GATX Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GATX Bundle

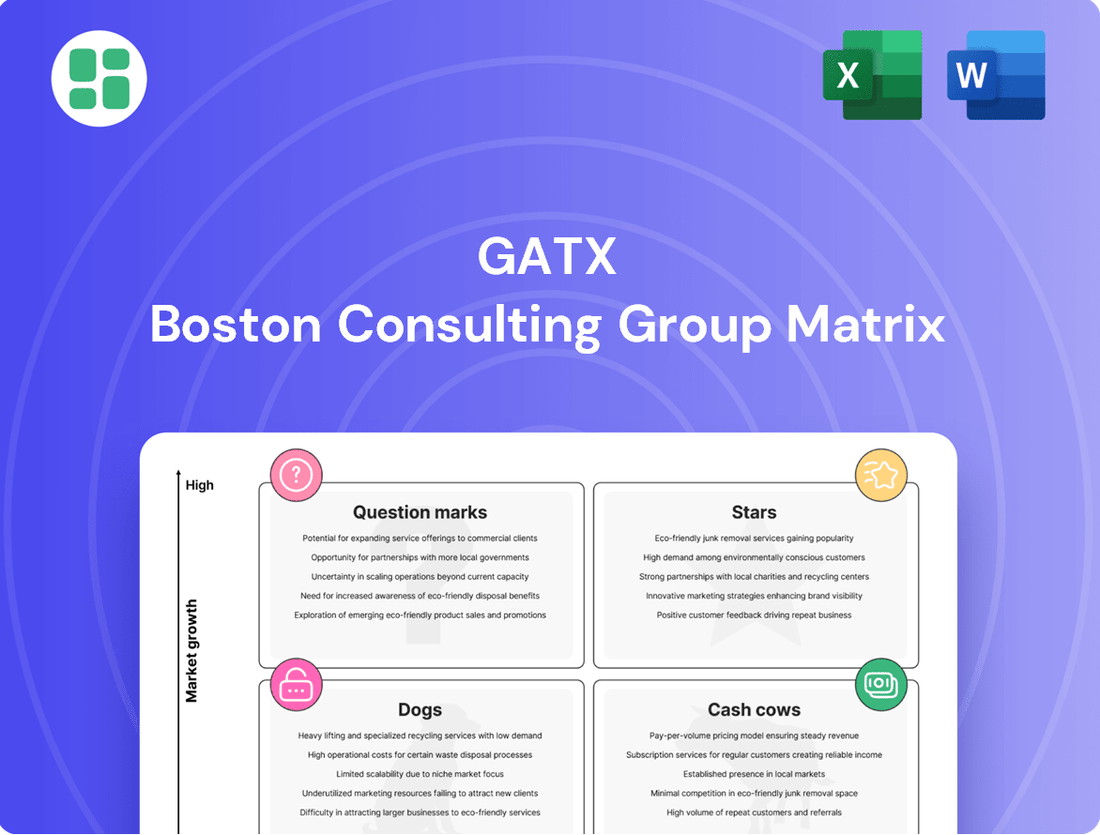

Unlock the strategic potential of GATX's diverse portfolio with a clear understanding of its BCG Matrix. See which segments are driving growth and which require careful consideration. Purchase the full report for a comprehensive breakdown of GATX's Stars, Cash Cows, Dogs, and Question Marks, empowering you with actionable insights for optimal resource allocation and future investment decisions.

Stars

GATX's Engine Leasing segment, notably its joint venture with Rolls-Royce, experienced impressive profit expansion through 2024 and into 2025. This growth is directly linked to a strong global appetite for aircraft spare engines, a critical component for maintaining flight schedules. The company's strategic investments have bolstered this portfolio, evidenced by the addition of new engines and a corresponding increase in net book value, reflecting a commitment to this burgeoning sector.

This strategic diversification into aerospace leasing is a key element in GATX's long-term growth strategy. By expanding its presence in this market, GATX effectively mitigates its exposure to the cyclical nature of the rail industry. For instance, in 2024, the engine leasing segment contributed significantly to overall company performance, providing a stable revenue stream that complements its core railcar leasing business.

