Fuyao Glass Industry Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyao Glass Industry Group Bundle

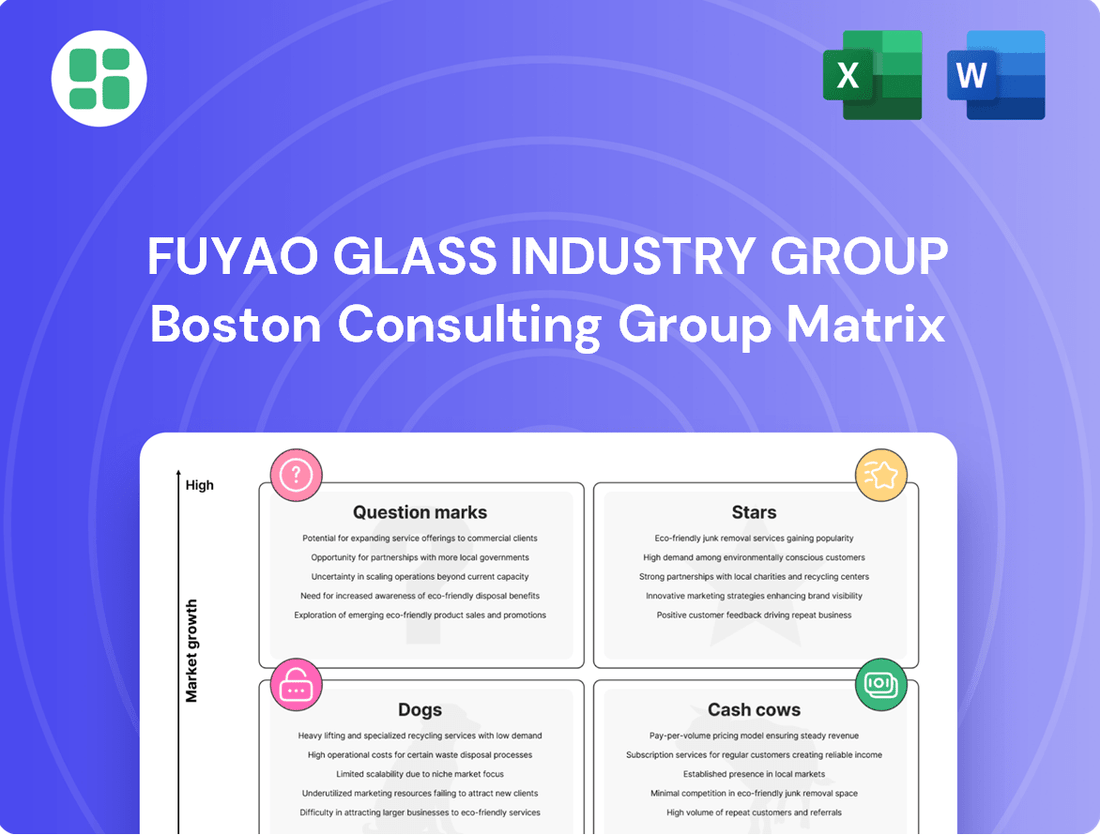

Curious about Fuyao Glass Industry Group's strategic positioning? This glimpse into their BCG Matrix reveals key product categories, but the full report unlocks the complete picture. Understand which segments are fueling growth and which require careful management.

Don't miss out on the critical details that drive Fuyao Glass's success. Purchase the full BCG Matrix for a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights to inform your own business strategies.

Gain the competitive edge by understanding Fuyao Glass's product portfolio in depth. The full BCG Matrix provides the strategic clarity needed to make informed decisions and identify future investment opportunities.

Stars

Fuyao Glass Industry Group is strategically positioning itself in the advanced automotive glass market, recognizing the significant growth potential in electric vehicles (EVs), advanced driver-assistance systems (ADAS), and heads-up displays (HUDs). This focus highlights their understanding of evolving automotive trends and the demand for specialized glass solutions.

