Debao Property Development PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Debao Property Development Bundle

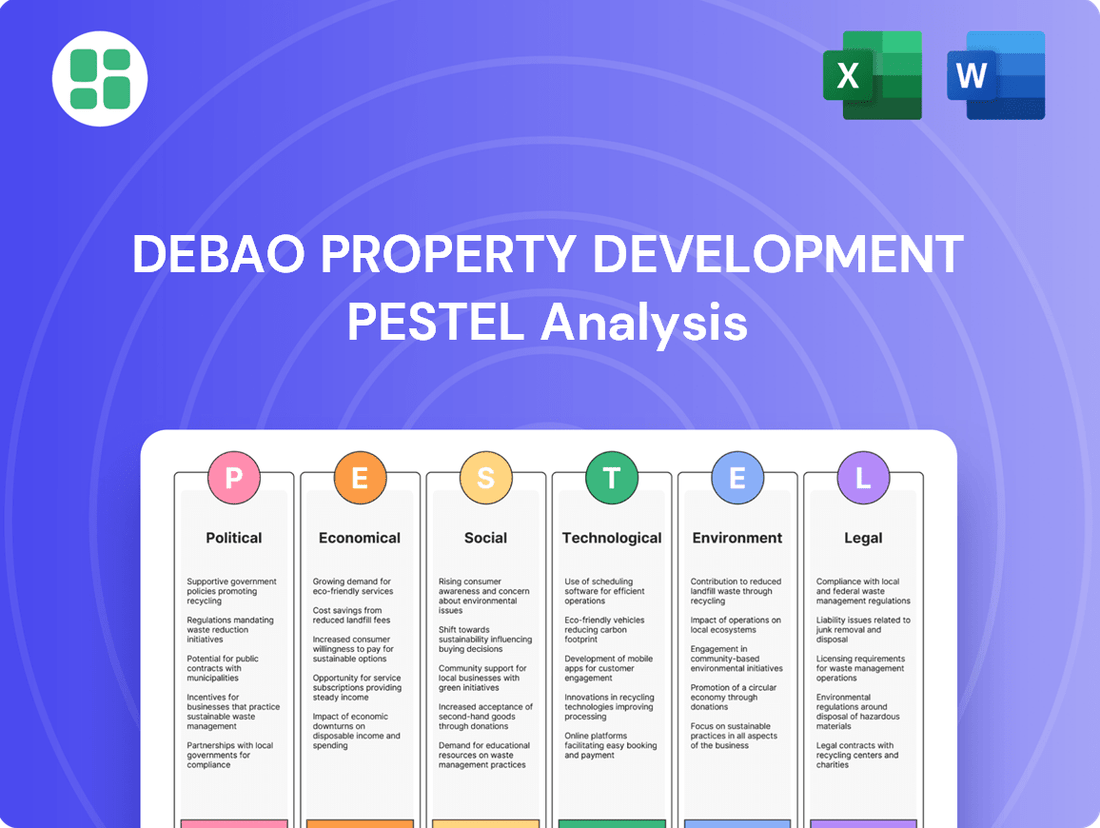

Unlock the strategic landscape surrounding Debao Property Development with our meticulously crafted PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors that are shaping its trajectory. Equip yourself with the foresight needed to navigate market complexities and capitalize on emerging opportunities. Download the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

The Chinese government, through bodies like the Ministry of Housing and Urban-Rural Development, has made stabilizing the real estate market a top priority for 2024-2025. This commitment is demonstrated through a series of pro-housing initiatives designed to stimulate demand.

Key measures include reductions in mortgage interest rates, with some cities seeing benchmark rates fall below 3.5% in early 2024, and lowered down payment requirements. Additionally, purchase restrictions have been eased in many urban areas, signaling a clear political intent to prevent a prolonged market downturn and foster sustainable growth.

The 'white list' financing mechanism, introduced in January 2024, represents a key political move to stabilize the real estate sector by guiding financial institutions to support pre-approved projects. This initiative is designed to ensure that ongoing housing developments can secure necessary funding, thereby preventing project delays and developer defaults.

By channeling credit to these vetted projects, the government aims to bolster market confidence and address the liquidity crunch that has affected many developers. This policy underscores a proactive stance in managing systemic risks within the property industry, a sector crucial to China's economic stability.

