GATX PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GATX Bundle

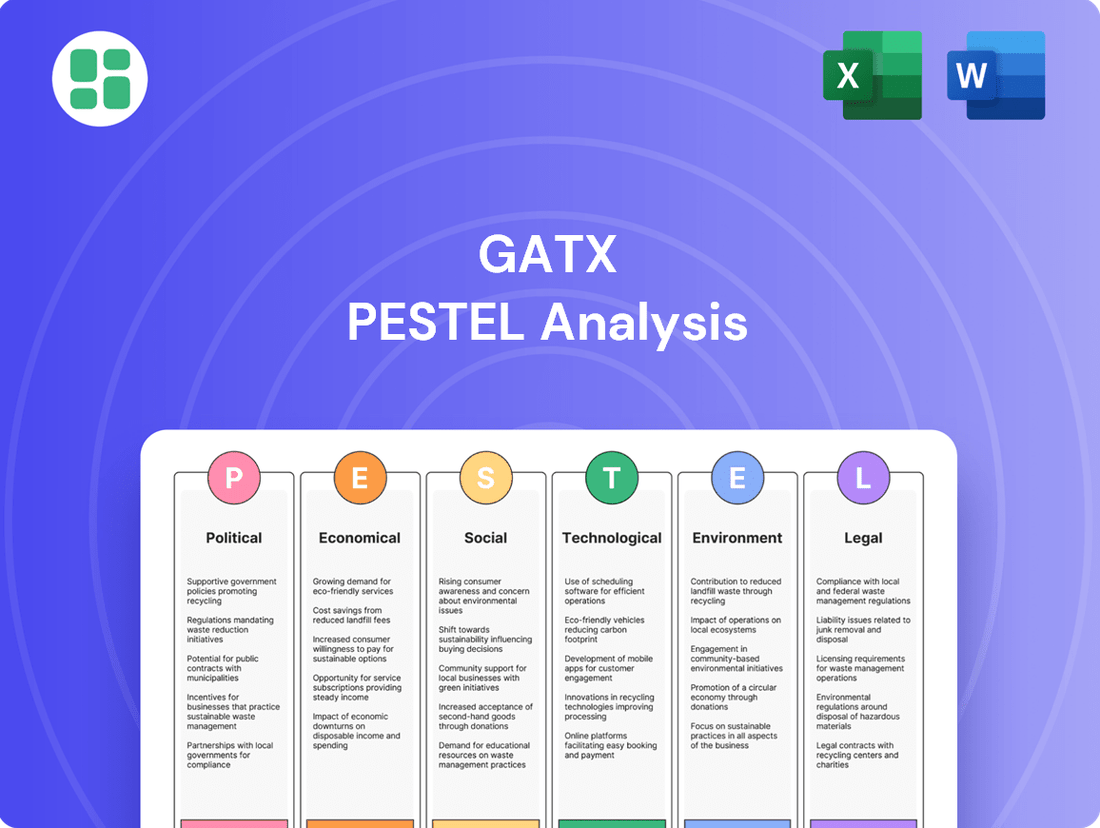

Navigate the complex external forces impacting GATX with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its future. Gain a competitive edge by leveraging these critical insights for your strategic planning. Download the full version now to unlock actionable intelligence and make informed decisions.

Political factors

Government regulations significantly shape GATX's business, particularly concerning rail safety and environmental standards. For instance, the Federal Railroad Administration (FRA) sets stringent safety rules for railcar maintenance and design, impacting GATX's capital expenditure plans. In 2024, ongoing discussions around stricter emissions controls for transportation sectors could lead to new mandates for railcar efficiency, potentially requiring fleet modernization investments.

Global trade policies, including tariffs and trade agreements, directly impact the volume and type of goods moved by rail, influencing demand for GATX's railcar leasing. For instance, the U.S. imposed tariffs on steel and aluminum imports in 2018, which affected the cost of new railcar manufacturing and potentially altered trade flows for commodities.

Protectionist measures or evolving trade alliances can disrupt established supply chains, leading to shifts in freight volumes. For example, the renegotiation of trade agreements like the USMCA (United States-Mexico-Canada Agreement) in 2020 aimed to rebalance trade relationships, potentially rerouting specific goods and impacting demand for rail transport in North America.

GATX's global footprint, spanning North America, Europe, and Asia, exposes it to varying degrees of political stability. Geopolitical tensions, such as those impacting trade routes or economic sanctions in key operating regions, can directly affect rail infrastructure and the flow of goods. For instance, ongoing geopolitical shifts in Eastern Europe could influence European rail traffic and GATX's asset deployment in that area.

