Galaxy Entertainment Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galaxy Entertainment Bundle

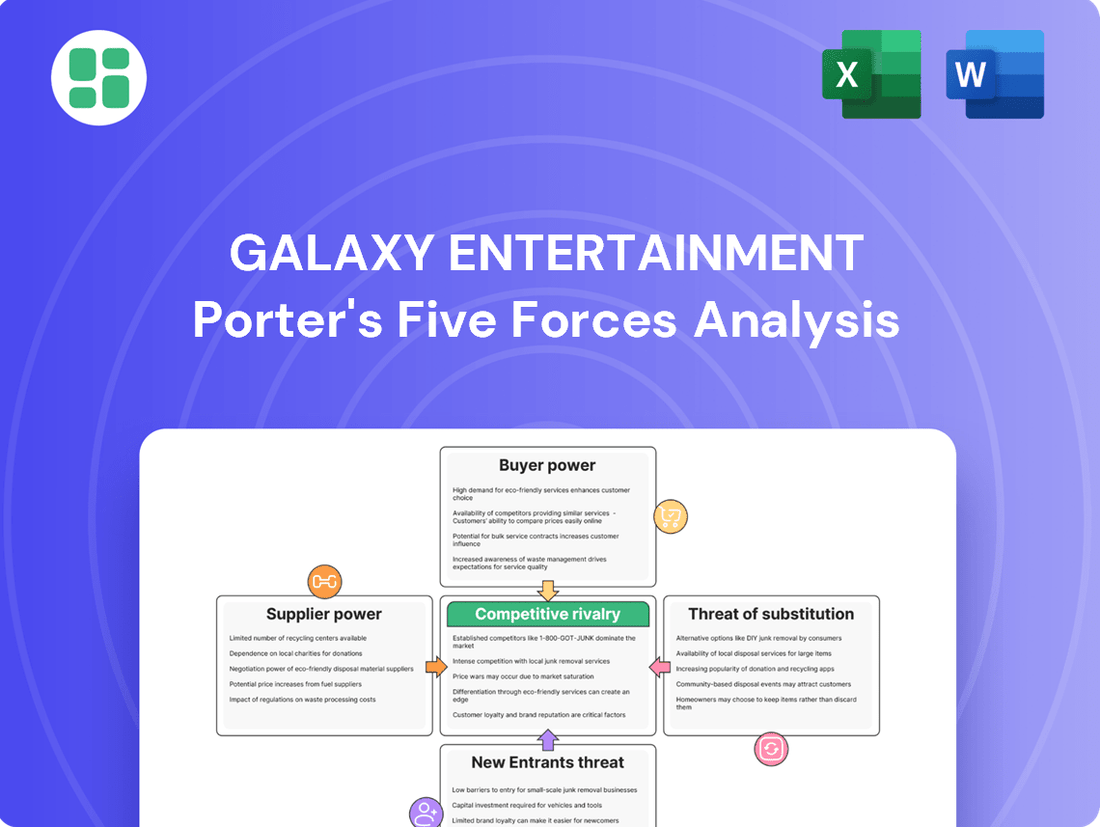

Galaxy Entertainment operates in a highly competitive landscape shaped by powerful forces. Understanding the intensity of buyer bargaining power, the threat of new entrants, and the impact of substitute products is crucial for navigating this dynamic market.

The full Porter's Five Forces Analysis for Galaxy Entertainment dives deep into each of these pressures, providing a comprehensive strategic roadmap. Unlock actionable insights to understand their competitive position and identify opportunities for sustainable advantage.

Suppliers Bargaining Power

The Macau government acts as a powerful supplier through its concession system, granting companies like Galaxy Entertainment the right to operate. In 2024, the government's influence on the gaming sector remains paramount, as it dictates the terms under which these concessions are awarded and maintained.

The specific conditions of these concessions, including tax rates and operational mandates, directly impact Galaxy Entertainment's profitability and strategic choices. Any adjustments to these terms, such as increased gaming taxes or new regulatory burdens, would significantly enhance the government's bargaining power, potentially increasing operational costs for Galaxy.

Suppliers of specialized gaming equipment, like advanced slot machines and sophisticated table game technology, often wield considerable bargaining power. This is primarily due to the highly specialized nature of their offerings and the substantial costs associated with switching to alternative providers, which can involve extensive system overhauls. For instance, in 2024, the global gaming equipment market saw continued innovation, with companies investing heavily in new technologies, making the integration of new systems a significant capital expenditure for operators like Galaxy Entertainment.