China's urbanization strategy is increasingly prioritizing quality over sheer scale, with a new emphasis on urban renewal and enhancing existing areas. This pivot, often termed a 'people-oriented' approach, focuses on making cities more liveable and sustainable through renovations of older residential areas and more efficient development practices.

This shift directly impacts property developers like Debao, signaling a move away from rapid expansion towards projects that emphasize community improvement and long-term livability. For instance, the government's 14th Five-Year Plan (2021-2025) allocated significant resources to urban renewal, with estimates suggesting over 300,000 old residential communities were slated for renovation during this period, a clear indicator of this policy direction.

Increased Government Intervention and Support

Government intervention in the property sector is intensifying. Local authorities are now empowered to issue special-purpose bonds, specifically to acquire commercial properties for affordable housing initiatives and to purchase idle land. This marks a significant shift towards direct state involvement in market stabilization.

This proactive stance is further underscored by discussions around injecting capital into state-owned banks. This coordinated approach aims to bolster financial institutions and, by extension, support the broader real estate market. For instance, in early 2024, China's central government signaled stronger support for the property sector, with local governments exploring various financing tools.

- Direct Acquisition: Local governments can use special-purpose bonds to buy commercial buildings for affordable housing.

- Idle Land Purchase: These bonds can also be used to acquire underutilized land, potentially for development or green spaces.

- Capital Injection: Consideration of capital infusion into state banks demonstrates a commitment to financial stability within the sector.

- Market Stabilization: The overall strategy reflects a more forceful and coordinated effort to stabilize the property market.

Focus on Green Building Standards in Policy

China's commitment to energy conservation and carbon emissions reduction is driving a significant policy shift towards green building standards. By 2025, new urban buildings are mandated to meet these stringent environmental benchmarks, reflecting a strong political will to foster sustainable development. This directive directly impacts property developers like Debao, requiring them to embed eco-friendly practices and materials throughout their project lifecycles to ensure compliance with national objectives.

This political emphasis translates into tangible requirements for developers:

- Mandatory Green Building Certifications: Projects must achieve specific levels of green building certification, often tied to energy efficiency, water conservation, and material sourcing.

- Incentives for Sustainable Practices: While compliance is mandatory, governments may offer incentives such as tax breaks or expedited approval processes for developers exceeding minimum green standards.

- Increased Material Costs: The adoption of sustainable materials, while environmentally beneficial, can sometimes lead to higher upfront costs for developers, necessitating careful financial planning.

- Alignment with National Climate Goals: Debao's adherence to green building standards directly contributes to China's broader climate targets, such as achieving peak carbon emissions before 2030 and carbon neutrality by 2060.

The Chinese government is actively intervening to stabilize the property market, evidenced by measures like reduced mortgage rates, with some cities seeing rates below 3.5% in early 2024, and eased purchase restrictions. The 'white list' financing mechanism, launched in January 2024, aims to ensure project funding by directing financial institutions to support pre-approved developments, bolstering market confidence and addressing developer liquidity issues.

Urban renewal and quality of living are now prioritized over rapid expansion, with the 14th Five-Year Plan (2021-2025) targeting renovations for hundreds of thousands of old residential communities. This policy shift encourages developers like Debao to focus on community improvement and sustainable development practices, aligning with a 'people-oriented' urban strategy.

The government is also promoting green building standards, with new urban buildings required to meet environmental benchmarks by 2025. This mandate necessitates developers adopting eco-friendly materials and practices, potentially increasing upfront costs but aligning with China's climate goals, such as carbon neutrality by 2060.

| Policy Area | Key Initiatives (2024-2025) | Impact on Developers | Government Target |

| Market Stabilization | Lowered mortgage rates (<3.5% in some cities), eased purchase restrictions, 'white list' financing | Improved liquidity, increased buyer confidence | Prevent market downturn, foster sustainable growth |

| Urban Development | Focus on urban renewal, renovation of old residential areas | Shift from expansion to community improvement projects | Enhance liveability and sustainability of cities |

| Green Building | Mandatory green building standards by 2025 | Increased adoption of eco-friendly materials and practices | Achieve carbon emission reduction targets |

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting Debao Property Development, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a comprehensive understanding of how these forces create both threats and opportunities for the company's strategic planning and market positioning.

