Fuchs Petrolub SE PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuchs Petrolub SE Bundle

Unlock the strategic landscape surrounding Fuchs Petrolub SE with our comprehensive PESTLE analysis. Understand how evolving political stability, economic fluctuations, and technological advancements are directly impacting the lubricants industry and Fuchs's operations. Gain actionable intelligence to anticipate market shifts and inform your investment decisions. Download the full version now to secure your competitive advantage.

Political factors

Fuchs Petrolub SE, operating globally, is significantly exposed to geopolitical shifts and changing trade regulations, including tariffs and restrictions. These can disrupt raw material sourcing, impact supply chain reliability, and alter market access across different territories.

Recent trade disputes, notably involving the U.S., have fostered cautious demand from key customer segments. Such tensions directly influence the cost and availability of essential components like additive chemicals and base oils, crucial for Fuchs' lubricant production.

Governments globally are tightening environmental rules, impacting lubricant manufacturers like Fuchs Petrolub SE. Stricter emissions standards for vehicles and industrial equipment, alongside regulations on lubricant biodegradability and disposal, are key drivers. For instance, the European Union's ambitious Green Deal aims for climate neutrality by 2050, which will undoubtedly translate into more stringent environmental requirements for the chemical industry, including lubricants.

Fuchs Petrolub SE must continually adapt its product formulations and manufacturing processes to meet these evolving standards. Compliance with regulations such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe is crucial for market access and product development. Failure to adapt could restrict market entry or necessitate costly reformulation efforts, potentially impacting sales and profitability in key regions.

The political stability and evolving regulatory landscapes in Fuchs Petrolub SE's primary markets are crucial. While Asia-Pacific, particularly China, has demonstrated robust growth with increasing industrial activity and vehicle penetration, contributing significantly to lubricant demand, Europe presents a more challenging environment. For instance, in 2024, industrial production growth in the Eurozone has been sluggish, impacting demand for industrial lubricants.

Fuchs Petrolub SE's strategic approach of maintaining a decentralized production network across approximately 30 countries is a key factor in navigating these regional political and economic uncertainties. This localized manufacturing footprint allows the company to adapt more readily to varying trade policies, tariffs, and supply chain disruptions that can arise from political instability in specific regions, thereby buffering its overall operational resilience.

Support for Green Technologies and E-Mobility

Government incentives and policies are increasingly steering the automotive industry towards green technologies and e-mobility. For instance, the German government has extended subsidies for electric vehicle purchases through 2025, aiming to boost adoption rates. This direct support for EVs and renewable energy sources significantly influences the demand for specialized lubricants essential for these new powertrain technologies.

Fuchs Petrolub SE must strategically adapt its research and development efforts and product offerings to align with this global shift. As the demand for traditional internal combustion engine lubricants is projected to decrease, the company's focus on e-mobility lubricants and electrolyte production becomes critical for capturing emerging market opportunities. This strategic pivot is essential for long-term growth and relevance in the evolving automotive landscape.

- Government incentives: Germany's extended EV subsidies through 2025 underscore a commitment to e-mobility.

- Market shift: Declining demand for traditional lubricants necessitates a focus on EV-specific products.

- R&D focus: Fuchs Petrolub SE is investing in e-mobility lubricants and electrolyte production to meet future market needs.

- Opportunity: The transition to e-mobility presents significant growth potential for lubricant manufacturers prepared to innovate.

International Trade Agreements and Alliances

Changes in international trade agreements and the formation or dissolution of economic alliances significantly impact market dynamics, influencing import/export costs and competitive landscapes for companies like Fuchs Petrolub SE. As a global player, Fuchs must navigate these shifting trade relations, which present both hurdles and avenues for market growth or contraction.

For instance, the European Union's continued emphasis on trade liberalization within member states, alongside its ongoing trade negotiations with countries like the United Kingdom post-Brexit, directly affects Fuchs' operational costs and market access in key regions. The World Trade Organization (WTO) reported that global trade in goods saw a modest increase of 0.6% in 2023, a figure expected to grow in 2024 and 2025, indicating a generally favorable, albeit cautious, environment for international commerce.

- Trade Policy Shifts: Evolving trade policies, such as tariffs or quotas, can increase the cost of raw materials for lubricant production or impact the pricing of finished goods in different markets.

- Regional Economic Blocs: The strength and scope of economic alliances, like ASEAN or USMCA, influence market access and can create preferential trade conditions for members, potentially disadvantaging non-members.

