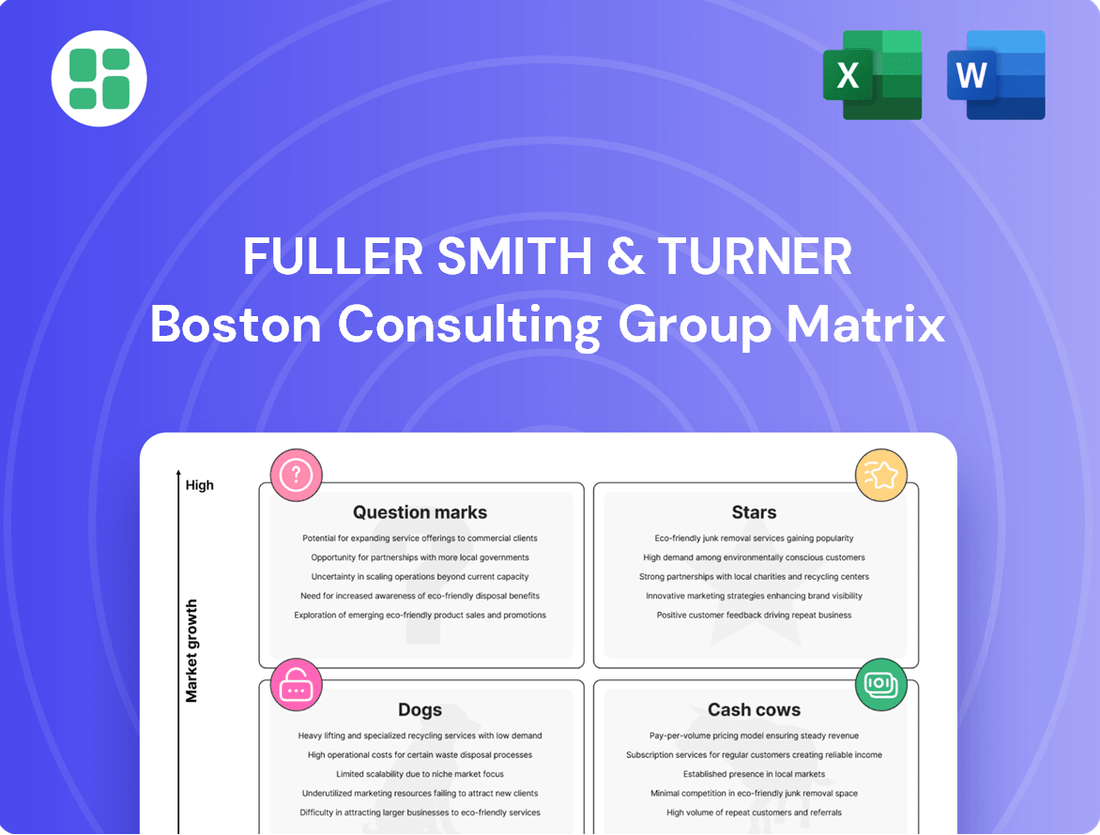

Fuller Smith & Turner Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuller Smith & Turner Bundle

Unlock the strategic potential of Fuller Smith & Turner's product portfolio with our comprehensive BCG Matrix analysis. See precisely where their brands sit as Stars, Cash Cows, Dogs, or Question Marks, and understand the market dynamics at play.

This glimpse is just the beginning. Purchase the full BCG Matrix report to gain detailed quadrant placements, actionable insights, and a clear roadmap for optimizing investment and future growth. Don't miss out on the complete picture.

Stars

Fuller's premium managed pubs situated in affluent and expanding urban or suburban areas are key performers. These locations are seeing robust like-for-like sales growth, contributing to the Managed Pubs and Hotels division's 5.2% revenue increase in FY2025, which outpaced the broader market.

Significant investment, including £28 million in transformational projects during FY2025, underpins the strong market position and future growth prospects of these establishments. They are considered leaders within their respective markets and are well-positioned to generate substantial cash flow if their current growth trajectory continues.