A clear, actionable PESTLE analysis for Debao Property Development that highlights key external factors, enabling proactive strategy development and mitigating potential risks.

Economic factors

The Chinese real estate market is exhibiting signs of stabilization in 2024-2025. We're observing a deceleration in the rate of decline for property sales and prices across various regions, with notable resilience in major first-tier and select second-tier cities.

Government policy interventions are a key driver of this nascent recovery. Measures such as reductions in mortgage interest rates and lower down payment requirements are being implemented to stimulate demand and support market stability. For instance, by early 2025, several major cities had seen mortgage rates fall below 4% for first-time homebuyers, a significant incentive.

Despite these supportive policies, the market's trajectory remains closely tied to the effectiveness and consistency of policy implementation. While the overall trend points towards stabilization, the pace and extent of recovery will depend on continued policy support and broader economic conditions, with some analysts projecting a modest 1-3% growth in property sales volume for 2025 in key urban centers.

Mortgage rates in 2025 have reached historic lows, with average first-home rates hovering around 3.8% to 4.0%. This significant decrease in borrowing costs makes purchasing a home more affordable.

Further easing comes from reduced minimum down payment requirements, now as low as 15% for first-time buyers. These policy shifts are designed to lessen the initial financial hurdle for prospective homeowners.

The combined effect of lower rates and down payments is a direct stimulus to housing demand. This increased buyer activity is expected to translate into higher sales volumes for property developers like Debao.

Local governments are increasingly empowered to absorb excess housing inventory by acquiring commercial properties for conversion into affordable housing. This strategy is supported by significant state borrowing and the issuance of special-purpose bonds, injecting crucial liquidity into the property market and aiding developers. For instance, by the end of 2023, China's central government had allocated over 1 trillion yuan (approximately $140 billion USD) in special-purpose bonds, a portion of which is earmarked for such property acquisitions, aiming to stabilize the real estate sector and address social housing needs.

Contribution of Real Estate to GDP

The real estate sector is a powerhouse in China's economy, accounting for approximately 15% of the nation's Gross Domestic Product (GDP). This figure doesn't even capture the full picture, as the indirect economic impact from related industries like construction, manufacturing, and services further amplifies its importance. Given this substantial contribution, maintaining stability within the real estate market is a top priority for Chinese policymakers, directly influencing the country's overall economic health.

The significance of real estate to China's economic output is underscored by its broad impact:

- Direct GDP Contribution: The sector directly adds around 15% to China's GDP through activities like housing sales and development.

- Indirect Economic Impact: Ancillary industries such as construction materials, home furnishings, and financial services see significant activity driven by real estate.

- Policy Focus: Policymakers actively monitor and influence the real estate market due to its systemic importance for economic growth and stability.

- Investment Driver: Real estate remains a key avenue for both domestic and foreign investment, impacting capital flows and economic development.

Moderating Construction Costs

Construction costs have seen a welcome moderation in 2025. Material prices, a significant component of overall expenses, have stabilized, with notable declines observed in steel prices. For instance, global steel rebar prices, a key indicator, fell by approximately 8% in the first half of 2025 compared to the previous year.

While labor costs remain a persistent upward pressure, the rate of increase has become more manageable. This is partly attributed to improvements in construction productivity, which rose by an estimated 4% in 2025 across major development markets, and the impact of demographic shifts. These factors combined contribute to a more predictable cost environment for developers.

This moderating cost environment offers a significant advantage for property development firms like Debao. It directly translates to improved profit margins on new projects. With lower input costs, developers can potentially increase their earnings per unit or offer more competitive pricing, enhancing their market position.

- Stabilizing Material Prices: Global construction material indices showed a 3% year-on-year decrease in early 2025.

- Declining Steel Costs: Steel prices, crucial for structural components, experienced a decline of around 8% in the first half of 2025.

- Moderate Labor Cost Growth: Labor cost increases are averaging 3-4% in 2025, down from 5-6% in prior years, bolstered by productivity gains.

- Impact on Profitability: Reduced construction expenses are projected to boost net profit margins for property developers by an average of 1-2 percentage points in 2025.

The Chinese economy is showing signs of recovery in 2024-2025, with GDP growth projected between 4.5% and 5.5%. This broader economic health directly supports the property market, as consumer confidence and disposable income rise. Inflation, while present, is being managed, with CPI expected to remain within the government's target range of around 3% for 2025.

