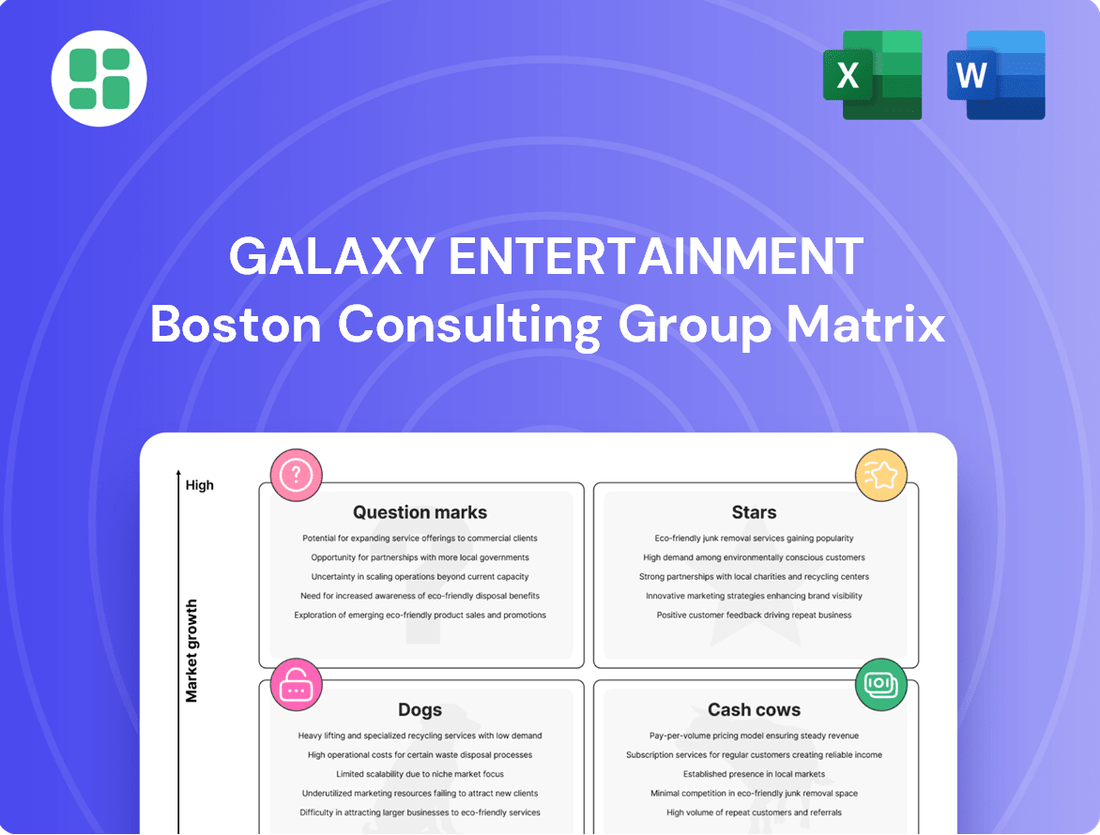

Galaxy Entertainment Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Galaxy Entertainment Bundle

Galaxy Entertainment's strategic positioning is laid bare in its BCG Matrix, revealing a dynamic portfolio of entertainment assets. Understand which ventures are fueling growth and which require careful consideration to optimize resource allocation.

This overview is just the tip of the iceberg; unlock the full potential by purchasing the complete BCG Matrix. Gain a comprehensive understanding of Galaxy Entertainment's market share and growth rate for each segment, empowering you to make informed strategic decisions.

Stars

The Galaxy International Convention Center (GICC) and Galaxy Arena are key drivers in Galaxy Entertainment's non-gaming growth. These venues are attracting substantial crowds and generating considerable revenue through major concerts and MICE (Meetings, Incentives, Conferences, and Exhibitions) events. This surge in entertainment offerings clearly indicates a high-growth trajectory for this segment.

In 2024, Galaxy Entertainment Group successfully hosted 460 live events, a testament to their commitment to diversifying entertainment. This included highly anticipated concerts and significant international gatherings like the ITTF World Cup Macao 2025. Such a robust event calendar highlights the strategic expansion beyond traditional gaming.

The impact of this entertainment focus is evident in the 64% year-on-year increase in foot traffic to Galaxy Macau during the first quarter of 2025. This impressive growth solidifies the GICC and Galaxy Arena's position as market leaders in the rapidly expanding non-gaming entertainment sector.

Galaxy Entertainment Group is making strong inroads in Macau's premium mass gaming sector, a key area of growth as the market continues its recovery. This segment is particularly attractive due to its high-value players.

