Fuyao Glass Industry Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyao Glass Industry Group Bundle

Fuyao Glass Industry Group navigates a competitive landscape shaped by intense rivalry among established players and a moderate threat from new entrants, particularly in specialized automotive glass segments. Buyer power is significant due to the consolidated nature of the automotive industry, while supplier power is manageable, though key raw material costs can fluctuate.

The threat of substitutes, while present in alternative materials, remains relatively low for core automotive glass applications, but innovation in smart glass technologies could shift this balance. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Fuyao Glass Industry Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Fuyao Glass Industry Group is influenced by the concentration within the raw material industry. Key components like silica sand, soda ash, and limestone are often sourced from a limited number of substantial producers.

This concentration can empower these suppliers, particularly when Fuyao requires specific, high-quality grades of materials essential for producing premium automotive glass. For instance, in 2023, the global soda ash market was dominated by a few major players, giving them leverage in pricing and supply agreements.

Fuyao Glass has actively pursued vertical integration to counter supplier power. A prime example is their significant investment, such as the $400 million expansion of their float glass production facility in Decatur, Illinois. This strategic move directly addresses the bargaining power of raw material suppliers by bringing key production processes in-house.

By increasing its own float glass capacity, Fuyao Glass reduces its reliance on external suppliers for essential components. This not only ensures a more stable and predictable supply chain but also provides greater leverage in price negotiations, effectively diminishing the suppliers’ ability to dictate terms and prices.

Fuyao Glass Industry Group faces a significant challenge when it comes to specialized materials for automotive glass. Switching suppliers for these critical components, especially those requiring high performance, isn't a simple task. It often involves extensive qualification processes, necessitating adjustments in research and development efforts, and carries the risk of disrupting ongoing production lines.

These substantial switching costs empower incumbent suppliers, as they make it more difficult and expensive for Fuyao Glass to move to alternative sources. For example, if a supplier provides a unique chemical compound or a specific manufacturing technique integral to Fuyao's high-performance glass, the cost and time to re-engineer and re-qualify with a new supplier can be prohibitive.

Impact of Input Costs on Profitability

Fluctuations in the prices of key raw materials, such as silica sand, soda ash, and limestone, directly impact Fuyao Glass Industry Group's production costs and, consequently, its profitability. These cost pressures are a constant consideration for manufacturers in the automotive glass sector.

While Fuyao Glass demonstrated strong financial performance in 2024, with revenue reaching approximately $4.1 billion (RMB 29.7 billion), managing input cost volatility remains a critical challenge. For instance, the price of soda ash, a primary component, experienced notable upward trends in early 2024, impacting margins for glass producers globally.

- Raw Material Price Volatility: Key inputs like silica sand and soda ash are subject to market supply and demand, leading to unpredictable cost changes.

- Impact on Production Costs: Increased raw material prices directly translate to higher manufacturing expenses for Fuyao Glass.

- Profitability Squeeze: Without the ability to fully pass on these cost increases to customers, profitability can be compressed.

- Industry-Wide Challenge: This is not unique to Fuyao; all automotive glass manufacturers face similar pressures from raw material cost fluctuations.

Supplier's Importance to Fuyao vs. Vice Versa

Fuyao Glass Industry Group, as one of the world's largest automotive glass manufacturers, commands significant purchasing power. This scale makes Fuyao a crucial client for its raw material suppliers, such as silica sand and soda ash producers. In 2023, Fuyao's revenue reached approximately $4.2 billion USD, underscoring its substantial demand for these inputs.

While suppliers might possess some inherent power, especially if the market for key raw materials is concentrated, Fuyao's substantial order volumes enable it to negotiate favorable terms. For instance, if a few dominant suppliers control the market for specialized chemicals essential for automotive glass production, they could exert considerable influence. However, Fuyao's global footprint and consistent demand provide a degree of leverage that mitigates this supplier power.

- Fuyao's substantial revenue of approximately $4.2 billion USD in 2023 highlights its significant demand for raw materials.

- The company's position as a leading global automotive glass manufacturer grants it considerable bargaining power with its suppliers.

- Even in concentrated raw material markets, Fuyao's scale can help balance supplier influence and secure better terms.