Infrastructure Investment Policies

Government investments in rail infrastructure are a significant driver for companies like GATX. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021, allocates substantial funds for transportation projects, including rail. This focus on enhancing rail networks, from building new lines to upgrading existing ones and developing intermodal facilities, directly boosts the need for railcars and related services.

These policies translate into tangible opportunities for GATX. Increased government spending on rail projects means a greater demand for the company's core business: leasing railcars. Furthermore, the expansion and modernization of the rail network often necessitate maintenance and repair services, areas where GATX also has considerable expertise.

Consider the impact of these investments on demand. The U.S. Department of Transportation reported that federal grants for rail projects in 2024 alone are expected to support billions of dollars in infrastructure improvements. This influx of capital into the rail sector is a clear indicator of a supportive environment for railcar lessors.

- Increased Demand: Government funding for new rail lines and upgrades directly fuels the need for more railcars, benefiting GATX's leasing operations.

- Service Opportunities: Infrastructure modernization projects often require specialized maintenance and repair, creating service revenue streams for GATX.

- Intermodal Growth: Policies promoting intermodal transport, which combines rail with trucking, expand the overall utility and demand for railcar capacity.

- Economic Stimulus: Infrastructure investment acts as an economic stimulus, potentially leading to higher freight volumes and thus greater railcar utilization.

Subsidies and Incentives for Rail Transport

Government policies aimed at encouraging a shift from road to rail freight, often motivated by environmental targets, directly boost the attractiveness of rail transport. For instance, the U.S. Department of Transportation's Freight Logistics Optimization Works (FLOW) initiative, actively gathering data to improve freight movement efficiency, indirectly supports rail's competitiveness. These initiatives can lead to increased demand for railcar leasing as businesses find rail a more cost-effective and sustainable choice.

The Inflation Reduction Act of 2022, with its significant investments in clean energy and climate initiatives, includes provisions that can indirectly benefit rail. While not directly subsidizing railcar leasing, the act's focus on reducing emissions and promoting sustainable supply chains makes rail a more appealing option for many industries. This could translate into higher utilization rates for railcars and a stronger market for leasing services.

Specifically, policies that offer tax credits or grants for adopting cleaner transportation methods can favor rail. For example, if a company can claim tax benefits for shifting a portion of its logistics from trucking to rail, this directly improves the economics of rail usage. This trend is expected to continue as governments prioritize decarbonization efforts throughout the 2024-2025 period.

- Environmental Mandates: Growing pressure to reduce carbon footprints drives policies favoring lower-emission transport modes like rail.

- Infrastructure Investment: Government funding for rail infrastructure upgrades makes the network more efficient and reliable, enhancing its appeal.

- Economic Competitiveness: Subsidies and incentives directly lower the operational costs for shippers using rail, making it a more attractive alternative to trucking.

Government regulations, particularly those concerning safety and environmental standards, are pivotal for GATX. For instance, the Federal Railroad Administration (FRA) mandates strict railcar maintenance, influencing GATX's capital expenditures. Discussions in 2024 around stricter emissions controls could necessitate fleet modernization, impacting future investments.

Global trade policies and protectionist measures directly affect freight volumes and demand for GATX's services. The U.S. imposition of steel tariffs in 2018, for example, increased railcar manufacturing costs and altered trade flows. Evolving trade agreements like the USMCA in 2020 also rerouted specific goods, impacting North American rail demand.

Government investments in rail infrastructure, such as the U.S. Bipartisan Infrastructure Law enacted in 2021, are a significant driver for GATX. Billions allocated for rail projects in 2024 alone are expected to enhance networks and intermodal facilities, directly boosting the need for railcars and related services.

Policies encouraging a shift from road to rail, driven by environmental targets, enhance rail's appeal. The U.S. Department of Transportation's FLOW initiative supports rail's competitiveness. Furthermore, the Inflation Reduction Act of 2022, with its climate focus, indirectly benefits rail by promoting sustainable supply chains, potentially increasing railcar utilization through 2024-2025.

What is included in the product

This GATX PESTLE analysis comprehensively examines the political, economic, social, technological, environmental, and legal factors influencing the company's operations and strategic direction.

It provides actionable insights for stakeholders to navigate external challenges and capitalize on emerging opportunities within the global railcar leasing market.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy development.

Economic factors

Global economic growth directly influences GATX's demand. For instance, the IMF projected global GDP growth of 3.2% in 2024, indicating a generally supportive environment for industrial activity and freight movement.