Galaxy Entertainment's reliance on a select group of high-end construction and development firms for its integrated resorts grants these suppliers considerable bargaining power. These specialized firms possess the unique expertise and capacity required for the complex, large-scale projects characteristic of Macau's gaming and hospitality sector.

The limited pool of qualified contractors, particularly those familiar with Macau's stringent regulations and logistical challenges, means Galaxy has fewer alternatives. This scarcity directly translates into increased leverage for these suppliers, enabling them to command higher prices and more favorable contract terms.

Disruptions or cost escalations from these key construction partners can significantly impact Galaxy's project timelines and overall financial performance. For instance, major infrastructure projects often involve multi-billion dollar budgets, making supplier reliability a critical factor.

Skilled Labor and Hospitality Talent

The integrated resort industry, including Galaxy Entertainment, relies heavily on a diverse and skilled workforce. This ranges from specialized gaming dealers and experienced hotel executives to front-line service staff. The demand for these roles, especially in tight labor markets, can significantly influence the bargaining power of employees and labor unions.

In 2024, Macau's gaming and hospitality sector continued to face a competitive labor environment. Reports indicated persistent challenges in attracting and retaining talent across various skill levels. This scarcity directly translates into increased leverage for workers, enabling them to negotiate for higher compensation packages and improved working conditions.

- Talent Demand: Integrated resorts require a broad spectrum of skilled professionals, from gaming operations to luxury hospitality management.

- Labor Market Constraints: A limited pool of specialized talent, particularly in regions like Macau, amplifies employee bargaining power.

- Wage Pressures: In 2024, Macau's tight labor market led to increased wage demands from hospitality and gaming staff, impacting operational costs.

- Retention Strategies: Companies like Galaxy Entertainment must implement robust human resource strategies to attract and retain essential personnel amidst these pressures.

Luxury Retail and Food & Beverage Brands

The bargaining power of suppliers in the luxury retail and food & beverage sectors within Galaxy Entertainment's properties is moderate. While these high-profile brands are essential for attracting a premium clientele and maintaining Galaxy's upscale image, their global recognition and specific operational requirements grant them leverage in negotiations. For instance, in 2023, luxury brands continued to see robust demand, with the global personal luxury goods market projected to reach €362 billion by the end of the year, indicating strong pricing power for these suppliers.

These brands often negotiate favorable lease terms and revenue-sharing agreements, as their presence directly drives foot traffic and sales for Galaxy. The exclusivity and curated nature of these offerings mean that Galaxy Entertainment is reliant on securing and retaining these specific operators. This reliance, coupled with the high costs associated with operating in prime integrated resort locations, can shift some of the negotiation power towards the suppliers.

- Brand Exclusivity: Luxury brands often demand prime locations and specific store designs, limiting Galaxy's flexibility and increasing supplier leverage.

- Global Demand: Strong global demand for luxury goods and premium F&B experiences in 2024 bolsters the pricing power of these suppliers.

- Operational Requirements: The specific operational needs of luxury retailers and F&B operators, such as specialized staffing and marketing support, can be factored into negotiations.

- Reputational Value: The association with prestigious brands provides significant reputational value to Galaxy, which these suppliers can leverage.

The Macau government, as the primary supplier of operating licenses, holds significant sway over Galaxy Entertainment. In 2024, the government's control over concession terms, including tax rates and operational mandates, directly impacts Galaxy's profitability.

Specialized gaming equipment suppliers also possess considerable bargaining power due to the high cost and technical complexity of switching providers. The ongoing innovation in gaming technology in 2024 means these suppliers can command premium prices for their advanced offerings.

Skilled labor, particularly in Macau's competitive hospitality and gaming market, presents another area where supplier bargaining power is evident. In 2024, persistent talent shortages led to increased wage demands from staff, impacting operational costs for companies like Galaxy Entertainment.

Luxury retail and food & beverage brands, while crucial for Galaxy's appeal, also leverage their global recognition and operational demands to negotiate favorable terms. In 2023, the luxury goods market's robust growth underscored the pricing power of these sought-after suppliers.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Galaxy Entertainment's position in the Macau gaming market.