GATX Rail India stands out as a Star in the GATX BCG Matrix, evidenced by its consistent 100% fleet utilization. This metric underscores its significant market dominance and operational prowess within the Indian railcar leasing sector.

As the leading private railcar lessor in India, GATX is strategically positioned in a burgeoning market. The company has ambitious plans to augment its fleet by 800 to 1,000 wagons each year for the next five years, signaling a strong growth trajectory.

GATX's acquisition of Wells Fargo Rail assets, including 105,000 railcars, positions it as a dominant player in the North American market. This substantial fleet expansion, managed by GATX, significantly bolsters its leasing capabilities and market share.

This strategic move is projected to be accretive to GATX's earnings, signaling a strong future growth trajectory. The deal solidifies GATX's leadership in the railcar leasing industry, demonstrating a clear Stars position within the BCG Matrix.

New Energy Solutions and Advanced Railcar Superstructures in Europe

GATX Rail Europe is strategically investing in new energy solutions and advanced railcar superstructures, recognizing these as key growth drivers in the European rail market. This initiative reflects a proactive approach to capitalize on evolving industry demands and technological advancements.

These investments are focused on high-growth segments, aiming to enhance GATX's competitive position by offering innovative solutions for future transportation needs. By embracing these new areas, GATX is positioning itself to meet the shifting requirements of the European logistics landscape.

- New Energy Solutions: GATX is exploring opportunities in transporting alternative fuels like hydrogen and biofuels, a sector projected for significant growth.

- Advanced Superstructures: Development includes specialized railcars for high-value or sensitive cargo, improving efficiency and safety.

- Market Alignment: These efforts align with the EU's Green Deal objectives, promoting sustainable freight transport solutions.

- Investment Focus: Capital expenditure in 2024 is earmarked for research, development, and pilot projects in these advanced railcar technologies.

Telematics and Digital Innovation Leadership

Telematics and Digital Innovation Leadership represents a significant strategic direction for GATX, placing them as a key player in the modernization of the railcar industry. Their involvement in RailPulse, a consortium focused on deploying GPS and telematics across North America's railcar fleet, underscores this commitment. This proactive stance in digital innovation is designed to boost operational effectiveness and elevate customer experiences.

GATX's leadership in telematics is pivotal for the industry's digital transformation. By being a core member of RailPulse, GATX is actively shaping the future of railcar tracking and data utilization. This initiative is expected to yield substantial improvements in asset visibility and predictive maintenance, crucial for optimizing fleet performance and reducing downtime.

- RailPulse Membership: GATX is a founding member of RailPulse, a collaborative effort to equip North American railcars with advanced telematics.

- Digital Transformation Driver: This initiative positions GATX as a leader in adopting digital solutions to enhance railcar management and customer service.

- Operational Efficiency Gains: The deployment of telematics technology is projected to improve asset utilization and reduce operational costs through better data insights.

- Customer Value Enhancement: Enhanced visibility and data-driven services offered through telematics are expected to provide greater value to GATX's customers.

GATX Rail India is a prime example of a Star within the GATX BCG Matrix, boasting a perfect 100% fleet utilization. This high operational efficiency highlights its strong market position and dominance in the Indian railcar leasing sector.

The company's strategic expansion plans, including adding 800 to 1,000 wagons annually for the next five years, further solidify its Star status. This growth is fueled by India's burgeoning demand for efficient logistics solutions.

GATX's acquisition of Wells Fargo Rail assets, encompassing 105,000 railcars, has cemented its leadership in North America. This move is anticipated to be earnings-accretive, reinforcing its position as a Star.

