Fuchs Petrolub SE Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuchs Petrolub SE Bundle

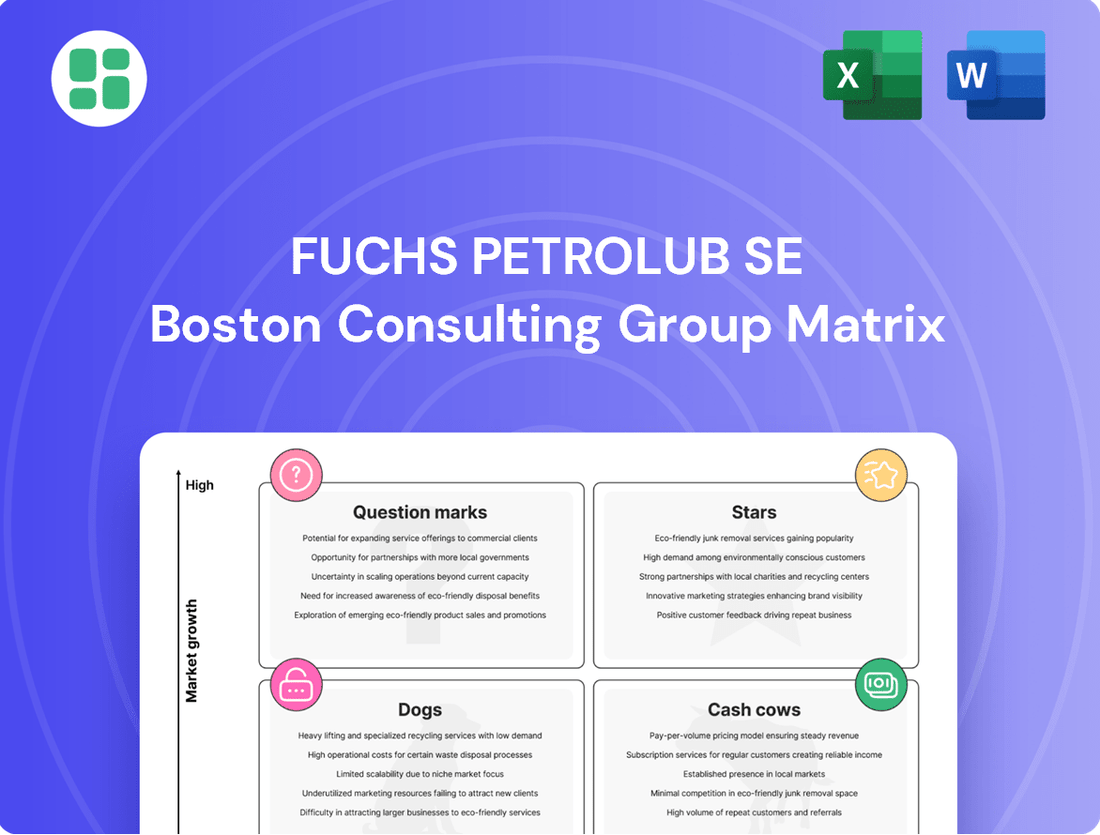

Curious about Fuchs Petrolub SE's strategic product positioning? Our BCG Matrix preview offers a glimpse into their market performance, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the complete picture; purchase the full report for a detailed breakdown and actionable insights to guide your investment decisions.

Stars

Fuchs Petrolub SE is strategically positioned in the burgeoning e-mobility lubricants market, often referred to as EV fluids. This sector is seeing significant expansion, fueled by the global surge in electric vehicle sales. For instance, the global EV market was projected to reach over 30 million units sold in 2024, a substantial increase from previous years.

These specialized fluids are indispensable for the distinct operational demands of EVs, necessitating superior thermal stability and advanced dielectric characteristics to protect electrical components. Fuchs is investing heavily in creating advanced formulations specifically for EV parts, including those made from aluminum, to enhance performance in areas such as noise dampening and effective thermal management.

High-Performance Industrial Lubricants are a key strength for Fuchs Petrolub SE, aligning with the industrial sector's projected rapid growth in the lubricants market. This expansion is fueled by increasing automation and technological upgrades across various industries. Fuchs' commitment to research and development, evidenced by significant R&D investment, positions it to capitalize on this trend by offering specialized lubricants that enhance machinery efficiency and longevity.

