Fuyao Glass Industry Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuyao Glass Industry Group Bundle

Fuyao Glass Industry Group masterfully navigates the market by offering a diverse product range, from automotive to architectural glass, ensuring broad appeal. Their strategic pricing, often competitive yet reflecting quality, positions them as a reliable supplier, while their extensive global distribution network guarantees accessibility for a wide customer base. The company's promotional efforts focus on building brand trust and highlighting technological innovation.

Ready to unlock the full strategic blueprint behind Fuyao Glass Industry Group's market dominance? Dive deeper into their product innovation, pricing strategies, distribution channels, and promotional campaigns with our comprehensive, ready-to-use 4Ps Marketing Mix Analysis.

Product

Fuyao Glass Industry Group's core product offering is a complete spectrum of automotive glass, featuring windshields, sidelites, backlites, and sunroofs. These are meticulously crafted to satisfy the stringent safety, performance, and visual requirements of leading car makers worldwide. Fuyao's commitment to durability and optical clarity is backed by its investment in precision manufacturing and cutting-edge material science.

Fuyao Glass Industry Group's product strategy is deeply rooted in integrated design, research, and development, enabling them to pioneer innovative glass solutions. This commitment fuels close collaboration with automotive OEMs, resulting in customized glass for new models and advanced applications, like enhanced acoustic insulation and lightweighting for better fuel efficiency.

Fuyao Glass Industry Group's product strategy extends significantly beyond automotive glass, encompassing a diverse range of industrial applications. This diversification leverages their core manufacturing expertise to serve sectors like construction and electronics, demonstrating a broad market penetration. For instance, in 2023, Fuyao reported that its non-automotive glass revenue contributed a notable portion to its overall sales, highlighting the segment's growing importance.

Advanced Manufacturing Technology and Processes

Fuyao Glass Industry Group heavily relies on advanced manufacturing technology and processes, a cornerstone of its Product strategy. This commitment is evident in their sophisticated tempering, lamination, and coating techniques, which directly translate to the superior quality and enhanced functionality of their automotive and architectural glass. For instance, in 2024, Fuyao continued its aggressive investment in automation, with reports indicating a significant portion of its production lines now incorporating robotic systems for precision handling and assembly, aiming to boost efficiency by an estimated 15-20% over the next two years.

This continuous investment in cutting-edge technology is not just about quality; it's crucial for maintaining high-volume production efficiency and the capacity to create complex glass designs. Fuyao’s ability to innovate in areas like lightweight, high-strength automotive glass, often achieved through advanced chemical strengthening and multi-layer lamination, keeps them competitive. By the end of 2024, the company was projected to have invested over $500 million globally in R&D and new manufacturing equipment, underscoring their dedication to staying at the forefront of glass production technology.

Their technological prowess allows for:

- Enhanced Durability and Safety: Through advanced tempering and lamination processes, Fuyao glass meets and often exceeds stringent automotive safety standards.

- Improved Functionality: Specialized coatings enable features like solar control, self-cleaning, and enhanced acoustic insulation in their products.

- Production Scalability: Investment in automated and high-speed machinery ensures they can meet the massive demand from global automotive manufacturers.

- Customization Capabilities: Advanced fabrication techniques allow for the creation of complex, curved, and integrated glass solutions tailored to specific vehicle designs.

Global Standards Compliance

Fuyao Glass Industry Group's commitment to global standards compliance is a cornerstone of its product strategy, ensuring its automotive glass is suitable for worldwide distribution. This adherence is vital for serving major global automakers who demand adherence to rigorous safety and quality benchmarks. For instance, Fuyao's products meet standards like DOT (Department of Transportation) for North America, ECE (Economic Commission for Europe) regulations, and CCC (China Compulsory Certification). This dedication to international certifications facilitates seamless integration into complex global supply chains, reinforcing Fuyao's position as a reliable worldwide supplier.

Fuyao's proactive approach to meeting these diverse international requirements directly impacts its market reach and customer trust. By consistently achieving certifications such as:

- DOT certification for the North American market, crucial for vehicle safety and roadworthiness.

- ECE R43, the European standard for safety glazing materials, ensuring compliance across a vast automotive market.

- CCC certification, a mandatory requirement for products sold within China, reflecting domestic regulatory adherence.

