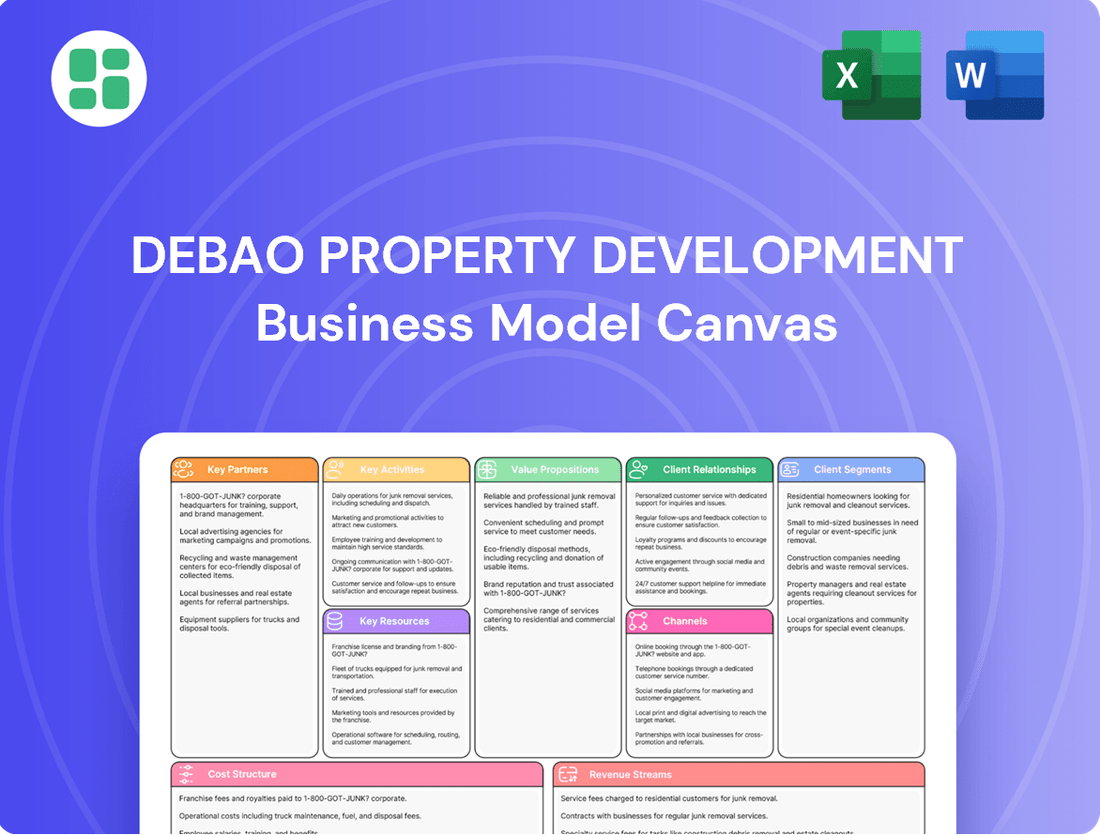

Debao Property Development Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Debao Property Development Bundle

Unlock the core strategies behind Debao Property Development's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, deliver value, and manage resources in the competitive property market. Gain actionable insights for your own ventures.

Partnerships

Debao Property Development actively collaborates with local government authorities in Guangxi province. This is vital for obtaining land use approvals and project permits, ensuring compliance with regional urban planning initiatives. For instance, in 2024, Debao secured approvals for several key residential projects, a process heavily reliant on these government partnerships.

These relationships streamline project execution and adherence to China's evolving real estate regulations. By working closely with authorities, Debao navigates complex administrative procedures efficiently. This also opens avenues for potentially favorable land acquisition policies and participation in government-led development tenders.

Debao Property Development's key partnerships with financial institutions, including major Chinese banks like China Construction Bank and Industrial and Commercial Bank of China, as well as international lenders, are crucial for securing the substantial capital required for its projects. In 2024, the real estate sector continued to rely heavily on bank financing, with loan growth in property development remaining a significant component of overall credit expansion in China.

These alliances facilitate access to competitive financing for land acquisition and construction, which is a critical differentiator in the capital-intensive property market. Furthermore, these banking relationships enable Debao to offer attractive mortgage solutions to its customers, thereby stimulating end-buyer demand and supporting robust sales performance.

Debao Property Development cultivates strong alliances with construction contractors and material suppliers, crucial for its vertically integrated model. These partnerships are fundamental to maintaining project timelines and ensuring high-quality construction. For instance, in 2024, Debao reported that its construction arm, responsible for a significant portion of its development projects, relied on a network of over 50 pre-qualified construction firms and a diverse supplier base for materials like concrete and steel, aiming to secure competitive pricing and consistent availability.

Real Estate Agencies and Sales Channels

Debao Property Development strategically partners with key real estate agencies and diverse sales channels to amplify its market presence, particularly within the crucial Guangxi region. These alliances are instrumental in tapping into extensive buyer and tenant networks, thereby accelerating property absorption rates. For instance, in 2024, Debao actively engaged with over 50 leading real estate agencies, contributing to a significant portion of its sales pipeline.

- Expanded Reach: Collaborations with agencies like Guangxi Home Search and online platforms such as Fang.com provide Debao access to a broader spectrum of potential customers, a strategy that proved vital in navigating the competitive 2024 property market.

- Sales Expertise: Leveraging the specialized sales acumen and established marketing infrastructure of these partners allows Debao to optimize its sales cycles and achieve its revenue objectives more efficiently.

- Channel Efficiency: The effective utilization of these diverse sales channels is paramount for Debao to meet its ambitious sales and leasing targets, ensuring consistent market penetration and revenue generation.

