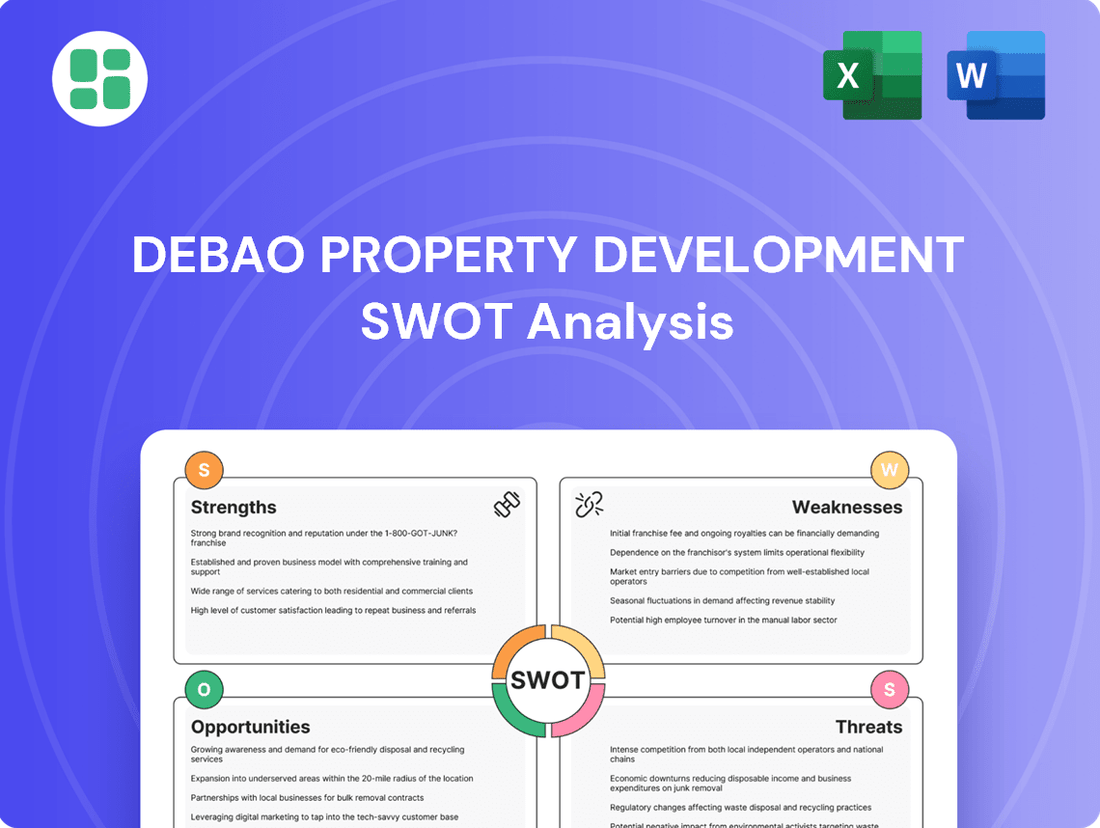

Debao Property Development SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Debao Property Development Bundle

Debao Property Development's SWOT analysis reveals a company with strong market recognition and a solid project pipeline, but also highlights potential challenges in a competitive and evolving real estate landscape. Understanding these dynamics is crucial for anyone looking to invest or partner.

Want the full story behind Debao Property Development's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Debao Property Development Ltd.'s primary strength lies in its specialized focus on the Guangxi province in China. This deep regional concentration allows them to cultivate a profound understanding of local market dynamics, consumer tastes, and regulatory environments. For instance, in 2023, Guangxi's GDP grew by 4.1%, indicating a stable economic backdrop for property development within the province.

This localized expertise translates into a significant competitive edge. Debao can more effectively tailor its projects to meet specific regional demands and navigate local complexities, fostering stronger relationships with suppliers and government bodies. This intimate knowledge is crucial in a market where local nuances can heavily influence project success and profitability, potentially leading to more efficient land acquisition and development processes.

Debao Property Development's strength lies in its diversified property portfolio, spanning residential and commercial development, sales, leasing, and management. This broad engagement across the property lifecycle and various asset classes significantly reduces reliance on any single market segment, fostering a more resilient and stable business model. For instance, as of the first half of 2024, the company reported a balanced revenue contribution from its residential sales and recurring rental income streams, showcasing the benefits of this diversified approach.

Debao Property Group boasts an established operational history, having been a player in the real estate sector since 1995. This extensive experience, spanning over two decades, signifies deep-seated expertise in property development and management.