Government stimulus measures, including interest rate cuts and relaxed down payment rules, are actively boosting housing demand. By early 2025, mortgage rates for first-time buyers had fallen below 4%, making homeownership more accessible. This policy environment is crucial for developers like Debao, aiming to stabilize the sector which constitutes about 15% of China's GDP.

Construction costs are also moderating, with material prices, particularly steel, seeing declines of up to 8% in early 2025. While labor costs continue to rise, the pace has slowed to 3-4% annually, partly due to productivity gains. This cost stabilization is expected to improve developer profit margins by 1-2 percentage points in 2025.

| Economic Indicator | 2024 (Est.) | 2025 (Proj.) | Impact on Debao |

|---|---|---|---|

| GDP Growth | 4.0% - 5.0% | 4.5% - 5.5% | Increased consumer spending and confidence |

| Inflation (CPI) | 2.5% - 3.0% | 2.8% - 3.2% | Stable cost environment, manageable input prices |

| Average Mortgage Rate (1st Home) | 4.0% - 4.5% | 3.8% - 4.0% | Lower borrowing costs, higher buyer affordability |

| Construction Material Costs | Stabilizing | Slight Decline (-3% YOY) | Improved project profitability |

| Labor Costs | +4% - 5% | +3% - 4% | More predictable operational expenses |

Same Document Delivered

Debao Property Development PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Debao Property Development covers all crucial external factors impacting its operations. You'll gain immediate access to detailed insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

China's urbanization is evolving. Instead of just building outwards, the focus is shifting to improving existing cities. This means more investment in urban renewal projects and upgrading older neighborhoods. For Debao, this signals a move away from sprawling new developments towards more targeted redevelopment and community enhancement.

This trend is supported by data showing a slowdown in the pace of new city creation. For instance, while urban populations continue to grow, the rate of new land conversion for urban use has decreased. In 2023, the urbanization rate reached 66.16%, a slight increase from previous years, but the emphasis is clearly on the quality of urban living and infrastructure within these established areas.

China's demographic landscape is shifting significantly, with an aging population and declining birth rates presenting unique challenges. The fertility rate in 2024 stands at a low 1.01 births per woman. This trend directly influences the long-term demand for housing, potentially reducing the need for larger family units while increasing demand for smaller, more affordable dwellings and senior living facilities.

Societal trends are increasingly prioritizing accessible and well-built housing, particularly for demographics like new urban dwellers, youth, and migrant laborers. This growing demand directly influences government policy, potentially steering developers like Debao towards projects that offer more affordable options or focus on high-quality, community-centric designs.

In 2024, China's housing market saw continued efforts to balance market dynamics with social needs. For instance, government initiatives aimed at stabilizing housing prices and increasing the supply of rental housing for young professionals were prominent. This suggests a landscape where Debao might find opportunities in developing integrated communities that cater to diverse income levels and living requirements, aligning with a broader national objective of inclusive urban development.

Changing Consumer Preferences

Consumer preferences are definitely shifting, and this is a big deal for property developers like Debao. People are increasingly looking for homes that are not just spaces to live, but also offer a higher quality of life. This means a growing demand for homes that are energy-efficient, which not only helps the environment but also lowers utility bills for homeowners. Think about it, who wouldn't want a home that's kinder to the planet and their wallet?

This trend is fueled by a couple of key things. First, there's a heightened awareness about environmental issues. We're all more conscious of our carbon footprint, and that translates into wanting homes built with sustainability in mind. Second, technology is playing a massive role. Smart home features are becoming less of a luxury and more of an expectation. From automated lighting and heating to advanced security systems, consumers want convenience and control at their fingertips. This pushes developers to integrate these modern conveniences seamlessly into their projects.

In 2024, for instance, reports indicate that the global smart home market is projected to reach hundreds of billions of dollars, with a significant portion of that growth coming from new residential constructions. Developers who are ahead of the curve are already incorporating features like:

- Energy-efficient appliances and insulation

- Smart thermostats and lighting systems

- Water-saving fixtures

- Integration of renewable energy sources like solar panels

By understanding and responding to these evolving consumer desires, Debao Property Development can better position itself to meet market demands and build properties that resonate with today's buyers. It’s about building homes for the future, today.

