FXCM, Inc. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FXCM, Inc. Bundle

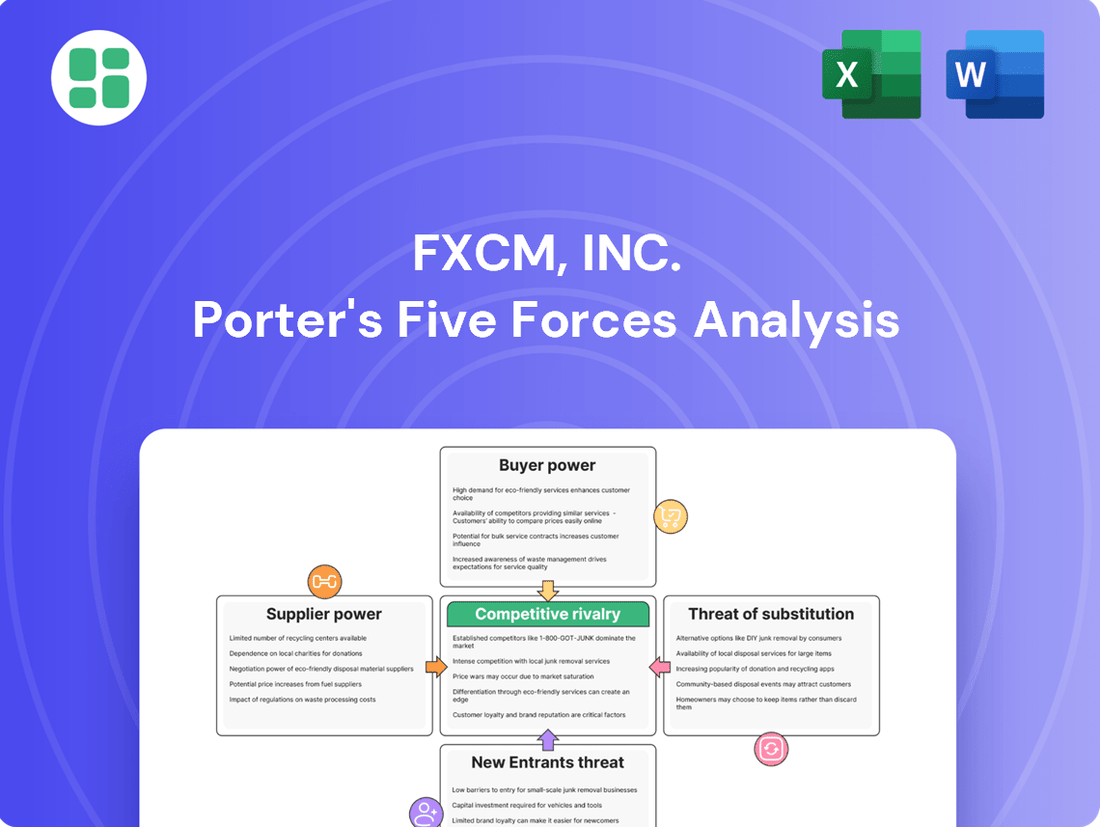

FXCM, Inc. operates in a dynamic forex and CFD trading landscape, where competitive pressures are intense. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating this market. Our analysis delves into the intensity of rivalry and the ever-present threat of substitutes, offering a comprehensive view of FXCM's strategic position.

The complete report reveals the real forces shaping FXCM, Inc.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of liquidity providers in the online forex and CFD market, including entities like B2BROKER, FXCM Pro, Finalto, and Swissquote, grants these major players significant bargaining power. These providers aggregate prices from numerous sources, and while the market has many participants, the deepest liquidity pools can be somewhat concentrated. This concentration means FXCM, like its competitors, must negotiate carefully to secure optimal spreads and execution speeds.

For FXCM, the costs associated with switching liquidity or technology providers are substantial. These include the expenses related to technical migration, rigorous testing phases, and the potential for temporary disruptions to their trading services. This complexity inherently strengthens the negotiating position of established suppliers, as the effort to change is considerable.

These switching costs are often amplified by the presence of long-term contracts and the integration of highly customized solutions. Such arrangements create deeper dependencies, making it significantly more challenging for FXCM to transition to alternative providers without incurring substantial penalties or operational hurdles.

