Fuchs Petrolub SE Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuchs Petrolub SE Bundle

Fuchs Petrolub SE operates in an industry characterized by moderate buyer power and significant supplier influence, particularly for specialized raw materials. The threat of new entrants is somewhat mitigated by high capital requirements and established brand loyalty, yet substitute products pose a growing concern.

The complete report reveals the real forces shaping Fuchs Petrolub SE’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fuchs Petrolub SE's bargaining power of suppliers is influenced by supplier concentration. The market for key raw materials like base oils and additives is characterized by a moderate number of large, established suppliers. While not as concentrated as some industries, a few major global players do hold significant market share, which can grant them leverage in price negotiations.

For instance, the global base oil market, a critical input for lubricants, sees major refining companies as primary suppliers. If these dominant suppliers were to consolidate further or experience production disruptions, Fuchs Petrolub could face increased input costs. The availability of alternative suppliers is generally present, but specialized additives might limit options, thereby strengthening the bargaining power of those niche providers.

The criticality of base oils—mineral, synthetic, and bio-based—along with performance-enhancing additives, significantly shapes the bargaining power of suppliers for Fuchs Petrolub SE. These components are fundamental to Fuchs' diverse product formulations, and their limited substitutability inherently grants suppliers considerable leverage.

Fluctuations in crude oil prices directly impact the cost of mineral-based lubricants, a key input for Fuchs. For instance, in 2023, Brent crude oil prices averaged around $82 per barrel, a notable increase from previous years, directly affecting the cost base for mineral oil feedstocks used in lubricant production.

Fuchs Petrolub SE faces significant switching costs when changing lubricant suppliers. These costs include the substantial expense of re-testing and reformulating existing products to ensure compatibility with new raw materials. For instance, a change in a base oil or additive could necessitate extensive laboratory work, potentially costing hundreds of thousands of euros.

Beyond formulation, Fuchs must also navigate the complex process of re-approving its products with a vast customer base, particularly in highly regulated industries like automotive and aerospace. This can involve lengthy qualification procedures and audits, delaying market entry for new formulations. In 2024, the automotive sector alone accounts for a significant portion of Fuchs' revenue, making customer re-approval a critical and time-consuming hurdle.

The technical intricacies and stringent regulatory approvals required for changing raw material sources further solidify high switching costs. Suppliers of specialized additives or performance-enhancing chemicals often have proprietary formulations and require extensive validation. Any disruption to the supply chain due to a supplier change could lead to production stoppages, impacting Fuchs' operational efficiency and potentially leading to lost sales, as seen in past industry-wide supply chain challenges.

Supplier's Product Differentiation

Fuchs Petrolub SE's reliance on highly differentiated or proprietary raw materials significantly influences supplier bargaining power. If key additives or base oils are unique and critical for Fuchs' specialized lubricant formulations, suppliers gain leverage, particularly in premium and high-tech segments.

For instance, the specialty chemicals sector, a key supplier for lubricants, often features products with proprietary formulations. In 2023, the global specialty chemicals market was valued at approximately $680 billion, indicating substantial scale but also highlighting the potential for niche, high-value components to command premium pricing. Fuchs' ability to secure these differentiated inputs directly impacts its cost structure and product competitiveness.

- Supplier Differentiation: The degree to which suppliers offer unique, hard-to-replicate raw materials or additives.

- Criticality of Inputs: The essential nature of these differentiated materials for Fuchs' specialized lubricant production.

- Market Value: The global specialty chemicals market, a key supplier segment, reached roughly $680 billion in 2023, underscoring the economic significance of these inputs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into lubricant production, directly competing with Fuchs Petrolub SE, is generally low. Major oil companies, the primary suppliers of base oils, have vastly different business models and typically focus on upstream and midstream operations rather than downstream specialized lubricant blending.