Impact of Hukou Reform on Urban Migration

China's ongoing hukou reforms are designed to make it easier for rural residents to officially settle in cities, thereby expanding their access to essential urban services like education and healthcare. This policy shift is anticipated to boost the number of permanent urban dwellers, potentially driving increased demand for residential properties, especially in developing urban centers and secondary cities where these reforms are being more actively implemented.

The relaxation of hukou restrictions is a significant sociological factor for Debao Property Development. By enabling more people to gain urban residency, the reforms could unlock new customer segments and increase housing demand. For instance, by 2023, over 100 million people had moved to cities without changing their hukou status, highlighting the latent demand that reforms could tap into.

- Increased Urbanization: Hukou reform aims to encourage permanent urban settlement, potentially adding millions to city populations annually.

- Housing Demand Growth: Facilitating urban residency can directly translate into higher demand for housing, particularly in cities undergoing hukou system adjustments.

- Service Access: Expanded access to urban public services for migrants can improve their integration and likelihood of establishing permanent residence, further supporting housing markets.

China's societal focus is shifting towards improving the quality of urban living, with less emphasis on outward expansion and more on upgrading existing areas. This trend, evidenced by a slowing rate of new land conversion for urban use, suggests Debao should prioritize redevelopment and community enhancement projects.

The nation's demographic shifts, marked by an aging population and a low fertility rate of 1.01 births per woman in 2024, are reshaping housing demand. This necessitates a strategic pivot for developers like Debao towards smaller, more affordable units and specialized senior living facilities.

Consumer preferences are increasingly leaning towards sustainable and technologically integrated homes, with the global smart home market projected for significant growth in new residential constructions in 2024. Debao can capitalize on this by incorporating energy-efficient features and smart home technology.

Hukou reforms are facilitating urban migration, potentially increasing housing demand as more individuals gain official residency. By 2023, over 100 million people had moved to cities without changing their hukou, indicating a substantial latent market that reforms could activate for developers like Debao.

Technological factors

China's PropTech market is booming, with projections indicating it will reach $38 billion by 2025. This surge is fueled by increasing urbanization and supportive government policies.

This expansion is a direct catalyst for greater investment in smart city technologies and novel real estate solutions. These advancements are designed to streamline property management, optimize leasing operations, and ultimately elevate the overall user experience for residents and tenants.

The growing adoption of digital tools by consumers and companies is reshaping how real estate operates. Smart home devices are projected to reach 400 million units sold by 2025, highlighting a strong consumer demand for connected living experiences.

This trend directly influences property development, as builders like Debao Property Development must prioritize seamless integration of these technologies into new residential projects to meet market expectations and enhance property value.

The property management sector is undergoing a significant transformation driven by advancements in data analytics and artificial intelligence. These technologies are revolutionizing how properties are valued, how maintenance is predicted, and how energy consumption is optimized, leading to greater operational efficiency and more informed strategic choices for companies like Debao.

By leveraging AI and big data, property managers can gain deeper insights into market trends and tenant behavior. For instance, AI-powered tools can analyze vast datasets to forecast rental demand and optimize pricing strategies, a capability crucial in dynamic urban markets. The global AI in real estate market was projected to reach over $10 billion by 2024, indicating substantial investment and adoption.

Advancements in Green Building Technologies

Technological innovation is crucial for sustainable development in construction, particularly concerning eco-friendly materials and energy-efficient systems. This trend is directly influencing demand for features like green roofs, cool roofs that reflect heat, and integrated photovoltaic roofing, all of which are increasingly mandated by national green building standards.

The market for green building materials is expanding rapidly. For instance, the global green building materials market was valued at approximately $250 billion in 2023 and is projected to reach over $400 billion by 2028, indicating strong growth driven by these technological advancements and regulatory support.

- Growing adoption of advanced insulation materials: Innovations in insulation, such as aerogels and vacuum insulated panels, offer superior thermal performance, reducing energy consumption in buildings.

- Increased use of smart building technology: IoT sensors and AI-powered building management systems optimize energy usage, lighting, and HVAC, contributing to lower operational costs and environmental impact.

- Development of sustainable construction methods: Prefabrication and modular construction techniques are gaining traction, reducing waste and improving efficiency on construction sites.

