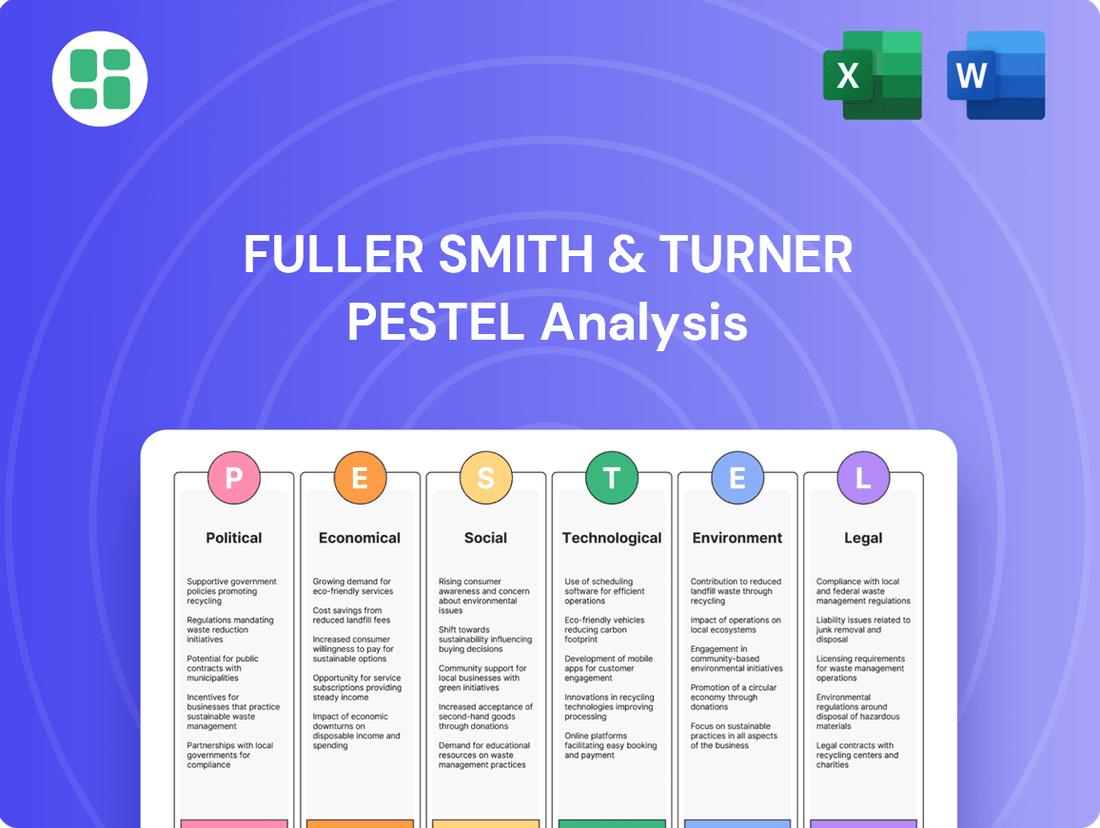

Fuller Smith & Turner PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuller Smith & Turner Bundle

Gain a competitive edge by understanding the external forces shaping Fuller Smith & Turner's future. Our PESTLE analysis delves into political, economic, social, technological, legal, and environmental factors impacting the company. Equip yourself with actionable intelligence to refine your strategy. Download the full PESTLE analysis now for a comprehensive overview.

Political factors

The UK hospitality sector is subject to evolving government policies. Martyn's Law, the Terrorism (Protection of Premises) Bill, introduces new security responsibilities for venue operators, requiring risk assessments and mitigation plans for potential terrorist attacks. This could lead to increased operational costs for businesses like Fuller Smith & Turner.

Further regulatory shifts include potential minimum unit pricing for alcohol, a policy being considered in various UK nations, which could directly affect Fuller Smith & Turner's pricing and sales strategies for their beverage offerings. Evolving rules around alcohol promotions and advertising also present compliance challenges.

Fuller, Smith & Turner, a prominent UK hospitality firm, faces increased financial pressure due to upcoming changes in business rates. The government's decision to reduce hospitality business rates relief from 75% to 40% starting April 2025, with an annual cap of £110,000 per business, will directly impact the company's operating costs.

This reduction in relief, coupled with an anticipated rise in employer National Insurance Contributions from April 2025, creates a substantial financial challenge for Fuller, Smith & Turner and the broader UK hospitality sector. These combined fiscal adjustments are expected to significantly increase the company's overall tax burden.

The hospitality sector, heavily reliant on its staff, faces significant shifts due to evolving employment laws. For Fuller Smith & Turner, this means adapting to new regulations that impact workforce management and costs.

