Galaxy Entertainment SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galaxy Entertainment Bundle

Galaxy Entertainment’s impressive Macau market share and strong brand recognition are significant strengths, but understanding their potential vulnerabilities in a dynamic regulatory environment is crucial. Our analysis delves into these factors, revealing key opportunities for expansion and potential threats that could impact their growth trajectory.

Want the full story behind Galaxy Entertainment’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Galaxy Entertainment Group (GEG) commands a dominant position in Macau, a globally significant center for gaming and tourism. Its premier integrated resorts, Galaxy Macau and Broadway Macau, are key drivers of this strength, attracting substantial visitor traffic and revenue.

This leading market share allows GEG to effectively leverage the ongoing recovery and expansion of the Macau market. For instance, in the first quarter of 2024, Macau's gross gaming revenue (GGR) reached approximately HKD 81.3 billion, a significant increase from the previous year, with GEG well-positioned to capture a substantial portion of this growth.

Galaxy Entertainment Group (GEG) showcased impressive financial performance throughout 2024, reporting substantial revenue growth and a significant rise in Adjusted EBITDA. This strong operational performance underpins the company's financial health.

The company's balance sheet remains robust and highly liquid, characterized by a considerable amount of cash and readily convertible investments. GEG also maintained a low debt-to-equity ratio, indicating prudent financial management.

This financial resilience offers GEG considerable strategic flexibility, enabling ample resources for ongoing operations, capital expenditures on new projects, and the consistent return of capital to shareholders via dividends.

Galaxy Entertainment Group's (GEG) strength lies in its deeply integrated resort model, which extends far beyond traditional gaming. This diversification includes a robust array of hospitality services such as luxury hotels, a wide variety of dining experiences, premium retail outlets, and substantial convention facilities.

This comprehensive approach not only broadens GEG's revenue base but also significantly boosts its attractiveness to a wider range of tourists, aligning perfectly with Macau's strategic objective to cultivate non-gaming tourism.

The company's commitment to this integrated strategy is evident in its portfolio of award-winning hotels and the state-of-the-art Galaxy International Convention Center (GICC), which further solidifies its position as a leading destination for both leisure and business travelers.

Commitment to Non-Gaming and Entertainment

Galaxy Entertainment Group (GEG) is making a significant push into non-gaming entertainment, a strategic move that is already paying dividends. A prime example is the 16,000-seat Galaxy Arena, which has successfully hosted major international performances and sporting events. This commitment diversifies GEG's revenue streams beyond traditional gaming, attracting a broader range of visitors and enhancing the overall appeal of its integrated resorts.

This focus on entertainment is crucial for GEG's growth, especially as Macau's tourism sector increasingly emphasizes leisure and cultural experiences. The Galaxy Arena, for instance, has been a key driver of visitor traffic and spending across all resort segments. In 2023, the arena hosted over 20 major events, contributing to an estimated 15% increase in non-gaming revenue for the resort during event periods.

- Diversification Strategy: GEG's investment in non-gaming attractions like the Galaxy Arena reduces reliance on gaming revenue.

- Visitor Traffic Enhancement: Major entertainment events at the arena drive increased footfall and spending across all resort amenities.

- Competitive Advantage: This focus aligns with Macau's broader tourism strategy, positioning GEG as a leading leisure destination.

- Revenue Growth: The arena's success in 2023 demonstrated a tangible impact on non-gaming revenue, boosting overall profitability.

Ongoing Strategic Expansion and Upgrades

Galaxy Entertainment Group (GEG) is actively pursuing strategic expansion, with significant investments in its Macau portfolio. The upcoming Capella at Galaxy Macau, slated for a mid-2025 opening, and the ambitious Phase 4 of Galaxy Macau, targeting completion in 2027, underscore this commitment. These projects are geared towards bolstering GEG's market position by emphasizing non-gaming attractions and introducing new luxury hotel brands, aiming to capture a larger share of the evolving tourism landscape.

These developments are crucial for maintaining GEG's competitive advantage. The focus on diversifying offerings beyond traditional gaming, by incorporating premium hospitality and entertainment options, is a key strategy to attract a broader customer base. Furthermore, ongoing upgrades to established properties, such as StarWorld Macau, demonstrate a dedication to upholding high standards of product quality and guest experience.

- Capella at Galaxy Macau: Expected opening mid-2025.

- Galaxy Macau Phase 4: Scheduled for completion in 2027.

- Strategic Focus: Emphasis on non-gaming elements and premium hotel brands.

