Fuchs Petrolub SE SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuchs Petrolub SE Bundle

Fuchs Petrolub SE, a global leader in lubricants, boasts significant strengths in its diversified product portfolio and strong customer relationships, yet faces challenges from fluctuating raw material prices and intense market competition. Understanding these dynamics is crucial for navigating the evolving lubricants industry.

Want the full story behind Fuchs Petrolub's market positioning, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Fuchs Petrolub SE is the undisputed global leader among independent lubricant manufacturers, commanding a substantial market share in its specialized sector. This premier position is a direct result of its unwavering focus on lubricants, fostering a level of expertise and customer intimacy that often surpasses that of broader oil conglomerates.

Fuchs Petrolub SE exhibits robust research and development capabilities, consistently investing in the creation of advanced lubricants and specialized solutions. This focus is particularly evident in their work on high-performance products for the burgeoning electric vehicle market, addressing critical needs like noise dampening and efficient thermal management.

Fuchs Petrolub SE's strength lies in its remarkably diversified portfolio, serving over 100,000 customers across a vast array of industrial sectors. This broad customer base spans critical industries such as automotive, mechanical engineering, mining, and aerospace, insulating the company from downturns in any single market.

Its extensive global footprint, with operations across EMEA, Asia-Pacific, and the Americas, is a significant advantage. This geographical diversification not only allows for broad market penetration but also provides crucial resilience against regional economic volatility, ensuring more stable performance.

Strategic Localized Production

Fuchs Petrolub's FUCHS2025 strategy heavily features localized production, bringing manufacturing closer to its core customer bases. This isn't just about efficiency; it's a direct response to the volatility seen in global supply chains. By decentralizing production, Fuchs aims to buffer itself against disruptions, which have been a significant concern for many industries in recent years.

This localized approach also offers a natural hedge against currency fluctuations. When manufacturing and sales occur within the same regional economic sphere, the impact of exchange rate volatility on profits is considerably lessened. This provides a more stable financial outlook, especially in diverse international markets.

Furthermore, having production facilities situated near key markets allows Fuchs Petrolub to be far more responsive to regional market demands and specific customer needs. This agility is crucial for maintaining a competitive edge, enabling quicker product development and delivery cycles tailored to local preferences. For instance, in 2024, the company continued to invest in expanding its production capabilities in high-growth regions, aiming to capture market share more effectively.

- Reduced Supply Chain Risk: Localized production minimizes reliance on long-distance logistics, a key lesson from recent global disruptions.

- Currency Hedging: Operating and selling within the same currency zones naturally mitigates foreign exchange rate risks.

- Market Responsiveness: Proximity to customers enables faster adaptation to regional demand shifts and product customization.

- Operational Resilience: A distributed manufacturing footprint enhances the company's ability to withstand localized operational challenges.

Robust Financial Health and Shareholder Returns

Fuchs Petrolub SE showcases impressive financial resilience, consistently delivering strong profitability and high returns on capital, even when the broader economy faces headwinds. This financial strength is a key advantage.

The company's robust free cash flow generation provides a solid foundation for its operations and strategic investments. This consistent cash generation is a testament to its efficient business model.

Fuchs Petrolub SE maintains a clear commitment to rewarding its shareholders. Notably, the company announced its 23rd consecutive dividend increase for 2024, signaling its financial stability and a shareholder-centric approach.

- Consistent Profitability: Achieved high returns on capital throughout various economic cycles.

- Strong Free Cash Flow: Demonstrates reliable cash generation capabilities.

- Shareholder Returns: Announced its 23rd consecutive dividend increase for 2024, highlighting financial stability and shareholder focus.

Fuchs Petrolub SE's leadership in the independent lubricants market is a significant strength, underpinned by its dedicated focus and deep expertise. This specialization allows for a superior understanding of customer needs and market dynamics, setting it apart from more diversified competitors.

