Debao Property Development Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Debao Property Development Bundle

Debao Property Development faces significant competitive pressures, with moderate buyer power and a growing threat from substitute products in the real estate market. Understanding the intensity of these forces is crucial for navigating the industry landscape effectively.

The complete report reveals the real forces shaping Debao Property Development’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for essential resources like land, construction materials such as steel and cement, and skilled labor directly impacts their leverage over developers like Debao Property Development. In the dynamic Chinese real estate sector, local governments often hold significant sway over land availability, giving them considerable bargaining power.

While the market for construction materials might appear broad, a few dominant suppliers can command strong positions if they are the sole providers of specific quality standards or large volumes required by developers. This limited number of key providers for critical inputs amplifies their ability to influence pricing and terms for Debao.

The availability of substitutes for essential construction inputs significantly influences supplier bargaining power for Debao Property Development. If alternative materials like different types of concrete or timber are readily available and cost-effective, it weakens the leverage of traditional suppliers of steel or cement. For instance, in 2024, the global construction market saw increased adoption of pre-fabricated components and modular building techniques, offering alternatives to on-site material sourcing and potentially reducing reliance on single-source suppliers.

However, the situation becomes more complex with specialized components or advanced construction technologies. Suppliers of unique facade systems, high-efficiency HVAC units, or proprietary smart home technology might possess considerable power if few alternatives exist. Debao's ability to source these specialized items internationally or from different regions within China can act as a crucial countermeasure to mitigate the bargaining power of these specialized suppliers.

Switching costs for Debao Property Development can be substantial, especially when dealing with established contractors for large-scale projects or long-term financing agreements. The expense and time involved in terminating existing contracts, securing new partners, and re-negotiating terms often make it prohibitive to switch suppliers frequently.

Debao's operational model, which frequently involves rolling over loans to finance ongoing development, underscores the critical nature of its relationships with financial institutions. A disruption in these relationships, perhaps due to a change in lending partners, could significantly impact project timelines and overall financial stability.

Threat of Forward Integration by Suppliers

Suppliers, particularly large construction firms or significant landholders, might consider developing properties themselves. This forward integration would transform them into direct rivals, especially if the property development market faces downturns, making it harder for existing developers. This potential competition necessitates maintaining strong, collaborative relationships with key suppliers.

The threat of suppliers engaging in forward integration means that property developers must cultivate robust partnerships. For instance, in 2024, the global construction market saw significant investment, with major players potentially eyeing development opportunities. This dynamic underscores the need for developers to secure reliable supply chains and favorable terms to mitigate the risk of direct competition from their own suppliers.

- Forward Integration Risk: Suppliers like large construction companies or landholders could enter property development, becoming direct competitors.

- Market Conditions: This threat is amplified in challenging property markets where developers struggle, making supplier entry more attractive.

- Relationship Management: Developers must maintain strong relationships with suppliers to deter this potential competitive move.

- Industry Trend Example: In 2024, the construction sector's growth suggests some larger entities might explore development, increasing this risk for existing players.

Impact of Government Policies on Supplier Power

Government policies can significantly shift the bargaining power of suppliers for real estate developers like Debao Property Development. For instance, regulations impacting land supply, such as zoning laws or initiatives to reclaim idle land, directly affect the availability and cost of crucial development inputs. In 2024, many regions continued to explore policies aimed at increasing housing supply, which could potentially moderate land prices and reduce the power of land suppliers.

Environmental regulations on material production, like those for cement or steel, can also influence supplier power by increasing production costs or limiting the number of compliant suppliers. Labor laws, affecting construction worker wages and conditions, similarly impact the cost of development and the leverage suppliers of labor have. For example, stricter safety standards introduced in 2024 might necessitate higher material costs or specialized labor, thereby strengthening certain supplier positions.

Policies designed to support specific industries, such as subsidies for green building materials or incentives for local manufacturing, can create new supply channels or bolster existing ones. These measures can either empower domestic suppliers by increasing demand for their products or, conversely, increase competition among suppliers, potentially reducing their bargaining power. The Chinese government's focus on sustainable development in 2024, for instance, could lead to greater demand for eco-friendly construction materials, benefiting suppliers in that niche.

