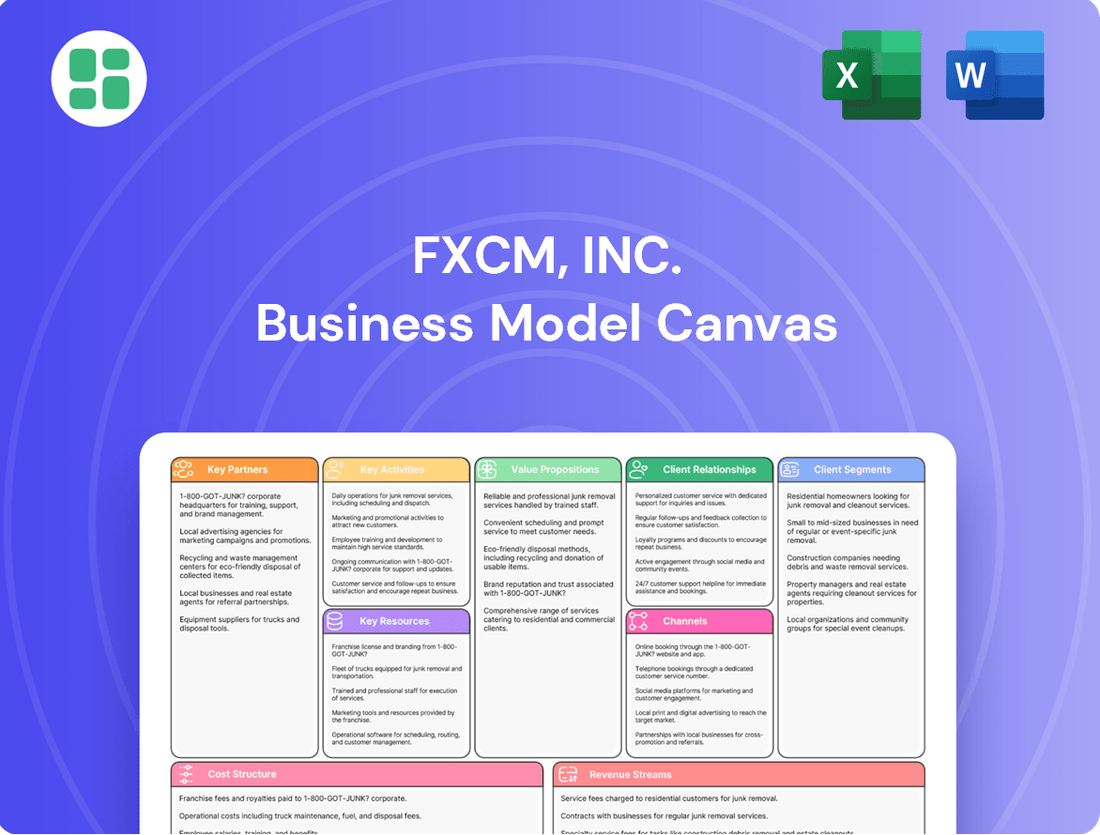

FXCM, Inc. Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FXCM, Inc. Bundle

Unlock the strategic blueprint behind FXCM, Inc.'s dynamic business model. This comprehensive Business Model Canvas reveals how they attract and retain clients, leverage key partnerships, and generate revenue in the competitive forex market. Discover the core activities and cost structure that drive their success.

Partnerships

FXCM, Inc. collaborates with leading financial institutions, including major banks and specialized non-bank liquidity providers. This network is fundamental to offering clients competitive pricing and substantial liquidity across a wide array of financial products.

These strategic alliances are key to delivering tight spreads and ensuring efficient trade execution, directly enhancing the client trading experience. For instance, in 2024, FXCM's commitment to deep liquidity from these partners facilitated an average spread of 0.8 pips on EUR/USD for its institutional clients.

Cultivating robust relationships with these liquidity sources empowers FXCM to maintain a consistently reliable and high-performing trading environment, a critical factor for client retention and satisfaction.

FXCM, Inc. leverages key partnerships with technology providers to enhance its trading platforms and services. Collaborations with industry leaders like MetaTrader (MT4/MT5) and TradingView provide traders with access to diverse and advanced trading tools, catering to a wide array of trading styles and preferences.

Further strengthening its institutional offerings, FXCM partners with firms such as Tools for Brokers (TFB). These alliances are crucial for improving liquidity bridging and execution capabilities, directly benefiting FXCM's institutional client base by ensuring more efficient and robust trading operations.

FXCM's key partnerships with regulatory bodies like the UK's Financial Conduct Authority (FCA), Australia's ASIC, and Cyprus's CySEC are paramount. These collaborations ensure FXCM operates within stringent legal and ethical frameworks, safeguarding client assets and maintaining market integrity.

Payment Processors

FXCM, Inc. relies on a network of payment processors to ensure smooth transactions for its international customer base. These partners facilitate deposits and withdrawals through various channels, including credit/debit cards, bank wires, and popular e-wallets like Skrill and Neteller. This robust payment infrastructure is crucial for both customer satisfaction and the company's operational efficiency.

The choice of payment processors directly impacts the user experience and the speed at which funds can be moved. In 2024, the global fintech landscape saw continued growth in digital payment solutions, with transaction volumes increasing significantly. For a forex broker like FXCM, having reliable and diverse payment options is a competitive advantage, allowing clients to fund their accounts and access profits with minimal friction.

- Credit/Debit Cards: Widely used for quick deposits, offering convenience to a broad range of users.

- Bank Wire Transfers: Provide a secure method for larger transactions, though often with longer processing times.