The company's commitment to research and development is a key differentiator, particularly in emerging areas like lubricants for electric vehicles. By investing in advanced solutions for thermal management and noise reduction, Fuchs is proactively addressing future market demands.

Fuchs Petrolub SE's broad customer base, exceeding 100,000 clients across diverse industries such as automotive, mining, and aerospace, provides substantial market insulation. This diversification across sectors mitigates risks associated with downturns in any single industry.

Its expansive global presence, spanning EMEA, Asia-Pacific, and the Americas, ensures broad market reach and resilience against regional economic fluctuations. This geographical spread contributes to more stable overall performance.

The FUCHS2025 strategy emphasizes localized production, enhancing supply chain resilience and responsiveness to regional market needs. This approach also naturally hedges against currency volatility.

Fuchs Petrolub SE demonstrates strong financial performance, characterized by consistent profitability and high returns on capital, even during challenging economic periods. This financial stability is a cornerstone of its operational strength.

Robust free cash flow generation supports ongoing operations and strategic investments, reflecting an efficient and well-managed business model. The company's commitment to shareholder returns is evident in its consistent dividend growth, with a 23rd consecutive increase announced for 2024.

| Strength | Description | Supporting Data |

|---|---|---|

| Market Leadership | Global leader in independent lubricants. | Substantial market share in specialized sector. |

| R&D Focus | Investment in advanced lubricants. | Development of EV-specific lubricants for thermal management and noise reduction. |

| Diversified Portfolio | Serves over 100,000 customers. | Presence in automotive, mechanical engineering, mining, aerospace. |

| Global Footprint | Operations across EMEA, Asia-Pacific, Americas. | Resilience against regional economic volatility. |

| Localized Production | Strategy for supply chain resilience and market responsiveness. | Reduces reliance on long-distance logistics; hedges currency risk. |

| Financial Resilience | Consistent profitability and high returns. | 23rd consecutive dividend increase announced for 2024. |

What is included in the product

Analyzes Fuchs Petrolub SE’s competitive position through key internal and external factors, detailing its strengths in product innovation and global reach, alongside weaknesses in supply chain reliance and opportunities in emerging markets and sustainability trends, while acknowledging threats from intense competition and fluctuating raw material prices.

Offers a clear visual representation of Fuchs Petrolub SE's strategic landscape, simplifying complex market dynamics for focused decision-making.

Weaknesses

Fuchs Petrolub SE's financial health is closely tied to the broader global economy. When industrial production slows down in crucial areas, particularly in Europe, and demand from key customer industries weakens, the company's performance can suffer. This sensitivity to macroeconomic trends is a significant vulnerability.

The impact of these global economic headwinds is already evident. For 2025, Fuchs Petrolub has had to adjust its sales and earnings before interest and taxes (EBIT) outlooks downwards. This revision underscores a cautious approach, acknowledging the prevailing economic uncertainties and their potential to dampen business activity.

Fuchs Petrolub's significant reliance on the automotive sector, which accounts for nearly half of its sales, positions it as a key player vulnerable to the ongoing shift away from internal combustion engines. The accelerating adoption of electric vehicles (EVs) presents a structural challenge, as EVs generally require fewer and different types of lubricants compared to traditional vehicles.

This transition directly impacts a substantial portion of Fuchs's established revenue streams. While the company is actively investing in and developing solutions for e-mobility, the inherent nature of EV powertrains means a potential long-term reduction in lubricant demand for this segment.

Fuchs Petrolub SE has been grappling with rising costs, notably a 6% increase in personnel expenses in 2023, which has put pressure on its earnings before interest and taxes (EBIT) margin. Digitalization efforts, while strategic, also contribute to these increased operational expenditures.

Furthermore, shifts in product mix have negatively impacted profitability. For instance, in North America, while sales saw growth, a less favorable product mix contributed to a decline in the EBIT margin for that region during the reporting periods of 2023 and early 2024.