Bio-based and sustainable lubricants are a growing segment, fueled by increasing environmental awareness and stricter regulations. Fuchs Petrolub SE is actively investing in this sector, recognizing its importance for industries such as agriculture, marine, and general industrial machinery. These lubricants offer biodegradability and a reduced environmental footprint, aligning perfectly with current market demands and promising future expansion.

Lubricants for Asia-Pacific Market

The Asia-Pacific region, a powerhouse of industrialization, has been a significant growth engine for Fuchs Petrolub SE. China and India, in particular, stand out for their expanding lubricants demand, directly benefiting Fuchs' strategic positioning. The company has reported robust business development and substantial earnings growth within this dynamic area.

Fuchs Petrolub SE's success in Asia-Pacific is largely attributed to its effective local-to-local strategy, enabling tailored solutions for regional needs. The company's specialty lubricants business in China has seen notable expansion, contributing significantly to overall performance. This focus allows Fuchs to tap into the burgeoning manufacturing sectors and infrastructure development across these key economies.

- Asia-Pacific Lubricants Market Growth: The region is a key driver for the global lubricants market, with China and India leading the expansion.

- Fuchs Petrolub SE Performance: The company has achieved strong business development and increased earnings in Asia-Pacific, reflecting successful market penetration.

- Strategic Advantage: Fuchs' local-to-local approach and focus on specialty products in China are crucial for capitalizing on regional industrial growth.

- Future Outlook: Continued industrialization and manufacturing expansion in Asia-Pacific are expected to sustain demand for Fuchs' lubricant solutions.

Electrolytes for Battery Market

Fuchs Petrolub SE's strategic entry into the battery market with its investment in E-Lyte Innovations GmbH and the September 2024 opening of an electrolyte production plant in Kaiserslautern marks a significant diversification. This move places Fuchs directly into the rapidly expanding world of battery technology, specifically focusing on electrolytes, which are vital for high-performance lithium-ion batteries. The global market for battery electrolytes is projected for substantial growth, driven by the surge in electric vehicle adoption and energy storage solutions.

Electrolytes are fundamental to the functioning of lithium-ion batteries, enabling the movement of ions between the anode and cathode. Fuchs's venture into this area represents a departure from its traditional lubricants business, tapping into a sector experiencing exponential demand. By September 2024, the Kaiserslautern plant was operational, signaling Fuchs's commitment to this new, high-potential market segment.

- Market Entry: Fuchs Petrolub SE entered the battery market by investing in E-Lyte Innovations GmbH.

- Production Facility: An electrolyte production plant was opened in Kaiserslautern in September 2024.

- Product Significance: Electrolytes are crucial components for high-performance lithium-ion batteries, particularly for e-mobility.

- Market Outlook: This strategic move positions Fuchs in a globally expanding market with significant future potential, driven by the electric vehicle revolution.

Fuchs Petrolub SE's e-mobility lubricants and its new venture into battery electrolytes represent significant growth opportunities, positioning them as potential Stars in the BCG matrix. The increasing demand for electric vehicles, with global sales projected to exceed 30 million units in 2024, directly fuels the need for specialized EV fluids. Furthermore, the company's strategic investment in E-Lyte Innovations and the September 2024 opening of an electrolyte production plant in Kaiserslautern places them at the forefront of the rapidly expanding battery technology sector, a critical component for the e-mobility revolution.

| Business Segment | Market Attractiveness | Relative Market Share | BCG Classification |

|---|---|---|---|

| E-mobility Lubricants (EV Fluids) | High (driven by EV sales growth) | Growing | Star |

| Battery Electrolytes | Very High (driven by EV and energy storage) | Emerging/Growing | Star |

| High-Performance Industrial Lubricants | High (driven by automation and tech upgrades) | Strong/Established | Cash Cow/Star |

| Bio-based & Sustainable Lubricants | High (driven by environmental awareness) | Growing | Question Mark/Star |

What is included in the product

This BCG Matrix analysis of Fuchs Petrolub SE offers strategic insights into its product portfolio, highlighting which business units to invest in, hold, or divest based on market share and growth.

A clear BCG Matrix visualizes Fuchs Petrolub SE's portfolio, easing strategic decision-making by highlighting growth and market share.

This simplified matrix offers a quick, actionable overview of business units, alleviating the pain of complex portfolio analysis.