The company's commitment is underscored by substantial investments in technologies catering to these high-growth sectors. For instance, battery electric vehicle (BEV) automotive glass is expected to see a compound annual growth rate (CAGR) of 17.4% through 2030, while smart glass, crucial for ADAS and HUDs, is projected to grow at a 12.8% CAGR during the same period. These figures demonstrate a clear market opportunity that Fuyao is actively pursuing.

Fuyao's investment in a new plant in Moraine, Ohio, alongside continued expansion in China, is a direct response to the anticipated demand for these next-generation automotive glass products. This expansion aims to bolster their production capacity and technological capabilities in these critical and expanding market segments.

Panoramic sunroofs are a rapidly growing segment in the automotive industry, with demand projected to increase at a 10.2% compound annual growth rate through 2030. Fuyao Glass Industry Group is strategically positioned to capitalize on this trend by developing and supplying advanced smart dimming glass for these expansive roof systems.

This focus on smart dimming glass for panoramic sunroofs places Fuyao in a high-growth niche within the automotive glass market. The company is actively enhancing its market share and the sophistication of its product offerings in this area, reflecting a commitment to innovation and future automotive trends.

Fuyao Glass Industry Group's lightweight and energy-efficient glass products are a prime example of their investment in innovation. These advanced materials can decrease vehicle weight by as much as 15%, a significant factor in improving fuel economy and lowering emissions. This strategic focus directly supports the automotive industry's drive towards sustainability, especially with the rapid expansion of the electric vehicle market.

High Value-Added Product Segment

Fuyao Glass Industry Group is actively repositioning its product portfolio to emphasize high value-added items. This strategic pivot is evident in the growing contribution of advanced products like panoramic canopies, ADAS-compatible glass, and Heads-Up Displays (HUDs) to their overall revenue.

These sophisticated offerings are becoming increasingly central to Fuyao's business. In fact, for the first three quarters of 2024, this high value-added segment represented a substantial 58.18% of the company's total revenue. This marks a significant upward trend compared to the prior year, underscoring the success of their strategic focus.

Looking ahead, the outlook for these premium products remains robust. Fuyao anticipates an average selling price (ASP) growth rate of 6-7% annually over the next five years for this segment. This projected growth further validates their strategy of investing in and promoting these technologically advanced and higher-margin glass solutions.

- Revenue Share: High value-added products constituted 58.18% of Fuyao's revenue in the first three quarters of 2024.

- Product Focus: Key products include panoramic canopies, ADAS-compatible glass, and HUDs.

- Projected Growth: The segment is expected to experience 6-7% annual ASP growth over the next five years.

Global Expansion in High-Growth Regions for Advanced Glass

Fuyao Glass Industry Group's strategic global expansion in high-growth regions, particularly in North America, is a cornerstone of its growth strategy. The company has made significant capital investments to bolster its manufacturing capabilities and cater to evolving market needs.

- Manufacturing Prowess: Fuyao invested $300 million in a new manufacturing facility in Moraine, Ohio, and an additional $400 million for expansion in Decatur, Illinois.

- Market Capture: These substantial investments are designed to meet the escalating demand for advanced float glass and specialized automotive glass in key international markets.

- Technological Alignment: The expansions are strategically situated to capitalize on the growth trajectory of advanced automotive technologies, ensuring Fuyao remains at the forefront of innovation.

Fuyao Glass Industry Group's high value-added products, such as panoramic canopies and ADAS-compatible glass, are clearly its Stars in the BCG Matrix. These sophisticated offerings represented a significant 58.18% of the company's revenue in the first three quarters of 2024. This segment is projected to see robust growth, with an anticipated average selling price increase of 6-7% annually over the next five years.

This strong performance and future potential position these advanced glass solutions as key growth drivers for Fuyao. Their strategic investments in manufacturing capabilities, like the $300 million facility in Moraine, Ohio, directly support the expansion of these Star products. This focus aligns with the booming demand for electric vehicles and advanced automotive technologies.

