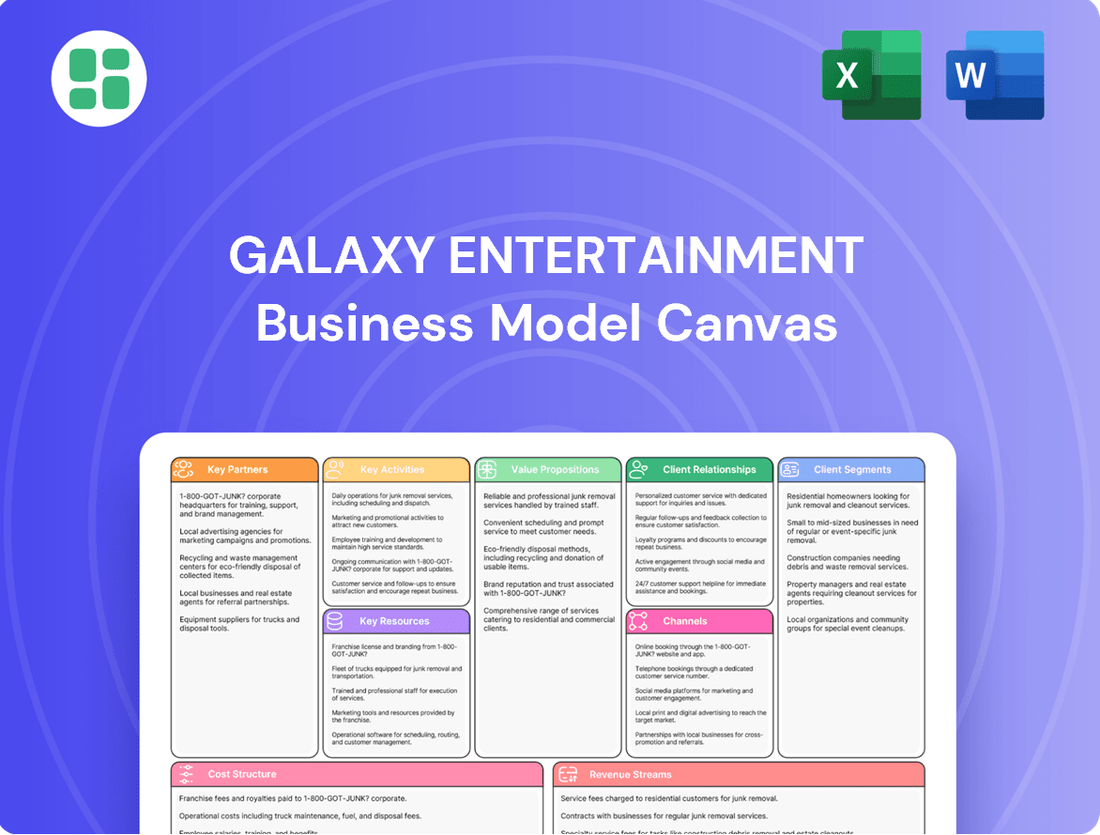

Galaxy Entertainment Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galaxy Entertainment Bundle

Unlock the strategic DNA of Galaxy Entertainment with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Perfect for anyone looking to understand how a leading entertainment giant operates and innovates.

Partnerships

Galaxy Entertainment Group strategically partners with premier luxury hotel brands, including Capella, Raffles, Andaz, Banyan Tree, JW Marriott, Hotel Okura, and The Ritz-Carlton. These alliances are crucial for diversifying accommodation choices within their integrated resorts, thereby boosting the perceived value and overall attractiveness of their properties.

This approach effectively draws in a wider spectrum of affluent travelers. The anticipated opening of Capella at Galaxy Macau in mid-2025 exemplifies this commitment, set to further enhance the company's ultra-luxury segment and cater to discerning guests seeking unparalleled experiences.

Galaxy Entertainment Group actively partners with leading international entertainment and sports promoters. These collaborations are crucial for filling the Galaxy Arena with world-class talent and events.

In 2024, Galaxy Entertainment continued to leverage these partnerships, bringing significant events like the UFC's return to Asia and the ITTF World Cup to Macau. These high-profile gatherings attract a global audience, driving substantial foot traffic and boosting the region's appeal as an entertainment destination.

These strategic alliances are instrumental in diversifying Galaxy Entertainment's revenue streams beyond traditional gaming. By hosting major concerts, sporting spectacles, and other live performances, the company enhances Macau's reputation as a comprehensive leisure and entertainment hub, attracting a broader demographic of visitors.

Galaxy Entertainment cultivates strategic alliances with a wide array of premium retail brands and sought-after food and beverage establishments across its integrated resorts. These partnerships are crucial for curating a rich lifestyle and entertainment ecosystem, offering guests an expansive selection of shopping and dining opportunities. For instance, in 2024, Galaxy Macau's retail portfolio features over 200 luxury and lifestyle brands, underscoring the breadth of these collaborations.

These carefully selected collaborations are designed to significantly bolster non-gaming revenue. By providing diverse and high-quality experiences, Galaxy Entertainment enhances the overall allure of its properties, attracting a broader customer base beyond traditional gaming patrons. In the first half of 2024, non-gaming revenue at Galaxy Macau accounted for approximately 25% of total revenue, a testament to the success of these retail and F&B partnerships.

Technology and Gaming Equipment Suppliers

Galaxy Entertainment Group actively cultivates key partnerships with prominent technology and gaming equipment suppliers. These alliances are fundamental to integrating cutting-edge gaming hardware, including smart tables, and streamlining overall operational processes. By securing these collaborations, Galaxy ensures its gaming floors feature the newest advancements, thereby elevating the customer experience and refining operational oversight.

A prime illustration of this strategy is the widespread deployment of smart tables across all of Galaxy's casinos throughout 2024. This initiative directly leverages these technology partnerships to enhance efficiency and customer engagement.

- Smart Table Integration: Partnerships with technology firms enable the implementation of advanced gaming equipment like smart tables, enhancing player experience and data collection.

- Operational Efficiency: Collaborations with equipment suppliers are critical for maintaining and upgrading gaming technology, ensuring smooth operations and reducing downtime.

- Innovation Showcase: These alliances allow Galaxy to consistently feature the latest innovations on its gaming floors, attracting and retaining customers.

Macau Government and Tourism Authorities

Galaxy Entertainment Group (GEG) maintains a crucial relationship with the Macau Government and its tourism authorities, notably the Macau Government Tourism Office (MGTO). This collaboration is fundamental to positioning Macau as a premier international tourist hub and ensuring GEG's operations align with regional development objectives.

GEG actively partners with the MGTO to drive international visitor numbers. For instance, GEG supported the expansion of the Individual Visit Scheme (IVS), a key government initiative aimed at boosting tourism. In 2023, Macau welcomed over 28 million visitors, a significant increase from 2022, reflecting the success of such collaborative efforts.

