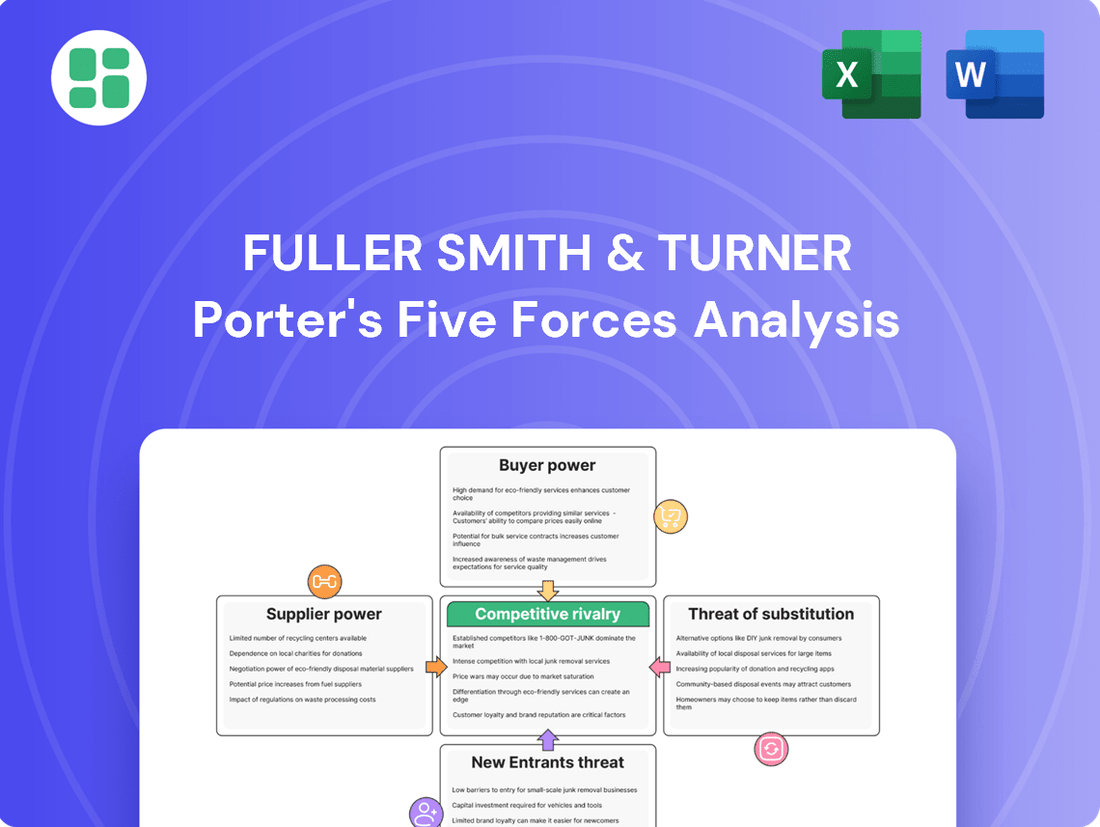

Fuller Smith & Turner Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuller Smith & Turner Bundle

Fuller Smith & Turner faces moderate bargaining power from its suppliers, particularly for key ingredients and brewing equipment. The threat of new entrants is somewhat limited by significant capital requirements and established brand loyalty in the pub and brewing sector.

The complete report reveals the real forces shaping Fuller Smith & Turner’s industry—from buyer power in its pubs to the threat of substitutes like ready-to-drink beverages. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers in the UK hospitality sector, especially for premium food, beverages other than beer, and specialized services, significantly impacts their bargaining power. For instance, in 2024, the UK's food and beverage wholesale market is characterized by a mix of large national distributors and smaller, specialized regional suppliers. If Fuller's relies heavily on a limited number of these specialized suppliers for unique ingredients or services, those suppliers gain leverage to dictate terms and pricing.

Fuller's faces varying switching costs depending on the supplier. For instance, changing a primary food or beverage supplier might involve costs like updating menus, retraining bar staff on new product preparation, and potentially adjusting inventory management systems. These costs, while present, are often manageable for a company of Fuller's scale.