The company's commitment to innovation in lightweight and energy-efficient glass further solidifies these products as Stars. These advancements contribute to vehicle sustainability, a critical factor in the expanding EV market. Fuyao's strategic pivot towards these premium, technologically advanced items is a clear indicator of their market leadership and future revenue streams.

| Product Category | BCG Matrix Quadrant | Key Growth Indicators | 2024 Revenue Share (Q1-Q3) | Projected ASP Growth (Next 5 Years) |

|---|---|---|---|---|

| High Value-Added Glass (Panoramic Canopies, ADAS, HUDs) | Stars | High demand in EV & ADAS markets, technological innovation | 58.18% | 6-7% annually |

What is included in the product

Fuyao Glass Industry Group's BCG Matrix likely categorizes its diverse product lines, indicating which segments are market leaders (Stars/Cash Cows) and which require strategic decisions (Question Marks/Dogs).

The Fuyao Glass Industry Group BCG Matrix offers a strategic roadmap, transforming complex market data into actionable insights for decisive resource allocation.

This visual tool simplifies portfolio management, providing a clear path to optimize investments and address underperforming segments.

Cash Cows

Fuyao Glass Industry Group's traditional automotive windshields and sidelites represent a classic cash cow. As the world's largest manufacturer, Fuyao commands a substantial market share in this mature segment, supplying essential components for internal combustion engine vehicles.

This dominance translates into a consistent and robust cash flow. Fuyao's deep-rooted relationships with major global automakers, coupled with its highly efficient, large-scale production capabilities, ensure predictable demand and profitability from these core products.

Fuyao Glass Industry Group's established OEM supply chains are a classic example of a Cash Cow within the BCG matrix. They are a primary supplier to major global automakers like Mercedes-Benz, BMW, Volkswagen, and Toyota, securing consistent, high-volume orders for standard automotive glass.

These long-standing relationships and broad customer base create predictable and substantial revenue streams. For instance, in 2024, Fuyao reported strong performance in its automotive glass segment, driven by these OEM contracts, contributing significantly to its overall profitability and market stability.

Fuyao's standard float glass production is a cornerstone of its business, supplying critical materials for its automotive and industrial glass segments. This division, though likely in a mature market, leverages economies of scale and efficient production to maintain profitability, acting as a stable revenue generator.

In 2023, Fuyao Glass reported revenue of RMB 27.5 billion, with its glass products segment, including float glass, being a significant contributor. The company’s focus on cost optimization in its float glass operations ensures it remains competitive, providing a reliable foundation for its more specialized offerings.

Industrial Glass Applications

Fuyao Glass Industry Group's industrial glass applications represent a significant, albeit less publicized, segment. This area likely houses mature products with predictable demand, contributing to the company's overall stability.

These industrial uses, encompassing sectors beyond automotive, bolster Fuyao's market share and provide consistent cash flow. The established nature of these applications means they are likely cash cows within the BCG matrix, generating more cash than they consume.

- Stable Demand: Industrial glass applications often cater to sectors with consistent, long-term needs, ensuring predictable revenue streams.

- Market Share Contribution: While automotive glass is prominent, industrial segments contribute to Fuyao's overall high market share, reinforcing its strong competitive position.

- Cash Generation: The maturity and established demand in industrial glass applications allow for efficient production and strong, consistent cash generation, characteristic of a cash cow.

Domestic Chinese Automotive Glass Market Dominance

Fuyao Glass Industry Group's dominance in the domestic Chinese automotive glass market positions it firmly as a Cash Cow. The company holds a commanding approximately 60% market share within China's highly mature and competitive automotive glass sector. This leadership translates directly into robust and stable cash flows, a hallmark of a Cash Cow.

The consistent revenue generation stems from Fuyao's established production capacity and a well-developed distribution network across China. In 2023, Fuyao Glass reported revenue of ¥27.5 billion, with its automotive glass segment being a significant contributor. The mature nature of the Chinese market, while competitive, means demand is relatively stable, allowing Fuyao to leverage its scale for efficient operations and strong profitability.