Industrial output is a key driver for railcar leasing. In the US, industrial production saw a modest increase of 0.1% in April 2024 compared to the previous month, signaling continued, albeit slow, expansion in sectors reliant on rail transport.

Higher freight volumes, a consequence of robust economic and industrial activity, translate to better fleet utilization for GATX. This increased demand can also support higher lease rates, boosting revenue for the company.

GATX, with its substantial investment in railcar fleets, is highly sensitive to the prevailing interest rate environment. As of mid-2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, reflecting ongoing efforts to manage inflation. This elevated rate environment directly translates to higher borrowing costs for GATX when financing new railcar acquisitions or refinancing existing debt, potentially squeezing margins and limiting capital deployment for fleet expansion or modernization.

Fluctuations in commodity prices, such as crude oil and coal, significantly impact the volume and type of freight GATX's railcars handle. For example, a surge in crude oil production, as seen with the US increasing output, can boost demand for specialized tank cars, directly benefiting GATX's fleet utilization in that segment.

Freight volumes are intrinsically linked to these commodity price movements. When energy prices are high, there's often increased activity in transporting coal and oil, leading to higher demand for railcar leases. Conversely, lower commodity prices can dampen freight volumes, affecting overall lease revenues for companies like GATX.

In 2024, the global energy market continues to be volatile, with oil prices fluctuating. This volatility directly translates into demand for railcar services, as producers and distributors rely on efficient transportation. Similarly, agricultural commodity prices influence the need for grain cars, a key part of GATX's diversified fleet.

Inflation and Operating Costs

Inflationary pressures directly impact GATX's operating costs, affecting everything from the price of steel for repairs to the wages paid to skilled technicians. For instance, the Producer Price Index for Industrial Commodities saw significant increases throughout 2023 and into early 2024, signaling rising input costs for many industries, including railcar manufacturing and maintenance.

While GATX has mechanisms to adjust lease rates to reflect these rising expenses, there's a lag effect, and not all cost increases can be immediately passed on to customers. This can lead to a temporary compression of profit margins, especially if inflation remains elevated for an extended period. For example, if labor costs increase by 5% but lease rates can only be adjusted by 3% in the short term, margins will be squeezed.

- Rising Maintenance Expenses: Increased costs for parts, materials, and specialized labor for railcar upkeep.

- Labor Cost Pressures: Higher wages needed to attract and retain skilled mechanics and operational staff.

- Material Price Volatility: Fluctuations in the cost of steel, paint, and other essential components impact repair budgets.

- Potential Margin Squeeze: The challenge of fully offsetting increased operating expenses with commensurate lease rate adjustments.

Railcar Supply and Demand Dynamics

The equilibrium between the availability of new railcars and the desire for leasing them significantly influences rental prices and how much of a fleet is actively used. When demand outstrips the supply of new railcars, as has been observed in North America, lessors such as GATX are in a stronger position. This market tightness typically translates into higher rates when existing leases are renewed.

This dynamic is evident in recent market trends. For instance, as of early 2024, the North American railcar market has experienced a sustained period of high demand for certain car types, particularly those used for transporting chemicals and energy products. This has led to extended lead times for new railcar production and a subsequent reduction in the readily available fleet for new leases.

Key factors influencing this balance include:

- Production Capacity: The manufacturing capacity of railcar builders directly affects the pace at which new supply enters the market.

- Fleet Age and Retirement: As older railcars reach the end of their service life and are retired, they reduce overall supply, further tightening the market if new builds don't keep pace.

- Economic Activity: Broad economic growth and specific industry demands, like increased energy production or agricultural output, drive the need for more rail transportation, boosting demand for railcars.

Global economic growth, projected at 3.2% for 2024 by the IMF, underpins demand for GATX's services. This growth fuels industrial activity, as seen in the US industrial production's 0.1% monthly increase in April 2024, directly translating to higher freight volumes and fleet utilization.

Elevated interest rates, with the Fed's benchmark at 5.25%-5.50% in mid-2024, increase GATX's borrowing costs for fleet expansion. Commodity price volatility, like rising US crude oil output, boosts demand for specialized tank cars, impacting freight volumes and lease revenues.