Cash Cows

Fuchs Petrolub SE's Conventional Industrial Lubricants are firmly positioned as Cash Cows. As the world's largest independent lubricant provider, Fuchs leverages its extensive industrial lubricant range, which caters to established sectors like manufacturing, energy, and construction.

These mature markets offer reliable, consistent cash flow due to stable demand. Despite moderate growth in these segments, Fuchs' significant market share and loyal customer network ensure ongoing profitability and a strong cash-generating capability for the company.

Traditional automotive lubricants for internal combustion engines (ICE) remain a cornerstone for Fuchs Petrolub SE, representing nearly half of its total sales. This mature segment, despite the ongoing transition to electric vehicles, continues to be a robust cash generator for the company.

Fuchs enjoys a commanding market share within this established sector, allowing it to benefit from significant and consistent cash flow. The established demand for these products means that the need for extensive promotional and placement investments is considerably lower.

Metalworking fluids represent a cornerstone of Fuchs Petrolub SE's industrial lubricants portfolio, a sector where the company commands a significant market share. This established position ensures a steady and predictable revenue stream, making them a classic cash cow. The demand from manufacturing and metal processing industries remains robust, providing a reliable contribution to Fuchs' overall financial performance.

In 2024, the industrial lubricants segment, which includes metalworking fluids, continued to be a vital contributor to Fuchs Petrolub's profitability. While specific figures for metalworking fluids alone are not always broken out, the broader segment demonstrates consistent demand. Fuchs' strategy for these mature product lines typically involves optimizing operational efficiency and maintaining market leadership, rather than substantial investment in rapid expansion.

Lubricating Greases

Fuchs Petrolub's lubricating greases represent a classic Cash Cow within their Business Growth Matrix. The company boasts an extensive portfolio, catering to a wide spectrum of industrial needs, from general-purpose applications to specialized high-temperature and food-grade requirements.

These essential products underpin the smooth functioning and upkeep of machinery across numerous mature industries. This consistent demand translates into a reliable and predictable revenue stream for Fuchs. Their widespread adoption and established market presence solidify their position as a stable cash generator.

- Product Diversity: Fuchs offers a comprehensive range of greases, including multi-purpose, high-temperature, and food-grade varieties.

- Mature Market Demand: Lubricating greases are critical for machinery operation and maintenance in established industrial sectors.

- Stable Revenue Generation: The broad utility and consistent demand for these products ensure a steady and predictable cash flow.

- Industry Reliance: Fuchs' greases are integral to various industries, highlighting their essential nature and market penetration.

Standard Hydraulic Oils

Standard hydraulic oils represent a core Cash Cow for Fuchs Petrolub SE. This segment is a cornerstone of the industrial lubricants market, where Fuchs holds a significant position. The consistent and high-volume demand for these essential fluids across numerous industries underscores their stable, low-growth, yet highly profitable nature.

Fuchs' leadership in industrial lubricants is directly supported by the reliable performance of its standard hydraulic oils. In 2024, the global industrial lubricants market was valued at approximately $70 billion, with hydraulic fluids accounting for a substantial portion of this. Fuchs' established market share in this segment ensures a steady revenue stream, contributing significantly to the company's overall financial stability.

- Market Dominance: Fuchs is a leading global supplier of industrial lubricants, with hydraulic oils being a key product category.

- Consistent Demand: These oils are critical for the operation of machinery in sectors like manufacturing, construction, and agriculture, ensuring a steady demand.

- Profitability: Despite low growth, the high volume and established market position of standard hydraulic oils provide a consistent and reliable profit margin for Fuchs.

- Financial Contribution: In 2023, Fuchs Petrolub reported total sales of €3.7 billion, with its Industrial division, which heavily features hydraulic oils, being a significant contributor.

Fuchs Petrolub SE's traditional automotive lubricants, particularly those for internal combustion engines, are prime examples of Cash Cows. Despite the automotive industry's shift towards electrification, these products continue to represent a significant portion of Fuchs' sales, nearly half, demonstrating their enduring market presence and profitability. The company's substantial market share in this mature segment ensures a consistent and reliable cash flow, requiring minimal incremental investment for maintenance and continued sales generation.

Metalworking fluids and standard hydraulic oils also firmly reside in the Cash Cow category for Fuchs Petrolub. These industrial lubricants are vital for machinery operation across numerous established sectors, guaranteeing a steady demand. Fuchs' leading position in these markets translates into predictable revenue streams and healthy profit margins, as they benefit from economies of scale and established customer relationships. The company's strategy for these products focuses on operational efficiency and market leadership rather than aggressive expansion.