GATX Rail Europe's focus on new energy solutions and advanced superstructures also positions it as a Star. Investments in transporting alternative fuels and specialized cargo align with future market demands.

| Segment | BCG Category | Key Performance Indicator | 2024/2025 Outlook |

| GATX Rail India | Star | 100% Fleet Utilization | Continued strong demand, fleet expansion |

| North American Railcar Fleet (Post-Acquisition) | Star | Market Dominance, Earnings Accretive | Solidified leadership, growth potential |

| GATX Engine Leasing | Star | Profit Expansion, Strong Global Appetite | Continued investment in spare engines |

| GATX Rail Europe (New Energy/Advanced Superstructures) | Star | Strategic Investment in Growth Areas | Alignment with EU Green Deal, technological advancement |

What is included in the product

The GATX BCG Matrix analyzes GATX's business units by market share and growth rate.

It guides strategic decisions on investing, holding, or divesting units.

The GATX BCG Matrix provides a clear, visual framework to identify and address underperforming business units, alleviating the pain of resource misallocation.

Cash Cows

GATX's Rail North America segment, boasting a wholly owned fleet of roughly 111,400 railcars, consistently operates at near-maximum utilization, often exceeding 99%. This robust performance underscores its status as a mature business with a dominant market position.

This segment is a significant cash generator for GATX, driven by stable lease revenues and high success rates in lease renewals. The consistent demand and GATX's strong hold in this segment solidify its role as a core cash cow.

GATX Rail Europe, with its extensive fleet of over 30,000 railcars and a robust utilization rate of 96.1% as of December 2024, exemplifies a classic Cash Cow within the BCG Matrix. This established operation benefits from a mature European market, providing a steady stream of predictable revenue.

As a leading full-service lessor, GATX Rail Europe commands a strong market position, allowing it to generate consistent cash flow with minimal need for aggressive marketing or significant capital reinvestment for growth. This translates into stable, reliable returns for the company.

GATX's strategic remarketing of railcars in the secondary market is a key component of its financial strength, generating consistent asset remarketing income. This practice highlights the enduring value of its diverse railcar fleet and provides a reliable, non-lease revenue stream. For instance, in 2023, GATX reported significant gains from asset sales, underscoring the robustness of the secondary market for its well-maintained assets.

Long-Term Lease Renewals and Stable Cash Flow

GATX's strategy of extending lease renewal terms, with an average term of approximately 60 months, is a key indicator of its cash cow status. This approach locks in predictable, high-quality cash flow from its existing, in-demand assets, emphasizing stability and consistent profitability.

- Secured Revenue: The company's focus on long-term lease renewals ensures a steady stream of income, minimizing revenue volatility.

- Asset Utilization: High demand for GATX's assets allows for attractive renewal rates, further bolstering cash flow.

- Financial Stability: This strategy directly contributes to GATX's financial resilience, a hallmark of a mature cash cow business.

- Profitability Focus: By prioritizing the retention and profitable extension of leases for established assets, GATX maximizes returns from its core operations.

Diversified Portfolio of Traditional Railcar Types

GATX's extensive collection of tank and freight railcars, deployed across sectors such as petroleum, chemicals, and agriculture, forms the bedrock of its earnings. These traditional railcar models serve well-established markets, ensuring a steady stream of income and robust profitability, a testament to GATX's dominant market position and streamlined operations.

In 2023, GATX reported total revenues of $1.51 billion, with its Rail North America segment, a significant contributor to its traditional railcar business, generating $1.15 billion. This segment benefits from high utilization rates, often exceeding 97% for its diverse fleet, underscoring the consistent demand for these essential assets.

- Stable Revenue Generation: The leasing of traditional tank and freight railcars to diverse industries provides a predictable and consistent revenue stream for GATX.

- Mature Market Dominance: Operating in mature markets allows GATX to leverage its established infrastructure and expertise, leading to high fleet utilization and profitability.

- Operational Efficiency: GATX's focus on operational efficiency in managing its large railcar fleet contributes to its ability to maintain high profit margins.

- Key Financial Indicator: In 2023, GATX's Rail North America segment reported segment operating profit of $748.5 million, highlighting the strong financial performance of its traditional railcar business.