The company's performance in Q1 2024 highlights this success, with Mass Gross Gaming Revenue (GGR) for GEG surging by 57% compared to the previous year. This substantial increase demonstrates GEG's ability to capture and retain these valuable customers.

Galaxy's commitment to providing superior entertainment and service experiences is a significant factor in drawing premium mass players. These offerings differentiate GEG and directly contribute to its revenue expansion in this lucrative market segment.

The luxury retail and high-end food & beverage at Galaxy Macau are cornerstones of GEG's premium offering, demonstrating robust expansion as tourism rebounds. These non-gaming segments, crucial to the resort's appeal, saw a significant 19% increase in revenue during 2024, underscoring their growing importance.

These sophisticated retail and dining experiences are attracting a discerning, high-spending demographic, solidifying Galaxy Macau's dominant position within the expanding luxury market segment.

Strategic Non-Gaming Activations & Entertainment

Galaxy Entertainment Group (GEG) is actively diversifying its revenue streams through strategic non-gaming activations and entertainment, positioning itself as a leader in the tourism and entertainment sector. This approach goes beyond traditional casino offerings, focusing on creating a comprehensive visitor experience.

GEG's commitment to entertainment is evident in its robust event calendar. In 2024, the company hosted over 50 concert nights and a significant number of major sports events. These spectacles are instrumental in attracting a broader demographic of visitors, thereby enhancing overall visitation numbers and spending.

This "tourism + entertainment" strategy is proving to be a powerful growth engine for GEG. By offering a rich tapestry of experiences, the company is not only differentiating itself from competitors but also capturing a larger share of the burgeoning leisure market.

- Diversified Entertainment Portfolio: GEG hosts over 50 concert nights annually, alongside major sporting events, attracting a wider audience beyond gaming patrons.

- Tourism + Entertainment Focus: This strategy is a key growth driver, aiming to establish market leadership in integrated resort experiences.

- Visitor Base Expansion: Non-gaming entertainment initiatives are designed to attract a diverse and growing visitor base to its properties.

- Revenue Stream Enhancement: These activations contribute significantly to overall revenue, reducing reliance solely on gaming income.

Luxury Hotel Brands Recently Added (Raffles, Andaz)

The recent integration of Raffles and Andaz Macau into Galaxy Macau's portfolio, as part of Phase 3 development, positions these luxury hotel brands as emerging Stars within the BCG Matrix. These properties are currently in a high-growth phase, actively building market presence and customer loyalty. Their expansion directly supports Galaxy Macau's strategy to solidify its standing as a premier integrated resort destination.

The ramp-up phase for Raffles and Andaz Macau is crucial for their long-term success. As of the latest available data, occupancy rates are steadily increasing, reflecting growing brand recognition. This upward trajectory suggests a strong potential to capture significant market share within the competitive luxury hospitality sector.

- Raffles and Andaz Macau are key additions to Galaxy Macau's luxury offerings.

- These brands are in their growth phase, indicating high potential.

- Their increasing popularity contributes to Galaxy Macau's comprehensive luxury appeal.

- Successful integration signals a strengthening market position in high-end hospitality.

The Raffles and Andaz Macau properties represent emerging Stars in Galaxy Entertainment's portfolio. These luxury hotels are experiencing robust growth and increasing market penetration, aligning with the company's strategy to expand its non-gaming offerings. Their current high-growth trajectory suggests a strong potential to become future cash cows.

In 2024, Galaxy Entertainment Group saw a significant uplift in its luxury hotel segment, with occupancy rates for its newest additions like Raffles and Andaz Macau showing a steady upward trend throughout the year. This growth is directly linked to the increasing demand for premium integrated resort experiences.

The successful integration of these brands into Galaxy Macau's ecosystem is a key indicator of their Star status. They are actively attracting a high-spending demographic, contributing to the overall diversification of revenue streams and solidifying Galaxy's position in the luxury hospitality market.

These hotels are instrumental in enhancing Galaxy Macau's appeal as a comprehensive luxury destination, drawing in visitors seeking high-quality accommodation and service. Their expansion is a critical component of Galaxy's long-term vision for market leadership.

| Property | Growth Rate (Est. 2024) | Market Share (Est. 2024) | Contribution to Non-Gaming Revenue | BCG Matrix Status |

| Raffles Macau | High | Growing | Significant | Star |

| Andaz Macau | High | Growing | Significant | Star |

What is included in the product

Galaxy Entertainment's BCG Matrix analyzes its portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

Galaxy Entertainment's BCG Matrix offers a clear, one-page overview, relieving the pain of strategic uncertainty by pinpointing each business unit's market position.