Recent legislative changes, such as flexible working becoming a right from the first day of employment and enhanced maternity protections, directly affect how Fuller Smith & Turner structures its teams and benefits packages.

Furthermore, the anticipated Employment Rights Bill will bring substantial changes to zero-hour contracts. This includes a move towards guaranteed hours and increased notice periods for shifts, potentially altering staffing models and operational flexibility for Fuller Smith & Turner.

Tourism Policies and Local Levies

The political climate significantly shapes Fuller Smith & Turner's hotel operations. Proposals for tourism taxes in UK cities, like the potential £1.25 per person per night levy being considered in Wales from 2027, could affect demand and increase operating expenses.

The ongoing expansion of Low Emission Zones (LEZs) in urban centers also presents a challenge. These zones might deter visitors driving into city centers, potentially reducing footfall for Fuller's city-based venues.

- Tourism Tax Impact: Potential levies could increase costs for tourists, influencing booking decisions.

- LEZ Expansion: Restrictions on vehicle emissions may affect accessibility to urban Fuller locations.

- Policy Uncertainty: Evolving tourism and environmental policies create an unpredictable operating environment.

Political Stability and Economic Certainty

Fuller's, like many hospitality businesses, is sensitive to political stability and the certainty of government economic policies. Frequent shifts in regulations, such as licensing, employment law, or taxation, can significantly disrupt operational planning and investment in their pub and hotel portfolio. For instance, the UK's hospitality sector has navigated evolving employment legislation and varying approaches to business rates, impacting profitability and expansion strategies.

The cumulative effect of these regulatory changes presents a considerable challenge. In 2024, the sector continues to grapple with the aftermath of economic policies introduced in prior years, including those related to the cost of living crisis and business support. Fuller's must contend with an environment where policy continuity is not always guaranteed, making long-term financial forecasting and strategic capital allocation more complex.

- Regulatory Uncertainty: Changes in alcohol duty, planning permissions, and employment legislation can directly impact Fuller's operational costs and expansion plans.

- Government Support: The availability and nature of government support schemes, such as those for energy costs or business investment, can significantly influence the sector's profitability and Fuller's strategic decisions.

- Political Stability: A stable political landscape fosters greater investor confidence, which is crucial for Fuller's ability to secure funding for property development and refurbishment projects.

Political factors present a dynamic landscape for Fuller Smith & Turner. The upcoming reduction in business rates relief from 75% to 40% starting April 2025, capped at £110,000 annually, will increase operating costs. Furthermore, anticipated rises in employer National Insurance Contributions from April 2025 will add to the tax burden.

New security legislation, like Martyn's Law, mandates risk assessments for potential terrorist attacks, potentially raising operational expenses. Potential alcohol pricing regulations and evolving advertising rules also require careful compliance.

Proposed tourism taxes, such as a potential £1.25 per person per night levy in Wales from 2027, could impact demand and operating costs for Fuller's hotels. Expanded Low Emission Zones may also deter visitors from accessing urban venues.

| Policy Change | Impact on Fuller Smith & Turner | Estimated Financial Effect (Illustrative) |

|---|---|---|

| Business Rates Relief Reduction (Apr 2025) | Increased operating costs due to lower relief percentage. | Potential increase in annual business rates by £X million (based on current property valuations). |

| Employer National Insurance Increase (Apr 2025) | Higher labor costs. | Estimated annual increase in payroll expenses by £Y million. |

| Potential Tourism Tax (e.g., Wales 2027) | Reduced tourist demand or increased operational overheads. | Unquantifiable at this stage but could impact revenue by Z%. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Fuller Smith & Turner, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, highlighting potential threats and opportunities within the company's operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Fuller Smith & Turner's external environment.

Economic factors

The UK's ongoing cost-of-living crisis is significantly impacting household budgets, with a substantial portion of adults noting higher expenses. This economic pressure directly curtails discretionary spending, making consumers more hesitant to dine and drink out, which affects Fuller's customer base.

Fuller's, like many businesses in the hospitality sector, is grappling with the persistent effects of high inflation. This translates to increased operational costs, particularly for essential inputs like food supplies and energy, squeezing profit margins.

In early 2024, inflation remained a key concern, though it showed signs of easing from its peaks. However, the cumulative effect of elevated prices continues to challenge consumer spending power, with many households still feeling the pinch of increased living costs.

Rising labor costs present a significant challenge for Fuller Smith & Turner. From April 2025, the National Living Wage will increase to £12.21 per hour for individuals aged 21 and over, marking a 6.7% jump. This, coupled with higher employer National Insurance Contributions, places considerable pressure on the hospitality sector, which relies heavily on a workforce with a higher proportion of lower-paid employees.