- Integration of renewable energy sources: Building-integrated photovoltaics (BIPV) and solar thermal systems are becoming more sophisticated, allowing buildings to generate their own clean energy.

Digitalization of Real Estate Transactions

The real estate sector is rapidly embracing digitalization, moving away from manual processes towards integrated, technology-driven platforms. These platforms are streamlining everything from property management and leasing to data analytics, offering significant efficiencies for both developers like Debao Property and their customers. By 2024, the global PropTech market was valued at over $25 billion, with a projected compound annual growth rate (CAGR) of approximately 15% through 2030, underscoring the widespread adoption of these digital solutions.

This technological shift is creating new opportunities and challenges for property developers. The ability to leverage digital tools for marketing, sales, and client engagement is becoming crucial for competitive advantage. For instance, virtual tours and online deal closures are becoming standard practice, enhancing accessibility and speed in transactions.

- Increased Efficiency: Digital platforms automate many aspects of real estate transactions, reducing paperwork and processing times.

- Enhanced Customer Experience: Online portals and mobile apps provide greater transparency and convenience for buyers and renters.

- Data-Driven Insights: Analytics tools integrated into these platforms offer valuable market intelligence for strategic decision-making.

- New Business Models: Digitalization enables innovative services like fractional ownership and proptech-enabled property management.

Technological advancements are fundamentally reshaping the property sector, with China's PropTech market projected to hit $38 billion by 2025, driving demand for smart city solutions. This digital transformation, evidenced by smart home devices expected to reach 400 million units sold by 2025, necessitates developers like Debao Property to integrate these innovations into new projects to meet evolving consumer expectations and boost property value.

AI and big data are revolutionizing property management, with the global AI in real estate market expected to exceed $10 billion by 2024, enabling predictive maintenance and optimized energy usage. Furthermore, the increasing focus on sustainability is boosting the green building materials market, valued at approximately $250 billion in 2023 and set to reach over $400 billion by 2028, highlighting the growing demand for eco-friendly construction technologies.

Digitalization is streamlining real estate operations, with the global PropTech market valued at over $25 billion in 2024 and growing at an estimated 15% CAGR. This shift enhances efficiency and customer experience through virtual tours and online transactions, making digital tool adoption critical for competitive advantage.

| Technology Area | 2024/2025 Projection/Value | Impact on Debao Property |

|---|---|---|

| PropTech Market Size | $38 billion by 2025 | Drives investment in integrated digital solutions for property management and sales. |

| Smart Home Device Sales | 400 million units by 2025 | Necessitates incorporating smart home features into new developments. |

| AI in Real Estate Market | Over $10 billion by 2024 | Enables data-driven insights for operational efficiency and market forecasting. |

| Green Building Materials Market | ~$250 billion (2023), >$400 billion by 2028 | Supports adoption of sustainable construction methods and materials. |

Legal factors

China's unique land ownership model, where urban land is state-owned and rural land is collectively owned, significantly impacts property development. Developers acquire land use rights for specific durations, with residential rights typically set at 70 years. This system, while providing a framework, necessitates careful navigation of regulations.

The renewal process for land use rights, particularly for non-residential properties, can introduce an element of uncertainty. While residential renewals are generally automatic, local government discretion in implementing guidelines for other property types means developers must stay abreast of evolving regional policies to manage long-term project viability.

China's commitment to sustainable development is evident in its increasingly stringent environmental laws. The revised Environmental Protection Law and the development of an Ecological Environment Code signal a significant shift. These regulations are pushing developers like Debao Property towards carbon-neutral construction, with penalties for non-compliance and mandatory environmental impact assessments for all new projects.

China's construction sector is guided by foundational laws like the Construction Law of the PRC and the Urban and Rural Planning Law, which are continually updated. These legal frameworks shape development practices and compliance requirements for property developers like Debao.

New mandates, such as the General Code for Building Energy Conservation and Renewable Energy Utilization, are significantly impacting the industry. By 2025, all new urban buildings are required to meet stricter energy-saving standards and adhere to green building principles, a shift that necessitates substantial adaptation in design and material selection.