Fuchs' lubricating greases further solidify their Cash Cow status. Their extensive range, covering diverse industrial applications from general use to specialized high-temperature and food-grade needs, ensures broad market penetration. The essential nature of greases for machinery upkeep in mature industries provides a consistent and predictable revenue stream, underpinning Fuchs' financial stability. In 2023, Fuchs Petrolub's Industrial division, which encompasses many of these Cash Cow products, was a significant contributor to their €3.7 billion in total sales.

| Product Category | BCG Matrix Status | Key Characteristics | 2024 Relevance/Data |

| Traditional Automotive Lubricants (ICE) | Cash Cow | Mature market, high market share, stable demand, significant sales contributor. | Represents nearly half of total sales; benefits from established demand despite EV transition. |

| Metalworking Fluids | Cash Cow | Cornerstone of industrial lubricants, significant market share, robust demand from manufacturing. | Continued vital contributor to profitability in 2024; focus on operational efficiency. |

| Standard Hydraulic Oils | Cash Cow | Core industrial lubricant, consistent high-volume demand, profitable, low-growth segment. | Global industrial lubricants market valued ~$70 billion in 2024, hydraulic oils a substantial part; Fuchs holds established share. |

| Lubricating Greases | Cash Cow | Extensive portfolio, essential for machinery upkeep, broad industrial use, stable revenue. | Integral to various industries, ensuring steady cash flow; part of the significant Industrial division sales. |

Full Transparency, Always

Fuchs Petrolub SE BCG Matrix

The preview you see is the exact Fuchs Petrolub SE BCG Matrix report you will receive upon purchase, offering a complete and unwatermarked analysis ready for immediate strategic application. This comprehensive document, meticulously crafted for clarity and professional use, provides an in-depth look at Fuchs Petrolub's product portfolio within the BCG framework. You can confidently expect this same, fully formatted report to be delivered directly to you, empowering your decision-making processes without any need for further editing or revision.

Dogs

In the realm of highly commoditized mineral oil-based lubricants, Fuchs Petrolub SE likely finds itself in a challenging position within the BCG matrix. These products, characterized by their undifferentiated nature and intense price competition, often struggle to command premium pricing, leading to thinner profit margins. For example, the global lubricants market, while vast, sees significant pressure on basic formulations. In 2024, the automotive lubricants segment, a major user of mineral oils, continued to face intense competition from both established players and new entrants, impacting overall profitability for commoditized offerings.

Certain older lubricant formulations within Fuchs Petrolub SE's portfolio, perhaps those not updated to meet the latest API or ACEA specifications, could be categorized as Dogs. These might include legacy industrial oils or automotive lubricants that have seen declining market share as newer, higher-performance alternatives emerge. For example, if a specific industrial lubricant line saw a sales decrease of over 15% in 2024 compared to 2023, it might be a candidate for this classification.

Fuchs Petrolub SE may hold a small share in highly specialized, niche applications within industries that are no longer growing, or are even shrinking. These areas typically see very little innovation and demand remains flat, offering minimal prospects for expansion.

These specific segments often require resources but yield little in terms of profits, making them prime candidates for either being sold off or receiving only the bare minimum of investment to maintain operations.

For instance, if Fuchs has a low market share in lubricants for older, specialized manufacturing equipment that is being phased out, this would represent an underperforming niche.

Certain Automotive Aftermarket Segments in Europe

Certain automotive aftermarket segments in Europe, particularly those catering to internal combustion engines, are facing a challenging environment. Subdued demand and weak industrial output in the region have directly impacted these areas. For Fuchs Petrolub SE, segments within this market where they may not possess a strong competitive advantage or hold a low market share would be classified as Dogs.

These segments are characterized by low growth prospects and limited market penetration, making them less attractive for investment and resource allocation. The ongoing shift towards electric mobility further exacerbates the decline in demand for traditional internal combustion engine parts and lubricants.

- Low Market Growth: The European automotive aftermarket for internal combustion engine components is experiencing stagnant or declining growth rates.

- Weak Industrial Output: Reduced manufacturing and economic activity in Europe directly correlates with lower demand for vehicle maintenance and parts.