Fuller's hotel portfolio, particularly the Cotswold Inns & Hotels, is a standout performer with significant growth prospects. Accommodation like-for-like sales saw a healthy 5.4% increase in FY2025, reflecting strong demand in these prime locations.

These establishments benefit from their presence in sought-after tourist and leisure spots, allowing them to command a substantial market share within their specific segments. The strategic reopening of The Chamberlain in London, following substantial investment, underscores Fuller's commitment to enhancing its premium accommodation offerings.

Fuller's recent acquisitions, including the Lovely Pubs collection (August 2024) and The White Swan in Twickenham (March 2025), are strategically positioned as Stars in its BCG Matrix. These pubs are situated in affluent commuter belts, a key indicator of their high growth potential and ability to capture significant market share quickly.

Premium Food & Drink Offerings

Fuller's premium food and drink offerings are clearly a Star in their BCG Matrix. They're focusing on delicious, fresh, and seasonal food, paired with an exciting drink selection, which is resonating well with customers.

This strategy is backed by solid financial performance. In the fiscal year 2025, Fuller's saw food like-for-like sales increase by 4.8%, and drink sales grew by 5.3%. These figures highlight a strong consumer appetite for their high-quality pub experiences.

The potential for growth in this segment is significant. As consumers increasingly prioritize quality dining and drinking experiences, especially in a premium pub environment, Fuller's is well-positioned to capture more market share. Continuous innovation in their menus and beverage choices will be key to maintaining this momentum.

- Strong Sales Growth: Food like-for-like sales up 4.8% and drink sales up 5.3% in FY2025.

- Consumer Demand: Demonstrates high consumer interest in premium food and drink.

- High Growth Potential: Reflects the market trend towards quality experiences.

- Strategic Focus: Emphasizes fresh, seasonal food and diverse beverage options.

Refurbished and Transformed Flagship Sites

Refurbished and transformed flagship sites represent Fuller Smith & Turner's Stars in the BCG Matrix. Major projects like The Drayton Court in Ealing and The Head of the River in Oxford, which was converted into a fully electric hotel, exemplify this strategic focus.

These significant investments, including a portion of the £28 million allocated for FY2025, are designed to breathe new life into prime properties. The goal is to draw in a wider customer base and expand market share in highly competitive areas.

The improved customer experience and upgraded facilities at these sites consistently lead to substantial sales increases. For instance, The Head of the River saw a significant uplift in revenue post-refurbishment. These revitalized locations are strategically positioned to secure dominant market positions through their enhanced offerings.

- Strategic Investment: £28 million allocated in FY2025 for key property enhancements.

- Flagship Examples: The Drayton Court (Ealing) and The Head of the River (Oxford).

- Key Feature: The Head of the River transformed into a fully electric hotel.

- Outcome: Drive new customer acquisition and market share growth.

Fuller's premium managed pubs, particularly those in affluent and growing urban or suburban areas, are classified as Stars. These pubs are experiencing robust like-for-like sales growth, with the Managed Pubs and Hotels division seeing a 5.2% revenue increase in FY2025. Significant investments, totaling £28 million in transformational projects during FY2025, support their strong market positions and future growth potential, making them leaders in their respective markets.

The company's hotel portfolio, especially Cotswold Inns & Hotels, also shines as a Star, with accommodation like-for-like sales up 5.4% in FY2025. These properties benefit from prime tourist and leisure locations, securing substantial market share. The strategic reopening of The Chamberlain in London further emphasizes Fuller's commitment to its premium accommodation segment.

Fuller's premium food and drink offerings are another key Star. The focus on fresh, seasonal food and an exciting drink selection is driving strong consumer demand, evidenced by a 4.8% increase in food like-for-like sales and a 5.3% rise in drink sales in FY2025. This segment holds significant growth potential as consumers increasingly value quality experiences.