- Geopolitical Stability: International trade is sensitive to geopolitical events; disruptions can lead to supply chain volatility, affecting Fuchs' ability to source inputs and distribute products efficiently across its global network.

Governmental support for e-mobility, such as Germany's extended EV subsidies through 2025, directly influences Fuchs Petrolub SE's market strategy by boosting demand for specialized lubricants. This policy shift necessitates a focus on adapting product portfolios away from traditional engine oils towards those catering to electric powertrains and electrolyte production. The global trend towards decarbonization, driven by political will and incentives, signals a significant opportunity for lubricant manufacturers prepared to innovate in the green technology space.

What is included in the product

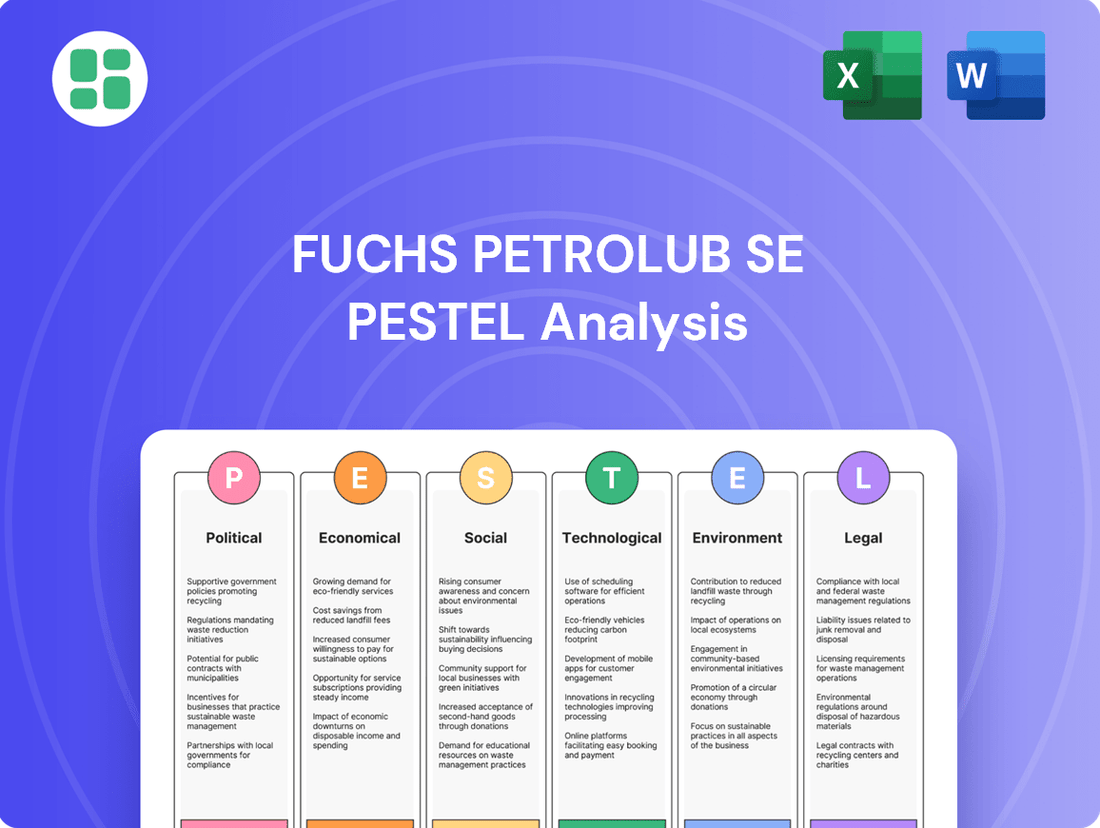

This PESTLE analysis examines the external macro-environmental factors impacting Fuchs Petrolub SE, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a comprehensive overview of these forces, offering insights into potential challenges and strategic opportunities for the company.

A concise PESTLE analysis for Fuchs Petrolub SE offers a clear roadmap to navigate external challenges, transforming potential market disruptions into actionable strategies for sustained growth.

Economic factors

The global economic landscape significantly shapes demand for lubricants, a core product for Fuchs Petrolub SE. In 2024, many economies experienced a slowdown, impacting industrial output and consequently, lubricant consumption in key sectors like automotive and manufacturing. This cautious demand environment directly affects Fuchs' sales revenues.

