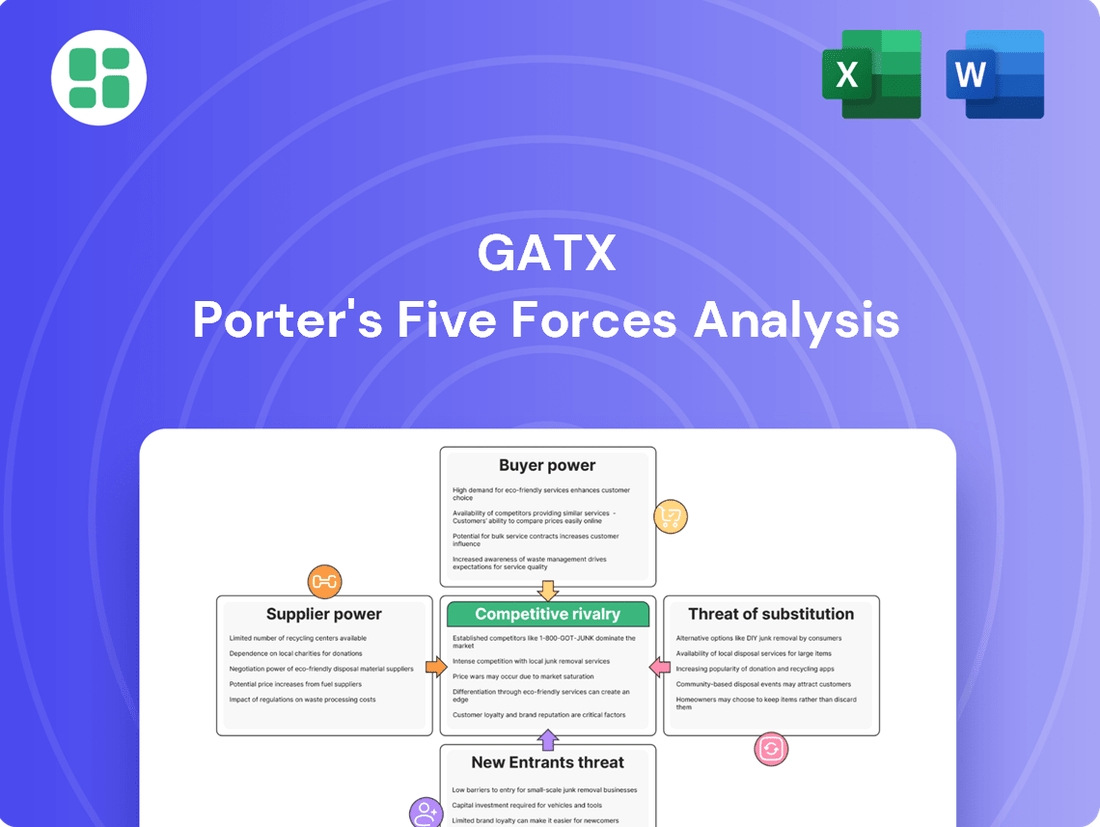

GATX Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GATX Bundle

GATX operates in a competitive landscape shaped by significant buyer power and the looming threat of substitutes. Understanding these forces is crucial for navigating the railcar leasing industry.

The full Porter's Five Forces Analysis for GATX reveals the intricate interplay of these pressures and the strategic advantages GATX leverages. Unlock actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers in the railcar manufacturing sector is considerable due to its concentrated nature. A small number of dominant manufacturers control a significant portion of the market, allowing them to dictate terms and pricing to buyers like GATX.

This concentration means fewer alternatives for railcar leasing companies, strengthening the suppliers' position. For instance, in 2024, the top three railcar manufacturers accounted for over 70% of North American production, a figure expected to remain robust.

Furthermore, projections for 2025 indicate a potential contraction in the overall US railcar manufacturing market size, which could further tighten supply and amplify supplier leverage. This tighter supply environment for new railcars means GATX may face increased costs and less favorable contract terms.

