Fuyao Glass Industry Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyao Glass Industry Group Bundle

Unlock the strategic landscape of Fuyao Glass Industry Group with our comprehensive PESTEL analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping its global operations and market position. This ready-to-use report offers critical insights for investors and strategists. Download the full version now to gain a competitive edge.

Political factors

Global trade tensions, particularly between the US, China, and Europe, pose a significant challenge for Fuyao Glass Industry Group. These geopolitical dynamics can disrupt international sales channels and complicate supply chain management for automotive glass. For instance, in 2023, the automotive industry continued to grapple with the lingering effects of trade disputes, leading to increased uncertainty for manufacturers like Fuyao.

The imposition of tariffs on imported glass or essential raw materials directly impacts Fuyao's operational costs. Such measures could either inflate production expenses or diminish the price competitiveness of Fuyao's offerings in key global markets. Navigating these protectionist policies requires strategic adaptation and careful cost management.

Fuyao must actively monitor and adapt to evolving international trade agreements and the increasing prevalence of protectionist trade measures. The company's ability to remain agile in response to shifts in trade policy will be crucial for maintaining its global market position and profitability in the coming years.

Government initiatives promoting electric vehicles (EVs) and smart manufacturing present significant opportunities for Fuyao Glass. For instance, China's continued support for EV production, with sales projected to reach 10 million units in 2024, directly benefits Fuyao as a key supplier of automotive glass. These policies can translate into increased demand for specialized glass solutions, such as lighter, more durable, and potentially smart-integrated glass for next-generation vehicles.

Regional subsidies for automotive components or glass manufacturing can also shape Fuyao's strategic decisions. For example, if a particular country or province offers tax breaks or direct financial aid for advanced manufacturing facilities, Fuyao might prioritize investment and expansion in those areas to leverage these incentives, potentially lowering production costs and enhancing competitiveness in 2024 and beyond.

Conversely, restrictive industrial policies, such as stringent environmental regulations or protectionist measures favoring domestic producers, could pose challenges. If new regulations increase compliance costs for glass production or if trade barriers limit market access in key regions, Fuyao's growth trajectory and ability to serve global markets might be constrained.

Political instability in regions where Fuyao Glass operates or sells its products, such as areas experiencing civil unrest or sudden policy shifts, can significantly disrupt its manufacturing processes, supply chain logistics, and overall market demand. For instance, heightened tensions in East Asia, a crucial region for automotive manufacturing and glass production, could impact raw material sourcing and finished goods distribution.

Geopolitical conflicts or the imposition of international sanctions, as seen with trade disputes impacting global supply chains in recent years, could directly affect Fuyao's access to essential raw materials like silica sand or sodium carbonate, and could also limit its ability to export to key markets. This necessitates the implementation of comprehensive risk management strategies, including contingency planning for alternative suppliers and distribution channels.

Fuyao Glass's strategy of maintaining a diversified global manufacturing and sales footprint, with facilities in North America, Europe, and Asia, is a key factor in mitigating the impact of localized political instability. This diversification allows the company to shift production or sales focus if one region experiences significant geopolitical challenges, thereby safeguarding its overall operational continuity and market access.

Automotive Industry Regulations

Government regulations concerning vehicle safety, emissions, and fuel efficiency significantly influence the automotive glass market. For instance, evolving safety standards, like those mandating enhanced impact resistance, can drive demand for specialized laminated and tempered glass. In 2024, global automotive safety regulations continue to tighten, pushing manufacturers to integrate more advanced materials.

Emissions targets also play a crucial role. As automakers strive for lighter vehicles to meet stricter CO2 limits, there's an indirect push for lighter glass solutions. Fuel efficiency mandates, such as the Corporate Average Fuel Economy (CAFE) standards in the US, encourage the use of lighter materials across the vehicle, including glass components. Fuyao's ability to innovate in lightweight glass technology is therefore critical for market competitiveness.

- Safety Standards: Increased adoption of advanced driver-assistance systems (ADAS) often requires precise integration of sensors and cameras within the windshield, impacting glass design and manufacturing.

- Emissions Regulations: The push for electric vehicles (EVs) and improved internal combustion engine (ICE) efficiency indirectly favors lightweight automotive glass to offset battery weight or improve aerodynamic performance.

- Fuel Efficiency Mandates: Regulations like the EU's CO2 emission performance standards for new passenger cars continue to pressure automakers to reduce vehicle weight, creating opportunities for advanced glass solutions.

Foreign Investment Policies

Fuyao Glass Industry Group's international expansion is heavily influenced by foreign investment policies. For instance, China's evolving FDI regulations, particularly concerning sectors like automotive manufacturing where Fuyao is a key player, can shape its strategic approach to new markets. As of early 2024, China has continued to signal a commitment to opening its economy, though specific sector-specific regulations remain critical for foreign investors.

Policies in North America and Europe, where Fuyao has significant operations and potential for growth, also play a crucial role. Restrictions on ownership percentages or requirements for local content can affect the cost and structure of Fuyao's manufacturing facilities and supply chains. For example, in the United States, any changes to regulations impacting foreign ownership in critical industries could necessitate adjustments to Fuyao's investment strategy.

- FDI Trends: Global FDI inflows saw a notable rebound in 2024, reaching an estimated $2.1 trillion, indicating a generally more favorable environment for international investment, though regional variations persist.