- Market Share: Approximately 60% in the Chinese automotive glass market.

- Market Maturity: Highly mature and competitive, indicating stable demand.

- Cash Generation: Substantial and consistent due to market leadership and scale.

- Revenue Contribution: The automotive glass segment is a key driver of Fuyao's overall financial performance, with the company reporting ¥27.5 billion in revenue for 2023.

Fuyao's traditional automotive windshields and sidelites are prime examples of cash cows. As the world's largest manufacturer, Fuyao Glass Industry Group benefits from a substantial market share in this mature automotive segment, ensuring consistent and robust cash flow. These core products, essential for internal combustion engine vehicles, are supported by deep-rooted relationships with major global automakers and highly efficient, large-scale production capabilities.

The company's established Original Equipment Manufacturer (OEM) supply chains, serving brands like Mercedes-Benz, BMW, Volkswagen, and Toyota, are a testament to its cash cow status. These long-standing relationships generate predictable, high-volume orders for standard automotive glass, contributing significantly to overall profitability and market stability. In 2024, Fuyao's automotive glass segment continued to perform strongly, bolstered by these crucial OEM contracts.

Fuyao's dominance in the Chinese automotive glass market, where it holds approximately 60% market share, further solidifies its cash cow position. This leadership in a mature market translates into stable demand and efficient operations, allowing for strong profitability. The company's overall revenue for 2023 reached RMB 27.5 billion, with automotive glass being a significant contributor to this financial strength.

| Product Segment | Market Position | Cash Flow Generation | Key Drivers |

|---|---|---|---|

| Automotive Windshields & Sidelites (Global) | World's Largest Manufacturer | High & Stable | Large Market Share, OEM Contracts, Scale Efficiency |

| Automotive Glass (China) | ~60% Market Share | Substantial & Consistent | Domestic Leadership, Mature Market Demand, Established Network |

| Standard Float Glass | Key Supplier | Reliable | Economies of Scale, Cost Optimization, Broad Application |

Full Transparency, Always

Fuyao Glass Industry Group BCG Matrix

The preview of the Fuyao Glass Industry Group BCG Matrix you are currently viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by industry experts, provides a clear strategic overview of Fuyao Glass's product portfolio, categorizing each business unit into Stars, Cash Cows, Question Marks, and Dogs. The full report is ready for immediate download and integration into your strategic planning, offering actionable insights without any further modifications or hidden content.

Dogs

Legacy niche industrial glass products, particularly those lacking innovation or adaptation to evolving market demands, likely reside in the Dogs quadrant for Fuyao Glass Industry Group. These items typically command a small market share within stagnant or contracting industrial sectors.

Such products contribute minimally to Fuyao's overall revenue and can tie up valuable capital that could be better allocated to more promising ventures. For instance, if Fuyao were to continue producing specialized glass for older, less efficient machinery that is being phased out, these would represent a clear example of a Dog.

Outdated production lines for basic glass at Fuyao Glass Industry Group, if they exist and are not slated for upgrades, would likely fall into the Dogs category of the BCG matrix. These lines, focused on undifferentiated products, would generate lower profit margins and offer limited growth potential, consuming resources without contributing significantly to the company's future expansion.

Underperforming regional markets with limited strategic focus for Fuyao Glass Industry Group would be considered Dogs in the BCG Matrix. These are markets where Fuyao's market share is low, and there are no substantial plans for investment or growth. Such regions typically offer minimal revenue potential and might even drain resources that could be better allocated elsewhere.

Products with High Carbon Footprint and Limited Sustainability Appeal

Fuyao Glass Industry Group, despite its sustainability focus, may have certain product lines that present a challenge. These are products with a high carbon footprint that are difficult to improve environmentally and offer little market distinction. In today's eco-aware market, these could be candidates for reduction or discontinuation.

For instance, consider older manufacturing processes for certain types of glass that are energy-intensive. If these processes cannot be easily upgraded to utilize renewable energy or capture emissions, and if the resulting products are commoditized with little brand loyalty, they would fall into this category. Fuyao’s 2024 sustainability report highlighted a 5% reduction in carbon intensity per ton of glass produced, but this doesn't negate the inherent footprint of certain legacy products.