This multi-faceted compliance strategy not only mitigates regulatory risks but also enhances Fuyao's competitive advantage by enabling its glass products to be readily accepted by automotive manufacturers operating on a global scale. In 2024, Fuyao Glass continued to invest heavily in quality control and certification processes, with reported expenditures in R&D and quality assurance exceeding previous years, underscoring the importance of this element in their marketing mix.

Fuyao Glass Industry Group's product portfolio is anchored in high-quality automotive glass, including windshields, sidelites, backlites, and sunroofs, designed to meet global automotive safety and performance standards. The company's focus on advanced materials and precision manufacturing ensures durability and optical clarity, crucial for OEM clients. Beyond automotive, Fuyao also diversifies into industrial glass for construction and electronics, demonstrating a broad market application of its core competencies.

Fuyao's product strategy emphasizes innovation through integrated R&D, leading to customized solutions for new vehicle models and advanced features like acoustic insulation. This commitment is supported by substantial investment in advanced manufacturing technologies, including automation and sophisticated coating processes, which enhance product quality and production efficiency. For instance, in 2024, the company continued its aggressive investment in automation, aiming for a 15-20% efficiency boost.

The company's product quality is underscored by its adherence to international compliance standards such as DOT, ECE R43, and CCC, essential for global market access and OEM partnerships. This rigorous certification process, coupled with ongoing R&D and quality assurance expenditures, ensures Fuyao's glass products are readily accepted worldwide. In 2024, Fuyao Glass reported significant investment in quality control and certification processes, reinforcing its position as a reliable global supplier.

| Product Segment | Key Features | 2024/2025 Focus | Compliance Standards |

|---|---|---|---|

| Automotive Glass | Windshields, Sidelites, Backlites, Sunroofs; High Durability, Optical Clarity | Lightweighting, Acoustic Insulation, Advanced Coatings | DOT, ECE R43, CCC |

| Industrial Glass | Construction, Electronics | Diversification, Leveraging Core Manufacturing Expertise | Varies by application |

What is included in the product

Fuyao Glass Industry Group's marketing mix focuses on a diverse product portfolio of automotive and architectural glass, competitive pricing strategies, a global distribution network, and targeted promotional efforts to maintain its market leadership.

This analysis distills Fuyao Glass's 4Ps into actionable insights, highlighting how their product quality, competitive pricing, strategic distribution, and promotional efforts alleviate customer pain points related to automotive glass reliability and cost-effectiveness.

Place

Fuyao Glass Industry Group boasts an extensive global manufacturing and distribution network, with strategically positioned production facilities across North America, Europe, and Asia. This international footprint, including significant operations in the United States and Germany, allows Fuyao to efficiently serve major automotive manufacturers worldwide, ensuring timely delivery and localized support. For instance, as of 2024, Fuyao's North American production capacity is a key component in its ability to supply leading automakers in the region.

Fuyao Glass's primary distribution strategy revolves around direct supply to Original Equipment Manufacturers (OEMs), a critical business-to-business (B2B) channel. This approach involves deep integration into the automotive production process, often utilizing just-in-time (JIT) delivery to meet the stringent demands of global carmakers. For instance, Fuyao's 2023 revenue reached $3.7 billion, with a significant portion attributed to these direct OEM partnerships, underscoring the importance of this channel for their market dominance.

Fuyao Glass Industry Group strategically locates its manufacturing plants and distribution centers very close to major automotive manufacturers. This proximity, a key part of their marketing strategy, helps cut down on shipping times and expenses. For instance, having facilities near major automotive hubs in North America allows for faster delivery of components.

This close geographical alignment with clients like General Motors and Ford means Fuyao can react much quicker to changing production schedules and specific needs. It also fosters stronger working relationships, making collaboration smoother and more efficient. In 2024, Fuyao's commitment to this strategy was evident in its continued investment in plants serving key automotive production regions.

Efficient Global Logistics and Supply Chain Management

Fuyao Glass Industry Group prioritizes highly efficient logistics and robust supply chain management to ensure timely, reliable global product delivery. This focus includes optimizing transportation routes, maintaining effective inventory control, and leveraging advanced tracking systems. For instance, in 2023, Fuyao reported a significant portion of its revenue being generated from international markets, underscoring the critical role of its global logistics network.

A streamlined and resilient supply chain is paramount for Fuyao, particularly in maintaining strong relationships with automotive manufacturers who rely on consistent and precise component delivery. This operational excellence directly supports their ability to meet demanding just-in-time production schedules for major automotive clients worldwide.