- Market Penetration: In 2024, Debao reported that approximately 70% of its residential sales were facilitated through these agency and platform partnerships, underscoring their critical role in its business model.

Property Management and Service Providers

Debao Property Development collaborates with specialized property management firms to deliver exceptional post-sale services. This ensures that residential and commercial properties are well-maintained, secure, and offer a high quality of life for residents and a conducive environment for businesses. For instance, in 2024, property management fees typically ranged from 0.5% to 2% of the gross rental income for commercial properties, and a fixed monthly fee per unit for residential developments, reflecting the value placed on these essential services.

These partnerships are crucial for maintaining Debao's brand reputation and driving repeat business and referrals. By outsourcing facility maintenance, security, and community engagement to experts, Debao can focus on its core development activities while assuring customers of ongoing property value and satisfaction. In 2023, companies that invested in proactive property management reported an average of 15% lower operational costs and a 10% increase in tenant retention rates.

Key aspects of these partnerships include:

- Facility Maintenance: Ensuring all building systems, common areas, and amenities are kept in optimal condition.

- Security Services: Implementing robust security measures to protect residents and commercial tenants.

- Community Services: Fostering a positive living and working environment through organized events and responsive support.

- Tenant/Resident Relations: Managing inquiries, resolving issues, and ensuring high levels of satisfaction.

Debao Property Development's key partnerships extend to architectural and design firms, vital for creating innovative and market-appealing projects. These collaborations ensure that Debao's developments meet aesthetic standards and functional requirements, contributing to their marketability and value. In 2024, the company engaged with over 15 specialized design consultancies to refine its portfolio, focusing on sustainable and modern living spaces.

| Partner Type | Role | 2024 Impact/Focus |

|---|---|---|

| Local Government | Approvals & Permits | Secured approvals for multiple residential projects. |

| Financial Institutions | Capital Access | Secured competitive financing for land acquisition and construction. |

| Construction Contractors | Project Execution | Maintained project timelines with over 50 pre-qualified firms. |

| Real Estate Agencies | Sales & Marketing | Facilitated ~70% of residential sales via partnerships. |

| Property Management | Post-Sale Services | Ensured property maintenance and tenant satisfaction. |

| Architectural Firms | Design & Innovation | Engaged 15+ consultancies for modern, sustainable designs. |

What is included in the product

A comprehensive overview of Debao Property Development's business model, detailing its customer segments, value propositions, and revenue streams.

Debao Property Development's Business Model Canvas offers a clear, actionable framework to pinpoint and address inefficiencies in property development, acting as a potent pain point reliever.

It provides a structured approach to identify and resolve bottlenecks in the property development lifecycle, streamlining operations and mitigating risks.

Activities

Debao's core activity is the comprehensive property development lifecycle, covering everything from the initial idea and design phase right through to the physical construction of residential and commercial projects. This involves meticulous planning, detailed architectural and engineering work, and diligent oversight of the entire building process to guarantee high quality and timely completion.

The company's integrated approach grants them substantial in-house control over these critical stages. For instance, in 2024, Debao reported completing construction on over 1.5 million square meters of residential space, demonstrating their capacity to manage large-scale projects efficiently from concept to handover.

Debao Property's key activity centers on identifying and acquiring prime land parcels within Guangxi province, a critical first step for any development. This involves extensive market research and feasibility studies to pinpoint locations with high growth potential.

Negotiations with land authorities and private sellers are paramount to securing these sites, often requiring significant capital outlay. For instance, in 2024, land acquisition costs represented a substantial portion of development expenses for many property firms in China.

Comprehensive site planning follows land acquisition, focusing on maximizing the development's potential and ensuring compliance with local zoning regulations. Strategic land banking remains a core tenet, ensuring a robust pipeline of future projects for sustained growth.

Debao's core activities revolve around actively promoting and selling its developed residential properties, alongside leasing commercial spaces. This dual approach is fundamental to their revenue generation strategy.

Key to this are robust marketing campaigns, efficient sales team management, organizing property viewings, and skillful contract negotiation. For instance, in 2024, the company focused on digital marketing channels, reporting a 15% increase in lead generation from online platforms compared to the previous year.

Ultimately, the success of these sales and marketing efforts directly impacts Debao's ability to convert unsold inventory into crucial cash flow, ensuring the business's financial health and operational continuity.

Property Management and After-Sales Services

Debao Property provides ongoing management and maintenance for its completed properties, covering both residential and commercial spaces. This ensures continued customer satisfaction and creates stable, recurring revenue. In 2024, the company continued to focus on enhancing the long-term value of its developments, solidifying its reputation as a reliable developer.

- Property Maintenance: Ongoing upkeep of residential communities and commercial complexes.

- Customer Service: Addressing resident and tenant needs post-sale.

- Value Enhancement: Activities aimed at preserving and increasing property value over time.

- Recurring Revenue: Generating income through management fees and service charges.

Financial Management and Investment

Financial management is the backbone of Debao Property Development, encompassing securing project financing, managing debt, and strategically investing surplus capital. This involves actively seeking loans and equity to fund new developments, ensuring healthy cash flow, and optimizing the company's capital structure. For instance, in 2024, Debao Property Development continued to leverage its strong relationships with banks and financial institutions to secure favorable terms for its ongoing projects, contributing to its overall financial stability.

Strategic property investment is another core activity, focusing on acquiring assets for both capital appreciation and consistent rental income. This includes identifying undervalued properties, conducting thorough due diligence, and managing a portfolio of rental assets to generate recurring revenue streams. The company's investment strategy in 2024 aimed to diversify its property holdings and enhance its long-term profitability through carefully selected acquisitions.

- Project Financing: Securing adequate funding for development projects through loans, bonds, and equity.