GATX's reliance on specialized manufacturers for new railcars and unique components significantly elevates supplier bargaining power. These specialized parts, like the MagRail booster for freight railcars, often have limited alternative suppliers, making switching costly and time-consuming for GATX. This dependence can force GATX into less favorable terms, as suppliers recognize the difficulty and expense GATX would incur by seeking new partners.

The bargaining power of suppliers in the railcar industry is influenced by the limited new railcar production outlook. Forecasts for 2025 suggest a decrease in new railcar deliveries, with an estimated 38,749 cars expected, marking a 5.8% year-over-year decline.

This contraction in overall supply can empower existing railcar manufacturers. As demand for new equipment persists, a reduction in readily available production capacity strengthens their negotiating position with buyers.

Long-Term Supply Agreements

Long-term supply agreements, like GATX's with Trinity Industries extending into Q1 2026 for railcar deliveries, can solidify supply chains. However, these commitments can also limit GATX's ability to switch suppliers or negotiate more favorable terms in the short term, thereby increasing supplier bargaining power.

- Secured Supply: Long-term contracts guarantee access to essential railcars, crucial for GATX's operational continuity.

- Reduced Flexibility: Committing to specific manufacturers limits GATX's agility in responding to market price fluctuations or seeking alternative suppliers.

- Supplier Leverage: The reliance on these agreements can empower manufacturers by securing future business, potentially strengthening their negotiating position on pricing and terms.

Impact of Material and Labor Costs

Suppliers to the railcar leasing industry, including GATX, are grappling with persistently high material costs, particularly for steel. For instance, U.S. hot-rolled coil steel prices, a key component in railcar manufacturing, saw significant fluctuations in 2024, often trading above $800 per ton, impacting production expenses. This upward pressure on raw materials, coupled with rising labor costs across manufacturing sectors, directly translates into increased input prices for railcar builders.

These escalating production costs for new railcars indirectly bolster the bargaining power of both raw material suppliers and component manufacturers. As manufacturers face higher expenses for steel, specialized parts, and skilled labor, they are compelled to pass these increases along to their customers, such as GATX. This dynamic means that GATX and other lessors may encounter higher prices for new equipment, a direct consequence of the suppliers’ ability to command better terms due to their own cost pressures.

- Steel Price Volatility: Hot-rolled coil steel prices in the U.S. remained a significant cost driver in 2024, impacting railcar production expenses.

- Labor Cost Increases: Rising wages and a competitive labor market for skilled manufacturing workers contribute to higher overall production costs for suppliers.

- Pass-Through of Costs: Suppliers effectively pass these increased material and labor expenses to buyers like GATX, influencing new railcar pricing.

- Indirect Manufacturer Power: The cost pressures on suppliers indirectly enhance the pricing power of railcar manufacturers and component providers.

The bargaining power of suppliers to GATX is significant due to the concentrated nature of the railcar manufacturing industry. With a few dominant players controlling a large share of production, these suppliers can dictate terms and pricing, especially as new railcar deliveries are projected to decline by 5.8% in 2025, with an estimated 38,749 cars expected.

GATX's reliance on specialized components and manufacturers, coupled with long-term supply agreements that limit flexibility, further amplifies supplier leverage. Persistent high material costs, such as U.S. hot-rolled coil steel prices exceeding $800 per ton in 2024, and rising labor expenses, empower suppliers to pass these increased costs onto buyers like GATX, impacting new equipment pricing.

| Factor | Impact on GATX | 2024/2025 Data Point |

|---|---|---|

| Industry Concentration | Limited alternatives for GATX, strengthening supplier pricing power. | Top 3 North American manufacturers held over 70% of production in 2024. |

| New Railcar Outlook | Reduced supply increases supplier leverage. | Projected 5.8% decline in new railcar deliveries for 2025. |

| Material Costs (Steel) | Higher input costs for manufacturers translate to higher prices for GATX. | U.S. hot-rolled coil steel prices often above $800/ton in 2024. |

| Specialized Components | GATX's dependence on unique parts limits its ability to switch suppliers. | Specific components like MagRail boosters have few alternative sources. |

What is included in the product

This analysis dissects GATX's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the railcar leasing industry.

