Fuller Smith & Turner SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuller Smith & Turner Bundle

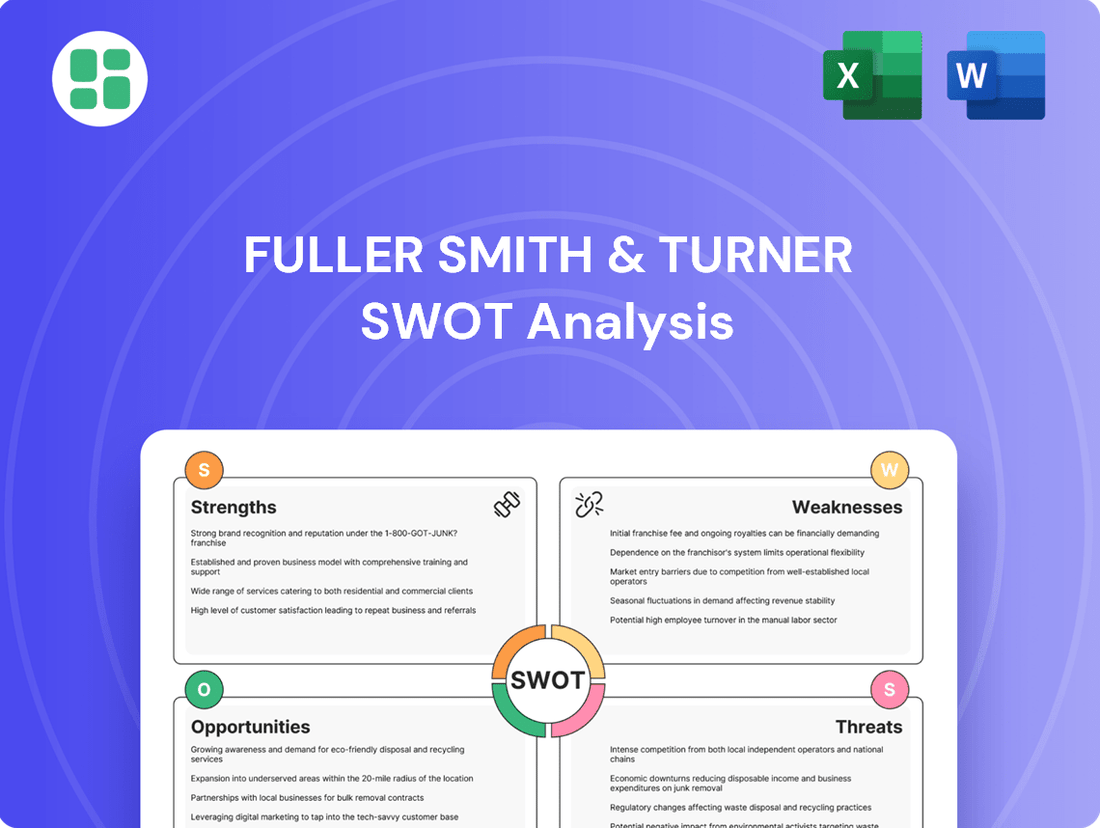

Fuller Smith & Turner, a renowned pub and hotel operator, boasts a strong brand heritage and a loyal customer base, but also faces challenges from evolving consumer preferences and a competitive market. Our comprehensive SWOT analysis delves into these dynamics, providing a clear view of their operational strengths and potential vulnerabilities.

Want the full story behind Fuller Smith & Turner's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fuller, Smith & Turner commands a premium brand image, deeply associated with high-quality pubs and hotels. Its portfolio is anchored by an exceptional estate of iconic properties, predominantly situated in the affluent Southern England region.

The company's strategic advantage lies in its largely freehold property ownership, which offers significant asset backing and financial stability. This ownership structure provides a solid foundation for long-term growth and resilience.

Fuller's commitment to delivering a superior customer experience, characterized by fresh, delicious food, a diverse beverage selection, and attentive service, cultivates strong brand loyalty. This focus on quality underpins its premium positioning in the market.

Fuller Smith & Turner showcased robust financial performance in its Full Year 2025 results, with revenue climbing 4.8% to £376.3 million. This growth was underpinned by a substantial 32% surge in adjusted profit before tax, reaching £27.0 million, highlighting strong operational efficiency and pricing power.

The company's like-for-like sales saw a healthy 5.2% increase, demonstrating an ability to attract and retain customers effectively, often outpacing broader market trends. This operational success translated directly into shareholder value, evidenced by a significant 40% expansion in adjusted earnings per share.