The uniqueness of technology and data providers significantly influences FXCM's bargaining power with its suppliers. Key platforms like MetaTrader (MT4/MT5) and cTrader, along with specialized risk management and data analytics tools, offer services that are complex and costly for FXCM to develop internally. These providers hold leverage because their proprietary technology and data feeds are not easily substitutable.

While FXCM employs a diverse technology stack, including its own Trading Station, MetaTrader 4, and NinjaTrader, the reliance on certain external platforms for core trading functionalities grants these suppliers bargaining power. For instance, the widespread adoption and established user base of MT4/MT5 mean that switching providers for these specific platforms could disrupt operations and client experience, thereby enhancing the suppliers' negotiation position.

Regulatory Compliance Services

Suppliers of regulatory compliance services and legal expertise wield considerable influence over FXCM, Inc., particularly given the stringent regulatory landscape of the forex and CFD markets. The potential for severe penalties, loss of operating licenses, and significant reputational harm underscores the critical importance of these specialized providers. In 2024, the global financial services sector continued to see increased regulatory scrutiny, with fines for non-compliance reaching billions of dollars across various jurisdictions, highlighting the direct financial risk associated with regulatory failures.

The specialized knowledge and proven track record of these compliance partners are paramount, making a transition to new suppliers a high-risk endeavor. This reliance can translate into less favorable contract terms for FXCM, as the cost of switching and the potential disruption to operations are substantial deterrents. For instance, a major fintech regulatory consultancy reported a 15% increase in demand for its services in early 2024, indicating a market where expertise is highly valued and priced accordingly.

- High Switching Costs: The investment in onboarding new legal and compliance teams, including training and integration into existing systems, represents a significant barrier for FXCM.

- Critical Expertise: The highly specialized nature of forex and CFD regulations means that few alternative suppliers possess the necessary depth of knowledge and experience.

- Reputational Risk: Any lapse in compliance, even during a supplier transition, could severely damage FXCM's brand and customer trust.

- Regulatory Dependence: The ever-evolving regulatory environment necessitates ongoing support from established, reliable compliance partners.

Input Importance to Service Quality

The quality of service offered by FXCM is intrinsically linked to the performance of its suppliers, especially those providing liquidity and technological infrastructure. Issues like slow trade execution or unstable platforms stemming from supplier deficiencies directly diminish customer satisfaction and FXCM's market position.

This reliance on key partners, such as major liquidity providers and technology vendors, vests significant bargaining power in these suppliers. For instance, in 2024, the foreign exchange market saw continued consolidation among prime brokers and liquidity aggregators, potentially concentrating power in fewer hands.

- Supplier Dependence: FXCM's operational efficiency and service delivery are heavily reliant on its suppliers for critical functions like real-time price feeds and trading platform technology.

- Impact on Customer Experience: Any failure or underperformance by these suppliers, such as increased latency or wider spreads, can directly translate into a degraded experience for FXCM's retail and institutional clients.

- Market Dynamics: The 2024 landscape in financial technology and liquidity provision indicates a trend where a smaller number of robust providers can command greater influence due to the high barriers to entry and the specialized nature of their services.

The bargaining power of suppliers for FXCM, Inc. is substantial due to several factors. High switching costs, the critical and often unique nature of specialized services like regulatory compliance and technology platforms, and the direct impact supplier performance has on customer experience all contribute to this leverage. For example, the reliance on established technology providers like MetaTrader, coupled with the significant investment required to migrate, strengthens these suppliers' negotiating positions.

In 2024, the forex market continued to see a concentration of liquidity providers, meaning fewer entities can offer the deep liquidity FXCM needs. This consolidation, alongside the specialized regulatory expertise required in financial services, means FXCM faces suppliers with considerable influence. The potential for hefty fines for non-compliance, which reached billions globally in 2024, further amplifies the power of compliance service providers.

| Supplier Type | Bargaining Power Factor | Impact on FXCM |

|---|---|---|

| Liquidity Providers | Concentration of deep liquidity pools | Negotiation for better spreads and execution |

| Technology Providers (e.g., MT4/MT5) | Unique, proprietary platforms, high integration costs | Limited ability to switch without operational disruption |

| Regulatory Compliance Services | Specialized knowledge, high risk of non-compliance penalties | Increased reliance, potentially less favorable contract terms |

What is included in the product

This analysis of FXCM, Inc. examines the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within the online forex brokerage industry.