However, switching major property maintenance contractors, especially those handling specialized equipment in their pubs, could incur significantly higher costs. This might include re-negotiating contracts, onboarding new service providers, and ensuring compliance with new service level agreements. The ease or difficulty of these transitions directly impacts the bargaining power of Fuller's suppliers.

The bargaining power of suppliers in the pub and brewing industry, including Fuller's, is influenced by how crucial Fuller's is as a customer. If Fuller's accounts for a significant percentage of a supplier's overall sales, that supplier might be more amenable to favorable pricing and terms to keep Fuller's business. This is particularly true for specialized ingredients or services where switching suppliers could be costly or disruptive.

Conversely, if Fuller's represents a minor portion of a supplier's revenue, the supplier holds greater leverage. In 2024, the UK food and beverage sector experienced fluctuating commodity prices, such as barley and hops, which are key inputs for brewers like Fuller's. Suppliers of these essential raw materials, especially if they have a diverse customer base, can exert more pressure on pricing and supply terms, knowing that losing Fuller's business wouldn't severely impact their operations.

Availability of Substitute Inputs

The availability of substitute inputs significantly influences the bargaining power of suppliers for Fuller Smith & Turner. If Fuller's can readily source comparable food, beverages, or services from multiple providers at competitive prices, the power of any single supplier diminishes. For instance, the ability to switch between various craft beer breweries or food suppliers for pub ingredients directly weakens individual supplier leverage.

However, the unique nature of certain premium or exclusive products can limit the availability of substitutes, thereby increasing supplier bargaining power. If Fuller's relies on specific, hard-to-replicate ingredients or specialized services, those suppliers gain an advantage. For example, a particular regional ale or a proprietary cleaning service might not have readily available alternatives, giving those suppliers more sway over pricing and terms.

- Reduced Supplier Power: Easy access to alternative suppliers for common goods like produce or cleaning supplies limits individual supplier influence.

- Increased Supplier Power: Reliance on unique or proprietary products, such as specific craft ales or specialized kitchen equipment, can grant suppliers greater bargaining leverage.

- Impact on Costs: The ease or difficulty of finding substitutes directly affects Fuller's input costs and operational flexibility.

- Strategic Sourcing: Fuller's strategy to diversify its supplier base for non-unique items helps mitigate the bargaining power of individual suppliers.

Labor Market Dynamics

In the hospitality sector, labor acts as a crucial 'supplier,' and their bargaining power can be substantial. This is especially true for skilled roles like chefs, general managers, and experienced front-of-house staff. The UK hospitality industry, for instance, has been experiencing notable talent shortages throughout 2024 and into 2025, a situation that directly impacts companies like Fuller's.

These labor market dynamics compel businesses to actively compete for talent by offering attractive wages and benefits packages. Such competition can significantly increase operating costs for Fuller's, directly affecting their profitability.

- Talent Shortages: Reports from 2024 indicated persistent difficulties in recruiting qualified staff across the UK hospitality sector.

- Wage Pressure: To secure and retain essential personnel, businesses are facing upward pressure on wage demands.

- Increased Operating Costs: Higher labor costs directly impact the bottom line, potentially reducing profit margins for companies like Fuller's.

The bargaining power of Fuller's suppliers is influenced by the concentration of suppliers in key areas like premium food and specialized services. In 2024, the UK hospitality sector saw continued consolidation among large food distributors, potentially increasing their leverage. However, the availability of substitute products and the ease of switching suppliers, while sometimes costly for specialized items, generally temper the power of most suppliers for Fuller's.

Labor, acting as a critical supplier, wields significant bargaining power due to persistent talent shortages in the UK hospitality sector throughout 2024 and into 2025. This scarcity forces companies like Fuller's to offer higher wages and better benefits to attract and retain skilled staff, directly increasing operating costs and impacting profitability.