Instantly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Force for Galaxy Entertainment.

Customers Bargaining Power

Galaxy Entertainment navigates distinct customer bases: the broad mass market and the exclusive VIP segment. Mass market patrons are typically more attuned to pricing and promotions, meaning their collective demand can exert significant influence on the company's offerings.

Conversely, the VIP segment, though smaller, represents a substantial revenue stream. These high-value customers possess considerable individual bargaining power, as their loyalty is often secured through bespoke services and unique perks, making them less susceptible to price alone.

For instance, in 2024, while mass market gaming revenue is crucial, the VIP segment's contribution per patron remains significantly higher, underscoring the importance of catering to their specific demands and maintaining high service standards to retain this powerful customer group.

The sheer number of competing integrated resorts in Macau significantly boosts customer bargaining power. With major players like Sands China, Wynn Macau, MGM China, SJM Holdings, and Melco Resorts & Entertainment all vying for attention, customers have a wealth of choices. For instance, in 2023, Macau's gross gaming revenue reached MOP 183.06 billion (approximately USD 22.7 billion), reflecting robust consumer spending across these diverse offerings.

This intense competition allows customers to readily switch between properties based on factors like perceived value, available amenities, or attractive loyalty programs. Galaxy Entertainment must therefore remain highly competitive, constantly innovating its services and offerings to retain its customer base. This dynamic forces a continuous focus on enhancing the customer experience to stand out in a crowded market.

For most patrons, the cost and effort to switch between casino resorts in Macau are quite low. A customer can easily opt for a different property on their next visit, or even shift during a single trip, highlighting minimal friction.

This ease of movement allows consumers to actively seek superior value, whether that's through better pricing, enhanced experiences, or more attractive loyalty programs. In 2024, Macau's gaming revenue reached approximately HKD 213.2 billion, indicating a highly competitive environment where customer choice significantly influences market dynamics.

Influence of Travel Agencies and Tour Operators

Travel agencies and tour operators wield considerable influence over Galaxy Entertainment, particularly concerning the substantial flow of tourists from mainland China. These intermediaries act as consolidators of demand, enabling them to negotiate advantageous terms, package deals, and commission rates with integrated resorts like Galaxy. Their capacity to channel significant customer volumes grants them substantial bargaining power, directly impacting Galaxy's pricing and promotional strategies.

For instance, in 2023, mainland China remained a primary source of visitors for Macau, with agencies playing a crucial role in facilitating these travel arrangements. The ability of these agencies to bundle accommodations, entertainment, and transportation allows them to exert pressure on pricing. This dynamic means Galaxy must carefully manage its relationships and offerings to maintain competitive packages that appeal to both the agencies and the end consumer.

- Consolidated Demand: Travel agencies aggregate demand from numerous individual travelers, creating a powerful bloc.

- Negotiating Leverage: This aggregation allows them to negotiate better rates and terms than individual customers could.

- Influence on Pricing: Their bargaining power directly affects the pricing strategies and profitability of integrated resorts.

- Volume-Based Commissions: Agencies often secure commissions based on the volume of bookings they drive, incentivizing them to seek favorable terms.

Impact of Online Gaming and Alternative Entertainment

The increasing popularity of online gaming and diverse global entertainment options presents a subtle yet significant challenge to Galaxy Entertainment's customer bargaining power. While not a direct replacement for the comprehensive integrated resort experience, these alternatives offer leisure choices that can dilute the imperative for some customers to visit physical properties. This broadens the competitive arena beyond Macau, potentially diminishing customer loyalty if Galaxy's unique value proposition isn't consistently reinforced.

For instance, the global online gaming market was projected to reach over $100 billion in 2024, showcasing a vast and accessible entertainment alternative.

- Online gaming platforms offer convenience and accessibility.

- Global entertainment destinations provide diverse leisure experiences.

- These alternatives can reduce customer urgency to visit physical resorts.

- Galaxy must maintain a unique and compelling offering to counter this trend.

Galaxy Entertainment faces significant customer bargaining power due to the highly competitive Macau market. With numerous integrated resorts, customers can easily switch between properties, forcing Galaxy to focus on value and experience. The ease of switching, with minimal cost or effort, empowers patrons to seek the best deals and amenities.

Travel agencies and tour operators also wield considerable influence by aggregating demand, particularly from mainland China, allowing them to negotiate favorable terms. This necessitates competitive packaging and strong relationships to retain booking volumes.