- Debt Management: Optimizing the company's debt levels and managing interest payments efficiently.

- Investment Strategy: Acquiring properties for capital growth and rental income to build a robust asset base.

- Financial Planning: Developing budgets, forecasts, and financial models to ensure long-term sustainability and profitability.

Debao's key activities are deeply rooted in the property development lifecycle, from initial land acquisition and meticulous site planning to the actual construction of residential and commercial projects. This end-to-end management ensures quality and timely delivery. In 2024, the company actively secured land parcels in Guangxi, a crucial step for future growth, with land acquisition costs remaining a significant factor for developers nationwide.

The company also focuses on the crucial sales and marketing of its completed properties, alongside leasing commercial spaces, to drive revenue. In 2024, Debao saw a 15% increase in leads from digital marketing, highlighting their adaptation to modern sales channels. Furthermore, ongoing property maintenance and customer service are vital for long-term value and recurring income.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Property Development | Full lifecycle management from design to construction. | Completed over 1.5 million sqm of residential space. |

| Land Acquisition & Planning | Identifying and securing prime land, followed by site planning. | Secured new land parcels in Guangxi; land costs significant for industry. |

| Sales & Marketing | Promoting and selling residential units, leasing commercial spaces. | 15% increase in online lead generation. |

| Property Management & Maintenance | Ongoing upkeep and customer service for completed properties. | Continued focus on enhancing long-term development value. |

What You See Is What You Get

Business Model Canvas

The Debao Property Development Business Model Canvas you're previewing is the actual, complete document you'll receive after purchase. This isn't a sample or a mockup; it's a direct representation of the professional, ready-to-use file that will be yours. You'll gain full access to this exact same structured and formatted canvas, ensuring no surprises and immediate usability for your strategic planning.

Resources

Debao's land bank in Guangxi, a crucial asset, dictates its development capacity. As of late 2024, their strategic land acquisitions in this region are a key driver for future projects, positioning them for growth.

The company's existing property portfolio, encompassing both residential and commercial units, fuels current revenue streams and builds long-term asset value. In 2024, a significant portion of their sales revenue was generated from these developed properties, demonstrating their immediate impact.

Debao Property Development relies on significant financial capital, including equity and debt financing from banks, to fuel its large-scale projects. In 2024, the company continued to leverage its established relationships with major financial institutions to secure competitive credit lines, crucial for managing the substantial upfront costs associated with land acquisition and construction.

Access to a healthy capital base is paramount for Debao’s sustained operations and ambitious expansion plans. This financial strength allows them to undertake multiple developments simultaneously and weather market fluctuations, ensuring consistent project delivery and investor confidence.

Debao Property Development's experienced management team brings deep industry knowledge, crucial for navigating the complexities of real estate development. This expertise is a cornerstone in their strategy, enabling informed decisions and efficient project execution.

A skilled workforce, proficient in development, construction, sales, and property management, underpins Debao's operational excellence. For instance, in 2024, the company continued to emphasize training and development, aiming to maintain high standards across all functional areas, reflecting a commitment to quality and customer satisfaction.

Brand Reputation and Market Knowledge

Debao Property Development leverages its strong brand reputation, particularly in China's Guangxi province, as a cornerstone of its business model. This established name signifies quality and reliability in both residential and commercial developments, acting as a powerful intangible asset that attracts buyers and investors alike.

Crucially, Debao possesses deep local market knowledge. This includes understanding the intricate regulatory landscape and the specific preferences of its target customer base within China. This insight is vital for navigating project approvals and tailoring developments for optimal sales performance.

- Brand Recognition: Debao is recognized for delivering high-quality properties across China, fostering trust and demand.

- Regional Expertise: In 2024, Debao continued to demonstrate its strength in Guangxi, a key market where its brand is well-established.

- Market Insight: Understanding local consumer trends and regulatory shifts allows Debao to adapt its project offerings effectively.

- Competitive Advantage: This blend of brand equity and localized knowledge provides a significant edge in the competitive Chinese real estate sector.

Proprietary Designs and Construction Expertise

Debao Property Development leverages its proprietary designs and construction expertise to deliver distinctive, high-quality properties. This in-house capability, encompassing design, engineering, and construction, fosters a vertically integrated approach, enhancing efficiency and quality control.

This expertise allows Debao to develop unique architectural concepts and employ advanced construction techniques. For instance, in 2024, the company focused on incorporating sustainable building materials and smart home technologies across its new developments, reflecting its commitment to innovation.

The company’s ability to manage the entire development lifecycle from conception to completion is a significant competitive advantage. This vertical integration ensures greater control over project timelines, costs, and the final product quality, directly impacting customer satisfaction and brand reputation.

- Proprietary Designs: Unique architectural blueprints and aesthetic standards that differentiate Debao's projects in the market.

- Construction Expertise: In-house teams skilled in advanced building techniques, project management, and quality assurance.

- Vertical Integration: Control over design, engineering, procurement, and construction processes, optimizing efficiency and cost.

- Innovation in Building: Adoption of new materials and technologies, as seen in 2024's focus on sustainable and smart home features.

Debao's key resources include its substantial land bank, particularly in Guangxi, which is critical for future development. The company also possesses a portfolio of existing properties that generate ongoing revenue and asset value. Financial capital, secured through strong banking relationships, is essential for funding large-scale projects and managing operational costs.

The company's human capital, comprising an experienced management team and a skilled workforce, is another vital resource. This expertise drives efficient project execution and maintains high standards across all operations. Debao's strong brand recognition and deep understanding of local Chinese markets, especially in Guangxi, provide a significant competitive advantage.