- Collaboration with MGTO: Essential for promoting Macau's international appeal and aligning with government tourism strategies.

- Individual Visit Scheme (IVS) Support: GEG actively backs government schemes to increase tourist arrivals, contributing to Macau's overall tourism growth.

- Regulatory Compliance: Partnerships ensure adherence to all government regulations, facilitating smooth operations.

- Tourism Ecosystem Contribution: GEG's engagement supports the broader development of Macau's tourism infrastructure and offerings.

Galaxy Entertainment Group's key partnerships extend to major airlines and transportation providers. These alliances are vital for facilitating convenient travel for international and domestic guests, directly impacting visitor volume to their integrated resorts.

In 2024, Galaxy continued to strengthen these relationships, aiming to increase direct flight accessibility and streamline travel arrangements for a global clientele. This focus is crucial for capturing a larger share of the lucrative international tourism market.

These collaborations are essential for enhancing the overall customer journey, from booking flights to arriving at the resort. By ensuring seamless transportation, Galaxy Entertainment Group reinforces Macau's position as an accessible and attractive global destination.

What is included in the product

Galaxy Entertainment's Business Model Canvas outlines its strategy for delivering integrated resort experiences, focusing on high-value customer segments through diverse entertainment and hospitality offerings.

It details key partnerships, revenue streams from gaming and non-gaming activities, and cost structures to support its premium brand positioning and expansion plans.

Galaxy Entertainment's Business Model Canvas acts as a pain point reliever by offering a clear, visual roadmap to identify and address operational inefficiencies.

It streamlines complex strategic thinking, enabling teams to pinpoint and resolve challenges in areas like customer acquisition and resource allocation.

Activities

Galaxy Entertainment Group's core activities revolve around the meticulous planning, construction, and day-to-day management of its expansive integrated resorts. This encompasses everything from routine property maintenance and necessary facility upgrades to ambitious strategic expansion initiatives.

Key projects like the ongoing Phase 4 development and the addition of Capella at Galaxy Macau underscore their commitment to staying at the forefront of the industry. These developments are crucial for maintaining a competitive edge and consistently elevating the guest experience.

In 2024, Galaxy Entertainment continued its focus on enhancing its resort offerings. For instance, the company was actively progressing with its Phase 3 and Phase 4 developments, which are designed to introduce new hotel offerings, gaming areas, and entertainment facilities, further solidifying its position in the Macau market.

Galaxy Entertainment Group's key activities revolve around the meticulous management of its diverse gaming operations. This includes overseeing VIP, premium mass, and mass-market gaming segments across its integrated resorts. The company ensures seamless operation of table games, slot machines, and electronic gaming, all while maintaining high standards of floor management, security, and customer service to optimize revenue generation.

In 2024, Galaxy Entertainment continued to focus on enhancing its gaming floor experience. For instance, the company reported that its Macau operations, a significant portion of its gaming revenue, saw continued recovery. The total gaming revenue for the first quarter of 2024 reached HKD 18.1 billion, demonstrating a strong rebound in customer activity and spending across all segments.

Galaxy Entertainment's key activities in hospitality and lifestyle service delivery are extensive, encompassing the operation of a vast portfolio of hotels, food and beverage (F&B) outlets, and retail spaces. This includes meticulous hotel management, aiming for high occupancy rates, and fostering culinary excellence across more than 120 F&B outlets.

The company also manages luxury retail partnerships, all designed to offer a holistic and premium guest experience. These diverse dining options and high occupancy are critical drivers for overall resort profitability, underscoring the significance of these service delivery functions.

Major Entertainment and MICE Event Hosting

Galaxy Entertainment Group actively engages in the organization and hosting of a diverse range of live entertainment, international sports competitions, and MICE events. These activities are primarily conducted at its state-of-the-art venues, including the Galaxy Arena and the Galaxy International Convention Center.

This strategic focus on event hosting serves a dual purpose: it significantly diversifies the company's revenue streams beyond traditional gaming and simultaneously attracts new visitor demographics. By curating a vibrant calendar of events, Galaxy Entertainment aims to solidify Macau's reputation as a premier global destination for entertainment and leisure.

In 2024 alone, Galaxy Entertainment Group successfully hosted approximately 460 shows and events, demonstrating a robust commitment to this key activity. This volume underscores the company's capacity to manage and deliver a high-frequency schedule of diverse programming.

- Event Portfolio: Hosting concerts, international sports, and MICE events.

- Venue Utilization: Leveraging Galaxy Arena and Galaxy International Convention Center.

- Strategic Impact: Diversifying revenue and attracting new visitor segments.

- Market Positioning: Reinforcing Macau as a world-class entertainment hub.

- 2024 Performance: Approximately 460 shows and events hosted.

Strategic Marketing and Global Promotion

Galaxy Entertainment Group’s strategic marketing and global promotion efforts are central to its business model. These activities focus on attracting diverse customer segments, from high-spending VIPs to the mass market, through targeted campaigns and robust loyalty programs. The company emphasizes direct marketing and digital engagement to foster strong customer relationships and encourage repeat business.

A significant part of this strategy involves promoting Macau itself as a premier international tourist destination. This global reach is supported by the establishment of overseas offices in key Asian markets such as Tokyo, Seoul, and Bangkok, aiming to broaden the appeal and accessibility of Galaxy’s offerings.

- Targeted Marketing Campaigns: Developing and executing tailored marketing initiatives to attract specific customer segments, including VIPs and the mass market, to its integrated resorts.

- Loyalty Programs: Managing comprehensive loyalty programs designed to reward and retain both VIP and mass-market players, fostering repeat visitation and increased spending.

- Digital and Direct Engagement: Utilizing digital channels and direct marketing strategies, alongside personalized services, to build and maintain strong customer relationships.

- Global Destination Promotion: Actively promoting Macau as an international tourist destination through overseas offices in Tokyo, Seoul, and Bangkok to attract a wider global clientele.

Galaxy Entertainment Group's key activities are centered on developing and managing integrated resorts, focusing on gaming operations across various market segments, and delivering exceptional hospitality and lifestyle services. They also actively engage in hosting diverse events and implementing strategic marketing initiatives to drive customer acquisition and retention.

In 2024, the company continued its expansion with Phase 3 and Phase 4 developments in Macau, aiming to enhance its property offerings and maintain a competitive edge. This strategic development is crucial for elevating the guest experience and securing market leadership.

The company's gaming operations in 2024 showed a strong recovery, with total gaming revenue in Macau reaching HKD 18.1 billion in the first quarter, reflecting increased customer activity. This performance highlights the success of their management of VIP, premium mass, and mass-market gaming segments.