- Global Reach: Fuyao's logistics network spans over 20 countries, facilitating efficient distribution to key automotive manufacturing hubs.

- Inventory Management: In 2024, the company invested in new warehouse management systems, aiming to reduce inventory holding costs by an estimated 10% by year-end.

- Technological Integration: Advanced tracking systems provide real-time visibility of shipments, enhancing predictability and customer service.

- Supplier Reliability: Fuyao maintains strong partnerships with key raw material suppliers, ensuring a consistent and high-quality input stream for its manufacturing processes.

Automotive Aftermarket Distribution Channels

Fuyao Glass Industry Group, while primarily known for its Original Equipment Manufacturer (OEM) supply, actively engages in the automotive aftermarket. This segment focuses on providing replacement glass for vehicles needing repair and maintenance. The aftermarket is a crucial area for ensuring the longevity and continued usability of vehicles fitted with Fuyao's products.

Distribution in the aftermarket is multifaceted. Fuyao leverages a network that includes:

- Authorized Dealerships: These outlets provide a direct channel for customers seeking OEM-quality replacement parts.

- Independent Glass Repair Shops: This broad network of specialized businesses is a primary destination for aftermarket glass replacements.

- Potential Fuyao Service Centers: The group may also operate or partner with dedicated service centers for direct customer interaction and service.

The aftermarket represents a significant revenue stream and strengthens Fuyao's brand presence beyond the initial vehicle sale. In 2024, the global automotive aftermarket was projected to reach over $500 billion, highlighting the market's substantial economic importance.

Fuyao's place in the market is defined by its extensive global manufacturing presence and strategic distribution channels, primarily serving automotive OEMs. This includes significant production facilities in North America and Europe, ensuring proximity to major car manufacturers. For example, as of 2024, Fuyao's substantial North American capacity is vital for supplying regional automakers.

The company's distribution strategy heavily relies on direct B2B supply to Original Equipment Manufacturers (OEMs), integrating into their just-in-time production cycles. This direct approach, evidenced by Fuyao's $3.7 billion revenue in 2023, highlights the critical nature of these OEM relationships for their market position.

Fuyao also caters to the automotive aftermarket through a network of authorized dealerships, independent repair shops, and potentially dedicated service centers. This aftermarket engagement, important for vehicle longevity, taps into a global market projected to exceed $500 billion in 2024, bolstering brand visibility post-vehicle sale.