- High Energy Consumption in Production: Certain glass types, especially those requiring very high melting temperatures without advanced energy recovery systems, contribute significantly to carbon emissions.

- Limited Differentiation: Products that are largely interchangeable with competitors' offerings, making it hard to justify premium pricing or build customer loyalty based on unique sustainable features.

- Regulatory Pressure: Increasing environmental regulations globally could make it economically unviable to continue producing goods with high, unmitigable carbon footprints.

- Shifting Consumer Preferences: A growing segment of consumers actively seeks out demonstrably eco-friendly products, potentially bypassing those with a higher environmental impact.

Commoditized Glass Products Facing Intense Price Competition

Certain highly commoditized glass products, where Fuyao Glass Industry Group possesses limited competitive advantage beyond sheer scale, are likely positioned as Dogs in the BCG Matrix. These items contend with relentless price competition from a multitude of smaller manufacturers, leading to razor-thin profit margins. For instance, while Fuyao's automotive glass segment is strong, less specialized construction or decorative glass might fall into this category if facing significant commoditization.

These products would typically generate minimal revenue growth and offer little strategic value for Fuyao's future expansion. Their contribution to overall profitability is likely negligible, and they may even drain resources that could be better allocated to high-growth areas. The market for such commoditized glass is often saturated, with differentiation being difficult to achieve beyond price points.

- Low Market Share: Products in this segment would likely hold a comparatively small share of their respective markets.

- Low Market Growth: The demand for these commoditized glass types is expected to grow very slowly, if at all.

- Thin Profit Margins: Intense price wars would compress profitability, making these products less attractive financially.

- Limited Strategic Importance: They offer little in terms of innovation, brand building, or future market leadership for Fuyao.

Products within Fuyao Glass Industry Group's portfolio that are characterized by low market share and operate in stagnant or declining industries are categorized as Dogs. These might include very basic, undifferentiated industrial glass used in legacy equipment that is being phased out. For example, if Fuyao continues to produce glass for older, less common machinery models, these would likely be Dogs.

These Dog products contribute little to Fuyao's revenue and profitability, potentially consuming resources without offering significant returns. Their low growth and low market share mean they are not strategic growth drivers for the company. In 2024, Fuyao reported a focus on high-tech automotive and architectural glass, suggesting a strategic move away from such legacy items.

Such products often face intense price competition and have limited potential for innovation or market expansion. Fuyao's efforts to enhance sustainability, as seen in their 2024 report detailing a 5% reduction in carbon intensity, would likely not be applied to these low-value, high-impact products.

The company's strategic direction in 2024 and beyond emphasizes advanced materials and smart glass, indicating a deliberate effort to divest or minimize investment in product lines that fit the Dog quadrant.

Question Marks

Fuyao Glass Industry Group's exploration into smart glass applications beyond automotive, particularly in architectural and consumer electronics, represents a strategic move into nascent markets. While current market share in these areas is minimal, the projected growth potential is substantial, with the global smart glass market anticipated to reach $9.2 billion by 2027, growing at a CAGR of 13.5%.

These emerging ventures, though currently small, are positioned as potential stars within Fuyao's BCG matrix. For instance, smart glass for high-end architectural projects, offering dynamic tinting and energy efficiency, could tap into the growing demand for sustainable building solutions. In 2024, the construction industry continues to prioritize green building certifications, driving innovation in materials.

Similarly, smart glass in consumer electronics, such as foldable displays or augmented reality interfaces, presents a high-growth, high-risk opportunity. The consumer electronics sector saw significant investment in display technology throughout 2024, with companies vying for market leadership in next-generation devices.

Successfully capturing market share in these specialized sectors will necessitate considerable investment in research and development, manufacturing capabilities, and market penetration strategies. Fuyao's ability to scale production and innovate in these niche areas will be critical for transforming these nascent ventures into future revenue drivers.