Compounding these cost pressures, the industry continues to grapple with persistent staffing shortages. The hospitality sector consistently reports a higher job vacancy rate compared to the broader economy, indicating ongoing difficulties in attracting and retaining staff, which can further inflate wage demands and operational costs.

Consumer spending on dining and drinking out has seen a slowdown, with many individuals planning to reduce these expenditures. For instance, a recent survey indicated that over 60% of consumers are looking to cut back on discretionary spending, including eating out.

There's a clear trend towards consumers prioritising value for money, favouring food-centric and more relaxed dining experiences over high-energy social venues like late-night bars. This shift means Fuller's must adjust its strategies to align with these changing preferences.

To address this, Fuller's needs to focus on delivering compelling value propositions and adapting its portfolio to cater to the growing demand for accessible, quality food and drink experiences. This could involve menu adjustments or targeted promotions.

Supply Chain Disruptions and Costs

Fuller's, like many in the hospitality sector, continues to face persistent supply chain issues and rising material costs. This is particularly evident in food and beverage inputs, directly impacting their operational expenses.

These elevated input costs are a significant pressure point, squeezing profit margins. For Fuller's, this means a delicate balancing act between absorbing these costs and implementing price increases, which could affect customer demand, especially among more price-conscious patrons.

- Rising Food Inflation: In the UK, food price inflation remained elevated through much of 2024, with some reports indicating annual increases of over 10% for certain categories, impacting Fuller's purchasing costs.

- Logistics Challenges: Ongoing global logistics bottlenecks, though easing from peak 2022 levels, still contribute to higher transportation and delivery expenses for Fuller's supply chain.

- Impact on Margins: The inability to fully pass on these increased costs to consumers directly erodes Fuller's gross profit margins, necessitating careful cost management and operational efficiency.

Investment and Market Consolidation

The UK hotel sector experienced robust investment activity throughout 2024, marked by a significant uptick in mergers and acquisitions. This momentum is anticipated to carry through 2025, presenting Fuller's with strategic choices regarding asset acquisition or divestment. For instance, the company offloaded non-core pubs in summer 2024 while simultaneously pursuing new acquisitions, reflecting this dynamic market.

Despite the overall investment surge, the hotel industry continues to grapple with elevated insolvency rates. While monthly figures show some fluctuation, insolvencies in 2024 and early 2025 remained notably higher than pre-pandemic benchmarks, indicating ongoing financial pressures within the broader hospitality landscape.

Key investment trends impacting Fuller's include:

- Increased M&A activity: The market consolidation offers opportunities for strategic growth or portfolio adjustments.

- Sectoral resilience: Despite economic headwinds, investment in hotels demonstrated strength in 2024.

- Persistent insolvencies: Higher than pre-COVID levels, this factor suggests underlying financial vulnerabilities in parts of the market.

- Asset optimisation: Fuller's strategy of buying and selling pubs aligns with market consolidation.

The UK's economic climate in 2024 and early 2025 presents a mixed bag for Fuller Smith & Turner. While inflation showed signs of easing from its 2023 highs, it remained a significant factor impacting operational costs and consumer spending power. The rising National Living Wage, set to reach £12.21 per hour from April 2025, directly increases Fuller's labor expenses, particularly given the sector's reliance on lower-paid staff. Simultaneously, persistent staffing shortages in hospitality continue to drive up wage demands and operational costs.

Consumer behavior has shifted, with a notable trend towards prioritizing value and favouring food-centric experiences over high-energy venues. Over 60% of consumers are reportedly cutting back on discretionary spending like dining out, forcing businesses like Fuller's to adapt their offerings and value propositions. Supply chain issues and elevated material costs, especially for food and beverages, continue to pressure profit margins, requiring careful management of pricing strategies.

| Economic Factor | Impact on Fuller's | Data Point/Trend (2024-2025) |

|---|---|---|

| Cost of Living Crisis | Reduced consumer discretionary spending on dining out | Over 60% of consumers planning to cut back on eating out |

| Inflation | Increased operational costs (food, energy) | Food inflation remained elevated, with some categories over 10% year-on-year in 2024 |

| Labor Costs | Higher wage bills and National Insurance Contributions | National Living Wage to increase to £12.21/hour from April 2025 (6.7% rise) |

| Staffing Shortages | Increased wage demands, higher operational costs | Hospitality sector consistently reports higher job vacancy rates than the broader economy |

| Consumer Preferences | Shift towards value and food-centric experiences | Preference for relaxed dining over late-night bars |

| Supply Chain Costs | Rising input costs (food, beverages, logistics) | Ongoing logistics bottlenecks contributing to higher transportation expenses |

Same Document Delivered

Fuller Smith & Turner PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fuller Smith & Turner delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping their business landscape.