- Land Supply Policies: Government measures to increase or restrict land availability directly impact developer costs and supplier leverage.

- Environmental Regulations: Stricter rules on material production can increase costs and consolidate the supplier base.

- Labor Laws: Changes in employment regulations affect labor costs and the power of construction labor suppliers.

- Industry Support: Subsidies or incentives for specific materials or industries can reshape supplier dynamics.

The bargaining power of suppliers for Debao Property Development is influenced by several factors, including supplier concentration, the availability of substitutes, switching costs, and the threat of forward integration. In 2024, the construction materials market in China saw continued consolidation, with a few major players dominating the supply of steel and cement, enhancing their pricing power.

The availability of alternative construction methods, such as pre-fabricated units, gained traction in 2024, offering developers like Debao more options and potentially reducing reliance on traditional material suppliers. However, specialized components still grant significant leverage to their providers.

Switching costs for critical suppliers, such as long-term financing partners or specialized construction firms, remain high for Debao, limiting their flexibility. The threat of suppliers like large construction companies integrating forward into development is a persistent concern, especially in a competitive market. In 2024, increased investment in infrastructure projects globally highlighted the potential for large construction firms to explore development opportunities.

| Factor | Impact on Debao | 2024 Relevance |

|---|---|---|

| Supplier Concentration (Materials) | High leverage for dominant suppliers | Continued consolidation in steel and cement sectors |

| Availability of Substitutes (Materials) | Weakens supplier power | Increased adoption of pre-fabricated components |

| Switching Costs (Services/Financing) | Limits flexibility, strengthens supplier position | High for established partnerships |

| Threat of Forward Integration | Potential for direct competition | Increased investment in construction may spur this |