Fuller's demonstrates a robust strategy in managing its property portfolio. In FY2024, the company strategically divested 37 non-core tenanted pubs, generating £18.3 million, while simultaneously acquiring 7 high-quality pubs under the Lovely Pubs brand for £22.5 million. This move significantly enhances the quality and profitability of its overall estate.

The company's commitment to its assets is evident through substantial capital expenditure. Fuller's invested £28 million in property improvements and acquisitions during FY2025, with ongoing plans for further investment. This proactive approach to maintaining and upgrading its pubs solidifies its competitive advantage and market standing.

Strong Balance Sheet and Financial Flexibility

Fuller Smith & Turner benefits from a robust financial foundation, underpinned by a strong balance sheet and significant freehold asset backing. This resilience is further demonstrated by its manageable debt levels, which provide considerable financial flexibility.

The company recently secured a new £185 million bank facility. This agreement, achieved at a lower interest margin, underscores its strong financial health and ensures ample liquidity for upcoming investments and operational needs.

- Strong Balance Sheet: Significant freehold asset backing provides a stable financial base.

- Financial Flexibility: Manageable debt levels and a new £185 million bank facility offer ample liquidity.

- Shareholder Returns: Ongoing share buyback programs indicate a commitment to enhancing shareholder value.

Experienced Leadership and People-Centric Culture

Fuller's boasts a robust team of over 5,000 employees, underscoring a significant commitment to a people-centric culture and ongoing investment in talent. This dedication is evident in their leadership development programs, fostering a skilled and engaged workforce. The company's operational excellence and consistent service quality are direct beneficiaries of this strong focus on its people.

Leadership continuity is a key strength, particularly with the Chief Executive transitioning to Executive Chairman. This move leverages extensive company experience, ensuring stable strategic direction and operational oversight. This experienced leadership team provides a solid foundation for navigating market challenges and opportunities.

- Over 5,000 employees form the backbone of Fuller's operations.

- People-centric culture drives employee development and engagement.

- Leadership continuity is maintained through experienced transitions.

- Investment in leadership programs enhances organizational capabilities.

Fuller's premium brand image, built on high-quality pubs and hotels, is a significant asset, particularly with its portfolio concentrated in affluent Southern England. The company's ownership of a largely freehold estate provides substantial asset backing and financial stability, a crucial advantage in the current market. This strong property foundation, coupled with a commitment to superior customer experience through quality food and beverages, cultivates deep brand loyalty and supports premium pricing.

| Metric | FY2024 | FY2025 |

|---|---|---|

| Revenue | £359.1 million | £376.3 million |

| Like-for-like Sales Growth | 4.5% | 5.2% |

| Adjusted Profit Before Tax | £20.5 million | £27.0 million |

What is included in the product

Analyzes Fuller Smith & Turner’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Helps identify and address weaknesses in Fuller Smith & Turner's operational efficiency and market positioning.

Weaknesses

Fuller's significant reliance on Southern England, while establishing a robust regional foothold, inherently creates a vulnerability. This geographic concentration means the company is more susceptible to localized economic downturns or intensified regional competition that could disproportionately impact its performance, unlike a more diversified operator.

Fuller's, despite its premium positioning, faces a significant weakness in its reliance on UK consumer discretionary spending. Economic headwinds, such as the persistent cost-of-living crisis, directly impact how much people are willing to spend on leisure activities like dining out and overnight stays.

This vulnerability is particularly pronounced outside of peak periods or major events. For instance, while specific figures for Fuller's discretionary spending exposure aren't publicly broken down, broader UK retail sales data from the Office for National Statistics (ONS) in early 2024 indicated continued caution among consumers regarding non-essential purchases, a trend likely to affect Fuller's core pub and hotel offerings.

Fuller Smith & Turner, like much of the UK's hospitality industry, is susceptible to escalating operational expenses. Increases in the National Living Wage, persistent general inflation, and ongoing supply chain issues are all contributing factors that can squeeze profitability.

While Fuller's has demonstrated resilience in managing these challenges, these cost pressures can still lead to reduced profit margins. Furthermore, the need to pass these increased costs onto consumers through higher prices could potentially affect the company's competitive standing in the market.

High Capital Expenditure Requirements

Fuller Smith & Turner's commitment to maintaining its premium, largely freehold pub estate and investing in strategic upgrades demands substantial capital. This ongoing investment, while crucial for brand image and customer experience, ties up significant financial resources. For instance, in the fiscal year ending September 28, 2024, the company reported capital expenditure of £31.6 million, primarily focused on property enhancements and new developments.