FXCM's Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making regarding competitive pressures.

Customers Bargaining Power

Traders in the online forex and CFD market generally face low switching costs. This is because many brokers provide comparable trading instruments, user-friendly platforms, and various account options, making it simple for clients to shift their business if they find better terms elsewhere.

For instance, a trader unhappy with FXCM's spreads or customer support can readily open an account with a competitor such as IG, Plus500, or Pepperstone. This ease of transition means FXCM must remain competitive in its offerings to retain its customer base.

The forex market's inherent transparency, where spreads and commissions are readily visible across numerous brokers, significantly amplifies customer price sensitivity. This means traders can effortlessly compare FXCM's pricing with that of its rivals, creating substantial pressure on FXCM to maintain competitive pricing to draw in and keep its client base. For instance, in early 2024, the average spread for EUR/USD on major forex platforms often hovered around 0.5-1.0 pips, a benchmark FXCM must actively contend with.

FXCM's revenue model is directly tied to these spreads and commissions. Consequently, any perceived disadvantage in pricing can have a direct and immediate impact on the company's profitability. A slight increase in spreads, even by a fraction of a pip, can deter a significant number of price-conscious retail traders, who collectively represent a substantial portion of FXCM's customer volume.

The sheer number of online brokerage options available to forex and CFD traders greatly empowers customers. With a market boasting over 3,800 active competitors, including many domestic and international players, finding a suitable alternative is remarkably easy.

This saturation means customers can quickly switch to another broker if FXCM's terms, fees, or services are not to their liking. The readily available alternatives ensure that customers hold significant leverage in negotiating better conditions or simply moving their business elsewhere.

Information Accessibility and Education

Customers are increasingly well-informed, a trend amplified by readily available financial news, market analysis, and educational content. This accessibility, often provided by brokers themselves or third-party platforms, significantly boosts their bargaining power.

With greater knowledge, clients can more effectively negotiate for superior services, sophisticated trading tools, and enhanced transparency from financial institutions like FXCM. For instance, FXCM actively supports its clientele with a wealth of educational materials and research insights, directly addressing this growing demand for informed decision-making.

- Increased Client Knowledge: Access to financial news and broker-provided education empowers traders.

- Demand for Better Services: Well-informed clients expect advanced tools and greater transparency.

- FXCM's Educational Offerings: FXCM provides extensive resources to meet client demand for knowledge.

- Leveraging Information: Customers use their understanding to negotiate better terms and services.

Demand for Advanced Trading Tools and Features

Sophisticated retail and institutional clients today expect more than just basic trading execution. They are actively seeking advanced tools, robust charting capabilities, and the flexibility of algorithmic trading. In 2024, the demand for seamless mobile trading experiences continues to grow, with many traders prioritizing platforms that allow them to manage their portfolios on the go.

Brokers that lag in offering these technological advancements face a significant risk of client attrition. This is because clients can easily switch to competitors providing superior platforms and features. For instance, a 2024 survey indicated that over 60% of active retail traders consider platform technology a primary factor in choosing a broker.

FXCM, Inc. addresses this by offering a suite of advanced trading platforms designed to meet diverse client needs. These include:

- MetaTrader 4 (MT4): A globally recognized platform known for its user-friendly interface and extensive charting tools.

- Trading Station: FXCM's proprietary platform offering real-time market data and advanced order management.

- NinjaTrader: A platform favored by active traders for its charting, backtesting, and automated trading capabilities.

The bargaining power of customers in the forex and CFD market is substantial, primarily due to low switching costs and the sheer volume of available brokers. Traders can easily move between platforms like FXCM, IG, or Plus500 if they find better pricing or services, making price competitiveness a critical factor for FXCM.