- China's Policy Stance: China's National Development and Reform Commission (NDRC) regularly updates its foreign investment catalog, with recent revisions in 2024 aiming to further encourage investment in high-tech manufacturing and services, potentially benefiting Fuyao's advanced materials segment.

- North American Market Access: Policies in the US and Canada, including those related to trade agreements and investment screening, can impact Fuyao's ability to freely operate and expand its automotive glass production capacity in these regions.

Government policies promoting electric vehicles (EVs) and advanced manufacturing create significant opportunities for Fuyao Glass. For instance, China's continued support for EV production, with sales projected to reach 10 million units in 2024, directly benefits Fuyao as a key automotive glass supplier. Regional subsidies for automotive components or glass manufacturing can also influence Fuyao's strategic investment decisions, potentially lowering production costs.

Conversely, restrictive industrial policies, such as stringent environmental regulations or protectionist measures favoring domestic producers, could pose challenges. If new regulations increase compliance costs or trade barriers limit market access, Fuyao's growth and ability to serve global markets might be constrained.

Political instability in regions where Fuyao Glass operates or sells products can disrupt manufacturing, supply chains, and market demand. Heightened geopolitical tensions, particularly in East Asia, could impact raw material sourcing and finished goods distribution, necessitating robust risk management strategies.

Government regulations concerning vehicle safety, emissions, and fuel efficiency significantly influence the automotive glass market. Evolving safety standards, like those mandating enhanced impact resistance, can drive demand for specialized glass. In 2024, global automotive safety regulations continue to tighten, pushing manufacturers to integrate more advanced materials.

What is included in the product

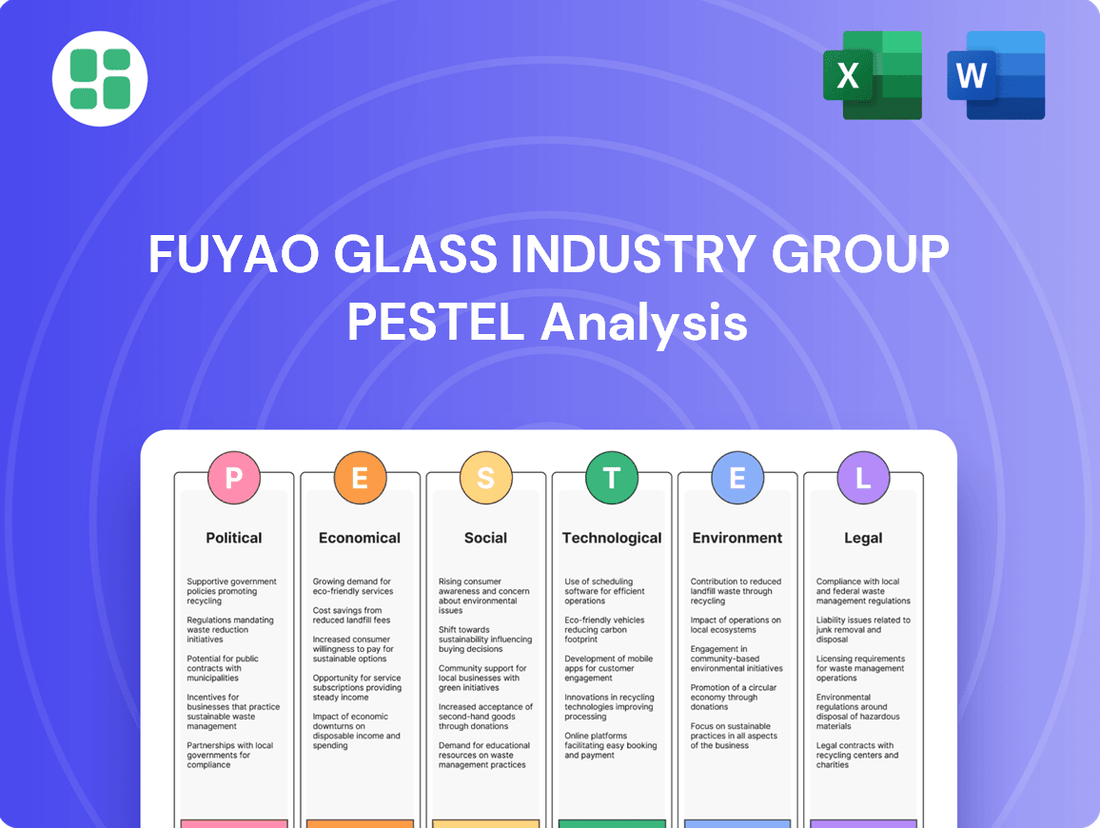

This PESTLE analysis examines the external macro-environmental factors influencing Fuyao Glass Industry Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers a strategic overview to identify opportunities and threats, aiding in informed decision-making for stakeholders.

A PESTLE analysis for Fuyao Glass Industry Group acts as a pain point reliever by providing a structured framework to proactively identify and address external challenges and opportunities, thereby mitigating risks and informing strategic decisions.

This analysis offers a clear, summarized version of Fuyao's operating environment, enabling quick referencing during meetings and facilitating informed discussions on external risks and market positioning.

Economic factors

The global automotive market's trajectory is a critical determinant of Fuyao Glass's performance. In 2024, the automotive industry is showing signs of recovery and growth after recent disruptions. For instance, global vehicle sales are projected to reach approximately 90 million units in 2024, a notable increase from previous years, directly translating to higher demand for automotive glass.