Cash Cows

Galaxy Macau's core mass gaming operations are the undisputed cash cows for Galaxy Entertainment Group. These operations are the primary engine for revenue and earnings, consistently churning out significant cash flow for the entire organization.

In 2024, the dominance of Galaxy Macau was starkly evident, contributing over 80% of the group's EBITDA. This highlights its substantial market share within the mature Macau gaming sector, underscoring its stability and profitability.

Further solidifying its cash cow status, Galaxy Macau reported HK$9.1 billion in revenue for Q1 2025. Coupled with high occupancy rates, this performance confirms its position as a reliable and highly profitable asset for the group.

The established hotel portfolio at Galaxy Macau, featuring seven premium brands, consistently operates at near-100% occupancy. This high utilization rate across properties like Galaxy Hotel, Banyan Tree, Hotel Okura, JW Marriott, and The Ritz-Carlton underscores their status as cash cows. These hotels are mature, dominant players in the premium hospitality market, generating substantial and stable revenue streams with strong profit margins.

Galaxy Macau's integrated resort model, a powerhouse of gaming, hospitality, retail, and entertainment, functions as a true cash cow. This synergistic approach allows Galaxy Entertainment Group (GEG) to consistently generate substantial cash flow by maximizing revenue across its diverse offerings in a mature market.

The resort's diversified amenities effectively buffer the inherent cyclicality of gaming revenue. This broad appeal ensures a steady stream of visitors, contributing to strong and predictable financial performance for GEG.

In 2024, Galaxy Macau continued to demonstrate its cash-generating prowess. For the first quarter of 2024, GEG reported total revenue of HK$18.7 billion, with the Macau operations being the primary driver of this growth.

Steady Cash Flow from Gaming and Non-Gaming

Galaxy Entertainment Group showcases robust financial health, underscored by substantial cash reserves and a consistent dividend policy. As of March 31, 2025, the company held HK$33.0 billion in cash and liquid assets, a testament to its operational efficiency. This strong liquidity position allowed for the recommendation of a final dividend of HK$0.50 per share, scheduled for payment in June 2025.

- Strong Liquidity: HK$33.0 billion in cash and liquid assets as of March 31, 2025.

- Dividend Payout: Recommended final dividend of HK$0.50 per share in June 2025.

- Operational Efficiency: Cash generation consistently exceeds consumption.

High Overall Market Share in Macau

Galaxy Entertainment Group (GEG) commands a dominant position in Macau's gaming sector, consistently holding over 20% market share as of early Q4 2024. This robust standing in a mature yet recovering market means GEG is well-positioned to capitalize on any upswings in the broader industry.

The company's strategic advantage is further underscored by its performance in Q2 2024, where it was recognized as Macau's largest market share gainer. This achievement solidifies GEG's role as a leader within the competitive Macau landscape.

- Market Share Dominance: GEG consistently secured over 20% of the Macau gaming market share in early Q4 2024.

- Industry Beneficiary: Its strong position allows it to benefit directly from overall Macau gaming industry growth.

- Market Share Gains: GEG emerged as the top market share gainer in Macau during Q2 2024.

Galaxy Macau's mass gaming operations are the bedrock of Galaxy Entertainment Group's financial strength, consistently generating substantial cash flow. In 2024, these operations were pivotal, contributing over 80% of the group's EBITDA, a clear indicator of their stability and profitability within the mature Macau market.

The integrated resort model, encompassing gaming, hospitality, and retail, further bolsters its cash cow status. This diversification, coupled with high occupancy rates across its seven premium hotel brands, ensures a steady and predictable revenue stream, solidifying its position as a reliable profit engine for GEG.

With HK$33.0 billion in cash reserves as of March 31, 2025, and a consistent dividend payout policy, GEG demonstrates robust financial health directly attributable to its cash cow assets. These operations consistently generate more cash than they consume, supporting the group's overall financial stability and growth initiatives.

| Asset | Contribution to EBITDA (2024) | Q1 2025 Revenue | Hotel Occupancy (2025) |

|---|---|---|---|

| Galaxy Macau (Mass Gaming) | > 80% | HK$9.1 billion | N/A (focus on gaming) |

| Galaxy Macau (Hotel Portfolio) | Significant contributor | N/A (integrated revenue) | Near 100% |

Preview = Final Product

Galaxy Entertainment BCG Matrix

The BCG Matrix for Galaxy Entertainment you are currently previewing is the identical, fully formatted document you will receive immediately after purchase. This means you're seeing the actual strategic analysis, complete with all data points and professional design, ready for your immediate use without any watermarks or demo content.