What is included in the product

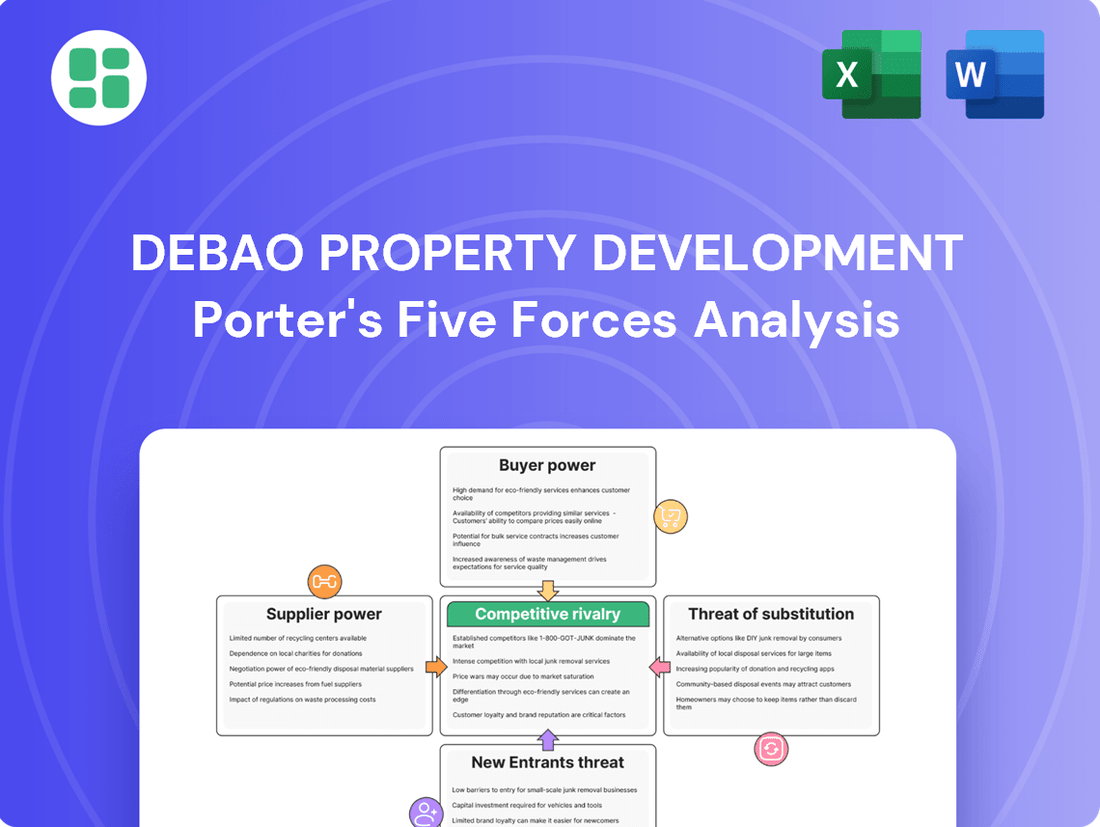

Analyzes the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes for Debao Property Development.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Debao Property Development.

Customers Bargaining Power

Customers in China's real estate market, including those in Guangxi, exhibit significant price sensitivity. This is largely due to a prolonged market downturn and weakened consumer confidence. For instance, by the end of 2023, China's housing inventory saw a notable increase, giving buyers more room to negotiate prices.

The sheer volume of housing supply amplifies buyer power. With millions of units still under construction and high existing inventory levels nationwide, potential buyers face a wide array of choices. This abundance directly translates into greater negotiation leverage for customers, as developers like Debao Property must compete more aggressively on price to attract sales.

The sheer volume of available properties, both new constructions and existing homes, significantly boosts customer bargaining power. In 2024, China's property market continued to grapple with substantial inventory levels, with many developers facing challenges in clearing unsold units. For instance, reports indicated that by mid-2024, the number of unsold residential units in major Chinese cities remained elevated, a trend that puts pressure on developers like Debao.

Government efforts to stimulate the property market, including policies aimed at reducing housing inventory, further amplify customer choice. These initiatives, while intended to support the sector, inadvertently provide buyers with more options and leverage. Customers can readily compare pricing, amenities, and locations across a broad spectrum of offerings, making it harder for any single developer to dictate terms or maintain high profit margins.

Recent government stimulus measures in the property sector have directly amplified the bargaining power of customers. For instance, in 2024, several key markets saw significant policy shifts, such as the reduction of mortgage interest rates by up to 0.5% and the easing of home purchase restrictions, as reported by financial news outlets in early 2024. These actions effectively lower the financial hurdles for potential buyers, giving them more leverage when negotiating prices or terms with developers like Debao Property Development.

Buyer Information and Transparency

Buyer information and transparency significantly bolster customer bargaining power in the property development sector. As of early 2024, the proliferation of online real estate portals and government-published market data has dramatically increased the accessibility of property pricing and transaction history. This readily available information empowers potential buyers, allowing them to compare offerings, understand fair market value, and identify opportunities for negotiation.

This heightened transparency directly correlates with a reduced information asymmetry, a key factor in Porter's Five Forces. When buyers are well-informed, they are less reliant on developer-provided data and can more effectively challenge pricing or demand better terms. For instance, in many major Chinese cities in 2023, the average time on market for new residential properties saw an increase, giving buyers more leverage as developers sought to move inventory.

- Increased Information Access: Online platforms and public databases provide buyers with detailed insights into property prices, sales volumes, and market trends.

- Reduced Information Asymmetry: Buyers can now easily access data that was previously held by developers, leveling the playing field for negotiations.

- Enhanced Negotiation Power: Informed buyers are better equipped to negotiate prices, payment terms, and additional amenities.

- Market Sensitivity: In 2023, reports indicated that buyers in certain oversupplied markets were more price-sensitive, further amplifying their bargaining power due to readily available comparative data.

Customer Loyalty and Brand Differentiation

Customer loyalty for developers like Debao Property Development can be a fragile thing in a crowded market. If Debao doesn't stand out with superior quality, innovative design, or exceptional after-sales support, buyers might easily jump to a competitor. For instance, in 2024, the residential property market in many regions saw increased competition, with developers offering various incentives to attract buyers, potentially weakening loyalty to any single brand without distinct advantages.