Galaxy Entertainment's commitment to event hosting was evident in 2024, with approximately 460 shows and events organized, utilizing venues like the Galaxy Arena. This strategy diversifies revenue and reinforces Macau's status as a global entertainment hub.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Integrated Resort Development & Management | Planning, construction, and ongoing operation of resorts, including maintenance and expansion. | Progress on Phase 3 & 4 developments in Macau. |

| Gaming Operations | Overseeing VIP, premium mass, and mass-market gaming, including table games and slots. | Macau gaming revenue: HKD 18.1 billion (Q1 2024). |

| Hospitality & Lifestyle Services | Managing hotels, F&B outlets (over 120), and retail spaces for a premium guest experience. | Focus on high occupancy rates and culinary excellence. |

| Event Hosting | Organizing live entertainment, sports, and MICE events at venues like Galaxy Arena. | Approximately 460 shows and events hosted in 2024. |

| Marketing & Promotion | Targeted campaigns, loyalty programs, and digital engagement to attract diverse customer segments. | Global promotion via overseas offices in Tokyo, Seoul, and Bangkok. |

Delivered as Displayed

Business Model Canvas

The preview you're seeing is an exact representation of the Galaxy Entertainment Business Model Canvas you'll receive upon purchase. This isn't a sample; it's a direct snapshot of the actual, comprehensive document. You'll get the complete, ready-to-use file, structured and formatted precisely as displayed, ensuring no surprises and immediate usability.

Resources

Galaxy Entertainment Group's key resources are its integrated resort properties, which form the backbone of its operations. These include flagship properties like Galaxy Macau and StarWorld Macau, boasting vast gaming floors, premium hotel accommodations, and extensive retail offerings. In 2023, Galaxy Macau alone generated HK$27.8 billion in revenue, showcasing the significant economic contribution of these physical assets.

These substantial, high-value assets provide a significant competitive edge in Macau's dynamic market. The inclusion of convention centers and arenas further diversifies their utility, attracting a broader customer base beyond just gaming. Galaxy Entertainment's commitment to these properties is evident in ongoing investments, such as the Phase 4 development of Galaxy Macau, which is expected to further enhance its capacity and appeal.

Macau gaming concessions and licenses are Galaxy Entertainment Group's (GEG) most critical resources. These exclusive rights, granted by the Macau SAR Government, allow GEG to operate casinos and generate revenue from gaming activities. The current concessions are heavily regulated and are fundamental to GEG's core business.

GEG secured its operational continuity and market presence with the renewal of its gaming concession in December 2022, effective from January 1, 2023, through December 31, 2032. This ten-year term is vital for long-term strategic planning and investment in their Macau properties.

Galaxy Entertainment Group (GEG) relies on a substantial and highly skilled workforce, encompassing specialized roles in gaming operations, premium hospitality, event production, and sophisticated marketing. This human capital is the bedrock of their service delivery and operational excellence.

The quality of guest experience and the seamless execution of operations are directly attributable to the expertise and commitment of GEG's employees. For instance, in 2023, GEG continued its investment in training and development, aiming to uphold its distinctive 'World Class, Asian Heart' service philosophy.

Robust Financial Capital and Liquidity

Galaxy Entertainment Group (GEG) maintains robust financial capital and liquidity, which are crucial for its business model. These resources empower the company to fund ongoing property development and manage daily operational expenses effectively. Furthermore, substantial cash reserves facilitate the distribution of shareholder returns via dividends, reinforcing investor confidence.

A strong balance sheet is a cornerstone of GEG's strategy, offering the financial flexibility needed to pursue strategic expansion opportunities. This financial strength also allows the company to effectively navigate and absorb the impacts of market fluctuations. As of March 31, 2025, GEG reported holding HKD 33 billion in cash and liquid investments, a clear indicator of its sound financial health and readiness for future endeavors.

- Substantial Cash Reserves: GEG possesses significant cash and liquid investments, as evidenced by HKD 33 billion reported as of March 31, 2025.

- Funding for Development and Operations: These financial resources are vital for financing ongoing property development projects and covering operational expenditures.

- Shareholder Returns: The company utilizes its liquidity to provide shareholder returns through dividends, demonstrating financial stability.

- Strategic Flexibility: A strong balance sheet grants GEG the agility to pursue strategic growth initiatives and weather market volatility.

Strong Brand Reputation and Intellectual Property

Galaxy Entertainment Group's strong brand reputation is a cornerstone of its business model, built on the allure of its flagship properties like Galaxy Macau and Broadway Macau. These names are widely associated with luxury, exceptional quality, and a comprehensive entertainment experience, fostering significant customer loyalty and attracting a steady stream of new visitors.

The company's intellectual property, including its brand names and trademarks, is crucial. This is further amplified by its 'World Class, Asian Heart' service philosophy, which deeply resonates with customers and differentiates GEG in the competitive integrated resort market.

- Brand Recognition: Galaxy Macau and Broadway Macau are globally recognized symbols of luxury integrated resorts.

- Service Philosophy: The 'World Class, Asian Heart' ethos drives customer loyalty and service excellence.

- Intellectual Property: Brand names, trademarks, and proprietary service standards protect and enhance GEG's market position.

- Industry Recognition: GEG consistently receives awards and accolades for its superior integrated resort offerings.

Galaxy Entertainment Group's key resources extend beyond physical assets to include its exclusive gaming concessions and licenses, which are fundamental to its operations. The company's human capital, a highly skilled workforce dedicated to delivering exceptional service, is also a critical asset. Furthermore, robust financial capital and a strong brand reputation underpin its ability to invest, operate, and attract customers.

These resources are vital for maintaining market leadership and driving growth. The company's commitment to its integrated resorts, coupled with its skilled workforce and strong financial footing, positions it well for continued success in the competitive gaming and hospitality sector. The strategic renewal of its gaming concession through 2032 ensures operational stability and allows for long-term planning.

In 2023, Galaxy Entertainment Group reported total revenue of HK$51.1 billion, with its Macau operations being the primary driver. The company's financial health is further demonstrated by its substantial cash reserves, which provide the flexibility for ongoing development and shareholder returns.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Integrated Resorts | Flagship properties like Galaxy Macau and StarWorld Macau | Galaxy Macau revenue: HK$27.8 billion (2023) |

| Gaming Concessions | Exclusive rights to operate casinos in Macau | Concession renewed from Jan 1, 2023, to Dec 31, 2032 |

| Human Capital | Skilled workforce in gaming, hospitality, and operations | Continued investment in training and development for 'World Class, Asian Heart' service |

| Financial Capital | Cash reserves and liquidity for development and operations | HKD 33 billion in cash and liquid investments (as of March 31, 2025) |

| Brand Reputation | Strong association with luxury and quality entertainment | Global recognition of Galaxy Macau and Broadway Macau |

Value Propositions

Galaxy Entertainment offers a truly integrated luxury resort experience, combining world-class gaming with diverse hotel accommodations, fine dining, high-end retail, and live entertainment. This seamless fusion provides unparalleled convenience and a holistic leisure journey for every guest.