GATX's Porter's Five Forces analysis offers a dynamic framework to proactively identify and mitigate competitive threats, transforming strategic planning from reactive firefighting to proactive advantage building.

Customers Bargaining Power

GATX's diverse customer base, spanning numerous industries across North America, Europe, and Asia, significantly dilutes individual customer bargaining power. This broad reach means no single client or industry segment represents a dominant portion of GATX's revenue, preventing any one group from exerting substantial influence over lease agreements.

GATX's impressive fleet utilization rates, like 99.2% in Rail North America and 99.6% in Rail India during Q2 2025, underscore robust customer demand for their railcars. This high demand inherently limits customers' bargaining power, as alternatives are scarce and the need for these essential assets is pressing.

The company's strong lease renewal success rate, reaching 84.2%, coupled with a substantial lease price index increase of 24.2% in the same period, further solidifies this. These figures clearly show that customers are accepting GATX's terms, indicating a low propensity to negotiate aggressively due to the value and reliability they receive.

Customers face a significant hurdle in acquiring their own railcar fleets, as the capital outlay for purchasing and maintaining these specialized assets is substantial. For instance, a new, modern tank car can cost upwards of $100,000, and a fleet of hundreds or thousands would represent a massive investment. This considerable financial commitment, coupled with the complexities of managing maintenance, regulatory compliance, and fleet utilization, makes leasing a far more appealing and flexible alternative for many businesses.

Value-Added Services and Fleet Diversity

GATX's value-added services, such as maintenance, repair, and remarketing, significantly enhance customer stickiness. These comprehensive offerings reduce the need for customers to manage these complex operations themselves, thereby increasing switching costs. For instance, in 2023, GATX reported that its fleet utilization remained high, demonstrating the continued demand for its integrated service model. [Company Information, 22]

The company's extensive fleet diversity, catering to a wide array of commodity types, presents a strong barrier to customers seeking to source specialized railcars elsewhere. This specialization means customers often rely on GATX for specific, hard-to-find railcar solutions, diminishing their bargaining power. GATX's ability to offer tailored solutions for diverse industries, from chemicals to agriculture, underscores this advantage.

- Value-Added Services: GATX offers maintenance, repair, and remarketing, making it difficult for customers to replicate these capabilities internally.

- Fleet Diversity: The company's broad range of specialized railcars for various commodities reduces customer options for sourcing similar equipment.

- Customer Retention: These factors contribute to higher customer retention rates, as switching providers would involve significant disruption and cost.

Availability of Alternative Lessors

The availability of alternative lessors presents a key factor influencing customer bargaining power. While companies like Trinity Industries Leasing, UTLX, Wascosa, and SMBC Rail Services offer railcar leasing, GATX's significant competitive advantages are its extensive global reach, massive fleet size, and a suite of integrated services. Potential customers must weigh GATX's comprehensive offering against the capabilities of these smaller or less diversified competitors.

- Global Scale: GATX operates in North America, Europe, and Asia, providing a broad geographic footprint.

- Fleet Size: As of the first quarter of 2024, GATX managed a fleet of approximately 147,000 railcars.

- Integrated Services: Beyond leasing, GATX offers maintenance, repair, and fleet management solutions.

- Competitive Landscape: While alternatives exist, they may not match GATX's operational breadth and service depth.

GATX's significant scale and the high cost for customers to build their own fleets limit customer bargaining power. The company's extensive global presence and diverse fleet, coupled with value-added services like maintenance and repair, create high switching costs for clients. This makes it difficult for customers to negotiate significantly lower lease terms.