The bargaining power of customers is significantly influenced by the availability of substitutes and the cost of switching. When potential buyers perceive many similar housing options from different developers, their ability to negotiate better prices or terms increases. This was evident in 2024, where reports indicated a slight softening in demand in certain segments, giving buyers more leverage. For example, some developers offered extended payment plans or included premium fittings as standard to capture market share, demonstrating the impact of customer choice.

- Limited Loyalty: In 2024, the property market's competitive nature meant customers often prioritized price and location over developer brand unless significant differentiation was present.

- Switching Behavior: Without strong brand differentiation in quality or service, customers were more inclined to switch between developers, impacting Debao's ability to retain clients.

- Price Sensitivity: Market conditions in 2024 often led to increased price sensitivity among buyers, amplifying their bargaining power when faced with numerous similar offerings.

The bargaining power of customers for Debao Property Development is substantial, driven by high inventory levels and increased buyer information access. In 2024, China's property market continued to face challenges with unsold units, providing buyers with more negotiation leverage. This situation is exacerbated by the ease with which consumers can now compare prices and features across numerous developments, making them less reliant on any single developer.

Government policies aimed at stimulating the market, such as reduced mortgage rates in early 2024, have further empowered buyers by lowering acquisition costs. This, combined with a general price sensitivity observed due to market conditions, means customers can effectively demand better terms or lower prices. For instance, reports from mid-2024 indicated that developers were offering incentives like premium fittings to attract buyers, a clear sign of customer influence.

The availability of numerous substitute properties means that customer loyalty is often secondary to price and location unless a developer offers significant differentiation. In 2024, the competitive landscape meant buyers were willing to switch developers if better deals were available, directly impacting Debao's pricing power and profit margins.

| Factor | Impact on Debao | 2024 Data/Trend |

|---|---|---|

| High Inventory Levels | Increased buyer negotiation power | Elevated unsold residential units in major Chinese cities. |

| Information Transparency | Reduced information asymmetry, empowered buyers | Proliferation of online real estate portals and market data. |

| Government Stimulus | Lowered buyer acquisition costs, increased choice | Mortgage rate reductions (up to 0.5%) and eased purchase restrictions. |

| Availability of Substitutes | Weakened customer loyalty, price sensitivity | Developers offering incentives to capture market share. |

Preview the Actual Deliverable

Debao Property Development Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Debao Property Development, offering a detailed examination of industry competition, bargaining power, and market threats. What you see here is the exact, professionally formatted document you will receive immediately upon purchase, ensuring transparency and immediate usability for your strategic planning.

Rivalry Among Competitors

The real estate sector in China, and specifically within Guangxi province where Debao Property Development operates, is crowded. It's a landscape populated by a broad spectrum of players, from massive state-backed entities to nimble, privately-owned companies. This sheer volume and variety of competitors means the competition is fierce, with each company striving to capture market share, especially as the market faces stabilization or contraction.

The Chinese real estate sector is grappling with a significant downturn, marked by negative investment growth and substantial inventory levels. This low-growth environment intensifies competition, transforming it into a zero-sum game where developers resort to aggressive pricing to move properties. For instance, in 2023, China's real estate investment fell by 9.6%, highlighting the challenging market conditions.

Debao Property Development operates in a Chinese real estate market where standard residential and commercial properties often lack significant differentiation. This homogeneity means that competition frequently devolves into price wars, intensifying the rivalry among developers.

In 2024, many of China's major cities saw a significant increase in housing inventory, with some reporting a 15-20% year-over-year rise in unsold units. This oversupply puts additional pressure on developers like Debao to offer competitive pricing, as buyers have a wider selection of similar properties to choose from.

The limited uniqueness of many property offerings forces developers to rely on factors like location, amenities, and marketing to stand out, but the core product itself often remains undifferentiated. This dynamic fuels intense competition, as any developer with a slight cost advantage can quickly gain market share.