GATX's core railcar leasing operations, particularly in North America and Europe, function as classic Cash Cows. These segments benefit from high asset utilization, often exceeding 99% in North America and 96.1% in Europe as of December 2024, generating stable and predictable lease revenues. The company's strategy of securing long-term lease renewals, averaging around 60 months, further solidifies this cash cow status by ensuring consistent income streams from its mature, in-demand fleet.

The strong market positions in both regions allow GATX to generate substantial cash flow with minimal need for aggressive reinvestment, a hallmark of a mature business. For instance, the Rail North America segment alone generated $1.15 billion in revenue in 2023, with a segment operating profit of $748.5 million, showcasing its significant contribution to GATX's overall financial health.

| Segment | Fleet Size (approx.) | Utilization (Dec 2024) | 2023 Revenue (approx.) | 2023 Operating Profit (approx.) |

| Rail North America | 111,400 railcars | >99% | $1.15 billion | $748.5 million |

| Rail Europe | 30,000+ railcars | 96.1% | N/A | N/A |

What You See Is What You Get

GATX BCG Matrix

The preview you are currently viewing is the definitive GATX BCG Matrix document that you will receive immediately after completing your purchase. This means the analysis, formatting, and strategic insights are identical to the final deliverable, ensuring no surprises and immediate usability. You'll get the complete, unwatermarked report, ready for integration into your strategic planning processes or presentations. This is the exact, professionally prepared GATX BCG Matrix that will empower your decision-making from the moment of acquisition.

Dogs

GATX's legacy boxcar fleet, comprising around 8,400 units in North America, may be considered a "dog" in the BCG matrix. While GATX boasts high overall fleet utilization, these boxcars are often excluded from core performance metrics, suggesting a segment with less strategic importance or growth potential.

The boxcar segment might be characterized by low market share and low growth, especially if demand for these specific assets is declining or if they demand disproportionate maintenance costs relative to their returns. This positions them as a potential cash drain rather than a growth driver within GATX's diversified railcar portfolio.

Older railcars slated for scrapping represent GATX's Dogs in the BCG matrix. The company typically retires between 2,500 to 3,000 railcars annually, indicating these assets have reached the end of their economically viable lifespan.

These older units often contribute little to no cash flow and may even incur costs for their disposal, making them prime candidates for divestiture rather than further capital allocation.

Within GATX's expansive railcar fleet, certain niche segments or older car types might face reduced demand due to evolving market needs or lower versatility. These underperforming assets, though not specifically quantified in recent public disclosures, would naturally exhibit a smaller market share and slower growth compared to the company's more robust core offerings.

Segments Affected by Prolonged Regional Economic Slowdowns

While GATX Rail Europe typically demonstrates strong performance, prolonged regional economic downturns, like the one experienced in Germany, can negatively impact fleet utilization in those specific areas. For instance, if a major industrial hub within Europe faces a significant contraction, the demand for railcars serving that region would naturally decrease.

Should these regional slowdowns persist or intensify, certain segments of the European fleet might experience a period of low growth coupled with a shrinking market share. This scenario could potentially relegate these operations to the 'cash trap' category within the BCG matrix if not managed proactively.

- Impact on Fleet Utilization: A slowdown in key industrial regions can directly reduce the number of railcars actively in service, lowering overall fleet utilization rates.

- Market Share Erosion: Prolonged economic weakness in specific European countries can lead to competitors with more localized operations gaining an advantage, thereby reducing GATX's market share in those affected segments.

- Potential for Cash Traps: If low growth and declining market share are sustained, the capital invested in these underperforming regional fleets might not generate sufficient returns, turning them into cash traps.

High-Maintenance, Low-Return Assets

Within GATX's diverse fleet, certain older railcars, often acquired opportunistically, can present a challenge. These assets, while part of the overall strong fleet management, may demand significantly higher maintenance expenditures than the revenue they generate through leases. In 2024, for instance, GATX reported that while its overall fleet utilization remained robust, a portion of its older, specialized railcars required more intensive upkeep, impacting their net profitability.