Economic downturns pose a significant risk, as seen in potential slowdowns in major markets like Europe and North America. A contraction in vehicle production, which could be triggered by rising inflation or interest rates, would directly impact Fuyao's sales volumes and profitability. For example, a 5% drop in global vehicle production could reduce Fuyao's revenue by a substantial margin.

Conversely, a robust automotive market, fueled by factors like pent-up consumer demand and the ongoing transition to electric vehicles (EVs), presents a significant opportunity. The increasing production of EVs, which often incorporate more advanced and larger glass components, is expected to drive Fuyao's revenue growth through 2025 and beyond.

Fuyao Glass Industry Group's manufacturing process is heavily dependent on key raw materials such as silica sand, soda ash, and various energy sources. The global market for these commodities is prone to significant price swings, directly affecting Fuyao's operational expenses and, consequently, its profitability. For instance, the price of soda ash, a critical component in glassmaking, saw considerable volatility in 2023 and early 2024 due to supply chain disruptions and increased demand from various industries.

To navigate this inherent volatility, Fuyao Glass must employ sophisticated procurement strategies. This could involve securing long-term supply contracts to lock in prices or exploring avenues for vertical integration to gain more control over its raw material inputs. Such measures are crucial for maintaining cost stability and ensuring predictable production expenses, which is vital for competitive pricing in the automotive and construction sectors.

Fuyao Glass Industry Group, as a global player with manufacturing and sales across various nations, faces significant exposure to currency exchange rate fluctuations. For instance, during 2024, a strengthening of the US Dollar against currencies like the Euro or Chinese Yuan could make Fuyao's exports from its US facilities more expensive for European and Chinese buyers, potentially impacting sales volume.

Conversely, a weaker Yuan in 2025 might increase the cost of raw materials or specialized equipment imported into China for Fuyao's production lines. This dynamic directly affects the cost of goods sold and overall profitability. For example, if the Yuan depreciates by 5% against the USD, the cost of imported components priced in USD would rise proportionally.

To mitigate these inherent risks, Fuyao likely employs various hedging strategies, such as forward contracts or currency options. These financial instruments aim to lock in exchange rates for future transactions, thereby providing a degree of predictability and protecting profit margins from adverse currency movements throughout 2024 and into 2025.

Inflationary Pressures and Cost of Labor

Rising inflation significantly impacts Fuyao Glass Industry Group by increasing operational expenses. For instance, global inflation rates remained elevated through much of 2024, with the IMF projecting inflation to be around 5.9% in advanced economies and 8.1% in emerging markets by year-end 2024, directly affecting the costs of raw materials, energy, and transportation. This surge in costs can compress profit margins if not effectively managed through pricing strategies or efficiency gains.

Wage inflation presents a notable challenge, particularly in Fuyao's key manufacturing hubs. As of early 2025, many regions experienced wage growth exceeding 4-5% year-over-year due to tight labor markets and increased living costs. To maintain competitiveness, Fuyao must focus on enhancing operational efficiency and exploring automation solutions to offset these rising labor expenditures, ensuring that its production costs remain manageable.

- Rising inflation: Global inflation projected around 5.9% in advanced economies and 8.1% in emerging markets for 2024, increasing raw material, energy, and logistics costs for Fuyao.

- Wage inflation: Labor costs are pressured by wage growth exceeding 4-5% in key manufacturing regions in early 2025.

- Competitiveness: Fuyao needs to balance cost control with attractive compensation to retain talent while investing in efficiency and automation.

Consumer Spending and Disposable Income

Consumer confidence and disposable income are key drivers for the automotive industry, directly impacting demand for new vehicles and, consequently, automotive glass. For instance, during periods of economic uncertainty, consumers often postpone large purchases like cars. This slowdown in vehicle sales can lead to reduced order volumes for Fuyao Glass from its automotive manufacturing clients.

Economic stability and growth are therefore critical for Fuyao Glass. When consumers feel financially secure and have more disposable income, they are more likely to purchase new vehicles. This trend directly translates to higher demand for automotive glass components. For example, in 2024, consumer spending on durable goods, including vehicles, showed resilience in many developed economies, supporting automotive production levels.

- Consumer Confidence: High consumer confidence generally correlates with increased spending on discretionary items like new vehicles.

- Disposable Income: Rising disposable income provides consumers with greater purchasing power for automobiles.

- Economic Downturn Impact: Reduced consumer spending during economic downturns directly dampens vehicle sales and automotive glass demand.

- 2024 Data Point: Reports from early 2024 indicated a slight uptick in consumer confidence in key automotive markets, providing a more stable outlook for vehicle production.