High Exit Barriers

The real estate development sector, including companies like Debao Property Development, is characterized by substantial exit barriers. These arise from significant capital tied up in land acquisition and ongoing construction projects, making assets illiquid and difficult to divest quickly. For instance, in 2023, the total value of unsold inventory in China's property market remained substantial, indicating the difficulty developers face in exiting positions rapidly.

These high exit barriers mean that developers facing financial difficulties are often compelled to remain in the market, even if unprofitable. This persistence can exacerbate oversupply issues and intensify competitive pressures as these firms continue to operate, potentially at lower margins, to recoup investments.

- High Capital Investment: Real estate development requires substantial upfront capital for land purchases and construction, creating a significant financial commitment.

- Illiquid Assets: Undeveloped land and partially completed projects are not easily converted to cash, making a swift exit challenging.

- Legal and Contractual Obligations: Developers are bound by numerous contracts with suppliers, contractors, and buyers, complicating any attempt to cease operations.

- Market Persistence: The inability to exit easily forces struggling developers to continue operations, potentially prolonging market oversupply and price competition.

Government Intervention and Consolidation

Government policies designed to stabilize the property market, such as those favoring state-owned enterprises or promoting the absorption of existing inventory, significantly influence the competitive dynamics for developers like Debao. These interventions often accelerate industry consolidation. For instance, in 2023, China's property sector saw increased government support for select developers, leading to a concentration of market power.

This consolidation trend places considerable pressure on smaller, privately held companies. Larger, state-backed entities can leverage their financial stability and government relationships to navigate challenging market conditions more effectively. This can result in a shrinking market share for independent developers.

- Government support for state-owned developers: Policies often prioritize financially stable, state-backed entities, enhancing their competitive advantage.

- Market stabilization measures: Initiatives to absorb existing inventory can benefit larger players with greater capacity.

- Industry consolidation: The trend favors larger entities, increasing pressure on smaller, private developers.

- Impact on private developers: Companies like Debao face intensified competition and potential market share erosion.

The competitive rivalry within China's real estate sector, impacting Debao Property Development, is exceptionally intense due to a crowded market and a low-growth environment. This often leads to price wars as developers struggle to sell properties, a situation exacerbated by significant unsold inventory. For example, in 2023, China's real estate investment dropped by 9.6%, underscoring the challenging conditions that fuel this rivalry.

The lack of product differentiation in many segments of the Chinese property market further intensifies competition, forcing developers to compete primarily on price. This is particularly evident in 2024, where many cities experienced a 15-20% year-over-year increase in unsold housing units, giving buyers more options and increasing pressure on developers to offer competitive pricing.

High exit barriers, such as substantial capital tied up in land and construction, mean that even struggling developers remain in the market, contributing to oversupply and prolonged price competition. This dynamic is compounded by government policies that can favor larger, state-backed entities, leading to industry consolidation and increased pressure on private developers like Debao.

| Factor | Description | Impact on Debao |

|---|---|---|

| Market Saturation | Numerous developers, from large state-owned to smaller private firms, compete for market share. | Increased difficulty in capturing and retaining market share. |

| Low Growth Environment | Negative real estate investment growth and high inventory levels intensify competition. | Pressure to lower prices and margins to move properties. |

| Product Homogeneity | Limited differentiation in standard residential and commercial properties. | Competition often devolves into price wars. |

| High Exit Barriers | Significant capital investment and contractual obligations make exiting difficult. | Struggling competitors remain active, exacerbating oversupply and price pressure. |

| Government Policy Influence | Policies favoring state-owned enterprises can lead to consolidation. | Disadvantage for private developers like Debao, potentially leading to market share erosion. |

SSubstitutes Threaten

The Chinese government's robust commitment to public rental housing and other affordable housing programs acts as a substantial substitute for Debao Property Development's market-rate residential offerings. These initiatives are specifically designed to tackle housing affordability issues, potentially siphoning off a considerable portion of prospective buyers, especially those in lower and middle-income brackets.

For instance, in 2023, China continued its significant investment in affordable housing, with plans to build or renovate 6.7 million units of public rental housing. This policy directly competes with Debao's commercial and commodity housing segments by providing a more accessible alternative for a large demographic.