The relative importance of Fuller's as a customer also shapes supplier power. If Fuller's represents a substantial portion of a supplier's business, the supplier is more likely to offer favorable terms. Conversely, if Fuller's is a small client for a supplier with a broad customer base, the supplier holds greater leverage, particularly when facing volatile input costs like those seen in 2024 for commodities such as barley and hops.

| Factor | Impact on Supplier Bargaining Power | Relevance to Fuller's (2024-2025) |

|---|---|---|

| Supplier Concentration | High concentration increases power | Mixed: Consolidation in large distributors, but many niche suppliers exist. |

| Switching Costs | High costs increase power | Moderate for common goods, higher for specialized ingredients/services. |

| Customer Importance | High importance reduces power | Varies by supplier; Fuller's is a significant customer for some, minor for others. |

| Substitute Availability | Low availability increases power | Generally good for common items, limited for unique/proprietary products. |

| Labor Market Conditions | Shortages increase power | Significant impact due to ongoing talent shortages in UK hospitality. |

What is included in the product

Analyzes the competitive intensity and profitability potential for Fuller Smith & Turner by examining the power of buyers and suppliers, threat of new entrants and substitutes, and rivalry among existing competitors.

Instantly assess competitive intensity by visualizing the interplay of Porter's Five Forces for Fuller Smith & Turner, clarifying strategic challenges.

Customers Bargaining Power

Fuller's customers, whether enjoying a pint or staying overnight, show a range of price sensitivity. For their premium offerings, some patrons prioritize the overall experience and are less swayed by minor price differences. However, in tougher economic periods, a larger segment of the market actively looks for good value.

The company’s efforts to retain customers are increasingly focused on loyalty programs and tailored rewards, aiming to foster repeat business and mitigate the impact of price competition. For instance, in 2024, the UK hospitality sector saw continued pressure on consumer spending, making value propositions even more critical for businesses like Fuller's.

The ease with which customers can switch to alternative venues or services significantly amplifies their bargaining power. In the UK pub and hotel sector, a diverse array of options exists, ranging from budget-friendly accommodations and independent pubs to large restaurant chains, all vying for customer attention.

Customers now readily access online platforms to meticulously compare services, prices, and reviews. For instance, by mid-2024, platforms like TripAdvisor and Google Reviews allow consumers to instantly assess hundreds of establishments, making informed decisions and demanding better value, thereby increasing their leverage over businesses like Fuller Smith & Turner.

Customers of Fuller Smith & Turner, like many today, have unprecedented access to information. Online reviews, booking platforms, and social media allow them to easily compare prices, quality, and overall experiences across Fuller's pubs and restaurants, as well as those of competitors. This heightened transparency significantly reduces information asymmetry, giving customers more leverage.

In 2024, the digital footprint of consumer opinion continues to grow, with platforms like TripAdvisor and Google Reviews playing a crucial role. For instance, a pub with consistently poor reviews regarding service or food quality can see a noticeable drop in footfall. This direct feedback loop pressures Fuller's to maintain high operational standards and competitive pricing to retain its customer base.

Switching Costs for Customers

For individual customers, the switching costs associated with choosing between pubs or hotels within the hospitality sector are typically quite low. This means a patron can easily opt for an alternative establishment for their next outing or stay without incurring substantial financial penalties or facing significant logistical hurdles.

This low switching cost directly amplifies customer bargaining power. It puts pressure on companies like Fuller, Smith & Turner to continuously differentiate themselves and offer compelling reasons for customers to return. In 2024, customer retention remains a key focus for hospitality businesses, with many investing in loyalty programs and personalized experiences to combat this ease of switching.

- Low Switching Costs: Customers can readily switch between pubs and hotels without significant financial or time investment.

- Increased Bargaining Power: This ease of switching empowers customers, forcing businesses to compete on value and experience.

- Focus on Retention: Businesses like Fuller's must prioritize customer satisfaction and loyalty to mitigate the impact of low switching costs.

Group vs. Individual Customer Power

While individual patrons of Fuller's pubs and hotels typically possess minimal direct bargaining power, their collective impact can be significant. However, when customers organize into larger groups, their ability to negotiate terms and pricing increases substantially. For instance, a large corporate event booking multiple rooms and extensive catering services at a Fuller's venue will have considerably more leverage than a single diner.

Fuller's operates by serving both individual customers and larger group bookings. In 2024, the company's revenue streams are influenced by the purchasing power of these different customer segments. Group bookings, such as wedding receptions or company conferences, often involve substantial expenditure, giving these organizers greater sway in negotiating package deals or discounts. This is a key consideration in managing customer relationships and revenue for Fuller's.