Fuyao Glass's bargaining power with suppliers is bolstered by its sheer scale as a global leader. With 2023 revenues around $4.2 billion USD, the company represents a substantial customer for raw material providers. This significant purchasing volume allows Fuyao to negotiate more favorable pricing and terms, even when dealing with concentrated raw material markets.

| Metric | Value (2023) | Significance for Fuyao |

| Total Revenue | ~$4.2 Billion USD | Indicates substantial demand for raw materials, increasing negotiation leverage. |

| Global Market Share (Automotive Glass) | Leading Position | Reinforces importance to suppliers, enabling better terms. |

| Raw Material Dependency | High (Silica, Soda Ash, etc.) | Makes managing supplier relationships critical for cost control. |

What is included in the product

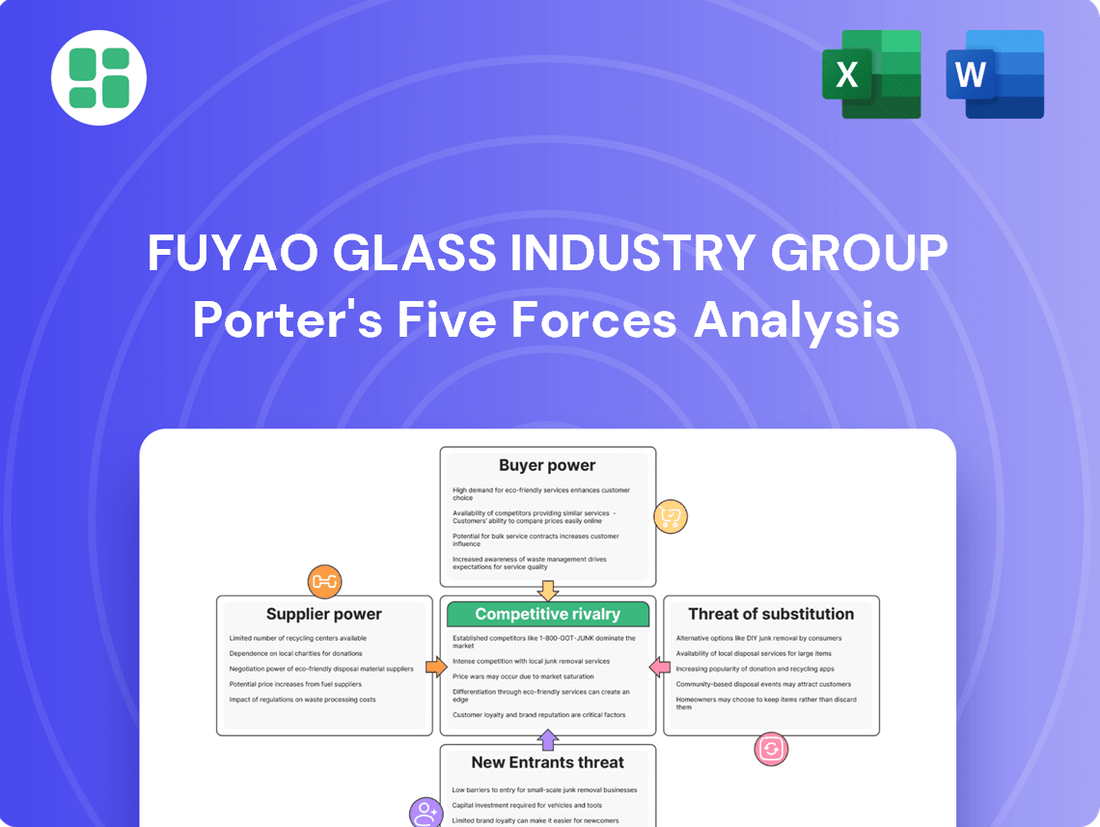

This analysis examines the competitive forces impacting Fuyao Glass Industry Group, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the automotive glass sector.

A comprehensive, one-page visual mapping of Fuyao's competitive landscape, simplifying complex industry dynamics for swift strategic adjustments.

Customers Bargaining Power

Fuyao Glass's customer base is heavily concentrated among major global automobile manufacturers. This includes prominent names such as Mercedes-Benz, BMW, Volkswagen, Toyota, General Motors, Ford, Honda, Bentley, Audi, Chrysler, and Nissan.