Looking ahead to 2025, projections suggest a potential shift. Anticipated interest rate cuts by central banks are expected to provide a stimulus, potentially boosting consumer spending and reigniting manufacturing activity. This could lead to a gradual recovery in lubricant demand, though the pace and extent remain subject to various economic uncertainties.

Fluctuations in raw material prices, especially crude oil and base oils, are a major factor for Fuchs Petrolub SE. These volatile costs directly affect production expenses and ultimately, the company's bottom line. For instance, while the base oil spot market saw price declines in 2024 due to oversupply and increased competition, this benefit was offset by other inflationary pressures that squeezed finished lubricant margins.

Supply chain disruptions remain a persistent challenge, forcing companies like Fuchs Petrolub to adapt. The need for innovative solutions and a greater emphasis on local sourcing has become critical to mitigate these ongoing global disruptions and ensure operational stability.

Fuchs Petrolub SE, operating in over 50 countries, faces significant exposure to currency exchange rate fluctuations. For instance, the Argentinian peso experienced substantial depreciation throughout 2023 and into early 2024, impacting companies with significant operations or sales in Argentina.

Such currency depreciations, like those seen in the Argentinian peso and Brazilian real, can translate into direct currency losses for Fuchs Petrolub, negatively affecting reported sales and overall profitability. For example, a 10% depreciation in the Argentine peso against the Euro could directly reduce the Euro-denominated value of sales generated in Argentina.

Effectively managing this currency risk is therefore paramount for Fuchs Petrolub to ensure stable financial performance and mitigate the impact of volatile global markets on its bottom line.

Inflationary Pressures and Cost Management

Persistent inflation continues to impact Fuchs Petrolub SE, particularly affecting personnel expenses and digitalization investments. These rising costs put pressure on profitability, even as lubricant prices have seen declines in certain market segments. For instance, the company noted in its 2024 reporting that while sales volumes increased, the impact of inflation on operating expenses remained a key challenge.

Fuchs is actively implementing stringent cost management strategies to counteract these inflationary headwinds. The company's focus on operational efficiency and careful expenditure control is designed to maintain a positive earnings trajectory. This commitment to managing costs was evident in its 2024 financial performance, where it aimed to deliver continued earnings growth despite the challenging economic environment.

- Personnel Expenses: Rising wages and benefits contribute to increased operational costs.

- Digitalization Costs: Investments in technology and digital transformation, while strategic, add to current expenses.

- Lubricant Price Volatility: Fluctuations in lubricant pricing, with some segments experiencing decreases, can offset cost increases.

- Cost Management Focus: Fuchs' strategy prioritizes strict cost control to safeguard profitability amidst inflationary pressures.

Demand Shifts in Automotive vs. Industrial Sectors

Demand trends are diverging significantly between the automotive and industrial lubricant sectors, presenting a key challenge for Fuchs Petrolub SE. While the U.S. consumer automotive lubricant market faces a downturn, driven by longer oil change intervals and the increasing adoption of electric vehicles (EVs), the industrial segment is projected for robust expansion. This divergence necessitates a strategic recalibration of Fuchs Petrolub's investment and focus to capitalize on growing industrial demand while navigating the automotive sector's evolving landscape.

The shift in demand is underscored by market projections. For instance, the global industrial lubricants market is anticipated to grow at a compound annual growth rate (CAGR) of approximately 3.5% through 2028, driven by increased manufacturing activity and infrastructure development. Conversely, the automotive lubricant market, particularly in developed regions like the U.S., is experiencing a slowdown. This necessitates Fuchs Petrolub to strategically reallocate resources and R&D efforts towards high-growth industrial applications.

- Automotive Lubricant Market: Facing headwinds from extended drain intervals and EV penetration, impacting traditional product demand.

- Industrial Lubricant Market: Poised for growth, fueled by manufacturing expansion, automation, and infrastructure projects.

- Strategic Imperative: Fuchs Petrolub must optimize its product portfolio and market strategies to align with these contrasting demand trajectories.

- EV Impact: The accelerating transition to electric vehicles is a significant long-term factor reducing demand for internal combustion engine lubricants.

Global economic slowdowns in 2024 impacted industrial output and lubricant demand, affecting Fuchs Petrolub's sales. Projections for 2025 suggest potential stimulus from interest rate cuts, which could boost manufacturing and lubricant consumption, though uncertainties remain.