The economic landscape significantly influences Fuyao Glass's operations through inflation, currency fluctuations, and consumer spending. Global inflation, projected around 5.9% in advanced economies and 8.1% in emerging markets for 2024, directly escalates raw material and energy costs, impacting Fuyao's profit margins. Wage inflation, with labor costs rising over 4-5% in key manufacturing regions by early 2025, necessitates efficiency improvements and automation to manage expenses. Currency volatility, for example, a strengthening USD against the Euro in 2024, can affect export competitiveness.

| Economic Factor | 2024 Projection/Data | Impact on Fuyao Glass | Mitigation/Opportunity |

|---|---|---|---|

| Global Inflation | 5.9% (Advanced Economies), 8.1% (Emerging Markets) | Increased raw material, energy, and logistics costs | Pricing strategies, efficiency gains, long-term supply contracts |

| Wage Inflation | >4-5% YoY (Early 2025) | Higher labor expenditures in manufacturing hubs | Automation, operational efficiency, talent retention strategies |

| Currency Exchange Rates (USD/EUR) | USD strengthening | Potentially higher export costs for European buyers | Hedging strategies (forward contracts, options) |

| Consumer Spending (Automotive) | Resilient in developed economies (2024) | Supports vehicle production and glass demand | Capitalizing on EV transition and increased vehicle sales |

Same Document Delivered

Fuyao Glass Industry Group PESTLE Analysis

The preview you see here is the exact Fuyao Glass Industry Group PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. You can confidently assess the political, economic, social, technological, legal, and environmental factors impacting Fuyao Glass with this comprehensive report. This is the real, ready-to-use file you’ll get upon purchase, providing valuable insights for strategic decision-making.

Sociological factors

Consumer tastes are shifting, with a growing appetite for vehicles featuring larger glass areas, panoramic sunroofs, and integrated heads-up displays. These evolving preferences directly translate into demand for advanced automotive glass solutions that enhance both aesthetics and functionality. Fuyao's ability to innovate and supply these sophisticated glass components is crucial for maintaining its edge.

Safety remains paramount, driving the integration of enhanced safety features within automotive glass, such as advanced driver-assistance systems (ADAS) that rely on precise glass calibration. Furthermore, the accelerating transition to electric vehicles (EVs) presents new design and material considerations for automotive glass, influencing everything from weight reduction to thermal management. For instance, by 2025, it's projected that EVs will constitute over 20% of new vehicle sales globally, a significant increase from just a few years prior, underscoring the need for Fuyao to adapt its product offerings to this burgeoning market.

Fuyao Glass Industry Group's manufacturing and R&D heavily rely on a skilled workforce. In 2024, China's manufacturing sector, a key operational area for Fuyao, faced a persistent need for specialized technical talent, with reports indicating a shortage in advanced manufacturing skills. This scarcity directly influences labor costs and the group's ability to innovate efficiently.

Demographic shifts present ongoing challenges. As of 2025, many developed economies, and increasingly China, are experiencing an aging workforce, potentially leading to a smaller pool of younger, adaptable workers and higher healthcare-related labor expenses. Conversely, rapid technological advancements demand continuous upskilling, creating a gap that Fuyao must actively address through training initiatives.

Maintaining harmonious labor relations is paramount for operational stability. Fuyao's commitment to employee development, including vocational training programs, aims to mitigate skill gaps and foster loyalty. For instance, investments in apprenticeships and continuous learning programs in 2024 were designed to ensure a pipeline of qualified technicians and engineers, crucial for maintaining production quality and driving future growth.

Fuyao Glass Industry Group faces growing societal expectations for robust health and safety measures. In 2024, global workplace accident rates remained a concern, with manufacturing sectors often showing higher incidents. This societal pressure means Fuyao must prioritize employee well-being, investing in advanced safety equipment and comprehensive training to meet evolving standards.

Maintaining high health and safety awareness is crucial for Fuyao's operational integrity and public image. By adhering to stringent protocols, the company can mitigate risks, reduce potential liabilities, and foster a positive work environment. This commitment can directly impact employee retention and attract talent, a significant factor in the competitive automotive and construction glass markets.

Corporate Social Responsibility (CSR) Expectations

Fuyao Glass Industry Group, like many global corporations, faces increasing societal pressure to demonstrate robust Corporate Social Responsibility (CSR). Consumers and investors in 2024 and 2025 are scrutinizing companies not just for their financial performance but also for their ethical conduct and community impact. This translates to expectations around responsible sourcing of raw materials and upholding fair labor standards throughout their supply chain. For instance, in 2023, reports indicated a growing consumer preference for brands with transparent and ethical supply chains, a trend expected to intensify.

The company's commitment to community engagement and sustainable practices directly influences its brand image and ability to attract and retain talent, as well as secure investor confidence. Strong CSR performance can be a significant differentiator in a competitive market. Surveys from late 2023 and early 2024 consistently show that a significant percentage of millennials and Gen Z consider a company's social and environmental impact when making purchasing decisions or choosing employers. This suggests that Fuyao's investments in CSR initiatives, such as environmental protection and employee well-being programs, are crucial for its long-term success and stakeholder relations.

- Ethical Operations: Societal demand for ethical business practices, including fair wages and safe working conditions, is a key driver for Fuyao's operational strategies in 2024-2025.

- Community Investment: Growing expectations for companies to contribute positively to the communities where they operate, through local employment and social programs, impacts Fuyao's corporate citizenship.

- Brand Reputation: Positive CSR initiatives, such as those focused on sustainability and employee welfare, are vital for enhancing Fuyao's brand loyalty and attracting socially conscious investors.

- Talent Acquisition: Companies with strong CSR track records, like Fuyao aiming to be a leader, find it easier to attract and retain top talent in the competitive labor market of 2024.

Urbanization and Lifestyle Changes

Global urbanization continues to reshape consumer habits, with a growing emphasis on personal mobility and longer commutes. This trend directly impacts the automotive sector, influencing the demand for specific vehicle types, sizes, and features. Consequently, Fuyao Glass Industry Group needs to closely track these evolving lifestyles to ensure its product offerings align with changing consumer preferences for automotive glass.