Refurbished flagship sites, such as The Drayton Court and The Head of the River, are also Stars. Investments in these properties aim to attract a broader customer base and expand market share, leading to substantial sales increases post-refurbishment.

| Category | Key Performance Indicators (FY2025) | Strategic Rationale |

| Premium Managed Pubs | 5.2% revenue increase (Managed Pubs & Hotels division) | Located in affluent, growing areas; strong market leadership. |

| Hotel Portfolio (Cotswold Inns & Hotels) | 5.4% like-for-like sales growth (Accommodation) | Prime tourist/leisure locations; high market share. |

| Premium Food & Drink | 4.8% food sales growth; 5.3% drink sales growth | High consumer demand for quality; significant growth potential. |

| Refurbished Flagship Sites | Post-refurbishment revenue uplift | Strategic investment to drive new customers and market share. |

What is included in the product

Highlights which units to invest in, hold, or divest for Fuller Smith & Turner's portfolio.

The Fuller Smith & Turner BCG Matrix provides a clear, one-page overview of each business unit's market position and growth potential, alleviating the pain of complex strategic analysis.

Cash Cows

Fuller's established freehold pub estate, primarily situated in Southern England, functions as a significant Cash Cow for the company. This mature portfolio of iconic pubs and hotels consistently delivers substantial and reliable cash flow.

The strength of these assets lies in their strong brand equity, dedicated customer following, and advantageous locations, which translate into high profit margins with minimal need for extensive marketing spend. For instance, in the fiscal year ending March 2024, Fuller's reported a robust performance from its pub businesses, contributing significantly to overall revenue and profitability, demonstrating the enduring value of this established estate.

Fuller's core traditional pub operations are firmly positioned as Cash Cows within the BCG Matrix. These establishments consistently deliver high-quality service and a welcoming atmosphere, a formula that resonates with a loyal customer base. Their strength lies in a significant market share within established, mature local markets, ensuring a predictable and steady revenue stream.

These pubs benefit from repeat business, a testament to their enduring appeal and operational efficiency. The focus here is on maintaining existing customer relationships and operational excellence rather than aggressive expansion. For example, in 2024, Fuller's reported that its pub businesses continued to be a significant contributor to overall revenue, with a strong emphasis on food and drink sales driving consistent cash flow.

Fuller Smith & Turner's high-margin standard beverage sales are a clear Cash Cow within their BCG Matrix. These are the reliable sellers, like their own bottled ales and popular soft drinks, that consistently bring in steady profits. Their margins are healthy because the company has efficient ways of getting these drinks and people always want them.

In 2024, the UK pub market saw continued resilience in beverage sales, with standard offerings forming the bedrock of revenue. Fuller's, known for its own brewed ales, benefits from strong brand loyalty and established distribution. These products, requiring minimal marketing spend, generate substantial and predictable cash flows, allowing the company to reinvest in other areas of its business.

Efficient Tenanted Inn Business

Fuller's tenanted inns, numbering 153 after divesting 37 non-core locations in July 2024, now operate as a prime Cash Cow. This strategic move has bolstered profitability and sustainability across the remaining estate.

The optimized portfolio benefits from increased average EBITDA per site, translating into more predictable income streams and reduced operational burdens for Fuller's. This segment's inherent low growth, combined with enhanced operational efficiency, solidifies its role as a consistent contributor to the company's overall cash generation.

- Portfolio Optimization: 37 non-core tenanted pubs were strategically sold in July 2024.

- Enhanced Profitability: Remaining 153 tenanted inns show increased average EBITDA per site.

- Consistent Cash Flow: The segment reliably contributes to Fuller's cash flow due to improved efficiency and low growth.

- Reduced Overhead: Lower operational overheads further bolster the segment's cash-generating capability.

Centralized Operational Efficiencies

Fuller's centralized operational efficiencies, particularly its supply chain optimization and cost control across its extensive estate, firmly position it as a Cash Cow within the BCG Matrix. By meticulously managing procurement, staffing, and maintenance, Fuller consistently achieves high profit margins from its widespread operations. This operational strength is key to converting revenue into enhanced profitability, generating substantial cash flow that exceeds its investment needs.

The company’s focus remains on refining and sustaining these efficiencies rather than pursuing rapid market expansion. For example, in the fiscal year ending March 2024, Fuller reported a 6.5% increase in revenue to £812.7 million, with operating profit rising by 10.2% to £93.1 million, showcasing its ability to drive profitability through operational excellence.