Raw material price volatility, particularly for base oils, directly impacts Fuchs Petrolub's production costs and profit margins. Despite some price declines in 2024 due to oversupply, inflationary pressures continued to squeeze margins.

Persistent inflation in 2024 increased operational costs for Fuchs Petrolub, especially in personnel expenses and digitalization investments, challenging profitability despite sales volume increases.

Currency depreciation, as seen with the Argentine peso and Brazilian real in 2023-2024, directly reduces the Euro-denominated value of Fuchs Petrolub's sales in those regions, necessitating robust currency risk management.

What You See Is What You Get

Fuchs Petrolub SE PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fuchs Petrolub SE delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You’ll gain valuable insights into market trends, competitive landscapes, and regulatory challenges relevant to Fuchs Petrolub SE.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a robust framework for understanding the external forces shaping the lubricants industry and Fuchs Petrolub's position within it.

Sociological factors

Consumer preferences are rapidly evolving, with a growing emphasis on sustainability and environmental impact. This shift is directly influencing the automotive sector, leading to increased demand for lubricants compatible with electric and hybrid vehicles. For instance, by the end of 2024, electric vehicle sales are projected to reach over 15% of the global market share, a significant jump from previous years.

This transition necessitates substantial investment in research and development for specialized e-mobility fluids. Fuchs Petrolub SE must adapt its product portfolio to cater to these new mobility trends, ensuring its offerings meet the unique requirements of electric powertrains, which operate differently from traditional internal combustion engines. The company's strategic focus on innovative lubricant solutions for these emerging vehicle types is crucial for maintaining market relevance and capturing future growth opportunities.

Emerging markets, especially in Asia-Pacific, are experiencing a surge in population growth and urbanization. This trend directly fuels demand for lubricants as more people move to cities and require transportation and industrial services. For instance, by 2023, over 60% of the world's population lived in urban areas, a figure projected to climb higher, with a significant portion of this growth occurring in developing nations.

Simultaneously, rapid industrialization across these same regions is a major catalyst for lubricant consumption. As factories expand and manufacturing output increases, the need for high-performance industrial lubricants rises. This, coupled with the expanding middle class and increasing vehicle ownership, creates a substantial market for automotive lubricants, directly benefiting companies like Fuchs Petrolub.

The manufacturing landscape is rapidly shifting with Industry 4.0 and digitalization, demanding a workforce proficient in data analytics, automation, and advanced technological systems. Fuchs Petrolub SE must proactively update its recruitment and training programs to cultivate these in-demand skills, ensuring its employees are equipped for the demands of smart manufacturing and ongoing digital integration.

By 2025, the demand for skills in areas like AI, IoT, and cybersecurity within manufacturing is projected to surge. For instance, reports from 2024 indicate a growing skills gap, with many companies struggling to find talent with the necessary digital competencies. Fuchs Petrolub SE's investment in upskilling its existing workforce and attracting new talent with these specialized abilities will be crucial for maintaining its competitive edge.

Societal Expectations for Corporate Social Responsibility (CSR)

Societal expectations for Corporate Social Responsibility (CSR) are significantly shaping how companies like Fuchs Petrolub SE operate and are perceived. Consumers and stakeholders increasingly demand that businesses go beyond profit generation to actively contribute positively to society and the environment. This includes upholding ethical labor practices, ensuring robust employee safety protocols, and engaging meaningfully with local communities. Fuchs Petrolub SE's proactive approach to sustainability, evidenced by its 'Corporate Citizenship' initiatives, directly addresses these growing demands. For instance, in 2023, the company reported a 9% reduction in CO2 emissions intensity compared to 2018, a tangible demonstration of its environmental commitment.

These CSR efforts are not merely altruistic; they are critical for maintaining and enhancing Fuchs Petrolub SE's reputation. A strong CSR profile makes the company more attractive to a wider customer base, particularly those who prioritize ethical sourcing and sustainable products. Furthermore, it significantly bolsters its appeal as an employer, helping to attract and retain top talent in a competitive market. In 2024, Fuchs Petrolub SE was recognized by EcoVadis with a Gold rating for its sustainability performance, placing it in the top 5% of companies assessed globally.

- Growing Demand for Ethical Business: Consumers are increasingly making purchasing decisions based on a company's social and environmental impact.

- Employee Attraction and Retention: A strong CSR reputation is a key factor for talent acquisition, with 70% of job seekers considering a company's social responsibility when choosing an employer (according to a 2024 Deloitte survey).