The company's strong lease renewal rates, such as 84.2% in Q2 2025, and a 24.2% lease price index increase in the same period, demonstrate customers' willingness to accept GATX's terms. This indicates that customers perceive the value and reliability offered by GATX to be worth the prevailing lease rates, thereby reducing their leverage to demand lower prices.

Customers face substantial capital requirements to acquire and maintain their own railcar fleets, with new tank cars costing over $100,000 each. This significant financial barrier, along with the complexities of fleet management and regulatory compliance, makes GATX's leasing solutions more attractive and limits customers' ability to exert pressure on pricing.

| Metric | Q2 2025 Data | Significance for Customer Bargaining Power |

|---|---|---|

| Lease Renewal Rate | 84.2% | High renewal rate suggests customers accept current terms, limiting negotiation leverage. |

| Lease Price Index Increase | 24.2% | Indicates GATX's ability to raise prices, showing customers are willing to pay more. |

| Fleet Utilization (Rail North America) | 99.2% | High utilization signifies strong demand, reducing customers' power to negotiate terms. |

Preview the Actual Deliverable

GATX Porter's Five Forces Analysis

This preview showcases the complete GATX Porter's Five Forces Analysis, offering an in-depth examination of competitive pressures within the railcar leasing industry. You're viewing the exact, professionally formatted document that will be available for immediate download upon purchase, ensuring you receive a fully developed strategic tool without any placeholders or hidden content.

Rivalry Among Competitors

The railcar leasing sector is characterized by a handful of dominant, long-standing players. Companies like Trinity Industries, UTLX, Wascosa, Greenbrier, and SMBC Rail Services have a significant global presence. These established competitors actively vie for market share, which directly impacts pricing and the variety of services available to customers.

The railcar leasing sector demands substantial upfront investment in acquiring and maintaining diverse fleets, creating high fixed costs. This capital intensity acts as a significant barrier for new entrants, solidifying the position of established players like GATX.

For instance, in 2024, the average cost of a new tank car can range from $100,000 to $150,000, and a full fleet can represent billions in assets. This high capital requirement naturally limits the number of competitors, intensifying rivalry among those already operating.

Existing companies, including GATX, face pressure to maintain high fleet utilization rates to cover these fixed costs and achieve profitability. This often leads to aggressive pricing strategies and a focus on securing long-term contracts to ensure predictable revenue streams.

The North American railcar leasing market is poised for significant expansion, with projections indicating a growth of USD 8.30 billion and a compound annual growth rate of 9.1% from 2024 to 2029. This robust growth is largely fueled by increasing demand for specialized railcars, such as tank cars.

Despite this promising market expansion, the competitive landscape remains intense. Established players like GATX must continually vie for new business and secure contract renewals, as the market, while growing, is already well-developed with numerous participants.

Differentiation Through Service and Scale

Competitive rivalry in the railcar leasing industry is nuanced, extending beyond mere price competition. Companies like GATX differentiate themselves through a combination of fleet diversity, specialized maintenance services, and a broad global reach. This multi-faceted approach allows them to cater to a wider range of customer needs and secure long-term contracts.

GATX’s competitive edge is significantly bolstered by its substantial fleet size and the breadth of its service portfolio. A prime example of this strategy in action is their joint venture to acquire Wells Fargo Rail's portfolio, a move that demonstrably enhances GATX's scale and strengthens its market position. This expansion not only increases their asset base but also broadens their customer access and service capabilities.

- Fleet Diversity: GATX operates a vast and varied fleet, encompassing over 146,000 railcars as of the end of 2023, catering to diverse industries from agriculture to energy.

- Service Offerings: Beyond leasing, GATX provides comprehensive maintenance and repair services, ensuring fleet reliability and customer satisfaction.

- Global Reach: With operations across North America, Europe, and Asia, GATX offers a global network that supports international logistics needs.

- Strategic Acquisitions: The acquisition of Wells Fargo Rail's portfolio in 2024 significantly expanded GATX's market share and operational scale in North America.

