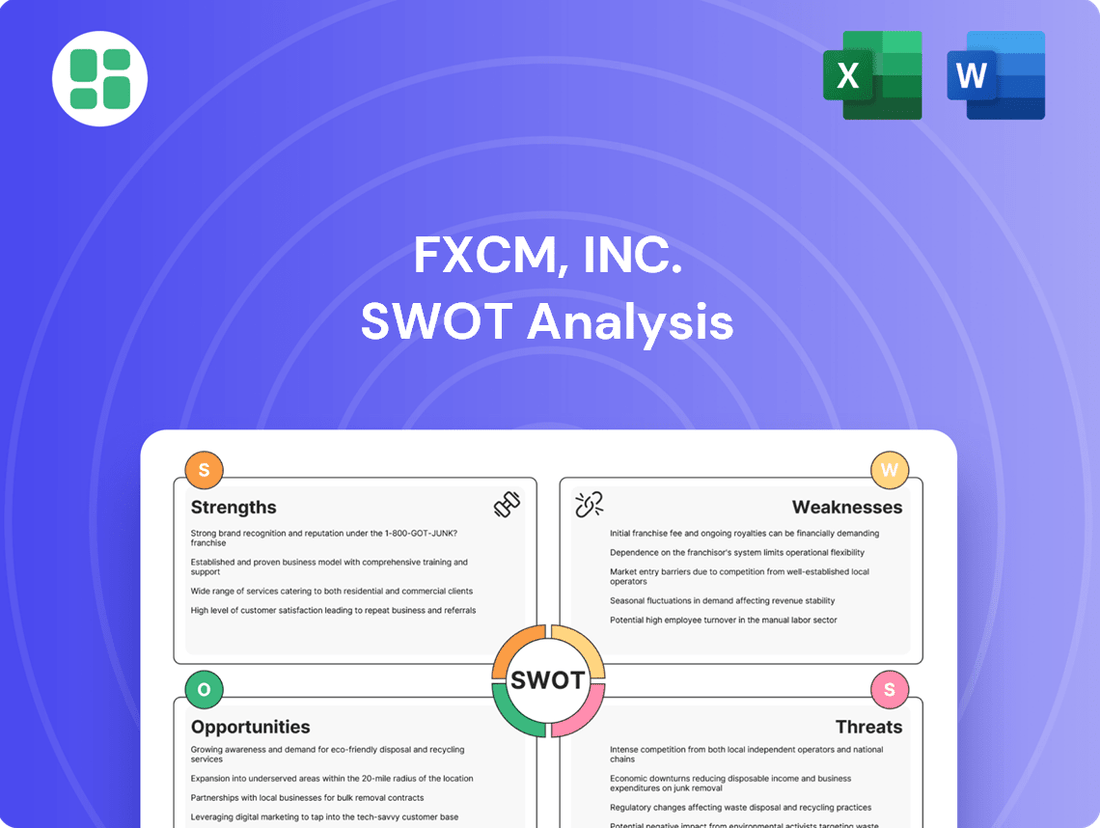

FXCM, Inc. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FXCM, Inc. Bundle

FXCM, Inc. navigates the competitive forex market with established brand recognition but faces intense pressure from rivals and evolving regulatory landscapes. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on opportunities within this sector.

Want the full story behind FXCM's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

FXCM's robust regulatory compliance is a significant strength, operating under the watchful eyes of multiple Tier-1 authorities like the FCA, CySEC, ASIC, and FSCA. This comprehensive oversight, which has been a cornerstone of FXCM's operations throughout 2024 and into 2025, provides a high degree of trust and security for its international customer base. Adherence to these strict financial standards and investor protection protocols is paramount in the forex market.

FXCM's strength lies in its diverse and advanced trading platform offerings, including its proprietary Trading Station, the industry-standard MetaTrader 4, and integrations with popular third-party tools like TradingView and Capitalise AI. This multi-platform approach ensures a broad appeal, accommodating traders of all experience levels, from those just starting out to sophisticated users focused on algorithmic trading and complex charting.