- Enhanced Brand Reputation: Positive CSR activities build trust and loyalty, differentiating Fuchs Petrolub SE from competitors.

- Community Engagement Benefits: Local community support fosters goodwill and can lead to smoother operations and stronger stakeholder relationships.

Awareness of Sustainability and Eco-friendly Products

Public and corporate focus on sustainability is significantly boosting the market for environmentally friendly lubricants. Consumers and businesses are increasingly seeking out bio-based and biodegradable alternatives, directly influencing product development. Fuchs Petrolub, like its competitors, is responding by prioritizing lubricants with a lower environmental impact, often backed by detailed lifecycle assessments to quantify their ecological footprint. For instance, the global biodegradable lubricants market was projected to reach approximately USD 16.5 billion by 2024, highlighting this significant shift.

This growing demand necessitates a strategic shift for lubricant manufacturers. Companies are investing in research and development to create innovative formulations that meet stringent environmental regulations and consumer expectations.

- Growing Demand for Bio-Lubricants: The market for lubricants derived from renewable sources is expanding rapidly.

- Regulatory Pressures: Stricter environmental laws worldwide are encouraging the adoption of eco-friendly products.

- Corporate Social Responsibility (CSR): Businesses are increasingly choosing sustainable suppliers to align with their CSR goals.

- Lifecycle Assessment Importance: Companies are conducting thorough assessments to understand and reduce the environmental impact of their products from production to disposal.

Societal expectations for Corporate Social Responsibility (CSR) are significantly shaping how companies like Fuchs Petrolub SE operate and are perceived, with consumers and stakeholders demanding positive societal and environmental contributions. By 2024, a significant 70% of job seekers consider a company's social responsibility when choosing an employer, underscoring the importance of ethical practices for talent attraction and retention. Fuchs Petrolub SE's commitment to CSR, demonstrated by its 2023 achievement of a 9% reduction in CO2 emissions intensity compared to 2018, directly addresses these growing demands and enhances its brand reputation.

Technological factors

Technological advancements are significantly enhancing lubricant performance, driving the creation of synthetic, bio-based, and specialized high-performance options. These innovations deliver superior thermal stability, extended service intervals, and better fuel economy. Fuchs Petrolub SE actively invests in research and development to align with these evolving industry benchmarks and customer expectations.

The accelerating adoption of electric vehicles (EVs) is reshaping lubricant demand, shifting away from traditional engine oils towards specialized fluids for EV powertrains, including electric motors, gearboxes, and battery cooling systems. Fuchs Petrolub SE, recognizing this trend, is actively investing in e-mobility, developing advanced lubricants and coolants specifically engineered for the unique thermal and mechanical demands of EVs.

This strategic pivot is crucial for Fuchs, as the global EV market is projected to reach approximately 30 million units sold annually by 2025, a significant increase from around 10 million in 2023, according to industry forecasts. Fuchs' commitment to e-mobility solutions, including investments in electrolyte production for batteries and a growing portfolio of specialized EV lubricants, positions them to capitalize on this transformative shift in the automotive industry.

Fuchs Petrolub SE is actively embracing digitalization and Industry 4.0 principles, integrating smart manufacturing, IoT sensors, and advanced data analytics across its operations. This strategic move is designed to boost supply chain visibility, streamline production, and foster deeper customer relationships, all key components of their FUCHS2025 strategy.

The lubricant industry is undergoing a significant transformation driven by these technological advancements. For instance, predictive maintenance, powered by AI and IoT data, is becoming crucial for optimizing equipment uptime and reducing operational costs. Fuchs Petrolub's commitment to these technologies positions them to capitalize on efficiency gains and deliver more responsive services.

Nanotechnology and Additive Technologies

Nanotechnology and advanced additive packages are revolutionizing lubricants, significantly boosting wear protection, corrosion resistance, and operational efficiency. These innovations allow lubricants to perform better under extreme conditions, leading to extended equipment life and reduced maintenance costs.

Fuchs Petrolub SE is strategically positioned to capitalize on these advancements, actively integrating cutting-edge lubrication solutions into its product portfolio. The company's commitment to developing highly efficient and advanced lubricants aligns perfectly with the capabilities offered by nanotechnology and novel additive formulations.

- Enhanced Performance: Nanoparticles can fill microscopic gaps in metal surfaces, providing superior lubrication and reducing friction by up to 15% in certain applications, as reported in industry studies from 2024.