- Individual Customer Power: Limited, typically focused on immediate purchase decisions and minor requests.

- Group Booking Power: Significant, especially for large events like conferences or weddings, influencing pricing, package inclusions, and service terms.

- Fuller's Revenue Mix: The company balances revenue from individual pub visits and hotel stays with larger, negotiated group events.

- Negotiation Leverage: The ability to book multiple rooms, extensive catering, or long-term contracts grants groups greater bargaining power with Fuller's.

The bargaining power of Fuller's customers is a significant factor, driven by low switching costs and increased access to information. Customers can easily compare prices and services across numerous hospitality options, pressuring Fuller's to maintain competitive offerings and high standards. In 2024, the UK hospitality market remains competitive, with consumer spending sensitive to value, making customer retention strategies like loyalty programs crucial.

While individual customers have limited direct power, large group bookings, such as corporate events or weddings, wield considerable influence. These groups can negotiate terms and pricing due to the substantial revenue they represent. Fuller's revenue mix in 2024 reflects this, balancing individual transactions with significant group event contracts.

| Customer Segment | Bargaining Power Drivers | Impact on Fuller's |

|---|---|---|

| Individual Patrons | Low switching costs, readily available information (reviews, price comparisons) | Forces competitive pricing and focus on customer experience; reliance on loyalty programs for retention. |

| Group Bookings (e.g., Corporate Events, Weddings) | High volume purchases, potential for long-term relationships, negotiation on package deals. | Significant leverage to negotiate discounts and customized services; key revenue driver requiring tailored relationship management. |

Same Document Delivered

Fuller Smith & Turner Porter's Five Forces Analysis

This preview showcases the complete Fuller Smith & Turner Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the brewing industry. The document you see here is precisely what you will receive instantly upon purchase, ensuring no surprises. This professionally formatted analysis is ready for immediate use, providing valuable insights into the strategic landscape of Fuller Smith & Turner.

Rivalry Among Competitors

The UK pub and hotel sector is a crowded space, with numerous players vying for customer attention. Fuller Smith & Turner finds itself competing against a substantial number of businesses, with reports indicating 672 active competitors. This includes major players like Marston's, J D Wetherspoon, and Young & Co.'s Brewery, alongside a vast array of smaller, independent establishments.

The UK hospitality market is poised for growth, with the hotel sector alone valued at £57.39 million and expected to expand at a compound annual growth rate of 2.53% from 2025 to 2033. The broader hospitality market is projected to reach USD 61.23 billion in 2025.

Despite this positive outlook, the rate of expansion and existing market saturation in specific areas can intensify rivalry. This means companies like Fuller Smith & Turner will likely face strong competition for consumer spending as more players vie for market share.

Fuller's distinguishes itself through a premium pub and hotel experience, focusing on high-quality food, beverages, and attentive service. This product differentiation is key to fostering strong brand recognition and customer loyalty, which are vital for competing beyond just price.

In 2024, Fuller's continued to leverage its heritage and unique pub aesthetics to build a loyal customer base. This strategy helps to insulate them from intense competition by creating a perceived value that transcends simple cost comparisons, a crucial element in the hospitality sector.

Exit Barriers

Fuller Smith & Turner, like many in the pub and hotel sector, faces significant exit barriers. These include substantial investments in freehold properties and long-term leases, making it costly and difficult to divest operations. The capital-intensive nature of maintaining and upgrading pubs and hotels further entrenches companies, even when returns are low.

These high exit barriers mean that businesses are often compelled to continue operating, even in challenging market conditions. This reluctance to leave the market can sustain or even intensify competitive rivalry. Companies might continue to compete fiercely to recover their investments or simply because exiting is financially unviable.

- High Fixed Asset Investment: Pubs and hotels require significant investment in physical assets, such as buildings, fixtures, and fittings.

- Lease Commitments: Many operators are bound by long-term leases, creating ongoing financial obligations that discourage early exit.

- Brand and Reputation: Exiting a market can damage brand reputation and future business prospects, acting as a de facto barrier.

- Specialized Workforce: The industry relies on specialized staff, and redundancy costs or retraining needs can add to exit expenses.