FXCM stands out with its competitive pricing, especially for active traders. For instance, their average EUR/USD spreads are notably low, often cited around 0.6 pips, making it a cost-effective choice for frequent forex transactions.

High-volume traders can further benefit from VIP discounts and rebate programs, such as the Active Trader Rebate Program, which can significantly reduce trading costs. This structure directly rewards consistent activity and larger trade volumes.

Furthermore, FXCM offers zero-commission trading on a range of products, including certain CFDs, shares, and cryptocurrencies. This commission-free model enhances affordability for a broad spectrum of traders looking to diversify their portfolios without incurring extra fees.

Extensive Educational Resources and Dedicated Support

FXCM is recognized for its robust educational platform, offering a wealth of resources like webinars, video tutorials, and an extensive investor dictionary. This makes it an excellent choice for individuals new to trading, providing them with the foundational knowledge required to navigate the markets. Its commitment to user education is a significant advantage.

The broker complements its educational materials with dedicated 24/5 customer support, ensuring traders receive timely assistance. Furthermore, FXCM equips its users with valuable trading tools and proprietary data, fostering an environment where knowledge and support converge to enhance trading success. This dual focus on learning and practical application is a key strength.

- Comprehensive Educational Library: Access to webinars, video tutorials, and an investor dictionary.

- 24/5 Customer Support: Dedicated assistance available throughout the trading week.

- Proprietary Trading Tools: Access to unique data and analytical instruments.

- Beginner-Friendly Approach: Resources tailored to help new traders learn and grow.

Broad Range of Tradable Instruments

FXCM, Inc. offers a significant advantage through its broad range of tradable instruments, providing clients with access to over 70 distinct financial assets. This extensive selection includes major and minor currency pairs, a variety of indices, commodities, and cryptocurrencies offered as Contracts for Difference (CFDs).

This wide variety empowers clients to diversify their investment portfolios effectively and seize opportunities across different global markets. For instance, in 2024, FXCM continued to expand its CFD offerings, reflecting a commitment to providing a comprehensive trading environment that caters to diverse investor needs and market trends.

- Over 70 Tradable Instruments: Access to a diverse asset universe.

- Currency Pairs: Trading major and minor forex markets.

- Indices and Commodities: Opportunities in global equity and raw material markets.

- Cryptocurrencies (CFDs): Exposure to digital asset volatility.

FXCM's strength is its comprehensive regulatory framework, holding licenses from top-tier bodies like the FCA, CySEC, and ASIC. This ensures a high level of trust and security for its global clientele throughout 2024 and into 2025. Their commitment to strict financial standards is a key differentiator in the forex market.

What is included in the product

Analyzes FXCM, Inc.’s competitive position through key internal and external factors, highlighting its strengths in technology and market reach while addressing weaknesses in regulatory scrutiny and opportunities in emerging markets.

Offers a clear, actionable SWOT analysis of FXCM, Inc. to identify and address critical business challenges.

Weaknesses

FXCM's exclusion of MetaTrader 5 (MT5) support is a notable weakness, particularly as MT5 has gained traction for its advanced charting tools and algorithmic trading capabilities. This omission potentially alienates a portion of the trading demographic who actively seek out or are accustomed to using MT5.

While FXCM offers other robust platforms, the lack of MT5 integration means it misses out on attracting traders who consider it a primary or essential trading environment. This is a competitive disadvantage in a market where platform choice is a significant factor for many.

FXCM's product portfolio, while offering around 70+ instruments or 440 tradeable symbols, falls short when measured against the extensive offerings of major industry players. This narrower selection may limit options for investors who prioritize access to a wider array of asset classes.

While FXCM provides attractive pricing for high-volume traders, those who don't trade frequently might find its standard fees to be on the higher side compared to competitors. This tiered approach, favoring active participants with discounts and rebates, can present a less appealing cost structure for casual or beginner traders who don't meet the volume thresholds for these benefits.