These specific railcars, if they consistently fail to contribute positively to the company's bottom line or prove difficult to lease out effectively, can be categorized as 'dogs' in the BCG matrix framework. Such assets effectively tie up valuable capital that could be deployed into more productive or higher-growth areas of the business, hindering overall return on investment.

- High Maintenance Costs: Some older railcars in GATX's fleet incurred maintenance costs that exceeded their lease revenue in 2024.

- Opportunistic Acquisitions: These underperforming assets often stem from previous opportunistic fleet purchases, which may not have fully factored in long-term maintenance needs.

- Capital Tie-Up: If these railcars cannot be efficiently remarketed or do not contribute to profitability, they represent capital that is not generating adequate returns.

- Strategic Re-evaluation: GATX continuously evaluates its fleet to identify and manage such 'dog' assets, potentially through refurbishment, sale, or repurposing to optimize capital allocation.

Older railcars slated for retirement or those with consistently low lease rates and high maintenance costs represent GATX's 'dogs' in the BCG matrix. These assets, often acquired opportunistically, can drain resources without generating significant returns. For example, in 2024, GATX identified certain specialized railcars requiring intensive upkeep that impacted their net profitability.

These 'dog' assets can tie up capital that could be better utilized in higher-growth segments of the business. GATX's strategy involves continuously evaluating its fleet to manage or divest these underperforming units, aiming to optimize capital allocation and improve overall fleet performance.

The company's proactive approach to fleet management, including the retirement of approximately 2,500 to 3,000 railcars annually, reflects an effort to shed these low-performing assets. Such units often incur disposal costs rather than contributing to cash flow.

While GATX's overall fleet utilization remains strong, the presence of these 'dogs' can dilute profitability in specific segments. Identifying and addressing these assets is crucial for maintaining a lean and efficient operational structure.

| Asset Type | BCG Category | Key Characteristics | 2024 Observation |

|---|---|---|---|

| Older Boxcars | Dog | Low market share, low growth, potentially high maintenance | May be excluded from core performance metrics |

| Older Specialized Railcars | Dog | High maintenance costs relative to lease revenue | Impacted net profitability due to intensive upkeep |

| Railcars nearing end-of-life | Dog | Minimal cash flow, potential disposal costs | Annual retirement of 2,500-3,000 units |

Question Marks

GATX Rail Europe is actively expanding its fleet with specialized railcars designed for emerging applications. Recent additions include Laaers automobile carriers, advanced tank railcars, and various types of E-railcars, reflecting a strategic investment in new market segments.

These new railcar types are engineered to meet evolving customer demands, such as efficient transport of automobiles and specialized liquid or gas products. While they represent significant growth opportunities, these newer models are still in the process of establishing a substantial market presence within GATX's extensive European railcar fleet.

For example, GATX's 2024 fleet in Europe includes a growing number of these specialized cars, though they currently represent a smaller percentage of the total fleet compared to more established types. Continued investment in marketing and operational support will be crucial for these emerging railcar categories to achieve their full market potential and contribute significantly to GATX's overall performance.

GATX significantly expanded its portfolio by acquiring Trifleet Holdings, adding 18,000 tank containers. This strategic move diversifies GATX into the tank container leasing market, catering to specialized sectors such as gas, cryogenics, and food industries.

While GATX has aspirations to become a leader in this segment, it's a relatively new area for the company. The tank container market shows high growth potential, but GATX's current market share in this niche is lower compared to its established and dominant railcar leasing business.

GATX's strategic investments in sustainable and eco-friendly rail solutions position these ventures as potential Stars within the BCG Matrix. The company's commitment to expanding its transportation portfolio with new energy solutions directly addresses the growing demand for decarbonization in the logistics sector.

These initiatives are fueled by increasing environmental regulations and corporate sustainability targets, creating a high-growth market where GATX is actively seeking to establish a strong presence. For instance, the global rail freight market, a key area for GATX, was valued at approximately $750 billion in 2023 and is projected to grow, with a significant portion of this growth expected from greener transportation alternatives.