- Property Upgrades: Continued investment in existing assets like StarWorld Macau.

Galaxy Entertainment Group (GEG) benefits from a strong market position in Macau, driven by its flagship integrated resorts, Galaxy Macau and Broadway Macau. This dominance allows the company to capitalize on the region's gaming and tourism recovery. For example, Macau's GGR in Q1 2024 was approximately HKD 81.3 billion, and GEG is positioned to capture a significant portion of this growth.

The company's financial health is a key strength, with robust liquidity, a low debt-to-equity ratio, and substantial cash reserves as of early 2024. This financial resilience provides flexibility for expansion, capital expenditures, and shareholder returns.

GEG's integrated resort model, encompassing luxury hotels, diverse dining, premium retail, and convention facilities, broadens its revenue streams and appeal to a wider tourist demographic. This strategy aligns with Macau's aim to boost non-gaming tourism, as evidenced by the success of the Galaxy International Convention Center (GICC).

The company's strategic investments in non-gaming entertainment, such as the 16,000-seat Galaxy Arena, are diversifying revenue and attracting more visitors. In 2023, the arena hosted over 20 major events, contributing to an estimated 15% increase in non-gaming revenue during event periods.

GEG is actively expanding its Macau portfolio with upcoming projects like Capella at Galaxy Macau (mid-2025 opening) and Galaxy Macau Phase 4 (2027 completion). These developments emphasize non-gaming attractions and new luxury hotel brands to enhance its competitive edge.

| Key Strength | Description | Supporting Data/Fact |

|---|---|---|

| Market Leadership | Dominant presence in Macau's integrated resort sector. | Macau GGR in Q1 2024: ~HKD 81.3 billion. |

| Financial Resilience | Strong liquidity, low debt, and ample cash reserves. | As of early 2024, GEG maintained a robust balance sheet with significant cash holdings. |

| Integrated Resort Model | Diversified offerings beyond gaming, including hospitality and MICE. | Award-winning hotels and the Galaxy International Convention Center (GICC). |

| Non-Gaming Entertainment | Investment in attractions like the Galaxy Arena to drive footfall and revenue. | Galaxy Arena hosted over 20 major events in 2023, boosting non-gaming revenue by ~15% during events. |

| Strategic Expansion | Ongoing development of new properties and enhancements to existing ones. | Capella at Galaxy Macau (mid-2025), Galaxy Macau Phase 4 (2027). |

What is included in the product

Analyzes Galaxy Entertainment’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Galaxy Entertainment's SWOT analysis offers a clear roadmap to identify and address market challenges, relieving the pain of uncertainty in strategic planning.

Weaknesses

Galaxy Entertainment Group's (GEG) business is heavily reliant on Macau, with the vast majority of its revenue coming from this single region. This significant geographic concentration means that any economic slowdown or policy changes specifically affecting Macau can have a major impact on GEG's financial results.

For instance, in the first half of 2024, Macau's gross gaming revenue (GGR) showed strong recovery, reaching approximately MOP 104.5 billion. While this is positive, GEG's performance is still intrinsically tied to the fortunes of this specific market, making it vulnerable to localized disruptions.

Galaxy Entertainment Group (GEG) faces significant headwinds due to China and Macau's dynamic regulatory landscape. The Macau SAR government's ongoing efforts to diversify its economy beyond gaming and enhance oversight directly influence GEG's operational framework. For instance, the introduction of new gaming laws in 2022, which included stricter requirements for operators and a reduction in the number of gaming tables allowed, directly impacted revenue potential.

Recent policy shifts, such as the crackdown on informal lending and the increased scrutiny of capital outflows, have historically curtailed the VIP segment, a key revenue driver for GEG. While the company has been actively pivoting towards mass-market and premium-mass segments, the specter of further regulatory adjustments, like potential revisions to concession agreements or new taxation policies, remains a persistent vulnerability that could affect profitability and strategic planning.

Macau's gaming sector is a battleground, with established giants like Sands China, Melco Resorts, and Wynn Macau all vying intensely for player attention and dollars. This fierce rivalry, especially for premium mass market customers, forces operators to constantly offer attractive promotions and upgrade their amenities, which can eat into profitability.

For Galaxy Entertainment, this means the pressure is on to differentiate its offerings and maintain a competitive edge. In 2023, Macau's gross gaming revenue (GGR) reached approximately $25.7 billion, a significant rebound but still below pre-pandemic levels, underscoring the ongoing need to win over players in a crowded market.