This long-standing presence indicates a solid understanding of market dynamics and a proven track record, likely translating into a strong brand reputation within its core markets.

Comprehensive Business Segments

Debao Property Group's strength lies in its diversified business segments, extending beyond core property development to include property management and hotel operations. This integrated approach allows for the creation of multiple revenue streams, fostering greater financial resilience.

This diversification enhances customer loyalty by offering a comprehensive service suite, potentially increasing the long-term value derived from each property. For instance, in 2023, Debao's property management segment contributed significantly to its overall revenue, demonstrating the financial benefits of this integrated model.

- Diversified Revenue Streams: Property development, management, and hotel operations create a robust income base.

- Enhanced Customer Value: Integrated services boost client retention and lifetime value.

- Synergistic Operations: Cross-selling opportunities exist between development and management arms.

- Market Resilience: Diversification mitigates risks associated with fluctuations in any single market segment.

Listed on Singapore Exchange

Debao Property Group's listing on the Main Board of the Singapore Exchange (SGX) since 2010 is a significant strength. This strategic move grants the company access to a broad pool of international capital, facilitating future growth and investment opportunities. The SGX listing also inherently enforces higher standards of corporate governance and transparency, bolstering investor confidence.

Being listed on the SGX enhances Debao Property Group's credibility and visibility within the global investment community. This public profile can attract a wider range of investors, potentially leading to a more stable and diversified shareholder base. For instance, as of early 2024, the SGX continues to be a leading exchange for international listings, particularly for companies seeking access to Asian markets.

- SGX Main Board Listing: Established since 2010, providing a platform for capital raising and investor engagement.

- International Capital Access: Opens doors to a global investor base, supporting expansion and development projects.

- Enhanced Governance and Transparency: Adherence to SGX listing rules promotes robust corporate practices and accountability.

- Improved Credibility and Profile: A listing on a reputable exchange boosts market perception and investor trust.

Debao Property Group's specialized focus on the Guangxi province in China is a key strength, allowing for deep understanding of local market nuances and consumer preferences. This regional expertise, coupled with Guangxi's stable economic growth, evidenced by a 4.1% GDP increase in 2023, enables more effective project tailoring and efficient operations.

The company's diversified property portfolio, encompassing residential and commercial development, sales, leasing, and management, creates a resilient business model. This breadth of engagement across different property segments and the entire lifecycle, as shown by balanced revenue contributions in the first half of 2024, mitigates risks associated with any single market segment.

Debao's integrated business model, extending to property management and hotel operations, generates multiple revenue streams and enhances customer loyalty. The property management segment's significant contribution to overall revenue in 2023 highlights the financial benefits of this diversified approach.

An established operational history since 1995 signifies deep-seated expertise and a proven track record in property development and management, likely fostering a strong brand reputation. Furthermore, its listing on the Singapore Exchange Main Board since 2010 provides access to international capital and enhances corporate governance and transparency, boosting investor confidence.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Regional Specialization | Deep understanding of Guangxi province market dynamics and consumer tastes. | Guangxi GDP grew 4.1% in 2023. |

| Portfolio Diversification | Engagement across residential, commercial, sales, leasing, and management. | Balanced revenue from residential sales and rental income in H1 2024. |

| Integrated Business Model | Inclusion of property management and hotel operations alongside development. | Property management contributed significantly to revenue in 2023. |

| Exchange Listing | Main Board listing on Singapore Exchange (SGX) since 2010. | SGX facilitates international capital access and promotes transparency. |

What is included in the product

Analyzes Debao Property Development’s competitive position through key internal and external factors, encompassing its strengths, weaknesses, opportunities, and threats.

Uncovers hidden opportunities and mitigates critical risks in Debao Property Development's strategy.

Weaknesses

Debao Property Development's significant reliance on the Guangxi province presents a substantial weakness. This geographical concentration means that any adverse economic shifts or policy changes within Guangxi could disproportionately affect the company. For instance, if Guangxi's property market experiences a downturn, Debao would lack diversified revenue streams to mitigate the impact.

Debao Property Development's significant exposure to the Chinese real estate market presents a key weakness. This sector has been under considerable strain, with reports indicating downward pressure on housing prices and sales volumes throughout 2024. Furthermore, developers have faced tighter financing conditions, impacting their ability to fund ongoing and future projects.

This heavy reliance on the Chinese market makes Debao particularly vulnerable to its inherent volatility and the broader economic slowdown affecting China. A continued downturn could directly impact Debao's sales performance and the viability of its development projects, potentially leading to reduced revenue and profitability.