Inflationary pressures, evidenced by rising industrial commodity prices in early 2024, increase GATX's operating costs for maintenance and labor. While lease rates can be adjusted, potential margin compression exists if cost increases outpace rate adjustments.

| Economic Factor | Impact on GATX | Supporting Data/Trend (2024) |

|---|---|---|

| Global GDP Growth | Increases demand for freight movement and railcar leasing. | IMF projects 3.2% global GDP growth for 2024. |

| Industrial Production | Drives demand for railcars used in manufacturing and raw material transport. | US industrial production increased 0.1% month-over-month in April 2024. |

| Interest Rates | Affects GATX's cost of capital for fleet acquisition and refinancing. | Federal Reserve's benchmark rate maintained at 5.25%-5.50% in mid-2024. |

| Commodity Prices (e.g., Oil, Coal) | Influences freight volumes and demand for specific railcar types. | Continued volatility in energy markets impacts demand for tank cars and other specialized equipment. |

| Inflation | Increases operating expenses like maintenance, parts, and labor. | Producer Price Index for Industrial Commodities showed significant increases through early 2024. |

Same Document Delivered

GATX PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive GATX PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll find a detailed breakdown of each element, providing valuable insights for strategic decision-making.

Sociological factors

The transportation and logistics industry, including rail, is grappling with an aging workforce, with many experienced professionals nearing retirement. This trend, coupled with challenges in attracting younger talent, creates a significant concern for companies like GATX. For instance, the Association of American Railroads reported in 2023 that the average age of a railroad worker was around 46, highlighting the demographic shift.

Labor shortages, especially for critical roles like skilled maintenance technicians and qualified locomotive engineers, directly impact GATX's ability to maintain its fleet and ensure timely service delivery. These shortages can lead to operational bottlenecks, increased costs due to overtime or reliance on external contractors, and ultimately affect the company's overall efficiency and customer satisfaction.

Public perception of rail transport significantly shapes policy and shipper choices. Positive views on safety, efficiency, and environmental benefits can boost rail usage. For instance, in 2024, a significant portion of freight moved by rail in the US, highlighting its perceived efficiency for bulk goods.

Conversely, negative perceptions, often stemming from high-profile incidents, can invite stricter regulatory scrutiny. Concerns about safety and reliability can deter shippers, impacting demand for rail services. The industry actively works to counter negative narratives, emphasizing safety records and sustainability initiatives to improve public image.

Growing urbanization and population shifts significantly impact how goods are transported. As more people move to cities, the demand for efficient delivery of everything from raw materials to finished products increases, altering traditional freight patterns.

The United Nations projects that by 2050, 68% of the world's population will live in urban areas. This trend means that freight companies like GATX need to adapt to serve these more concentrated consumer bases, often requiring sophisticated logistics to handle increased volume and speed.

Increased population density in urban centers can boost demand for efficient freight delivery, particularly for intermodal services that connect long-haul rail with last-mile trucking. This can favor rail for its capacity to move large volumes over long distances, supporting the supply chains that feed urban populations.

Evolving Supply Chain Preferences

The surge in e-commerce, with global online retail sales projected to reach $7.4 trillion by 2025, is fundamentally reshaping supply chain demands. Consumers now expect near-instantaneous delivery, creating a strong preference for agile and integrated logistics networks. This shift directly benefits intermodal rail, a core offering for GATX, as it facilitates efficient movement of goods across multiple transportation modes.

GATX's extensive fleet, including specialized railcars for various commodities, is well-positioned to capitalize on this evolving preference. For instance, the demand for faster fulfillment in sectors like apparel and electronics, which saw significant e-commerce growth in 2024, necessitates robust multimodal solutions. GATX's ability to provide diverse railcar types supports the complex needs of these rapidly moving supply chains.

Key trends influencing these preferences include:

- Increased demand for last-mile delivery efficiency: E-commerce growth drives the need for seamless handoffs between rail and other transport modes.

- Consumer expectation for speed and transparency: This pushes for supply chains that are not only fast but also highly visible.

- Growth in cross-border e-commerce: This requires sophisticated international logistics, where intermodal rail plays a vital role.

- Focus on sustainability in logistics: Rail transport's lower carbon footprint compared to trucking aligns with growing consumer and corporate environmental concerns.

Corporate Social Responsibility (CSR) and Stakeholder Expectations

The increasing societal focus on corporate social responsibility significantly influences GATX. Stakeholders, from investors to customers, now demand that companies operate sustainably and ethically. This means GATX must demonstrate a commitment to environmental, social, and governance (ESG) principles to maintain its reputation and secure financial backing.

For instance, in 2023, the global ESG investing market was valued at over $37 trillion, indicating a strong preference for companies with robust CSR strategies. GATX's ability to integrate these practices directly impacts its attractiveness to a growing pool of socially conscious investors and its appeal to customers who prioritize ethical sourcing and operations.