- Low Market Share: Segments where Fuchs Petrolub SE has not established a dominant position are particularly vulnerable to the overall market slowdown.

- Competitive Pressures: Intense competition, coupled with evolving vehicle technologies, puts pressure on profitability in these mature or declining segments.

Challenged Product Mix in Americas

Fuchs Petrolub SE has identified a challenged product mix in the Americas as a significant hurdle. This situation points to certain product categories or specific regional sub-segments within North and South America that are likely performing as dogs in the BCG matrix. These segments are characterized by low market share and profitability.

The company has explicitly stated that unfavorable product mix and tariff pressures in the Americas negatively impacted its Earnings Before Interest and Taxes (EBIT). This financial impact underscores the difficulties faced in these markets. For instance, in 2024, Fuchs reported that the Americas region faced particular headwinds, contributing to a more challenging operational environment compared to other segments.

- Challenged Product Mix: The company's product portfolio in the Americas is not resonating as strongly as desired, leading to underperformance in certain areas.

- Tariff Pressures: Import duties and trade regulations in the Americas have added to operational costs and reduced profitability for specific product lines.

- EBIT Impact: These combined factors resulted in a noticeable negative effect on the company's earnings before interest and taxes for the region.

- Low Market Share & Profitability: Segments within the Americas are likely exhibiting characteristics of 'dogs' – low growth, low market share, and consequently, low profitability.

Products classified as Dogs within Fuchs Petrolub SE's portfolio are those with low market share in low-growth industries. These offerings typically require significant resources to maintain but generate minimal returns, often due to intense competition and commoditization. In 2024, the global lubricants market continued to see price pressures on basic formulations, particularly in the automotive sector, impacting the profitability of such products.

Legacy lubricant formulations that haven't been updated to meet current industry standards can also fall into the Dog category. These might include older industrial oils or automotive lubricants that have lost market share to newer, higher-performance alternatives. For example, a specific industrial lubricant line experiencing a sales decline of over 10% year-over-year in 2024 would be a strong candidate for this classification.

Fuchs Petrolub SE may also have Dog products in niche applications within industries experiencing decline. These segments offer limited growth prospects and minimal innovation, making them unattractive for further investment. For instance, lubricants for older, specialized manufacturing equipment that is being phased out would represent an underperforming niche.

The company's challenged product mix in the Americas, as highlighted in their 2024 reports, indicates segments with low market share and profitability, fitting the Dog profile. Tariff pressures and an unfavorable product mix in this region negatively impacted their EBIT, underscoring the difficulties in these underperforming areas.

Question Marks

Fuchs Petrolub SE is strategically shifting its focus from solely selling lubricants to offering comprehensive digital lubrication management services. This evolution is driven by the increasing demand from industries for enhanced lubricant performance and proactive maintenance strategies, positioning these digital offerings as a significant growth avenue.

These digital services, while representing a high-growth potential for Fuchs, are likely in their nascent stages of market penetration. As new business models, they require substantial investment to build market share and achieve widespread industry adoption, characteristic of a question mark in the BCG matrix.

Fuchs Petrolub SE's strategy for expanding into new emerging geographic markets aligns with the characteristics of "Question Marks" in the BCG matrix. These markets, while offering high growth potential, typically see Fuchs initially holding a low market share due to the challenges of establishing a presence.

For instance, Fuchs' stated aim for above-average growth in Asia-Pacific and the Americas, coupled with efforts to penetrate emerging markets, implies a significant investment in these less-developed territories. This investment is crucial for building brand recognition and distribution networks from the ground up, a common trait of Question Mark ventures.

While specific 2024 data on market share in entirely new emerging territories is not yet widely published, Fuchs' consistent investment in global expansion, including a reported capital expenditure of €351 million in 2023, underscores their commitment to nurturing these high-potential, but currently low-share, markets.

Fuchs Petrolub SE is actively exploring specialized lubricants for burgeoning advanced manufacturing sectors beyond e-mobility, such as semiconductors and advanced robotics. These high-tech applications demand unique lubricant formulations to ensure optimal performance and longevity.

While Fuchs is investing in research and development for these future solutions, their market share in these nascent, high-growth niches is likely still developing as the technologies themselves mature and gain wider industrial acceptance. For instance, the global semiconductor manufacturing equipment market, a key area for specialized lubricants, was projected to reach over $100 billion in 2024, indicating significant growth potential.