Furthermore, the rise of online gaming and global entertainment options presents an alternative, potentially diluting customer loyalty to physical resorts. For example, the global online gaming market was projected to exceed $100 billion in 2024, highlighting the breadth of entertainment choices available.

| Factor | Impact on Galaxy Entertainment | 2023/2024 Data Point |

|---|---|---|

| Number of Competitors | High bargaining power for customers | Macau GGR: MOP 183.06 billion (approx. USD 22.7 billion) in 2023 |

| Ease of Switching | Customers can easily change resorts | Macau GGR: approx. HKD 213.2 billion in 2024 |

| Travel Agency Influence | Negotiate package deals and commissions | Mainland China is a primary source of Macau visitors |

| Alternative Entertainment | Potential dilution of loyalty | Global online gaming market projected over $100 billion in 2024 |

Full Version Awaits

Galaxy Entertainment Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Galaxy Entertainment, detailing the competitive landscape and strategic positioning within the industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, offering no surprises and ready for immediate use. This professional report provides actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry, all crucial for understanding Galaxy Entertainment's market dynamics.

Rivalry Among Competitors

Macau's gaming sector is a tight oligopoly where a handful of major players, including Galaxy Entertainment, Sands China, Wynn Macau, MGM China, SJM Holdings, and Melco Resorts & Entertainment, fiercely compete. This intense rivalry stems from the limited number of gaming licenses and the concentrated geographical location, driving aggressive marketing campaigns and substantial investments in new properties to capture market share.

Integrated resorts, like those operated by Galaxy Entertainment, demand colossal upfront capital. Think billions of dollars for construction and development. These aren't small ventures; they're sprawling complexes. This massive investment translates into substantial ongoing fixed costs for everything from maintaining opulent properties to employing thousands of staff and adhering to strict gaming regulations.

Because of these high fixed costs, there's a powerful drive for companies like Galaxy Entertainment to keep their facilities running at peak capacity. The goal is simple: generate as much revenue as possible to offset those significant expenses. This pressure to fill every hotel room and gaming table is a constant factor in their operations.

This intense need for capacity utilization naturally fuels competitive behavior. Operators are often compelled to engage in aggressive pricing strategies and enticing promotional offers. For instance, in 2024, Macau’s gaming revenue saw a significant rebound, with operators actively competing for market share, which can lead to discounting to attract players and maintain occupancy rates.

Competitive rivalry in the entertainment sector, including for Galaxy Entertainment, goes far beyond just the gaming floor. It spills over into a fierce battle for customers through non-gaming amenities. Think luxury hotels, a wide array of dining experiences from casual to fine dining, and world-class entertainment shows. For instance, in 2024, many integrated resorts were heavily investing in expanding their F&B portfolios and upgrading hotel facilities to attract a broader customer base.

This constant drive to enhance offerings is all about differentiation. Companies are pouring resources into creating unique customer journeys and memorable experiences. This non-price competition is absolutely vital for drawing in and keeping those high-spending customers. It’s how they build loyalty and maintain a strong position in a crowded market.

Market Share Dynamics and Investment Cycles

The competitive rivalry within the gaming and entertainment sector is intense, with operators constantly vying for market share through significant investments. For instance, in 2024, Macau's gaming revenue saw a substantial increase, reaching approximately MOP 213 billion (around $26.6 billion USD) by the end of the year, indicating robust demand but also heightened competition among major players like Galaxy Entertainment. This surge fuels a cycle of expansion and renovation as companies aim to attract and retain customers.

These investment cycles often translate into periods of aggressive competition. Companies are compelled to innovate and enhance their offerings, whether through new property developments, extensive renovations, or forging strategic alliances. Galaxy Entertainment must remain acutely aware of these strategic maneuvers by competitors, such as the ongoing development of new integrated resorts by rivals, to effectively defend and grow its market standing.

- Macau's gaming revenue in 2024 exceeded MOP 213 billion, highlighting a competitive market.

- Operators are investing in expansions and renovations to capture market share.

- Strategic partnerships are a key tactic to gain a competitive edge.

- Galaxy Entertainment must monitor and react to rivals' investment strategies.