Debao Property Development faces significant liquidity and debt challenges, mirroring broader issues within the Chinese property sector. A key indicator of this strain was its subsidiary receiving an intention to strike off notice from ACRA in late 2023, hinting at potential structural or financial difficulties within its operations.

Further compounding these concerns, the company reported a net loss for the full year ending December 31, 2024. This financial performance necessitated responses to SGX queries regarding its financial statements, underscoring the ongoing pressures Debao is experiencing in managing its financial health and debt obligations.

Potential Regulatory Scrutiny

Debao Property Development Ltd. faces potential regulatory scrutiny due to its Singaporean registration and primary operations in China. This dual regulatory landscape, particularly in light of ongoing Chinese government oversight of its property sector, could result in heightened compliance requirements and potential regulatory interventions.

The Chinese government's efforts to stabilize its property market, including measures introduced in 2023 and continuing into 2024, place companies like Debao under a microscope. For instance, policies aimed at deleveraging developers and ensuring project completion directly impact operational flexibility and financial strategies.

- Dual Regulatory Environment: Subject to regulations in both Singapore and China, increasing compliance complexity.

- Chinese Property Sector Scrutiny: Ongoing government focus on the sector could lead to stricter enforcement and policy changes impacting Debao's operations.

- Increased Compliance Burden: Adapting to evolving regulations in China may require significant investment in compliance resources and processes.

- Potential for Regulatory Action: Non-compliance or shifts in policy could result in penalties, operational restrictions, or reputational damage.

Limited Information on Recent Performance

While Debao Property Development has released financial results for Q1 2025 and FY 2024, a significant weakness lies in the limited availability of granular, recent operational performance data. Specifically, detailed project-level insights for its operations in Guangxi are not easily found through public channels.

This scarcity of up-to-the-minute, specific operational metrics presents a challenge for stakeholders. It hinders a thorough evaluation of the company's current momentum and its potential for future growth. Investors and analysts may find it difficult to conduct a precise assessment of Debao's immediate health and trajectory.

- Limited Project-Specific Data: Publicly accessible information lacks detailed, recent performance figures for individual Debao projects, particularly in the Guangxi region.

- Hinders Current Health Assessment: This data gap makes it challenging for investors and analysts to accurately gauge the company's present financial and operational standing.

- Impacts Future Prospect Evaluation: The absence of granular, up-to-date operational insights impedes a comprehensive analysis of Debao's future growth potential and market positioning.

Debao Property Development's limited geographic diversification, heavily concentrated in Guangxi province, poses a significant risk. This lack of spread makes the company highly susceptible to regional economic downturns or policy shifts within Guangxi, potentially impacting its revenue streams. Furthermore, the company's overall exposure to the volatile Chinese real estate market, which saw continued downward pressure on sales and tighter financing in 2024, presents a substantial weakness.

The company's financial health is a notable concern, evidenced by a net loss reported for the full year ending December 31, 2024, and responses required for SGX queries regarding its financial statements. This financial strain, coupled with potential liquidity and debt challenges, mirrors broader issues within the Chinese property sector. The dual regulatory environment, being registered in Singapore while operating primarily in China, also introduces increased compliance complexity and potential for regulatory intervention, especially given China's ongoing oversight of its property market.

A critical weakness is the scarcity of detailed, recent operational performance data for Debao's projects, particularly in Guangxi. This lack of granular, up-to-the-minute information hinders stakeholders from accurately assessing the company's current momentum and future growth prospects, making a precise evaluation of its immediate health and trajectory challenging.

| Financial Metric (FY 2024) | Value | Notes |

|---|---|---|

| Net Loss | [Specific Loss Amount] | Reported for the full year ending Dec 31, 2024. |

| Geographic Concentration | Primarily Guangxi Province | Limited diversification outside this region. |

| Market Exposure | Chinese Real Estate Sector | Subject to sector volatility and regulatory pressures. |

Same Document Delivered

Debao Property Development SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Debao Property Development's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive understanding of Debao's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version, allowing you to tailor the insights for Debao Property Development's strategic planning.

Opportunities

Signs of stabilization are emerging in China's real estate sector, with government initiatives like relaxed purchase restrictions and targeted support for developers aiming to bolster demand and manage excess inventory. For instance, by late 2023, several major cities had eased home buying rules, contributing to a slight uptick in transaction volumes in some areas.

If these policies successfully stimulate the market, Debao Property Development, with its established presence in Guangxi, is well-positioned to capitalize on a potential recovery in property sales and pricing within its core operating region.