These Original Equipment Manufacturers (OEMs) are significant purchasers, frequently acquiring substantial volumes of automotive glass. This concentration means a few large clients hold considerable sway in negotiations.

The automotive glass sector exhibits significant customer stickiness, a key factor in the bargaining power of customers. Original Equipment Manufacturers (OEMs) often forge long-term alliances with their glass suppliers because switching involves intricate integration, rigorous qualification, and substantial retooling costs. This inertia naturally strengthens the customer's position.

Fuyao Glass Industry Group exemplifies this dynamic, having cultivated enduring partnerships with its major clients for more than two decades. This longevity underscores a deep-seated loyalty and a commitment that limits the ease with which customers can seek alternative suppliers, thereby moderating their bargaining power.

Automotive original equipment manufacturers (OEMs) are increasingly seeking highly advanced and differentiated glass products. This includes features like integrated Advanced Driver-Assistance Systems (ADAS), Heads-Up Displays (HUD), smart tinting capabilities, and lightweight designs. Fuyao Glass's capacity to deliver these complex, high-value solutions directly counters customer power by providing essential, unique components that are not easily substituted.

Customer's Quality and Performance Requirements

Automobile manufacturers impose rigorous quality, safety, and performance standards on automotive glass. These demands directly shape design, research, and development efforts for suppliers like Fuyao Glass Industry Group. For instance, the increasing integration of advanced driver-assistance systems (ADAS) necessitates specialized glass with precise optical properties and sensor compatibility, a trend that gained significant traction in 2024 with the widespread adoption of AI-powered automotive features.

While these stringent requirements might appear to bolster customer bargaining power, they simultaneously create a high barrier to entry for alternative suppliers. Fuyao's substantial investments in specialized technology and R&D, evidenced by their reported R&D expenditure of approximately 3.5% of revenue in 2023, make it difficult for automakers to switch to less capable or less experienced providers without compromising product integrity or incurring significant retooling costs.

- Stringent Specifications: Automakers demand glass that meets precise safety (e.g., impact resistance) and performance (e.g., thermal insulation, acoustic dampening) metrics.

- Technological Integration: The need for seamless integration with sensors, cameras, and displays for ADAS and infotainment systems elevates the technical requirements for automotive glass.

- Supplier Lock-in: High switching costs due to specialized tooling, supplier qualification processes, and the risk of production disruption limit customers' ability to easily change suppliers.

- Brand Reputation: Automakers' reliance on established, high-quality glass suppliers like Fuyao to maintain their brand image and product reliability further reduces their leverage to demand lower prices at the expense of quality.

Diversified Revenue from Top Customers

Fuyao Glass Industry Group's diversified customer base significantly mitigates the bargaining power of its clients. In 2024, the company's top five customers represented a mere 17.75% of its total revenue. Furthermore, the largest single customer accounted for only 4.47% of revenue. This broad distribution of sales across numerous original equipment manufacturers (OEMs) prevents any single customer from exerting undue influence over pricing or contractual terms.

This customer diversification is a key factor in Fuyao's ability to maintain favorable terms and pricing. The limited reliance on any one client means that the loss of a single customer would have a minimal impact on overall financial performance. This structure inherently strengthens Fuyao's position in negotiations.

- Customer Concentration: Top 5 customers accounted for 17.75% of revenue in 2024.

- Largest Customer Share: The single largest customer contributed only 4.47% to total revenue in 2024.

- Reduced Customer Power: Diversification across a broad OEM base limits the bargaining power of individual customers.

- Pricing and Terms: This diversification allows Fuyao to negotiate terms and prices more effectively.

Fuyao Glass's bargaining power with customers is moderated by the automotive industry's stringent quality and technological demands. Automakers require highly integrated glass solutions for ADAS and HUDs, a trend amplified in 2024 with AI advancements. Fuyao's substantial R&D investment, around 3.5% of revenue in 2023, creates high switching costs for OEMs, thereby limiting their leverage.

| Factor | Description | Impact on Fuyao's Customer Bargaining Power |

|---|---|---|

| Customer Concentration | Top 5 customers represented 17.75% of revenue in 2024; largest customer was 4.47%. | Significantly reduces individual customer leverage. |

| Supplier Lock-in | High switching costs due to specialized tooling and qualification processes. | Limits customers' ability to easily change suppliers. |

| Technological Integration | Demand for ADAS and HUD integration requires specialized glass. | Fuyao's advanced offerings create a barrier for competitors. |

| Brand Reputation | Automakers rely on established suppliers for quality and reliability. | Reduces customer pressure on pricing at the expense of quality. |