Fuyao Glass Industry Group's new geographic market entries with initially low market share represent classic 'Question Marks' in the BCG Matrix. These are markets experiencing significant growth but where Fuyao's presence is nascent, meaning its market share is currently small. This strategic positioning requires careful consideration of future investment to either gain significant traction or divest if prospects dim.

For instance, consider Fuyao's recent expansions into emerging automotive markets in Southeast Asia. While these regions show robust projected GDP growth and increasing vehicle production, Fuyao's brand recognition and distribution networks are still developing. In 2024, many of these markets are projected to see automotive sales growth exceeding 8%, yet Fuyao's share in these specific new territories might be under 5% initially.

Fuyao Glass Industry Group's strategic move into high-end aluminum trim, targeting 21 million precision aluminum parts annually in Shanghai, signifies a clear diversification. This venture into a new product category, while promising significant growth, positions it as a Question Mark within the BCG matrix.

The substantial investment in this high-growth area, coupled with Fuyao's likely nascent market share in aluminum trims, firmly places this initiative in the Question Mark quadrant. This classification suggests a need for careful market analysis and strategic resource allocation to determine its future potential.

Next-Generation Glass for Autonomous Driving Systems

Next-generation glass for autonomous driving systems represents a classic question mark in the BCG matrix for Fuyao Glass Industry Group. This segment demands significant research and development investment due to the complexity of integrating advanced sensors and displays, with market adoption currently in its nascent stages. Fuyao's commitment to innovation in this futuristic area positions them for potentially massive future returns, but the path to widespread commercialization is still uncertain.

- High R&D Investment: Fuyao is channeling substantial resources into developing specialized glass solutions for autonomous vehicles, a sector still maturing.

- Nascent Market Adoption: While the potential is vast, the widespread integration of advanced sensor-laden glass in consumer vehicles is still a few years away.

- Future Growth Potential: Success in this area could unlock significant future revenue streams as autonomous driving technology becomes mainstream.

- Technological Complexity: The integration of LiDAR, radar, cameras, and advanced displays within glass surfaces presents considerable engineering challenges.

Exploration of New Manufacturing Processes (e.g., Zero-Carbon Factories)

Fuyao Glass's investment in a 3.25 billion yuan smart automotive safety glass project, targeting zero-carbon intelligent factories, positions this initiative as a Star in the BCG Matrix. This is a high-growth, high-investment endeavor, reflecting significant capital allocation towards innovation and sustainability.

- The 3.25 billion yuan investment signifies a substantial commitment to advanced manufacturing.

- The objective of becoming a global benchmark in zero-carbon intelligent factories highlights a focus on future industry standards.

- While enhancing existing product lines, the zero-carbon factory capability itself represents a novel, high-potential offering with currently limited market share in manufacturing technology.

- This strategic move aims to attract new clientele by offering a demonstrably sustainable and technologically advanced production solution.

Fuyao Glass Industry Group's ventures into new geographic markets with limited initial penetration, such as emerging automotive sectors in Southeast Asia, are prime examples of Question Marks. These regions exhibit strong economic growth and increasing vehicle demand, with projected automotive sales growth exceeding 8% in 2024, yet Fuyao's market share in these specific new territories might be under 5%.

The strategic development of high-end aluminum trims, targeting a significant annual production volume in Shanghai, also falls into the Question Mark category. This diversification into a new product line, despite its growth potential, means Fuyao likely holds a nascent market share, necessitating careful analysis to determine future investment strategies.

Next-generation glass for autonomous driving systems, requiring substantial R&D and facing uncertain widespread adoption, represents another classic Question Mark. Fuyao's commitment to this complex, high-potential area underscores the need for strategic resource allocation to navigate its developmental phase.

These initiatives, characterized by high growth potential but low current market share, demand significant investment and strategic decision-making to either capture substantial market traction or be divested if prospects are unfavorable.

BCG Matrix Data Sources

Our Fuyao Glass BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on market share, and expert commentary on growth trends.