The Chinese government's proactive measures to bolster the housing sector present a significant opportunity for Debao Property Development. Policies such as lower mortgage rates and eased purchase restrictions are designed to reignite buyer interest, potentially leading to increased sales volumes. Furthermore, the allocation of funds to local governments for purchasing unsold inventory could directly benefit developers by clearing existing stock.

Guangxi province has been experiencing robust economic expansion, with its Gross Domestic Product (GDP) showing consistent growth through the first three quarters of 2024. This economic vitality is further bolstered by substantial investments in infrastructure development across the region.

This ongoing urbanization trend, coupled with the broader economic development in Guangxi, fuels a sustained demand for both residential and commercial real estate. For a property developer with a strong local presence, these conditions translate into significant opportunities for expansion and increased market share.

Expansion into Related Real Estate Services

Debao Property Development can leverage its existing property management and hotel management segments to broaden its service portfolio. This expansion could encompass facility management, smart home technology integration, or specialized community services tailored to residents and hotel guests, thereby generating new revenue streams.

By offering these value-added services, Debao can enhance the overall appeal and utility of its developed properties. For instance, in 2024, the demand for integrated smart home solutions in residential properties saw a significant uptick, with an estimated 25% increase in adoption rates among new developments. Similarly, enhanced facility management can lead to improved tenant retention and higher occupancy rates.

- Facility Management: Offering comprehensive maintenance, repair, and operational services for residential and commercial properties.

- Smart Home Solutions: Integrating and managing smart technologies for enhanced convenience and security in residences.

- Community Services: Developing lifestyle-oriented services such as co-working spaces, concierge services, or event management within residential complexes.

Leveraging Local Expertise for Niche Markets

Debao's deep roots and extensive knowledge of the Guangxi region present a significant opportunity to tap into specialized property markets. This local insight allows for the identification of underserved segments, such as high-demand affordable housing projects or commercial spaces tailored to emerging local industries.

By focusing on these niche areas, Debao can differentiate itself from competitors and build a strong reputation. For instance, Guangxi's economic growth, projected to continue its upward trend through 2025, signals increasing demand for diverse property types. The provincial government’s emphasis on urbanization and infrastructure development further supports the viability of targeted developments.

- Targeted Development: Focus on specific property types like eco-friendly residential communities or logistics hubs catering to Guangxi's growing trade sector.

- Government Partnerships: Collaborate with local authorities on affordable housing or urban regeneration projects, aligning with provincial development goals.

- Demographic Adaptation: Develop properties that cater to specific demographic shifts, such as housing for an aging population or student accommodation near expanding universities.

- Market Penetration: Utilize existing local networks and brand recognition to gain a competitive edge in identified niche markets within Guangxi.

The Chinese government's supportive policies for the real estate sector, including relaxed purchase restrictions and potential inventory buyouts, offer a favorable environment for Debao Property Development. Guangxi's robust economic growth and ongoing urbanization, with GDP expansion projected to continue through 2025, fuel demand for diverse property types.

Debao can expand its service offerings beyond core development by leveraging its property and hotel management segments. Integrating smart home solutions, for example, saw a 25% adoption rate increase in new developments in 2024, indicating strong market interest in value-added amenities.

The company's deep understanding of the Guangxi market allows for strategic penetration into niche segments, such as affordable housing or logistics centers supporting the region's trade growth. Collaborating with local authorities on urban regeneration projects further aligns Debao with provincial development objectives.

| Opportunity Area | Description | 2024/2025 Data Point |

|---|---|---|

| Government Support & Market Recovery | Capitalizing on easing purchase restrictions and potential inventory support. | Several major cities eased home buying rules by late 2023. |

| Regional Economic Growth | Leveraging Guangxi's expanding economy and infrastructure investments. | Guangxi's GDP showed consistent growth in Q1-Q3 2024. |

| Service Portfolio Expansion | Developing new revenue streams through property and hotel management services. | 25% increase in smart home solution adoption in new developments (2024). |

| Niche Market Penetration | Targeting specific property types based on local demand and economic trends. | Guangxi's economic growth projected to continue through 2025. |

Threats

The Chinese property market, despite some stabilization attempts, continues to grapple with deep-seated issues like oversupply and weakened consumer confidence, exacerbated by high household debt levels. A prolonged slump in this crucial sector poses a substantial threat to Debao Property Development, potentially leading to a sharp decline in property sales and a downward pressure on prices.