However, specialized additive manufacturers could potentially pose a threat. If their proprietary additive packages become indispensable for high-performance lubricants, they might consider forward integration. For instance, a company developing a breakthrough additive for electric vehicle lubricants could see this as a strategic move.

- Low Likelihood for Major Oil Companies: Their core business remains crude oil extraction and refining, not specialized lubricant formulation.

- Potential for Specialized Additive Suppliers: If their products become critical and proprietary, forward integration becomes a viable, albeit niche, threat.

- Market Dynamics: The capital investment and technical expertise required for lubricant blending and distribution act as significant barriers to entry for most suppliers.

The bargaining power of Fuchs Petrolub SE's suppliers is moderate, primarily influenced by the concentration within the base oil and additive markets. While a few large global players dominate base oil supply, the availability of alternative sources and the presence of specialized additive providers create a somewhat balanced negotiation landscape.

The criticality of inputs, particularly specialized additives, and the significant switching costs Fuchs faces when changing raw material suppliers contribute to a moderate level of supplier leverage. These switching costs involve extensive re-testing, reformulation, and lengthy customer re-approval processes, especially in regulated sectors like automotive.

The threat of forward integration by suppliers is generally low, particularly from major oil companies whose business models are distinct from specialized lubricant production. However, niche additive manufacturers with highly proprietary and indispensable products could potentially pose a limited threat.

| Factor | Influence on Supplier Bargaining Power | Example/Data Point |

|---|---|---|

| Supplier Concentration | Moderate | Key base oil suppliers are large, established refining companies. |

| Criticality of Inputs | High | Specialized additives are essential for high-performance lubricant formulations. |

| Switching Costs | High | Re-testing, reformulation, and customer re-approval can cost hundreds of thousands of euros. |

| Supplier Differentiation | Moderate to High | Proprietary formulations in specialty chemicals can grant leverage. |

| Forward Integration Threat | Low | Major oil companies focus on upstream/midstream; niche additive suppliers pose a limited threat. |