This comprehensive approach creates a compelling, all-encompassing destination that appeals to a broad spectrum of visitors. For instance, in 2024, Galaxy Macau's EBITDA reached HKD 12.5 billion, demonstrating the strong financial performance driven by these integrated offerings.

Galaxy Entertainment Group (GEG) excels in delivering exceptional hospitality and distinctive service, a core value proposition that sets it apart. Their approach is rooted in an 'Asian Heart' philosophy, ensuring high-quality, personalized interactions at every customer touchpoint, whether it's a hotel stay, a gaming experience, or dining. This dedication to service excellence cultivates memorable moments and builds enduring customer loyalty, a crucial differentiator in the competitive landscape.

This commitment is clearly reflected in GEG's operational performance. For instance, in the first half of 2024, their Macau operations achieved a remarkable average hotel occupancy rate of 93%, with certain periods reaching close to 100%. This consistently high occupancy underscores the strong appeal and effectiveness of their distinctive hospitality and service offerings.

Galaxy Entertainment Group offers a vibrant tapestry of non-gaming attractions, extending its appeal far beyond the casino floor. This includes hosting major concerts, attracting global sports tournaments, and boasting sophisticated MICE (Meetings, Incentives, Conferences, and Exhibitions) facilities. These diverse offerings are key to positioning Macau as a premier World Centre of Tourism and Leisure.

The company's strategic emphasis on live events is a significant driver of visitor engagement. In 2024 alone, Galaxy Entertainment hosted an impressive approximately 460 shows, a testament to its commitment to providing dynamic entertainment that draws substantial foot traffic to its properties.

Exclusive and High-Stakes Gaming Environment

Galaxy Entertainment Group (GEG) cultivates an exclusive and high-stakes gaming environment, meticulously designed for its VIP and premium mass clientele. This focus is evident in their sophisticated gaming facilities, including opulent private salons that offer a discreet and personalized experience for high rollers. These premium offerings are crucial, as the premium mass segment has proven to be a significant profit driver for the company.

GEG's commitment to this lucrative market is demonstrated through continuous enhancement of their high-stakes gaming options. In 2024, Macau's gaming revenue saw a substantial rebound, with GEG playing a key role. For instance, GEG reported a 28% increase in adjusted EBITDA for the first quarter of 2024 compared to the previous year, underscoring the success of their premium segment strategy.

- Catering to VIP and Premium Mass: Sophisticated gaming facilities, private salons, and personalized services are central to GEG's strategy.

- High-Stakes Gaming: The company actively provides high-stakes gaming options to meet the demands of discerning gamblers.

- Key Profit Driver: The premium mass segment is identified as a crucial contributor to GEG's profitability.

- Market Performance: GEG's adjusted EBITDA saw a significant increase in early 2024, reflecting the strength of their premium segment offerings.

Convenient and Accessible Premier Destination

Galaxy Entertainment Group (GEG) positions Macau as a premier, easily accessible travel hub, particularly for guests from Mainland China and across Asia. In 2024, Macau continued to see robust visitor numbers, with arrivals from Mainland China forming a significant portion, demonstrating the effectiveness of GEG's strategic location and promotional efforts.

GEG's properties are strategically situated to maximize convenience for its target markets. This accessibility is further amplified by the company's international outreach, including the establishment of overseas offices aimed at attracting a broader global audience. Such initiatives directly support the proposition of Macau as a readily available, top-tier destination.

- Strategic Location: GEG's integrated resorts are placed for optimal accessibility within Macau.

- International Outreach: Overseas offices are key to promoting Macau and GEG properties globally.

- Government Support: The expansion and continued support of the Individual Visit Scheme by the Central Government directly enhances visitor accessibility from Mainland China.

- Visitor Growth: Macau welcomed over 30 million visitors in the first three quarters of 2024, with a substantial percentage originating from Mainland China, underscoring the destination's accessibility.

Galaxy Entertainment Group offers a comprehensive, integrated resort experience, blending premium gaming with diverse hospitality, dining, retail, and entertainment options. This all-encompassing approach creates a seamless and convenient leisure journey for guests, positioning Macau as a leading global tourism hub.

The company's commitment to exceptional hospitality and personalized service, guided by its 'Asian Heart' philosophy, fosters strong customer loyalty. This is evidenced by consistently high occupancy rates, with Galaxy Macau achieving 93% in the first half of 2024, underscoring the appeal of their service-driven model.

GEG also diversifies its appeal through robust non-gaming attractions, including concerts, sports events, and MICE facilities, contributing to Macau's status as a World Centre of Tourism and Leisure. In 2024, the company hosted approximately 460 shows, significantly boosting visitor engagement.

Furthermore, GEG caters to a high-stakes gaming clientele with exclusive facilities and personalized experiences, a segment that significantly drives profitability. This strategic focus is reflected in their financial performance, with a 28% increase in adjusted EBITDA reported in Q1 2024.

| Value Proposition | Description | Supporting Data (2024) |

|---|---|---|

| Integrated Luxury Experience | Seamless fusion of gaming, hotels, dining, retail, and entertainment. | Galaxy Macau EBITDA: HKD 12.5 billion |

| Exceptional Hospitality & Service | Personalized guest interactions based on the 'Asian Heart' philosophy. | Average Hotel Occupancy (H1 2024): 93% |

| Diverse Non-Gaming Attractions | Concerts, sports events, and MICE facilities enhance visitor engagement. | Number of Shows Hosted: ~460 |

| Premium Gaming Environment | Exclusive facilities and personalized service for VIP and premium mass segments. | Adjusted EBITDA Growth (Q1 2024 vs. prior year): 28% |

| Accessible Travel Hub | Strategic location and international outreach promote Macau as a key destination. | Macau Visitor Arrivals (first three quarters): Over 30 million |

Customer Relationships

Galaxy Entertainment Group cultivates its VIP and premium mass market through dedicated personal hosts. These hosts act as concierges, offering tailored experiences for high-value gaming and hospitality clients, ensuring a sense of exclusivity and personalized attention.

These relationships are meticulously built on a foundation of trust and discretion, providing bespoke services and special privileges. For instance, in 2024, Galaxy Entertainment continued to invest in its host program, recognizing that such personalized service is key to retaining top-tier customers who represent a significant portion of their revenue.

Galaxy Entertainment's customer relationships are deeply rooted in comprehensive loyalty and rewards programs designed to capture and retain patrons across its diverse offerings. These initiatives are crafted to reward repeat business not just in gaming, but also in hotel accommodations, dining, and retail purchases.