Developing these advanced lubricants requires substantial investment in research and development, along with dedicated market development efforts to establish a strong foothold. The company’s strategic positioning in these areas will be critical for future growth, mirroring the trajectory of other specialized chemical markets.

Recently Acquired Businesses in Growth Niches

Fuchs Petrolub SE has strategically expanded its portfolio through acquisitions in promising growth sectors. Notable examples include the acquisition of LUBCON and STRUB in 2024, and BOSS and IRMCO in 2025. These moves are designed to bolster external growth by integrating businesses operating in high-potential market niches.

The successful integration of these newly acquired entities is crucial for their contribution to Fuchs' overall market share. While these businesses operate in growth niches, their full potential is still being realized as they are assimilated into the Fuchs brand. Strategic investments are necessary to ensure these acquisitions transition from potential stars to established cash cows, avoiding the risk of becoming dogs.

- Acquisition of STRUB in 2024: This move aimed to strengthen Fuchs' position in specialized lubrication solutions.

- Acquisition of IRMCO in 2025: This acquisition targets the growing market for metalworking fluids, a key growth niche.

- Strategic Investment Required: Ongoing investment is vital for the successful integration and market penetration of acquired businesses.

- Growth Niche Focus: Acquisitions like these are key to Fuchs' strategy of capturing market share in high-demand, specialized lubricant segments.

Newly Developed Bio-based Lubricant Formulations (Early Stage)

Fuchs Petrolub's newly developed bio-based lubricant formulations, while part of a growing 'Star' category, can be considered question marks in their early stages. These innovative products target niche, emerging applications, placing them in a high-growth market but requiring significant investment to gain traction and market share.

These early-stage bio-based lubricants represent a high-potential but unproven segment for Fuchs. The global bio-lubricants market is projected to reach USD 12.5 billion by 2027, growing at a CAGR of 7.2%, highlighting the growth opportunity. However, these specific formulations require substantial marketing and customer education to overcome adoption barriers and establish a strong market position.

- High Growth Potential: The overall bio-lubricant market shows strong upward trajectory, indicating a favorable environment for these new formulations.

- Market Uncertainty: Early-stage development means these specific products may not yet have proven market acceptance or a clear path to high market share.

- Investment Required: Significant marketing, sales, and potentially R&D investment will be necessary to drive customer adoption and achieve scale.

- Strategic Focus: Fuchs must carefully manage these question marks, deciding whether to invest further to turn them into stars or divest if they fail to gain momentum.

Fuchs Petrolub SE's expansion into new geographic markets, particularly emerging economies, exemplifies a classic Question Mark scenario. These regions offer substantial growth prospects, but Fuchs often begins with a relatively low market share due to the inherent challenges of establishing operations and brand recognition in unfamiliar territories.

The company's strategic focus on achieving above-average growth in areas like Asia-Pacific and the Americas, as well as its commitment to penetrating less-developed markets, necessitates significant upfront investment. This investment is crucial for building essential infrastructure, distribution networks, and brand awareness from the ground up, a hallmark of Question Mark ventures.

Fuchs Petrolub's 2023 capital expenditure of €351 million underscores its dedication to nurturing these high-potential, low-share markets. While specific 2024 market share data for entirely new emerging territories is still emerging, this investment signals a clear strategy to cultivate these areas into future revenue drivers.

Fuchs is also actively developing specialized lubricants for advanced manufacturing sectors like semiconductors and robotics. While these niches present high growth potential, Fuchs' market share is likely still developing as these technologies mature and gain broader industrial acceptance. The global semiconductor manufacturing equipment market, for instance, was projected to exceed $100 billion in 2024, signaling substantial growth opportunities for specialized lubricants.

| Area of Focus | Market Growth Potential | Fuchs Market Share | Strategic Consideration |

|---|---|---|---|

| Emerging Geographic Markets | High | Low to Moderate | Requires significant investment in infrastructure and brand building. |

| Advanced Manufacturing Lubricants (e.g., Semiconductors) | Very High | Developing | Investment in R&D and market development is critical for penetration. |

| Bio-based Lubricant Formulations | High | Nascent | Needs substantial marketing and customer education for adoption. |

BCG Matrix Data Sources

Our BCG Matrix is built on comprehensive data, incorporating Fuchs Petrolub SE's financial reports, market share analysis, and industry growth forecasts to provide strategic clarity.