What You Preview Is What You Download

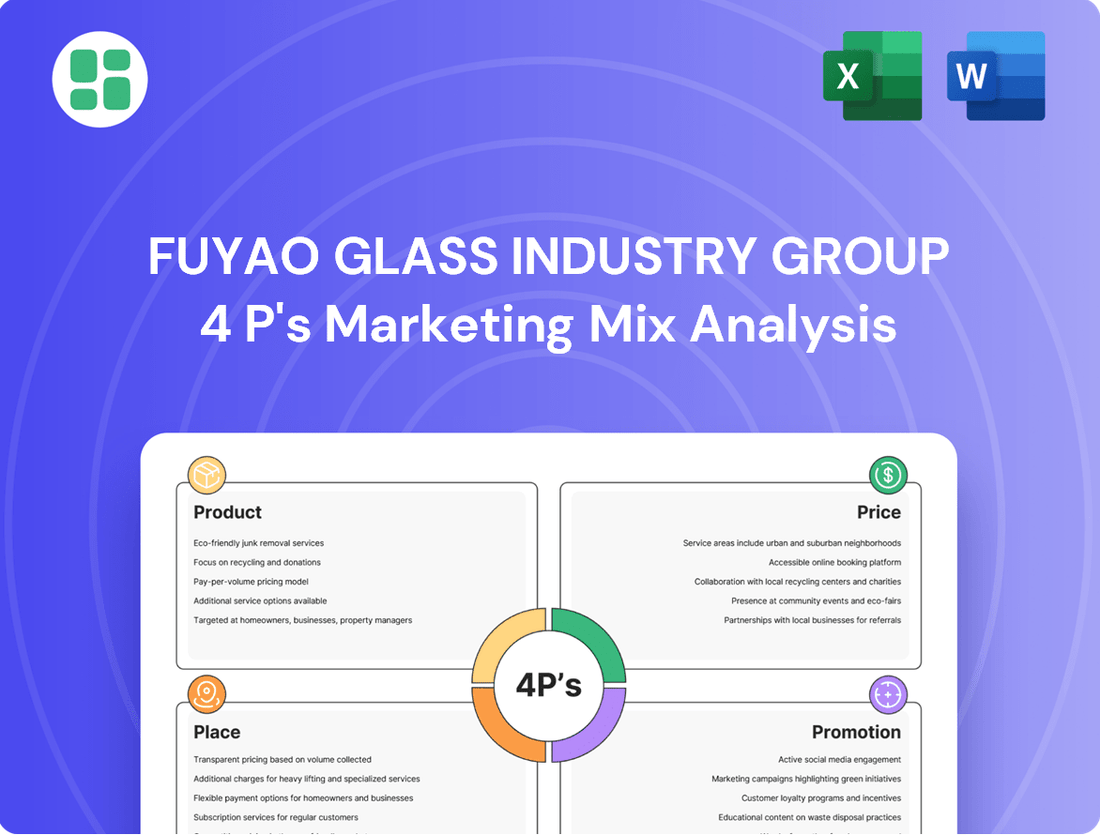

Fuyao Glass Industry Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Fuyao Glass Industry Group's Product, Price, Place, and Promotion strategies. Understand their market positioning and competitive advantages through this ready-to-use marketing mix breakdown.

Promotion

Fuyao Glass Industry Group consistently exhibits at major global automotive and glass industry trade shows. For instance, their presence at the 2024 SEMA Show in Las Vegas provided a direct avenue to connect with automotive aftermarket professionals and showcase advancements in automotive glass technology.

These exhibitions are crucial for displaying new product lines and manufacturing innovations to a discerning audience of industry buyers and partners. Fuyao's 2024 participation in events like the Auto Glass Week in Reno, Nevada, allowed them to highlight their latest OE and aftermarket solutions.

This strategic engagement is vital for lead generation and solidifying Fuyao's reputation as a dominant force in the global automotive glass market. Their consistent presence at these events underscores their commitment to industry leadership and market penetration.

Fuyao Glass Industry Group's direct sales and strategic relationship marketing are crucial for its B2B model. Dedicated teams focus on automotive OEMs, ensuring tailored solutions through account managers, technical support, and clear communication. This fosters long-term partnerships built on trust and consistent service.

Fuyao Glass Industry Group actively engages in technical seminars and workshops, a key component of their promotional strategy. These events are designed to educate clients, industry partners, and stakeholders on the advantages of their cutting-edge glass technologies.

By sharing expertise, Fuyao showcases its dedication to innovation and its role as a technical leader in the automotive sector. For instance, in 2023, Fuyao reported a revenue of approximately $3.2 billion, underscoring the scale of their operations and the importance of these knowledge-sharing platforms in maintaining their market position.

These educational initiatives not only build stronger relationships but also subtly promote Fuyao's advanced products and solidify its image as a trusted authority in the field. This approach directly supports their product development and market penetration efforts.

Building and Maintaining a Strong Corporate Reputation

Fuyao Glass Industry Group prioritizes a strong corporate reputation, built on product quality, reliability, and technological advancements. This commitment is evident in their consistent delivery of high-performance products and adherence to rigorous global standards, fostering positive customer feedback and industry accolades. For instance, in 2023, Fuyao reported a net profit of RMB 5.5 billion, underscoring their operational strength and market trust.

A well-cultivated brand image within the specialized automotive supply chain is crucial for Fuyao, enhancing their credibility and opening doors to new business ventures. This focus on reputation management directly supports their marketing efforts by attracting and retaining key partnerships.

- Product Excellence: Consistent delivery of high-quality automotive glass.

- Global Standards: Adherence to stringent international quality and safety regulations.

- Customer Trust: Cultivating positive testimonials and long-term client relationships.

- Industry Recognition: Achieving awards and certifications that validate their market position.

Strategic Public Relations and Industry Media Engagement

Fuyao Glass Industry Group actively cultivates strategic public relations, leveraging industry media to bolster its standing. By issuing press releases on advancements like their automotive laminated glass innovations and securing features in publications such as Automotive News and Glass Magazine, Fuyao reinforces its market leadership. This proactive engagement highlights their commitment to innovation and strengthens their brand perception.

The company's media strategy includes contributing expert articles that showcase their technical prowess in areas like lightweight glass solutions. For instance, their participation in industry forums and the publication of thought leadership pieces on sustainable manufacturing practices in 2024 and early 2025 have further cemented their reputation as an industry influencer.