Sensitivity to Raw Material Price Volatility

The lubricant industry, including Fuchs Petrolub SE, faces significant headwinds from the unpredictable nature of commodity prices. This general economic uncertainty directly impacts the cost of acquiring essential raw materials, primarily base oils and additives. Even minor shifts in these prices can have a noticeable effect on the company's overall cost structure and, consequently, its profit margins. For instance, a 10% increase in base oil prices, a common occurrence, could significantly squeeze profitability if not effectively managed through pricing strategies or hedging.

- Raw Material Dependency: Lubricant production relies heavily on base oils, a derivative of crude oil, making Fuchs Petrolub susceptible to oil price fluctuations.

- Margin Squeeze: Volatility in base oil costs, which can swing by significant percentages within a quarter, directly impacts the company's gross margins if these costs cannot be fully passed on to customers.

- Procurement Challenges: Unpredictable commodity markets create difficulties in long-term procurement planning and cost management, potentially leading to higher inventory costs or stock-outs.

- Competitive Pricing: Intense competition in the lubricants market limits the ability to immediately pass on all cost increases to customers, further pressuring margins during periods of rising raw material prices.

Limited Market Share Compared to Oil Majors

While Fuchs Petrolub SE leads as the top independent lubricant manufacturer, its global market share remains modest at approximately 2.5% as of recent reports. This contrasts sharply with the integrated oil majors who benefit from vast, diversified operations and established brand recognition across multiple energy sectors.

This smaller footprint can present challenges:

- Scale Disadvantage: Fuchs may not achieve the same economies of scale in raw material sourcing or production as its larger competitors.

- Competitive Pressure: The dominance of oil majors can exert significant pricing and distribution pressure, potentially impacting Fuchs' ability to gain further market traction.

- Limited Diversification: Unlike integrated players, Fuchs' reliance on lubricants makes it more susceptible to industry-specific downturns or shifts in demand.

- Brand Perception: While strong in its niche, Fuchs may face hurdles in challenging the deeply ingrained brand loyalty associated with major oil brands in certain consumer segments.

Fuchs Petrolub SE's profitability is vulnerable to rising operational costs, including personnel expenses which increased by 6% in 2023. Digitalization initiatives, while strategic, also add to these expenditures. Furthermore, shifts in product mix, such as a less favorable mix in North America, have negatively impacted regional EBIT margins during 2023 and early 2024, demonstrating a challenge in maintaining consistent profitability across diverse markets.