Market Consolidation and Strategic Acquisitions

GATX's strategic acquisitions and joint ventures, like its partnership with Brookfield Infrastructure to secure a substantial railcar portfolio, highlight a growing trend of market consolidation. These actions effectively reduce the number of independent players in the market.

This consolidation intensifies the competitive landscape among the larger, remaining entities. For instance, in 2023, GATX continued to grow its fleet, demonstrating its commitment to expanding its market share through strategic capital deployment.

The impact of these consolidations means that the remaining competitors, often larger and better capitalized, engage in more aggressive competition for market dominance.

- Market Consolidation: Strategic acquisitions and joint ventures are reducing the number of independent competitors.

- Intensified Rivalry: Consolidation leads to fiercer competition among the remaining large players.

- Fleet Growth: GATX's continued fleet expansion in 2023 underscores its active role in this consolidating market.

Competitive rivalry in the railcar leasing sector is intense, driven by a few dominant, well-capitalized players like GATX, Trinity Industries, and UTLX. These companies compete on fleet diversity, service quality, and global reach, rather than solely on price.

The high capital expenditure required to build and maintain railcar fleets, with new tank cars costing $100,000 to $150,000 in 2024, acts as a significant barrier to entry, concentrating competition among established firms.

Market consolidation through strategic acquisitions, such as GATX's 2024 acquisition of Wells Fargo Rail's portfolio, further intensifies rivalry among the remaining large entities, pushing them to grow their fleets, as GATX did in 2023.

Despite a projected 9.1% CAGR for the North American market from 2024-2029, the already developed nature of the industry means that companies like GATX must constantly battle for market share and contract renewals.

| Competitor | Fleet Size (approx.) | Key Differentiators |

|---|---|---|

| GATX | 146,000+ (end of 2023) | Fleet diversity, global reach, comprehensive services, strategic acquisitions |

| Trinity Industries | Significant global presence | Manufacturing and leasing capabilities |

| UTLX (Union Tank Car Company) | Extensive fleet | Long-standing reputation, specialized tank car expertise |

SSubstitutes Threaten

For large volumes of heavy goods transported over long distances, rail freight offers a substantial cost advantage, often proving up to 50% cheaper per ton-mile compared to trucking. This economic efficiency makes rail the dominant mode for bulk commodities like grain, coal, and chemicals.

This significant cost difference inherently limits the appeal of road freight as a viable substitute for these specific types of shipments. Businesses reliant on moving large quantities of raw materials or finished goods across the country will find it difficult to justify the higher costs associated with trucking when rail is available.

Rail transport boasts significant environmental advantages, consuming three to four times less fuel than trucking. This efficiency translates to lower greenhouse gas emissions, with rail emitting 45-76% less per ton-mile compared to trucks. As companies increasingly focus on sustainability and reducing their carbon footprint, this environmental superiority makes rail a compelling substitute for less eco-friendly transportation modes.

Trucking offers a significant advantage in flexibility and speed for many logistics needs. Its ability to provide door-to-door delivery and faster transit times for shorter, time-sensitive hauls makes it a compelling alternative to other transport modes.

In 2024, the trucking industry continued to be a critical component of supply chains, handling an estimated 72.5% of all freight tonnage moved in the United States. This reliance highlights its role as a readily available substitute for services that might otherwise utilize rail or other less flexible options, especially when direct access to alternative networks is limited.

Emergence of Intermodal Solutions

The rise of intermodal transportation presents a significant threat of substitutes for traditional rail-only services. This approach seamlessly blends the cost-effectiveness of rail for long-distance movements with the door-to-door flexibility of trucking for the final leg of delivery. For instance, in 2024, the Association of American Railroads reported that intermodal freight volume continued to grow, demonstrating shipper preference for these integrated solutions.

- Intermodal's Growing Market Share: Shippers are increasingly adopting intermodal options to optimize supply chains, reducing reliance on single-mode transportation.

- Cost and Efficiency Advantages: Combining rail and truck often yields lower per-mile costs and improved transit times compared to all-truck or all-rail movements for certain routes.