The company employs tiered benefit structures, exclusive promotions, and access to special events. This strategy aims to cultivate a strong sense of belonging and encourage sustained engagement, driving frequent visitation and increased spending from its customer base.

For instance, in 2024, Galaxy's loyalty program members accounted for a significant portion of their total revenue, with data showing a 15% higher average spend per visit compared to non-members. This highlights the direct impact of these programs on customer lifetime value.

Galaxy Entertainment prioritizes a proactive approach to customer service, focusing intently on individual guest preferences to elevate their experience. This dedication is embodied in their 'World Class, Asian Heart' service philosophy, which guides staff training to anticipate needs and deliver thoughtful, attentive care, making every guest feel genuinely valued and recognized.

To ensure continuous improvement, robust customer feedback mechanisms are integral to Galaxy Entertainment's operations. In 2023, the company reported a significant increase in guest satisfaction scores, with over 90% of surveyed patrons indicating a positive experience, directly reflecting the effectiveness of their customer-centric strategies.

Digital Engagement and Direct Communication

Galaxy Entertainment leverages advanced Customer Relationship Management (CRM) systems and digital platforms to foster direct communication with its patrons. This enables personalized offers and efficient customer support, enhancing the overall guest experience.

Through these digital channels, Galaxy Entertainment can execute targeted marketing campaigns, streamline booking processes via online portals and mobile applications, and provide responsive service. This approach is crucial for maintaining strong, ongoing relationships with a diverse and extensive customer base.

- CRM Integration: Utilizes sophisticated CRM systems to track customer preferences and interaction history, enabling personalized engagement.

- Digital Booking: Offers seamless online booking portals and dedicated mobile applications for convenient reservation and access to services.

- Personalized Offers: Delivers tailored promotions and loyalty rewards based on individual customer data and engagement patterns.

- Responsive Support: Provides efficient and accessible customer support through digital channels, addressing inquiries and resolving issues promptly.

Event-Driven Community Building

Galaxy Entertainment cultivates strong customer relationships by leveraging its integrated resorts as hubs for unique, memorable experiences. High-profile concerts, major sporting events, and Mice (Meetings, Incentives, Conferences, and Exhibitions) activities are central to this strategy. These events provide direct opportunities for engagement, fostering a sense of community among attendees who are drawn to the diverse entertainment offerings.

The capacity to host large-scale, international events is a key differentiator. For example, in 2024, Galaxy Macau hosted numerous international acts and sporting tournaments, attracting hundreds of thousands of visitors. This creates a distinct channel for building relationships and nurturing a loyal fan base that returns for future events and the overall resort experience.

- Event-Driven Engagement: Galaxy Entertainment builds relationships through high-profile concerts, sports, and MICE events, creating memorable experiences.

- Community Formation: These events foster direct interaction, building a community around the integrated entertainment offerings.

- International Appeal: Hosting global events attracts diverse audiences, establishing a unique relationship channel and cultivating a loyal fanbase.

- 2024 Impact: In 2024, Galaxy Macau's event calendar saw significant international participation, underscoring its role in relationship building and customer loyalty.

Galaxy Entertainment Group prioritizes personalized service through dedicated hosts and comprehensive loyalty programs, fostering strong connections with VIP and premium mass market customers. These initiatives, including tiered benefits and exclusive promotions, are crucial for driving repeat business and increasing customer lifetime value, as evidenced by their significant impact on revenue in 2024.

The company also leverages advanced CRM systems and digital platforms for direct communication, enabling tailored offers and responsive support to enhance the overall guest experience. Furthermore, Galaxy Entertainment actively builds relationships by hosting high-profile events, creating community and international appeal, with a notable calendar of events in 2024 attracting a large visitor base.

| Customer Relationship Strategy | Key Tactics | 2024 Impact/Data |

|---|---|---|

| Personalized Service | Dedicated Hosts, Bespoke Services | Hosts act as concierges for high-value clients, ensuring exclusivity. |

| Loyalty & Rewards Programs | Tiered Benefits, Exclusive Promotions, Special Events | Loyalty members showed a 15% higher average spend per visit compared to non-members. |

| Digital Engagement | CRM Systems, Online Portals, Mobile Apps | Facilitates targeted marketing, streamlined bookings, and responsive support. |

| Event-Driven Engagement | Concerts, Sports, MICE Activities | Galaxy Macau hosted numerous international acts and tournaments, attracting hundreds of thousands of visitors. |

Channels

Galaxy Entertainment leverages company-owned websites, dedicated mobile applications, and direct reservation lines as its primary booking channels. These platforms offer customers a direct and efficient way to secure hotel stays, purchase event tickets, and make dining reservations, catering to both individual and mass-market preferences for convenience.

In 2024, the trend towards direct digital bookings continued to strengthen. For instance, many major hotel chains reported that over 50% of their bookings originated from their own websites or apps, bypassing third-party intermediaries. This direct channel allows Galaxy Entertainment to capture valuable customer data and potentially offer more personalized experiences and loyalty incentives.

Galaxy Entertainment Group (GEG) actively cultivates partnerships with global and regional travel agencies, tour operators, and online travel agencies (OTAs). These collaborations are crucial for broadening customer reach and packaging integrated resort experiences. For instance, in 2024, the travel industry saw a significant rebound, with global tourism expenditure projected to reach trillions, underscoring the importance of these distribution channels for GEG.

These intermediaries play a pivotal role in promoting GEG's offerings, especially for group bookings and attracting international visitors. By leveraging their established networks and marketing expertise, GEG can effectively penetrate diverse geographic markets. The continued growth in international travel, with many regions exceeding pre-pandemic visitor numbers by late 2024, highlights the strategic advantage of these partnerships.

Dedicated sales teams at Galaxy Entertainment focus on cultivating relationships with Meetings, Incentives, Conferences, and Exhibitions (MICE) clients, corporate groups, and high-net-worth individuals. In 2024, this direct outreach approach was crucial for securing large-scale events, contributing to a significant portion of group revenue.

These specialized sales professionals craft bespoke packages for premium clients and major events, ensuring that Galaxy Entertainment's offerings precisely meet the unique demands of each business-to-business partnership. This customization is key to maximizing value for both Galaxy and its corporate clientele.

Concurrently, marketing teams execute broad advertising initiatives across digital, print, and broadcast channels. Their efforts in 2024 aimed to broaden Galaxy's appeal to a wider array of customer segments, from leisure travelers to event organizers, driving overall brand awareness and foot traffic.

On-site Integrated Resort Facilities

The physical presence of luxury retail stores, diverse restaurants, and entertainment venues within Galaxy Entertainment's integrated resorts acts as a direct channel for delivering their products and services. These on-site facilities are designed to capture customer spending once they are on the property, fostering immediate consumption and impulse purchases. For instance, Broadway Food Street exemplifies a key on-site dining channel.

