FXCM, Inc. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FXCM, Inc. Bundle

Navigate the complex external environment impacting FXCM, Inc. with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, social attitudes, environmental regulations, and legal frameworks are shaping FXCM's operations and future growth. Gain a strategic advantage by uncovering critical insights that drive informed decision-making.

Unlock actionable intelligence with our expertly crafted PESTLE analysis of FXCM, Inc. This detailed report provides a deep dive into the external forces influencing the company, empowering you to anticipate challenges and capitalize on opportunities. Download the full version now to gain a competitive edge and refine your market strategy.

Political factors

Government and regulatory bodies are constantly updating policies that affect forex and CFD trading, which in turn influences how FXCM operates in various countries. These updates frequently bring more stringent rules for broker licensing, how much capital they need to hold, and how client money is kept separate, all of which directly impact FXCM's compliance tasks and ability to access markets.

For example, in 2024, the UK's Financial Conduct Authority (FCA) and the European Securities and Markets Authority (ESMA) continued to issue guidance and enforce rules that significantly shape the operational environment for companies like FXCM in key European markets. These regulatory actions can necessitate adjustments to business models and client offerings, impacting profitability and strategic direction.

Global political stability and evolving trade relations are critical for FXCM, as these factors directly shape currency markets. For instance, the ongoing trade tensions between major economies in 2024 continued to create currency fluctuations, impacting trading volumes and client activity.

Geopolitical events, such as regional conflicts or significant political shifts, can trigger sharp increases in market volatility. This heightened volatility in 2024, seen in major currency pairs like EUR/USD and USD/JPY, can present both opportunities for traders to profit from price swings and risks that FXCM must manage through its hedging operations.

International sanctions or the imposition of new trade barriers can lead to rapid and unpredictable movements in exchange rates. The impact of these shifts on client profitability, and by extension FXCM's revenue streams, underscores the importance of closely monitoring the global political landscape.

Central bank decisions, like the US Federal Reserve's interest rate adjustments, directly impact currency strength and trading volumes. For instance, a hawkish stance, signaling potential rate hikes, often strengthens the dollar, influencing FXCM's trading activity in USD pairs.

Government fiscal stimulus packages, such as the infrastructure spending plans discussed in many developed economies for 2024-2025, can boost economic growth and investor confidence, indirectly affecting currency markets. This can lead to increased trading in currencies of countries implementing robust stimulus measures.

Divergent monetary policies, like the European Central Bank's approach compared to the Bank of England's, create currency differentials that drive speculative trading. These policy differences are key drivers for currency pair volatility, directly impacting the business of brokers like FXCM.

International Cooperation and Standards

The global financial landscape is increasingly shaped by international cooperation, fostering a more unified approach to regulation. This trend is crucial for firms like FXCM, impacting how they operate across borders and interact with diverse client bases.

The FX Global Code, notably updated in December 2024, exemplifies this cooperative spirit. It provides a framework of principles designed to promote efficiency, integrity, and transparency in the foreign exchange market. Adherence to such codes is not merely about compliance; it's a strategic imperative.

For FXCM, aligning with these international standards can significantly bolster its credibility. A strong reputation for ethical conduct and transparent practices, underscored by adherence to global benchmarks, can attract and retain a broader international clientele. This focus on harmonization aims to reduce regulatory friction and create a more predictable operating environment for multinational financial institutions.

- Harmonized Regulation: International cooperation seeks to standardize financial regulations, simplifying cross-border operations for firms like FXCM.

- FX Global Code: Updated in December 2024, this code sets best practices for the FX market, emphasizing transparency and ethical conduct.

- Reputational Enhancement: Adherence to international standards builds trust and enhances FXCM's standing with a global customer base.

- Market Integrity: Cooperative efforts contribute to a more stable and trustworthy global financial system, benefiting all participants.

Political Influence on Market Sentiment

Political events, such as the upcoming US presidential election in late 2024, can significantly impact market sentiment. Uncertainty surrounding policy changes, trade agreements, or geopolitical stability often leads to increased volatility in currency markets, which directly affects FXCM's client activity.

Policy announcements from central banks and governments, particularly regarding interest rates and fiscal stimulus, create ripples across financial markets. For instance, the Federal Reserve's decisions on interest rates in 2024 have already demonstrated their power to influence currency valuations and trading volumes, impacting FXCM's operational environment.

The anticipation of major political outcomes can lead to sharp shifts in trading behavior. Periods leading up to significant elections or policy votes often see heightened trading volumes as investors and traders position themselves, creating both opportunities and risks for FXCM.

- 2024 US Presidential Election: Expected to introduce significant policy uncertainty, potentially driving currency market volatility.

- Central Bank Policy: Decisions by the US Federal Reserve and European Central Bank on interest rates in 2024 continue to shape FX trading patterns.