Cost Structure and Pricing Strategies

Fuller's, like many in the hospitality industry, grapples with significant cost pressures. The National Living Wage increases, coupled with rising National Insurance Contributions, directly impact staffing expenses. Furthermore, volatile energy prices and business rates add to the operational burden, forcing a constant focus on efficiency.

These escalating costs necessitate strategic pricing adjustments for Fuller's to safeguard profitability. The company must balance maintaining competitive pricing to attract customers with the need to cover its increased operational outlays. This delicate act is crucial for sustained success in a dynamic market.

- Staffing Costs: Increased National Living Wage and NICs are primary drivers of higher labor expenses.

- Energy Prices: Fluctuations in energy markets directly impact utility bills for pubs and hotels.

- Business Rates: Property-related taxes remain a consistent overhead for Fuller's establishments.

- Pricing Strategy: Fuller's must adapt pricing to offset cost increases while remaining attractive to consumers.

The competitive rivalry within the UK's pub and hotel sector is intense, driven by a large number of operators and the inherent difficulty in exiting the market due to high fixed asset investments and lease commitments. Fuller Smith & Turner, with 672 active competitors including major players, must differentiate itself through premium offerings and heritage to build customer loyalty and avoid competing solely on price.

In 2024, Fuller's continued to focus on its unique pub aesthetics and heritage, a strategy crucial for building brand loyalty in a saturated market. This approach helps them stand out against competitors like Marston's and J D Wetherspoon, who also vie for market share in the growing hospitality sector, projected to reach USD 61.23 billion in 2025.

The industry faces significant cost pressures, including rising labor expenses due to increased National Living Wage and National Insurance Contributions, alongside volatile energy prices and business rates. Fuller's must strategically adjust pricing to offset these operational burdens while remaining competitive.

| Competitor Type | Examples | Fuller's Strategy |

|---|---|---|

| Major Pub Chains | Marston's, J D Wetherspoon | Premium experience, heritage branding |

| Independent Pubs | Numerous smaller establishments | Focus on quality food and beverages |

| Hotel Operators | Various hotel groups | Integrated pub and hotel experience |

SSubstitutes Threaten

A significant threat to Fuller's traditional pub and hotel offerings comes from at-home consumption of food and beverages, amplified by readily available home entertainment options. This trend gained considerable traction, especially following the pandemic, offering a more cost-effective alternative to dining out and socialising in traditional venues.

For many consumers, the convenience and lower price point of preparing meals at home and enjoying streaming services or other digital entertainment present a compelling substitute. This shift directly impacts Fuller's revenue streams by reducing the demand for their core services, particularly for casual dining and drinks.

In 2024, consumer spending on home entertainment, including subscriptions and digital content, continued to be robust, with the global market projected to reach hundreds of billions of dollars. Similarly, the at-home food and beverage sector, encompassing grocery sales and meal kits, also saw sustained growth, indicating a persistent preference for domestic leisure activities.

Consumers have a vast selection of leisure activities competing for their disposable income. These include going to the cinema, attending theatre performances, watching live sports, or simply socializing in other venues, all of which can draw spending away from Fuller's pubs and hotels.

In 2024, the UK's leisure and hospitality sector faced continued competition. For instance, cinema admissions in the UK saw a steady recovery, with box office revenues reaching over £1 billion in 2023, indicating a strong consumer appetite for alternative entertainment options.

The threat of substitutes for hotel services is significant, encompassing options like Airbnb, guesthouses, serviced apartments, and even staying with friends or family. These alternatives can cater to a wide range of preferences, from budget-conscious travelers seeking unique local experiences to business professionals requiring extended stays with home-like amenities.

In 2024, the short-term rental market, dominated by platforms like Airbnb, continued to grow, offering a compelling alternative for many travelers. For instance, Airbnb reported over 1.5 billion guest arrivals globally by the end of 2023, indicating a substantial portion of the travel market is considering or actively using these substitutes over traditional hotels.

Ready-to-Eat Meals and Food Delivery Services

The growing availability of ready-to-eat meals and the explosive growth of food delivery services present a significant threat of substitution for Fuller's pubs. Consumers can now easily access a wide variety of restaurant-quality meals at home, often with just a few clicks. This convenience directly competes with the traditional pub dining experience.