Trailing in Research and Educational Leadership

While FXCM offers a good amount of educational content, some industry observers note that its research and educational resources might not be as advanced as those from leading competitors like IG or Saxo. This could potentially affect its attractiveness to traders who prioritize top-tier market analysis and learning tools.

For instance, while FXCM had a significant presence in retail forex trading, competitor analysis in late 2023 and early 2024 often highlighted the extensive, in-depth research reports and live educational webinars provided by firms such as IG, which are frequently cited as benchmarks in the industry.

- Research Depth: Competitors like IG and Saxo are often lauded for their more sophisticated and frequently updated market research, including proprietary analysis and economic calendars.

- Educational Breadth: While FXCM provides educational materials, some reviews suggest a gap in the breadth and depth of advanced trading courses and live educational sessions compared to market leaders.

- Trader Preference: Advanced traders and those focused on continuous learning may gravitate towards platforms offering more specialized educational content and cutting-edge analytical tools.

Potential Financial Performance Concerns

Public financial data for Global Brokerage Inc., the parent company of FXCM, revealed a negative trailing twelve-month revenue of approximately -$10.2 million for fiscal year 2023. This figure, while encompassing the entire group, raises questions about the overall financial health and could indicate underlying pressures that might indirectly affect FXCM's operational capacity and investment in growth.

While FXCM is a distinct operating entity, the group's financial performance can influence its access to capital and strategic flexibility. For instance, a negative revenue trend at the parent level might lead to tighter financial controls or reduced R&D budgets, potentially impacting FXCM's competitive edge.

The financial performance of the broader group is a key consideration for stakeholders evaluating FXCM's long-term viability and potential for expansion. Understanding these group-level dynamics is crucial for a comprehensive assessment.

FXCM's product range, while offering around 440 tradeable symbols, is less extensive than many major competitors, potentially limiting options for traders seeking a wider variety of assets. Furthermore, its standard trading fees can be higher for less active traders, as discounts are often geared towards high-volume participants. The platform's absence of MetaTrader 5 (MT5) support also excludes a segment of traders who prefer or rely on this popular trading environment.

| Weakness | Description | Impact |

| Limited Instrument Variety | Offers approximately 440 tradeable symbols, fewer than many leading brokers. | May restrict portfolio diversification for traders seeking a broad asset selection. |

| Standard Fee Structure | Standard fees can be higher for low-volume traders compared to competitors. | Less attractive for casual or beginner traders who do not qualify for volume-based discounts. |

| No MetaTrader 5 (MT5) Support | Does not integrate with the widely used MT5 platform. | Alienates traders who prefer or require MT5 for its advanced charting and algorithmic trading features. |

Full Version Awaits

FXCM, Inc. SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're getting an accurate look at the FXCM, Inc. SWOT analysis, including its Strengths, Weaknesses, Opportunities, and Threats. Purchase unlocks the complete, in-depth report for your strategic planning needs.

Opportunities

The global Contracts for Difference (CFD) market is experiencing robust expansion, with projections indicating continued growth through 2025. This surge is largely fueled by a rising tide of retail investors entering financial markets and ongoing innovations in trading platforms and accessibility.

This expanding market presents a significant opportunity for FXCM to solidify its position and attract a broader client base. By leveraging its established reputation and technological capabilities, FXCM can aim to capture a larger share of this burgeoning sector.

For instance, the retail trading sector saw substantial inflows in 2024, with many new traders seeking accessible platforms. This trend is expected to persist, offering FXCM a fertile ground for client acquisition and revenue growth.

Emerging markets across Asia-Pacific, Latin America, and Africa are showing significant economic growth and expanding internet access, fueling a surge in demand for financial trading services. FXCM can capitalize on this by broadening its global reach and accessing a new base of potential clients eager to engage in forex and CFD trading.

The cryptocurrency market's inherent volatility, coupled with the potential for substantial returns, is drawing in a fresh wave of traders. This trend presents a significant opportunity for FXCM.