As more people move to cities, the need for efficient and comfortable personal transportation increases. This can translate into a higher demand for SUVs and crossover vehicles, which often require larger and more complex glass components. For instance, the global urban population is projected to reach 68% by 2050, according to the UN, highlighting the sustained growth in urban living and its associated transportation needs.

- Urban Population Growth: The UN projects global urbanization to reach 68% by 2050, a significant increase from 56% in 2021.

- Commuting Patterns: Increased urban density often leads to longer average commute times, driving demand for comfortable and feature-rich vehicles.

- Vehicle Preferences: Urban dwellers often favor compact SUVs and crossovers, which have different glass requirements compared to traditional sedans.

- Personal Mobility Focus: The desire for personal mobility in urban environments fuels the overall automotive market, indirectly affecting glass demand.

Societal expectations for ethical business practices, including fair wages and safe working conditions, are a significant driver for Fuyao's operational strategies in 2024-2025. There's a growing demand for companies to contribute positively to their communities through local employment and social programs, impacting Fuyao's corporate citizenship. Strong Corporate Social Responsibility (CSR) initiatives, particularly those focused on sustainability and employee welfare, are vital for enhancing brand loyalty and attracting socially conscious investors.

Companies with robust CSR track records, like Fuyao aiming to be a leader, find it easier to attract and retain top talent in the competitive labor market of 2024. For instance, surveys from late 2023 and early 2024 consistently show that a significant percentage of millennials and Gen Z consider a company's social and environmental impact when making purchasing decisions or choosing employers.

Global urbanization trends, with the UN projecting urban populations to reach 68% by 2050, are reshaping consumer habits and increasing the demand for personal mobility. This directly impacts the automotive sector, influencing preferences for vehicle types like SUVs and crossovers, which in turn have different glass requirements. Longer average commute times in denser urban areas also drive demand for comfortable and feature-rich vehicles, indirectly affecting glass demand for Fuyao.

| Societal Factor | Impact on Fuyao Glass | Key Data/Trend |

| Ethical Business Practices | Influences operational strategies, labor relations, and supply chain management. | Growing consumer and investor scrutiny on fair labor and ethical sourcing (2024-2025). |

| Corporate Social Responsibility (CSR) | Enhances brand reputation, talent acquisition, and investor confidence. | Millennials and Gen Z prioritize companies' social/environmental impact (late 2023-early 2024 surveys). |

| Urbanization | Drives demand for specific vehicle types (SUVs/crossovers) with complex glass needs. | UN projects global urban population to reach 68% by 2050. |

| Talent Demand | Highlights the need for skilled labor in advanced manufacturing and R&D. | Shortage of specialized technical talent in China's manufacturing sector (2024 reports). |

Technological factors

Fuyao Glass is benefiting from continuous advancements in glass manufacturing. Innovations like improved production efficiency and reduced energy consumption, driven by new technologies, are key. For instance, in 2023, Fuyao reported significant investments in upgrading its production lines, aiming to enhance output by an estimated 15% while simultaneously cutting energy usage by 10% across its major facilities.

Investing in cutting-edge machinery directly translates to higher quality products and lower production costs for Fuyao. The company's strategic focus on automation and the integration of Artificial Intelligence (AI) in its manufacturing processes is becoming increasingly critical. By 2024, Fuyao plans to have automated over 70% of its primary assembly processes, a move expected to further boost precision and cost-effectiveness.

The evolution of smart glass, encompassing switchable, heated, and sensor-integrated variants, opens substantial avenues for Fuyao Glass Industry Group. Automotive clients are increasingly seeking these advanced glass solutions for improved vehicle safety, passenger comfort, and in-car connectivity, driving demand for innovation.

Fuyao's investment in research and development for these cutting-edge glass technologies is paramount to capitalizing on this burgeoning market. For instance, the global smart glass market was valued at approximately USD 4.5 billion in 2023 and is projected to reach over USD 10 billion by 2030, indicating robust growth potential.

Fuyao Glass Industry Group's embrace of automation and robotics is a significant technological driver, enhancing production efficiency and reducing labor costs. This strategic adoption allows for the precise execution of complex manufacturing processes, directly contributing to improved product consistency and superior quality.

By investing in advanced robotics, Fuyao can optimize operational expenditures, a crucial factor for maintaining its competitive edge in the global automotive glass market. For instance, the automotive industry's overall investment in industrial robots saw a substantial increase, with global installations reaching over 500,000 units in 2023, signaling a strong trend towards automated manufacturing that Fuyao is actively participating in.

Research and Development Investment

Fuyao Glass Industry Group's commitment to research and development is a cornerstone of its technological advancement. In 2024, the company continued to prioritize innovation, focusing on creating lighter, stronger, and more energy-efficient glass solutions for the automotive sector. This sustained investment ensures Fuyao remains a leader in advanced glass technologies, meeting the evolving demands of vehicle manufacturers.

The company's R&D efforts are geared towards developing next-generation products, including smart glass functionalities and advanced coatings. Fuyao's dedication to a robust R&D pipeline is crucial for maintaining its competitive edge. For instance, their ongoing work in developing thinner yet more impact-resistant glass directly addresses the automotive industry's drive for weight reduction and enhanced safety. This focus is reflected in their strategic allocation of resources, aiming to push the boundaries of what's possible in glass manufacturing.