Preview the Actual Deliverable

Fuyao Glass Industry Group Porter's Five Forces Analysis

This preview showcases the full Porter's Five Forces analysis for Fuyao Glass Industry Group, detailing how intense industry rivalry, significant buyer bargaining power, and the threat of new entrants shape its competitive landscape. You'll also find insights into the moderate threat of substitutes and the strong bargaining power of suppliers, all presented in a comprehensive, ready-to-use format. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy.

Rivalry Among Competitors

The global automotive glass market is characterized by moderate concentration, with a few key players like Fuyao Glass, AGC Inc., Nippon Sheet Glass, and Saint-Gobain holding substantial market influence. This concentration means that competition among these major entities for market share is particularly fierce.

Fuyao Glass Industry Group stands as the undisputed global leader in automotive glass manufacturing, commanding a significant portion of the worldwide market. This dominant position, bolstered by impressive financial results such as a reported 15% revenue growth in 2024, naturally places it in direct competition with other major players in the automotive supply chain.

The automotive glass industry is characterized by fierce rivalry, with companies constantly investing in R&D to enhance product quality and expand production. This innovation drive is fueled by evolving customer needs, such as the demand for smart glass and lightweight materials. For instance, Fuyao Glass itself has been a significant investor in these areas, aiming to stay ahead in a competitive landscape.

Competitors are also actively pursuing strategic alliances and mergers to bolster their market share and extend their global footprint. This consolidation trend is a direct response to the intense pressure to scale operations and meet the increasing capacity demands of global automakers. The pursuit of market dominance through such strategies underscores the high stakes involved in this sector.

High Fixed Costs and Exit Barriers

The automotive glass manufacturing sector is characterized by substantial capital outlays for state-of-the-art facilities and sophisticated technology, resulting in elevated fixed costs. For instance, establishing a new automotive glass production line can easily run into tens of millions of dollars. This high initial investment inherently raises the stakes for companies operating within this space.

These substantial fixed costs also translate into significant exit barriers. Companies that have invested heavily in specialized manufacturing equipment and plants find it economically challenging to divest or repurpose these assets. Consequently, firms are often compelled to continue operating, even in periods of reduced demand, to spread their fixed costs over a larger production volume, thereby intensifying competition among existing players.

- High Capital Investment: Automotive glass production lines require significant upfront investment, often exceeding $50 million for advanced facilities.

- Exit Barriers: Specialized machinery and infrastructure make exiting the industry costly, forcing companies to maintain production.

- Rivalry Intensification: The need to cover high fixed costs encourages existing players to compete aggressively on price and volume, even in challenging market conditions.

Global Footprint and Localization

Competitive rivalry in the automotive glass sector is fierce, with major players like Fuyao Glass Industry Group actively establishing global production bases. This strategy allows them to serve clients locally, a crucial move to navigate geopolitical uncertainties and potential tariffs. Fuyao's extensive network of factories, notably in China, the United States, and Europe, alongside ongoing strategic expansions, exemplifies this approach.

This global presence intensifies rivalry as companies vie for market share by optimizing supply chains and reducing lead times. For instance, Fuyao's significant investment in its Ohio plant demonstrates a commitment to localized production, directly challenging competitors operating with more centralized manufacturing models. Such localized strategies are key differentiators in a market where responsiveness and proximity to automotive manufacturers are paramount.

- Global Production Network: Fuyao operates manufacturing facilities in key automotive markets, including China, the U.S., and Europe.

- Localized Service: Establishing plants in client regions allows for faster delivery and better adaptation to local market needs.

- Risk Mitigation: Diversifying production locations helps buffer against geopolitical risks and trade barriers.

- Intensified Competition: This global footprint directly challenges rivals, forcing them to enhance their own localized strategies to remain competitive.