- Geopolitical Tensions: Ongoing global events can trigger safe-haven flows, impacting currency pairs traded on platforms like FXCM.

Government policies and regulatory shifts remain paramount, directly influencing FXCM's operational landscape. The ongoing enforcement of stricter capital requirements and client fund segregation by bodies like the FCA and ESMA in 2024 continues to shape compliance strategies.

Global political stability and trade relations significantly impact currency markets, with trade tensions in 2024 contributing to notable fluctuations in major currency pairs. Geopolitical events also drive volatility, presenting both opportunities and risks that FXCM must actively manage.

International cooperation, exemplified by the December 2024 update to the FX Global Code, promotes market integrity and transparency. Adherence to these harmonized standards is crucial for FXCM to enhance its global credibility and attract a wider client base.

Anticipation of key political events, such as the late 2024 US presidential election, can lead to increased market volatility and trading volumes. Central bank decisions on interest rates, like those from the Federal Reserve in 2024, continue to be major drivers of currency valuation and trading activity on FXCM platforms.

What is included in the product

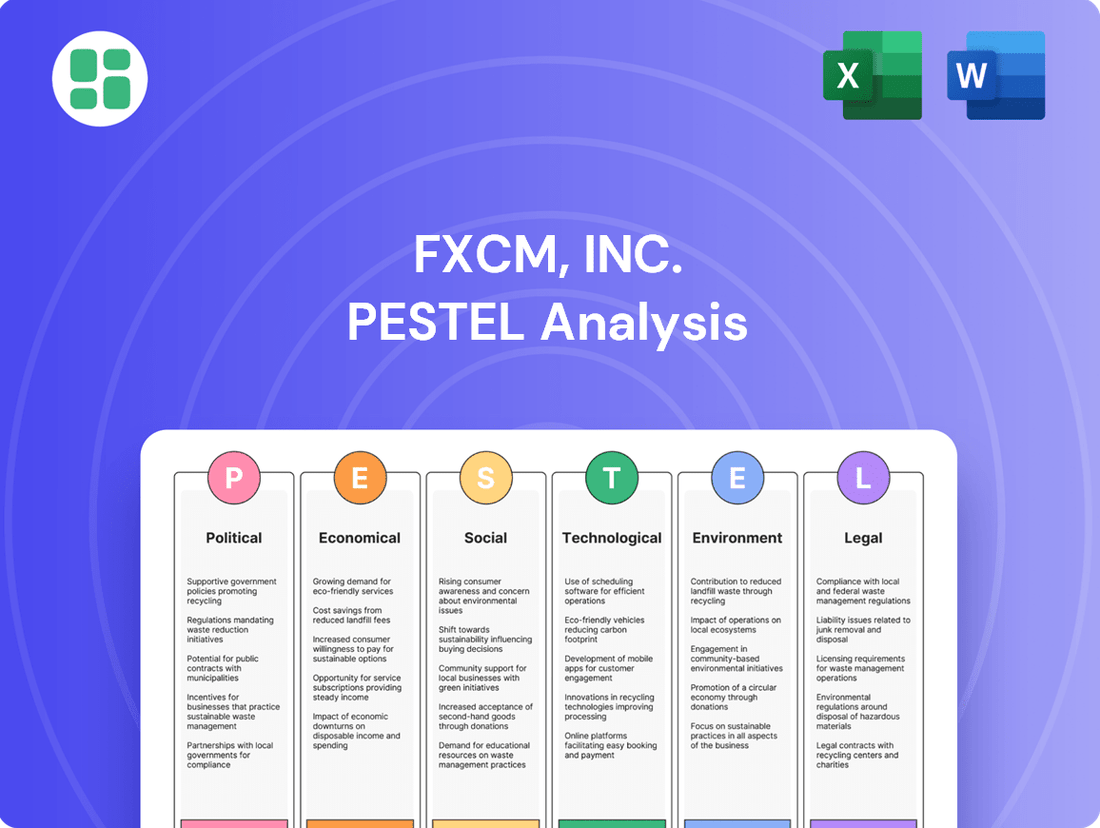

This PESTLE analysis examines the external macro-environmental factors impacting FXCM, Inc., covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into market dynamics and regulatory landscapes, aiding strategic decision-making for FXCM, Inc.

This PESTLE analysis for FXCM, Inc. offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing during strategic discussions and planning sessions.

Economic factors

The overall health of the global economy is a critical determinant for trading volumes and investor sentiment, directly influencing FXCM's performance. Strong economic expansion typically fuels more speculative trading, which is advantageous for FXCM, whereas concerns about recessions can dampen trading activity and heighten client risk aversion.

Economic projections for 2024 and 2025 indicate a trajectory of continued global growth. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024 in its April 2024 World Economic Outlook report, with a slight moderation to 3.1% anticipated for 2025. However, these forecasts are accompanied by significant underlying uncertainties, including geopolitical tensions and persistent inflation, which could impact trading volumes.