- Innovation Focus: Developing lighter, stronger, and energy-efficient glass for automotive applications.

- Product Development: Creating advanced glass solutions with integrated functionalities and coatings.

- Competitive Edge: Maintaining leadership in automotive and industrial glass technology through a strong R&D pipeline.

- Market Responsiveness: Addressing industry trends like vehicle weight reduction and enhanced safety through technological advancements.

Digitalization of Supply Chain and Operations

Fuyao Glass is actively embracing digitalization to streamline its supply chain and operations. By integrating technologies like the Internet of Things (IoT) and big data analytics, the company aims to achieve greater efficiency and transparency. This digital transformation is crucial for enhancing real-time monitoring of production processes and inventory levels.

The adoption of these advanced technologies is expected to yield significant benefits. Fuyao Glass can anticipate improved forecasting accuracy, optimized inventory management, and a more responsive operational framework. These advancements directly translate to potential cost savings and a superior customer service experience, keeping them competitive in the evolving automotive glass market.

Real-world examples highlight the impact of such digital initiatives. For instance, many leading manufacturers have reported substantial improvements in on-time delivery rates, often exceeding 95%, after implementing advanced supply chain visibility tools. Furthermore, studies indicate that companies leveraging big data analytics in their operations can reduce operational costs by as much as 10-15%.

- Enhanced Efficiency: Digital tools enable real-time tracking and optimization of logistics and production.

- Improved Transparency: IoT sensors and data platforms provide clear visibility across the entire supply chain.

- Cost Reduction: Better forecasting and inventory control directly impact operational expenses.

- Customer Service: Faster response times and reliable delivery lead to greater customer satisfaction.

Fuyao Glass is leveraging technological advancements to boost production efficiency and product quality through automation and AI. The company's investment in upgrading production lines aims for a 15% output increase and 10% energy reduction by 2023.

The development of smart glass, including switchable and sensor-integrated variants, is a key area of focus, responding to automotive industry demands for enhanced safety and connectivity. The global smart glass market is projected to grow significantly, reaching over USD 10 billion by 2030.

Fuyao's adoption of robotics and digitalization, including IoT and big data analytics, is streamlining operations and supply chains. This digital transformation is expected to improve forecasting, inventory management, and reduce operational costs by up to 15%.

| Technology Area | Fuyao's Investment/Focus | Impact/Benefit | Market Data/Projection |

|---|---|---|---|

| Automation & AI | Upgrading production lines, automating assembly processes (70% by 2024) | Increased output (15%), reduced energy consumption (10%), improved precision | Automotive industry investment in industrial robots exceeded 500,000 units in 2023 |

| Smart Glass Development | R&D in switchable, heated, sensor-integrated glass | Meeting automotive demand for safety, comfort, connectivity | Global smart glass market valued at USD 4.5 billion in 2023, projected to exceed USD 10 billion by 2030 |

| Digitalization (IoT, Big Data) | Streamlining supply chain and operations | Enhanced efficiency, transparency, improved forecasting, cost reduction (up to 15%) | Companies using big data analytics report up to 15% operational cost reduction |

Legal factors

Fuyao Glass Industry Group navigates a complex landscape of international trade laws, including import/export regulations and customs duties across its global operations. For instance, the automotive industry, a key sector for Fuyao, is heavily influenced by trade policies. In 2024, ongoing trade discussions and potential adjustments to tariffs, particularly between major economic blocs, could directly affect Fuyao's cost of goods and market access.

Free trade agreements (FTAs) are critical for Fuyao's international trade. The continued evolution of agreements like the Regional Comprehensive Economic Partnership (RCEP), which came into force in early 2022 and includes many of Asia's largest economies, presents both opportunities and challenges for supply chain efficiency and market penetration. Compliance with these evolving agreements is paramount to avoid penalties and ensure the seamless movement of glass products across borders.

Environmental protection laws and regulations significantly shape Fuyao Glass Industry Group's operations. For instance, stringent rules on emissions, waste management, and resource use necessitate substantial capital expenditure on advanced pollution control systems and eco-friendly manufacturing methods. Failure to comply can result in severe financial penalties, operational disruptions, and damage to the company's public image.

As a key supplier to the global automotive sector, Fuyao Glass Industry Group operates under a complex web of product safety and liability laws. These regulations, which vary significantly by region, dictate everything from material composition to impact resistance. For instance, in 2024, the U.S. National Highway Traffic Safety Administration (NHTSA) continued its rigorous enforcement of Federal Motor Vehicle Safety Standards (FMVSS), including those pertaining to glazing materials, with potential fines for non-compliance reaching millions of dollars.

Failures in automotive glass, such as shattering or improper sealing, can result in serious accidents, leading to substantial product liability claims, costly recalls, and severe damage to Fuyao's brand reputation. In 2023, the automotive industry saw an increase in product recall costs, with some major manufacturers facing hundreds of millions in expenses due to component defects, underscoring the financial risks involved.

To navigate these legal landscapes effectively, Fuyao must maintain exceptionally robust quality control and rigorous testing protocols. Investments in advanced testing equipment and adherence to international standards like ISO 2022-1, which covers automotive safety glazing, are critical for mitigating legal exposure and ensuring market access in 2025.