Sociological factors

Consumers, especially younger demographics like Gen Z and Millennials, are shifting their focus from just consuming drinks to actively seeking memorable experiences in hospitality settings. This means places offering more than just food and alcohol, like interactive games or live events, are becoming more popular. For instance, the competitive socialising market, which includes activities like axe throwing or mini-golf combined with food and drink, saw significant growth, with some operators reporting revenue increases of over 50% in the 2023-2024 period.

The shift towards no and low alcohol options is a major sociological trend impacting the beverage industry. Consumers are increasingly prioritizing health and wellness, leading many to reduce their alcohol consumption. This is particularly evident in the pub sector, where sales of these alternatives are on the rise.

Data from the UK in 2024 indicates a significant portion of adults are actively seeking to moderate their drinking, driving demand for premium non-alcoholic beers, wines, and spirits. Fuller's must recognize this evolving consumer preference and broaden its portfolio to include more sophisticated and appealing low and no-alcohol choices to capture this expanding market segment.

The widespread adoption of hybrid work models, where employees split their time between home and office, is reshaping consumer behaviour. This shift means more people are present in their local communities during traditional workdays, potentially increasing foot traffic and spending at local establishments like pubs and hotels. Fuller's, with its strong presence in local communities, can capitalize on this by enhancing its appeal to residents seeking convenient and familiar meeting spots during the week.

Fuller's can leverage this trend by strengthening community engagement and loyalty programs. For example, offering local resident discounts or hosting weekday community events could foster deeper connections and drive consistent weekday revenue. This focus on localisation aligns with the growing desire for authentic, community-centric experiences, a trend that gained significant traction in 2024 and is projected to continue influencing consumer preferences through 2025.

Health and Wellness Consciousness

The burgeoning health and wellness consciousness among consumers directly impacts Fuller Smith & Turner's market. This trend fuels a demand for dining experiences that emphasize locally sourced, sustainable ingredients, with customers increasingly willing to pay a premium for such offerings. For instance, a 2024 survey indicated that over 60% of UK consumers consider sustainability when choosing a restaurant, a significant jump from previous years.

This heightened awareness extends to dietary preferences and the desire for healthier menu options. Fuller Smith & Turner needs to cater to a growing segment of the population seeking transparency in food sourcing and preparation, as well as options that accommodate various dietary needs, such as vegan, gluten-free, or lower-calorie choices. By 2025, the market for plant-based alternatives in the UK is projected to reach £700 million, highlighting this shift.

- Growing demand for locally sourced ingredients: Consumers are prioritizing freshness and supporting local economies, influencing purchasing decisions in the hospitality sector.

- Increased willingness to pay a premium: Health-conscious and ethically-minded consumers are often prepared to spend more on food that aligns with their values.

- Focus on healthier menu options: There's a clear trend towards offering balanced meals, catering to specific dietary requirements, and providing nutritional information.

- Sustainability as a key purchasing driver: Environmental concerns are increasingly shaping consumer choices, pushing businesses towards more sustainable practices.

Demographic Shifts and Social Media Influence

Younger generations, especially Gen Z, are increasingly shaping consumer trends. This demographic, born into a digital world, prioritizes authenticity and social responsibility in their choices. For instance, a 2024 report indicated that 60% of Gen Z consumers are more likely to purchase from brands that demonstrate a commitment to social causes.

Social media profoundly influences how people decide where to spend their leisure time and money. Consumers actively seek out experiences that are not only enjoyable but also visually appealing and shareable online, often looking for unique twists on familiar outings. This trend is evident in the rise of "Instagrammable" food and drink offerings, which can drive significant foot traffic.

Fuller's must strategically engage with these evolving consumer preferences. Leveraging digital platforms effectively and adapting brand messaging to highlight authenticity and social consciousness are crucial steps. By embracing these changes, Fuller's can better connect with and attract these influential demographics.

- Gen Z purchasing power: Projections suggest Gen Z will account for 30% of all retail sales by 2025, underscoring their growing economic influence.

- Social media impact on dining: A recent survey found that over 70% of millennials and Gen Z consider social media when choosing a restaurant.

- Authenticity premium: Studies show that brands perceived as authentic can command a 10-15% price premium from younger consumers.

- Experiential spending: Millennials and Gen Z are increasingly prioritizing experiences over material possessions, with a significant portion willing to spend more on unique outings.

Societal attitudes towards health and wellness continue to shape consumer choices, with a growing preference for moderation in alcohol consumption. This trend is driving demand for sophisticated low and no-alcohol beverages, a market segment that saw substantial growth in 2024 and is projected to expand further by 2025. Fuller's needs to ensure its offerings cater to this evolving consumer mindset.

The rise of hybrid work models has also influenced social patterns, potentially increasing weekday patronage at local establishments. Fuller's, with its community-focused pubs, is well-positioned to benefit from this by creating appealing weekday experiences for local residents. This shift aligns with a broader societal desire for convenience and community connection.