Expansion into Specific Challenged but Growing Intermodal Sectors

GATX Rail Europe sees significant potential in specific intermodal sectors, even amidst broader industry challenges. This strategic focus indicates a commitment to navigating current obstacles to capture future growth opportunities and expand market share.

The intermodal sector, while facing issues like capacity constraints and infrastructure bottlenecks, is projected for robust growth. For instance, in 2024, the European intermodal freight market is expected to see a compound annual growth rate (CAGR) of approximately 4.5%, reaching an estimated value of over €100 billion by 2029. GATX's investment in this area reflects an understanding of these dynamics.

- Growth Potential: Intermodal transport offers environmental benefits and cost efficiencies, driving demand.

- Challenges: GATX navigates issues such as terminal congestion and the need for specialized rolling stock.

- Strategic Focus: Expansion efforts are concentrated on segments with high growth forecasts despite these hurdles.

- Market Share Ambition: GATX aims to solidify its position by overcoming current operational difficulties in these key intermodal areas.

Continued Development and Adoption of Telematics and IoT Solutions

GATX is actively developing and promoting telematics and IoT solutions, exemplified by its RailPulse initiative. While GATX is a frontrunner in encouraging telematics adoption, the complete public rollout and broad integration of these advanced technologies across its railcar fleet are still in progress. This area represents a significant growth opportunity driven by technological advancements, with GATX making substantial investments. However, the company's ultimate market share in offering or utilizing these specific digital services remains an area of ongoing development and future potential.

The rail industry is increasingly recognizing the value of telematics for asset management and operational efficiency. For instance, in 2024, the global railway telematics market was projected to reach approximately $2.5 billion, with a compound annual growth rate expected to exceed 8% through 2030, indicating a strong trend toward digital integration. GATX's commitment through RailPulse positions it to capitalize on this expanding market.

- Technological Frontier: GATX's investment in telematics and IoT solutions places it at the forefront of technological innovation within the railcar leasing sector.

- Market Penetration: The full extent of GATX's market share in providing or leveraging these digital services is still being established as adoption rates grow.

- Growth Potential: The increasing demand for real-time data and predictive maintenance in rail operations signifies a high-growth avenue for GATX's telematics offerings.

- Strategic Investment: GATX's proactive approach with initiatives like RailPulse demonstrates a strategic focus on future-proofing its fleet and service offerings.

Question Marks represent new ventures with high growth potential but low market share, requiring significant investment to determine their future viability. GATX's expansion into specialized railcars for emerging applications and the tank container leasing market exemplifies this category. These areas offer promising growth but are still establishing their presence within GATX's broader portfolio.

GATX's investment in telematics and IoT solutions, such as RailPulse, also falls into the Question Mark quadrant. While the technology itself is in a high-growth market, GATX's penetration and market share in offering these specific digital services are still developing. Continued investment and strategic focus are crucial to convert these into Stars or Dogs.

The company's strategic positioning in intermodal sectors, despite current industry challenges, also aligns with the Question Mark characteristics. The intermodal market shows strong growth projections, but GATX's market share in these specific segments is still being solidified, making their long-term success a subject of ongoing strategic development and investment.

| Business Unit/Initiative | Market Growth Rate | Relative Market Share | BCG Quadrant | Strategic Implication |

|---|---|---|---|---|

| Specialized Railcars (e.g., Laaers) | High | Low | Question Mark | Monitor and invest to gain share or divest if potential is not realized. |

| Tank Container Leasing (Trifleet) | High | Low | Question Mark | Requires significant investment to build market position. |

| Telematics/IoT (RailPulse) | High | Low | Question Mark | Invest to develop technology and capture market share in a growing digital services sector. |

| Intermodal Sectors | High | Low | Question Mark | Strategic focus needed to overcome operational hurdles and capture growth. |

BCG Matrix Data Sources

Our GATX BCG Matrix is built on comprehensive market data, integrating financial disclosures, industry growth rates, and competitor analysis to provide strategic insights.