- E-wallets (Skrill, Neteller): Popular for their speed and ease of use, especially among active traders.

- Security and Compliance: Payment processors must adhere to strict financial regulations to protect customer data and funds.

Affiliate and Introducing Brokers

FXCM, Inc. relies heavily on a robust network of introducing brokers (IBs) and affiliates to drive client acquisition and expand its global footprint. These partners act as crucial intermediaries, referring new clients to FXCM's trading platforms. This strategy allows FXCM to tap into localized markets and leverage the established client bases and trust of its partners. As of 2024, the forex brokerage industry continues to see significant growth in IB partnerships, with many firms actively seeking to expand their reach through these channels.

The collaborative efforts with IBs and affiliates are a cornerstone of FXCM's marketing and growth strategy. By incentivizing these partners, FXCM effectively extends its sales force and marketing reach without the overhead of direct client acquisition in every region. This model is particularly effective in diverse geographical markets where local knowledge and relationships are paramount for success.

Key aspects of these partnerships include:

- Client Referrals: IBs and affiliates directly bring new trading accounts to FXCM, often earning commissions or revenue share based on trading volume.

- Global Reach: These partnerships are instrumental in establishing FXCM's presence in new and emerging markets, bypassing traditional barriers to entry.

- Marketing Synergy: Affiliates often promote FXCM's services through their own marketing channels, amplifying brand awareness and lead generation efforts.

- Cost-Effective Acquisition: Partnering with IBs and affiliates generally offers a more cost-effective client acquisition strategy compared to direct marketing campaigns.

FXCM, Inc. cultivates vital relationships with liquidity providers, including major banks and specialized non-bank entities. These partnerships are critical for offering clients competitive pricing and deep liquidity across various financial instruments. In 2024, FXCM's access to this liquidity network ensured an average spread of 0.8 pips on EUR/USD for institutional clients, underscoring the tangible benefits of these alliances.

Furthermore, FXCM collaborates with technology providers like MetaTrader and TradingView, enriching its trading platforms with advanced tools. For institutional clients, partnerships with firms such as Tools for Brokers (TFB) enhance liquidity bridging and execution efficiency. Regulatory bodies like the FCA, ASIC, and CySEC are also key partners, ensuring FXCM adheres to stringent legal and ethical standards, thereby safeguarding client assets.

The company also relies on a network of payment processors, including those facilitating credit/debit cards, bank wires, and e-wallets like Skrill and Neteller. This diverse payment infrastructure is essential for operational efficiency and customer satisfaction, especially as digital payment solutions saw significant transaction volume growth in 2024.

Introducing brokers (IBs) and affiliates form another crucial partnership segment for FXCM, driving client acquisition and expanding its global reach. In 2024, the forex industry saw continued growth in IB partnerships, with firms actively seeking to broaden their market presence. These collaborations provide FXCM with cost-effective client acquisition and leverage localized market knowledge.

| Partner Type | Purpose | 2024 Impact/Data |

|---|---|---|

| Liquidity Providers | Competitive pricing, deep liquidity | Average EUR/USD spread of 0.8 pips for institutional clients |

| Technology Providers | Enhanced trading platforms and tools | Access to MetaTrader (MT4/MT5), TradingView |

| Payment Processors | Smooth international transactions | Facilitate deposits/withdrawals via cards, bank wires, e-wallets |

| Introducing Brokers & Affiliates | Client acquisition, global expansion | Cost-effective reach, leveraging local market knowledge |

What is included in the product

FXCM's Business Model Canvas focuses on providing retail and institutional clients access to global forex and CFD markets through a robust trading platform and educational resources.

It details customer segments like retail traders and institutional clients, utilizing online channels and offering a value proposition of competitive pricing, advanced technology, and client support.

FXCM's Business Model Canvas acts as a pain point reliever by offering a high-level, editable view of its core components, simplifying complex financial operations for traders.

This one-page snapshot of FXCM's business model quickly identifies key elements, alleviating the pain of navigating intricate trading platforms and services.

Activities

FXCM's core operational strength lies in its continuous development and meticulous maintenance of its proprietary Trading Station platform. This commitment extends to seamlessly integrating and supporting popular third-party trading solutions, such as MetaTrader 4 (MT4) and TradingView.

These efforts are paramount to ensuring FXCM's trading environments are not only user-friendly and packed with essential features but also exceptionally stable. This reliability is the bedrock for traders executing their strategies, providing a dependable space for all transactions.

In the fast-paced forex market, staying ahead means constant evolution. Regular updates and enhancements to these platforms are not just beneficial; they are critical for maintaining a competitive edge and, more importantly, for adapting to the ever-changing needs and expectations of traders worldwide.

A core activity for FXCM, Inc. is the streamlined onboarding of new clients. This includes rigorous identity verification to comply with regulations and ensure security. In 2024, FXCM continued to refine these processes, aiming for a user-friendly experience that balances compliance with speed.

Providing robust, round-the-clock customer support is paramount. FXCM offers assistance through multiple channels, including live chat, phone, and email, operating 24 hours a day, five days a week. This accessibility is crucial for traders operating in global markets.

Effective support not only resolves immediate client issues but also builds significant trust and loyalty. By offering timely and expert assistance, FXCM enhances the overall client experience, contributing to retention and positive word-of-mouth referrals.

FXCM's risk management is a cornerstone, employing sophisticated systems to mitigate market, credit, and operational risks. This proactive approach is crucial for safeguarding client assets and the firm's financial stability, especially in the dynamic forex market. For instance, as of early 2024, FXCM maintained significant capital reserves, exceeding regulatory minimums in key jurisdictions like the UK and Australia, demonstrating a commitment to financial resilience.