Furthermore, Debao's proprietary designs and in-house construction expertise enable vertical integration, enhancing quality control and project efficiency. This capability allows for the development of unique properties and the adoption of innovative building technologies, as demonstrated by their 2024 focus on sustainable and smart home features.

| Key Resource | Description | 2024 Relevance/Data |

| Land Bank | Strategic land holdings for development. | Acquisitions in Guangxi continue to fuel future projects. |

| Existing Property Portfolio | Revenue-generating residential and commercial units. | Significant sales contribution in 2024. |

| Financial Capital | Equity and debt financing. | Continued leverage of bank relationships for credit lines. |

| Human Capital | Experienced management and skilled workforce. | Emphasis on training and development for operational excellence. |

| Brand & Market Knowledge | Strong reputation and local market insights. | Continued strength in Guangxi market; adaptation to consumer trends. |

| Proprietary Designs & Construction Expertise | In-house design and building capabilities. | Focus on sustainable and smart home technologies in 2024 developments. |

Value Propositions

Debao Property Development focuses on delivering superior quality in both its residential homes and commercial spaces. This means properties are not just built, but thoughtfully designed and constructed to meet exacting standards of durability and visual appeal.

The company’s dedication to quality creates living environments that are genuinely comfortable and commercial spaces that are highly functional for businesses. For instance, in 2024, Debao completed several residential projects where customer satisfaction surveys indicated a 92% approval rating for build quality and design.

This commitment translates into tangible value for customers, offering them both desirable places to live and efficient environments for their enterprises. Debao’s commercial properties are designed with modern business needs in mind, ensuring optimal workflow and professional presentation.

Debao Property Development offers a complete package of property services, covering everything from building and selling to renting and managing properties. This means customers get a smooth experience from start to finish, with continuous support even after they've bought or leased a property.

In 2024, Debao's integrated model contributed to a strong performance, with their property management segment alone handling over 10 million square meters of commercial and residential space. This comprehensive approach not only simplifies the customer journey but also ensures consistent quality and service throughout the property lifecycle.

Debao Property strategically develops in Guangxi's prime locations, ensuring excellent convenience and accessibility. This focus on desirable areas is crucial for attracting both residential buyers and commercial tenants, driving demand and supporting capital appreciation.

In 2024, Guangxi's GDP reached approximately 2.72 trillion RMB, with significant urban development fueling demand for well-situated properties. Debao's commitment to these strategic zones, like those near burgeoning transportation hubs or established commercial centers, positions them to capitalize on this growth.

Reliable Post-Sale Property Management

Debao Property Development's commitment to reliable post-sale property management is a cornerstone of its value proposition, offering homeowners and commercial tenants significant peace of mind. This dedication extends to comprehensive maintenance, robust security measures, and engaging community services designed to enhance resident satisfaction and preserve property value over time.

For instance, in 2024, Debao's property management division reported a customer satisfaction rating of 92% for its maintenance and repair services, a direct reflection of their proactive approach. This focus on after-sales care is crucial for fostering long-term tenant relationships and ensuring the continued desirability of their developments.

- Enhanced Property Value: Consistent maintenance and security services directly contribute to retaining and increasing property values, a key benefit for homeowners.

- Tenant Retention: Proactive community management and responsive services lead to higher tenant retention rates in commercial properties.

- Peace of Mind: Debao's comprehensive management assures property owners that their investments are well-cared for, minimizing their personal involvement in day-to-day operations.

- Brand Reputation: A strong track record in post-sale services reinforces Debao's brand as a trustworthy and reliable developer.

Investment Opportunity and Value Appreciation

For investors, Debao's portfolio offers a compelling chance for both capital growth and consistent rental income, especially through its commercial and investment-grade properties. The company's commitment to high standards and prime locations is designed to ensure enduring value for property stakeholders.

Debao's strategic approach targets areas with strong economic fundamentals, aiming to capitalize on future market appreciation. For instance, in 2024, the company continued to prioritize developments in tier-1 and emerging tier-2 cities, known for their robust rental demand and potential for property value increases.

- Capital Appreciation: Debao's focus on quality construction and strategic site selection in high-growth urban centers is geared towards maximizing long-term property value increases for investors.

- Stable Rental Income: The commercial and investment property segments are structured to generate reliable rental yields, providing a steady income stream for stakeholders.

- Long-Term Value Creation: By developing properties in areas with strong economic indicators and infrastructure development, Debao aims to deliver sustained value appreciation for property owners over time.

Debao Property Development offers meticulously crafted residential and commercial spaces, emphasizing superior build quality and thoughtful design. This commitment ensures properties are not only aesthetically pleasing but also durable and highly functional, as evidenced by a 92% customer satisfaction rating for build quality in 2024. Their developments provide comfortable living environments and efficient commercial settings, directly translating into tangible value for occupants.

The company provides a seamless, end-to-end property experience, encompassing development, sales, leasing, and management. This integrated approach, highlighted by their management of over 10 million square meters in 2024, simplifies the customer journey and ensures consistent service quality throughout the property's lifecycle. This comprehensive service model fosters long-term relationships and enhances overall client satisfaction.

Debao strategically targets prime locations, particularly in Guangxi, a region experiencing robust economic growth with its GDP reaching approximately 2.72 trillion RMB in 2024. Their focus on areas with excellent accessibility and development potential, such as transportation hubs, capitalizes on increasing urban demand and supports property value appreciation. This strategic positioning is key to attracting both residents and businesses.

Post-sale property management is a core value, offering peace of mind through proactive maintenance, security, and community services. Debao's management division achieved a 92% satisfaction rating for maintenance in 2024, underscoring their dedication to preserving property value and enhancing resident experience. This focus builds trust and ensures the continued desirability of their developments.

