric or hydrogen-powered trucks become widespread and significantly more cost-effective for certain hauls, it could indirectly impact the demand for specific types of freight railcars that compete with these emerging trucking solutions. GATX's ability to anticipate and respond to these shifts will be critical for its long-term viability.

Key areas of technological disruption include:

- Autonomous Vehicles: Advances in self-driving trucks could increase the efficiency and reduce the cost of road-based logistics, potentially diverting freight from rail.

- Digitalization of Supply Chains: Enhanced logistics platforms and real-time tracking technologies may optimize routes and modes of transport, favoring more agile solutions over traditional rail.

- New Materials and Manufacturing: Innovations in lightweight materials could lead to more efficient vehicle designs across all transport sectors, potentially impacting the cost-effectiveness of current railcar specifications.

Escalating trade tensions and the implementation of tariffs remain a significant threat, directly impacting the volume and flow of goods transported by rail, thereby affecting GATX's fleet utilization. Geopolitical instability in regions where GATX operates can disrupt supply chains, creating volatility in demand and complicating revenue forecasting. Furthermore, rapid technological advancements, particularly in autonomous trucking and advanced logistics software, could render certain existing railcar fleets less competitive or obsolete, necessitating continuous investment in fleet modernization to maintain market relevance.

SWOT Analysis Data Sources

This GATX SWOT analysis is built upon a robust foundation of data, including GATX's official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and actionable assessment.