The rental market presents a significant threat of substitutes for Debao Property Development, impacting both residential and commercial sectors. For individuals and businesses alike, renting offers a viable alternative to property ownership, especially during economic downturns. For instance, in early 2024, many markets saw increased rental demand as potential buyers hesitated due to rising interest rates and economic uncertainty, making leasing a more attractive option due to its lower initial financial commitment and greater flexibility.

The second-hand property market presents a significant threat of substitutes for Debao Property Development. In 2024, major Chinese cities continued to see robust activity in the pre-owned home sector. This is partly due to price stabilization in certain areas and the substantial existing supply, making these properties a direct alternative to new builds.

Buyers often find the second-hand market attractive due to the potential for better value or more immediate occupancy. For instance, reports from early 2024 indicated that in some Tier 1 cities, the resale market accounted for a substantial portion of total transactions, sometimes exceeding 70% of monthly sales volumes, directly competing with new developments.

Alternative Investment Vehicles

The threat of substitutes for Debao Property Development's offerings is growing as investors re-evaluate traditional real estate. The ongoing property crisis and declining returns in the sector are pushing investors toward alternative asset classes. For instance, in 2024, while real estate investment trusts (REITs) saw mixed performance, many investors shifted capital towards equities and fixed income, seeking more stable or higher yields. This diversification reduces the inherent demand for direct property investment, a core area for Debao.

Investors are increasingly looking beyond physical property for wealth creation. The appeal of financial instruments like stocks and bonds, which offer greater liquidity and often more predictable income streams, is amplified when property markets falter. For example, global equity markets, despite volatility, provided an average return of approximately 10% in 2024, a figure that many property investments struggled to match, especially in distressed markets.

This shift impacts Debao by diminishing the pool of capital available for property development and sales. Investors who previously saw real estate as a primary hedge against inflation or a growth asset are now exploring:

- Equities: Publicly traded stocks offering potential capital appreciation and dividends.

- Bonds: Fixed-income securities providing regular interest payments and principal repayment.

- Alternative Investments: Such as private equity, venture capital, or even digital assets, which can offer uncorrelated returns.

- Commodities: Precious metals or energy resources as inflation hedges.

Consequently, Debao Property Development faces pressure to demonstrate superior returns or unique value propositions to attract and retain investor interest in its projects, as capital can easily flow to these more attractive substitute investment vehicles.

Relocation to Lower-Tier Cities or Rural Areas

The trend of consumers and businesses seeking lower living and operational costs presents a threat of substitutes for Debao Property Development. While Debao operates within Guangxi, a regional focus, a broader economic sentiment could drive individuals and companies to consider relocating to even less expensive, lower-tier cities or rural areas. This offers a distinct substitute in terms of location and property type, directly competing on affordability.

For instance, the increasing adoption of remote work models, which gained significant traction in 2024, allows businesses and employees greater flexibility in location. This can make a move to a rural area with substantially lower housing and land costs a viable alternative to purchasing property in Debao’s target cities. In 2023, China's urbanization rate reached 66.16%, indicating a large rural population that could potentially be attracted by new development in these areas, or conversely, existing urban dwellers might consider such moves for cost savings.

- Lower Cost of Living: Rural areas often boast significantly lower expenses for housing, transportation, and daily necessities compared to even lower-tier cities within a developed region.

- Remote Work Enablement: The continued growth of remote and hybrid work arrangements in 2024 reduces the necessity for employees to live near major urban centers, opening up rural locations.

- Government Incentives: Some local governments in less developed regions may offer incentives for businesses and residents to relocate, further reducing the cost barrier.

- Property Type Substitution: The availability of land and construction in rural areas can lead to the development of different property types, such as larger single-family homes or agricultural-adjacent properties, which serve as substitutes for urban or suburban residential and commercial spaces.

The availability of alternative investment vehicles, such as equities and bonds, presents a significant substitute threat to Debao Property Development. As of early 2024, many investors were diversifying away from traditional real estate due to market volatility and seeking more stable returns from financial markets.