- Continued investment in technology for supply chain visibility and automation.

- Aggressive negotiation with suppliers to maintain favorable procurement costs.

- Standardization of operational procedures across all pubs and hotels to minimize waste and maximize resource utilization.

- Focus on staff training and retention to improve service efficiency and reduce labor costs.

Fuller's tenanted inns, following a strategic divestment of 37 non-core locations in July 2024, now represent a core Cash Cow. This streamlined portfolio of 153 inns benefits from increased average EBITDA per site, offering predictable income streams with reduced operational complexity for Fuller's.

The segment's inherent low market growth, coupled with enhanced operational efficiencies and a focus on partner support, solidifies its role as a consistent and reliable contributor to the company's overall cash generation. This strategic optimization enhances the segment's profitability and sustainability.

| Segment | BCG Classification | Key Characteristics | 2024 Financial Insight |

|---|---|---|---|

| Tenanted Inns | Cash Cow | 153 remaining inns, increased average EBITDA per site, predictable income, reduced operational burden. | Divested 37 non-core pubs in July 2024, focusing on profitable partnerships. |

Delivered as Shown

Fuller Smith & Turner BCG Matrix

The Fuller Smith & Turner BCG Matrix preview you see is the definitive version you will receive upon purchase, offering a complete and unwatermarked strategic analysis. This document has been meticulously prepared to provide immediate actionable insights, reflecting the exact same professional formatting and detailed content that will be delivered to you. You can confidently expect to download this fully realized BCG Matrix report, ready for integration into your business planning and decision-making processes without any further modifications. This is your direct access to a comprehensive tool designed to illuminate Fuller Smith & Turner's brand portfolio and guide strategic resource allocation.

Dogs

The divestiture of 37 non-core tenanted pubs by Fuller Smith & Turner to Admiral Taverns in July 2024 exemplifies the strategic removal of Dogs from its BCG Matrix. These pubs likely represented assets with low growth potential and a small market share within Fuller's portfolio.

This sale aligns with Fuller's focus on its premium managed pubs, indicating these tenanted properties were not contributing significantly to overall profitability or strategic objectives. The transaction, valued at an undisclosed sum, allowed Fuller's to streamline operations and reinvest capital into higher-potential areas of its business.

The Mad Hatter hotel, sold by Fuller Smith & Turner in July 2024 for £20 million, fits the profile of a Dog in the BCG matrix. This classification suggests it held a low market share within its segment and was likely not contributing significantly to the company's growth or profitability.

While the precise reasons for its underperformance are not publicly detailed, the decision to divest indicates it was a drain on resources, tying up capital without generating adequate returns.

The sale of the Mad Hatter hotel allowed Fuller's to free up capital, which could then be strategically reinvested in higher-potential assets or growth areas within their portfolio, a common move for managing underperforming "Dog" assets.

Individual underperforming pub units within Fuller's extensive estate are those consistently showing poor performance metrics. These pubs often struggle with low customer traffic, falling revenues, and a lack of profitability. For instance, in the first half of fiscal year 2024, Fuller's reported that a small number of its pubs were significantly impacting overall profitability, necessitating a review of these specific locations.

Outdated Pub Concepts

Outdated pub concepts within Fuller's estate, such as those with tired decor or a lack of modern amenities, can be categorized as Dogs in the BCG Matrix. These pubs may be in mature locations but struggle to attract younger demographics or those seeking contemporary experiences, resulting in low market share and minimal growth. For instance, a traditional pub that hasn't updated its seating or food offering might see declining footfall even in a stable neighborhood.

These underperforming outlets often require substantial capital for refurbishment to meet current consumer expectations, making revitalization challenging. Fuller's emphasis on strategic investment in 'transformational schemes' aims to address these issues proactively, preventing pubs from becoming financial burdens. The company's approach suggests a focus on modernizing the estate to ensure continued relevance and profitability.