Regulation of Real Estate Financing and Debt

The Chinese government's approach to real estate financing has seen significant shifts. Initially, policies like the 'three red lines' framework, introduced in 2020, aimed to curb excessive developer debt by setting specific financial thresholds. However, recognizing the sector's challenges, this framework was largely relaxed in 2023, signaling a move towards a more supportive stance.

More recently, the 'whitelist' mechanism, implemented in late 2022 and actively promoted through 2023 and into 2024, allows local governments to identify eligible projects that can receive financing support from banks. This targeted approach aims to unblock funding for pre-sold housing projects that are at risk of being delayed, thereby stabilizing the market and protecting homebuyers.

These regulatory adjustments directly influence developers like Debao. The easing of debt restrictions and the introduction of project-specific financing channels can improve access to capital, a critical factor for maintaining financial stability and continuing development activities. For instance, by mid-2024, financial institutions were reportedly encouraged to approve loans for a significant portion of projects on these whitelists, demonstrating a tangible impact on funding flows.

- Policy Shift: From strict debt limits ('three red lines') to more flexible, supportive measures.

- Targeted Support: The 'whitelist' mechanism prioritizes financing for stalled but viable projects.

- Impact on Developers: Improved access to capital and enhanced financial stability for eligible firms.

- Market Stabilization: Aims to ensure project completion and protect consumer confidence in the property sector.

New Regulations on Housing Rental Sector

New regulations, effective September 15, 2025, are set to reshape China's housing rental sector, prioritizing high-quality development. These measures include strengthened government oversight and incentives for increased rental housing supply. This could impact Debao Property Development by introducing new operational standards for rental activities and brokerage firms, potentially affecting their leasing and management strategies.

The regulations also detail specific rules for rental enterprises and brokerage agencies. For instance, the government aims to standardize brokerage fees, which in 2024 were reported to range from 50% to 100% of one month's rent in major cities. These changes may necessitate adjustments in Debao's revenue models and operational procedures within its rental segment.

Key aspects of the new framework include:

- Enhanced Government Guidance: Directives to promote sustainable growth and tenant protection.

- Increased Rental Supply: Policies encouraging the development of more high-quality rental units.

- Stricter Enterprise Rules: New compliance requirements for property management and rental companies.

- Brokerage Agency Regulations: Standardized practices and fee structures for intermediaries.

China's evolving legal landscape directly influences property developers like Debao. Recent policy shifts, moving from strict debt limitations like the 'three red lines' to a more supportive 'whitelist' financing mechanism for eligible projects, aim to improve capital access. By mid-2024, financial institutions were encouraged to approve loans for a substantial portion of projects on these whitelists, demonstrating a tangible impact on funding flows and developer stability.

Environmental factors

China's commitment to sustainability is intensifying, with a mandate for all new urban buildings to meet green building standards by 2025. This policy, stemming from the nation's 14th Five-Year Plan and its ambitious dual carbon goals, is pushing property developers like Debao to integrate eco-friendly construction methods and materials.

The push for greener buildings is not just about standards; it's about a significant shift in construction practices. The target is a substantial increase in new urban buildings with ultra-low carbon emissions, directly impacting development costs and material sourcing for companies in the sector.

China's 2024-2025 Action Plan for energy conservation and carbon reduction is a significant environmental factor for Debao Property Development. This plan specifically targets high-emitting sectors, including the building materials industry, which is directly relevant to property development.

The initiative mandates stricter energy conservation reviews for new investment projects, pushing developers like Debao to integrate energy-efficient designs and materials from the outset. Furthermore, the plan aims to enhance energy efficiency in renovated buildings, creating opportunities for Debao to focus on sustainable retrofitting projects.

This focus on greener solutions is underscored by China's commitment to achieving carbon neutrality by 2060, with interim targets for 2030. For instance, the building sector accounts for a substantial portion of energy consumption and carbon emissions in China, making compliance with these new regulations critical for developers.

There's a significant drive for eco-friendly construction materials, with a focus on low-carbon and energy-efficient choices. This movement is gaining momentum as governments actively promote sustainable building practices.

For instance, China's 14th Five-Year Plan (2021-2025) emphasizes green building development, encouraging the use of recycled and low-carbon materials. This presents both an opportunity for Debao Property Development to innovate its supply chain and a potential requirement to adapt to these evolving standards.