For example, global equity markets delivered an average return of around 10% in 2024, outperforming many property investments. This trend diverts capital that might otherwise flow into property development, forcing Debao to offer more compelling value propositions.

The rental market also acts as a strong substitute, particularly in early 2024, where increased demand for rentals was observed due to hesitant buyers facing rising interest rates and economic uncertainty. This makes leasing a more appealing option for many, reducing the direct demand for Debao's new residential properties.

The second-hand property market in major Chinese cities remained active in 2024, with resale transactions sometimes exceeding 70% of monthly sales in Tier 1 cities. These pre-owned homes offer a direct alternative to new builds, often at more stable or attractive price points, directly impacting Debao's sales pipeline.

Government-backed affordable housing initiatives are another key substitute. In 2023, China's commitment to building millions of public rental units directly competes with Debao's market-rate offerings by providing a more accessible housing solution for a large segment of the population.

| Substitute Type | 2023/2024 Trend | Impact on Debao | Example Data/Fact |

|---|---|---|---|

| Affordable Housing Programs | Continued strong government investment | Siphons off lower/middle-income buyers | Plans for 6.7 million public rental units in 2023 |

| Rental Market | Increased demand due to buyer hesitancy | Reduces demand for ownership | Higher rental demand driven by rising interest rates in early 2024 |

| Second-Hand Property Market | Robust activity in major cities | Direct competition with new builds | Resale transactions >70% of sales in some Tier 1 cities in early 2024 |

| Alternative Investments (Equities/Bonds) | Investor diversification away from real estate | Diverts capital from property development | Global equities averaged ~10% return in 2024 |

Entrants Threaten

The property development sector demands significant upfront investment. Aspiring developers need substantial capital for land purchases, construction costs, and extensive marketing campaigns. This creates a considerable barrier to entry.

For instance, in 2024, many established property developers faced liquidity issues, impacting their ability to secure new financing. This environment, characterized by negative investment growth in the sector, further amplifies the financial hurdles for newcomers, making it exceptionally difficult to launch new projects.

The real estate sector in China is a minefield of regulations, demanding extensive permits, licenses, and strict adherence to ever-changing government policies concerning land use, construction quality, and sales limitations. For instance, in 2024, the central government continued to emphasize stringent controls on property speculation and developer debt, making it harder for new players to secure financing and operate.

Successfully navigating this intricate and often shifting regulatory landscape presents a formidable barrier to entry for any new property developer aiming to compete with established firms like Debao Property Development. The sheer volume of compliance required, coupled with potential policy shifts, significantly increases the cost and risk associated with market entry.

Established developers like Debao Property Development benefit from deep-rooted relationships with land authorities, giving them preferential access to prime development sites. This advantage is crucial in a market where land acquisition is a significant barrier to entry. For instance, in 2024, prime land prices in major Chinese cities continued their upward trend, making it increasingly difficult for newcomers to compete for desirable parcels.

Furthermore, Debao's long-standing presence has fostered robust supply chains, including established networks of contractors, material suppliers, and logistics providers. New entrants would face considerable challenges in replicating these established relationships and securing reliable, cost-effective resources, especially when competing against incumbents with proven track records and bulk purchasing power.

Brand Recognition and Market Experience

Existing developers like Debao Property Development benefit significantly from established brand recognition and deep market experience, especially within their core regions such as Guangxi. This brand equity translates into customer trust, a crucial factor in property purchases, making it challenging for newcomers to gain traction. In 2024, for instance, developers with a long-standing presence often have a more robust sales pipeline compared to emerging players.

New entrants often struggle to build the same level of trust and awareness from scratch. They lack the years of successful project delivery and community engagement that solidify a developer's reputation. This intangible asset is a substantial barrier, as it directly impacts a new company's ability to attract buyers and secure market share against seasoned competitors.

Consider the impact on sales conversion rates. A developer with a recognized brand might see higher conversion rates from initial inquiries due to inherent trust. For example, in 2024, industry reports indicated that top-tier developers consistently outperformed newer entrants in buyer acquisition cost metrics, largely attributable to their brand strength.