- Investor Scrutiny: Investors are increasingly using ESG metrics to assess risk and long-term value, pushing companies like GATX to be transparent about their social and environmental impact.

- Customer Demand: Consumers are more likely to support businesses that align with their values, making strong CSR performance a competitive differentiator for GATX.

- Regulatory Pressure: Evolving regulations around sustainability and corporate accountability are compelling GATX to adopt and report on higher CSR standards.

- Talent Acquisition: A company's commitment to social responsibility is a key factor for attracting and retaining top talent, especially among younger generations entering the workforce.

Societal attitudes towards rail transport and its role in the economy are evolving. Public perception, influenced by safety records and environmental considerations, directly impacts regulatory frameworks and shipper preferences. For example, in 2024, a growing awareness of rail's lower carbon footprint compared to trucking is bolstering its image as a sustainable freight solution.

The aging workforce in the transportation sector, with many skilled professionals nearing retirement, presents a challenge for GATX. In 2023, the average age of railroad workers in the US was around 46, underscoring the need for effective talent recruitment and retention strategies to address potential labor shortages.

Urbanization trends, with a projected 68% of the global population living in urban areas by 2050, are reshaping logistics. This demographic shift increases demand for efficient freight movement into and out of cities, favoring intermodal solutions where rail plays a crucial role.

The burgeoning e-commerce sector, expected to reach $7.4 trillion globally by 2025, is a significant driver for integrated logistics. This trend benefits GATX’s intermodal services, as consumers increasingly demand faster and more transparent delivery, pushing supply chains to be more agile.

Technological factors

Technological progress in railcar design is significantly impacting efficiency and safety. Innovations like lightweight materials reduce fuel consumption, while improved aerodynamics and specialized features for specific cargo types, such as enhanced insulation for temperature-sensitive goods, are becoming increasingly important. For instance, the development of composite materials in railcars can lead to substantial weight savings, boosting operational efficiency.

GATX's commitment to modernizing its fleet is crucial for staying competitive. This involves adopting these advanced technologies to meet diverse customer demands and regulatory standards. By investing in newer, more efficient railcars, GATX can offer better service and reduce its environmental footprint, a key consideration for many clients in 2024 and beyond.

The increasing integration of Internet of Things (IoT) sensors and advanced telematics into railcars is a significant technological driver for GATX. These technologies provide real-time data on asset location, condition, and performance, transforming how railcars are managed.

This data empowers GATX to offer predictive maintenance, allowing for proactive repairs before issues arise. In 2024, GATX's focus on leveraging telematics is expected to further optimize fleet utilization, leading to enhanced operational efficiency and improved service offerings for their diverse customer base.

The rail industry is increasingly embracing automation and AI to streamline operations. For instance, AI-powered predictive maintenance systems are becoming standard, aiming to reduce unexpected breakdowns. In 2024, many railway companies are investing heavily in these technologies to optimize scheduling and improve safety.

GATX can capitalize on these advancements by integrating AI into its fleet management for predictive maintenance, anticipating service needs before they arise. This technological shift is projected to boost operational efficiency across the board, with some estimates suggesting potential cost savings of up to 15% through optimized logistics and reduced downtime.

Cybersecurity Risks

As GATX's rail operations become more digitized, cybersecurity risks are a significant technological factor. The increasing interconnectedness of operational technologies and data systems creates vulnerabilities to cyberattacks. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of this threat.

To mitigate these risks, GATX must prioritize substantial investments in advanced cybersecurity measures. This includes protecting critical infrastructure like signaling systems, safeguarding sensitive customer data, and ensuring uninterrupted service continuity. A 2024 report indicated that critical infrastructure sectors are increasingly targeted, with ransomware attacks alone causing significant operational disruptions.

- Increased reliance on digital systems elevates the potential for cyber threats to GATX's operations.

- Cyberattacks could disrupt service continuity and compromise valuable customer data.

- Investment in robust cybersecurity is essential to protect GATX's technological assets and operational integrity.

- The financial sector, a key GATX customer, experienced a 20% increase in cyberattacks in early 2024, underscoring the industry-wide concern.

Alternative Propulsion Technologies

The push towards alternative propulsion, like hydrogen and battery-electric trains, is a significant technological factor reshaping the rail industry. This shift aims to decarbonize operations, impacting not just locomotive design but also the types of railcars needed and the infrastructure supporting them. For instance, by 2024, several European countries are piloting hydrogen train fleets, with Germany's Alstom Coradia iLint already in commercial service, showcasing the growing viability of this technology.