Central bank interest rate decisions are pivotal for forex market dynamics. For instance, the Federal Reserve's stance on interest rates, contrasted with the European Central Bank's, creates significant differentials that influence currency pairs like EUR/USD on platforms like FXCM. As of mid-2024, the US Federal Funds Rate target range remains higher than the ECB's main refinancing operations rate, a key driver for carry trades.

These widening or narrowing interest rate gaps directly impact the profitability of carry trades and speculative positioning. When a central bank, like the Bank of Japan, maintains ultra-low rates while others, such as the Bank of England, begin to tighten, it can dramatically shift the attractiveness of currency pairs traded on FXCM, influencing capital flows and exchange rates.

Monetary policy divergences are a fundamental factor in currency valuation. For example, if the Bank of Canada signals a more hawkish approach than the Reserve Bank of Australia, this policy divergence will likely strengthen the Canadian Dollar against the Australian Dollar, a common trading scenario for FXCM clients.

Currency volatility is a double-edged sword for FXCM. High volatility can boost trading volumes and widen spreads, directly benefiting FXCM's revenue streams. For instance, during periods of significant geopolitical events or economic data releases, trading activity on major currency pairs often surges.

However, extreme currency swings, like those seen in emerging markets or during unexpected global shocks, pose substantial risks. Such volatility can lead to magnified client losses, potentially increasing margin calls and impacting FXCM's own risk management protocols. For example, a sudden 5% depreciation of a client's base currency against their trading positions could quickly deplete their account equity.

Liquidity is intrinsically linked to volatility. When markets are highly volatile, liquidity can sometimes dry up, making it harder for FXCM to execute trades at desired prices. This can widen the bid-ask spread even further, impacting both client profitability and FXCM's operational efficiency.

Inflationary Pressures and Purchasing Power

Inflationary pressures directly impact the real value of currencies, influencing the decisions of both individual traders and institutional investors on platforms like FXCM. For instance, persistent inflation erodes purchasing power, potentially reducing the amount of disposable income available for retail trading activities.

Central banks often respond to high inflation with interest rate hikes, which can significantly alter exchange rates. These shifts in currency values directly affect trading volumes and profitability for FXCM and its clients. As of early 2025, many developed economies continue to grapple with inflation rates that, while moderating from 2023 peaks, remain above central bank targets, creating a dynamic trading environment.

- Inflation's Impact on Currency Value: Higher inflation generally weakens a currency's purchasing power, making it less attractive to investors.

- Central Bank Responses: Monetary policy adjustments, such as interest rate changes, are key responses to inflation that directly influence FX markets.

- Purchasing Power and Retail Trading: Changes in the cost of living affect how much discretionary income individuals have for trading.

- 2024-2025 Inflation Trends: While inflation has eased in many regions, it remains a significant factor influencing global economic stability and currency valuations.

Disposable Income and Retail Investor Participation

The level of disposable income directly influences the growth of the retail trading sector, a crucial demographic for FXCM. As economies strengthen and individuals gain more discretionary funds, engagement with online trading, encompassing forex and CFDs, typically rises. For instance, in the United States, real disposable income saw an increase, contributing to a more robust consumer base for financial services.

The proliferation of user-friendly online trading platforms further fuels this trend, making markets more accessible to a broader audience. This accessibility encourages more individuals to explore investment opportunities, thereby expanding the pool of potential retail clients for companies like FXCM. Many platforms in 2024 and 2025 are reporting significant user growth, driven by intuitive interfaces and educational resources.

- Increased Disposable Income: Higher discretionary spending power allows more individuals to allocate funds towards investment activities.

- Retail Trading Growth: Economic improvements often correlate with a rise in retail investor participation in markets like forex and CFDs.

- Platform Expansion: The availability and ease of use of online trading platforms are key drivers for attracting new retail traders.

- Market Accessibility: Lower barriers to entry, facilitated by technology, are democratizing access to financial markets for everyday investors.

Economic growth forecasts for 2024 and 2025 suggest continued global expansion, though with notable uncertainties. The IMF's projection of 3.2% global growth for 2024, moderating to 3.1% in 2025, highlights a generally positive outlook. However, persistent inflation and geopolitical risks could temper trading volumes and investor sentiment, impacting FXCM's revenue streams.

Central bank policies, particularly interest rate differentials, remain a primary driver of currency markets. The divergence between the US Federal Reserve's higher rates and the ECB's lower rates, for example, directly influences EUR/USD trading. As of mid-2024, these rate gaps continue to shape carry trade profitability and speculative positioning, with ongoing monetary policy adjustments by central banks like the Bank of England and the Bank of Japan creating dynamic trading opportunities.