What is included in the product

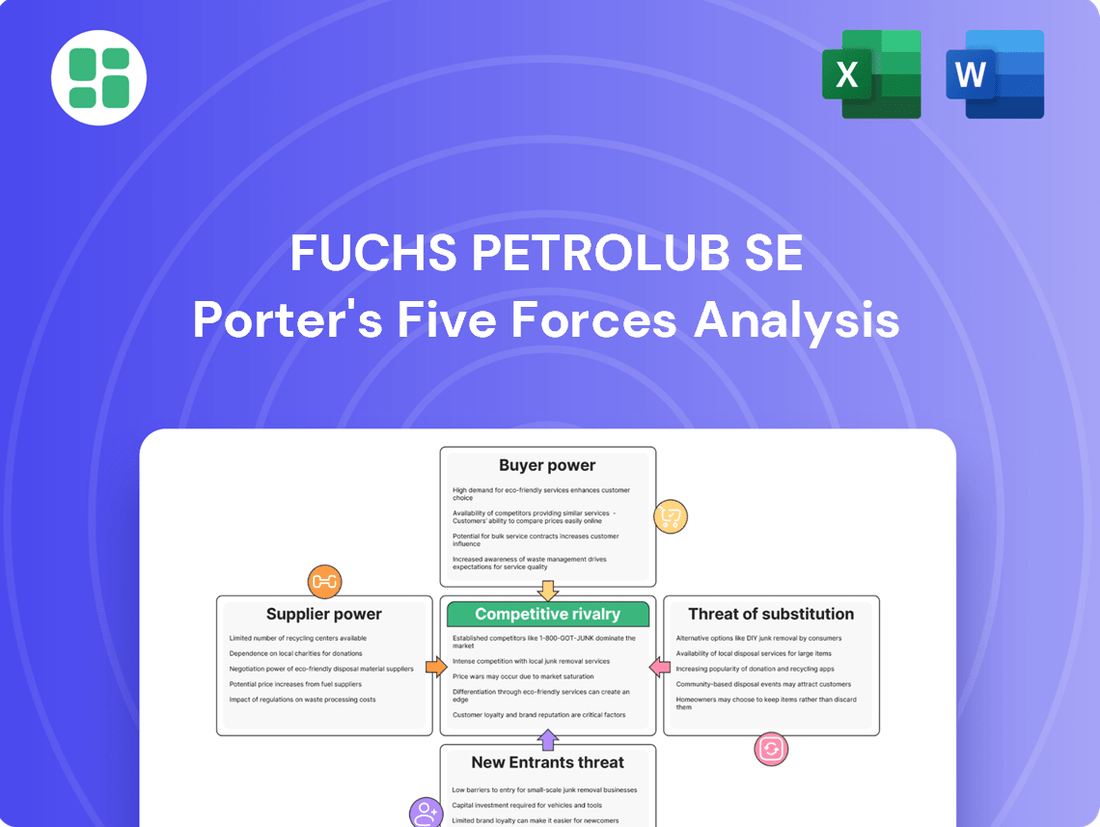

This Porter's Five Forces analysis for Fuchs Petrolub SE meticulously examines the competitive intensity within the lubricants industry, assessing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players to reveal strategic vulnerabilities and opportunities.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's five forces impacting Fuchs Petrolub SE.

Customers Bargaining Power

Fuchs Petrolub SE serves a vast global customer base exceeding 100,000 across automotive, industrial, and specialized segments. This broad distribution of customers generally dilutes the bargaining power of any single buyer.

While the sheer number of customers limits individual leverage, a significant portion of Fuchs' revenue can still be influenced by a few key accounts within its major sectors. For instance, in 2023, the automotive segment represented a substantial part of Fuchs' sales, meaning large automotive manufacturers could hold considerable sway.

Customer switching costs for Fuchs Petrolub SE's lubricants are a significant factor in their bargaining power. If customers can easily switch to a competitor's product with minimal disruption or cost, their power increases. However, Fuchs' specialized lubricants often require extensive testing and compatibility assessments for specific industrial machinery, making a switch costly and time-consuming. For instance, in the automotive sector, changing lubricant suppliers can necessitate re-calibration of engine components and performance monitoring, adding to the switching burden.

Fuchs' commitment to providing comprehensive services, such as application engineering and advanced lubricant management programs, further solidifies customer loyalty and raises switching costs. These services ensure optimal performance and longevity of machinery, creating a dependency that discourages customers from seeking alternative suppliers. In 2024, Fuchs continued to emphasize these value-added services, aiming to lock in customers and mitigate the impact of potential price pressures.

Fuchs Petrolub SE faces varying customer price sensitivity across its product lines. In the commodity lubricant segments, where products are more standardized, customers tend to be highly sensitive to price fluctuations. This means that even small price increases can lead to customers seeking out lower-cost alternatives. The lubricant market in 2024 saw a general decline in prices, suggesting a degree of price sensitivity among buyers, particularly for less specialized products.

However, for high-performance and specialized lubricants, which are often critical for the efficient and reliable operation of complex machinery, customers are typically less price-sensitive. In these cases, factors like product quality, performance, technical support, and brand reputation often outweigh minor price differences. Businesses relying on these specialized lubricants may prioritize minimizing downtime and maximizing operational efficiency, making them willing to pay a premium for superior products and services.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while generally low for lubricant manufacturers like Fuchs Petrolub SE, can still influence pricing power. Large, high-volume customers, particularly in sectors like automotive or heavy machinery, could theoretically consider producing their own lubricants.

However, the significant technical expertise, specialized manufacturing equipment, and substantial capital investment required make this a rare occurrence. For Fuchs, this potential, even if unlikely, acts as a ceiling on how aggressively they can price their less specialized, high-volume product lines, especially when dealing with major industry players.

- Low Likelihood of Direct Backward Integration: The complexity and cost of lubricant production, including research and development, specialized blending facilities, and quality control, deter most customers from attempting in-house manufacturing.