For instance, the UK food delivery market saw substantial expansion, with platforms like Deliveroo and Uber Eats reporting significant order volume increases, particularly in urban areas where Fuller's often operates. In 2024, it's estimated that over 70% of UK consumers have used a food delivery service at least once. This trend means that a casual meal at a pub is now easily replaced by ordering in.

- Convenience Factor: Ready-to-eat meals and delivery services offer unparalleled convenience, saving consumers time and effort compared to visiting a pub.

- Variety and Customization: Online platforms provide access to a vast array of cuisines and the ability to customize orders, often exceeding the typical pub menu.

- Cost Perception: While not always cheaper, the perceived value and the ability to control spending by ordering specific items can make substitutes attractive.

- Changing Consumer Habits: Post-pandemic, there's a continued shift towards home dining, with many consumers now accustomed to the ease of delivered meals.

Low Switching Costs for Substitutes

The threat of substitutes for Fuller Smith & Turner is amplified by low switching costs. Customers can readily shift to alternative leisure activities, dining options, or accommodation providers without facing significant hurdles or financial penalties. This ease of substitution means Fuller's must consistently deliver a superior and distinctive customer experience to retain its market share.

For instance, a consumer looking for a pub meal can easily choose a casual dining restaurant, a takeaway service, or even prepare a meal at home. Similarly, for accommodation, hotels, bed and breakfasts, and short-term rental platforms present readily available alternatives. This lack of customer loyalty to a specific type of establishment, driven by low switching costs, puts pressure on Fuller's to innovate and differentiate.

- Low Switching Costs: Customers can easily switch between pubs, restaurants, cafes, and home dining without incurring substantial costs or effort.

- Alternative Leisure Activities: Options like cinemas, bowling alleys, or simply staying home with streaming services compete for discretionary spending.

- Accommodation Alternatives: Hotels, guesthouses, and short-term rentals offer substitutes for traditional pub accommodation or dining experiences.

- Price Sensitivity: The ease of switching often correlates with price sensitivity, making it crucial for Fuller's to remain competitive.

The threat of substitutes for Fuller Smith & Turner is substantial, with consumers readily opting for at-home dining and entertainment, or alternative leisure activities. This is driven by convenience, cost-effectiveness, and increasing variety in substitute offerings. The ease with which customers can switch to these alternatives, due to low switching costs, forces Fuller's to continually enhance its value proposition.

In 2024, the continued strength of the food delivery market, with over 70% of UK consumers using these services, directly challenges traditional pub dining. Similarly, the robust growth in home entertainment subscriptions means less discretionary spending is allocated to out-of-home experiences. For accommodation, the expanding short-term rental market, with platforms like Airbnb reporting over 1.5 billion global guest arrivals by the end of 2023, presents a significant alternative to hotel stays.

| Substitute Category | Key Offerings | Impact on Fuller's | 2024 Data/Trend |

|---|---|---|---|

| At-Home Dining | Food delivery services, meal kits, home cooking | Reduced pub food and drink sales | UK food delivery market expansion; >70% UK consumers use delivery services. |

| Home Entertainment | Streaming services, gaming, digital content | Decreased demand for pub socialising and drinks | Global home entertainment market in hundreds of billions of dollars. |

| Alternative Leisure | Cinemas, live events, other social venues | Diversion of discretionary spending | UK cinema box office revenue over £1 billion in 2023. |

| Alternative Accommodation | Airbnb, guesthouses, serviced apartments | Reduced hotel occupancy and revenue | Airbnb reported >1.5 billion global guest arrivals by end of 2023. |

Entrants Threaten

The threat of new entrants in the premium pub and hotel sector is significantly dampened by high capital requirements. Establishing a presence, especially in the premium segment Fuller Smith & Turner (Fuller's) operates within, demands considerable financial outlay for property acquisition or leasing, extensive refurbishment, and the establishment of robust operational infrastructure. For instance, acquiring a prime freehold pub in a desirable urban location can easily run into millions of pounds, a substantial hurdle for aspiring competitors.

Fuller's own portfolio, largely comprised of freehold properties, underscores this barrier to entry. This ownership model means new entrants must not only secure funding for initial setup but also for property ownership, a far more capital-intensive approach than leasing. This high upfront investment acts as a formidable deterrent, limiting the pool of potential new competitors capable of entering the market at a scale that could meaningfully challenge established players like Fuller's.