Labor and Employment Laws

Fuyao Glass Industry Group, like any global manufacturer, must navigate a complex web of labor and employment laws across its operational territories. These regulations dictate everything from minimum wage and overtime pay to crucial workplace safety standards and the rights of employees to organize. For instance, in 2024, the U.S. Department of Labor continues to enforce strict guidelines on working hours and overtime, while many European nations, such as Germany, have robust worker protection laws and strong union influence, impacting collective bargaining agreements and daily operations.

The significant variations in these legal frameworks necessitate a proactive and adaptable approach to human resource management. Fuyao's commitment to fair labor practices across its global footprint, which includes major manufacturing hubs in China, the United States, and Russia, means meticulously adhering to differing national and regional labor statutes. Failure to do so can result in costly legal battles, reputational damage, and operational disruptions. For example, a 2023 report highlighted increased scrutiny on supply chain labor practices, making compliance a critical business imperative.

- Compliance with diverse labor laws: Fuyao must adhere to varying regulations concerning wages, working hours, and safety in countries like China, the US, and Germany.

- Impact of unionization rights: The right to unionize in different jurisdictions affects collective bargaining and labor relations, as seen in the strong union presence in European automotive supply chains.

- Risk of legal challenges: Non-compliance can lead to significant legal disputes and financial penalties, underscoring the importance of diligent oversight.

- Global HR strategy: Developing a unified yet flexible HR strategy is essential to manage these legal complexities effectively and ensure consistent labor standards.

Intellectual Property Rights (IPR)

Protecting Fuyao Glass Industry Group's intellectual property, such as patents for its advanced manufacturing techniques and unique product designs, is paramount to sustaining its market leadership. These protections are essential for maintaining a competitive edge and fostering continued innovation within the automotive glass sector.

Fuyao must also diligently navigate the complex legal landscape to ensure its operations and products do not infringe upon the intellectual property rights of other entities. This vigilance is critical to avoid costly litigation and reputational damage.

The effectiveness of legal frameworks governing intellectual property enforcement and protection directly impacts Fuyao's ability to innovate and secure market exclusivity for its advancements. For instance, in 2024, global spending on patent litigation saw significant activity, underscoring the importance of robust IPR strategies.

- Patent Portfolio Strength: Fuyao’s investment in R&D, leading to a growing patent portfolio, directly supports its competitive advantage.

- Freedom to Operate: Ensuring no infringement on competitors' patents is a continuous legal and operational necessity.

- IP Enforcement: Strong legal recourse for IP violations is vital for safeguarding Fuyao's innovations and market share.

- Global IP Laws: Navigating varying international IP regulations is key for Fuyao's global manufacturing and sales operations.

Fuyao Glass Industry Group operates under a stringent regulatory environment for product safety and liability, particularly within the automotive sector. In 2024, compliance with standards like the U.S. FMVSS for glazing materials remains critical, with potential fines for non-compliance escalating into millions of dollars. The company's commitment to rigorous quality control and advanced testing, aligned with international standards such as ISO 2022-1, is essential to mitigate risks associated with product defects, costly recalls, and brand damage, especially given the increasing product recall expenses observed in the automotive industry in 2023.

| Legal Factor | Impact on Fuyao Glass | 2024/2025 Relevance |

|---|---|---|

| Product Safety & Liability | Ensures adherence to automotive glazing standards (e.g., FMVSS, ISO 2022-1). | Critical for market access and avoiding substantial fines and recall costs. |

| International Trade Laws | Governs import/export regulations and tariffs across global operations. | Tariff adjustments and trade policy shifts can impact cost of goods and market access in 2024. |

| Intellectual Property Rights | Protects patents for manufacturing techniques and product designs. | Safeguarding innovations is key to market leadership and preventing costly IP litigation. |

| Labor & Employment Laws | Dictates wages, safety, and collective bargaining rights in various countries. | Compliance with diverse labor statutes in hubs like China and the US is vital to avoid legal disputes and reputational harm. |

Environmental factors

Fuyao Glass faces mounting pressure from governments, investors, and consumers to enhance its sustainability practices. This includes a significant push to reduce its carbon footprint through improved energy efficiency in its manufacturing processes and a strategic shift towards renewable energy sources. For instance, by the end of 2023, Fuyao had invested in solar power installations across several of its facilities, aiming to power a notable portion of its operations with clean energy.

The glass manufacturing process inherently creates waste, and with environmental regulations tightening, Fuyao Glass Industry Group faces increasing pressure for responsible waste management and recycling. This means investing in advanced technologies to reduce waste at the source and enhance the recycling of glass cullet, a key raw material. For instance, by 2024, many regions saw stricter limits on landfilling glass waste, pushing companies like Fuyao to innovate in their circular economy practices.

Effectively managing waste and maximizing recycling not only helps Fuyao meet regulatory requirements but also presents a significant opportunity for cost savings. Increased cullet usage, for example, directly reduces the need for virgin raw materials like sand and soda ash, which can be costly. In 2025, reports indicate that the global glass recycling rate is still below optimal levels, highlighting the potential for companies that prioritize these efforts to gain a competitive edge and improve their environmental footprint.

Fuyao Glass Industry Group's reliance on silica sand and soda ash means that their availability and sustainable sourcing are paramount. Environmental concerns, such as potential resource depletion or disruptions in the supply chain, are driving the need for Fuyao to investigate alternative materials and enhance the efficiency of their current resource utilization. For instance, global demand for silica sand is projected to grow, with significant consumption in construction and manufacturing sectors, underscoring the importance of securing stable supply lines.