- Impact on Pricing for Standard Products: For commoditized lubricants, the latent threat of a large customer considering backward integration can limit Fuchs' ability to command premium pricing.

- Customer Concentration: Fuchs' reliance on a few very large automotive or industrial clients might increase the perceived leverage these customers have, even if actual integration is improbable.

Information Availability and Product Importance

Customers in the lubricant market, including those dealing with Fuchs Petrolub SE, often have access to a significant amount of information regarding alternative products and pricing. This is particularly true for industrial clients who may possess in-house technical teams capable of detailed product comparisons and cost analyses. For instance, in 2024, the proliferation of online technical data sheets and industry forums allows buyers to easily benchmark lubricant performance and cost-effectiveness across various suppliers.

The criticality of lubricants to a customer's operations plays a crucial role in their bargaining power. For applications where equipment failure due to improper lubrication can lead to substantial downtime and financial losses, customers are inherently less price-sensitive. They prioritize reliability and performance, making them less likely to switch to a cheaper alternative if it poses any risk to their critical machinery. In 2023, the automotive sector, a key market for lubricant manufacturers, continued to emphasize durability and extended service intervals, underscoring the importance of quality over marginal cost savings for many end-users.

- Information Accessibility: Online resources and industry expertise provide customers with detailed insights into lubricant alternatives and pricing structures.

- Technical Expertise: Customers with in-house technical capabilities can conduct thorough evaluations, increasing their leverage in negotiations.

- Product Criticality: For essential operational applications, customers prioritize lubricant quality and reliability, reducing their sensitivity to price fluctuations.

- Market Trends: In 2023, sectors like automotive showed a preference for high-performance lubricants, indicating a willingness to invest in quality for critical functions.

Fuchs Petrolub SE's customer bargaining power is moderately low due to high switching costs, especially for specialized lubricants crucial for machinery performance. While a large customer base limits individual leverage, key accounts in sectors like automotive, which formed a significant portion of sales in 2023, can still exert influence. The availability of information and the criticality of lubricants to operations also play a role, though Fuchs mitigates this through value-added services and technical support, a strategy reinforced in 2024.

| Factor | Assessment | Impact on Fuchs |

|---|---|---|

| Customer Concentration | Moderate (Key accounts in automotive) | Potential for increased leverage by large buyers |

| Switching Costs | High (Specialized lubricants, testing) | Reduces customer bargaining power |

| Information Availability | High (Online data, industry forums) | Increases customer awareness and potential leverage |

| Product Criticality | High (Essential for machinery operation) | Reduces price sensitivity, favors quality |

Preview Before You Purchase

Fuchs Petrolub SE Porter's Five Forces Analysis

This preview showcases the precise Porter's Five Forces Analysis for Fuchs Petrolub SE that you will receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You'll gain immediate access to this fully formatted and professionally written document, ensuring no surprises or placeholders. The insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the lubricants industry are all included in this exact file.

Rivalry Among Competitors

The global lubricants market is characterized by a significant number of competitors, ranging from integrated oil giants like Shell, ExxonMobil, and BP to specialized independent lubricant manufacturers such as Kluber Lubrication and Carl Bechem. This broad spectrum of players, each with varying degrees of market share and product specialization, fuels a highly competitive environment.

The presence of these numerous and diverse competitors, including major oil companies with substantial resources and independent specialists focusing on niche applications, intensifies rivalry. For instance, in 2023, the global lubricants market was valued at approximately $170 billion, with these key players vying for market share across various segments.

The global lubricants market is experiencing a modest growth rate, with projections indicating an expansion of approximately 2.6% to 3.8% annually between 2024 and 2030. This relatively slow pace of market expansion means that companies like Fuchs Petrolub SE face intensified competition, as they must actively vie for existing market share rather than primarily benefiting from a rapidly growing overall market. This dynamic forces a greater focus on strategic differentiation and operational efficiency to capture and retain customers.