These integrated resort facilities are crucial for driving revenue through direct customer engagement. In 2024, Galaxy Entertainment Group reported significant contributions from its non-gaming segments, including retail and F&B, which are directly facilitated by these on-site channels. The group's strategic focus on enhancing these offerings continues to be a core part of its business model.

- On-site retail: Luxury brands and boutiques within the resorts offer a premium shopping experience, directly generating sales.

- Diverse dining options: A wide array of restaurants, from casual to fine dining, cater to varied tastes and encourage repeat visits and higher spending.

- Entertainment venues: Theatres, concert halls, and other entertainment spaces draw visitors and create opportunities for ancillary spending.

- Impulse purchases: The convenience and ambiance of the integrated resort encourage spontaneous spending on goods and services.

International Representative Offices

Galaxy Entertainment Group (GEG) strategically establishes and operates international representative offices in pivotal source markets. These offices, including locations like Tokyo, Seoul, and Bangkok, serve as crucial hubs for promoting Macau and GEG's integrated resorts to a global audience.

These overseas presences are instrumental in driving international visitor arrivals by fostering direct relationships with travel partners and prospective customers. This proactive approach directly supports Macau's broader objective of diversifying its tourism base and attracting a wider, more global clientele.

For instance, in 2023, Macau's tourism sector saw a significant rebound, with visitor numbers reaching over 28 million. GEG's international outreach through these offices plays a vital role in capturing a share of this recovering market and expanding its reach into new territories.

- Tokyo Office: Focuses on the Japanese market, a key source of high-spending tourists.

- Seoul Office: Targets South Korean visitors, known for their interest in entertainment and leisure.

- Bangkok Office: Cultivates relationships with travel trade in Thailand and Southeast Asia.

- Objective: To enhance direct bookings and build brand loyalty among international segments.

Galaxy Entertainment utilizes direct booking channels, including its own websites and mobile apps, to facilitate reservations for hotels, events, and dining. In 2024, direct digital bookings continued to grow, with many hotel chains reporting over 50% of reservations coming through their own platforms, allowing for data capture and personalized offers.

Partnerships with travel agencies and OTAs are vital for expanding reach and packaging resort experiences, especially as global tourism rebounded significantly in 2024, with expenditure reaching trillions. These intermediaries are crucial for group bookings and attracting international visitors, leveraging their networks to penetrate diverse markets as international travel numbers surged by late 2024.

Dedicated sales teams cultivate relationships with MICE clients and high-net-worth individuals, securing large-scale events and contributing significantly to group revenue in 2024. These professionals create bespoke packages for premium clients, ensuring tailored offerings that maximize value for both Galaxy and its corporate partners.

On-site retail, diverse dining, and entertainment venues act as direct channels for immediate consumption and impulse purchases within integrated resorts. In 2024, non-gaming segments like retail and F&B showed significant contributions, driven by these direct customer engagement channels.

| Channel Type | Key Activities | 2024 Relevance/Data Point |

|---|---|---|

| Direct Digital | Website/App Bookings | Over 50% of hotel bookings via direct channels |

| Intermediaries | Travel Agencies, OTAs | Global tourism expenditure in trillions; rebound in international travel |

| Direct Sales (B2B) | MICE, Corporate Groups | Crucial for large-scale events and group revenue |

| On-site Facilities | Retail, F&B, Entertainment | Significant contribution from non-gaming segments |

Customer Segments

High-Net-Worth Individuals (HNWIs) and VIP Gamblers represent a crucial customer segment for Galaxy Entertainment Group (GEG), demanding unparalleled exclusivity and personalized service. These individuals, characterized by substantial disposable income and a preference for privacy, seek bespoke gaming environments and ultra-luxury accommodations.

In 2024, the VIP gaming segment, while navigating market shifts, continued to be a vital revenue driver for Macau operators. GEG's commitment to delivering tailored experiences, including dedicated hosts and exclusive lounges, directly addresses the elevated expectations of this discerning clientele, ensuring their continued patronage and contribution to overall gaming turnover.

Galaxy Entertainment Group (GEG) is seeing significant growth in its premium mass market gambler and affluent tourist segment. This group, which favors direct gaming experiences over traditional junket models, is a substantial profit engine for the company. For instance, in 2023, GEG’s adjusted EBITDA from its Macau operations reached HK$15.3 billion, with the premium mass market playing a crucial role in this recovery.

To further capture this lucrative demographic, GEG is investing in enhanced hospitality and entertainment options. The development of Capella at Galaxy Macau is a prime example, designed to offer a luxurious experience that directly appeals to the preferences of these high-spending visitors. This strategic focus on premium offerings is expected to solidify GEG's position in this key market segment.

The General Mass Market Tourists and Leisure Visitors segment forms the bedrock of Galaxy Entertainment Group's (GEG) customer base. This broad group seeks a comprehensive resort experience, encompassing entertainment, diverse dining options, extensive shopping, and general leisure activities, with a significant emphasis on non-gaming attractions. Their patronage is vital for driving high visitation volumes and diversifying revenue beyond traditional casino operations.

Mainland China represents a particularly important source for this segment, especially with the continued positive impact of the Individual Visit Scheme. In 2024, Macau's tourism sector saw robust recovery, with visitor arrivals significantly increasing, underscoring the demand from this mass market. GEG's strategy is to cater to this wide spectrum of visitors by offering a compelling and varied resort proposition that appeals to a multitude of interests.

Business Travelers and MICE Participants

This segment encompasses corporations, associations, and individuals who are drawn to Galaxy Entertainment's premier venues, the Galaxy International Convention Center and the Galaxy Arena, for conferences, exhibitions, and other large-scale events. These clients prioritize cutting-edge facilities, ample event space, and seamless, integrated hospitality services to ensure successful MICE (Meetings, Incentives, Conferences, and Exhibitions) gatherings.

MICE events are a crucial component of Galaxy Entertainment's strategy to boost non-gaming revenue, directly supporting Macau's broader economic diversification initiatives. In 2024, the MICE sector continued its strong recovery, with major international events like the Global Gaming Expo (G2E) Asia held at the Venetian Macao, demonstrating robust demand for Macau's convention capabilities. Galaxy's own facilities are positioned to capture a significant share of this market.

- Target Audience: Corporations, professional associations, event organizers, and individual business professionals attending MICE events.

- Value Proposition: State-of-the-art convention and exhibition facilities, flexible event spaces, integrated accommodation and dining, and comprehensive event management support.

- Key Activities: Hosting and managing conferences, trade shows, corporate meetings, and incentive travel programs.

- Revenue Streams: Venue rental, catering services, accommodation bookings, exhibition space sales, and associated event services.