- Brand Recognition: Established developers possess a significant advantage through years of consistent branding and project delivery.

- Market Experience: Deep understanding of regional nuances, buyer preferences, and regulatory landscapes is honed over time.

- Customer Trust: Long-term presence fosters trust, directly impacting sales and customer loyalty.

- Competitive Disadvantage for New Entrants: Lack of brand equity and experience makes it harder to attract buyers and build market share.

Current Market Downturn and Oversupply

The current real estate crisis, marked by falling prices and significant financial strain on existing developers, creates a highly uninviting environment for new players. For instance, China's property sector experienced a contraction, with new housing starts falling by 9.5% in 2023 compared to the previous year, indicating a challenging landscape.

This persistent oversupply, with high inventory levels across many markets, coupled with the uncertainty surrounding a potential recovery, serves as a powerful deterrent. Potential new entrants are likely to be wary of entering a market where demand is weak and the risk of further price erosion is substantial.

- Declining Property Values: Many regions are still grappling with falling property values, making it difficult for new developers to achieve profitability.

- High Inventory Levels: Oversupply in key markets means new projects will face intense competition for a limited pool of buyers.

- Developer Financial Distress: The financial difficulties faced by many existing developers signal underlying market weaknesses that deter new investment.

- Uncertain Economic Outlook: Broader economic uncertainties further dampen enthusiasm for entering a capital-intensive and cyclical industry like real estate development.

The threat of new entrants into the property development sector, particularly concerning Debao Property Development, is significantly mitigated by high capital requirements and stringent regulatory hurdles. For example, in 2024, the sheer cost of land acquisition in desirable locations, coupled with the need for substantial upfront investment in construction and marketing, presented a formidable financial barrier. Navigating China's complex and evolving property regulations, which in 2024 continued to emphasize developer debt controls and land use policies, adds another layer of difficulty for newcomers.

Established players like Debao benefit from entrenched relationships with land authorities and robust supply chains, enabling preferential access to prime sites and cost-effective resources. This is particularly relevant in 2024, where prime land prices remained elevated, and securing reliable suppliers was critical. New entrants would struggle to replicate these established networks and the bulk purchasing power that incumbents wield.

Furthermore, brand recognition and customer trust are critical assets that new entrants find difficult to build. Debao's long-standing presence, especially in regions like Guangxi, fosters loyalty and a stronger sales pipeline, as evidenced by 2024 industry reports showing higher buyer acquisition cost metrics for established developers. This intangible advantage, built over years of successful project delivery, makes it challenging for new companies to gain market traction against seasoned competitors.

The current market conditions, characterized by a property sector downturn and high inventory levels, further deter new entrants. For instance, China's property sector saw a contraction in 2023, with new housing starts falling by 9.5% year-on-year, indicating a challenging demand environment. This, combined with the financial distress of many existing developers in 2024, creates an uninviting landscape for new investment.

| Barrier Type | Description | 2024 Relevance |

| Capital Requirements | High costs for land, construction, and marketing. | Elevated land prices and financing challenges in 2024 amplified this barrier. |

| Regulatory Hurdles | Complex permits, licenses, and compliance with government policies. | Continued stringent controls on developer debt and land use in 2024 increased compliance burden. |

| Established Relationships | Preferential land access and robust supply chains. | Prime land scarcity and supplier reliability in 2024 favored developers with existing networks. |

| Brand Equity & Trust | Customer loyalty and market reputation built over time. | Higher buyer acquisition costs for new entrants in 2024 highlighted the value of established brands. |

| Market Conditions | Oversupply, declining property values, and developer financial distress. | A contracting property sector in 2023 and ongoing developer financial strain in 2024 deterred new investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Debao Property Development is built upon a foundation of robust data, including the company's annual reports, industry-specific market research from firms like JLL and Knight Frank, and publicly available regulatory filings.

We also incorporate insights from macroeconomic data providers and financial news outlets to capture the broader economic context influencing the property development sector and Debao's competitive landscape.