This high capital expenditure requirement can limit financial flexibility. The substantial funds allocated to property maintenance and development could otherwise be directed towards reducing debt or pursuing alternative growth opportunities. This necessitates stringent financial planning to ensure that these capital-intensive strategies generate sufficient returns to justify the outlay and maintain a healthy balance sheet.

- Significant Capital Outlay: Maintaining and enhancing a premium pub estate requires continuous, substantial investment in property and infrastructure.

- Tied-Up Capital: Large portions of capital are committed to physical assets, potentially limiting funds for debt reduction or other strategic initiatives.

- Need for Financial Discipline: Ensuring adequate returns on these significant capital investments is paramount and requires rigorous financial oversight.

- 2024 CAPEX: Fuller Smith & Turner invested £31.6 million in capital expenditure in FY24, highlighting the scale of ongoing property-related spending.

Potential for Slower Adaptation to Rapid Market Shifts

Fuller Smith & Turner's established premium pub and hotel model, while a strength, could be a weakness if it hinders adaptation to the hospitality sector's rapid evolution. Consumer preferences are shifting, with a growing demand for quicker service formats and technology-integrated experiences. In 2024, the UK hospitality sector continued to see growth in casual dining and food-to-go segments, which may present a challenge for Fuller's traditional pub-centric approach.

The company's significant physical estate, a core asset, might also pose a challenge in pivoting quickly to new service models or catering to rapidly changing consumer behaviors. For instance, the increasing adoption of online ordering and delivery platforms across the industry requires agile operational adjustments that a more traditional infrastructure might find difficult to implement at speed. Fuller's, like many established players, needs to balance its heritage with the agility demanded by the modern market.

Consider these points:

- Slower adoption of digital-first strategies: While Fuller's is investing in technology, the pace of digital transformation in hospitality is accelerating, potentially leaving established businesses behind.

- Resistance to new service models: The rise of ghost kitchens and subscription-based food services represents a significant shift that may not align easily with Fuller's existing operational framework.

- Physical asset inflexibility: The cost and time involved in reconfiguring or repurposing a large number of pubs and hotels to meet new consumer demands could be substantial.

Fuller's faces a considerable weakness in its substantial capital expenditure requirements, driven by the need to maintain and upgrade its premium, largely freehold pub and hotel estate. This ongoing investment, essential for brand appeal and customer experience, ties up significant financial resources, as evidenced by £31.6 million in capital expenditure reported for the fiscal year ending September 28, 2024. This high level of spending can constrain financial flexibility, potentially limiting funds available for debt reduction or alternative growth avenues, thus demanding rigorous financial planning to ensure these capital-intensive strategies yield adequate returns and uphold a strong balance sheet.

| Financial Metric | Value (FY24) | Implication |

|---|---|---|

| Capital Expenditure | £31.6 million | High investment in property assets limits financial flexibility. |

| Focus of CAPEX | Property enhancements, new developments | Reinforces commitment to physical estate, potentially at the expense of other strategic options. |

Same Document Delivered

Fuller Smith & Turner SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You are viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Fuller's has a significant opportunity to build upon its successful strategy of estate enhancement and strategic acquisitions. The company can continue to acquire high-quality pubs and hotels that align with its premium brand, further solidifying its market position. This proactive approach to portfolio optimization is crucial for long-term growth and value creation.

The company's recent activity, including the disposal of non-core assets and the acquisition of new, well-performing sites, underscores its ability to effectively manage and grow its property portfolio. For instance, in the fiscal year ending March 30, 2024, Fuller's completed the sale of 15 pubs, generating £16.5 million, while also acquiring three new pubs, demonstrating a clear commitment to refining its estate and investing in profitable locations.

Fuller's can capitalize on the increasing consumer desire for memorable, social dining occasions. This trend, evident in the UK's hospitality sector, presents a prime opportunity for Fuller's premium pubs and hotels to offer more than just food and drink, focusing on unique experiences. For instance, in 2024, consumer spending on leisure activities and dining out remained robust, with a particular emphasis on quality and atmosphere.

Fuller's can capitalize on a potentially weaker pound, making the UK a more attractive destination for international tourists. In 2023, London alone welcomed 31 million visitors, a significant increase from previous years, and this trend is expected to continue into 2024 and 2025, directly benefiting Fuller's London-centric operations.

The sustained popularity of staycations presents another key opportunity. Domestic tourism remained robust in 2023, with many Britons choosing to holiday within the UK. Fuller's, with its network of pubs and hotels across the country, is well-positioned to benefit from this ongoing preference for local travel and leisure.