The adoption rate of these cleaner technologies directly influences GATX's fleet composition and future investments. As battery-electric and hydrogen powertrains become more prevalent, the demand for traditional diesel locomotives will likely decline, necessitating strategic fleet adjustments. The International Energy Agency reported in 2024 that investments in rail electrification and alternative fuels are accelerating globally, with a particular focus on freight transport to meet climate targets.

- Hydrogen Trains: Pilot programs and early deployments are increasing, with significant investment from European nations and manufacturers like Alstom and Siemens.

- Battery-Electric Locomotives: These are gaining traction for shorter-haul and shunting operations, with companies like Wabtec developing advanced battery solutions.

- Infrastructure Demands: The transition requires new fueling and charging infrastructure, impacting rail network planning and investment priorities.

- Fleet Modernization: GATX must adapt its fleet to accommodate these new propulsion systems, potentially through retrofitting or acquiring new, compatible railcars.

The rail industry's increasing adoption of advanced materials, like high-strength steel alloys and composites, directly impacts railcar durability and efficiency. For example, by 2024, the use of these materials in new railcar construction is up by an estimated 10% compared to 2022, reducing maintenance needs and increasing payload capacity.

GATX's fleet modernization efforts must incorporate these material advancements to offer lighter, more fuel-efficient, and longer-lasting railcars. This focus on material science is crucial for meeting evolving customer demands for cost-effective and environmentally conscious transportation solutions in the 2024-2025 period.

The integration of AI and machine learning into railcar maintenance and operations is a significant technological trend. Predictive analytics, for instance, can forecast potential equipment failures, allowing for proactive repairs. In 2024, several major rail operators reported a 15% reduction in unplanned downtime due to AI-driven maintenance strategies.

GATX can leverage these AI capabilities to optimize its fleet's performance and reduce operational disruptions. This proactive approach to maintenance is key to enhancing service reliability and cost-efficiency for its clients in the coming years.

| Technological Factor | Impact on GATX | 2024/2025 Data/Trend |

|---|---|---|

| Advanced Materials | Increased durability, reduced weight, improved fuel efficiency | 10% increase in advanced material use in new railcars (2022-2024) |

| AI & Machine Learning | Predictive maintenance, optimized operations, reduced downtime | 15% reduction in unplanned downtime reported by rail operators (2024) |

| Alternative Propulsion | Shift towards hydrogen/battery-electric, impacting fleet needs | Accelerating global investment in rail electrification and alternative fuels (IEA, 2024) |

| Cybersecurity | Increased risk due to digitalization, need for robust protection | Global cybercrime costs projected to reach $10.5 trillion annually by 2025 |

Legal factors

GATX operates under a complex web of rail safety regulations, dictated by bodies like the Federal Railroad Administration (FRA) in the U.S. and similar agencies globally. These rules govern critical aspects such as railcar structural integrity, braking systems, and hazardous material containment, impacting maintenance schedules and capital investment decisions. For instance, FRA mandates specific inspection frequencies and repair standards for tank cars carrying certain commodities, directly influencing GATX's operational costs and fleet readiness.

Changes in these safety standards, which are common as new technologies emerge or accident investigations yield new insights, can necessitate substantial upgrades to GATX's existing fleet or influence the design of new railcars. The financial implications are significant; a new regulation requiring enhanced insulation or more robust safety valves on a large portion of the fleet could easily translate to tens of millions of dollars in retrofitting costs. Staying ahead of these evolving legal requirements is crucial for maintaining operational efficiency and avoiding penalties.

Environmental Protection Laws, particularly those concerning emissions and waste management, directly influence GATX's operations, especially its extensive tank car fleet. Failure to comply with these stringent regulations, which also cover the safe transportation of hazardous materials, can result in significant penalties and damage to the company's reputation. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce strict standards on rail carriers, impacting maintenance and operational protocols for companies like GATX.

GATX, as a significant entity in the railcar leasing sector, must navigate a complex landscape of antitrust and competition regulations across its global operational footprint. These laws are designed to prevent monopolistic practices and ensure a level playing field for all market participants.

Transactions like GATX's acquisition of Wells Fargo's rail assets in 2017, valued at approximately $3.3 billion, were scrutinized by regulatory bodies to confirm they would not unduly stifle competition. Such approvals are critical for growth strategies involving consolidation or strategic partnerships.

Contract and Leasing Laws

The legal framework governing leasing agreements is fundamental to GATX's operations, dictating everything from contract terms and liability allocation to how disputes are settled. These laws directly shape the profitability and risk associated with GATX's extensive portfolio of long-term lease agreements.