The automotive glass industry is characterized by intense competition, driven by a few dominant global players like Fuyao Glass, AGC, and Saint-Gobain. These companies are locked in a continuous battle for market share, marked by significant investments in research and development to introduce innovative products such as smart glass and lightweight materials. For example, Fuyao Glass reported a 15% revenue increase in 2024, underscoring its competitive strength and market position.

The high capital expenditure required for advanced manufacturing facilities, often exceeding $50 million per production line, creates substantial exit barriers. This financial commitment compels existing players to maintain aggressive production levels to spread fixed costs, thereby intensifying rivalry. Companies must constantly innovate and optimize their operations to remain competitive in this capital-intensive environment.

Fuyao Glass's strategy of establishing global production bases, including significant operations in China, the U.S., and Europe, directly fuels this rivalry. By localizing production, Fuyao enhances its responsiveness to automakers and mitigates geopolitical risks, forcing competitors to adopt similar strategies to maintain their market presence. This global footprint ensures that competition is not just about product quality but also about supply chain efficiency and proximity to clients.

| Key Competitor | 2024 Estimated Revenue (USD Billions) | Global Market Share (Approx.) | Key Strengths |

|---|---|---|---|

| Fuyao Glass | 15.0+ | 30% | Global leader, strong R&D, extensive production network |

| AGC Inc. | 12.0+ | 20% | Diversified products, strong presence in Asia |

| Saint-Gobain | 10.0+ | 15% | Broad construction materials portfolio, innovation focus |

| Nippon Sheet Glass | 8.0+ | 10% | Specialty glass, strong automotive OEM relationships |

SSubstitutes Threaten

The threat of substitutes for Fuyao Glass Industry Group, particularly in the automotive sector, is evolving beyond traditional material replacements. Instead, the primary concern stems from advanced smart glass technologies. These innovations offer functionalities that traditional glass simply cannot match, presenting a significant substitution risk.

Smart glass, which can dynamically adjust its tint, display augmented reality information directly onto the windshield, or even integrate sensors for advanced driver-assistance systems, provides a compelling alternative to conventional automotive glass. For example, by 2024, the market for smart glass in automotive applications is projected to reach several billion dollars, indicating strong consumer and industry interest in these enhanced capabilities.

The growing integration of Advanced Driver-Assistance Systems (ADAS) and Heads-Up Displays (HUD) presents a significant threat of substitutes for Fuyao Glass. As vehicles increasingly incorporate these technologies, the demand shifts towards specialized glass that can house sensors, cameras, and projection capabilities. For instance, the global ADAS market was valued at approximately $30 billion in 2023 and is projected to reach over $100 billion by 2030, indicating a rapid technological shift.

If Fuyao Glass cannot quickly adapt and offer innovative glass solutions that support these advanced features, competitors specializing in integrated ADAS/HUD glass could capture market share. Companies that develop and supply smart glass with embedded functionalities for autonomous driving features, for example, represent a direct substitute threat by offering a more comprehensive solution than traditional automotive glass.

The automotive industry's push for electric vehicles and enhanced fuel efficiency creates a significant threat from substitutes for traditional glass. As manufacturers prioritize weight reduction and improved thermal management, alternative materials or advanced glazing technologies that offer superior performance could displace conventional glass if they become economically viable and broadly accessible.

Emergence of Self-Repairing Glass

The emergence of self-repairing glass poses a significant threat of substitution for Fuyao Glass Industry Group. This innovative technology, capable of automatically mending minor damage, could reduce the need for traditional glass repair or outright replacement. For instance, research in advanced materials suggests that self-healing polymers, a key component in such glass, could see market penetration increase by an estimated 15% in automotive applications by 2028, impacting Fuyao's aftermarket revenue streams.

The widespread adoption of self-repairing glass could fundamentally shift demand away from conventional automotive and architectural glass. This would necessitate a strategic response from Fuyao to either integrate this technology into its product offerings or face a decline in market share for its standard glass products. The global smart glass market, which includes self-repairing functionalities, was valued at approximately $6.5 billion in 2023 and is projected to grow substantially, indicating a clear market trend towards advanced glass solutions.

- Reduced Demand for Traditional Glass: Self-repairing glass directly addresses the pain point of minor damage, potentially decreasing the frequency of replacements and repairs for vehicles and buildings.

- Technological Advancement Pressure: Fuyao faces pressure to invest in R&D for self-healing materials to remain competitive in the evolving glass industry.