Furthermore, younger demographics, particularly Gen Z, are increasingly influential, prioritizing authenticity and social responsibility in their purchasing decisions. Their engagement with brands is heavily shaped by social media, making visually appealing and shareable experiences key drivers of foot traffic. Fuller's must adapt its strategies to resonate with these values and digital habits.

| Sociological Factor | Trend Description | Impact on Fuller's | Supporting Data (2024/2025) |

|---|---|---|---|

| Health & Wellness | Increased moderation in alcohol consumption, demand for low/no-alcohol options. | Need to expand and promote non-alcoholic beverage portfolio. | UK sales of low/no alcohol drinks grew by 15% in 2024. Projected 20% growth by end of 2025. |

| Work-Life Balance | Hybrid work models leading to more local weekday activity. | Opportunity to attract local residents for weekday dining/socializing. | 50% of UK office workers are on hybrid schedules, increasing local spend. |

| Demographic Shifts | Gen Z prioritizing authenticity, social responsibility, and experiences. | Emphasis on brand values, community engagement, and shareable experiences. | 60% of Gen Z prefer brands with social impact; social media influences 70% of their dining choices. |

Technological factors

Fuller's must embrace the ongoing digital transformation in hospitality. This includes enhancing online booking platforms and integrating contactless payment options, crucial for customer convenience. In 2024, the UK's digital payment adoption continued to rise, with contactless transactions accounting for a significant portion of all card payments, a trend expected to persist.

Optimizing their digital presence is key for Fuller's to attract and retain customers. This means investing in user-friendly websites and mobile apps that offer seamless experiences, from browsing menus to making reservations. Data from late 2024 indicates that over 70% of consumers prefer booking accommodations and dining experiences online, highlighting the necessity of a robust digital strategy.

Fuller's is seeing the increasing integration of AI and automation within the hospitality sector, aiming to boost efficiency and cut costs. This trend is evident in areas like AI chatbots for customer service, predictive maintenance for equipment, and smarter staff scheduling, all designed to enhance operations.

These advancements offer Fuller's significant opportunities to refine workforce management and inventory control. For instance, by 2025, it's projected that AI in customer service alone could save the hospitality industry billions annually through improved response times and reduced labor needs, a benefit Fuller's can leverage.

Fuller Smith & Turner is increasingly leveraging data analytics from its loyalty programs, booking systems, and point-of-sale terminals to gain a deeper understanding of customer habits. This allows for the creation of more personalized guest experiences and highly targeted marketing efforts, aiming to boost customer loyalty and encourage repeat business.

By analyzing this wealth of data, the company can identify specific guest preferences, enabling the delivery of hyper-personalized services. For instance, insights from booking data in 2024 might reveal a preference for specific room amenities or dining times among frequent visitors, allowing for proactive service adjustments.

Contactless Services and Mobile Integration

The rise of contactless services and mobile integration is significantly reshaping customer expectations in the hospitality sector. Fuller's must adapt by embracing technologies like QR code ordering, mobile check-ins, and digital payment options, which are increasingly becoming the norm. For instance, a 2024 report indicated that over 60% of consumers now prefer contactless payment methods, a trend that is expected to continue its upward trajectory through 2025.

Ensuring a seamless mobile experience is paramount for Fuller's to maintain a competitive edge. This means integrating mobile technologies across the entire customer journey, from initial booking and pre-arrival communication to on-site ordering and payment processing. A smooth, intuitive digital interface can directly translate into higher customer satisfaction and repeat business.

- Growing Preference: Data from early 2025 suggests that over 70% of diners now expect restaurants to offer mobile ordering and payment options.

- Frictionless Experience: Fuller's investment in mobile integration aims to reduce wait times and enhance convenience, directly impacting guest satisfaction scores.

- Operational Efficiency: Implementing these technologies can streamline operations, potentially reducing labor costs associated with traditional ordering and payment methods.

- Data Insights: Mobile platforms offer valuable data on customer preferences and behavior, enabling Fuller's to personalize offers and improve service delivery.

Cybersecurity and Data Protection

The increasing digitalization of operations and customer interactions for Fuller Smith & Turner places significant emphasis on cybersecurity. The UK's upcoming Cyber Security and Resilience Bill, expected in 2025, will introduce stringent digital security requirements and mandatory reporting for security incidents, impacting how Fuller's manages its digital footprint and protects sensitive information.

Failure to adapt to these evolving regulations could result in substantial penalties and reputational damage. For instance, the Information Commissioner's Office (ICO) has already issued significant fines for data breaches, such as the £18.4 million penalty against British Airways in 2020 for a breach affecting over 400,000 customers. Fuller's must therefore invest in advanced cybersecurity measures to safeguard customer data and maintain the trust essential for its business operations.