Inflationary pressures, while showing signs of moderation in early 2025, continue to influence currency valuations and disposable income. Higher inflation erodes purchasing power, potentially reducing retail trading activity, while central bank responses through interest rate hikes directly impact exchange rates. This creates a complex environment where currency volatility can boost trading volumes but also increase risk for both clients and FXCM.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on FXCM |

|---|---|---|---|

| Global GDP Growth (IMF) | 3.2% | 3.1% | Supports trading volumes, but risks remain. |

| US Federal Funds Rate (Target Range) | 5.25%-5.50% (as of mid-2024) | Varies (dependent on inflation) | Drives USD strength and carry trades. |

| Eurozone Main Refinancing Rate | 4.00% (as of mid-2024) | Varies (dependent on inflation) | Influences EUR strength against USD. |

| Inflation (Developed Economies) | Moderating but above targets (early 2025) | Continued moderation expected | Impacts disposable income and central bank policy. |

Full Version Awaits

FXCM, Inc. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of FXCM, Inc. covers all critical Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering an in-depth look at the external forces shaping FXCM’s operational landscape.

Sociological factors

A significant driver for FXCM's growth is the increasing financial literacy worldwide. By late 2024, estimates suggest over 60% of adults globally possess some level of financial literacy, a figure that has steadily climbed. This enhanced understanding of financial concepts directly translates into a greater willingness to engage with investment and trading platforms.

Simultaneously, digital adoption continues its upward trajectory. As of mid-2025, internet penetration is projected to exceed 70% globally, with mobile internet usage being even higher. This widespread digital access makes online trading services, like those provided by FXCM, more accessible than ever to a broader demographic, fueling demand for user-friendly trading solutions.

The investor landscape is shifting, with younger generations, particularly millennials and Gen Z, demonstrating a growing appetite for online trading platforms like FXCM, often engaging with cryptocurrencies and commodities. This demographic, projected to control significant wealth in the coming years, favors intuitive, mobile-centric trading experiences.

These evolving preferences are compelling brokers to enhance their digital offerings. For instance, a 2024 report indicated that over 70% of new retail trading accounts were opened by individuals under 35, highlighting the demand for accessible, user-friendly interfaces.

FXCM is responding by investing in advanced trading tools and platform innovation to meet the needs of its diverse global clientele, ensuring it remains competitive by aligning with these changing investor demographics and their preference for digital engagement.

Social media platforms like Reddit's r/Forex and X (formerly Twitter) are powerful drivers of retail investor behavior. Discussions on these forums can rapidly amplify interest in specific currency pairs or trading strategies, potentially leading to surges in trading volumes for FXCM. For instance, during 2024, sentiment analysis of online discussions indicated a notable increase in retail interest in emerging market currencies, directly impacting the demand for related trading instruments.

Demand for Accessible and User-Friendly Trading

Societal trends highlight a growing desire for trading platforms that are not only intuitive but also competitively priced, backed by robust educational materials. FXCM addresses this by offering both its own platforms and integrating third-party solutions equipped with sophisticated trading tools, aiming to appeal to a broad range of traders from beginners to seasoned professionals. In 2024, the demand for simplified trading experiences is paramount, as evidenced by the surge in retail investor participation, with many new entrants seeking accessible entry points into financial markets.

User-friendly interfaces are no longer a luxury but a necessity, bridging the gap for individuals new to trading and enhancing efficiency for experienced traders. This societal shift means platforms must be navigable and provide clear, actionable insights. For instance, a significant percentage of new accounts opened in late 2023 and early 2024 were on platforms that emphasized ease of use and mobile accessibility, underscoring the importance of this factor for market penetration and client retention.

- Growing Demand for Simplicity: Over 60% of surveyed retail traders in early 2024 indicated that ease of use was a primary factor when selecting a trading platform.

- Educational Resource Importance: Platforms offering comprehensive tutorials and market analysis saw a 25% higher engagement rate among novice traders compared to those with limited educational content.

- Competitive Pricing Expectations: The average retail trader expects low commission fees and competitive spreads, with many willing to switch providers for better value.

Risk Appetite and Cultural Attitudes Towards Investing

Societal attitudes toward financial risk and speculation are deeply ingrained in cultural norms, significantly influencing investment behaviors globally. For instance, while some cultures might embrace speculative trading, others lean towards more conservative, long-term investment strategies, directly impacting the adoption of leveraged products like CFDs and forex. This variation means FXCM's market penetration strategies must be tailored to local cultural predispositions towards financial risk.

These cultural nuances play a crucial role in shaping how individuals perceive and engage with financial markets. A region with a higher inherent risk appetite might see greater uptake of high-leverage instruments. Conversely, cultures that prioritize capital preservation may be more hesitant. This underscores the necessity for FXCM to develop localized marketing campaigns and product offerings that resonate with these distinct societal attitudes.