Fuchs Petrolub SE effectively differentiates its lubricant products through advanced performance, specialized applications, and comprehensive customer services. This strategy allows them to move beyond simple price competition, as seen in their strong market position in sectors requiring highly specific lubrication solutions. For instance, their tailored offerings for the automotive and industrial sectors often command premium pricing due to their specialized nature and the technical support provided.

Innovation is a cornerstone of Fuchs' competitive strategy, particularly in developing bio-based and energy-efficient lubricants. This forward-thinking approach not only addresses growing environmental concerns but also provides a distinct advantage in markets increasingly focused on sustainability. In 2023, Fuchs continued to invest heavily in R&D, aiming to expand its portfolio of environmentally friendly products, which are becoming a significant selling point for many clients.

Exit Barriers

Fuchs Petrolub SE faces considerable exit barriers in the lubricant market. The industry is characterized by high asset specificity, meaning that specialized machinery and production facilities are difficult to repurpose or sell for alternative uses. This makes it costly for companies to simply shut down operations and exit the market, potentially leading to prolonged, intense competition even in less profitable segments.

Furthermore, strategic interdependencies can also act as an exit barrier. Lubricant businesses are often integrated with broader chemical or automotive supply chains. Divesting a lubricant division might disrupt the operations of other, more profitable business units within a conglomerate, creating a reluctance to exit.

In 2023, Fuchs Petrolub reported a substantial revenue, indicating the scale of operations and the significant capital tied up in fixed assets. For instance, their investments in production capacity and R&D for specialized lubricant formulations represent a considerable commitment that cannot be easily recouped. This deep investment discourages smaller players or those with less diversified portfolios from simply walking away.

- High Capital Investment: The lubricant industry demands significant upfront investment in specialized manufacturing plants, blending facilities, and distribution networks, making it economically challenging to exit.

- Brand Reputation and Customer Loyalty: Established lubricant brands have built decades of trust and loyalty. Competitors exiting would forfeit this accumulated goodwill, which is hard to transfer.

- Specialized Technology and Know-how: Developing and producing high-performance lubricants requires specific technical expertise and proprietary formulations, creating a knowledge-based barrier to exit.

- Supply Chain Integration: Lubricant producers are often deeply integrated into automotive and industrial supply chains. Exiting can disrupt these established relationships and create ripple effects.

Market Share and Concentration

The lubricant market is quite fragmented, with Fuchs Petrolub SE holding the top spot as the largest independent lubricant manufacturer. However, major integrated oil companies, like Shell and ExxonMobil, command substantially larger overall market shares due to their upstream integration and broader product portfolios.

This dynamic means that while Fuchs is a leader in its niche, the competitive rivalry is intense. Companies frequently engage in aggressive pricing and marketing strategies to capture or retain market share. For instance, in 2023, the global lubricants market was valued at approximately $170 billion, with significant portions held by these larger players.

- Market Fragmentation: While Fuchs is the #1 independent lubricant producer, it competes against global oil giants with much larger market footprints.

- Aggressive Competition: The presence of major integrated oil companies fuels intense rivalry, often leading to price wars and aggressive market share acquisition tactics.

- Market Value: The global lubricants market, estimated at around $170 billion in 2023, highlights the substantial scale of competition.

Competitive rivalry within the global lubricants market is fierce, driven by a large number of diverse players, including major oil companies and specialized manufacturers. This intense competition is further amplified by the market's modest growth rate, compelling companies like Fuchs Petrolub SE to focus on differentiation and efficiency to gain an edge. For example, the global lubricants market was valued at approximately $170 billion in 2023, indicating the significant scale of competition and the substantial resources deployed by key players.