The transparency of forex spreads, often visible across multiple platforms, intensifies customer price sensitivity. For example, in early 2024, EUR/USD spreads typically ranged from 0.5 to 1.0 pips, a benchmark FXCM must actively match to retain clients.

With over 3,800 active competitors globally, customers have ample choices, empowering them to seek better terms. This market saturation means clients can readily switch brokers if FXCM's offerings are not satisfactory, giving them significant leverage.

Furthermore, increased client knowledge, fueled by readily available financial news and broker-provided educational content, enhances their bargaining power. Informed traders can more effectively demand superior services and transparency, a trend FXCM addresses through its extensive educational resources.

Same Document Delivered

FXCM, Inc. Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for FXCM, Inc., detailing the competitive landscape and strategic positioning within the forex and CFD trading industry. The document you see here is exactly what you’ll be able to download after payment, providing an in-depth examination of bargaining power of buyers and suppliers, threat of new entrants and substitutes, and the intensity of rivalry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ensuring you receive a complete and ready-to-use analysis.

Rivalry Among Competitors

The online forex and CFD brokerage landscape is incredibly crowded, featuring a vast array of global and regional competitors. Major players such as IG, Plus500, Saxo Bank, and Pepperstone are prominent, but FXCM also contends with thousands of other active brokers, creating a fiercely competitive environment.

While FXCM, Inc. and its competitors attempt to stand out with unique trading platforms, extensive educational materials, or specialized asset selections, the fundamental forex and CFD trading services often appear quite similar to the typical customer. This lack of strong perceived difference can fuel aggressive price wars, especially concerning trading spreads and commission fees, as brokers vie for market share.

The forex and CFD market is experiencing robust growth, with global trading volumes consistently high. Projections indicate the market size will continue to expand, reaching an estimated USD 10.72 trillion by 2027, up from USD 7.1 trillion in 2023. This expansion fuels intense competition as new entrants vie for market share and existing firms broaden their offerings.

This heightened competition translates into aggressive pricing strategies and increased marketing efforts among brokers like FXCM. The inherent volatility of currency and CFD markets further exacerbates this rivalry, as firms compete to attract and retain clients by offering superior trading platforms, tighter spreads, and enhanced customer support during periods of significant market movement.

Aggressive Marketing and Promotions

Brokers, including FXCM, frequently deploy aggressive marketing and promotional tactics. These often involve enticing bonuses, reduced spreads, or specialized trading tools designed to capture new clientele. This continuous promotional battle significantly inflates customer acquisition costs, thereby squeezing profit margins across the forex brokerage sector.

FXCM's competitive positioning inherently relies on its ability to offer compelling value propositions against rivals. For instance, in early 2024, many forex brokers were observed to be offering welcome bonuses that could range from $50 to $500, alongside competitive spreads that often started as low as 0.1 pips on major currency pairs like EUR/USD.

- High Customer Acquisition Costs: Aggressive marketing drives up the expense of attracting each new trader.

- Price Competition: Bonuses and low spreads become standard, intensifying price wars.

- Profitability Pressure: Constant promotional spending can erode net profit margins for brokers.

- Client Retention Challenges: Traders may switch brokers based on the latest promotional offers.

Exit Barriers and Consolidation

The foreign exchange brokerage industry, including players like FXCM, faces intense rivalry partly due to substantial exit barriers. High capital investments are required for advanced trading technology, obtaining and maintaining regulatory licenses across various jurisdictions, and acquiring new customers. These significant upfront and ongoing costs make it difficult for underperforming firms to simply exit the market gracefully, thereby keeping them in the competitive fray and contributing to sustained rivalry.

These high exit barriers mean that even struggling brokers often continue to operate, adding to the competitive pressure. For instance, in 2024, the global fintech market, which includes forex platforms, saw continued investment, with many firms needing to maintain cutting-edge technology to attract and retain clients. This ongoing need for technological advancement acts as a constant barrier to entry and a deterrent to easy exit.

While some consolidation does occur as larger, more established firms acquire smaller ones, the overall competitive landscape remains robust. The difficulty in exiting the market for many smaller players ensures a steady supply of competitors, even as the industry matures. This dynamic sustains a high level of rivalry, as firms fight for market share and client retention.