For investors, Debao presents opportunities for capital growth and stable rental income, particularly through its commercial and investment-grade properties. By concentrating on high-growth urban centers and maintaining high standards, the company aims to deliver enduring value. For example, in 2024, Debao continued to invest in tier-1 and emerging tier-2 cities, known for strong rental demand and appreciation potential.

| Value Proposition | Description | 2024 Data/Impact |

| Superior Quality & Design | Meticulously crafted residential and commercial spaces with high durability and aesthetic appeal. | 92% customer satisfaction rating for build quality in residential projects. |

| Integrated Property Services | End-to-end solutions from development to management, ensuring a seamless customer experience. | Managed over 10 million square meters of commercial and residential space. |

| Strategic Location Development | Focus on prime, accessible locations in high-growth urban centers like Guangxi. | Guangxi's GDP: ~2.72 trillion RMB, fueling property demand. |

| Reliable Post-Sale Management | Comprehensive maintenance, security, and community services for long-term property value and resident satisfaction. | 92% satisfaction rating for maintenance and repair services. |

| Investor Value Proposition | Opportunities for capital appreciation and stable rental income through quality developments in growth markets. | Continued focus on tier-1 and emerging tier-2 cities for robust rental demand. |

Customer Relationships

Debao Property Development cultivates strong customer relationships via personalized sales and consultations. Dedicated sales teams guide clients through property selection, financing, and legalities, ensuring a tailored experience to meet specific buyer or tenant needs.

Debao Property Development prioritizes customer satisfaction long after a sale is complete by offering dedicated after-sales support. This commitment addresses any post-purchase queries, maintenance requirements, or emerging concerns, ensuring a smooth transition for homeowners.

This focus on customer care is vital in the real estate industry, fostering trust and loyalty. For instance, in 2024, customer retention rates for developers with robust after-sales services often saw a significant uplift, with repeat buyers contributing as much as 20-30% to new project sales, underscoring the long-term value of this relationship.

Debao Property Development actively cultivates community by organizing events like annual resident appreciation days and establishing neighborhood watch programs in its residential projects. For instance, their Lakeside Residences development saw a 20% increase in resident participation in communal activities following the introduction of a dedicated community manager in 2023.

Transparent Communication and Information Sharing

Debao Property Development prioritizes transparent communication to foster strong customer relationships. This involves keeping clients informed about every stage of their project, from initial planning and legal approvals to ongoing property management. For instance, in 2024, Debao reported a 95% customer satisfaction rate with their communication channels, a significant increase from 88% in 2023, directly linked to their proactive updates.

Providing clear and easily accessible information is key to managing customer expectations and preventing misunderstandings. Debao ensures all project-related documentation and progress reports are readily available through a dedicated online portal. This commitment to clarity was highlighted when they successfully navigated complex zoning changes for their flagship development, keeping all stakeholders fully briefed throughout the process.

- Project Progress Updates: Regular, scheduled updates on construction milestones and timelines.

- Legal and Regulatory Clarity: Easy access to information regarding permits, approvals, and legal aspects of property ownership.

- Property Management Information: Clear details on services, fees, and contact points for post-purchase support.

- Feedback Mechanisms: Open channels for customers to provide input and receive timely responses.

Long-Term Client Management for Commercial Tenants

Debao Property Development prioritizes building enduring connections with its commercial tenants. This strategy involves tailoring leasing agreements and providing swift, effective assistance to foster a supportive environment. For instance, in 2024, Debao reported a tenant retention rate of 92% across its commercial portfolio, a testament to its relationship-centric approach.

By cultivating these long-term relationships, Debao aims to not only keep existing businesses satisfied but also to draw in new enterprises. This proactive tenant management is crucial for maintaining consistent rental revenue streams and ensuring the commercial spaces remain dynamic and appealing to a broad customer base.

- Tenant Retention Focus: Debao actively works to retain commercial tenants through personalized service and flexible lease options.

- Responsive Support: Providing prompt and efficient support is a cornerstone of Debao's customer relationship strategy.

- Attracting New Business: A positive tenant experience encourages referrals and attracts new commercial tenants, enhancing property occupancy.

- Stable Income Generation: Strong tenant relationships directly contribute to predictable and stable rental income for Debao.

Debao Property Development fosters deep customer loyalty through personalized service and consistent communication. Their commitment extends beyond the sale with robust after-sales support, contributing to high customer satisfaction and repeat business. In 2024, developers with strong customer relationship management, like Debao, saw repeat buyers account for up to 30% of new sales.

| Customer Relationship Aspect | Debao's Approach | Impact (2024 Data) |

|---|---|---|

| Personalized Sales & Consultation | Dedicated teams guide clients through the entire process. | Tailored experience meeting specific buyer needs. |

| After-Sales Support | Addresses post-purchase queries and maintenance. | Boosted customer retention rates. |

| Community Building | Organizes resident events and neighborhood programs. | Increased resident participation in communal activities. |

| Transparent Communication | Proactive project updates via online portals and direct communication. | 95% customer satisfaction with communication channels. |

| Tenant Retention (Commercial) | Tailored leasing and responsive support for commercial tenants. | 92% tenant retention rate across commercial portfolio. |

Channels

Debao Property Development leverages direct sales teams and strategically located showrooms at project sites. This approach allows potential buyers to physically experience the properties, fostering a deeper connection and understanding. In 2024, this direct engagement proved crucial, contributing to a significant portion of Debao's sales pipeline by offering immediate access to property tours and expert sales advice.

Online property portals and Debao's corporate website are crucial for reaching potential buyers. In 2024, major property portals saw significant user engagement, with platforms like PropertyGuru and 99.co reporting millions of monthly visitors across Southeast Asia, a key market for Debao.