Leveraging Technology for Operational Efficiency and Customer Engagement

Fuller Smith & Turner can significantly boost its operations by embracing advanced technologies. Think about how a smarter booking system can reduce no-shows and optimize table turnover. In 2024, many hospitality businesses saw improved margins by implementing AI-driven inventory management, cutting down on waste and ensuring popular items are always in stock. This focus on efficiency directly impacts the bottom line.

Technology also offers a powerful avenue for connecting with customers on a deeper level. Personalized loyalty programs, which remember customer preferences and offer tailored rewards, are key. Digital ordering and payment systems, already popular, streamline the customer experience. Fuller Smith & Turner can leverage data analytics from these interactions to understand what patrons want, leading to more effective marketing and menu development. For instance, data from 2024 indicated that pubs offering personalized digital promotions saw a 15% increase in repeat customer visits.

- Streamlined booking and reservation systems to maximize table utilization.

- AI-powered inventory management to reduce waste and optimize stock levels.

- Personalized loyalty programs and digital ordering for enhanced customer experience.

- Data analytics to understand customer behavior and tailor offerings for increased retention.

Further Shareholder Value Creation through Capital Allocation

Fuller Smith & Turner's robust financial health and consistent cash flow generation present a significant opportunity to further enhance shareholder value. This strong financial footing allows for strategic capital deployment, potentially through acquisitions or reinvestment in core businesses, which could drive future growth and profitability.

The company's commitment to returning capital to shareholders, exemplified by its ongoing share buyback programs and a progressive dividend policy, is a key driver for investor confidence. For instance, Fuller's reported a 10% increase in its interim dividend in early 2024, reflecting management's positive outlook and efficient capital management. This approach not only attracts new investors but also retains existing ones by demonstrating a clear path to capital appreciation and income generation.

- Share Buybacks: Continued share repurchases can reduce the number of outstanding shares, thereby increasing earnings per share and potentially boosting the stock price.

- Dividend Growth: A progressive dividend policy signals financial stability and a commitment to rewarding shareholders, making the stock more attractive to income-focused investors.

- Strategic Investments: Utilizing strong cash flow for targeted acquisitions or organic growth initiatives can unlock new revenue streams and market share, leading to long-term value creation.

- Financial Flexibility: Maintaining a strong balance sheet provides the flexibility to navigate economic downturns and capitalize on opportunistic investments.

Fuller's can leverage the growing trend of experiential dining by focusing on unique pub atmospheres and high-quality food offerings. This aligns with consumer demand for memorable social occasions, a trend that saw significant growth in the UK's hospitality sector throughout 2023 and into 2024.

The company is well-positioned to benefit from increased international tourism, particularly in London, which welcomed 31 million visitors in 2023. A potentially weaker pound further enhances the UK's appeal to overseas travelers, a factor expected to persist through 2024 and 2025, directly benefiting Fuller's prime London locations.

Capitalizing on the sustained popularity of staycations offers another avenue for growth, as domestic tourism remained strong in 2023. Fuller's extensive network of pubs and hotels across the UK is ideally situated to capture this ongoing preference for local travel and leisure experiences.

Embracing technological advancements, such as AI-driven inventory management and personalized loyalty programs, presents an opportunity to improve operational efficiency and customer engagement. In 2024, hospitality businesses adopting such technologies reported enhanced margins and increased customer retention, with personalized digital promotions leading to a 15% rise in repeat visits.

| Opportunity | Description | Supporting Data |

| Experiential Dining | Focus on unique atmospheres and quality food to meet consumer demand for memorable social occasions. | UK hospitality sector saw significant growth in experiential dining trends in 2023-2024. |

| International Tourism | Benefit from increased overseas visitors, especially in London, aided by a potentially weaker pound. | London welcomed 31 million visitors in 2023, with growth expected through 2024-2025. |

| Staycations | Capitalize on the continued popularity of domestic holidays across the UK. | Domestic tourism remained robust in 2023, with ongoing preference for local travel. |

| Technology Adoption | Improve efficiency and engagement through AI, digital ordering, and personalized loyalty programs. | AI-driven inventory management boosted margins; personalized promotions increased repeat visits by 15% in 2024. |

Threats

Fuller Smith & Turner, like much of the UK hospitality sector, is navigating persistent economic headwinds. The ongoing cost-of-living crisis and high inflation continue to put pressure on consumer spending. For instance, in early 2024, inflation remained elevated, impacting household budgets and potentially reducing discretionary spending on items like dining out and hotel stays.