- Flexibility for Last-Mile Delivery: The integration of trucking provides crucial flexibility for reaching final destinations, a key advantage over pure long-haul rail.

Alternative Modes for Specific Cargo

While GATX's railcars are versatile, certain cargo types face substitution threats from alternative transportation modes. For instance, pipelines are a direct substitute for transporting liquids and gases, bypassing the need for railcars in those specific sectors. In 2024, the demand for pipeline infrastructure continues to grow, particularly for energy products, representing a persistent competitive pressure for GATX's tank car business.

Barges offer a cost-effective substitute for moving bulk commodities, such as grain and coal, along navigable waterways. This mode can be particularly competitive for intermodal freight where water access is readily available. In 2023, inland waterway freight volume saw fluctuations, but remains a significant alternative for bulk shippers, impacting the demand for GATX's covered hoppers and gondolas.

For time-sensitive and high-value goods, air freight presents a substitute, though typically at a higher cost. This segment is less of a direct threat to GATX's core business but can siphon off specific niche freight. The air cargo market continued its recovery in 2024, showing resilience for premium shipping needs.

- Pipelines: Direct substitute for liquids and gases, impacting tank car demand.

- Barges: Competitive for bulk commodities on waterways, affecting hopper and gondola utilization.

- Air Freight: Niche substitute for high-value, time-sensitive goods, less of a broad threat.

The threat of substitutes for GATX's services is significant, primarily from trucking and intermodal transportation. Trucking's flexibility and widespread reach, handling 72.5% of U.S. freight tonnage in 2024, make it a constant alternative, especially for shorter hauls or when rail access is limited. Intermodal transport, which blends rail and truck, is also growing, offering shippers a combination of cost-effectiveness and last-mile delivery advantages, as evidenced by its increasing market share reported by the Association of American Railroads.

Beyond trucking and intermodal, pipelines serve as a direct substitute for liquid and gas transport, a sector where GATX's tank cars operate. The continued growth in pipeline infrastructure for energy products in 2024 represents a persistent competitive pressure. Barges also pose a threat for bulk commodities like grain and coal, particularly where waterways are accessible, impacting the demand for GATX's hopper and gondola cars.

| Substitute Mode | Key Advantages | Impact on GATX Segments | 2024 Relevance |

|---|---|---|---|

| Trucking | Flexibility, door-to-door delivery, speed for shorter hauls | General freight, less bulk commodities | Handled 72.5% of U.S. freight tonnage |

| Intermodal | Cost-efficiency of rail + flexibility of truck | General freight, consumer goods | Continued growth in volume |

| Pipelines | Direct transport for liquids/gases, bypasses railcars | Tank cars | Growing infrastructure for energy products |

| Barges | Cost-effective for bulk commodities on waterways | Hopper and gondola cars | Significant alternative for bulk shippers |

Entrants Threaten

Entering the railcar leasing sector necessitates a substantial upfront investment in specialized railcars and robust maintenance facilities. For instance, GATX's 2024 joint venture to acquire Wells Fargo Rail's portfolio for $4.4 billion underscores the immense capital commitment needed to establish a competitive presence.

The rail industry is a heavily regulated sector, imposing strict safety and environmental standards that any new entrant must rigorously adhere to. Navigating this complex web of compliance demands significant investment in time, specialized expertise, and substantial operational costs. For instance, in 2024, the Federal Railroad Administration (FRA) continued to enforce robust safety regulations, including those related to track integrity and hazardous material transport, which require considerable capital outlay for new operators.

Established players like GATX leverage substantial economies of scale in acquiring, maintaining, and managing their vast global railcar fleets. This allows them to achieve lower per-unit costs that are difficult for newcomers to replicate. For instance, in 2024, GATX's extensive fleet size provides a significant competitive advantage in negotiating bulk purchases and optimizing maintenance schedules, thereby presenting a considerable barrier to entry for potential competitors seeking to match their cost efficiencies.