Fuchs Petrolub SE navigates this competitive landscape by emphasizing product innovation, such as bio-based lubricants, and providing specialized solutions that command premium pricing. Despite its leading position among independent manufacturers, Fuchs faces formidable competition from integrated oil giants with broader market reach. The industry's high capital investment requirements and strong brand loyalty create significant barriers to exit, ensuring that competition remains robust even in challenging market conditions.

| Competitor Type | Key Players | Market Share Impact | Competitive Intensity |

|---|---|---|---|

| Integrated Oil Companies | Shell, ExxonMobil, BP | Substantial due to upstream integration and broad portfolios | High, often leading to price wars |

| Independent Specialists | Fuchs Petrolub SE, Kluber Lubrication | Leading in niche segments, but smaller overall than giants | High, driven by innovation and specialization |

| Global Lubricants Market Value (2023) | $170 billion | Indicates scale of competition | Intense |

| Projected Market Growth (2024-2030) | 2.6% - 3.8% annually | Modest growth necessitates share capture | High |

SSubstitutes Threaten

Emerging technologies like advanced dry lubrication, magnetic bearings, and self-lubricating materials present a potential long-term threat to traditional lubricants. While these are not yet mainstream, their continued development could eventually reduce or even eliminate the demand for conventional lubricants in certain applications.

Extended drain intervals and the development of 'fill-for-life' lubricants present a significant threat of substitution for lubricant manufacturers like Fuchs Petrolub. These advancements directly reduce the overall volume of lubricant required throughout a vehicle's or piece of equipment's operational life. For instance, advancements in synthetic lubricant technology mean that in some automotive applications, oil changes that were once required every 10,000 miles might now extend to 20,000 miles or more, effectively halving lubricant consumption for that specific service interval.

The accelerating shift towards electric vehicles (EVs) presents a significant threat of substitutes for traditional lubricant manufacturers like Fuchs Petrolub. EVs, by their nature, require fewer and different types of lubricants than internal combustion engine (ICE) vehicles. For instance, while EVs still need specialized fluids for their e-transmissions, battery thermal management, and other components, the overall volume of engine oil, transmission fluids, and other traditional automotive lubricants consumed is expected to decline.

Global EV sales have seen remarkable growth, with projections indicating continued strong expansion. In 2023, global EV sales surpassed 13 million units, a substantial increase from previous years. This trend is expected to continue, with forecasts suggesting EVs will constitute a significant portion of new vehicle sales by the end of the decade. This growing market share directly translates to a shrinking demand for the core products of many lubricant companies.

New Materials and Designs

Advancements in material science and engineering design present a significant threat by potentially reducing the fundamental need for lubricants. Innovations in self-lubricating materials, advanced coatings, and novel bearing technologies can drastically lower friction and wear in machinery. For instance, the development of ceramic or composite materials engineered for low-friction operation could bypass the requirement for traditional oil or grease-based lubrication systems.

These design shifts aim to create machinery components that require minimal to no external lubrication, directly impacting lubricant demand. Consider the automotive sector's drive for efficiency; new engine designs might incorporate materials that inherently reduce friction, lessening the reliance on engine oil. In 2024, the global market for advanced materials, including those with self-lubricating properties, is experiencing robust growth, indicating a tangible shift in manufacturing priorities.

The implications for lubricant manufacturers like Fuchs Petrolub SE are substantial, as a widespread adoption of these technologies would mean a shrinking market for their core products. This threat is amplified by the increasing focus on sustainability and reduced maintenance, making lubricant-free or low-lubricant solutions highly attractive. The potential for these substitute technologies to gain traction across various industrial applications poses a direct challenge to the established lubricant market.

- Reduced Lubricant Demand: Innovations in self-lubricating materials and low-friction coatings directly decrease the need for conventional lubricants.

- Material Science Advancements: New ceramic, composite, and engineered materials offer inherent wear resistance and reduced friction, acting as substitutes.

- Design Engineering Focus: Machinery redesigns prioritizing lubricant-free operation or significantly reduced lubrication requirements pose a threat.