- Extended Equipment Lifespan: Improved wear protection through advanced additives can increase the service life of critical components by an estimated 10-20%, lowering total cost of ownership for end-users.

- Fuchs' Innovation Focus: Fuchs Petrolub invested €132 million in research and development in 2023, a significant portion of which is directed towards exploring and integrating these next-generation lubrication technologies.

Development of Circular Economy Technologies

The lubricants industry is increasingly focused on circular economy principles, driving innovation in technologies for recycling and re-refining used lubricants and base oils. This shift aims to minimize waste and create more sustainable supply chains. Fuchs Petrolub SE is actively investing in these advanced circular technologies.

By embracing circularity, Fuchs Petrolub SE seeks to reduce its environmental footprint, ensure a more stable supply of raw materials, and bolster its sustainability credentials. This strategic move positions the company for long-term resilience and aligns with growing market demands for eco-friendly solutions. For instance, the company has been involved in pilot projects for lubricant re-refining, aiming to recover valuable base oils from used products.

- Circular Economy Focus: Growing industry emphasis on recycling and re-refining used lubricants and base oils.

- Fuchs Petrolub SE Investment: Exploration and investment in advanced circular technologies to reduce waste and secure raw material streams.

- Sustainability Goals: Moving towards a more circular business model to enhance the company's sustainability profile.

- Market Trend: Alignment with increasing consumer and regulatory demand for environmentally responsible products and practices.

The integration of Industry 4.0 and digitalization is a key technological factor for Fuchs Petrolub SE, enabling enhanced operational efficiency and supply chain transparency. The company's FUCHS2025 strategy specifically highlights these advancements, aiming to leverage smart manufacturing and data analytics. This focus is crucial as the global industrial automation market is projected to grow significantly, with investments in IoT and AI becoming standard practice for leading manufacturers.

The continuous evolution of lubricant formulations, driven by nanotechnology and advanced additive packages, is another significant technological driver. These innovations lead to improved wear protection and extended equipment lifespan, directly impacting operational costs for customers. Fuchs Petrolub's R&D investment, which stood at €132 million in 2023, is heavily geared towards exploring and implementing these cutting-edge solutions.

The shift towards e-mobility necessitates specialized fluids for electric vehicles, a trend Fuchs Petrolub is actively addressing. With global EV sales expected to reach around 30 million units annually by 2025, the demand for tailored EV lubricants and coolants presents a substantial growth opportunity. Fuchs' strategic investments in this area underscore their commitment to adapting to the changing automotive landscape.

| Technology Area | Impact on Lubricants | Fuchs Petrolub SE Strategy |

|---|---|---|

| Industry 4.0 / Digitalization | Improved efficiency, supply chain visibility, predictive maintenance | FUCHS2025 strategy, smart manufacturing, data analytics |

| Nanotechnology & Advanced Additives | Enhanced wear protection, extended equipment life, improved efficiency | R&D investment (€132M in 2023), developing next-gen solutions |

| E-Mobility Fluids | Specialized lubricants for EV powertrains, cooling systems | Active investment in e-mobility, developing EV-specific products |

Legal factors

Fuchs Petrolub SE operates under the stringent Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation within the EU, alongside similar global chemical safety laws. These regulations mandate rigorous compliance for chemical substances used in lubricants, impacting production and import processes. For instance, as of early 2024, the ongoing evaluation of per- and polyfluoroalkyl substances (PFAS) under REACH continues to shape the industry, requiring companies like Fuchs to adapt their product formulations and supply chains to meet evolving restrictions on Substances of Very High Concern (SVHCs).

Governments worldwide are tightening environmental regulations, with a significant focus on reducing CO2 emissions. For instance, the European Union's CO2 emission standards for new cars are becoming increasingly stringent, pushing for an average of 15% reduction by 2025 and 55% by 2030. This directly impacts lubricant manufacturers like Fuchs Petrolub SE, necessitating the development of advanced, lower-viscosity engine oils and bio-based or biodegradable lubricant alternatives to meet these evolving standards and maintain market access.

Fuchs Petrolub SE operates under strict product liability laws and safety regulations, demanding that its lubricants meet exacting performance and safety standards to safeguard both users and the machinery they protect. This means rigorous quality control and extensive testing are not just good practice, but essential for compliance and avoiding legal pitfalls from product failures.

In 2023, the global lubricants market, valued at approximately $170 billion, saw continued emphasis on product safety and environmental compliance, influencing R&D investments for companies like Fuchs. Failure to adhere to these stringent criteria, such as those set by REACH in Europe or EPA standards in the US, can result in significant fines and reputational damage.