These economic pressures directly threaten Fuller's revenue streams. Even with its premium positioning, a general downturn in consumer confidence can lead to fewer visits to pubs and hotels, impacting sales volumes. This subdued consumer sentiment, a lingering effect from 2023's economic challenges, poses a significant threat to the company's top-line growth.

Fuller Smith & Turner faces mounting challenges from evolving UK hospitality regulations. Potential increases in business rates, national insurance, and the National Living Wage, which rose to £11.44 per hour for those aged 21 and over in April 2024, will directly impact operating costs.

New legislation, such as the proposed 'Martyn's Law' aimed at enhancing security at public venues, could introduce significant compliance expenses and administrative overhead. These regulatory shifts threaten to squeeze profit margins and divert resources from core business activities, potentially affecting the company's financial performance.

The UK hospitality market is a battleground, with Fuller Smith & Turner facing a multitude of rivals, from nimble independent pubs to vast hotel conglomerates. This crowded landscape means constant pressure to innovate and attract customers.

This fierce competition often translates into price wars, squeezing profit margins, and demanding significant investment in marketing just to stay visible. For instance, in 2024, the average marketing spend for UK hospitality businesses saw an increase of 8% compared to the previous year, reflecting this competitive intensity.

Maintaining market share and pricing power becomes a significant hurdle, especially when consumer spending is tight. In early 2025, consumer confidence in the UK remained fragile, with retail sales volumes showing only a marginal 0.2% increase month-on-month, impacting discretionary spending on dining and lodging.

Labour Shortages and Wage Inflation Challenges

Fuller Smith & Turner, like many in the hospitality sector, faces a persistent threat from labor shortages. This difficulty in attracting and keeping staff is a major concern for maintaining consistent service standards.

Wage inflation, driven by factors such as rising National Living Wage rates, directly increases operational expenses. For example, the UK's National Living Wage increased to £11.44 per hour for those aged 21 and over from April 2024, impacting businesses with a significant hourly workforce.

- Recruitment difficulties: Finding and keeping skilled employees remains a challenge across the industry.

- Rising wage costs: Increased minimum wage legislation and general wage inflation put pressure on profitability.

- Service quality risk: Understaffing or less experienced staff due to shortages can negatively affect customer experience.

Changing Consumer Preferences and Lifestyle Shifts

Fuller's faces a significant threat from evolving consumer preferences, particularly a growing demand for healthier and more sustainable options. For instance, in 2024, the UK's food and beverage market saw a notable increase in demand for plant-based alternatives and ethically sourced products, a trend that could impact traditional pub offerings.

Furthermore, a continued shift towards home-based entertainment and dining, accelerated by changing work patterns, presents a long-term challenge. While Fuller's premium positioning might offer some resilience, the convenience and cost-effectiveness of home consumption cannot be ignored, potentially reducing footfall in their establishments.

The company must remain agile in adapting its menu and overall customer experience to cater to a diverse and dynamic consumer base. Failure to do so could lead to a gradual erosion of market share as preferences move towards more health-conscious or convenience-driven choices.

- Health Consciousness: Growing consumer interest in low-alcohol or alcohol-free beverages and healthier food choices.

- Sustainability Focus: Increased demand for sustainably sourced ingredients and environmentally friendly business practices.

- Home Entertainment: The persistent trend of consumers opting for at-home dining and leisure activities.

- Digital Habits: Changing social habits influenced by technology, potentially impacting traditional social gathering spaces.

Fuller's faces intense competition from a wide range of hospitality providers, from independent pubs to large hotel chains. This crowded market necessitates continuous innovation and marketing investment to maintain visibility and attract customers, especially during periods of subdued consumer spending. For example, the average marketing spend in the UK hospitality sector increased by 8% in 2024, highlighting this competitive pressure.

Rising operational costs due to regulatory changes, such as increased business rates and the National Living Wage, which reached £11.44 per hour in April 2024, directly threaten profit margins. Furthermore, new legislation like 'Martyn's Law' could impose significant compliance costs, diverting resources from core business activities and impacting financial performance.

Labor shortages and wage inflation continue to be a major concern, impacting service quality and increasing operational expenses. The National Living Wage increase in April 2024 exemplifies this trend, directly affecting businesses with a large hourly workforce. Evolving consumer preferences, such as a demand for healthier and sustainable options, alongside the persistent trend of home-based entertainment, also pose significant challenges to Fuller's traditional pub and hotel model.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial reports, comprehensive market research, and expert industry commentary to provide a robust and accurate strategic overview.