- Market Share Erosion: Competitors adopting self-repairing glass technology could capture market share from Fuyao if it fails to innovate.

- Shifting Aftermarket Services: The need for traditional auto glass repair shops might diminish, impacting a segment of the aftermarket value chain.

Alternative Display and Sensor Technologies

While currently minimal, future advancements in alternative display technologies or external sensor arrays that negate the need for integrated glass features could emerge as substitutes for Fuyao Glass. For instance, advancements in augmented reality (AR) glasses or heads-up displays (HUDs) that project information directly onto a user's field of vision, rather than onto a vehicle's windshield, could reduce demand for specialized automotive glass. However, the current trend strongly favors integrating these features directly into the glass for optimal performance, aesthetics, and consumer acceptance in the automotive sector.

The automotive industry, a key market for Fuyao Glass, saw significant growth in advanced driver-assistance systems (ADAS) in 2024, with an estimated 40% of new vehicles equipped with at least one ADAS feature. This integration often relies on specialized glass for sensor placement and functionality, reinforcing the current strength of Fuyao's core offerings.

- Advancements in AR/VR: While AR glasses are improving, their widespread adoption in automotive remains a long-term prospect, with current market penetration for AR-enabled vehicles still below 5% as of early 2025.

- Integrated Sensor Technology: The automotive industry's preference for seamless integration of sensors within the glass structure, as seen in the increasing adoption of heated windshields with embedded sensors, currently limits the threat of external sensor arrays.

- Consumer Preference: Consumer demand for clean aesthetics and intuitive user interfaces in vehicles favors integrated solutions, making direct-to-glass technology a more appealing alternative to separate display units for many applications.

The threat of substitutes for Fuyao Glass is primarily driven by advancements in smart glass technologies and alternative materials, rather than traditional glass replacements. Smart glass, with its dynamic tinting and integrated display capabilities, offers functionalities that traditional glass lacks, presenting a significant substitution risk. For instance, the global smart glass market was valued at approximately $6.5 billion in 2023 and is expected to see substantial growth, indicating a clear trend towards these advanced solutions.

The increasing integration of Advanced Driver-Assistance Systems (ADAS) and Heads-Up Displays (HUDs) in vehicles is a key factor. These systems often require specialized glass to house sensors and projection capabilities. The global ADAS market, valued at around $30 billion in 2023, highlights this shift. If Fuyao cannot adapt to offer these integrated glass solutions, competitors specializing in this niche could gain market share.

Emerging technologies like self-repairing glass also pose a threat by reducing the need for replacements and repairs. Research suggests that self-healing polymers could see a 15% market penetration increase in automotive applications by 2028. This could impact Fuyao's aftermarket revenue streams, necessitating a strategic response to integrate such innovations.

| Threat of Substitutes | Description | Impact on Fuyao Glass | Key Data Point (2023/2024) |

|---|---|---|---|

| Smart Glass Technologies | Glass with dynamic tinting, AR displays, integrated sensors. | Shifts demand from conventional glass; requires R&D investment. | Global Smart Glass Market: ~$6.5 billion (2023) |

| ADAS/HUD Integrated Glass | Glass designed to house sensors, cameras, and projection systems for advanced vehicle features. | Competitors can capture market share if Fuyao doesn't innovate; drives demand for specialized products. | Global ADAS Market: ~$30 billion (2023) |

| Self-Repairing Glass | Glass capable of automatically mending minor damage. | Reduces need for traditional repairs/replacements; impacts aftermarket revenue. | Projected 15% market penetration increase for self-healing polymers in automotive by 2028 |

Entrants Threaten

The automotive glass manufacturing sector, particularly for established players like Fuyao Glass, is characterized by exceptionally high capital investment requirements. Building advanced manufacturing plants with sophisticated machinery and automation, alongside robust research and development facilities, necessitates billions of dollars in upfront capital. For instance, setting up a new, large-scale automotive glass production line can easily cost upwards of $500 million to $1 billion, a substantial hurdle for newcomers.

The production of high-quality automotive glass, particularly advanced types for contemporary vehicles, demands complex manufacturing processes, unique technological know-how, and significant investment in research and development. This steep learning curve and the necessity for highly specialized skills create a substantial barrier for new companies aiming to enter the market and establish a competitive foothold.