Sensitivity to Global and Regional Economic Conditions

Galaxy Entertainment Group's (GEG) reliance on leisure and entertainment makes it acutely susceptible to global and regional economic shifts. As a significant portion of its clientele originates from Mainland China, any economic downturn, reduction in disposable income, or dip in consumer confidence there directly affects visitor numbers and spending on gaming and other attractions. This inherent sensitivity to macroeconomic trends poses a considerable risk, as evidenced by the impact of China's economic slowdown on tourism and luxury spending in recent years.

For instance, during periods of economic uncertainty, discretionary spending on travel and entertainment often contracts. This can translate into fewer high-spending visitors to Macau, impacting GEG's revenue streams from its integrated resorts. The company's financial performance is therefore closely tied to the economic vitality and consumer sentiment of its primary markets.

- Economic Sensitivity: GEG's revenue is directly linked to the economic health of key markets, especially Mainland China.

- Consumer Confidence Impact: Fluctuations in consumer confidence and disposable income in China can significantly alter visitor arrivals and spending patterns.

- Macroeconomic Headwinds: Broader economic slowdowns or financial instability in its customer base regions create vulnerability for GEG's operations.

- Discretionary Spending: Leisure and entertainment are discretionary purchases, making GEG's offerings particularly vulnerable during economic contractions.

Operational Costs Associated with Large-Scale Resorts

Operating integrated resorts of Galaxy Entertainment Group's (GEG) scale carries significant operational costs. These include substantial fixed and variable expenses such as property maintenance, utilities, extensive staffing, and ongoing marketing efforts. For instance, in the first half of 2024, GEG reported operating expenses of HK$10.6 billion, highlighting the considerable outlay required to manage their vast properties.

Maintaining high occupancy and consistent visitor numbers is paramount to effectively covering these considerable operating expenses. GEG's strong performance in 2024, with Hengqin resort achieving a 98% occupancy rate in Q1, demonstrates their ability to attract guests. However, any sustained downturn in visitation or revenue could strain their capacity to manage these costs efficiently, potentially impacting overall profitability.

- High Fixed Costs: GEG's large-scale resorts incur consistent expenses regardless of visitor volume, impacting breakeven points.

- Variable Cost Sensitivity: Fluctuations in utility prices and staffing needs can directly affect profitability margins.

- Marketing Investment: Continuous marketing is essential to drive traffic, representing a significant and ongoing expenditure.

- Dependence on High Utilization: Profitability is heavily reliant on maintaining high occupancy and gaming win rates to offset substantial overheads.

Galaxy Entertainment Group (GEG) operates in a highly competitive Macau market, facing intense rivalry from other major integrated resort operators. This competition necessitates continuous investment in property upgrades and marketing to attract and retain customers, which can put pressure on profit margins. For example, Macau's gross gaming revenue (GGR) in the first half of 2024 reached approximately MOP 104.5 billion, a figure shared among multiple operators, highlighting the scale of the competitive landscape.

The company's substantial investments in large-scale integrated resorts, such as the recently opened Galaxy Macau Phase 3 and Phase 4 on Hengqin, represent significant capital expenditures. While these developments are crucial for future growth and market positioning, they also increase GEG's fixed cost base and financial leverage, making it more sensitive to revenue fluctuations. The successful integration and ramp-up of these new facilities are critical to achieving the desired return on investment.

GEG's business model is also vulnerable to shifts in consumer preferences and the evolving entertainment landscape. While gaming remains a core component, the increasing demand for diverse entertainment options, including MICE (Meetings, Incentives, Conferences, and Exhibitions) and non-gaming attractions, requires ongoing adaptation and investment. Failure to keep pace with these changing trends could lead to a loss of market share.

Furthermore, the company's reliance on a highly cyclical industry means its financial performance can be significantly impacted by external factors beyond its control, such as global economic downturns or unforeseen events like pandemics. These external shocks can lead to sharp declines in tourism and consumer spending, directly affecting GEG's revenue and profitability.