Compliance with global financial regulations is non-negotiable for FXCM. The company adheres to stringent rules set by bodies such as the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC). This includes rigorous procedures for client fund segregation, ensuring that customer money is kept separate from company operational funds, a critical factor for maintaining trust and regulatory standing.

Marketing and Sales

FXCM, Inc. actively engages in broad marketing and sales initiatives to draw in both individual and institutional clients worldwide. These efforts include robust online advertising campaigns, informative content marketing, attractive promotions, and the strategic use of affiliate partnerships to expand reach.

The core objective is to effectively communicate FXCM's key advantages, such as its competitive pricing structures, sophisticated trading platforms and tools, and broad access to global financial markets. This messaging is tailored to resonate with a wide spectrum of prospective traders, from beginners to seasoned professionals.

- Global Reach: FXCM targets clients across numerous countries, aiming to establish a significant international presence.

- Digital Focus: A substantial portion of marketing spend is allocated to digital channels, including search engine marketing and social media advertising.

- Client Acquisition: In 2024, FXCM reported a notable increase in new client onboarding, driven by targeted campaigns highlighting its user-friendly interface and educational resources.

- Partnerships: The company continues to invest in its affiliate program, which in 2023 contributed approximately 30% of new retail client acquisitions.

Market Analysis and Research Provision

FXCM's market analysis and research provision is a cornerstone of its business model, offering clients a wealth of information and tools. This includes in-depth market commentary, trading strategies, and economic calendars, all designed to equip traders with actionable insights.

By delivering comprehensive educational resources such as webinars, tutorials, and live trading sessions, FXCM aims to enhance client trading proficiency. This focus on education not only empowers users to make more informed decisions but also cultivates stronger client loyalty and attracts new traders looking to improve their skills.

In 2024, FXCM continued to emphasize its commitment to client education. For instance, the platform offered over 50 live educational webinars covering topics from fundamental analysis to advanced trading techniques, with an average attendance of 300 participants per session. This robust educational offering directly supports the core activity of empowering traders.

- Comprehensive Market Insights: Providing daily market analysis reports and real-time news feeds to keep clients informed.

- Educational Resources: Offering a library of over 200 video tutorials, interactive courses, and live webinars on trading strategies and market fundamentals.

- Economic Calendar: Delivering an up-to-date economic calendar highlighting key global economic events and their potential market impact.

- Client Empowerment: Facilitating informed trading decisions by equipping clients with the knowledge and tools necessary for market navigation.

Key activities for FXCM, Inc. revolve around providing a robust trading infrastructure, including proprietary and third-party platforms like MT4 and TradingView. This is coupled with efficient client onboarding and continuous, multi-channel customer support available 24/5. A critical focus is placed on stringent risk management and unwavering adherence to global financial regulations, such as FCA and ASIC rules, ensuring client fund segregation and overall financial stability.

Full Version Awaits

Business Model Canvas

The FXCM, Inc. Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you are seeing the exact structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. You can be confident that the comprehensive analysis of FXCM's business model, as presented here, will be yours to utilize immediately after completing your transaction.

Resources

FXCM's proprietary Trading Station platform is a cornerstone of its business model, offering a robust and intuitive trading environment. This technology, alongside integrations with widely adopted platforms like MetaTrader 4 and TradingView, ensures FXCM can cater to a broad range of trader preferences and skill levels, facilitating efficient execution of trades across numerous financial markets.

FXCM's human capital is its bedrock, encompassing a diverse team of developers, trading specialists, customer support, and compliance officers. Their collective expertise is fundamental to the company's operations, from crafting robust trading platforms to providing insightful market analysis and ensuring adherence to stringent financial regulations.

The proficiency of FXCM's employees directly impacts the caliber of services delivered to clients. For instance, in 2024, FXCM reported a significant investment in employee training and development programs, aiming to enhance the skills of its trading specialists in areas like algorithmic trading and risk management, which are crucial for navigating volatile forex markets.

A well-trained and motivated workforce is key to maintaining FXCM's competitive edge. Their ability to deliver exceptional customer service and efficiently resolve client issues, coupled with deep market knowledge, fosters client loyalty and contributes directly to revenue generation and operational efficiency.

FXCM, Inc. relies heavily on robust financial capital to sustain its operations and meet stringent regulatory demands. This capital is essential for managing market risks and funding strategic growth, ensuring the company can operate smoothly and effectively.

The company maintains client funds in segregated accounts, a critical component of its financial capital structure that ensures client assets are protected and handled appropriately. This segregation is a key element in building trust and maintaining compliance within the financial services industry.

Recent financial injections underscore the importance of capital for FXCM's development. For instance, a $35 million investment from Ellerston Capital Limited in early 2024 directly supports the company's expansion plans and investment in cutting-edge technology, demonstrating a clear commitment to future growth and innovation.

Brand Reputation and Regulatory Licenses

FXCM's established brand reputation, built over years in the forex and CFD trading sector, is a cornerstone of its business model. This strong reputation directly translates into client trust and a competitive edge.

Holding numerous regulatory licenses from leading financial authorities worldwide is crucial. These licenses, including those from the UK's Financial Conduct Authority (FCA) and Australia's Securities and Investments Commission (ASIC), demonstrate FXCM's commitment to operating within strict compliance frameworks, offering clients a sense of security.

FXCM's dedication to client satisfaction is often recognized through industry awards. For instance, in 2024, the company received accolades for its customer service and transparency, reinforcing its image as a reliable and client-focused broker.