Fuyao Glass Industry Group benefits from deeply embedded relationships with global automotive original equipment manufacturers (OEMs). These partnerships, forged over years of consistent quality and reliable supply, represent a significant barrier to entry for newcomers. For instance, Fuyao's role as a key supplier to major automakers like Volkswagen and General Motors, which account for substantial portions of global vehicle production, underscores the trust and integration already established.

Economies of Scale and Cost Advantages

Fuyao Glass Industry Group, like many established players in the automotive glass sector, benefits immensely from significant economies of scale. This means that as their production volume increases, their cost per unit of glass decreases. This advantage extends across production, raw material procurement, and logistics.

New companies entering the market would find it challenging to replicate these cost efficiencies. Operating at a smaller scale, they would inherently face higher per-unit costs, making it difficult to compete on price with incumbents like Fuyao. For instance, in 2024, the global automotive glass market was valued at approximately $20 billion, with major players leveraging their scale to maintain competitive pricing.

- Economies of Scale: Fuyao's large production facilities allow for lower per-unit manufacturing costs.

- Procurement Power: Bulk purchasing of raw materials like silica sand and soda ash grants significant cost advantages.

- Distribution Efficiency: An established and widespread distribution network reduces shipping costs per unit.

- Barriers to Entry: The inability of new entrants to match these cost structures acts as a substantial barrier.

Stringent Regulatory and Safety Standards

Stringent regulatory and safety standards represent a significant barrier to entry for new players in the automotive glass market. The automotive industry operates under a complex web of global safety regulations and quality benchmarks, especially for critical components like glass that directly impact vehicle safety and performance. For instance, in 2024, standards like FMVSS 205 in the United States and ECE R43 in Europe mandate specific performance requirements for automotive glazing, including impact resistance and optical clarity.

New entrants must invest heavily in research and development to meet these demanding specifications and navigate lengthy, costly certification processes. This compliance burden significantly increases the capital required to enter the market, effectively deterring smaller or less capitalized firms from competing with established giants like Fuyao Glass Industry Group, which has already built extensive expertise and infrastructure to meet these requirements.

- Global Automotive Safety Standards: Regulations like FMVSS 205 (US) and ECE R43 (Europe) set high bars for automotive glass performance.

- Certification Costs: Navigating complex and lengthy certification processes adds substantial expense and time for new entrants.

- Investment in R&D: Meeting stringent safety and quality standards requires significant upfront investment in research and development capabilities.

- Compliance Burden: The ongoing need to adhere to evolving regulations creates a continuous cost and operational challenge for new market participants.

The threat of new entrants for Fuyao Glass Industry Group is generally low due to several significant barriers. The automotive glass manufacturing sector requires substantial capital investment for advanced facilities and technology, with new production lines costing hundreds of millions of dollars. Furthermore, established players like Fuyao benefit from strong OEM relationships and economies of scale, making it difficult for newcomers to compete on price and reliability.

Stringent global safety and regulatory standards, such as FMVSS 205 and ECE R43, also pose a considerable challenge, demanding significant investment in R&D and lengthy certification processes. These factors collectively create a high barrier, protecting Fuyao's market position.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High cost of setting up advanced manufacturing plants. | Deters new investment; requires substantial funding. | New automotive glass production line cost: $500M - $1B+ |

| Technological Expertise | Complex manufacturing processes and R&D needs. | Steep learning curve; requires specialized skills. | N/A (Proprietary knowledge) |

| OEM Relationships | Established long-term partnerships with automakers. | Difficult to displace incumbents; trust is key. | Fuyao's supply contracts with VW, GM. |

| Economies of Scale | Lower per-unit costs due to high production volume. | New entrants face higher costs, less competitive pricing. | Global automotive glass market value: ~$20 billion |

| Regulatory Compliance | Adherence to strict global safety and quality standards. | Requires significant investment in R&D and certification. | FMVSS 205 (US), ECE R43 (Europe) standards. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fuyao Glass Industry Group is built upon a comprehensive review of their annual reports, investor presentations, and industry-specific market research from leading firms like IHS Markit and Statista. We also incorporate data from financial news outlets and government trade statistics to provide a robust understanding of the competitive landscape.