Fuller Smith & Turner, often known as Fuller's, has cultivated a powerful brand identity and a deeply loyal customer base over its long history. This strong recognition, built through consistent quality and customer experience, makes it difficult for new entrants to gain traction. For example, in 2024, Fuller's continued to operate a significant number of pubs, each contributing to its brand visibility and customer connection.

Licensing and regulatory hurdles present a significant barrier to entry in the UK hospitality sector for new businesses like Fuller Smith & Turner. Navigating the intricate web of licensing, health, safety, and planning regulations requires substantial time and financial investment. For instance, obtaining a Personal Licence to sell alcohol can involve fees and training, adding to the initial startup costs.

Access to Distribution Channels and Prime Locations

Newcomers face significant hurdles in securing prime locations for pubs and hotels. The availability of desirable urban or scenic spots is inherently limited, driving up property acquisition and rental costs considerably. This scarcity makes it difficult for new entrants to establish a strong physical presence comparable to established players.

Fuller Smith & Turner, often referred to as Fuller's, benefits from a substantial and well-maintained portfolio of properties situated in highly sought-after locations. This existing estate, a result of long-term investment, acts as a formidable barrier to entry. New competitors would struggle to replicate Fuller's strategic advantage in site selection and property development.

- Limited Availability: Prime real estate in popular tourist destinations and city centers is scarce.

- High Property Costs: Acquiring or leasing prime locations can involve substantial upfront investment. In 2024, commercial property prices in key urban areas continued to reflect this demand.

- Established Estate: Fuller's extensive network of pubs and hotels in prime spots provides a competitive edge.

- Barriers to Entry: The cost and difficulty of securing comparable locations deter new entrants.

Economies of Scale and Experience Curve

Existing large pub and hotel groups, such as Fuller Smith & Turner, leverage significant economies of scale. This allows them to achieve lower per-unit costs in purchasing, marketing, and overall operations compared to smaller or newer competitors.

New entrants face a considerable hurdle in matching these cost advantages. Without the established volume of operations, they would likely find it difficult to compete on price or maintain similar profit margins, thereby limiting the threat of new entrants.

Fuller's, for instance, benefits from bulk purchasing power for ingredients, beverages, and supplies, which directly impacts their cost of goods sold. Their extensive marketing reach also spreads fixed advertising costs over a larger revenue base.

- Economies of Scale: Fuller's benefits from bulk purchasing, reducing input costs.

- Marketing Reach: Wider brand recognition spreads marketing expenses.

- Operational Efficiency: Established processes lead to lower overheads.

- Experience Curve: Years of operation have refined processes, further reducing costs.

The threat of new entrants for Fuller Smith & Turner is considerably low due to substantial barriers. High capital investment for property acquisition and refurbishment, particularly in prime locations, presents a significant financial hurdle. For example, securing a freehold pub in a desirable area can cost millions, a cost many new ventures cannot absorb.

Furthermore, Fuller's established brand loyalty and reputation, built over decades, make it challenging for newcomers to attract customers. Navigating complex licensing and regulatory requirements also demands significant time and resources, adding to the initial cost and complexity for potential competitors entering the UK hospitality market.

Economies of scale enjoyed by Fuller's, through bulk purchasing and efficient operations, create a cost advantage that new entrants would struggle to match, further diminishing the threat.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High cost of property acquisition/leasing and refurbishment | Significant financial barrier, limiting the number of potential entrants |

| Brand Loyalty | Established customer base and reputation | New entrants struggle to gain market share and customer trust |

| Licensing & Regulations | Complex and costly compliance procedures | Increases startup time and costs, deterring new businesses |

| Economies of Scale | Lower per-unit costs due to large-scale operations | New entrants face higher operational costs, making price competition difficult |

Porter's Five Forces Analysis Data Sources

Our Fuller Smith & Turner Porter's Five Forces analysis is built upon a foundation of comprehensive data, including company annual reports, industry-specific market research from firms like Mintel and Statista, and relevant trade publications. We also incorporate publicly available financial statements and news releases from competitors to provide a robust understanding of the competitive landscape.