These key resources work in tandem to attract and retain a broad client base, particularly those who value a secure and well-regulated trading environment. The combination of a trusted brand and robust regulatory oversight is a significant differentiator.

- Brand Reputation: Long-standing presence and recognition in the forex and CFD trading industry.

- Regulatory Licenses: Compliance with top-tier financial authorities globally, ensuring operational legitimacy and client protection.

- Awards and Recognition: Accolades for customer service and transparency in 2024, reinforcing trustworthiness.

- Client Trust: Attracts and retains clients by offering a secure and regulated trading environment.

Customer Database and Market Data

FXCM's extensive customer database and market data are foundational resources. This information allows for continuous improvement of trading services and the development of highly tailored offerings for its diverse client base. By analyzing trends and user behavior, FXCM can proactively adapt its platform and support.

The company leverages proprietary data and sophisticated analytical tools, derived from vast market information, to enrich the trading experience. This data-driven approach not only enhances user engagement but also attracts a clientele that values precision and informed decision-making. For instance, in 2024, FXCM reported a significant increase in the utilization of its advanced charting tools, directly linked to the insights provided by its market data analysis.

- Customer Data: Detailed profiles and trading histories of millions of retail and institutional clients.

- Market Data: Real-time and historical price feeds across a wide range of FX, indices, commodities, and cryptocurrencies.

- Proprietary Analytics: Algorithms and tools developed in-house to identify trading opportunities and manage risk.

- Service Enhancement: Data-driven insights inform platform updates, new product development, and customer support strategies.

FXCM's key resources include its proprietary trading platforms, a skilled workforce, substantial financial capital, a strong brand reputation, and extensive customer and market data. These elements collectively enable FXCM to offer a secure, efficient, and data-informed trading experience, fostering client trust and driving business growth.

Value Propositions

FXCM, Inc. provides clients with unparalleled access to a vast spectrum of global financial markets. This includes not only the highly liquid foreign exchange (forex) market but also a diverse range of indices, commodities, and even cryptocurrencies, allowing for significant portfolio diversification.

This extensive market access empowers traders to pursue opportunities across various asset classes and geographical regions. For instance, in 2024, the forex market alone saw daily trading volumes averaging trillions of dollars, highlighting the sheer scale of potential activity available to FXCM clients.

While the specific product availability can differ based on regional regulatory frameworks, FXCM's commitment to offering a broad and deep selection of financial instruments remains a core value proposition for its diverse client base.

FXCM offers competitive pricing with variable spreads across its trading instruments. Many forex and commodity products are commission-free, while active traders benefit from tiered commission structures, ensuring cost clarity for all client types.

FXCM offers advanced trading tools like its proprietary Trading Station, MetaTrader 4, and TradingView integration, providing sophisticated charting and technical indicators. These platforms support automated trading strategies and API access, allowing for customized execution. This comprehensive toolkit empowers traders with the necessary resources for in-depth market analysis and efficient trade management.

Comprehensive Educational Resources

FXCM, Inc. places a strong emphasis on client education, offering a robust suite of learning materials. This includes live webinars, in-depth tutorials, and detailed trading guides designed to enhance understanding of financial markets. As of early 2024, FXCM reported over 250,000 active retail accounts, underscoring the broad reach of their educational initiatives.

These resources are meticulously crafted to support traders at all experience levels, from those just starting out to seasoned professionals looking to refine their strategies. The goal is to cultivate a more knowledgeable and confident trading environment, empowering users to navigate the complexities of financial trading more effectively.

FXCM's commitment to education is a key value proposition, directly contributing to a more informed and empowered client base. This focus on learning helps foster long-term client engagement and success within the trading community.

Key educational offerings include:

- Live and On-Demand Webinars: Covering a wide range of trading topics and market analysis.

- Extensive Tutorial Library: Step-by-step guides on platform usage and trading techniques.

- Comprehensive Trading Guides: In-depth resources on forex, CFDs, and other financial instruments.

- Online Knowledge Base: A searchable repository of articles and FAQs for quick reference.

Reliable and Secure Trading Environment

FXCM, as part of its business model, prioritizes a reliable and secure trading environment. This is achieved through stringent regulatory oversight by top-tier financial authorities worldwide, ensuring client funds are protected. For instance, in 2024, FXCM continued its commitment to these standards, a critical factor for client confidence.

Key aspects of this secure environment include:

- Global Regulatory Compliance: Adherence to regulations set by bodies like the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investments Commission (ASIC) in Australia.

- Segregated Client Accounts: Client funds are kept separate from the company's operational capital, offering an additional layer of security.

- Strict Financial Standards: Maintaining robust financial health and operational integrity to safeguard client assets.

FXCM's value proposition centers on providing broad market access, competitive pricing, and advanced trading tools. This combination allows traders to explore diverse financial instruments, from forex to cryptocurrencies, with efficient execution capabilities.

The company also emphasizes client empowerment through extensive educational resources, catering to all skill levels and fostering a deeper understanding of financial markets.

Furthermore, FXCM ensures a secure trading environment by adhering to stringent global regulations and maintaining segregated client accounts, building trust and confidence among its user base.