By expanding its offerings to include a diverse array of cryptocurrency CFDs, FXCM can effectively tap into this escalating demand. This strategic move is poised to attract both individual retail investors and larger institutional players eager to gain exposure to digital assets.

For instance, the global cryptocurrency market capitalization reached approximately $2.5 trillion in early 2024, underscoring the scale of this burgeoning sector and the potential client base for FXCM's CFD products.

Integration of AI and Advanced Trading Technologies

The growing use of AI and machine learning in trading platforms offers significant opportunities. These technologies enable personalized insights, automated strategies, and deeper market analysis, which can attract a more sophisticated client base. For instance, by Q1 2025, the global AI in finance market was projected to reach $30 billion, indicating substantial growth and client interest in AI-driven solutions.

FXCM can capitalize on this trend by enhancing its platform with advanced AI capabilities. This would involve developing more sophisticated algorithmic trading tools and providing clients with data-driven market predictions. Such advancements are crucial for staying competitive, especially as competitors increasingly adopt similar technologies.

- Enhanced Client Experience: AI can personalize trading recommendations and provide real-time market sentiment analysis.

- Automated Trading Strategies: Implementing AI-powered bots can offer clients automated execution and strategy optimization.

- Improved Risk Management: Machine learning algorithms can detect anomalies and predict potential market risks more effectively.

- Competitive Edge: Integrating cutting-edge tech can attract and retain clients seeking advanced trading tools.

Leveraging Multi-Asset Trading Platforms

The introduction of new multi-asset trading platforms, like Tradu by FXCM's parent company, presents a significant opportunity for FXCM, Inc. This allows the company to move beyond its core forex and CFD offerings and incorporate a wider array of tradable assets, including equities and other financial instruments.

This strategic expansion into multi-asset trading can attract a more diverse client base, appealing to investors seeking a single platform for various investment needs. By offering a broader selection of assets, FXCM can enhance its competitive position and increase client retention.

The global multi-asset trading market is experiencing robust growth. For instance, the total value of retail trading across all asset classes is projected to reach trillions of dollars annually by 2025, indicating a substantial market for platforms that can cater to a wide range of investor preferences.

- Diversification of Asset Offerings: Expanding beyond forex and CFDs to include equities, bonds, and other instruments.

- Broader Client Acquisition: Attracting new demographics of investors who prefer integrated trading solutions.

- Enhanced Client Value Proposition: Offering a one-stop-shop for trading, potentially increasing user engagement and loyalty.

- Market Share Growth: Capitalizing on the increasing demand for multi-asset platforms in the retail trading sector.

The expanding global CFD market, projected for continued growth through 2025, offers FXCM a prime opportunity to increase its client base and market share. This growth is driven by a rising number of retail investors and advancements in trading technology, with retail trading seeing significant inflows in 2024.

Emerging markets present a substantial growth avenue for FXCM, as countries in Asia-Pacific, Latin America, and Africa show increasing economic development and internet penetration, leading to a higher demand for financial trading services.

The cryptocurrency market's volatility and potential for high returns are attracting new traders, creating an opportunity for FXCM to expand its offerings to include a diverse range of cryptocurrency CFDs, appealing to both retail and institutional investors.

AI and machine learning integration in trading platforms presents a chance for FXCM to attract sophisticated clients by offering personalized insights and advanced market analysis, especially as the AI in finance market was projected to reach $30 billion by Q1 2025.

The development of multi-asset trading platforms, like Tradu, allows FXCM to broaden its appeal beyond forex and CFDs, attracting a more diverse clientele seeking integrated trading solutions for various financial instruments, tapping into a market expected to handle trillions in retail trading volume by 2025.

Threats

The burgeoning Contracts for Difference (CFD) market has triggered a significant increase in global regulatory oversight. Jurisdictions are actively tightening their grip, implementing more stringent rules and compliance requirements. This intensified scrutiny poses a direct threat to FXCM, potentially leading to higher operational costs and limitations.