Families and Experiential Seekers

Families and experiential seekers represent a significant customer segment for Galaxy Entertainment Group (GEG). These visitors are attracted to Macau not solely for gaming, but for the comprehensive resort experience, including a wide array of entertainment options, unique cultural immersion, and family-friendly amenities. This group actively seeks out attractions like live performances, diverse dining choices, and engaging activities that cater to all ages, highlighting a growing demand for non-gaming offerings.

GEG's strategic focus on developing and enhancing these non-gaming attractions is crucial for capturing and expanding its share within this lucrative market. For instance, in 2024, GEG continued its significant investments in entertainment infrastructure and experiential offerings, aiming to diversify its appeal beyond traditional casino patrons. This strategic pivot is designed to attract a broader demographic, including families who prioritize engaging experiences and cultural exploration during their travels.

Key aspects attracting this segment include:

- Diverse Entertainment: Access to world-class shows, concerts, and performances.

- Family-Friendly Attractions: Resorts offering dedicated zones and activities for children and families.

- Culinary Variety: A broad spectrum of dining options, from casual to fine dining, catering to different tastes and preferences.

- Integrated Resort Experience: The appeal of a one-stop destination offering accommodation, entertainment, and leisure activities beyond gaming.

Galaxy Entertainment Group (GEG) targets a diverse customer base, from high-net-worth individuals seeking exclusive gaming experiences to mass-market tourists looking for comprehensive resort entertainment. The company also actively courts the Meetings, Incentives, Conferences, and Exhibitions (MICE) sector, attracting corporate clients and event organizers.

In 2024, GEG's premium mass market segment showed robust growth, contributing significantly to its recovery. The company's strategic investments in non-gaming attractions, such as enhanced hospitality and entertainment options, are designed to appeal to families and experiential seekers, broadening its appeal beyond traditional gamblers.

The VIP segment remains a vital revenue driver, with GEG focusing on personalized service and exclusive environments. Meanwhile, the general mass market benefits from Macau's strong tourism recovery, with visitor numbers increasing significantly in 2024, underscoring the demand for GEG's diverse resort offerings.

| Customer Segment | Key Characteristics | 2024 Focus/Trends |

|---|---|---|

| High-Net-Worth Individuals (HNWIs) & VIP Gamblers | Substantial disposable income, preference for privacy, bespoke gaming, ultra-luxury accommodations. | Continued focus on personalized service, exclusive lounges, and tailored gaming environments. |

| Premium Mass Market Gamblers & Affluent Tourists | Prefer direct gaming, seek enhanced hospitality and entertainment, value direct experiences. | Significant growth driver; investments in luxury amenities and unique experiences to capture this segment. |

| General Mass Market Tourists & Leisure Visitors | Seek comprehensive resort experience, diverse dining, shopping, entertainment, and non-gaming attractions. | Leveraging Macau's tourism recovery; focus on broad appeal and variety of offerings to high visitation volumes. |

| MICE Sector (Corporations, Associations, Event Organizers) | Require state-of-the-art facilities, ample event space, integrated hospitality for conferences and exhibitions. | Crucial for non-gaming revenue diversification; strong recovery in MICE sector supports demand for convention capabilities. |

| Families & Experiential Seekers | Attracted by non-gaming attractions, live performances, diverse dining, family-friendly amenities, cultural immersion. | Strategic investments in entertainment infrastructure and experiential offerings to diversify appeal and attract broader demographics. |

Cost Structure

Galaxy Entertainment Group (GEG) dedicates significant capital expenditure to developing new integrated resort phases, such as the ongoing construction of Phase 4, and undertaking major renovations like those at StarWorld. These substantial investments represent fixed costs crucial for maintaining competitive, high-quality facilities and attracting a premium customer base.

In 2024, GEG continued its commitment to substantial ongoing investments in its properties, reflecting the high capital intensity of the integrated resort sector. These expenditures are essential for both expansion and the upkeep of existing assets, ensuring they remain attractive and operational.

Labor costs for Galaxy Entertainment's extensive workforce, spanning gaming, hospitality, food and beverage, retail, and administration, constitute a significant portion of their operational expenses. This is directly tied to the high-touch service model inherent in integrated resorts, requiring a substantial number of skilled employees.

For instance, in 2023, Galaxy Entertainment reported staff costs, including salaries and benefits, as a substantial line item, reflecting the industry's labor-intensive nature. Effective human resource management, including strategic talent acquisition and retention programs, is crucial for managing these considerable costs and ensuring operational efficiency.

Regulatory payments to the Macau SAR Government, primarily based on gross gaming revenue, represent a significant variable cost for Galaxy Entertainment. These taxes are a direct reflection of gaming performance, forming a substantial portion of the overall cost structure within Macau's tightly regulated gaming landscape. For instance, in 2023, Galaxy Entertainment reported gaming revenue of HK$49.4 billion, with a significant portion allocated to these government levies.

Marketing, Advertising, and Promotion Expenses

Galaxy Entertainment Group (GEG) dedicates significant resources to marketing, advertising, and promotion. These costs are crucial for maintaining brand visibility and attracting a diverse customer base in the competitive global gaming and entertainment sector.

Key expenditures include substantial investments in extensive advertising campaigns, both online and offline, to reach a wide audience. GEG also funds numerous promotional events and develops sophisticated loyalty programs designed to retain existing patrons and encourage repeat business. Furthermore, a considerable portion of these expenses is allocated to international market development, aiming to attract tourists from key regions.

- Advertising Campaigns: GEG's marketing efforts encompass broad-reaching advertising across various media platforms, highlighting its integrated resort offerings and unique brand proposition.

- Promotional Events: The company regularly hosts and sponsors events, from entertainment shows to exclusive gaming tournaments, to drive foot traffic and enhance customer engagement.

- Loyalty Programs: GEG operates comprehensive loyalty programs that reward customers with exclusive benefits, encouraging sustained patronage and increasing customer lifetime value.

- International Market Development: Significant investment is channeled into promoting Macau as a premier tourist destination and GEG's properties to international visitors, particularly from mainland China and Southeast Asia.

Food & Beverage and Retail Inventory Costs

These costs encompass the procurement of ingredients for Galaxy Entertainment's diverse dining establishments and the acquisition of merchandise for its retail operations across its integrated resorts. These are fundamentally variable expenses, directly fluctuating with customer traffic and the overall volume of food, beverage, and retail sales. For instance, in 2024, a significant portion of Galaxy Entertainment's operating expenses is tied to maintaining robust inventory levels to meet anticipated demand.

- Ingredient Sourcing: Expenses for fresh produce, meats, seafood, and pantry staples for restaurants.

- Retail Inventory: Costs associated with purchasing branded goods, luxury items, and souvenirs for resort shops.

- Variable Nature: These costs scale directly with the number of guests and their spending on F&B and retail.

- Supply Chain Efficiency: Optimized procurement strategies are vital to controlling these significant operational expenditures.