For example, a 2024 survey indicated that in countries like Australia, where retail trading is prevalent, there's a higher reported tolerance for risk compared to some European nations, where regulatory scrutiny and consumer protection sentiment are more pronounced. This directly correlates with the potential market size for FXCM's services in these diverse geographical areas.

- Regional Risk Tolerance: Cultural differences in risk appetite directly affect the adoption of leveraged trading products like CFDs and forex.

- Market Penetration Impact: Societal attitudes influence FXCM's ability to penetrate and grow in different geographical markets.

- Localized Strategies: Understanding these cultural nuances is essential for effective, region-specific marketing and product development.

- 2024 Data Insight: Surveys in 2024 suggest varying levels of risk tolerance across regions, impacting the potential client base for FXCM.

The global surge in financial literacy, with over 60% of adults possessing some understanding by late 2024, fuels a greater willingness to engage with trading platforms like FXCM. This, coupled with over 70% global internet penetration by mid-2025, makes online trading increasingly accessible. Younger demographics, particularly millennials and Gen Z, are driving demand for intuitive, mobile-first trading experiences, with over 70% of new retail accounts in 2024 opened by individuals under 35.

Social media's influence is undeniable, with platforms like Reddit and X shaping retail investor behavior; sentiment analysis in 2024 showed increased interest in emerging market currencies, impacting demand for related instruments. Societal expectations for simplicity and competitive pricing are paramount, with over 60% of retail traders in early 2024 prioritizing ease of use, and platforms with robust educational content seeing 25% higher engagement from novices.

Cultural attitudes towards risk vary significantly, impacting the adoption of leveraged products; for example, 2024 surveys indicated higher risk tolerance in Australia compared to some European nations, directly influencing FXCM's market penetration strategies and the need for localized offerings.

| Sociological Factor | 2024/2025 Data Point | Impact on FXCM |

|---|---|---|

| Financial Literacy Growth | >60% adult global financial literacy (late 2024) | Increased demand for trading services. |

| Digital Adoption | >70% global internet penetration (mid-2025) | Enhanced accessibility to online trading platforms. |

| Demographic Shift | >70% new accounts from <35s (2024) | Need for mobile-centric, user-friendly interfaces. |

| Social Media Influence | Increased retail interest in EM currencies (2024 analysis) | Potential for rapid shifts in trading volumes. |

| User Preference | >60% traders prioritize ease of use (early 2024) | Necessity for intuitive platform design. |

| Risk Tolerance Variation | Higher risk appetite in AUS vs. some EU nations (2024 survey) | Requirement for tailored marketing and product strategies. |

Technological factors

The forex and CFD trading landscape is being reshaped by rapid advancements in Artificial Intelligence (AI) and machine learning. These technologies are significantly enhancing market analysis, enabling the automation of trading strategies, and improving risk management. For instance, AI algorithms can process vast amounts of data to identify patterns and predict market movements with a higher degree of accuracy than traditional methods, directly influencing how FXCM's clientele approaches their trading activities.

FXCM actively supports algorithmic trading, recognizing the power of these technological leaps. By integrating AI and machine learning, the company can offer clients more sophisticated tools for automated execution and strategy development. This integration is crucial for staying competitive, as platforms that leverage AI can provide an edge in identifying trading opportunities and managing positions more efficiently, potentially leading to better client outcomes.

The impact of AI extends to operational efficiencies for brokers like FXCM. Predictive analytics, driven by AI, can help in anticipating client needs and potential market shifts, allowing for proactive service adjustments. In 2024, the global AI market was projected to reach over $200 billion, with significant investment flowing into financial applications, underscoring the growing importance of these technologies in the trading sector.

As an online financial service provider, FXCM, Inc. is continually exposed to evolving cybersecurity threats such as ransomware, phishing, and data breaches. The financial services sector remains a prime target for increasingly sophisticated cyberattacks, making robust defense mechanisms absolutely critical for maintaining operational continuity and client trust.

Protecting sensitive client data and ensuring the integrity of trading platforms are paramount for FXCM. In 2024, the global average cost of a data breach reached $4.45 million, highlighting the significant financial and reputational risks associated with security failures in the financial industry.

The increasing reliance on mobile devices for financial transactions, with global mobile trading app downloads projected to reach over 1.5 billion in 2024, necessitates robust and feature-rich mobile trading applications. FXCM's ability to offer seamless and secure mobile trading experiences is crucial for attracting and retaining clients who prefer trading on the go, a trend evidenced by a 25% year-over-year increase in mobile trading volume for many retail brokers in 2024.

Mobile applications are key to accessibility and convenience for market participants, with over 60% of retail traders now primarily using mobile devices for their trading activities. FXCM's investment in user-friendly interfaces and advanced charting tools on its mobile platform directly impacts its competitive standing in a market where mobile-first solutions are becoming the norm.