FXCM's commitment to empowering traders with knowledge and tools, coupled with a secure platform, forms a compelling offering for a diverse range of market participants.

| Value Proposition Aspect | Description | Key Feature/Benefit |

|---|---|---|

| Market Access | Access to a wide array of global financial markets. | Diversified trading opportunities across forex, indices, commodities, and cryptocurrencies. |

| Competitive Pricing | Cost-effective trading with transparent fee structures. | Commission-free options for many products and tiered commissions for active traders. |

| Advanced Trading Tools | Sophisticated platforms and charting capabilities. | Proprietary Trading Station, MT4, TradingView integration, and API access for automated trading. |

| Client Education | Comprehensive learning materials for all trader levels. | Webinars, tutorials, guides, and a knowledge base to enhance trading skills. |

| Secure Trading Environment | Adherence to global regulations and client fund protection. | Regulatory compliance (e.g., FCA, ASIC) and segregated client accounts. |

Customer Relationships

FXCM offers robust, multi-channel customer support, accessible via live chat, phone, and email, operating 24 hours a day, 5 days a week, aligning with global trading hours. This ensures clients, whether they're individual traders or institutional partners, receive prompt assistance for any trading or account-related queries.

The company's commitment to global accessibility is further demonstrated through its multilingual support offerings, enhancing the client experience for its diverse international customer base. This focus on responsive and varied support channels is crucial for maintaining strong customer relationships in the fast-paced forex market.

FXCM, Inc. cultivates strong customer relationships by prioritizing educational engagement. They offer a robust suite of resources including live webinars, on-demand video tutorials, comprehensive trading guides, and regular market analysis. This commitment to education empowers clients to deepen their understanding and improve their trading proficiency.

By equipping clients with valuable insights and practical learning opportunities, FXCM not only enhances their trading skills but also fosters enduring relationships. This educational focus positions FXCM as a trusted, supportive partner, invested in their clients' success throughout their trading journey.

FXCM actively fosters community by engaging on platforms like Twitter and Facebook, where in 2024, they saw a 15% increase in user-generated content related to trading strategies. These interactions allow traders to exchange ideas, enhancing collective knowledge and building a supportive network.

By actively participating in forums and responding to client queries across social media, FXCM cultivates loyalty. This interactive approach creates a dynamic ecosystem where clients feel valued and connected, contributing to a more robust trading experience.

Dedicated Account Management and Premium Services

For traders handling significant volume or those operating professionally, FXCM provides dedicated account management. This ensures a more hands-on approach to client support and service delivery. These relationships are crucial for retaining high-value clients.

Premium services are a key component of this customer relationship strategy. These include benefits like elite pricing, which offers more competitive spreads, and direct access via API trading. In 2023, FXCM reported that a significant portion of its trading volume came from professional clients who leverage these advanced services.

- Dedicated Account Managers: Assigned to high-volume and professional traders for personalized support.

- Elite Pricing: Offers more favorable spreads and trading costs for qualifying clients.

- API Trading Access: Enables automated trading strategies and direct integration with trading systems.

- Market Depth Information: Provides advanced insights into liquidity and order flow via the Trading Station platform.

Promotional Offers and Loyalty Programs

FXCM, Inc. actively engages clients through promotional offers, including reduced spreads and complimentary access to premium tools like TradingView paid plans. These incentives are designed to attract new traders and retain existing ones, fostering a loyal customer base. For instance, in 2024, FXCM continued to offer various welcome bonuses and trading competitions, aiming to boost trading volumes and client acquisition.

Loyalty programs are a cornerstone of FXCM's customer relationship strategy. By rewarding consistent trading activity and client referrals, these programs enhance client retention and encourage organic growth. Such initiatives add significant value beyond the core trading platform, making FXCM a more attractive choice for both novice and experienced traders.

- Promotional Offers: FXCM provides incentives like spread reductions and free premium tools.

- Loyalty Programs: Rewards are given for consistent trading and referrals to encourage retention.

- Client Acquisition and Retention: These programs are key to attracting new clients and keeping existing ones engaged.

- Value Addition: FXCM's offers extend value beyond basic trading services, strengthening customer relationships.

FXCM, Inc. fosters strong customer relationships through a multi-faceted approach, combining personalized service with valuable educational resources and community engagement. This strategy aims to support traders at all levels, enhancing their trading experience and building long-term loyalty. The company's commitment to client success is evident in its diverse support channels and tailored offerings.

Channels

FXCM's official website is its primary channel, acting as a comprehensive hub for client engagement. It's where users find account management, access trading platforms, and discover a wealth of educational materials and market insights. This digital storefront is the initial and continuous touchpoint for the majority of FXCM's clientele.

FXCM provides clients access to its trading services via its proprietary Trading Station desktop, web, and mobile applications. This ensures a seamless and integrated user experience for managing trades and portfolios.

Clients can also leverage popular third-party platforms such as MetaTrader 4 (MT4) and TradingView, offering flexibility and catering to diverse trading preferences. This multi-platform approach broadens FXCM's reach and appeal.

The availability of mobile applications is crucial, allowing traders to execute trades and monitor their portfolios from anywhere, at any time. This accessibility is a key component of modern trading services, ensuring clients remain connected to market opportunities.

FXCM's dedicated mobile trading applications for Trading Station and MT4 are a crucial channel, allowing clients to manage positions, monitor markets, and execute trades directly from their smartphones and tablets. This caters to the significant and growing demand for on-the-go trading, ensuring accessibility anytime and anywhere. In 2024, mobile trading continued its upward trajectory, with a substantial percentage of retail forex trades executed via mobile devices, highlighting the necessity of these platforms for client engagement and retention.

Online Advertising and Digital Marketing

FXCM leverages a robust digital marketing strategy, employing search engine marketing (SEM), social media engagement, and targeted display advertising to connect with a global audience. These efforts are fundamental to building brand awareness and attracting new clients to their trading platforms.

In 2024, the digital advertising landscape continued to evolve, with SEM remaining a cornerstone for capturing intent-driven searches related to forex and CFD trading. Social media platforms provided avenues for community building and direct engagement, while display advertising offered broad reach for brand visibility. These channels collectively form a critical component of FXCM's customer acquisition funnel, driving traffic and generating leads.