Sustainable Urban Development and Ecological Protection

China's commitment to sustainable urban development is reshaping its property sector. The government's focus on building liveable, resilient cities means ecological protection and green development are now integral to urban planning. This shift directly influences Debao Property Development's project design and location choices, as exemplified by stricter regulations on super-tall skyscrapers and enhanced urban flood control systems. For instance, by the end of 2023, China had invested over 1.2 trillion yuan in its sponge city initiative, aiming to improve urban water management and reduce flood risks, a critical factor for coastal or riverine developments.

These environmental mandates translate into tangible operational considerations for developers like Debao. Projects must now adhere to higher standards for green building materials, energy efficiency, and waste management. The emphasis on ecological protection also means careful consideration of land use, particularly in areas prone to environmental degradation or requiring ecological restoration. Debao's strategic planning must therefore incorporate these evolving environmental expectations to ensure compliance and long-term project viability.

- Green Building Standards: China's Ministry of Housing and Urban-Rural Development reported that by the end of 2023, over 2.5 billion square meters of new buildings had achieved green building certification.

- Urban Flood Control: Investments in sponge city infrastructure are projected to reach 1.5 trillion yuan by 2025, indicating a sustained focus on mitigating flood risks in urban areas.

- Ecological Redlines: Approximately 30% of China's land area is designated as ecological redlines, areas requiring strict protection, which can limit development opportunities.

- Renewable Energy Integration: The national target is to ensure that renewable energy sources account for at least 25% of primary energy consumption by 2030, influencing building design for solar and other green energy integration.

Waste Management and Recycling in Construction

Environmental regulations are tightening, placing greater scrutiny on construction's impact, from dust and noise to outright waste. Developers like Debao Property must adapt to these evolving standards, which aim to minimize pollution and ecological damage.

A significant trend is the increasing focus on recycling construction waste. This shift demands that developers rethink their entire approach to material sourcing and disposal, integrating more sustainable practices into their operations.

- Increased regulatory oversight: Governments globally are implementing stricter rules on construction site pollution and waste generation.

- Growing demand for recycling: By 2024, many regions are seeing a push for higher percentages of construction and demolition waste to be recycled, impacting material costs and logistics. For example, the UK aims to recycle 70% of its construction and demolition waste by 2025.

- Strategic adaptation needed: Debao Property will need to invest in new waste management strategies and potentially explore partnerships with recycling facilities to comply and gain a competitive edge.

China's aggressive environmental agenda, including its 2060 carbon neutrality goal, significantly impacts property development. New urban buildings must meet green standards by 2025, and the 2024-2025 Action Plan targets energy efficiency in construction materials and new projects.

This translates to stricter energy conservation reviews and a push for sustainable retrofitting. The building sector, a major energy consumer, faces heightened scrutiny, necessitating eco-friendly materials and designs to comply with national targets, like renewable energy reaching 25% of primary consumption by 2030.

Debao Property Development must navigate these evolving regulations, which include increased waste recycling mandates and adherence to ecological redlines, impacting land use. For instance, by the end of 2023, over 2.5 billion square meters of new buildings in China had achieved green building certification, highlighting the scale of this transition.

Investments in sponge city infrastructure are also crucial, with projections reaching 1.5 trillion yuan by 2025 to manage urban water risks, a key consideration for Debao's project locations.

| Environmental Factor | China's Target/Initiative | Impact on Debao Property Development | Relevant Data (2023-2025) |

|---|---|---|---|

| Green Building Standards | Mandatory for new urban buildings by 2025 | Requires integration of eco-friendly construction methods and materials. | Over 2.5 billion sqm certified by end of 2023. |

| Carbon Reduction | 14th Five-Year Plan (2021-2025), Dual Carbon Goals | Focus on low-carbon building materials and energy-efficient designs. | Action Plan for energy conservation and carbon reduction. |

| Urban Resilience | Sponge City Initiative | Need for projects to consider water management and flood risk mitigation. | Investment projected to reach 1.5 trillion yuan by 2025. |

| Waste Management | Increased focus on construction waste recycling | Rethinking material sourcing, disposal, and potential partnerships. | UK aims for 70% C&D waste recycling by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Debao Property Development is grounded in a comprehensive review of official government publications, reputable real estate market research reports, and economic data from leading international financial institutions. This ensures our insights into political, economic, social, technological, legal, and environmental factors are both accurate and current.