Regulatory Environment and Concession Renewal

The regulatory environment in Macau, particularly concerning concession renewals, creates a unique competitive dynamic. Operators like Galaxy Entertainment must not only meet financial performance metrics but also demonstrate a tangible commitment to Macau's broader economic diversification goals. This means investing in non-gaming attractions and local community initiatives.

The Macau government's rigorous process for renewing gaming concessions, which are typically awarded for 20-year terms, directly impacts competitive rivalry. For instance, the concessions for the current operators were set to expire in 2022 but were extended to December 2022, with new 10-year concessions awarded in June 2022 to six operators, including Galaxy Entertainment. This renewal process incentivizes operators to align their long-term strategies with government objectives to ensure license security.

- Government Oversight: Macau's DICJ (Gaming Inspection and Coordination Bureau) enforces strict regulations on all gaming operators.

- Economic Diversification Mandate: Operators are required to invest in non-gaming elements, such as MICE facilities and entertainment, as part of their concession obligations.

- Concession Renewal as a Competitive Lever: The success in meeting these diversification targets directly influences the likelihood and terms of future concession renewals, fostering strategic competition beyond just gaming revenue.

- Social Responsibility: Demonstrating social responsibility and contributing to local employment and development are increasingly important factors in regulatory assessments.

Competitive rivalry among Macau's integrated resorts, including Galaxy Entertainment, is exceptionally intense due to the oligopolistic structure and high fixed costs. Operators are driven to maximize capacity utilization, leading to aggressive marketing and pricing strategies. For example, Macau's gaming revenue in 2024 exceeded MOP 213 billion, underscoring the fierce competition for market share. This environment necessitates continuous investment in property expansions, renovations, and non-gaming amenities to differentiate offerings and attract a broader customer base.

| Competitor | Key 2024 Focus Areas | Strategic Imperative |

|---|---|---|

| Galaxy Entertainment | New property developments, F&B expansion, customer loyalty programs | Maintain market leadership through innovation and service excellence. |

| Sands China | Integrated resort upgrades, MICE facilities enhancement, luxury retail | Leverage existing infrastructure and brand strength for premium segment. |

| Wynn Macau | Thematic entertainment, premium dining, personalized guest experiences | Differentiate through unique, high-value offerings and service quality. |

| MGM China | Artistic installations, digital integration, family-friendly attractions | Attract a diverse demographic by blending entertainment with cultural elements. |

SSubstitutes Threaten

The threat of substitutes for Galaxy Entertainment is significantly amplified by the burgeoning online gaming and digital entertainment sector. Platforms offering online casinos, sports betting, and mobile games present a compelling alternative due to their sheer convenience and lower initial investment, directly competing for consumer leisure spending. For instance, the global online gambling market was valued at approximately $72.1 billion in 2023 and is projected to reach $159.1 billion by 2029, showcasing a substantial shift towards digital alternatives.

Travelers looking for leisure and luxury have many international options besides Macau. Destinations like Singapore, Las Vegas, and various cruise lines offer comparable experiences and vie for the same tourist dollars. These alternatives present a significant threat, as they can attract visitors who might otherwise choose Macau.

Customers have a vast array of choices for their leisure spending beyond just gaming. For instance, the global live entertainment market, encompassing concerts and sporting events, saw significant recovery and growth in 2024, with many major events selling out quickly, indicating strong consumer demand for these experiences. This means a portion of a potential visitor's entertainment budget might be allocated to a major music festival or a championship sports match, diverting funds that could otherwise be spent at an integrated resort.

Galaxy Entertainment itself offers non-gaming attractions like shopping and dining, but these are often within the context of an integrated resort. The true threat of substitutes comes from entirely separate, world-class entertainment venues. Consider the rise of experiential tourism; in 2024, destinations known for unique cultural immersion or adventure activities continued to attract significant international tourist numbers, showcasing that leisure time and money can be directed towards experiences completely unrelated to casino gaming.

Home-Based Entertainment and Staycations

The increasing sophistication of home entertainment systems and streaming services presents a significant threat of substitutes for traditional resort destinations. For instance, the global video-on-demand market was projected to reach over $130 billion in 2024, indicating a strong consumer preference for accessible in-home entertainment. This trend can divert spending that might otherwise go towards travel, particularly impacting the mass-market segment of the entertainment industry.