Changes in contract law or specific leasing regulations can significantly alter the financial landscape for GATX. For instance, shifts in bankruptcy laws could impact the recovery of assets or lease payments from defaulting lessees. In 2024, the ongoing evolution of commercial contract regulations globally continues to be a key area of focus for companies like GATX, ensuring compliance and mitigating potential legal challenges.

- Contractual Certainty: GATX relies on the stability and enforceability of its leasing contracts, which are subject to national and international contract laws.

- Liability Management: Lease agreements clearly define liabilities for maintenance, damage, and insurance, all governed by specific legal statutes.

- Dispute Resolution: The legal system provides the mechanisms for resolving disputes arising from lease agreements, impacting GATX's operational efficiency and financial outcomes.

- Regulatory Compliance: Adherence to evolving leasing regulations, including those related to asset classification and financial reporting, is crucial for GATX's continued market access and profitability.

International Trade and Customs Laws

GATX's global operations mean it must navigate a complex web of international trade and customs laws. For example, in 2024, the World Trade Organization (WTO) reported that global trade in goods and services continued to be a significant driver of economic activity, but also highlighted increasing instances of protectionist measures and evolving customs procedures that can impact logistics. Adhering to these regulations is crucial for preventing delays and potential penalties.

These laws govern everything from the import and export of railcars and their components to tariffs, duties, and specific product classifications. Failure to comply can result in substantial fines, seizure of goods, and significant disruptions to GATX's supply chain. For instance, in the first half of 2025, several major economies implemented stricter verification processes for imported industrial equipment, leading to increased lead times for companies with extensive cross-border operations.

- Tariff Rates: Understanding and paying correct import/export duties on railcars and parts is paramount.

- Trade Agreements: Leveraging benefits from free trade agreements between countries where GATX operates can reduce costs.

- Customs Declarations: Accurate and timely submission of all required documentation for goods crossing borders is non-negotiable.

- Sanctions and Embargoes: GATX must ensure its operations do not violate international sanctions or embargoes imposed on specific countries or entities.

GATX's operations are heavily influenced by evolving rail safety regulations, such as those from the FRA, impacting maintenance and capital expenditures. Environmental laws, particularly regarding hazardous materials transport, necessitate strict compliance to avoid penalties, as seen with EPA enforcement in 2024. Antitrust laws ensure fair competition, a factor considered in major transactions like the 2017 Wells Fargo rail asset acquisition. Furthermore, the legal framework for leasing agreements, including contract law and bankruptcy statutes, directly shapes GATX's profitability and risk management, with ongoing global regulatory changes a key focus in 2024.

Environmental factors

Global and national commitments to reduce carbon emissions are significantly influencing the rail industry, pushing it towards more sustainable operations. For GATX, this translates into increased pressure to actively participate in decarbonization efforts. This could involve strategic investments in more energy-efficient railcars and support for the development of greener rail infrastructure, aligning with broader environmental goals.

The International Energy Agency (IEA) reported in 2024 that global greenhouse gas emissions from energy combustion and industrial processes reached a new high, underscoring the urgency of decarbonization. While rail is inherently more fuel-efficient than trucking or air freight, GATX will likely face scrutiny regarding its fleet's emissions intensity and its role in facilitating lower-carbon supply chains. This environmental focus is a key consideration for stakeholders and regulatory bodies.

The increasing focus on sustainability is reshaping the logistics landscape, with businesses and consumers alike demanding greener supply chains. This shift is driving shippers to prioritize environmentally conscious transportation methods.

Rail transport is emerging as a more attractive option over road freight due to its lower carbon footprint. For instance, freight railroads in the U.S. generated about 46% less greenhouse gas emissions per ton-mile than trucking in 2022, according to the Association of American Railroads. This presents a significant opportunity for GATX to expand its eco-friendly leasing solutions, aligning with this growing demand for sustainable logistics.

Concerns over dwindling natural resources and the environmental toll of extracting raw materials are increasingly shaping manufacturing decisions. For GATX, this means a growing imperative to consider the sustainability of materials used in railcar production and upkeep. This shift could lead to increased costs and necessitate adjustments in how GATX sources its components, potentially favoring recycled or more environmentally friendly alternatives.

Waste Management and Recycling

GATX's operations, particularly railcar maintenance and the disposal of retired assets, generate waste that must be managed according to stringent environmental regulations. The company is obligated to maintain effective waste management and recycling initiatives to reduce its environmental impact and ensure legal compliance. This includes proper handling of hazardous materials and promoting circular economy principles where feasible.