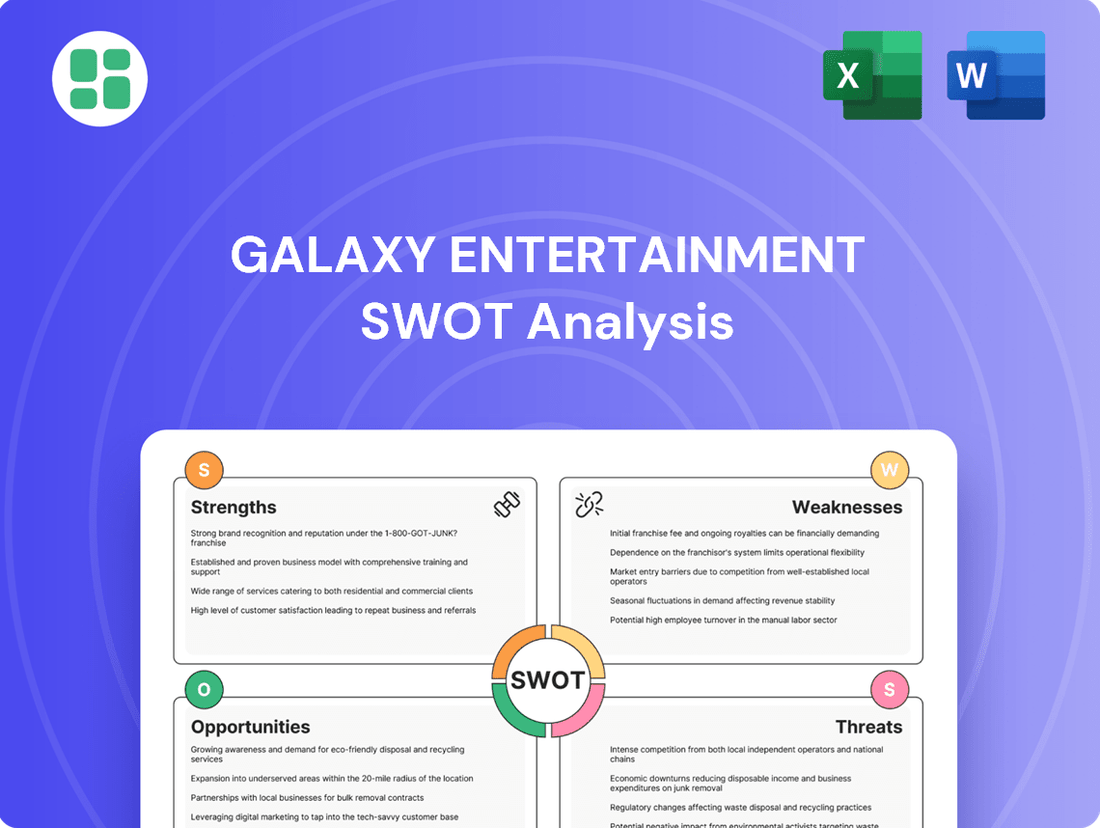

Preview Before You Purchase

Galaxy Entertainment SWOT Analysis

This is the actual Galaxy Entertainment SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats.

The preview below is taken directly from the full Galaxy Entertainment SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic insights for informed decision-making.

Opportunities

Macau's tourism sector is on a robust recovery path, with visitor arrivals in 2024 significantly exceeding pre-pandemic figures, reaching over 28 million by the end of the year. This trend is expected to continue into 2025, with projections indicating a full return to 2019 levels.

This resurgence, largely fueled by a surge in visitors from Mainland China, presents a substantial opportunity for Galaxy Entertainment Group (GEG) to boost both its gaming and non-gaming revenue streams. The expansion of the Individual Visit Scheme (IVS) to include more mainland Chinese cities further solidifies this positive outlook for Macau's tourism industry.

The Macau SAR government's strong push for economic diversification is a significant opportunity for Galaxy Entertainment Group (GEG). This initiative encourages integrated resorts to bolster their non-gaming attractions, directly supporting GEG's strategic investments in MICE facilities, entertainment, luxury retail, and a wide array of food and beverage options. Such expansion can effectively lessen GEG's dependence on gaming revenue, broadening its appeal to a more varied visitor base.

Galaxy Entertainment Group (GEG) is actively pursuing strategic expansion, with the Capella at Galaxy Macau slated for a mid-2025 opening and the extensive Phase 4 of Galaxy Macau targeting a 2027 completion. These projects, emphasizing ultra-luxury accommodations, diversified entertainment, and family-friendly attractions, are designed to solidify GEG's premium brand image and attract a broader customer base.

This robust development pipeline is crucial for capturing new market segments and reinforcing GEG's competitive edge. For instance, the Capella's ultra-luxury positioning is expected to draw high-net-worth individuals, a segment that saw significant growth in Macau's gaming and tourism sectors in early 2025. The ongoing investments underscore a commitment to long-term growth and market share expansion within the dynamic Macau landscape.