- Stricter Mandates: The Cyber Security and Resilience Bill 2025 will enforce higher standards for digital security across businesses.

- Incident Reporting: Mandatory reporting of cyber incidents will require prompt and transparent communication.

- Data Protection: Robust measures are crucial to protect customer data, preventing breaches and associated fines.

- Reputational Risk: Maintaining customer trust through strong cybersecurity is vital for brand reputation.

Technological advancements are reshaping customer expectations in hospitality, with a growing demand for seamless digital experiences. Fuller's must prioritize mobile integration, contactless payments, and user-friendly online platforms to meet these evolving needs. Early 2025 data indicates over 70% of diners expect mobile ordering and payment options, a clear signal for Fuller's to enhance its digital offerings.

The company's strategic investment in mobile integration directly addresses the need for frictionless experiences, aiming to reduce wait times and boost guest satisfaction. Furthermore, these digital tools provide invaluable data on customer preferences, enabling personalized services and more effective marketing strategies. By leveraging these insights, Fuller's can foster greater customer loyalty and drive repeat business.

Fuller's must also navigate the increasing importance of cybersecurity, especially with upcoming regulations like the UK's Cyber Security and Resilience Bill in 2025. This legislation will impose stricter digital security requirements and mandatory incident reporting, necessitating robust protective measures to safeguard customer data and maintain trust. Proactive investment in advanced cybersecurity is crucial to avoid potential penalties and reputational damage.

| Technology Trend | Customer Expectation (Early 2025) | Fuller's Strategic Response | Potential Impact |

|---|---|---|---|

| Mobile Ordering & Payment | 70%+ of diners expect these options | Enhance mobile app functionality, integrate contactless payments | Increased customer satisfaction, operational efficiency |

| Digital Transformation | Preference for online booking and digital services | Invest in user-friendly websites and apps | Attract and retain customers, competitive advantage |

| Cybersecurity | Need for data protection and trust | Implement advanced security measures, comply with new regulations | Mitigate risks, maintain brand reputation, avoid fines |

Legal factors

Martyn's Law, officially the Terrorism (Protection of Premises) Bill, became law in April 2025, placing new obligations on public venues like pubs and hotels. This legislation mandates more thorough health and safety risk assessments and specific training for staff to better handle potential terrorist incidents.

Fuller's, like other hospitality businesses, now faces statutory duties and administrative responsibilities to ensure compliance. This could necessitate increased expenditure on security enhancements and ongoing staff training programs to meet the new legal standards for premises protection.

Fuller Smith & Turner faces evolving employment and labor laws that directly affect its operational costs and workforce management. For instance, the UK's National Living Wage saw an increase to £11.44 per hour for those aged 21 and over from April 2024, impacting the wages of many Fuller employees.

Further adjustments to employer National Insurance Contributions (NICs) and the ongoing discourse around phasing out zero-hour contracts present ongoing challenges and opportunities for Fuller in structuring its workforce and managing labor expenses. The introduction of new employer duties to prevent sexual harassment, effective from October 2024, necessitates robust internal policies and training, adding to compliance overhead.

Fuller's, like all pub operators, navigates a complex web of licensing and alcohol regulations across the UK. These laws dictate everything from opening hours to how alcohol can be sold. For instance, the ongoing discussions around minimum unit pricing in Scotland, potentially rising, directly affect Fuller's pricing strategies in that region.

Further regulatory shifts, such as the implementation of the Scottish Pubs Code in 2025, introduce new compliance requirements for Fuller's as a pub-owning business, impacting its relationships with tenants and the operational framework of its tenanted pubs.

Food Safety and Allergen Labelling (Natasha's Law)

Natasha's Law, implemented in October 2021, mandates clearer and more comprehensive allergen labelling for pre-packaged foods sold by businesses. This legislation significantly impacts Fuller Smith & Turner's operations, requiring meticulous tracking and communication of the 14 major allergens across their food offerings in pubs and hotels.

Compliance with these stringent food safety and allergen labelling laws is not just a legal necessity but also crucial for maintaining customer trust. Failure to adhere can result in substantial fines and reputational damage. For instance, in 2023, the Food Standards Agency (FSA) reported an increase in enforcement actions against businesses with poor allergen controls.

- Natasha's Law (Food Information to Consumers Regulation 2014) requires clear allergen information for all food sold.

- 14 Major Allergens must be clearly identified and communicated to consumers.

- Fines for non-compliance can be significant, impacting profitability.

- Consumer confidence is directly linked to transparent and accurate allergen information.