- Low Market Share: Traditional pubs with dated interiors or limited menu options often fail to capture a significant portion of the local market, especially when competing with newer, more dynamic establishments.

- Low Growth Prospects: Without significant investment or a change in concept, these pubs are unlikely to see an increase in customer numbers or revenue, remaining stagnant in a dynamic hospitality sector.

- Need for High Investment: Revitalizing an outdated pub concept typically demands substantial capital for renovations, menu development, and marketing to attract a new customer base.

- Potential Divestment or Transformation: Fuller's strategy likely involves either divesting these underperforming assets or undertaking major 'transformational schemes' to reposition them for future success.

Low-Demand Niche Food/Drink Items

Fuller Smith & Turner, like many hospitality businesses, faces the challenge of low-demand niche food and drink items on its menus. These are offerings that consistently show very low sales volumes across its estate. For instance, a specific craft beer with limited appeal or an obscure regional delicacy might fall into this category. In 2024, restaurants and pubs often find that such items, while perhaps catering to a very small customer segment, tie up valuable menu space and incur inventory holding costs without generating meaningful revenue. This directly impacts profitability, as these items represent a low market share within their respective categories and contribute negligibly to overall growth.

Menu optimization is therefore a crucial strategy for Fuller Smith & Turner to avoid these "cash traps." By analyzing sales data, the company can identify items that are not resonating with the majority of customers. For example, if a particular wine varietal, despite its premium positioning, accounts for less than 0.5% of total beverage sales in 2024, it might be a candidate for removal. Such items can dilute the focus on more popular and profitable offerings, hindering the company's ability to maximize returns from its core menu.

- Low Sales Volume: Items with less than 1% of total sales contribution are often flagged for review.

- Inventory Costs: Holding stock for slow-moving niche items can increase waste and reduce cash flow.

- Menu Space: Limited menu real estate is better utilized by high-performing products.

- Profitability Impact: Negligible revenue generation from these items can drag down overall profit margins.

Dogs in Fuller Smith & Turner's BCG Matrix are typically pubs or menu items that exhibit low market share and low growth potential. The divestiture of 37 non-core tenanted pubs to Admiral Taverns in July 2024 directly addresses this, removing underperforming assets from the portfolio. Similarly, the sale of the Mad Hatter hotel for £20 million in July 2024 signifies the strategic removal of an asset that was likely a Dog, tying up capital without generating sufficient returns.

These underperforming units, whether entire pubs or specific menu items, are characterized by consistently poor sales metrics and a failure to capture significant customer interest. For instance, menu items with less than 1% of total sales contribution, like obscure craft beers or niche food items, represent inventory costs and wasted menu space. Fuller's strategy involves either divesting these "cash traps" or undertaking substantial "transformational schemes" to revitalize them, thereby improving overall portfolio performance.

Question Marks

The seven Lovely Pubs acquired by Fuller Smith & Turner in August 2024 are currently positioned as Question Marks in the BCG Matrix. While strategically located in affluent areas and demonstrating high growth potential, their integration into Fuller's operational framework and the effort to establish a significant market share in their respective villages are still in progress.

These newly acquired establishments, despite their promising locations and inherent quality, currently possess a relatively low market share under the Fuller's brand within these new micro-markets. This indicates a need for substantial investment and targeted marketing strategies to effectively transition them into the 'Stars' category.

The White Swan in Twickenham, acquired in March 2025, is positioned as a Question Mark within Fuller Smith & Turner's portfolio. This riverside property offers significant growth potential, enhancing the company's footprint in southwest London's competitive pub market.

Despite the promising location and its type, the White Swan's market share under Fuller's ownership is currently minimal due to its recent acquisition. Its progression to a Star depends heavily on successful integration, strategic investment in its development, and robust operational management to unlock its full potential.

Fuller's strategic initiatives to expand its premium pub and hotel model into new UK micro-markets, where its brand presence is currently limited, would place these ventures in the Question Marks category of the BCG Matrix. These markets often present high growth potential for the hospitality sector, but Fuller's would likely begin with a low market share.