- High Capital Requirements: Significant investments in trading platforms, cybersecurity, and regulatory compliance create substantial financial hurdles for exiting firms.

- Regulatory Hurdles: Obtaining and transferring regulatory licenses is a complex and costly process, discouraging rapid departures.

- Customer Acquisition Costs: The ongoing expense of attracting and retaining clients means brokers must continue competing to recoup these investments.

- Market Saturation: Despite consolidation, the forex market remains crowded, with numerous brokers vying for a limited pool of active traders.

The competitive rivalry within the online forex and CFD brokerage sector is exceptionally high, with FXCM facing thousands of global and regional competitors. This intense competition is driven by a growing market, estimated to reach USD 10.72 trillion by 2027, fueling aggressive marketing and pricing strategies among brokers vying for market share.

Brokers like FXCM frequently offer incentives such as welcome bonuses, sometimes ranging from $50 to $500, and competitive spreads starting as low as 0.1 pips on major currency pairs in early 2024. This constant promotional battle leads to elevated customer acquisition costs and can pressure profit margins, making client retention a significant challenge as traders may switch for better offers.

Substantial exit barriers, including high capital investments in technology and regulatory compliance, keep even struggling firms in the market. This dynamic sustains a crowded competitive landscape where brokers must continuously innovate and offer compelling value to attract and retain clients, contributing to sustained rivalry.

| Competitor Type | Examples | Key Competitive Tactics | Impact on FXCM |

|---|---|---|---|

| Large Global Brokers | IG, Plus500, Saxo Bank | Brand recognition, extensive product offerings, advanced platforms | Forces FXCM to maintain competitive features and pricing |

| Niche/Regional Brokers | Various smaller firms | Specialized services, localized marketing, aggressive pricing | Can capture specific market segments, requiring FXCM to differentiate |

| New Entrants | Fintech startups | Innovative technology, disruptive pricing, digital marketing | Challenge established players, pushing for technological adoption |

SSubstitutes Threaten

Traditional investment vehicles such as direct stock purchases, mutual funds, ETFs, and bonds represent significant substitutes for Contracts for Difference (CFDs) and forex trading. These established instruments appeal to investors prioritizing long-term wealth accumulation and those preferring lower leverage, offering a distinct risk-reward profile and often subject to different regulatory frameworks. For instance, in 2024, the global ETF market alone managed trillions of dollars, indicating a substantial pool of capital that might otherwise flow into leveraged products.

For commodities like gold, silver, or oil, investors can bypass CFDs by directly investing in physical assets or futures contracts. This direct approach offers tangible ownership, a key differentiator for those wary of leveraged derivative products. For instance, the global gold market saw significant direct investment in 2024, with central banks alone adding 33 tonnes in Q1, demonstrating a strong preference for physical holdings.

Alternative investment platforms like peer-to-peer (P2P) lending and crowdfunding present a significant threat of substitutes for traditional brokerage services, including those offered by FXCM. These platforms allow individuals to directly fund businesses or other individuals, often seeking higher yields than traditional fixed-income products. For instance, by mid-2024, the P2P lending market globally was projected to reach over $200 billion, demonstrating a substantial shift in capital allocation away from conventional channels.

These substitute options appeal to a growing segment of investors looking for diversification and potentially higher returns by investing in non-traditional asset classes. Crowdfunding platforms, in particular, have seen robust growth, with the global market estimated to exceed $30 billion in 2024. This indicates a clear trend of capital seeking alternative avenues, thereby reducing reliance on established financial intermediaries for investment opportunities.

Cryptocurrency Spot Trading

While FXCM provides cryptocurrency contracts for difference (CFDs), the direct spot trading of cryptocurrencies on specialized exchanges presents a significant threat of substitutes. Investors seeking to hold the actual digital asset, rather than merely speculating on price fluctuations via derivatives, may opt for these platforms. For instance, in 2024, the global cryptocurrency market capitalization fluctuated significantly, with daily trading volumes on major exchanges often exceeding hundreds of billions of dollars, indicating substantial investor participation in direct spot markets.