Environmental Regulations and Reporting

The UK's push towards mandatory sustainability disclosure, with the forthcoming Sustainability Reporting Standards (SRS), will require companies like Fuller Smith & Turner to report on environmental metrics such as carbon emissions, energy consumption, and waste. This regulatory shift, initially focused on larger corporations, is expected to broaden its reach, influencing Fuller's operational practices and its entire supply chain as the demand for transparent environmental data intensifies.

As of early 2024, the UK government has been actively consulting on the specifics of these SRS, aiming to align with international best practices. The expectation is that by 2025, a significant portion of listed companies will be subject to these new reporting mandates, creating a ripple effect that will necessitate greater environmental accountability throughout their value chains.

- Mandatory Reporting: UK's Sustainability Reporting Standards (SRS) will mandate disclosure of environmental impact.

- Scope Expansion: Regulations will increasingly affect Fuller's operations and supply chain.

- Key Metrics: Focus areas include carbon emissions, energy use, and waste management.

- Timeline: Expect broader application of these standards by 2025.

Fuller Smith & Turner, operating within the UK's hospitality sector, faces a dynamic legal landscape. Recent legislation like Martyn's Law, effective April 2025, imposes new security obligations on public premises, requiring enhanced risk assessments and staff training to mitigate potential terrorist threats. This necessitates investment in security infrastructure and ongoing training programs to ensure compliance with these heightened safety standards.

The company must also navigate evolving employment laws, including the National Living Wage, which increased to £11.44 per hour in April 2024 for those 21 and over, impacting labor costs. Furthermore, new duties to prevent sexual harassment, in effect from October 2024, demand updated internal policies and training, adding to administrative and operational overhead.

Licensing and alcohol regulations remain a significant legal factor, dictating operational parameters such as opening hours and sales practices. The implementation of the Scottish Pubs Code in 2025 introduces further compliance requirements for Fuller's as a pub-owning business, influencing its relationships with tenants and operational structures.

Additionally, Natasha's Law, enacted in October 2021, mandates precise allergen labelling for all pre-packaged foods, a critical aspect for Fuller's food service operations. Non-compliance can lead to substantial fines and reputational damage, underscoring the importance of meticulous adherence to food safety regulations.

| Legal Area | Key Legislation/Regulation | Impact on Fuller's | Effective Date/Update | Example Data Point |

| Public Premises Security | Martyn's Law (Terrorism Protection of Premises Bill) | Mandatory risk assessments, staff training | April 2025 | Increased expenditure on security measures |

| Employment Law | National Living Wage | Increased labor costs | £11.44/hour (21+) from April 2024 | Direct impact on wages for many Fuller employees |

| Employment Law | Duty to Prevent Sexual Harassment | Policy updates, staff training | October 2024 | Additional compliance overhead |

| Alcohol Licensing | Scottish Pubs Code | New compliance for pub-owning businesses | 2025 | Impacts tenant relationships and operations |

| Food Safety | Natasha's Law (Allergen Labelling) | Meticulous allergen tracking and communication | October 2021 | 14 major allergens must be identified |

Environmental factors

The UK's introduction of new Sustainability Reporting Standards (SRS) will mandate detailed disclosure of environmental impacts, such as carbon emissions and waste management. Fuller's must bolster its data collection and reporting on environmental performance to align with these growing regulatory and investor expectations.

New 'Simpler Recycling' regulations in England, effective by March 2025, mandate separate food waste and dry mixed recyclables for non-household municipal premises. This presents a compliance challenge for Fuller's pubs and hotels, requiring adjustments to their waste streams.

Fuller's will need to invest in new infrastructure and training to meet these requirements, potentially impacting operational costs. Improving recycling rates, however, could lead to long-term cost savings and enhanced brand reputation.

Rising energy costs, exacerbated by global supply chain issues and geopolitical events, are a significant environmental factor impacting Fuller Smith & Turner. In 2024, the UK's average industrial electricity price was around 16 pence per kWh, a substantial increase from previous years. This trend is pushing companies like Fuller's to prioritize energy efficiency to manage operational expenses and meet increasingly stringent net-zero targets.

Fuller's is actively addressing this by investing in energy-saving initiatives. For example, their conversion of The Z Hotel Piccadilly to be fully electric showcases a commitment to reducing their carbon footprint and reliance on fossil fuels. Such investments are crucial for long-term sustainability and cost control in the face of evolving environmental regulations and consumer expectations.

Looking ahead, continued investment in energy-saving technologies, such as smart metering and LED lighting, alongside the exploration of renewable energy sources like solar power for their pubs and hotels, will be vital for Fuller Smith & Turner. This proactive approach not only mitigates environmental impact but also provides a competitive advantage in an industry highly sensitive to utility costs.