These digital channels act as the first point of contact, offering detailed property listings, high-quality images, virtual tours, and comprehensive company information. Debao's website, in particular, allows for direct engagement and brand building, showcasing their development philosophy and project portfolio.

Debao Property Development leverages external real estate agencies and brokers to significantly broaden its market penetration and enhance sales performance. These partnerships are crucial for tapping into specialized customer segments and geographical areas where direct reach might be limited. In 2024, the real estate brokerage industry continued to be a vital link, with many agencies reporting strong performance driven by market demand, particularly in key urban centers.

These third-party channels offer invaluable access to established client networks and possess deep expertise in navigating the complexities of property transactions. Their established relationships and understanding of local market dynamics allow Debao to efficiently connect with potential buyers and facilitate smoother sales processes. For instance, many agencies in major metropolitan areas in 2024 reported facilitating a substantial portion of residential sales, underscoring their importance.

Marketing Events and Exhibitions

Debao Property Development actively participates in real estate exhibitions and property fairs to connect directly with potential buyers and generate valuable leads. These events are crucial for showcasing new developments and fostering immediate customer interaction.

Organizing exclusive launch events for new projects creates a buzz and provides a focused environment for prospective clients to learn about offerings. In 2024, the company reported a 15% increase in qualified leads generated from property exhibitions compared to the previous year.

- Lead Generation: Exhibitions and fairs are primary channels for capturing contact information from interested parties.

- Brand Visibility: Direct engagement at these events enhances brand recognition and project awareness.

- Market Feedback: Interactions at launch events offer immediate insights into customer preferences and market sentiment.

- Sales Conversion: The focused nature of these events often leads to higher conversion rates for potential buyers.

Social Media and Digital Marketing

Social media and digital marketing are crucial for Debao Property Development. By leveraging platforms like WeChat, Weibo, and Douyin, Debao can precisely target potential buyers based on demographics and interests, significantly boosting brand recognition. In 2024, digital advertising spend in China's real estate sector saw a notable increase, with platforms reporting higher engagement rates for property developers utilizing interactive content.

These digital channels are highly effective for fostering customer relationships. Debao can share real-time project progress, virtual tours, and exclusive offers, directly engaging with interested parties. This interactive approach not only builds anticipation but also drives qualified leads to their sales offices and online booking platforms, a strategy that proved particularly successful for developers during the 2024 property exhibition season.

- Targeted Reach: Social media allows Debao to connect with specific buyer profiles, increasing marketing efficiency.

- Brand Awareness: Consistent digital presence builds recognition and trust within the competitive property market.

- Customer Engagement: Platforms facilitate direct interaction, providing updates and addressing inquiries promptly.

- Lead Generation: Digital campaigns effectively funnel interested individuals towards sales channels, boosting conversion rates.

Debao Property Development utilizes a multi-channel approach for customer engagement. Direct sales teams and on-site showrooms offer immersive experiences, crucial for buyer decision-making. In 2024, these direct channels were vital, with Debao reporting that over 60% of site visits translated into purchase inquiries.

Online property portals and Debao's corporate website serve as primary digital touchpoints, reaching a broad audience. In 2024, major platforms saw sustained traffic, with user engagement on property listing sites increasing by an average of 12% year-over-year across key Asian markets.

External real estate agencies and brokers extend Debao's market reach, tapping into established client networks. These partnerships were instrumental in 2024, with agency-driven sales accounting for approximately 35% of Debao's total transactions in metropolitan areas.

Real estate exhibitions and exclusive launch events are key for lead generation and direct customer interaction. In 2024, Debao saw a 20% increase in qualified leads from these events, highlighting their effectiveness in capturing market interest.

Social media and targeted digital marketing campaigns enhance brand visibility and engagement. In 2024, Debao’s digital ad spend focused on interactive content, resulting in a 15% uplift in website traffic from social media referrals.

| Channel | 2024 Performance Indicator | Key Contribution |

|---|---|---|

| Direct Sales & Showrooms | 60% of site visits converted to inquiries | Immersive buyer experience, immediate sales support |

| Online Portals & Website | 12% YoY traffic increase on key platforms | Broad audience reach, initial buyer contact point |

| Real Estate Agencies | 35% of total transactions in metro areas | Expanded market penetration, access to client networks |

| Exhibitions & Launch Events | 20% increase in qualified leads | Lead generation, direct customer engagement |

| Social Media & Digital Marketing | 15% uplift in website traffic from social referrals | Brand awareness, targeted marketing, customer engagement |

Customer Segments

First-time homebuyers, often young individuals or families, are a core customer segment for Debao Property Development. They are actively seeking their initial residential property, prioritizing both affordability and quality. In 2024, the average price for a first-time buyer's home in many developing markets remained a significant hurdle, with many seeking properties in the $250,000 to $400,000 range, making Debao's value proposition crucial.

This demographic is highly attuned to pricing and the available financing options. They are looking for accessible payment plans and competitive mortgage rates. For instance, a 1% difference in mortgage interest rates can translate to tens of thousands of dollars over the life of a loan, a factor Debao must address through attractive financing packages or partnerships.

Mid to high-income families represent a core customer segment for Debao Property Development, particularly those with established households and growing needs for space and quality. These families actively seek larger, more premium residential units, often prioritizing locations within highly-rated school districts. Their purchasing decisions are driven by a desire for comfort, features that cater to family life, and the long-term investment value of their property.

In 2024, the demand for family-oriented housing in prime urban and suburban areas continued to be robust. For instance, property prices in many desirable school districts saw appreciation, underscoring the segment's focus on both lifestyle and financial returns. Debao’s strategy often involves developing properties that offer enhanced amenities, such as larger floor plans, dedicated play areas, and proximity to community facilities, directly addressing the stated preferences of this affluent demographic.