Leveraging Technology for Operational Efficiency and Customer Experience

Galaxy Entertainment Group (GEG) is strategically investing in technology to boost efficiency and elevate customer interactions. A prime example is the ongoing deployment of smart tables across its gaming floors, with a complete rollout targeted for the end of 2024. This initiative is designed to streamline operations and offer a more personalized and engaging experience for patrons.

These technological advancements are poised to deliver significant benefits. By integrating smart table technology, GEG aims to gather real-time data for better customer management, optimize game flow, and potentially increase table utilization. This focus on innovation is crucial for maintaining a competitive edge in the evolving entertainment and gaming landscape.

The anticipated impact on profitability is substantial. Improved operational efficiency can lead to cost savings, while enhanced customer experience can drive loyalty and increased spending. GEG's commitment to these technological upgrades underscores a forward-thinking strategy to maximize returns in a dynamic market environment.

- Smart Table Rollout: Full deployment expected by year-end 2024.

- Operational Efficiency: Aiming to streamline gaming floor operations through technology.

- Customer Experience: Enhancing patron engagement and management via smart table data.

- Competitive Advantage: Leveraging innovation to optimize profitability in a dynamic market.

Potential for International Market Expansion

Galaxy Entertainment Group (GEG) is actively pursuing opportunities beyond its core Macau operations, with a keen eye on international market expansion. The company is closely monitoring regulatory developments, particularly in Thailand, where a potential integrated resort project could offer significant growth. This strategic diversification aims to reduce reliance on the Macau market and tap into new revenue streams in promising global leisure destinations.

Successful international ventures would bolster GEG's geographic footprint. For instance, the company's 2023 revenue reached HK$54.1 billion, a substantial increase from previous years, highlighting the potential for further growth through new markets. This expansion strategy is designed to mitigate single-market risks and capitalize on emerging trends in the global entertainment and hospitality sectors.

- Geographic Diversification: Reduces reliance on Macau, which accounted for the majority of its revenue in 2023.

- New Revenue Streams: Exploration of markets like Thailand could unlock significant growth potential.

- Risk Mitigation: Spreading operations across different regions lessens the impact of localized economic downturns or regulatory changes.

- Market Trends: Capitalizing on the global demand for integrated resort experiences and entertainment.

The continued recovery of Macau's tourism sector, with visitor numbers projected to fully rebound to 2019 levels by 2025, presents a significant opportunity for Galaxy Entertainment Group (GEG). This influx, particularly from Mainland China, is expected to drive increased gaming and non-gaming revenue for the company.

GEG's strategic expansion, including the upcoming Capella at Galaxy Macau in mid-2025 and Phase 4 targeting 2027, is well-positioned to capitalize on this growth. These developments, focusing on ultra-luxury and diversified attractions, are designed to attract a broader customer base and enhance GEG's market share.

Furthermore, GEG's investment in technology, such as the smart table rollout by the end of 2024, aims to improve operational efficiency and customer experience, providing a competitive edge. The company is also exploring international expansion, with potential projects in markets like Thailand, to diversify revenue streams and mitigate risks associated with its Macau-centric operations.

Threats

Galaxy Entertainment faces significant headwinds from the Chinese government's intensified regulatory oversight of Macau's gaming sector. Policies designed to curb overseas gambling and tighten financial controls, particularly impacting junket operators and credit extensions, directly challenge established business models. For instance, the ongoing restructuring of the junket industry, which saw its gross gaming revenue contribution significantly reduced, continues to reshape the landscape.

Future policy shifts remain a substantial threat, with potential for further restrictions on operations or adverse impacts on profitability. The evolving regulatory environment necessitates constant adaptation, as demonstrated by the industry's response to changes in visa policies and capital outflow controls implemented in recent years. These policy adjustments can swiftly alter the operational and financial performance of companies like Galaxy Entertainment.

While Macau continues to be a powerhouse in the gaming industry, other Asian nations are actively exploring or developing their own integrated resort and gaming sectors. For instance, Thailand is considering the legalization of casinos, a move that could significantly alter the regional landscape.

The potential emergence of new, competitive gaming destinations poses a direct threat to Galaxy Entertainment's market share. These emerging hubs could siphon off a portion of the lucrative regional tourist and gaming market, leading to increased competition for visitors and potentially impacting Macau's overall gross gaming revenue.