Dogs

StarWorld Macau's gaming operations are currently positioned as a Dog in the BCG Matrix. Revenue saw a 9% year-on-year decline in Q1 2025, with EBITDA falling by 20%, largely attributed to unfavorable gaming outcomes and property enhancements.

Despite strong hotel occupancy, the gaming segment's performance suggests a diminished market share within Macau's highly competitive casino environment. Galaxy Entertainment Group (GEG) is undertaking substantial upgrades to StarWorld's primary gaming floor and lobby, signaling a need for significant capital infusion to revitalize its market position.

Broadway Macau, situated within Galaxy Entertainment's portfolio, is currently positioned as a 'Dog' in the BCG Matrix. In 2024, it posted a modest Adjusted EBITDA of HK$24 million, signaling very low profitability and a consequently small market share. This financial performance indicates that Broadway Macau neither generates significant cash nor requires substantial investment, suggesting it might be a prime candidate for a strategic review or a decision to maintain minimal capital allocation.

Within Galaxy Entertainment Group's (GEG) diverse food and beverage portfolio, certain established or older outlets might be experiencing a slowdown. While GEG's overall F&B segment is robust, these specific locations may not be drawing the crowds or generating the revenue expected, placing them in the Dogs quadrant of the BCG matrix.

This underperformance is a key consideration as GEG actively plans to enhance its F&B offerings. For instance, initiatives at properties like StarWorld are focused on upgrading existing dining experiences and introducing new concepts. This strategic move indicates a recognition that some current F&B outlets need revitalization to stay competitive and meet evolving consumer preferences.

Traditional VIP (Junket) Gaming Segment

The traditional VIP or junket gaming segment in Macau is experiencing a prolonged period of subdued growth. This is largely a consequence of evolving regulatory landscapes and a strategic pivot by operators towards the more robust mass and premium mass gaming sectors.

S&P Global's projections for 2025 suggest that VIP volume is expected to remain stagnant at its current low levels. This outlook is contingent on the absence of significant regulatory shifts, firmly positioning this segment as a low-growth, low-market-share category for gaming enterprises.

- Low Growth Prospects: Regulatory changes and a market shift have curtailed expansion opportunities.

- Stagnant Volume Forecast: S&P Global anticipates VIP volume to stay near current lows in 2025.

- Strategic Focus Shift: Operators are prioritizing mass and premium mass segments over VIP.

- Market Position: The segment is characterized by low growth and low market share for operators.

Less Profitable Niche Gaming Areas

Certain niche gaming areas or older gaming terminals within Galaxy Entertainment Group's (GEG) resort complexes might represent less profitable segments. These areas, perhaps those not drawing significant player volume or generating high revenue, could be candidates for re-evaluation. For instance, while GEG is actively investing in technologies like smart tables to boost efficiency and player engagement, any legacy gaming facilities that remain unoptimized or see insufficient play would align with this description.

GEG's strategic emphasis on mass Gross Gaming Revenue (GGR) growth suggests that resources and attention are primarily directed towards these higher-performing segments. Consequently, less prioritized areas, even within a large resort, may exhibit lower profitability. For example, in 2024, GEG reported a significant portion of its revenue from its mass market operations, underscoring the focus on these core segments over potentially underperforming niche areas.

- Underperforming Niche Gaming: Areas with low player traffic and revenue generation.

- Legacy Terminals: Older gaming machines not optimized for current player preferences or efficiency.

- Strategic Prioritization: GEG's focus on mass GGR growth means these areas receive less investment and attention.

- Efficiency Measures: While smart tables are being deployed, legacy systems in less popular zones may lag behind.

The traditional VIP gaming segment within Macau, including operations that might fall under Galaxy Entertainment Group's (GEG) umbrella, is firmly in the 'Dog' category. This is due to a significant market shift away from VIP players towards mass market segments. S&P Global projected in 2025 that VIP volume would remain stagnant, reflecting low growth and a diminished market share for this segment.

Certain older or less popular gaming terminals and niche gaming areas within GEG's properties can also be classified as Dogs. These areas experience low player volume and revenue, especially as the company prioritizes investment in modern technologies like smart tables and focuses on the more lucrative mass market GGR. For example, GEG’s 2024 financial reports highlighted the strong performance of its mass market operations, indirectly indicating the underperformance of other segments.

Broadway Macau, a part of GEG's portfolio, also resides in the 'Dog' quadrant. Its 2024 Adjusted EBITDA of HK$24 million signifies low profitability and a small market share, suggesting it neither generates substantial cash nor demands significant investment, making it a candidate for strategic review.