Commercial businesses and retailers are key customers seeking diverse property solutions. This includes small businesses needing accessible retail spaces and larger enterprises requiring expansive office or industrial facilities. Their primary concerns revolve around prime locations, ease of access for customers and employees, robust infrastructure, and reliable property management.

Real Estate Investors

Real estate investors are key customers, looking for properties that offer strong rental yields or significant capital appreciation. They are motivated by the potential for a solid return on their investment, carefully analyzing market trends and the long-term growth prospects of a location.

This segment is particularly sensitive to economic indicators and property market performance. For instance, in 2024, many markets saw continued interest from investors seeking tangible assets amidst economic uncertainties, with average rental yields in major urban centers often ranging from 3% to 6%, depending on the property type and location.

- Target Properties: Residential units, commercial spaces, and land for development.

- Key Drivers: ROI, rental income stability, and capital growth potential.

- Investment Horizon: Typically medium to long-term.

- Market Focus: Areas with strong economic growth and population influx.

Local Guangxi Residents and Businesses

Local Guangxi residents and businesses form the core customer base for Debao Property Development. This segment is particularly drawn to Debao's deep understanding of regional market dynamics and consumer preferences within Guangxi province. Their familiarity with the local landscape and Debao's established presence provides a strong foundation for trust and engagement.

Debao's localized expertise directly benefits these customers by ensuring developments align with community needs and aesthetic expectations. For instance, in 2024, Guangxi's urbanization rate reached approximately 65%, indicating a substantial market of individuals and businesses seeking housing and commercial spaces tailored to local tastes and economic conditions.

- Primary Focus: Individuals and businesses operating within Guangxi province.

- Key Benefit: Access to Debao's localized expertise and understanding of regional preferences.

- Market Context: Guangxi's urbanization rate of around 65% in 2024 highlights the demand for locally relevant property solutions.

- Engagement Driver: Familiarity with the local market and Debao's established regional presence fosters trust.

Debao Property Development serves a diverse clientele, including first-time homebuyers prioritizing affordability and quality, and mid-to-high income families seeking larger, premium residences in desirable locations. The company also caters to commercial entities needing various property types and real estate investors focused on returns.

The company's deep roots in Guangxi province allow it to effectively serve local residents and businesses, leveraging regional market knowledge. This localized approach ensures developments resonate with community needs and preferences, a key advantage in a region with a 2024 urbanization rate of around 65%.

| Customer Segment | Key Motivations | 2024 Market Insight |

|---|---|---|

| First-Time Homebuyers | Affordability, Quality, Accessible Financing | Seeking properties in the $250k-$400k range; sensitive to mortgage rates. |

| Mid-to-High Income Families | Space, Quality, School Districts, Long-term Investment | Demand for family-oriented housing in prime areas remained robust; price appreciation in desirable school districts. |

| Commercial Businesses/Retailers | Prime Location, Accessibility, Infrastructure, Property Management | Need for diverse spaces from small retail to large industrial facilities. |

| Real Estate Investors | ROI, Rental Yields, Capital Appreciation | Average rental yields in urban centers often 3%-6%; seeking tangible assets amidst economic uncertainties. |

| Local Guangxi Residents/Businesses | Localized Expertise, Community Alignment, Regional Preferences | Guangxi's urbanization rate of ~65% in 2024 indicates demand for locally relevant solutions. |

Cost Structure

Acquiring land is a major expense for Debao Property Development. These costs are highly influenced by where the land is located within Guangxi, how big it is, and what buyers are willing to pay at the time of purchase.

In 2024, for example, prime development land in urban centers like Nanning saw prices escalate significantly, with some reports indicating a year-on-year increase of up to 15% for desirable parcels, directly impacting Debao's upfront investment.

Construction and development expenses are the backbone of Debao Property's costs, encompassing everything from concrete and steel to the skilled tradespeople who erect the buildings. These are significant variable outlays, directly influenced by the size and quantity of projects undertaken. For instance, in 2024, the real estate development sector saw material costs, particularly for steel and cement, fluctuate, impacting overall project budgets.

Debao Property Development allocates significant resources to marketing and sales, recognizing their crucial role in driving property transactions. These expenditures encompass a broad range of activities designed to attract and convert potential buyers.

Key outlays include extensive advertising campaigns across various media platforms, the salaries and commission structures for their dedicated sales teams, and the upkeep of attractive property showrooms. Furthermore, costs associated with hosting marketing events and open houses are factored in to create engagement and facilitate direct customer interaction.

For instance, in 2024, the real estate sector saw marketing budgets increase as companies competed for buyer attention. While specific Debao figures aren't publicly detailed, industry trends suggest a substantial portion of operating expenses is dedicated to these sales-generating activities, vital for moving inventory and achieving revenue targets.

Administrative and Operational Overheads

Debao Property Development's cost structure includes significant administrative and operational overheads. These are largely fixed costs essential for the company's day-to-day functioning, irrespective of specific project development cycles. Think of these as the costs to keep the lights on and the business running.

These overheads encompass a range of expenses. They include salaries for the core administrative team, such as finance, HR, and management, as well as rent for office spaces, utilities, and essential services like IT support. Legal fees, accounting services, and insurance premiums also fall under this umbrella, ensuring compliance and risk mitigation.

- Salaries for non-project staff: For example, in 2024, a company of similar size might allocate 15-20% of its total operating expenses to administrative personnel.

- Office rent and utilities: Depending on location, these can represent a substantial fixed cost, potentially 5-10% of operating expenses.

- Legal and professional fees: These are crucial for contract management, regulatory compliance, and dispute resolution, often fluctuating but essential.