For instance, the European Securities and Markets Authority (ESMA) has consistently reviewed and reinforced its measures on CFD product intervention, including leverage limits and negative balance protection. In 2023, many European regulators continued to enforce these strict rules, impacting how firms like FXCM can market and offer CFDs. This trend is likely to persist and even expand to other regions, demanding substantial investment in compliance infrastructure and potentially restricting business growth avenues.

The online brokerage space is incredibly crowded, with both legacy players and agile newcomers vying for market share. This intense rivalry often forces firms like FXCM to compete on price, squeezing their profit margins on crucial revenue sources like spreads and commissions.

The pressure on spreads is a significant concern. For instance, in the competitive forex market, average retail spreads can be as low as 0.1 pips for major currency pairs, a stark contrast to earlier periods. This compression directly impacts FXCM's ability to generate revenue from its core trading services.

Global macroeconomic pressures, including persistent inflation and currency instability, are significant drivers of market volatility. Geopolitical tensions, such as ongoing conflicts and trade disputes, further exacerbate these uncertainties, creating unpredictable swings in currency markets. For FXCM, this volatility can impact trading volumes and revenue stability, as seen in the fluctuating economic landscapes of 2024 and projected into 2025.

Shifting Trader Preferences on Leverage

Retail forex traders are increasingly shying away from high leverage. This trend is driven by a combination of factors, including heightened market volatility and stricter regulations on leverage limits imposed by financial authorities. For instance, the UK's Financial Conduct Authority (FCA) has had leverage restrictions in place since 2019, and similar measures have been adopted by other regulators globally.

This shift away from high-leverage trading could directly impact brokers like FXCM. Reduced leverage often translates to lower trading volumes as traders may need larger capital outlays for the same position size. Consequently, this could alter the revenue streams for brokers, potentially affecting their profitability and business models. FXCM, like other retail FX providers, needs to adapt to this evolving trader preference to maintain its competitive edge.

- Reduced Leverage Appetite: Retail traders are moving towards lower leverage ratios due to increased market uncertainty and regulatory pressures.

- Impact on Volumes: A decrease in leverage can lead to lower trading volumes, as traders may require more capital to enter positions.

- Revenue Model Adjustments: Brokers may need to recalibrate their revenue models, which often rely on trading commissions and spreads influenced by trading activity.

- Regulatory Influence: Stricter regulatory frameworks globally are a significant driver behind the shift in trader preferences regarding leverage.

Inherent Risk of CFD Trading and Negative Client Outcomes

The inherent risk in Contracts for Difference (CFDs) presents a significant threat. A substantial portion of retail trader accounts, often exceeding 60%, experience losses, underscoring the high-risk nature of these leveraged products. For instance, regulatory bodies frequently report that around 70% of retail CFD accounts lose money.

These negative client outcomes can severely impact FXCM's reputation, leading to a surge in customer complaints and potentially attracting stricter regulatory scrutiny. Such oversight often aims to shield less experienced investors from substantial financial harm, which could result in more restrictive trading conditions or increased compliance burdens.

- High Probability of Client Losses: Data consistently shows a significant majority of retail CFD traders incur losses, with figures often cited in the 66% to 73% range across various platforms and jurisdictions.

- Reputational Damage: A pattern of negative client outcomes directly affects brand perception, potentially deterring new clients and eroding trust among existing ones.

- Increased Regulatory Scrutiny: Regulators globally are increasingly focused on investor protection, particularly in leveraged products like CFDs. This can lead to investigations, fines, and mandated changes to business practices.

The global financial landscape is increasingly complex, with evolving regulatory frameworks posing a significant challenge. Stricter rules on leverage and product offerings, as seen with ESMA's continued focus on CFD interventions, can increase operational costs and limit business expansion for FXCM. This heightened regulatory environment demands substantial investment in compliance, potentially impacting profitability and growth strategies throughout 2024 and into 2025.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of credible data, including FXCM's official financial filings, comprehensive market research reports, and expert commentary from financial analysts to ensure a well-rounded and insightful assessment.