- Market Trends: The growing emphasis on sustainability and lower maintenance costs in industries favors lubricant-free alternatives.

Sustainability and Bio-based Alternatives

The increasing demand for environmentally acceptable lubricants (EALs) and bio-based alternatives presents a significant threat of substitutes for Fuchs Petrolub SE. Stricter environmental regulations and corporate sustainability goals are driving this shift, pushing industries towards greener lubricant solutions.

While Fuchs is actively involved in developing and marketing these sustainable products, the rapid evolution of this market segment could empower new entrants or existing specialized players to gain market share if Fuchs' offerings are not sufficiently competitive or innovative. For instance, by 2024, the global bio-lubricants market was projected to reach over $12 billion, indicating substantial growth potential for those who can capture this demand.

Fuchs' ability to adapt its product portfolio and manufacturing processes to meet the growing preference for bio-based lubricants will be crucial. The company’s 2023 annual report highlighted investments in R&D for sustainable lubricants, aiming to address this evolving customer need.

- Growing regulatory pressure: Many regions are implementing stricter emissions standards and waste disposal regulations that favor biodegradable lubricants.

- Customer demand for sustainability: End-users, particularly in sectors like marine and agriculture, are increasingly seeking lubricants with a lower environmental impact.

- Technological advancements: Innovations in base oil technology and additive packages are improving the performance of bio-based lubricants, making them viable substitutes for traditional mineral oil-based products.

- Potential for new market entrants: The perceived lower capital intensity for producing certain bio-lubricants could attract new, agile competitors focused solely on this niche.

The threat of substitutes for Fuchs Petrolub SE primarily stems from technological advancements and evolving market demands that reduce the need for traditional lubricants. Emerging technologies like advanced dry lubrication and self-lubricating materials offer inherent friction reduction, potentially bypassing the requirement for conventional oils and greases. Furthermore, the significant shift towards electric vehicles (EVs) fundamentally alters lubricant consumption patterns, as EVs require fewer and different types of specialized fluids compared to internal combustion engine vehicles. In 2023, global EV sales exceeded 13 million units, underscoring this substantial market transition.

Entrants Threaten

Establishing a presence in the lubricants industry, like Fuchs Petrolub SE operates within, demands substantial capital. Newcomers must finance the construction or acquisition of advanced blending plants, invest in robust research and development facilities to formulate competitive products, and build extensive global distribution networks to reach customers effectively. For instance, setting up a state-of-the-art blending facility can easily run into tens of millions of dollars, a significant hurdle for potential entrants.

The threat of new entrants in the lubricants sector, particularly concerning R&D and technological expertise, is significantly mitigated by the immense investment required. Developing high-performance, specialized lubricants demands extensive research and development to meet rigorous industry standards and unique customer specifications. For instance, Fuchs Petrolub SE, a leader in this field, leverages decades of accumulated technical know-how and proprietary formulations, creating substantial barriers to entry for newcomers who would need to replicate this deep expertise and innovation pipeline.

Newcomers face significant hurdles in securing access to established distribution channels within the lubricants industry. Fuchs Petrolub SE leverages its vast global network and deep-rooted relationships across various customer segments, making it challenging for new entrants to replicate this market penetration. For instance, in 2024, Fuchs continued to expand its reach through strategic partnerships and direct sales forces, solidifying its presence in key automotive and industrial markets.

Brand Loyalty and Customer Relationships

Brand loyalty and established customer relationships present a significant barrier to new entrants in the lubricant market, especially for industrial applications where reliability is paramount. Fuchs Petrolub SE, for instance, has cultivated deep trust and long-standing partnerships with its clients, built over decades of consistent performance and tailored solutions. Newcomers would find it incredibly challenging to replicate this level of credibility and customer intimacy quickly.

Fuchs's strong brand reputation is a direct result of its commitment to quality and service, making it difficult for new players to gain traction. In 2024, the global lubricants market, valued at approximately $180 billion, still sees established brands holding substantial market share due to these very relationships. Acquiring and retaining customers requires not just competitive pricing but also a proven track record and deep understanding of specific industry needs, which new entrants lack.