Climate Change Impacts

Climate change presents significant operational challenges for Fuyao Glass. Extreme weather events, like the severe storms and flooding experienced in various regions in 2024, can directly impact manufacturing facilities and disrupt the transportation of raw materials and finished goods, thereby affecting Fuyao's supply chain stability.

To mitigate these risks, Fuyao Glass must increasingly focus on adapting its infrastructure and sourcing strategies. This includes investing in resilient manufacturing sites and exploring diversified supply chains to reduce reliance on single geographic areas prone to climate-related disruptions. For instance, companies globally are increasing their climate resilience investments, with projections indicating a substantial rise in spending on adaptation measures in the coming years.

Furthermore, evolving climate-related policies, such as carbon pricing mechanisms and stricter environmental regulations, directly influence operational costs for energy-intensive industries like glass manufacturing. These policies can also shape market demand, as consumers and business partners increasingly prioritize sustainability, potentially impacting Fuyao's competitive positioning and market share.

- Supply Chain Disruption: Extreme weather events in 2024, including major floods in Asia and severe storms in Europe, highlighted vulnerabilities in global supply chains, impacting logistics and raw material availability for manufacturers like Fuyao.

- Adaptation Investments: Global spending on climate adaptation is projected to grow significantly, with businesses across sectors enhancing the resilience of their operations and diversifying sourcing to counter climate-related risks.

- Policy Influence: Emerging carbon taxes and emissions standards in key markets are expected to increase operational expenses for energy-intensive industries, while also potentially driving demand for more sustainable products and processes.

Circular Economy Principles

Fuyao Glass Industry Group is increasingly integrating circular economy principles, focusing on reducing, reusing, and recycling materials. This strategy aims to significantly improve their environmental footprint across the entire product lifecycle. By 2024, the automotive industry's push for sustainability is driving demand for manufacturers like Fuyao to adopt more eco-friendly production methods.

Designing glass for easier disassembly and recycling is a key component of Fuyao's approach. Furthermore, they are actively collaborating with automotive manufacturers to develop robust end-of-life vehicle glass management programs. This partnership is crucial for ensuring that valuable materials are recovered and reintroduced into the production cycle, aligning with global resource efficiency goals.

- Enhanced Resource Efficiency: By 2025, the global push for a circular economy is projected to unlock trillions in economic value, with material efficiency being a core driver. Fuyao's adoption of these principles directly contributes to reducing reliance on virgin raw materials.

- Reduced Waste and Emissions: Implementing recycling programs for automotive glass can divert significant tonnage from landfills. For instance, the European Union aims to increase recycling rates for construction and demolition waste, a principle applicable to automotive glass, by 70% by 2030.

- Improved Brand Reputation: Consumers and business partners are increasingly prioritizing environmentally responsible companies. Fuyao's commitment to circularity enhances its image as a forward-thinking and sustainable supplier in the automotive sector.

- Innovation in Product Design: The focus on recyclability encourages innovation in glass composition and manufacturing processes, potentially leading to new product development opportunities and cost savings in the long run.

Fuyao Glass is navigating a landscape increasingly shaped by environmental regulations and a global push for sustainability. The company is investing in renewable energy, with solar installations at several sites by late 2023 to power operations. There's also a strong focus on waste management and recycling, driven by stricter landfill limits in 2024 and the economic benefits of using recycled glass cullet, which reduces reliance on costly virgin materials.

Climate change poses direct operational risks, as seen with extreme weather events in 2024 disrupting supply chains. Consequently, Fuyao is enhancing infrastructure resilience and diversifying sourcing. Emerging climate policies, such as carbon pricing, are anticipated to increase operational costs for energy-intensive manufacturing, while also potentially boosting demand for sustainable products.

The company is actively embracing circular economy principles, aiming to reduce, reuse, and recycle materials throughout the product lifecycle. This includes designing glass for easier recycling and collaborating on end-of-life vehicle glass management programs. By 2025, these circular economy strategies are expected to unlock significant economic value through enhanced resource efficiency and reduced waste, while also improving brand reputation among environmentally conscious consumers.

| Environmental Factor | Impact on Fuyao Glass | Key Data/Trend |

|---|---|---|

| Carbon Footprint Reduction | Pressure to lower emissions; investment in energy efficiency and renewables. | Solar installations at multiple sites by end of 2023. |

| Waste Management & Recycling | Need for advanced waste reduction and cullet recycling technologies. | Stricter landfill limits in 2024; cullet use reduces raw material costs. |

| Resource Availability | Concerns over silica sand and soda ash supply chain stability. | Global silica sand demand projected to grow. |

| Climate Change Adaptation | Risk of supply chain disruption from extreme weather; need for resilient infrastructure. | Global climate adaptation investments projected to rise. |

| Circular Economy Integration | Focus on reducing, reusing, and recycling for sustainability and cost savings. | Automotive industry demand for eco-friendly production methods (2024). |

PESTLE Analysis Data Sources

Our PESTLE analysis for Fuyao Glass Industry Group is built on a comprehensive review of data from official government publications, leading economic and market research firms, and reputable industry associations. We gather insights on regulatory changes, economic forecasts, technological advancements, and social trends to ensure a well-rounded understanding of the macro-environment.