Key achievements, such as securing major supply contracts with leading automakers or announcing significant R&D investments, are communicated through targeted media outreach. This ensures that Fuyao's financial and technological milestones are recognized, contributing to a positive market narrative.

- Enhanced Visibility: Proactive PR and industry media engagement increase Fuyao's profile in the automotive and glass sectors.

- Thought Leadership: Expert articles and media features position Fuyao as a knowledgeable leader, particularly in areas like advanced automotive glass.

- Brand Reinforcement: Positive media coverage of new technologies and financial achievements strengthens Fuyao's image as an innovative and reliable supplier.

- Market Influence: Consistent media presence and strategic communication amplify Fuyao's influence on industry trends and perceptions.

Fuyao Glass Industry Group employs a multifaceted promotional strategy, heavily relying on industry trade shows and direct engagement. Their consistent presence at major events like the 2024 SEMA Show and Auto Glass Week allows for direct interaction with industry professionals, showcasing their latest automotive glass technologies and solutions. This approach is vital for generating leads and reinforcing their market leadership.

Beyond exhibitions, Fuyao leverages technical seminars and workshops to educate clients and partners on their innovative glass solutions, positioning themselves as technical authorities. Furthermore, a strong emphasis on public relations, including press releases on advancements and features in industry publications, enhances their visibility and brand perception. These efforts are supported by a robust corporate reputation built on product quality and adherence to global standards, as evidenced by their reported revenue and net profit figures.

| Promotional Tactic | Key Activities | Impact/Objective |

|---|---|---|

| Industry Trade Shows | Participation in SEMA Show (2024), Auto Glass Week | Showcase new products, lead generation, industry connection |

| Technical Engagement | Seminars, workshops | Educate clients, build relationships, establish technical leadership |

| Public Relations | Press releases, industry media features (Automotive News, Glass Magazine) | Enhance visibility, reinforce brand perception, thought leadership |

| Corporate Reputation | Focus on quality, reliability, global standards | Build trust, attract partnerships, support marketing efforts |

Price

Fuyao Glass Industry Group, as a key supplier to automotive Original Equipment Manufacturers (OEMs), likely utilizes a value-based pricing strategy. This approach acknowledges that Fuyao's high-quality glass contributes significantly to vehicle safety, design appeal, and overall performance, justifying a price point that reflects these critical attributes.

The pricing for Fuyao's automotive glass is underpinned by substantial investments in advanced manufacturing technologies, continuous research and development, and rigorous quality assurance processes. These elements ensure that their products meet the exacting standards of the automotive industry, thereby commanding a premium that aligns with the value delivered.

For instance, in 2023, Fuyao reported revenue of approximately RMB 27.4 billion (around $3.8 billion USD), a testament to the significant volume and perceived value of their offerings to major automotive players. This financial performance indicates that their value-based pricing model resonates effectively within the OEM market, where reliability and innovation are paramount.

Fuyao Glass Industry Group employs a competitive pricing strategy to maintain its strong global market position. In 2023, the automotive glass market saw intense price competition, with Fuyao leveraging its scale to offer attractive terms. This approach is crucial for securing and growing its significant market share against rivals.

The company's pricing decisions are informed by rigorous analysis of competitor pricing, market demand, and internal production efficiencies. For instance, in 2024, Fuyao's ability to achieve economies of scale, exemplified by its extensive manufacturing footprint, allows for cost advantages that directly translate into competitive pricing, particularly in high-volume segments.

Fuyao Glass Industry Group, as one of the world's largest automotive glass manufacturers, leverages significant economies of scale. In 2023, their production capacity reached over 10 million automotive sets annually, allowing them to negotiate favorable terms for raw materials like silica sand and soda ash, thereby reducing per-unit input costs.

This immense scale translates directly into a cost leadership advantage. By spreading fixed manufacturing costs across a massive output, Fuyao achieves lower production expenses compared to smaller competitors. For instance, their advanced, automated production lines in 2024 are designed for high throughput, minimizing labor costs per unit.

This cost advantage allows Fuyao to offer competitive pricing in the automotive sector, a key element of their marketing strategy. Their ability to maintain lower prices while ensuring quality strengthens their position with major automakers who prioritize cost-efficiency in their supply chains.

Long-Term Contractual Pricing Agreements

Fuyao Glass Industry Group often structures pricing for its major Original Equipment Manufacturer (OEM) clients through extensive long-term contracts. These agreements typically incorporate volume-based discounts, fixed price periods, and mechanisms to adjust for material cost volatility, ensuring a stable pricing environment.