Furthermore, the rise of staycations, fueled by convenience and cost-effectiveness, offers another viable alternative. Many individuals are opting for local leisure activities and short trips closer to home, reducing the perceived need for more elaborate resort experiences. This shift is partly driven by evolving consumer preferences for more personalized and less time-consuming leisure options.

- Home Entertainment Growth: The global streaming market is experiencing robust growth, with significant investments in content and technology, making in-home entertainment increasingly compelling.

- Staycation Appeal: The convenience and lower costs associated with staycations appeal to a broad demographic, especially in times of economic uncertainty or when travel restrictions are a concern.

- Impact on Mass Market: These substitutes directly affect the mass market by offering more affordable and readily available entertainment alternatives to destination-based travel.

- Shifting Consumer Priorities: Consumer spending is increasingly allocated towards experiences that offer immediate gratification and flexibility, which home entertainment and local leisure often provide more readily than traditional resort vacations.

Economic Downturns and Shifting Consumer Priorities

Economic downturns present a significant threat of substitutes for Galaxy Entertainment. During periods of recession, consumers often cut back on discretionary spending, including luxury travel and entertainment. This means that even if Galaxy's offerings remain appealing, financial constraints can push customers towards more essential goods and services, effectively substituting what Galaxy provides.

For instance, a prolonged economic slowdown could see individuals prioritizing savings or essential purchases over a Macau holiday. This broader economic environment acts as a powerful substitute force, as consumer behavior fundamentally shifts due to financial pressures. Galaxy's revenue, heavily reliant on consumer confidence and disposable income, becomes particularly vulnerable in such scenarios.

- Consumer spending on travel and leisure is highly elastic and sensitive to economic conditions.

- During economic contractions, substitute activities like home entertainment or local, lower-cost leisure options become more attractive.

- Galaxy Entertainment's reliance on high-discretionary spending makes it susceptible to shifts towards more budget-friendly alternatives during economic downturns.

The threat of substitutes for Galaxy Entertainment is multifaceted, encompassing digital alternatives, competing international destinations, and evolving leisure preferences. The burgeoning online gaming sector, valued at approximately $72.1 billion in 2023 and projected to reach $159.1 billion by 2029, offers convenience and lower entry costs. Furthermore, destinations like Singapore and Las Vegas, alongside the growing global live entertainment market, directly compete for discretionary spending. Even home entertainment, with the video-on-demand market projected to exceed $130 billion in 2024, presents a compelling substitute, especially for the mass market.

| Substitute Category | Key Characteristics | Market Data/Trend |

|---|---|---|

| Online Gaming | Convenience, lower cost, accessibility | Global market ~ $72.1B (2023), projected $159.1B (2029) |

| International Destinations | Comparable luxury, diverse experiences | Singapore, Las Vegas, cruise lines |

| Live Entertainment | Experiential, high demand | Strong recovery and growth in 2024 |

| Home Entertainment | Accessibility, cost-effectiveness | VOD market > $130B (2024) |

Entrants Threaten

Establishing an integrated resort, such as Galaxy Macau, demands an astronomical capital outlay, often running into billions of dollars. This includes the costs associated with acquiring prime real estate, the extensive construction of the resort itself, and the development of necessary supporting infrastructure. For instance, the initial phase of Galaxy Macau's development involved an investment of approximately $2 billion USD.

This substantial financial hurdle effectively creates a formidable barrier to entry for any potential new competitors. The sheer magnitude of the required investment significantly narrows the field of possible entrants, restricting it primarily to massive global corporations with deep pockets and extensive financial resources.

The threat of new entrants for Galaxy Entertainment in Macau is significantly mitigated by the strict and limited concession system. The Macau government tightly controls the gaming market, historically issuing only a very small number of casino operating licenses, known as concessions. As of the latest renewals, the market is dominated by six major concessionaires, including Galaxy Entertainment, with their agreements being long-term and the process for obtaining new concessions being infrequent and highly regulated. This creates a substantial barrier to entry, effectively preventing new companies from easily joining the market.

Established brand loyalty is a significant barrier for new entrants in the gaming and hospitality sector. Galaxy Entertainment, for instance, has cultivated deep customer relationships over many years, particularly with its VIP clientele. In 2024, the company continued to leverage its extensive loyalty programs, which are crucial for retaining high-spending customers who are less likely to be swayed by new competitors.