The importance of brand loyalty is underscored by the fact that switching lubricant suppliers in critical industrial settings can involve significant costs and risks, including potential equipment damage. Fuchs's ability to offer specialized formulations and technical support further solidifies its customer base. This makes it a formidable challenge for any new entrant to disrupt the existing market dynamics.

Key factors contributing to this barrier include:

- Established Reputation: Decades of reliable product performance and service build strong brand equity.

- Customer Trust: Critical industrial clients rely on proven suppliers for operational continuity.

- Switching Costs: The expense and risk associated with changing lubricant providers are substantial.

- Technical Expertise: Deep industry knowledge and tailored solutions foster long-term customer commitment.

Regulatory Hurdles and Environmental Standards

The lubricant industry faces significant regulatory hurdles, particularly concerning environmental and safety standards. New entrants must navigate complex compliance requirements, which can be costly and time-consuming. For instance, REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe mandates extensive data submission and risk assessment for chemical substances, impacting lubricant formulations.

Meeting stringent environmental regulations, such as those related to biodegradability and emissions, presents a substantial barrier. Specialized lubricants, like those for the automotive or aerospace sectors, often require specific certifications and approvals, adding layers of complexity. In 2024, the focus on sustainability and reduced environmental impact continues to drive stricter regulations globally, increasing the capital expenditure needed for compliance.

- Regulatory Compliance Costs: New lubricant manufacturers face substantial upfront investment to meet environmental, health, and safety regulations.

- Specialized Product Requirements: Obtaining certifications for high-performance or eco-friendly lubricants adds significant cost and time.

- Global Harmonization Challenges: Varying international standards create complexity for companies aiming for global market entry.

- Ongoing Compliance Burden: Continuous monitoring and adaptation to evolving regulatory landscapes represent a persistent challenge.

The threat of new entrants in the lubricants market is generally considered low due to significant capital requirements for blending plants, R&D, and distribution networks. For example, setting up a modern blending facility can cost tens of millions of dollars. Furthermore, deep technical expertise and proprietary formulations, like those developed by Fuchs Petrolub SE over decades, create substantial barriers.

Established brand loyalty and customer relationships, particularly in industrial sectors where reliability is crucial, also deter new players. Fuchs Petrolub SE, with its long-standing partnerships and proven track record, enjoys a high level of customer trust. In 2024, the global lubricants market, valued at approximately $180 billion, still shows established brands holding significant market share due to these deep-rooted relationships.

Navigating complex and evolving regulatory landscapes, especially environmental standards, adds another layer of difficulty for potential entrants. Compliance costs can be substantial, and obtaining certifications for specialized lubricants, such as those meeting biodegradability requirements, further increases the capital expenditure needed for market entry. These factors collectively make it challenging for new companies to compete effectively.

| Barrier to Entry | Description | Impact on New Entrants | Fuchs Petrolub SE Strength |

|---|---|---|---|

| Capital Requirements | High cost of blending plants, R&D, and distribution networks. | Significant financial hurdle. | Extensive global infrastructure and investment capacity. |

| Technical Expertise & R&D | Need for specialized formulations and innovation. | Requires substantial investment in research and development. | Decades of accumulated know-how and proprietary technologies. |

| Brand Loyalty & Switching Costs | Customer trust and the risk/cost of changing suppliers. | Difficult to acquire and retain customers. | Strong reputation and long-term client relationships. |

| Regulatory Compliance | Meeting environmental and safety standards. | Costly and time-consuming to achieve compliance. | Established processes for meeting global regulations. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fuchs Petrolub SE is built upon a foundation of comprehensive data, including the company's annual reports, investor presentations, and publicly available financial statements. We also leverage industry-specific market research reports and trade publications to gain a nuanced understanding of the lubricants sector.