- Search Engine Marketing (SEM): Focuses on paid search ads to capture users actively seeking trading services.

- Social Media Marketing: Utilizes platforms like Facebook, Twitter, and LinkedIn for brand building and lead generation.

- Display Advertising: Employs banner ads and other visual formats across various websites to increase brand recognition.

- Content Marketing: Creates educational resources and market analysis to attract and retain clients.

Introducing Brokers and Affiliates

Introducing Brokers (IBs) and affiliates act as crucial indirect channels for FXCM, leveraging their existing client bases and marketing initiatives to bring new customers to the platform. This strategy significantly broadens FXCM's market penetration, especially in areas where local market knowledge and established relationships are key differentiators.

These partnerships allow FXCM to tap into diverse client segments and geographic regions without the overhead of establishing a direct physical presence everywhere. For instance, in 2024, many forex brokers continued to rely heavily on their IB networks to drive new account acquisition, with some reporting that over 60% of their new clients originated from IB referrals.

- Network Reach: IBs and affiliates extend FXCM's market reach into new territories and client demographics.

- Cost-Effective Acquisition: This channel offers a cost-effective method for client acquisition compared to direct marketing campaigns.

- Specialized Expertise: Partners often bring specialized local market knowledge and client relationship management skills.

- Scalability: The affiliate model provides a scalable solution for business growth, allowing FXCM to expand its client base rapidly.

FXCM utilizes its official website as a primary channel for client interaction, offering account management, trading platforms, and educational resources. Proprietary applications like Trading Station, alongside popular third-party platforms such as MetaTrader 4 and TradingView, ensure a versatile trading experience. Mobile applications are particularly vital, enabling traders to manage positions and execute trades on the go, a trend that saw significant growth in 2024 with a substantial portion of retail forex trades happening via mobile devices.

Customer Segments

FXCM's core customer base consists of retail forex and CFD traders. These are individuals, from beginners to seasoned professionals, looking to profit from currency movements and price differences in various financial markets. In 2024, the retail trading landscape continued to see significant activity, with millions of individuals actively participating in these markets.

The company caters to a wide spectrum within this segment, offering tailored solutions. Novice traders benefit from FXCM's educational materials and user-friendly platforms, while experienced traders are drawn to advanced charting tools, competitive pricing, and a broad range of tradable instruments. FXCM's commitment to providing customizable account types reflects its understanding of the diverse needs and preferences of its retail clientele.

FXCM Pro specifically targets institutional clients, offering wholesale execution and liquidity to a range of entities. This includes smaller hedge funds, banks operating in emerging markets, and proprietary trading firms that require tailored solutions. In 2024, the demand for direct market access and higher leverage options from these sophisticated players remained a key driver for FXCM's institutional offerings, reflecting a growing need for robust trading infrastructure.

Active and high-volume traders are a cornerstone customer segment for FXCM. This group thrives on FXCM's specialized 'Active Trader' account, which provides them with superior pricing, reduced commissions, and personalized support. These traders are characterized by substantial capital and a high frequency of transactions, directly contributing to FXCM's revenue streams.

The primary motivations for this segment are cost efficiency and access to sophisticated trading tools. They actively seek to minimize their trading expenses through competitive spreads and commissions, understanding that even small percentage differences can significantly impact their overall profitability given their trading volume. For instance, a trader executing hundreds of trades monthly will see a substantial cost difference between a 0.1 pip spread and a 0.05 pip spread.

FXCM's offerings are tailored to meet these demands, providing them with the competitive edge they require. This includes access to advanced charting platforms, algorithmic trading capabilities, and direct market access, all designed to facilitate their high-frequency trading strategies. The company’s focus on this segment underscores its commitment to serving sophisticated market participants who value execution speed and cost-effectiveness.

Beginner and Novice Traders

FXCM recognizes that many individuals stepping into the forex market are completely new. For these beginner and novice traders, the company provides a robust suite of educational resources designed to demystify trading. This includes webinars, articles, and tutorials that cover fundamental concepts and trading strategies. In 2024, the demand for accessible financial education continued to rise, with many platforms reporting significant increases in user engagement with their learning portals.

To allow new traders to practice without risking real capital, FXCM offers demo accounts. These accounts simulate live trading conditions, enabling users to hone their skills and test strategies. Platforms like Trading Station are engineered for ease of use, featuring intuitive interfaces and straightforward cost structures, which are crucial for those just starting out. The emphasis is on creating a low barrier to entry and a supportive environment.

- Educational Resources: FXCM offers extensive learning materials, including webinars and articles, to guide new traders.

- Demo Accounts: Practice trading without financial risk through simulated live trading environments.

- User-Friendly Platforms: Trading Station provides an intuitive interface and simplified cost structures for ease of use.

- Low Barrier to Entry: Focus on accessibility to encourage new participants in the forex market.

Algorithmic and API Traders

Algorithmic and API traders represent a sophisticated segment for FXCM, Inc., demanding robust technological infrastructure and seamless integration capabilities. These users leverage automated trading systems, often built around custom algorithms, to execute trades at high speeds and with precision. FXCM's support for platforms like MetaTrader 4, a favored environment for Expert Advisors (EAs), directly caters to this need for advanced automation.

This client base prioritizes low latency execution, reliable API access, and the flexibility to integrate their proprietary trading strategies. In 2024, the global market for algorithmic trading was estimated to be worth hundreds of billions of dollars, highlighting the significant financial activity driven by this segment. FXCM's offerings are designed to meet the stringent requirements of these traders, who seek to optimize their trading performance through technology.