This preference for direct ownership bypasses the need for a CFD provider like FXCM, as users can buy and sell cryptocurrencies directly on platforms like Binance, Coinbase, or Kraken. These exchanges offer a wide array of digital assets, providing a more comprehensive investment universe for those focused on long-term holding or active participation in the underlying asset's ecosystem. The accessibility and growing maturity of these dedicated crypto exchanges make them a compelling alternative for a segment of the trading population.

- Direct Ownership Appeal: Investors prioritize holding the actual digital asset over derivative speculation.

- Exchange Accessibility: Platforms like Binance and Coinbase offer direct access to a broad range of cryptocurrencies.

- Market Volume Indicator: Significant daily trading volumes on crypto exchanges underscore their role as a substitute.

Managed Investment Services and Robo-Advisors

Managed investment services and robo-advisors present a significant threat of substitution for FXCM's self-directed trading clients. These platforms offer automated portfolio management, catering to individuals seeking a less hands-on approach to investing. For instance, the global robo-advisory market was valued at approximately $1.5 trillion in assets under management (AUM) by the end of 2023 and is projected to grow substantially in the coming years.

These automated services simplify investment by aligning portfolios with user-defined risk tolerance and financial goals, directly competing with the active trading offered by FXCM. By providing a streamlined, often lower-cost, alternative, they can attract clients who might otherwise engage in forex or CFD trading. The convenience factor is a major draw, especially for newer investors or those with limited time.

The appeal of robo-advisors is growing, with many platforms boasting significant client growth and AUM increases. For example, some leading robo-advisors saw their AUM nearly double between 2020 and 2023. This indicates a clear shift in client preference towards automated, passive investment strategies, potentially diverting business from active trading platforms.

- Automated Portfolio Management: Robo-advisors construct and manage investment portfolios based on algorithms and user input regarding risk tolerance and objectives.

- Hands-Off Approach: They appeal to clients who prefer not to actively manage their investments, offering a convenient alternative to self-directed trading.

- Cost-Effectiveness: Many robo-advisory services charge lower fees than traditional financial advisors or active trading platforms, making them an attractive option.

- Growing Market Share: The increasing adoption of robo-advisory services signifies a growing segment of the investment market that may bypass traditional forex and CFD trading.

The threat of substitutes for FXCM's offerings is significant, encompassing traditional investments, direct commodity ownership, alternative financing platforms, direct cryptocurrency trading, and automated investment services. These alternatives cater to diverse investor preferences, from long-term wealth building to direct asset ownership and passive management, drawing capital away from leveraged derivative products. The sheer scale of these substitute markets, such as the trillions managed in ETFs in 2024 and the billions in P2P lending, highlights the competitive landscape FXCM navigates.

| Substitute Category | Examples | Key Differentiator | 2024 Market Indicator |

|---|---|---|---|

| Traditional Investments | ETFs, Mutual Funds, Bonds | Long-term focus, lower leverage | Global ETF market valued in trillions USD |

| Direct Commodity Ownership | Physical Gold, Futures Contracts | Tangible asset, direct control | Central banks added 33 tonnes of gold in Q1 2024 |

| Alternative Financing | P2P Lending, Crowdfunding | Direct funding, potentially higher yields | P2P lending market projected over $200 billion USD globally |

| Direct Crypto Trading | Spot trading on exchanges | Ownership of digital asset | Daily crypto trading volumes often exceed hundreds of billions USD |

| Managed Investment Services | Robo-advisors | Automated, passive management | Global robo-advisory market AUM ~$1.5 trillion USD (end of 2023) |

Entrants Threaten

The online forex and CFD brokerage sector faces substantial hurdles due to stringent regulatory requirements. New companies must navigate complex and costly licensing procedures across various global financial centers, a process that can take years and significant capital investment.

Securing licenses from reputable authorities such as the UK's Financial Conduct Authority (FCA) or Australia's Securities and Investments Commission (ASIC) demands rigorous compliance and substantial financial resources, effectively deterring many potential entrants.

For instance, the capital requirements for operating a forex brokerage in the UK, regulated by the FCA, can range from £100,000 to over £730,000 depending on the specific services offered, presenting a formidable entry barrier.