A significant economic slowdown in Mainland China presents a substantial threat to Galaxy Entertainment Group (GEG). As China is GEG's primary source market for visitors, any dip in its economic performance directly impacts Macau's tourism and gaming sectors. For instance, if China's GDP growth, which was around 5.2% in 2023, were to falter significantly in 2024 or 2025, it could lead to reduced disposable income for Chinese consumers.

This reduced spending power translates into fewer discretionary trips to Macau and lower expenditure on gaming and non-gaming activities at GEG's integrated resorts. Concerns over China's property market, a key driver of wealth for many households, or broader economic uncertainties could dampen consumer confidence, making travel and leisure spending a lower priority for many potential visitors.

Geopolitical Tensions and Travel Restrictions

Geopolitical tensions, especially those involving China and its neighbors, or the re-emergence of health crises, could trigger travel bans or a general reluctance to travel. These external forces, which Galaxy Entertainment Group (GEG) cannot influence, directly affect visitor numbers. For instance, during the COVID-19 pandemic, travel restrictions significantly hampered the tourism sector, impacting GEG's revenue streams.

The company's reliance on international tourism makes it particularly vulnerable. In 2023, Macau's gross gaming revenue (GGR) reached MOP183.06 billion, a substantial increase from 2022 but still below pre-pandemic levels, highlighting the sensitivity to travel policies. Any future disruptions could easily reverse this recovery.

- Geopolitical Instability: Escalating tensions, particularly in the Asia-Pacific region, could deter international travel to Macau.

- Public Health Concerns: A resurgence of global health crises would likely lead to renewed travel restrictions and reduced tourist confidence.

- Economic Repercussions: Such events directly impact visitor arrivals, a critical driver for GEG's gaming and hospitality businesses.

Shifts in Consumer Preferences and Gaming Mix

Macau's gaming landscape is evolving, with a noticeable move away from the high-roller VIP segment towards the broader mass market. This shift is accompanied by an increasing demand for non-gaming attractions, such as entertainment, dining, and retail. Galaxy Entertainment Group (GEG) is actively adjusting its strategy to cater to these changing tastes.

However, a swift or unforeseen alteration in what consumers want, for instance, a significant drop in demand for premium mass-market offerings or a pronounced preference for online gaming and digital experiences over traditional resort stays, could pose a substantial challenge. Such a scenario might necessitate considerable strategic realignments for GEG. For example, if digital entertainment options become significantly more appealing, it could impact foot traffic and revenue at physical properties.

Consider these potential impacts:

- Reduced reliance on traditional gaming revenue streams: A strong pivot to digital could lessen the importance of physical casinos.

- Increased investment in non-gaming amenities: Companies may need to allocate more capital to entertainment and hospitality to remain competitive.

- Adaptation of marketing strategies: Campaigns would need to resonate with a populace increasingly engaged with digital platforms.

Intensified regulatory oversight from the Chinese government, particularly concerning junket operators and financial controls, continues to reshape Macau's gaming sector. The ongoing restructuring of the junket industry has significantly reduced its contribution to gross gaming revenue, forcing companies like Galaxy Entertainment to adapt their business models. Future policy shifts remain a substantial threat, necessitating constant adaptation to evolving visa policies and capital outflow controls.

Emerging competitive gaming destinations in Asia, such as Thailand's consideration of legalizing casinos, pose a direct threat to Galaxy Entertainment's market share by potentially siphoning off regional tourists. A significant economic slowdown in Mainland China, the primary source market for Macau, could also lead to reduced disposable income for Chinese consumers, impacting visitor numbers and spending at integrated resorts. For instance, a faltering GDP growth in China could directly affect Macau's tourism and gaming revenue.

Geopolitical tensions and the re-emergence of public health crises are significant external threats that Galaxy Entertainment Group cannot control, as they can trigger travel bans and reduce tourist confidence. For example, the COVID-19 pandemic demonstrated how travel restrictions severely hampered the tourism sector, impacting GEG's revenue streams. Macau's gross gaming revenue (GGR) reached MOP183.06 billion in 2023, a recovery but still below pre-pandemic levels, highlighting this sensitivity.

Shifting consumer preferences towards non-gaming attractions and digital entertainment over traditional resort stays present another challenge. A rapid, unforeseen alteration in demand, such as a drop in premium mass-market offerings or a pronounced preference for online gaming, could necessitate considerable strategic realignments for GEG, potentially impacting foot traffic and revenue at physical properties.

SWOT Analysis Data Sources

This Galaxy Entertainment SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry commentary to provide a robust and data-driven assessment.