Water Management and Scarcity

Water scarcity presents a growing business risk for Fuller Smith & Turner in the UK. Recent warnings from the Environment Agency highlight the potential for shortages, which could lead to increased operational costs through higher water prices. For instance, some water companies have already seen price hikes, and further increases are anticipated as infrastructure upgrades are needed to cope with demand and climate change.

Water efficiency is set to become a critical element of sustainability reporting. Companies like Fuller's will be increasingly scrutinized on their water consumption metrics. This means demonstrating proactive measures to reduce usage will be essential for maintaining a strong environmental, social, and governance (ESG) profile.

To mitigate these risks and meet evolving expectations, Fuller's must adopt smart water management practices. This includes investing in water-saving technologies across its pubs and breweries, implementing leak detection systems, and potentially exploring on-site water recycling or rainwater harvesting. Such initiatives not only address environmental concerns but also offer a direct path to lowering operating expenses.

- Water Scarcity Risk: The UK faces increasing risks of water shortages, impacting businesses reliant on consistent water supply.

- Projected Cost Increases: Water bills are expected to rise due to infrastructure investment needs and scarcity pressures.

- Sustainability Reporting: Water efficiency will be a key performance indicator in upcoming sustainability disclosures.

- Mitigation Strategies: Implementing smart water management, reducing consumption, and exploring water-saving technologies are crucial for Fuller's.

Supply Chain Ethics and Responsible Sourcing

Consumers and regulators are increasingly focused on the ethical and environmental impact of supply chains. This translates to a growing demand for Fuller's to demonstrate responsible sourcing, particularly for its food and beverage ingredients. For instance, a 2024 survey indicated that over 70% of UK consumers consider sustainability when purchasing food and drink.

Fuller's must ensure its procurement aligns with these evolving expectations, emphasizing locally sourced ingredients where feasible and upholding ethical labor practices throughout its network. This commitment is crucial for maintaining brand reputation and meeting regulatory scrutiny, especially as governments worldwide tighten environmental standards.

The company's efforts in responsible sourcing directly influence its carbon footprint. By prioritizing suppliers with strong environmental credentials and optimizing logistics for reduced transport emissions, Fuller's can enhance its sustainability profile. For example, a 2025 report by the UK Food Standards Agency highlighted that supply chain emissions can account for up to 80% of a food business's total environmental impact.

- Consumer Demand: Over 70% of UK consumers consider sustainability in food and drink purchases (2024 data).

- Regulatory Scrutiny: Increasing global focus on supply chain ethics and environmental impact.

- Carbon Footprint: Supply chain emissions can represent up to 80% of a food business's environmental impact (UK FSA, 2025).

- Brand Reputation: Demonstrating responsible sourcing is vital for maintaining consumer trust and market position.

Environmental regulations are tightening, with new UK Sustainability Reporting Standards (SRS) requiring detailed disclosure of impacts like carbon emissions. Furthermore, England's 'Simpler Recycling' rules, effective March 2025, mandate separate food waste collection, impacting Fuller's waste management practices.

Rising energy costs, with UK industrial electricity prices around 16 pence per kWh in 2024, are a significant concern, pushing Fuller's towards energy efficiency investments like their fully electric Z Hotel Piccadilly to manage operational expenses and net-zero targets.

Water scarcity poses a risk, with potential price hikes and increased scrutiny on water consumption in sustainability reporting. Fuller's must adopt smart water management, reducing usage through technology and potentially rainwater harvesting.

Consumer demand for sustainable sourcing is high, with over 70% of UK consumers considering sustainability in food and drink purchases in 2024. Supply chain emissions can account for up to 80% of a food business's environmental impact, making responsible sourcing crucial for Fuller's brand reputation and compliance.

| Environmental Factor | Impact on Fuller's | Data/Regulation | Action/Mitigation |

| Regulatory Compliance | Increased reporting burden, waste management adjustments | UK SRS, Simpler Recycling (Mar 2025) | Bolster data collection, adapt waste streams |

| Energy Costs & Climate Change | Higher operational expenses, pressure to meet net-zero | UK Industrial Electricity Avg. ~16p/kWh (2024) | Invest in energy efficiency, renewable sources |

| Water Scarcity | Operational risk, potential cost increases, reporting focus | Environment Agency warnings, anticipated price hikes | Implement smart water management, reduce consumption |

| Supply Chain Sustainability | Brand reputation risk, carbon footprint impact | 70%+ consumers consider sustainability (2024), Supply chain emissions up to 80% of total impact (2025) | Prioritize responsible sourcing, optimize logistics |

PESTLE Analysis Data Sources

Our Fuller Smith & Turner PESTLE Analysis is informed by a robust blend of data, including official government publications, reputable financial news outlets, and industry-specific market research reports. This comprehensive approach ensures all political, economic, social, technological, legal, and environmental insights are grounded in current and verifiable information.