Preview the Actual Deliverable

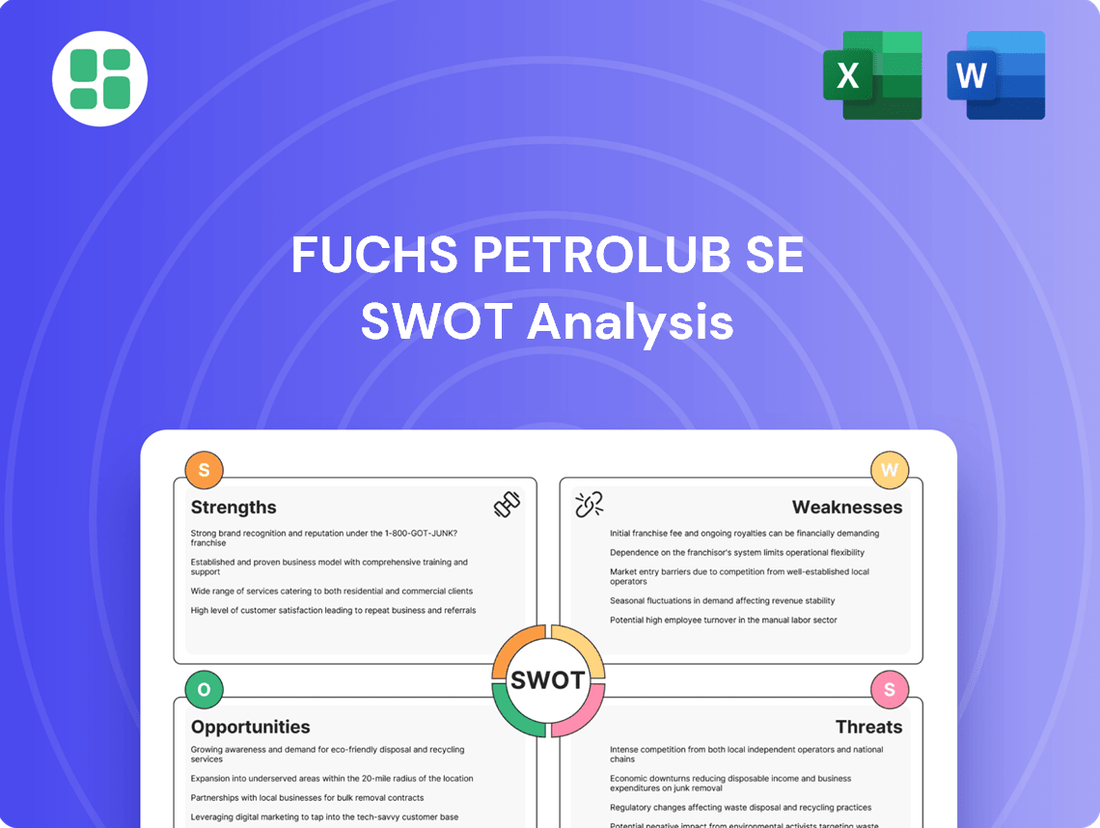

Fuchs Petrolub SE SWOT Analysis

This is the actual Fuchs Petrolub SE SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key strategic considerations for Fuchs Petrolub SE.

Opportunities

The accelerating global shift towards electric vehicles (EVs) presents a substantial opportunity for Fuchs Petrolub. The company can leverage its innovation to develop specialized lubricants and electrolyte solutions crucial for EV powertrains and battery components, tapping into a rapidly expanding, high-value market segment.

Fuchs Petrolub SE has a significant opportunity to expand its market presence in emerging economies. These regions often exhibit robust industrialization and automotive sector growth, presenting a fertile ground for lubricant demand. By strategically increasing its footprint in these markets, Fuchs can offset slower growth rates observed in more established economies, thereby diversifying its revenue streams and enhancing its global market share.

Fuchs Petrolub is actively embracing digitalization to transform its service offerings and explore innovative business models. This strategic shift is geared towards creating high-margin, service-driven revenue streams by developing advanced digital lubrication platforms. These platforms aim to significantly enhance customer connectivity and operational efficiency, marking a key opportunity for growth in the evolving lubrication market.

Strategic Acquisitions and Partnerships

Fuchs Petrolub SE has a strong history of successful strategic acquisitions, including the integration of LUBCON, STRUB, and BOSS during 2024 and early 2025. These moves significantly broadened Fuchs' product range, enhanced its technological capabilities, and provided more direct pathways into key markets. Pursuing similar inorganic growth opportunities will be crucial for solidifying its competitive standing and diversifying its revenue streams.

The company's acquisition strategy has demonstrably paid off, with these recent integrations expected to contribute positively to its market share and profitability in the coming fiscal years. For instance, the acquisition of BOSS in early 2025 is anticipated to add approximately €50 million in annual revenue, further bolstering Fuchs' top-line growth.

Key opportunities stemming from this strategy include:

- Market Consolidation: Acquiring smaller, specialized lubricant manufacturers can lead to greater market share and economies of scale.

- Technology Acquisition: Purchasing companies with advanced additive technologies or sustainable lubricant formulations can accelerate innovation.

- Geographic Expansion: Targeting acquisitions in underpenetrated regions offers a faster route to establishing a strong presence.

- Synergistic Integration: Leveraging acquired companies' distribution networks and customer bases can create significant operational efficiencies.