Such expansion requires significant upfront investment in market entry, brand building, and customer acquisition. For instance, entering a new town might involve acquiring and refurbishing a property, marketing campaigns, and hiring local staff. These initial outlays can strain cash flow.

The success of these new ventures hinges on their ability to gain traction and market share. If they capture significant customer interest and achieve profitability, they could transition into Stars. However, if they fail to gain momentum and continue to consume cash without substantial returns, they risk remaining cash consumers, potentially leading to divestment.

New Digital & Customer Engagement Platforms

Fuller Smith & Turner's investments in new digital platforms, such as advanced booking systems and loyalty programs, are positioned as question marks within their BCG matrix. These initiatives are designed to boost customer engagement and unlock future revenue streams.

While the broader digital hospitality sector is expanding, Fuller's may still be in the early stages of establishing its presence and market share within this technology-focused segment. The company's 2024 performance indicators for digital adoption will be crucial in assessing their progress.

These ventures require significant capital expenditure for development and marketing, with their ultimate success hinging on broad customer uptake and effective differentiation from competitors.

- Investment Focus: Enhancing customer engagement through digital tools.

- Market Position: Potentially building share in a growing but competitive digital hospitality market.

- Financial Implication: Cash consumption for development, with uncertain but potentially high future returns.

- Future Outlook: Success depends on customer adoption and competitive edge to move towards Star status.

Innovative Sustainability-Driven Hotel Concepts

Fuller's investment in transformational schemes, such as The Head of the River in Oxford transitioning to a fully electric hotel, exemplifies an innovative sustainability-driven concept that aligns with a Question Mark in the BCG Matrix. This initiative taps into the burgeoning eco-friendly hospitality market, a sector experiencing significant growth, yet the specific 'fully electric hotel' model within Fuller's portfolio is still nascent.

While the market for sustainable tourism is expanding, with projections indicating continued robust growth through 2024 and beyond, the market share for hotels operating exclusively on electric power is likely modest at this stage. This presents a high-growth potential opportunity, attracting a segment of environmentally conscious travelers, but it also necessitates substantial capital investment and relies on broader market acceptance to transition from a Question Mark to a Star performer.

- High Growth Potential: The increasing consumer demand for sustainable travel options fuels the growth prospects for concepts like fully electric hotels.

- Low Market Share: As a relatively new concept within Fuller's portfolio and the broader industry, its current market penetration is likely limited.

- Capital Intensive: Achieving a fully electric operational model requires significant upfront investment in infrastructure and technology.

- Market Adoption Risk: Success hinges on widespread consumer adoption and the development of supporting infrastructure, such as reliable renewable energy sources and charging capabilities.

New pub acquisitions, like the seven pubs added in August 2024, are typically classified as Question Marks. These pubs, while in high-growth areas, are still building their market share under the Fuller's brand, requiring significant investment to become Stars.

Similarly, innovative ventures such as the fully electric hotel concept at The Head of the River in Oxford represent Question Marks. These initiatives tap into growing markets, such as sustainable tourism, but currently hold low market share and demand substantial capital to prove their viability.

Fuller's digital platform enhancements, including new booking systems, also fall into the Question Mark category. While the digital hospitality sector is expanding, Fuller's is investing to build its presence and market share, with 2024 adoption rates being key indicators of future success.

These Question Mark ventures are characterized by high growth potential but low current market share, necessitating significant investment. Their future success hinges on gaining traction and market share to transition into Stars, or they risk becoming cash drains.

| Category | Description | Strategic Implication | Example (Fuller's) | Financial Need |

|---|---|---|---|---|

| Question Marks | Low market share, high market growth | Invest to gain market share or divest | New pub acquisitions, Digital platforms | High investment required |

| Stars | High market share, high market growth | Invest to maintain leadership | Established premium pubs in prime locations | Investment to support growth |

| Cash Cows | High market share, low market growth | Milk for cash | Mature, well-established pubs with loyal customer base | Minimal investment needed |

| Dogs | Low market share, low market growth | Divest or harvest | Underperforming pubs in declining markets | Low investment, potential divestment |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.