Competition Law and Anti-Trust Regulations

Fuchs Petrolub SE, as a significant player in the global lubricants market, navigates a complex web of competition and anti-trust regulations across various jurisdictions. These laws are designed to foster fair competition and prevent any single entity from wielding undue market power, directly impacting Fuchs' strategic decisions, from pricing to potential mergers and acquisitions. For instance, in 2024, the European Commission continued its scrutiny of various sectors for anti-competitive practices, a landscape Fuchs actively monitors to ensure compliance.

Navigating these regulations requires Fuchs Petrolub to be acutely aware of market share thresholds and potential collusion risks. Violations can lead to substantial fines and operational restrictions. The company's market strategies, including its approach to product development and distribution, must be carefully calibrated to avoid any perception or reality of monopolistic behavior. This ongoing compliance effort is crucial for maintaining its global operational license and reputation.

- Market Share Scrutiny: Regulators globally, including the US Federal Trade Commission and the European Commission, closely monitor market shares in concentrated industries like lubricants.

- Merger Control: Fuchs' acquisition activities are subject to review by competition authorities to prevent the creation of dominant market positions.

- Pricing Policies: Anti-trust laws prohibit price-fixing and other forms of collusion, necessitating independent pricing strategies for Fuchs.

- Regulatory Fines: In 2023, several companies in related industries faced significant fines for anti-competitive behavior, underscoring the importance of strict adherence to competition law.

Labor Laws and Workplace Safety Standards

Fuchs Petrolub SE must navigate a complex web of global labor laws, encompassing employee safety, working conditions, and employment practices. Compliance is not merely a legal requirement but a fundamental aspect of responsible corporate citizenship, directly impacting operational continuity and reputation. For instance, in 2024, Germany, a key operational hub for Fuchs, continued to enforce stringent workplace safety regulations, with the Federal Institute for Occupational Safety and Health reporting a focus on preventing musculoskeletal disorders, a common issue in industrial settings.

Maintaining a safe and compliant working environment across Fuchs Petrolub's numerous international sites presents an ongoing legal obligation. This involves adhering to varying national standards and international conventions. As of early 2025, the International Labour Organization (ILO) continues to emphasize the importance of decent work, pushing for updated national legislations that align with global best practices in worker protection and fair labor standards.

- Adherence to diverse national labor regulations: Fuchs Petrolub must comply with varying employment laws across its global subsidiaries.

- Workplace safety compliance: Continuous investment in and adherence to stringent safety standards are critical to prevent accidents and ensure employee well-being.

- Fair employment practices: Upholding ethical hiring, compensation, and anti-discrimination policies is essential for maintaining a positive workforce and avoiding legal challenges.

- Impact of evolving labor legislation: Staying abreast of and adapting to changes in labor laws, such as those concerning remote work or gig economy workers, is crucial for ongoing compliance.

Legal factors significantly shape Fuchs Petrolub SE's operations, particularly concerning chemical regulations like REACH, which mandate strict compliance for lubricants. Ongoing evaluations of substances like PFAS as of early 2024 require continuous adaptation of product formulations and supply chains to meet evolving restrictions on Substances of Very High Concern.

Product liability and safety laws are paramount, demanding that Fuchs' lubricants meet exacting performance and safety standards. Failure to comply with regulations such as REACH in Europe or EPA standards in the US can result in substantial fines and reputational damage, as highlighted by the global lubricants market's emphasis on safety and environmental compliance in 2023.

Furthermore, Fuchs must navigate a complex landscape of competition and anti-trust laws globally, ensuring fair market practices and avoiding monopolistic behavior. Regulatory scrutiny, such as that from the European Commission in 2024, necessitates careful calibration of market strategies, including pricing and potential mergers, to prevent violations and maintain operational licenses.

Labor laws also present a critical legal dimension, requiring adherence to diverse national standards for employee safety and working conditions across Fuchs' international sites. As of early 2025, the ILO's continued emphasis on decent work pushes for updated national legislation aligning with global best practices in worker protection.

Environmental factors

Global climate change initiatives and decarbonization targets are significantly reshaping the lubricant industry, pushing companies like Fuchs Petrolub SE towards more sustainable operations. This shift is driven by increasing regulatory pressure and growing consumer demand for environmentally friendly products.