Integration of Blockchain and DLT

While blockchain and DLT are still emerging in retail forex, their potential to boost transparency, security, and efficiency in cross-border payments is significant. FXCM, Inc. should monitor these advancements for future integration into its infrastructure and services.

Blockchain technology is actively improving the security and transparency of forex transactions. For instance, in 2024, several pilot programs demonstrated how DLT could reduce settlement times for foreign exchange trades by up to 90%, from days to hours.

- Enhanced Security: Cryptographic hashing inherent in blockchain makes transactions tamper-proof.

- Increased Transparency: DLT can provide a shared, immutable ledger for all participants, reducing disputes.

- Efficiency Gains: Automation through smart contracts can streamline post-trade processes, cutting costs and delays.

- Potential for New Products: Exploration into tokenized fiat currencies could create new avenues for forex trading and settlement.

Scalability and Cloud Computing Infrastructure

FXCM's technological backbone relies heavily on scalable cloud computing infrastructure to manage the immense volume of trades and data, particularly during periods of high market volatility. This resilience is critical for maintaining consistent service availability for its global client base.

The adoption of cloud solutions by FXCM provides significant flexibility and efficiency in managing its worldwide operations. For instance, in 2024, many financial institutions reported increased reliance on cloud services for cost optimization, with some seeing up to a 20% reduction in infrastructure expenses.

While cloud computing is now fundamental to modern financial operations, it also introduces a broader threat surface that FXCM must actively manage. Cybersecurity investments in cloud environments are paramount. In 2025, the global cloud security market is projected to reach over $100 billion, reflecting the industry's focus on securing these critical infrastructures.

- Scalability: FXCM's infrastructure must handle peak trading volumes, which can surge dramatically during major economic events.

- Cloud Adoption: Leveraging cloud platforms allows for dynamic resource allocation, ensuring performance and cost-effectiveness.

- Security Challenges: The shift to cloud necessitates robust cybersecurity measures to protect against an expanded range of digital threats.

- Operational Efficiency: Cloud computing enables FXCM to streamline its global operations and deliver a seamless user experience.

Technological advancements are fundamentally altering the forex trading environment, with AI and machine learning becoming integral to market analysis and automated strategies. FXCM's investment in these areas allows for enhanced client tools and operational efficiency. The global AI market's projected growth to over $200 billion in 2024 highlights the significant trend towards AI integration in finance.

Mobile trading is increasingly dominant, with over 60% of retail traders preferring mobile devices and app downloads projected to exceed 1.5 billion in 2024. FXCM's focus on robust mobile platforms directly addresses this shift, with mobile trading volumes seeing a 25% year-over-year increase for many brokers in 2024.

Cloud computing is essential for FXCM's scalability and operational efficiency, with financial institutions reporting up to a 20% reduction in infrastructure expenses through cloud adoption in 2024. However, this also expands the threat surface, necessitating strong cybersecurity measures, as evidenced by the projected $100 billion global cloud security market in 2025.

| Technology Area | Impact on FXCM | 2024/2025 Data Point |

|---|---|---|

| AI & Machine Learning | Enhanced market analysis, automated trading, risk management | Global AI market projected over $200 billion in 2024 |

| Mobile Trading | Increased accessibility, feature-rich apps needed | Over 60% of retail traders use mobile; 25% YoY increase in mobile volume (2024) |

| Cloud Computing | Scalability, operational efficiency, cost reduction | 20% infrastructure cost reduction reported by some institutions (2024); Cloud security market projected over $100 billion (2025) |

| Blockchain & DLT | Potential for improved security, transparency, efficiency | Pilot programs showed up to 90% reduction in settlement times (2024) |

Legal factors

FXCM, Inc. navigates a complex web of Forex and CFD specific regulations across its global operations. For instance, in the UK, the Financial Conduct Authority (FCA) sets strict leverage limits, recently capping retail client leverage at 30:1 for major currency pairs, a significant change impacting client trading capacity and FXCM's product offering.

Similarly, the Australian Securities and Investments Commission (ASIC) imposes similar leverage restrictions and product intervention measures to protect retail investors. In South Africa, the Financial Sector Conduct Authority (FSCA) also mandates specific margin requirements and operational standards, ensuring a baseline of consumer protection.

Compliance with these diverse regulatory frameworks is not merely a formality but a fundamental requirement for FXCM's continued legal operation and market access. Failure to adhere to these rules can result in substantial fines and reputational damage, impacting FXCM’s ability to serve clients in these key markets.

FXCM, like all financial institutions, operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These legal frameworks are designed to combat financial crime, including money laundering and terrorist financing. For example, the Bank Secrecy Act in the United States mandates that financial institutions report suspicious activities to the Financial Crimes Enforcement Network (FinCEN).

Meeting these legal obligations necessitates comprehensive client verification during onboarding, continuous monitoring of trading activities for unusual patterns, and timely reporting of any suspicious transactions to authorities. These processes add significant operational overhead and increase the complexity of compliance management for FXCM.