Increasing Demand for High-Tech Lubricants

The global demand for advanced lubricants is on an upward trajectory, driven by a growing world population and the increasing mechanization across diverse sectors. Fuchs Petrolub SE is strategically positioned to benefit from this trend due to its emphasis on specialized, high-performance lubricant solutions that enhance operational efficiency and sustainability.

This burgeoning market presents significant opportunities for Fuchs, particularly in areas requiring advanced formulations. For instance, the automotive sector's shift towards electric vehicles (EVs) necessitates new types of coolants and specialized greases, a segment Fuchs has actively invested in. In 2024, the global industrial lubricants market was valued at approximately USD 160 billion, with projections indicating continued growth, especially in high-tech segments.

- Growing EV Market: The increasing adoption of electric vehicles creates a demand for new lubricant technologies, such as specialized EV fluids for thermal management and driveline components.

- Industrial Automation: As industries increasingly adopt automation and robotics, the need for high-precision, long-life lubricants that ensure optimal performance and reduced downtime becomes critical.

- Sustainability Focus: The push for environmentally friendly solutions is driving demand for biodegradable and energy-efficient lubricants, aligning with Fuchs's commitment to sustainable product development.

- Aerospace and Defense: These sectors require highly specialized lubricants that can withstand extreme conditions, offering a niche but lucrative market for advanced formulations.

Fuchs Petrolub SE is well-positioned to capitalize on the growing demand for specialized lubricants driven by technological advancements and market trends. The company's strategic focus on innovation, particularly in areas like electric vehicle fluids and sustainable lubrication solutions, presents significant growth avenues. Furthermore, the ongoing trend of market consolidation offers opportunities for Fuchs to expand its reach and capabilities through targeted acquisitions, as evidenced by its successful integrations in 2024 and early 2025.

Threats

Ongoing geopolitical tensions and trade conflicts, particularly those involving the U.S. and major trading partners, present a significant threat to Fuchs Petrolub SE. These disputes can lead to increased tariffs and trade barriers, potentially disrupting supply chains and increasing the cost of raw materials and finished goods. For example, the ongoing trade friction between the U.S. and China, which saw significant tariff escalations in previous years, continues to create an unpredictable global trade landscape.

Such global political dynamics can directly impact demand from key customer segments, especially in industries reliant on international trade and stable economic conditions. Uncertainty stemming from these tensions can cause customers to delay or reduce their purchasing decisions, impacting Fuchs Petrolub's revenue streams. The volatility in global markets, exacerbated by these geopolitical factors, necessitates a cautious approach to forecasting and strategic planning.

Weak industrial production, especially in Europe, presents a significant challenge for Fuchs Petrolub SE. A slowdown in manufacturing directly impacts demand for their lubricants, affecting sales volumes and revenue. For instance, in the first half of 2024, industrial production in the Eurozone saw a contraction, a trend that directly correlates with reduced lubricant consumption.

Fuchs Petrolub SE operates in a highly competitive landscape, particularly against oil majors like Shell, ExxonMobil, and BP. These giants benefit from integrated upstream operations, providing them with cost advantages and significant financial muscle for R&D and market expansion. For instance, in 2023, Shell reported a net profit of $28.4 billion, dwarfing the resources available to independent lubricant specialists.

Beyond the majors, Fuchs also contends with a multitude of other independent lubricant manufacturers, both global and regional. This fragmented market can lead to intense price wars, particularly in commoditized product segments. The constant need to innovate and differentiate is crucial to avoid market share erosion, as evidenced by Fuchs' ongoing investment in specialty lubricants.

Accelerated Decline of Internal Combustion Engine Market

The accelerated decline of the internal combustion engine (ICE) market presents a significant threat to Fuchs Petrolub SE. A substantial portion of their current revenue is still tied to lubricants for traditional vehicles. For instance, in 2023, the automotive sector remained a key market for lubricants, but the pace of electric vehicle (EV) adoption is a growing concern.