Fuchs Petrolub SE has responded by setting ambitious sustainability targets, including achieving CO2-compensated status globally and working towards net-zero emissions. This involves optimizing their production processes and investing in climate protection projects, demonstrating a proactive approach to environmental responsibility.

In 2023, Fuchs Petrolub reported a 20% reduction in CO2 emissions from its own operations (Scope 1 and 2) compared to 2019. Their commitment extends to developing biodegradable lubricants and exploring bio-based raw materials, aligning with the broader industry trend of reducing environmental impact.

Growing environmental awareness and tightening regulations are significantly boosting the market for bio-based and biodegradable lubricants. Fuchs Petrolub SE is actively addressing this trend by investing in R&D for sustainable lubricants derived from renewable resources, aiming to lessen the ecological footprint of its product portfolio.

Growing concerns over resource scarcity are accelerating the shift towards circular economy principles within the lubricant sector, emphasizing the reuse and recycling of materials like re-refined base oils. Fuchs Petrolub SE is actively engaged in establishing robust standards and metrics to quantify and certify sustainability across its operations, directly supporting these circularity objectives and lessening dependence on primary resources.

Waste Management and Pollution Control

Environmental regulations concerning waste disposal and pollution control for industrial byproducts and spent lubricants are becoming more rigorous globally. Fuchs Petrolub SE is actively addressing this by enhancing its waste management protocols and investing in advanced, resource-efficient production technologies. For instance, their Kaiserslautern electrolyte plant exemplifies this commitment by employing processes designed to significantly reduce waste generation and minimize environmental impact.

The company's proactive approach is crucial for maintaining compliance and operational sustainability. Fuchs Petrolub SE's investment in low-waste production is a strategic move to not only meet but exceed environmental standards. This focus on minimizing its ecological footprint is becoming a key differentiator in the lubricants industry, reflecting a broader trend towards corporate environmental responsibility.

- Increased Regulatory Scrutiny: Governments worldwide are tightening regulations on industrial waste and pollution, impacting operations like lubricant manufacturing.

- Investment in Sustainable Processes: Fuchs Petrolub SE's Kaiserslautern electrolyte plant showcases a commitment to modern, low-waste production methods.

- Ecological Footprint Reduction: The company prioritizes minimizing its environmental impact through robust waste management and cleaner production techniques.

- Industry Trend Towards Sustainability: Adherence to stringent environmental standards is becoming essential for long-term viability and corporate reputation in the lubricants sector.

Water and Energy Consumption Reduction

Fuchs Petrolub SE actively pursues the reduction of water and energy consumption across its manufacturing operations as a core environmental objective. This commitment is demonstrated through continuous process optimization aimed at minimizing resource utilization. By the close of 2024, the company achieved a significant milestone, increasing its share of green electricity to 76%, a key driver of its broader sustainability strategy.

The drive for efficiency directly impacts operational costs and environmental footprint. Fuchs Petrolub SE’s focus on optimizing production processes is designed to yield tangible reductions in both water and energy inputs. This strategic emphasis on resource management underscores the company's dedication to environmentally responsible manufacturing practices.

- Green Electricity Share: Fuchs Petrolub SE's green electricity consumption reached 76% by the end of 2024.

- Process Optimization: Continuous efforts are made to optimize manufacturing procedures for reduced water and energy usage.

- Sustainability Goal: Water and energy consumption reduction is a key environmental objective for the company.

Fuchs Petrolub SE is navigating a landscape increasingly shaped by environmental regulations and a global push for sustainability. The company's commitment to reducing its ecological footprint is evident in its operational targets and investment in greener technologies.

By the end of 2023, Fuchs Petrolub achieved a 20% reduction in CO2 emissions (Scope 1 and 2) compared to 2019, underscoring its dedication to decarbonization. Furthermore, the company significantly increased its use of green electricity, reaching 76% by the close of 2024, a crucial step in minimizing its environmental impact.

| Environmental Metric | 2019 Baseline | 2023/2024 Achievement | Target/Progress |

| CO2 Emissions (Scope 1 & 2) | N/A | 20% Reduction | Ongoing Reduction |

| Green Electricity Share | N/A | 76% (End of 2024) | Increasing Share |

| Biodegradable Lubricants | N/A | Active R&D and Development | Market Growth Focus |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Fuchs Petrolub SE is built on a comprehensive review of official government publications, reputable financial news outlets, and leading industry-specific market research reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in current and authoritative data.