The global regulatory landscape is increasingly emphasizing financial transparency, with authorities like the Financial Action Task Force (FATF) regularly updating guidance and increasing scrutiny. This trend means FXCM must continually adapt its compliance measures to meet evolving legal standards and avoid substantial penalties.

FXCM must navigate a complex web of global data privacy laws, including Europe's GDPR and similar frameworks in other jurisdictions, to protect sensitive client information. These regulations dictate strict protocols for data collection, storage, processing, and security, directly influencing FXCM's IT infrastructure and operational policies.

The increasing focus on data privacy, amplified by the rise of generative AI, presents a significant challenge. For instance, in 2024, data breach incidents globally continued to rise, with financial services firms frequently targeted, underscoring the critical need for robust data protection measures.

Consumer Protection Laws and Dispute Resolution

Consumer protection laws significantly shape FXCM's operations, particularly in marketing and client dispute resolution. Regulations mandate clear risk disclosures and transparent fee structures, ensuring clients understand the inherent risks of forex trading. For instance, in 2024, the Financial Conduct Authority (FCA) in the UK continued to emphasize stringent rules on financial promotions, requiring firms like FXCM to provide clear, fair, and not misleading communications. This regulatory environment directly influences how FXCM presents its services and manages client interactions.

Dispute resolution mechanisms are also heavily influenced by legal frameworks designed to safeguard consumers. FXCM must adhere to established procedures for handling client complaints, often involving internal escalation processes and external arbitration or ombudsman services. These processes are crucial for maintaining client trust and regulatory compliance. For example, the Financial Industry Regulatory Authority (FINRA) in the US oversees dispute resolution for its member firms, a model that influences global best practices.

- Enhanced Risk Warnings: Regulators globally, including the European Securities and Markets Authority (ESMA), have tightened requirements for risk warnings. In 2024, ESMA continued its focus on product intervention measures, which often include enhanced disclosures for leveraged products.

- Fee Transparency Mandates: Laws increasingly require detailed breakdowns of all fees, commissions, and charges. This ensures clients are fully aware of the costs associated with trading, preventing hidden charges.

- Client Complaint Handling: Regulatory bodies often set specific timelines and procedures for how financial firms must address client grievances, promoting fair and timely resolutions.

- Fair Treatment of Clients: Principles of treating customers fairly (TCF) are embedded in many legal frameworks, obligating FXCM to act in its clients' best interests throughout their engagement.

Licensing and Jurisdictional Restrictions

FXCM's operational reach is directly tied to its success in securing and upholding necessary licenses across various global markets. This licensing framework is crucial for offering its trading services legally and compliantly.

The regulatory landscape is not uniform; consequently, the specific products and services FXCM can provide differ significantly from one jurisdiction to another. Strict adherence to each region's licensing mandates is therefore a fundamental requirement for continued operation.

For instance, the United States presents a notable example of these jurisdictional restrictions. Due to specific regulatory prohibitions, FXCM's ability to offer certain financial instruments, such as Contracts for Difference (CFDs), is significantly curtailed in the US market. This highlights how legal and regulatory frameworks directly shape service availability.

- Licensing Dependency: FXCM must acquire and maintain licenses in every jurisdiction where it operates to legally offer its financial services.

- Regulatory Variations: Product and service availability fluctuates by region due to differing regulatory requirements, necessitating localized compliance.

- Product Restrictions: Jurisdictions like the United States impose limitations, restricting access to products such as CFDs for FXCM clients in those areas.

Legal factors significantly shape FXCM's operational landscape, demanding strict adherence to diverse global regulations. For example, leverage limits, like the 30:1 cap for retail clients in the UK by the FCA, directly impact product offerings and client trading capacity. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, such as the Bank Secrecy Act in the US, adds considerable operational overhead. Furthermore, data privacy laws like GDPR necessitate robust IT infrastructure and policies to protect sensitive client information, a critical concern given the rise in global data breaches in 2024.

Environmental factors

The increasing focus on Environmental, Social, and Governance (ESG) criteria is reshaping investment landscapes, potentially influencing the assets available and favored on platforms like FXCM. For instance, by early 2024, sustainable funds saw continued inflows, with assets under management in ESG-focused ETFs globally reaching over $300 billion, indicating a strong investor preference for companies demonstrating strong ESG performance.

This shift can indirectly impact FXCM by altering market sentiment and the demand for specific trading instruments. As more capital flows into ESG-compliant products, companies with weaker ESG profiles might experience valuation pressures, affecting the indices and individual stocks available for trading on the platform.

FXCM's operational carbon footprint, largely tied to its data centers and overall energy consumption, is an emerging factor in its corporate social responsibility. As a technology-dependent firm, the energy intensity of its IT infrastructure is a key area of focus.