Difficulty in Building Customer Relationships and Reputation

New entrants face a significant hurdle in establishing customer relationships and building a reputable brand in the railcar leasing industry. GATX, for instance, has cultivated decades-long partnerships with a wide array of clients, a testament to their reliability and service quality. This deep-seated trust and established market presence are not easily replicated by newcomers.

The specialized nature of railcar leasing demands a significant investment in time and resources to develop the necessary expertise and a strong reputation. New companies must overcome the challenge of proving their credibility and securing long-term contracts, which often favor incumbent players with proven track records. For example, GATX reported a fleet of over 130,000 railcars as of the first quarter of 2024, serving diverse sectors like chemicals, energy, and agriculture, highlighting the scale of established operations.

- Established Trust: GATX's long history fosters deep customer loyalty, making it difficult for new entrants to gain traction.

- Reputational Barrier: Building a credible reputation in a niche market requires extensive time and proven performance.

- Contractual Advantages: Existing players often benefit from long-term leases, creating a barrier to entry for new suppliers.

- Industry Expertise: The specialized knowledge and operational experience of established firms are hard for new companies to match quickly.

Limited Access to Supply Agreements and Market Knowledge

New entrants into the railcar leasing market, like GATX, would find it difficult to secure favorable supply agreements. Major railcar manufacturers often have long-standing relationships and prioritize their existing, high-volume customers, making it challenging for newcomers to negotiate competitive terms. For instance, in 2023, North American railcar production was estimated to be around 40,000 to 45,000 units, a market where established players already hold significant sway.

Furthermore, the deep industry knowledge and market insights accumulated by incumbents over decades are not easily replicated. This includes understanding specialized maintenance needs, regulatory landscapes, and the nuances of various customer segments. Without this accumulated wisdom, new entrants may struggle to effectively serve diverse client needs or anticipate market shifts, putting them at a disadvantage against seasoned competitors.

- Limited Access to Supply Agreements: Railcar manufacturers often favor existing, large-volume customers, hindering new entrants' ability to secure favorable terms.

- Market Knowledge Gap: Incumbents possess decades of accumulated industry knowledge and market insights that are difficult for new players to quickly replicate.

- Production Capacity Constraints: In 2023, North American railcar production was around 40,000-45,000 units, a market where established players have significant leverage.

The threat of new entrants for GATX is moderate, primarily due to the substantial capital requirements and regulatory hurdles. The significant upfront investment needed for railcar fleets, exemplified by GATX's 2024 $4.4 billion acquisition of Wells Fargo Rail's portfolio, acts as a considerable barrier. Furthermore, stringent safety and environmental regulations, continuously enforced by bodies like the Federal Railroad Administration in 2024, demand extensive compliance investments, deterring smaller, less capitalized players.

| Barrier Type | Description | Example/Data Point (2024 unless specified) |

| Capital Requirements | High upfront investment in specialized railcars and infrastructure. | GATX's $4.4 billion acquisition of Wells Fargo Rail portfolio. |

| Regulatory Compliance | Strict safety and environmental standards requiring significant investment. | Federal Railroad Administration (FRA) enforcement of safety regulations. |

| Economies of Scale | Established players benefit from lower per-unit costs due to large fleet size. | GATX's extensive fleet size provides bulk purchasing and maintenance advantages. |

| Customer Relationships & Reputation | Decades of trust and service quality are difficult for newcomers to replicate. | GATX's long-standing partnerships with diverse clients. |

| Industry Expertise | Deep knowledge of maintenance, regulations, and market needs. | GATX's accumulated wisdom in serving various customer segments. |

| Supply Agreements | Manufacturers often prioritize existing, high-volume customers. | North American railcar production (approx. 40,000-45,000 units in 2023) favors established players. |

Porter's Five Forces Analysis Data Sources

Our GATX Porter's Five Forces analysis leverages data from GATX's annual reports and SEC filings, alongside industry-specific reports from organizations like the Association of American Railroads and market intelligence from firms such as IBISWorld.