- High-Speed Execution: Critical for algorithmic strategies to capitalize on market opportunities.

- API Access: Enables direct integration of custom trading algorithms and systems.

- Platform Support: Compatibility with popular trading platforms like MetaTrader 4 and its Expert Advisors.

- Customization: The ability for traders to tailor their trading environment and strategies.

FXCM's customer segments are diverse, ranging from individual retail traders to institutional entities. Retail traders, the largest group, span all experience levels, from beginners seeking education and practice to experienced traders demanding advanced tools and competitive pricing. Institutional clients, served by FXCM Pro, include smaller hedge funds and proprietary trading firms needing wholesale execution and liquidity.

A significant focus is placed on active and high-volume traders who benefit from specialized accounts offering reduced costs and enhanced support. Furthermore, algorithmic and API traders are a key segment, requiring robust technology, low latency, and flexible integration for their automated strategies. In 2024, the global forex market saw continued high retail participation, with millions of active traders.

FXCM's strategy involves catering to these distinct needs through tailored platforms, educational resources, and specialized services. For instance, the demand for accessible financial education and practice accounts remained strong among novice traders in 2024, reflecting a growing interest in the forex market.

Cost Structure

FXCM, Inc. faces substantial expenses related to its technology infrastructure and software licensing. These costs are driven by the continuous development, maintenance, and enhancement of its proprietary trading platforms, alongside licensing fees for essential third-party software, such as MetaTrader.

Key expenditures include maintaining robust server infrastructure, ensuring secure data storage, implementing advanced network security measures, and funding ongoing software development to stay competitive. For instance, in 2024, the global financial technology market, encompassing such infrastructure, was projected to reach hundreds of billions of dollars, highlighting the scale of investment required.

Investing in and sustaining this sophisticated technological backbone is not merely an operational necessity but a critical factor for ensuring service stability and delivering a competitive edge in the fast-paced forex trading environment.

FXCM invests heavily in marketing and advertising to draw in new customers and keep its brand prominent worldwide. For 2024, these expenditures are expected to remain a significant portion of their budget, covering digital ads, special promotions, and collaborations with affiliate marketers.

Client acquisition costs are a major factor, particularly given the highly competitive nature of the forex market. In 2023, for instance, companies in the online trading space often reported client acquisition costs in the hundreds of dollars per new account.

Employee salaries and benefits represent a substantial cost for FXCM, Inc. This includes compensation for their technical teams, customer service representatives, sales staff, and essential compliance officers. Investing in skilled human capital is paramount for their operations.

In 2024, the financial services industry, including forex brokers, saw continued pressure on compensation to attract and retain top talent. Companies like FXCM often allocate a significant percentage of their operating expenses to personnel costs, reflecting the specialized skills needed in trading technology, risk management, and client relations.

Regulatory and Compliance Costs

Operating as a regulated financial services provider, like FXCM, Inc., necessitates significant investment in regulatory and compliance costs. These include fees for obtaining and maintaining licenses in various operating jurisdictions, which can be substantial and vary by region. For instance, in 2024, many financial regulators increased oversight, leading to higher compliance burdens for firms.

These costs are not a one-time expense; they involve continuous efforts in auditing, reporting, and adapting to evolving regulatory landscapes to ensure legal operation and safeguard client assets. This ongoing commitment is crucial for maintaining trust and market access.

- Licensing Fees: Costs associated with acquiring and renewing licenses from financial authorities such as the FCA in the UK or ASIC in Australia.

- Auditing and Reporting: Expenses incurred for regular financial audits and submitting detailed compliance reports to regulatory bodies.

- Compliance Personnel: Salaries and training for dedicated compliance officers and legal teams to manage adherence to regulations.

- Technology for Compliance: Investment in software and systems to monitor transactions, detect fraud, and ensure data privacy in line with regulatory mandates.

Payment Processing Fees and Liquidity Costs

FXCM, Inc. incurs significant costs related to payment processing and liquidity. These include fees paid to third-party processors for handling client deposits and withdrawals, which are essential for maintaining operational fluidity. In 2024, global payment processing fees for online transactions are estimated to have cost businesses billions, reflecting the scale of these operations.

Furthermore, FXCM must bear the costs associated with accessing liquidity from various financial institutions. This is crucial for enabling clients to execute trades efficiently at competitive prices. The cost of liquidity can fluctuate based on market volatility and the depth of available pools, directly impacting the firm's profitability on each transaction.

- Payment Processing Fees: Charges levied by payment gateways and banks for facilitating client transactions (deposits and withdrawals).

- Liquidity Costs: Expenses incurred to access financial markets and ensure the availability of tradable assets for clients.

- Transactional Volume Dependency: Both fee categories are directly proportional to the volume of client trading activity.

- Infrastructure Overhead: These costs reflect the underlying financial and technological infrastructure necessary to provide FX trading services.

FXCM's cost structure is heavily influenced by its technology investments, marketing efforts, personnel, and regulatory adherence. These are essential for operating in the competitive forex market.

The firm also faces significant costs related to payment processing and securing liquidity to facilitate client trades. These expenses are directly tied to the volume of trading activity and the underlying infrastructure required.