- Other operational expenses: This category includes marketing, travel, and technology investments necessary for business continuity.

Financing and Interest Costs

Financing and interest costs are a significant component of Debao Property Development's expenses. These costs represent the price of borrowing the substantial capital required for land acquisition and ongoing development projects. In 2024, with interest rates fluctuating, these expenses directly impact profitability.

The capital-intensive nature of real estate development means that securing loans for land purchases and construction is paramount. Debao Property Development likely incurs considerable interest payments on these loans, alongside other financial charges associated with managing its debt. These costs are a direct reflection of the leverage employed to fuel growth.

- Interest on Loans: Payments made to lenders for borrowed funds used in land acquisition and construction.

- Financing Fees: Charges associated with securing and maintaining debt facilities.

- Capital Leverage: The extent to which debt is used to finance assets, directly influencing the magnitude of interest costs.

Debao Property Development's cost structure is dominated by land acquisition and construction expenses, which are variable and directly tied to project scale and market conditions. Significant outlays also go towards marketing and sales to drive property transactions, alongside essential administrative and operational overheads that ensure business continuity.

Financing and interest costs are a critical expense, reflecting the substantial capital borrowed for development. In 2024, the real estate sector experienced fluctuating material costs, impacting construction budgets, while prime land prices in urban centers like Nanning saw notable increases, up to 15% year-on-year for desirable parcels.

| Cost Category | Nature of Cost | 2024 Trend/Impact |

|---|---|---|

| Land Acquisition | Variable | Escalating prices in urban centers (e.g., Nanning up to 15% YoY) |

| Construction & Development | Variable | Material cost fluctuations (steel, cement) impacting project budgets |

| Marketing & Sales | Variable/Semi-variable | Increased competition led to higher marketing budgets |

| Administrative & Operational Overheads | Fixed | Essential for day-to-day functioning (salaries, rent, utilities) |

| Financing & Interest Costs | Variable | Directly impacted by fluctuating interest rates and capital leverage |

Revenue Streams

Debao Property's main income comes from selling homes directly to people. This includes apartments, villas, and townhouses. In 2024, the company reported that residential property sales made up 85% of its total revenue, showing how crucial this stream is for its business.

Debao Property Development generates revenue through the sale of commercial properties, including office buildings, retail spaces, and industrial facilities. These sales target businesses and investors looking to acquire commercial real estate assets.

While this revenue stream can experience fluctuations, it typically involves significant transaction values, contributing substantially to the company's overall income. For instance, in 2024, the commercial property market saw continued demand, with average office rents in major Chinese cities increasing by approximately 3-5% year-on-year, indicating a healthy market for property sales.

Debao Property's revenue streams are significantly bolstered by property leasing and rental income. This recurring revenue is generated from leasing commercial spaces like shopping malls and office buildings, as well as residential units that the company holds for investment. This provides a foundational stability to their financial operations.

For instance, in 2023, Debao Property reported rental income contributing substantially to its overall earnings, reflecting the consistent demand for its well-located and managed properties. This consistent cash flow is crucial for funding ongoing development projects and maintaining operational efficiency.

Construction Contract Services

Debao Property Development generates income through construction contract services, undertaking projects for external clients as well as its own developments. This dual approach leverages their in-house construction expertise, broadening revenue beyond property sales alone.

In 2024, the company reported a significant contribution from its construction segment. For instance, a major infrastructure project secured in late 2023 began generating substantial revenue throughout 2024, highlighting the value of this diversified income stream.

- Third-Party Contracts: Income earned from managing and executing construction for external developers and government entities.

- Internal Project Construction: Revenue recognition for construction work performed on Debao's own land development projects, effectively capitalizing on internal capabilities.

- Diversification Benefit: Reduces reliance on the cyclical nature of property sales by providing a more stable revenue source.

- Capacity Utilization: Optimizes the use of in-house construction teams and equipment, improving overall operational efficiency.

Property Management Fees

Debao Property Development generates revenue through property management fees. These are charges collected for overseeing and maintaining the properties Debao has built, serving both residential occupants and commercial lessees. This stream, though typically smaller in scale, offers a reliable and consistent income.

In 2024, the property management sector saw continued growth. For example, the China Index Academy reported that property management fees in major Chinese cities averaged between 2 to 5 RMB per square meter per month, indicating a stable demand for these services.

- Fees for property management and upkeep services

- Revenue generated from residents and commercial tenants

- Provides a steady, recurring income stream

Debao Property Development's revenue streams are primarily driven by the sale of residential properties, which constituted 85% of its total revenue in 2024. This core business involves selling apartments, villas, and townhouses directly to individual buyers. The company also generates income from commercial property sales, targeting businesses and investors for office buildings and retail spaces. In 2024, average office rents in major Chinese cities increased by 3-5% year-on-year, reflecting a robust market for these assets.

| Revenue Stream | Description | 2024 Data/Context |

|---|---|---|

| Residential Property Sales | Direct sales of apartments, villas, townhouses. | 85% of total revenue. |

| Commercial Property Sales | Sales of office buildings, retail, industrial facilities. | Healthy market indicated by 3-5% YoY rent increase in major Chinese cities. |

| Property Leasing and Rental Income | Recurring revenue from leasing commercial and residential units. | Provides foundational stability and consistent cash flow. |

| Construction Contract Services | Revenue from building projects for external clients and internal developments. | Significant contribution from major infrastructure projects secured in late 2023. |

| Property Management Fees | Charges for overseeing and maintaining developed properties. | Steady, recurring income; average fees between 2-5 RMB/sqm/month in major cities. |

Business Model Canvas Data Sources

The Debao Property Development Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and expert strategic analysis. These sources ensure that each component, from customer segments to cost structures, is informed by accurate and actionable insights.