Newcomers would need to invest heavily in marketing and offer substantial incentives to even begin chipping away at this entrenched customer base. This makes the threat of new entrants relatively low, as the cost and effort to acquire a comparable level of loyalty are immense. The incumbent advantage, built on decades of service and targeted engagement, remains a formidable hurdle.

Limited Availability of Prime Land and Infrastructure

The threat of new entrants for Galaxy Entertainment, particularly concerning the limited availability of prime land and infrastructure in Macau, is notably low. Macau is a compact and densely populated region, meaning desirable locations for integrated resorts are exceptionally scarce. Existing major operators, including Galaxy Entertainment, have already secured the most advantageous sites, creating a significant barrier for any newcomers looking to establish a presence.

Furthermore, acquiring suitable land for development is a complex and lengthy process, often involving government approvals and extensive negotiations. This scarcity directly impacts the cost and feasibility of new projects. For instance, the Cotai Strip, where most of the large integrated resorts are located, has seen very limited new land reclamation and development opportunities in recent years, underscoring the difficulty of entry.

- Scarce Prime Locations: Macau’s limited landmass makes prime sites for large-scale resorts highly sought after and already occupied by established players.

- Infrastructure Hurdles: New entrants face significant challenges in accessing essential infrastructure and logistical support, which are critical for operating integrated resorts.

- High Development Costs: The combination of land scarcity and infrastructure requirements translates into extremely high initial investment costs for any potential new competitor.

Operational Complexity and Regulatory Compliance

Operating an integrated resort, particularly in a highly regulated market like Macau, presents significant operational complexity. Newcomers must grapple with managing vast workforces, diverse entertainment and hospitality offerings, and the intricacies of gaming operations. For instance, in 2023, Macau's gaming revenue reached MOP 183.1 billion (approximately USD 22.8 billion), highlighting the scale of operations and the need for sophisticated management systems.

New entrants face substantial hurdles in developing the necessary expertise and robust compliance frameworks required for gaming operations. Navigating stringent gaming regulations, including anti-money laundering (AML) laws, demands significant investment in specialized personnel and technology. Failure to comply can result in severe penalties, making this a critical barrier to entry.

The steep operational learning curve, coupled with the capital-intensive nature of establishing compliant infrastructure, acts as a formidable barrier. Building the operational know-how to effectively manage all facets of an integrated resort, from customer service to security and financial controls, takes considerable time and experience. This makes it challenging for new entities to compete with established players who have honed these capabilities over years.

- Operational Scale: Macau's integrated resorts, like those operated by Galaxy Entertainment, manage tens of thousands of employees and a wide array of services.

- Regulatory Environment: Strict gaming laws and AML regulations in Macau require extensive compliance infrastructure.

- Capital Investment: Establishing a new integrated resort demands billions in upfront capital for construction, licensing, and operational setup.

- Expertise Acquisition: Developing the specialized knowledge for gaming management and regulatory adherence is a lengthy and costly process for new entrants.

The threat of new entrants for Galaxy Entertainment in Macau is significantly low due to the immense capital required, estimated in the billions of dollars, for integrated resort development. This financial barrier, coupled with the scarcity of prime land and the stringent, limited concession system controlled by the Macau government, effectively deters new companies. Established brand loyalty and the complex operational expertise needed to navigate Macau's strict gaming regulations further solidify this low threat.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Billions of USD for land, construction, and infrastructure. Galaxy Macau's initial phase cost ~ $2 billion USD. | Extremely high, limiting entrants to major global corporations. |

| Government Concessions | Limited number of licenses issued by the Macau government, with long-term agreements. | Substantial barrier; new entrants cannot easily enter the market. |

| Brand Loyalty & Customer Base | Established relationships and loyalty programs, especially with VIP clients, are hard to replicate. | New entrants need massive marketing investment and incentives to gain traction. |

| Land & Infrastructure Scarcity | Prime locations on Cotai Strip are occupied; new land development is limited and complex. | Increases development costs and feasibility challenges for newcomers. |

| Operational Complexity & Regulation | Managing large workforces, diverse offerings, and strict gaming/AML compliance requires significant expertise and investment. | Steep learning curve and high compliance costs create a formidable hurdle. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Galaxy Entertainment is built upon a foundation of comprehensive data, including their annual reports, investor presentations, and regulatory filings. We supplement this with industry-specific market research reports and analyses from reputable financial news outlets to capture the competitive landscape accurately.