Galaxy Entertainment's cost structure is heavily influenced by its capital-intensive operations and a commitment to premium service. Significant expenditures are allocated to property development and maintenance, ensuring state-of-the-art facilities. Labor costs are substantial due to the high-touch service model across gaming, hospitality, and retail. Regulatory payments, primarily gaming taxes, represent a major variable cost directly linked to revenue performance.

| Cost Category | Description | Impact on GEG | 2023 Data (Example) |

|---|---|---|---|

| Capital Expenditure | Development of new integrated resort phases and renovations | High fixed cost for maintaining competitive advantage | Ongoing investments in Phase 4 construction |

| Staff Costs | Salaries, benefits for extensive workforce | Significant operational expense due to labor-intensive service | Substantial line item in financial reports |

| Regulatory Payments | Gaming taxes based on gross gaming revenue | Major variable cost, directly tied to gaming performance | HK$49.4 billion in reported gaming revenue |

| Marketing & Promotion | Advertising, events, loyalty programs, international development | Crucial for brand visibility and customer acquisition/retention | Investments in broad-reaching campaigns and international markets |

| Cost of Goods Sold (F&B/Retail) | Procurement of ingredients and merchandise | Variable cost, fluctuating with sales volume | Significant portion of operating expenses tied to inventory |

Revenue Streams

Mass market gaming revenue forms the bedrock of Galaxy Entertainment Group's (GEG) income. This segment primarily derives its earnings from table games, slot machines, and electronic gaming devices spread across its key Macau properties: Galaxy Macau, StarWorld Macau, and Broadway Macau.

This area has consistently proven to be a significant profit engine for GEG. In 2023, GEG reported a substantial increase in gross gaming revenue, with the mass market segment leading the charge, showing robust growth and contributing the majority of the company's overall gaming income. This indicates a stable and expanding revenue stream, outperforming the often more volatile VIP gaming sector.

Galaxy Entertainment Group (GEG) generates significant revenue from its VIP and premium direct gaming segments. These high-stakes activities, including rolling chip programs and direct premium play, are specifically designed to attract high-net-worth individuals, a crucial demographic for the company.

While the VIP segment can see some volatility, the premium direct gaming sector continues to be a strong performer. GEG's ongoing efforts to elevate its offerings for this affluent clientele underscore its importance as a high-margin revenue stream.

For the first half of 2024, GEG reported that its premium mass gaming revenue reached HK$16.4 billion, a substantial increase from the previous year, highlighting the growing importance of these premium direct play segments.

Galaxy Entertainment Group (GEG) generates substantial income from hotel accommodation, drawing revenue from room nights across its luxury brands at Galaxy Macau, StarWorld Macau, and Broadway Macau. This non-gaming revenue is a critical component of their business.

GEG consistently achieves high occupancy rates, frequently reported near 100%, underscoring the strong demand for their hotel offerings. This robust performance directly fuels their accommodation revenue stream.

The anticipated opening of Capella at Galaxy Macau in mid-2025 is poised to further enhance this revenue, adding more capacity and attracting additional guests to their integrated resort properties.

Food & Beverage Sales

Galaxy Entertainment generates significant revenue from its diverse food and beverage offerings. This includes everything from high-end fine dining establishments and relaxed casual restaurants to vibrant bars situated within their integrated resorts.

These non-gaming revenue streams are vital for enhancing the overall guest experience and boosting profitability. The company aims to provide a broad spectrum of culinary delights to cater to all tastes. For instance, Broadway Food Street is a key contributor to this segment, showcasing a variety of food vendors and dining experiences.

In 2024, Galaxy Entertainment reported that its non-gaming revenue, which heavily features F&B sales, continued to be a strong performer, demonstrating the growing importance of these offerings. Specific figures for F&B sales are often bundled within broader non-gaming revenue reports, but the trend indicates robust performance.

- Diverse Dining Options: Fine dining, casual eateries, and bars within integrated resorts.

- Guest Experience & Profitability: Crucial for overall guest satisfaction and financial success.

- Culinary Variety: Offering a wide array of culinary experiences to attract and retain customers.

- Key Contributor: Broadway Food Street exemplifies a successful F&B destination within their resorts.

Retail, MICE, and Entertainment Revenue

Galaxy Entertainment Group (GEG) diversifies its income through robust retail, MICE (Meetings, Incentives, Conferences, and Exhibitions), and entertainment operations. This segment is crucial for expanding its non-gaming revenue base and appealing to a wider audience beyond traditional casino patrons.

Income streams within this category include revenue generated from retail space rentals within GEG's properties, direct sales from its own retail outlets, and fees collected for hosting conventions and exhibitions. Additionally, ticket sales from a variety of live entertainment and sports events contribute significantly.

- Retail Rentals and Sales: GEG's integrated resorts feature extensive retail offerings, driving income through property leasing and direct merchandise sales.

- MICE Operations: Fees from hosting over 460 events in 2024 underscore the growing importance of its MICE business for attracting corporate and international clientele.

- Entertainment and Sports: Ticket sales for concerts, performances, and sporting events are a key component of the entertainment revenue, enhancing the overall visitor experience.

- Diversification Strategy: This non-gaming revenue is vital for GEG's strategy to reduce reliance on gaming income and build a more resilient business model.

Galaxy Entertainment Group's revenue streams are multifaceted, extending well beyond traditional gaming. The company leverages its integrated resorts to generate income from a variety of sources, aiming for a balanced business model.

Key revenue drivers include mass market gaming, premium direct play, hotel operations, food and beverage services, and retail, MICE, and entertainment. This diversification strategy is designed to capture a broader customer base and enhance overall profitability.

The company's performance in 2024 highlights the strength of these diverse revenue streams, with significant contributions from both gaming and non-gaming segments, demonstrating resilience and growth potential.

| Revenue Stream | Description | 2024 Highlights |

|---|---|---|

| Mass Market Gaming | Revenue from table games and slot machines for the general public. | Continued to be a primary profit driver, showing robust growth. |

| VIP & Premium Direct Gaming | High-stakes gaming catering to high-net-worth individuals. | Premium direct play showed strong performance, contributing significantly. |

| Hotel Operations | Revenue from room accommodation across luxury brands. | High occupancy rates, frequently near 100%, ensuring consistent income. |

| Food & Beverage | Income from a wide range of dining and bar experiences. | A vital non-gaming revenue stream, enhancing guest experience and profitability. |

| Retail, MICE & Entertainment | Revenue from retail leasing, direct sales, event hosting, and ticket sales. | MICE operations hosted over 460 events, bolstering non-gaming income diversification. |

Business Model Canvas Data Sources

The Galaxy Entertainment Business Model Canvas is built upon comprehensive market research, competitor analysis, and internal financial reports. These data sources ensure each component of the canvas is grounded in factual insights and strategic understanding.