These contractual arrangements are crucial for providing price predictability and stability, which in turn helps cultivate strong, lasting relationships with key automotive manufacturers. This approach is a well-established norm within the global automotive sector's supply chain dynamics.

For instance, Fuyao's commitment to long-term partnerships is reflected in its ongoing supply agreements with major global automakers, many of which were renewed or extended through 2024 and into 2025. These contracts are vital for Fuyao's revenue forecasting and operational planning.

- Contractual Stability: Long-term agreements with OEMs provide predictable revenue streams.

- Volume Discounts: Pricing tiers are often structured to reward higher purchase volumes.

- Price Hedging: Clauses for material cost fluctuations help mitigate input price risks.

- Industry Standard: These practices are fundamental to the automotive supply chain's operational model.

Differentiated Aftermarket Pricing Strategies

Fuyao Glass Industry Group likely employs differentiated pricing for its automotive aftermarket replacement glass. This strategy acknowledges that aftermarket sales, often to independent repair shops, incur different costs than direct OEM supply. These costs can include broader distribution networks and marketing efforts to build brand trust among repair professionals. For instance, in 2024, the global automotive aftermarket was valued at over $450 billion, highlighting the segment's significant economic impact and the importance of strategic pricing within it.

Pricing in the aftermarket may also reflect a premium for convenience and the assurance of high quality, akin to OEM standards but readily accessible. This approach recognizes that independent repairers value reliable, easily sourced parts to minimize vehicle downtime. Fuyao's pricing would aim to capture this perceived value, balancing competitiveness with the benefits of its established brand reputation and product quality within the aftermarket segment.

The aftermarket buyer profile differs from OEM clients, often prioritizing immediate availability and trusted brand performance over the volume-based negotiations typical of original equipment manufacturing. Fuyao's pricing strategy would therefore be tailored to these distinct purchasing criteria, ensuring its aftermarket offerings are attractive and profitable.

- Aftermarket Distribution Costs: Higher logistical expenses for reaching a fragmented network of repair shops compared to consolidated OEM supply chains.

- Brand Recognition: Fuyao's investment in brand building with independent repairers can justify a slight premium for trusted quality and availability.

- Perceived Value: Aftermarket pricing may incorporate the value of readily available, high-quality OEM-equivalent parts, crucial for minimizing vehicle repair times.

- Competitive Landscape: While competitive, aftermarket pricing can incorporate a premium for convenience and brand assurance, reflecting distinct buyer needs.

Fuyao Glass Industry Group employs a multi-faceted pricing strategy, balancing value-based pricing for OEMs with competitive pricing to maintain market share. Their 2023 revenue of approximately RMB 27.4 billion underscores the effectiveness of this approach in a demanding automotive sector.

Economies of scale, driven by a 2023 production capacity exceeding 10 million automotive sets annually, enable cost leadership. This allows Fuyao to offer competitive pricing, a critical factor for securing contracts with major automakers prioritizing cost-efficiency.

Long-term contracts with OEMs provide pricing stability, often including volume discounts and material cost adjustment clauses, as seen in renewals extending through 2024 and 2025. Differentiated pricing strategies are also applied to the aftermarket, reflecting distinct distribution costs and buyer needs.

| Pricing Strategy Element | Description | Example/Data Point |

| Value-Based Pricing (OEM) | Reflects high quality, safety, and design impact. | Justified by investments in advanced manufacturing and R&D. |

| Competitive Pricing (OEM) | Aims to secure and grow market share against rivals. | Leverages scale for attractive terms in a competitive 2023 market. |

| Economies of Scale | Cost advantage from high production volume. | 2023 capacity >10 million sets/year reduces per-unit input costs. |

| Contractual Pricing (OEM) | Long-term agreements with volume discounts. | Contracts extended through 2024-2025 with major automakers. |

| Differentiated Pricing (Aftermarket) | Tailored for independent repair shops. | Balances competitiveness with brand assurance for readily available parts. |

4P's Marketing Mix Analysis Data Sources

Our Fuyao Glass Industry Group 4P's Marketing Mix Analysis is built upon a foundation of verified data, including official company reports, investor relations materials, and comprehensive industry analyses. We meticulously examine product portfolios, pricing strategies, global distribution networks, and promotional activities to provide an accurate representation of their market approach.