StarWorld Macau’s gaming operations are also positioned as Dogs. A 9% year-on-year revenue decline in Q1 2025 and a 20% EBITDA fall, partly due to property enhancements, highlight its struggles in Macau's competitive casino landscape. Despite strong hotel occupancy, the gaming segment's performance indicates a need for substantial capital to revitalize its market position.

Question Marks

Galaxy Macau Phase 4, slated for completion around 2027, represents a significant strategic investment focusing on non-gaming attractions like new luxury hotels and a 5,000-seat theater. This expansion is designed to diversify revenue streams and capture future market growth.

Currently, as an ongoing development project, Galaxy Macau Phase 4 has no market share and is in a high investment phase. Its potential is substantial, but it requires considerable capital outlay before it can contribute to the company's revenue or market position.

Capella at Galaxy Macau, with its recent soft launch of 100 suites and sky villas and full operational readiness anticipated in mid-2025, represents a potential Star in the Galaxy Entertainment portfolio. Its positioning in the ultra-luxury segment taps into a high-growth market, aiming to attract affluent travelers seeking exclusive experiences.

As a new venture, Capella faces the challenge of building brand recognition and market share in a competitive landscape. Significant investment in marketing and operational excellence will be crucial for its transition from a question mark to a recognized leader, mirroring the trajectory of successful luxury brands.

Galaxy Entertainment Group's (GEG) proposed high-tech branded and immersive theme park is a bold venture into a high-growth, albeit currently non-existent, market segment. This initiative aims to capture a new demographic of visitors, differentiating GEG from traditional entertainment offerings.

As a nascent concept, the theme park represents a significant investment in future diversification, with zero current market share. Realizing this vision will necessitate substantial capital outlay and crucial collaboration with governmental bodies for approvals and support.

New Diversification Initiatives Beyond Gaming and Traditional Hospitality

Galaxy Entertainment Group is actively pursuing diversification beyond its core gaming and hospitality operations. This strategic pivot targets new ventures within the broader leisure and entertainment landscape, aiming to capture emerging high-growth opportunities. These initiatives, while promising, are in their nascent stages, currently possessing minimal market share and necessitating substantial investment to establish a foothold.

- Diversification Strategy: Galaxy Entertainment is expanding into new leisure and entertainment sectors, moving beyond its established gaming and hospitality base.

- Growth Prospects: These new ventures are positioned as high-potential growth areas within the evolving entertainment industry.

- Current Market Position: The initiatives currently hold a low or negligible market share, indicating early-stage development.

- Investment Needs: Significant strategic investment and meticulous execution are required to validate and grow these new diversification efforts.

Targeting International Visitor Segments (beyond Greater China)

Macau's strategic push to diversify its tourism base beyond Greater China presents a significant opportunity for Galaxy Entertainment Group (GEG). The region is targeting 3 million overseas visitors by 2025, a goal that GEG is well-positioned to capitalize on through its extensive portfolio of world-class entertainment and luxury accommodations.

While mainland China and Hong Kong continue to be GEG's core markets, the growth potential in other international segments is substantial. This demographic, currently representing a smaller visitor share, signifies a high-growth, lower-share quadrant within the BCG matrix, making it an ideal area for strategic investment and development.

- Target: 3 million overseas visitors by 2025.

- GEG's luxury and entertainment offerings are key attractors for international tourists.

- This segment is a high-growth, lower-share market, indicating strong potential for increased market penetration.

- Diversifying visitor sources reduces reliance on traditional markets and enhances overall resilience.

Galaxy Entertainment Group's new ventures, like the high-tech theme park and Phase 4 of Galaxy Macau, are currently in the Question Mark category. They require substantial investment to build market share in potentially high-growth areas.

These initiatives, including the Capella ultra-luxury suites, represent future growth drivers but have minimal current market penetration. Success hinges on strategic execution and capturing emerging market segments.

The company's focus on attracting 3 million overseas visitors by 2025 highlights a strategic move into a lower-share, high-growth international market. This diversification is key to their long-term strategy.

Ultimately, these Question Marks are GEG's bets on future revenue streams, demanding careful management and significant capital to transform them into Stars or Cash Cows.

| Venture | Category | Current Market Share | Investment Required | Growth Potential |

|---|---|---|---|---|

| Galaxy Macau Phase 4 | Question Mark | Negligible | High | High |

| Capella at Galaxy Macau | Question Mark | Low | Medium | High |

| Theme Park Initiative | Question Mark | Zero | Very High | High |

| International Visitor Segment | Question Mark | Low | Medium | High |

BCG Matrix Data Sources

Our Galaxy Entertainment BCG Matrix is built upon a foundation of comprehensive financial disclosures, including annual reports and investor presentations, alongside robust market research and industry growth forecasts.