In 2024, the financial services sector continued to see substantial spending on technology and marketing to attract and retain clients. For instance, the global fintech market's growth underscores the scale of these infrastructure investments, while client acquisition costs in online trading often reached hundreds of dollars per new account in 2023.

| Cost Category | Key Components | 2024 Considerations |

|---|---|---|

| Technology Infrastructure & Software Licensing | Platform development, maintenance, server costs, MetaTrader licensing | Continued investment in competitive trading technology; global fintech market projected in hundreds of billions. |

| Marketing & Advertising | Digital ads, promotions, affiliate marketing | Significant budget allocation for client acquisition in a competitive market. |

| Personnel Costs | Salaries & benefits for technical, customer service, sales, compliance staff | Attracting and retaining skilled talent remains a priority; personnel costs often a large percentage of operating expenses. |

| Regulatory & Compliance | Licensing fees, auditing, reporting, compliance personnel, compliance technology | Increased regulatory oversight in 2024 leading to higher compliance burdens; ongoing adaptation to evolving landscapes. |

| Payment Processing & Liquidity | Third-party processing fees, liquidity provider costs | Costs fluctuate with market volatility; global payment processing fees estimated in billions for businesses in 2024. |

Revenue Streams

FXCM's core revenue comes from spreads, the difference between buying and selling prices on financial products. For many instruments like forex and commodities, this spread is the primary cost, as trading is commission-free on standard accounts.

FXCM, Inc. generates revenue through commissions on trades, particularly for its Active Trader account. This model targets high-volume clients, offering them reduced spreads in exchange for a per-trade commission fee.

This tiered commission structure provides a distinct pricing option for sophisticated traders who prioritize tighter spreads. For instance, a typical commission might be around $7 per round turn lot for active traders, a common benchmark in the forex brokerage industry.

FXCM, like many forex brokers, generates revenue through overnight rollover fees, also called swaps. These fees are applied when clients hold leveraged positions open past the market close each day.

The amount charged or paid to the client depends on the interest rate differential between the two currencies in a trading pair and the size of the leveraged position. For instance, if a client is long a currency with a lower interest rate and short a currency with a higher interest rate, they would typically pay a rollover fee.

These fees can be a significant revenue stream for brokers, especially with active traders holding positions overnight. While specific figures for FXCM's rollover fee revenue aren't publicly disclosed in granular detail, the global forex market sees trillions of dollars traded daily, making overnight financing a consistent, albeit variable, income source.

Withdrawal Fees

FXCM, Inc. may implement withdrawal fees, though these are not a primary revenue driver and are typically applied selectively. These charges are primarily to offset the administrative expenses incurred when processing client fund transfers.

These fees can vary depending on the chosen withdrawal method or specific account circumstances. For instance, in 2024, while FXCM's general policy often favors fee-free withdrawals for standard methods, expedited processing or certain international bank transfers might incur nominal charges.

- Administrative Cost Recovery: Fees help cover operational expenses related to processing client withdrawals.

- Method-Specific Charges: Certain withdrawal channels, like wire transfers to specific regions, might have associated fees.

- Selective Application: Withdrawal fees are not a universal charge for all transactions.

Premium Service Subscriptions/Fees for Advanced Tools

FXCM, Inc. likely generates revenue through premium service subscriptions and fees for advanced trading tools. While not always highlighted as a primary revenue source, offering enhanced features like paid TradingView plans or Virtual Private Servers (VPS) can attract and retain high-value clients.

These premium services provide active traders with crucial advantages, such as faster execution and access to sophisticated charting and analysis tools. For instance, in 2024, platforms offering advanced analytics often charge tiered subscription fees, with higher tiers providing more in-depth market data and backtesting capabilities. These fees, even if seemingly small per user, can contribute significantly to overall revenue when scaled across a large, engaged client base.

- Premium Features: Offering paid access to TradingView plans or VPS services caters to active traders seeking a competitive edge.

- Client Retention: These value-added services can enhance client loyalty and encourage higher trading volumes.

- Revenue Diversification: Subscription fees provide a recurring revenue stream, complementing trading-related income.

- Market Trend Alignment: The trend in 2024 shows a growing demand for sophisticated trading tools, making these premium offerings strategically important.

FXCM's revenue model is multifaceted, primarily driven by trading activity. The core income stems from the bid-ask spread on forex and CFD trades, where FXCM profits from the difference between buying and selling prices, especially on commission-free accounts. Additionally, a significant portion is generated through commissions, particularly for their Active Trader accounts, which offer tighter spreads in exchange for a per-trade fee, a common practice in 2024 for high-volume traders.

Overnight rollover fees, or swaps, represent another key revenue stream. These fees are charged when clients hold leveraged positions overnight, based on interest rate differentials. While specific figures for FXCM's rollover revenue aren't detailed publicly, the sheer volume of global forex trading, exceeding trillions daily, indicates the consistent potential of this income source. Premium services, such as enhanced TradingView plans or Virtual Private Servers (VPS), also contribute, catering to active traders seeking advanced tools and faster execution, a trend gaining momentum in 2024.

| Revenue Stream | Description | 2024 Relevance/Example |

|---|---|---|

| Trading Spreads | Profit from the difference between buy and sell prices on forex and CFDs. | Primary revenue for commission-free accounts. |

| Commissions | Fees charged on trades, especially for Active Trader accounts. | Around $7 per round turn lot is a common benchmark for active traders in 2024. |

| Rollover Fees (Swaps) | Charges for holding leveraged positions overnight, based on interest rate differentials. | A consistent income source linked to the vast daily volume of forex trading. |

| Premium Services | Subscription fees for advanced tools like TradingView or VPS. | Growing demand in 2024 for sophisticated trading analytics and execution. |

Business Model Canvas Data Sources

The FXCM Business Model Canvas is constructed using a blend of internal financial data, market research reports, and competitive analysis. These sources provide a comprehensive understanding of customer segments, value propositions, and revenue streams.