While not as significant as heavy industry, the financial sector, including forex brokers like FXCM, faces growing pressure regarding energy efficiency. For instance, global data center energy consumption accounted for an estimated 1-1.3% of total worldwide electricity usage in 2023, a figure that continues to be scrutinized.

This trend may encourage FXCM to investigate and adopt more sustainable IT solutions, potentially through cloud computing providers with strong renewable energy commitments or by optimizing its own energy usage to reduce its environmental impact.

Broader climate change impacts, like increasingly frequent extreme weather events and growing resource scarcity, are demonstrably affecting global economic stability. For instance, the World Meteorological Organization reported in early 2024 that 2023 was the warmest year on record, with global average temperatures 1.45°C above the pre-industrial average, leading to significant agricultural losses and infrastructure damage in various regions. These macro-environmental shifts can disrupt global supply chains and alter national economic landscapes, directly contributing to volatility within forex and CFD markets that FXCM's platforms would inevitably reflect.

Corporate Social Responsibility (CSR) and Reputation

FXCM's dedication to corporate social responsibility, particularly concerning environmental stewardship, significantly shapes its brand image and attracts clients who prioritize ethical business practices. Demonstrating a commitment to sustainability, even in areas peripheral to its core trading operations, can bolster public trust and positive perception.

In 2024, the financial services sector, including forex brokers, is increasingly scrutinized for its environmental, social, and governance (ESG) performance. A strong CSR profile can translate into a competitive advantage, as evidenced by the growing demand for ESG-integrated investment products, which saw global assets reach an estimated $37.7 trillion by the end of 2023, according to Bloomberg Intelligence.

- Reputation Enhancement: A proactive stance on CSR, including environmental initiatives, can differentiate FXCM in a crowded market.

- Client Attraction: Socially conscious investors and traders are more likely to align with firms that exhibit strong ethical and sustainable operations.

- Trust Building: Transparent reporting on CSR efforts fosters greater trust among clients and stakeholders.

- Risk Mitigation: Strong CSR practices can mitigate reputational risks associated with environmental or social missteps.

Resource Availability for Infrastructure

The availability and cost of critical resources, like energy and rare earth minerals essential for technological infrastructure, pose long-term environmental considerations for companies like FXCM. While not an immediate crisis, the global shift towards sustainable resource management could eventually impact the supply chain for the hardware and energy FXCM depends on.

For instance, the International Energy Agency reported in 2024 that the demand for critical minerals like lithium and cobalt, vital for advanced electronics and data centers, is projected to surge significantly in the coming years due to the ongoing digital transformation and electrification trends.

- Rising demand for critical minerals: Projections indicate a substantial increase in the need for materials like lithium, cobalt, and nickel, driven by renewable energy and digital infrastructure growth.

- Energy cost volatility: Fluctuations in global energy prices, influenced by geopolitical factors and supply chain disruptions, can directly impact the operational costs of data centers and trading platforms.

- Supply chain sustainability pressures: Increasing investor and regulatory focus on environmental, social, and governance (ESG) factors may lead to greater scrutiny of resource sourcing and ethical extraction practices.

- Technological obsolescence and e-waste: The rapid pace of technological advancement necessitates frequent hardware upgrades, raising concerns about the environmental impact of electronic waste management.

Growing investor demand for ESG-compliant investments, with global assets reaching an estimated $37.7 trillion by the end of 2023, directly influences FXCM by shaping market preferences for sustainable trading instruments.

FXCM's operational energy consumption, particularly for its data centers, is under increasing scrutiny, mirroring the broader financial sector's focus on reducing its environmental footprint, as global data center energy usage was estimated at 1-1.3% of worldwide electricity in 2023.

Extreme weather events, with 2023 being the warmest year on record, globally impacting economies and supply chains, can introduce volatility into forex markets, which FXCM platforms would reflect.

The demand for critical minerals like lithium and cobalt, essential for FXCM's technological infrastructure, is projected to surge, creating potential long-term supply chain and cost considerations.

| Environmental Factor | Impact on FXCM | Supporting Data (2023-2024) |

|---|---|---|

| ESG Investment Trend | Influences asset demand and platform offerings. | Global ESG assets: ~$37.7 trillion (end of 2023). |

| Energy Consumption | Affects operational costs and CSR profile. | Data center energy use: 1-1.3% of global electricity (2023). |

| Climate Change Events | Creates market volatility in forex. | 2023 warmest year on record, 1.45°C above pre-industrial levels. |

| Critical Mineral Demand | Impacts technology infrastructure costs. | Projected surge in demand for lithium, cobalt, etc. |

PESTLE Analysis Data Sources

Our FXCM PESTLE Analysis is built on comprehensive data from financial regulatory bodies, economic forecasting agencies, and industry-specific market research. We integrate insights from global economic indicators, technological advancements, and socio-political trends to provide a robust understanding of the external environment.