A rapid shift away from ICE vehicles could outpace Fuchs's strategic investments in EV-specific lubrication solutions. While the company is actively developing products for the EV sector, a faster-than-expected market transition could strain its ability to adapt its product portfolio and manufacturing capabilities.

- Market Shift: The global automotive market saw a notable increase in EV sales in 2024, with projections indicating continued strong growth through 2025, potentially impacting demand for traditional lubricants.

- Product Transition: Fuchs's reliance on ICE-related lubricant sales means a swift decline in this segment could create revenue gaps if EV lubricant solutions do not scale up quickly enough.

- Investment Lag: The capital expenditure required for retooling and developing new lubricant formulations for EVs is substantial, and a rapid market change could mean these investments don't yield returns as anticipated.

Regulatory Changes and Environmental Standards

Fuchs Petrolub SE faces a significant threat from increasingly stringent environmental regulations and evolving sustainability standards globally. These changes can lead to higher compliance costs, necessitating substantial investment in research and development for new, eco-friendlier lubricant formulations. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to impact chemical product development and market access, potentially restricting the use of certain existing ingredients in Fuchs' product lines.

Adapting to these dynamic regulatory landscapes presents an ongoing challenge. Companies like Fuchs must proactively monitor and anticipate changes to avoid disruptions and maintain market competitiveness. Failure to adapt could result in penalties, product bans, or a loss of market share to competitors who are better positioned to meet new environmental mandates. The company's ability to innovate and reformulate products in line with global sustainability goals, such as those promoted by the UN's Sustainable Development Goals, will be critical for its long-term success.

Specific areas of concern include:

- Increased compliance costs: Adhering to new environmental standards, such as those related to biodegradability or reduced toxicity, can significantly raise operational expenses.

- R&D investment requirements: Developing new product formulations that meet stricter environmental criteria demands considerable investment in research and development.

- Potential product restrictions: Existing lubricant formulations may face restrictions or outright bans if they do not comply with updated environmental regulations.

- Market access challenges: Divergent environmental regulations across different regions can create complexity and hinder seamless market entry for standardized products.

The accelerating shift towards electric vehicles (EVs) poses a significant threat to Fuchs Petrolub SE, as a substantial portion of its current revenue is derived from lubricants for internal combustion engine (ICE) vehicles. The global market saw a substantial increase in EV sales in 2024, with projections indicating continued strong growth through 2025, potentially impacting demand for traditional lubricants. This rapid market transition could outpace Fuchs's ability to adapt its product portfolio and manufacturing capabilities, creating revenue gaps if EV lubricant solutions do not scale up quickly enough.

Fuchs Petrolub SE is also vulnerable to increasing environmental regulations and evolving sustainability standards worldwide. These changes can lead to higher compliance costs and necessitate significant R&D investment for eco-friendlier lubricant formulations. For example, the European Union's REACH regulation continues to impact chemical product development, potentially restricting certain ingredients in Fuchs's product lines. Failure to adapt could result in penalties, product bans, or loss of market share.

Intensifying competition, particularly from integrated oil majors like Shell, ExxonMobil, and BP, presents another major threat. These companies benefit from upstream cost advantages and possess significant financial resources for R&D and market expansion. For instance, Shell's 2023 net profit of $28.4 billion highlights the disparity in financial muscle compared to independent lubricant specialists. Beyond these majors, a fragmented market with numerous independent lubricant manufacturers can lead to aggressive price wars, especially in commoditized product segments.

Global geopolitical tensions and trade conflicts create an unpredictable operating environment, potentially disrupting supply chains and increasing raw material costs. Trade friction, such as that between the U.S. and China, continues to foster uncertainty. Such dynamics can directly impact demand from key customer segments, especially those reliant on international trade, leading customers to delay or reduce purchasing decisions and impacting Fuchs Petrolub's revenue streams.

SWOT Analysis Data Sources

This analysis is built upon a foundation of robust data, including Fuchs Petrolub SE's official financial reports, comprehensive market research, and expert industry analyses to provide a well-rounded strategic overview.