The threat of new entrants into the online brokerage space, particularly for platforms like FXCM, is significantly mitigated by the sheer volume of capital required. Launching a competitive brokerage demands massive investment in robust technology, securing reliable liquidity sources, extensive marketing campaigns to build brand awareness, and covering ongoing operational costs. For instance, in 2024, the average cost to establish a fully compliant and technologically advanced online trading platform with adequate liquidity and marketing reach can easily run into tens of millions of dollars, a substantial barrier for newcomers.

Building a strong brand reputation and fostering customer trust in the financial services industry is a long and arduous process, often taking years to cultivate. Newcomers face a significant hurdle in replicating the established credibility of firms like FXCM, which has been a player since 1999 and boasts a recognized global footprint.

The sheer time and consistent performance required to build this level of trust means that new entrants find it exceptionally difficult to attract clients away from established brokers. Customer confidence is paramount when dealing with financial transactions, and this is a hard-won asset.

Access to Liquidity and Technology

New entrants in the forex brokerage space face significant hurdles in establishing access to liquidity and robust trading technology. Building relationships with prime brokers and liquidity aggregators, which are crucial for offering competitive pricing and execution, requires substantial capital and a proven track record. This is a major barrier, as securing deep, reliable liquidity pools is not a trivial undertaking.

While white-label solutions offer a shortcut, they often come with limitations or require significant customization to truly compete. The cost of acquiring and integrating advanced trading platforms, ensuring low latency, and maintaining high uptime can be prohibitive for startups. For instance, sophisticated trading infrastructure can easily cost hundreds of thousands of dollars to set up and maintain annually.

The threat of new entrants is therefore somewhat mitigated by these high upfront costs and the complexity involved in sourcing and managing critical technological and liquidity resources.

- High Capital Requirements: New brokers need substantial capital to secure prime brokerage relationships and access deep liquidity.

- Technological Investment: Acquiring and maintaining advanced, low-latency trading platforms is a significant and ongoing expense.

- Liquidity Provider Relationships: Establishing trust and favorable terms with top-tier liquidity providers is challenging for unknown entities.

- White-Label Limitations: While available, white-label solutions may not offer the customization or depth of liquidity needed to compete effectively.

Customer Acquisition Costs

The foreign exchange market is highly competitive, and for new entrants looking to establish a presence, the cost of acquiring customers can be a significant hurdle. Existing players, like FXCM, Inc., have well-established brands and extensive marketing campaigns, making it difficult for newcomers to gain traction without substantial investment.

Building a loyal client base in the FX market demands considerable spending on advertising, forging strategic partnerships, and offering compelling, competitive products. This high customer acquisition cost acts as a substantial barrier, deterring many potential new entrants from entering the market.

- High Marketing Spend: Established firms often outspend new entrants on advertising and promotional activities.

- Brand Loyalty: Existing customers tend to stick with reputable brokers, requiring new firms to offer superior value propositions.

- Regulatory Compliance Costs: New entrants must also navigate complex and costly regulatory requirements, adding to initial expenses.

- Technological Investment: Keeping pace with trading technology requires continuous and significant investment, further increasing the barrier to entry.

The threat of new entrants in the online forex brokerage sector is considerably low due to substantial capital requirements and the need for sophisticated technology. Establishing a fully compliant and competitive trading platform, complete with deep liquidity and robust marketing, can cost tens of millions of dollars in 2024 alone.

Furthermore, building brand trust and customer loyalty is a lengthy and expensive endeavor, often taking years. New entrants struggle to match the established credibility and client base of firms like FXCM, which has operated since 1999.

| Barrier Type | Description | Estimated Cost/Effort (Illustrative) |

|---|---|---|

| Capital Requirements | Securing licenses, liquidity, and initial operations. | £100,000 - £730,000+ (UK FCA minimums) |

| Technology Investment | Advanced trading platforms, low latency infrastructure. | Hundreds of thousands of dollars annually. |

| Brand Building | Cultivating trust and market presence. | Years of consistent performance and marketing spend. |

| Liquidity Access | Establishing relationships with prime brokers. | Significant capital and proven track record required. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for FXCM, Inc. is built upon a robust foundation of data, including FXCM's own annual reports and investor presentations, alongside industry-specific research from firms like ForexForex and IBISWorld.