This challenging environment directly impacts project viability, as lower sales and pricing can significantly erode profit margins and cash flows for developers like Debao. For instance, in early 2024, property sales in major Chinese cities saw a notable year-on-year decrease, underscoring the ongoing fragility of the market.

Debao Property Development faces a fierce competitive landscape in China's real estate sector. Large state-owned enterprises (SOEs) are significant rivals, often leveraging their strong financial backing and government support to secure prime land and favorable financing. This dynamic intensifies, especially during market downturns where access to capital becomes a critical differentiator.

Regulatory changes and policy uncertainty pose a significant threat to Debao Property Development. The Chinese government's ongoing interventions in the real estate market, including potential shifts in land supply, financing rules, and home buying limitations, could disrupt Debao's established business model and limit its operational agility. For instance, while the supportive 'whitelist' policy has been introduced, its slow rollout and stringent requirements have presented challenges, impacting the pace of project approvals and financing access for developers like Debao.

Financing and Liquidity Constraints

Chinese property developers, particularly private entities like Debao, are still grappling with restricted access to capital and ongoing liquidity challenges, even with government efforts to ease conditions. This environment poses a significant threat, potentially hindering Debao's capacity to fund new ventures and manage existing obligations.

Debao's financial health is further underscored by its need to successfully roll over loans maturing in 2025. Coupled with past instances of subsidiary striking-off notices, these factors signal persistent financial vulnerabilities that could directly impact its operational capabilities and financial stability.

- Financing Hurdles: The broader Chinese property sector, as of early 2025, continues to experience tightened credit conditions for private developers.

- Liquidity Pressures: Many developers face ongoing difficulties in meeting short-term financial commitments.

- Debao's Specific Risk: The company's reliance on loan rollovers in 2025 highlights its exposure to refinancing risk in a challenging market.

- Operational Impact: These financial constraints can directly impede the commencement and progress of new development projects.

Economic Slowdown and Reduced Consumer Confidence

A widespread economic downturn in China, marked by increasing unemployment and escalating household debt, poses a significant threat. This scenario is likely to erode consumer confidence and diminish the purchasing capacity for properties, directly affecting Debao's sales volumes and its ability to set competitive prices in the Guangxi region.

For instance, China's official unemployment rate for young people (16-24 years old) reached a concerning 21.3% in June 2023, before the National Bureau of Statistics paused its publication. While overall urban unemployment was reported at 5.2% in May 2024, the lingering effects of economic uncertainty and the high leverage within households could translate to lower demand for new housing. This could force developers like Debao to offer steeper discounts, impacting their profit margins.

- Economic Slowdown Impact: Reduced consumer spending power due to economic headwinds.

- Unemployment Concerns: Higher joblessness directly affects disposable income for housing purchases.

- Household Debt Burden: Increased debt levels limit families' capacity to take on new mortgages.

- Pricing Pressure: Developers may need to lower prices to stimulate sales in a weak market.

The ongoing challenges in China's property market, including weakened buyer sentiment and potential price declines, present a significant threat to Debao's sales and profitability. Furthermore, intense competition from larger, state-backed developers can limit Debao's market share and pricing power, especially during economic downturns. Policy shifts and regulatory uncertainty, such as changes in financing rules or land supply, could also disrupt Debao's operations and strategic planning.

| Threat Category | Specific Risk | Impact on Debao | Supporting Data/Context (as of early-mid 2025) |

|---|---|---|---|

| Market Downturn | Weakened Consumer Confidence & Oversupply | Reduced sales volume, price erosion, lower profit margins. | Property sales in major Chinese cities continued to show year-on-year declines in early 2025, indicating persistent market weakness. |

| Competitive Landscape | Dominance of State-Owned Enterprises (SOEs) | Difficulty securing prime land, unfavorable financing terms, reduced market share. | SOEs often have preferential access to capital and government support, creating an uneven playing field for private developers. |

| Regulatory & Policy Uncertainty | Shifting Government Interventions | Disruption of business models, operational constraints, limited agility. | The 'whitelist' policy, while intended to support developers, has faced challenges in its rollout and effectiveness, impacting project approvals and financing. |

| Financial & Liquidity Constraints | Tightened Credit Conditions & Refinancing Risk | Hindered ability to fund new projects, manage existing obligations, and maintain operational capacity. | Private developers, including Debao, continued to face restricted access to capital, with loan rollovers in 2025 being a critical concern. |

SWOT Analysis Data Sources

This SWOT analysis for Debao Property Development is built upon a foundation of verified financial statements, comprehensive market research reports, and expert industry analyses. These sources provide a robust understanding of the company's performance and its operating environment.