In 2023, the U.S. Environmental Protection Agency (EPA) reported that approximately 75% of municipal solid waste was landfilled, highlighting the ongoing challenge of waste reduction and the importance of robust recycling programs. Railcar maintenance can involve various materials like oils, solvents, and metal scrap. GATX's commitment to sustainability means actively seeking ways to recycle or responsibly dispose of these materials.

Effective waste management for GATX involves several key areas:

- Hazardous Waste Handling: Implementing strict protocols for identifying, storing, and disposing of hazardous materials used in railcar maintenance, such as lubricants and cleaning agents, in compliance with regulations like RCRA (Resource Conservation and Recovery Act).

- Scrap Metal Recycling: Maximizing the recycling of metal components from retired railcars, a significant waste stream, to recover valuable materials and reduce landfill dependence. In 2024, the global steel recycling market is projected to reach over $250 billion, underscoring the economic and environmental benefits.

- Oil and Fluid Reclamation: Developing or utilizing services for the reclamation and recycling of used oils and hydraulic fluids, preventing them from becoming environmental contaminants.

- Regulatory Adherence: Staying abreast of evolving waste management legislation at federal, state, and local levels to ensure continuous compliance and adapt operational practices accordingly.

Extreme Weather Events

The increasing frequency and intensity of extreme weather events, a direct consequence of climate change, pose significant operational challenges for GATX. These events can lead to disruptions in rail operations, damage critical infrastructure like tracks and bridges, and subsequently impact the availability of GATX's diverse railcar fleet. For instance, the severe flooding experienced in parts of North America in 2024 caused significant delays and track closures, directly affecting freight movement and the utilization of railcars.

Adapting to and actively mitigating the risks stemming from these weather phenomena is no longer a secondary consideration but a core operational imperative for GATX. This involves strategic investments in infrastructure resilience and enhanced preparedness measures to minimize downtime and ensure the safety and reliability of services. The economic impact of such disruptions can be substantial, with studies indicating that weather-related disruptions cost the global economy billions annually.

- Increased operational costs: Repairing weather-damaged infrastructure and rerouting shipments adds to operating expenses.

- Fleet availability reduction: Damaged or inaccessible railcars due to extreme weather limit GATX's service capacity.

- Supply chain disruptions: Extreme weather events can halt the movement of goods, impacting GATX's customers and revenue streams.

- Need for infrastructure investment: GATX must consider climate-resilient infrastructure upgrades to safeguard its assets and operations.

The global push for decarbonization is a major environmental factor impacting GATX, driving demand for greener logistics solutions. Rail's inherent efficiency advantage over trucking, with U.S. freight railroads emitting 46% less greenhouse gas per ton-mile than trucking in 2022, positions GATX favorably. However, scrutiny over fleet emissions and supply chain sustainability requires proactive engagement.

Resource scarcity and the environmental impact of raw material extraction are influencing manufacturing. GATX must consider sustainable materials in railcar production and maintenance, potentially increasing costs but aligning with circular economy principles. Effective waste management, including hazardous materials handling and scrap metal recycling, is crucial for regulatory compliance and reducing environmental footprint.

Extreme weather events, a consequence of climate change, pose significant operational risks for GATX, causing infrastructure damage and service disruptions. Adapting to these challenges through infrastructure resilience and preparedness is essential to mitigate economic impacts, which cost the global economy billions annually.

| Environmental Factor | Impact on GATX | Supporting Data/Trend |

|---|---|---|

| Decarbonization & Sustainability | Increased demand for eco-friendly leasing; pressure to reduce fleet emissions. | Rail emits 46% less GHG per ton-mile than trucking (AAR, 2022). Global green bond issuance reached $270 billion in Q1 2024 (Climate Bonds Initiative). |

| Resource Scarcity & Circular Economy | Need for sustainable materials in railcar production; focus on waste reduction. | Global steel recycling market projected over $250 billion in 2024. U.S. EPA reported 75% of municipal solid waste landfilled in 2023. |

| Climate Change & Extreme Weather | Operational disruptions, infrastructure damage, increased costs. | Weather-related disruptions cost global economy billions annually. Severe flooding in North America (2024) caused significant rail delays. |

PESTLE Analysis Data Sources

Our GATX PESTLE Analysis is meticulously constructed using data from reputable financial news outlets, industry-specific publications, and official company filings. We ensure every insight into political, economic, social, technological, legal, and environmental factors is grounded in factual reporting and verifiable information.