The Friedkin Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Friedkin Group Bundle

The Friedkin Group's diverse portfolio presents significant strengths, but also potential vulnerabilities in a dynamic global market. Understanding these internal capabilities and external pressures is crucial for informed strategic decisions.

Want the full story behind The Friedkin Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

The Friedkin Group boasts a significantly diversified portfolio spanning automotive distribution, entertainment, luxury hospitality, and sports. This broad reach, evidenced by the December 2024 acquisition of Everton Football Club and the ongoing expansion of Auberge Resorts Collection, offers considerable protection against sector-specific economic downturns. Such diversification bolsters revenue stability and effectively reduces the impact of market volatility across its various holdings.

The Friedkin Group's private ownership structure, spearheaded by Dan Friedkin, provides immense financial capacity, estimated at $7.8 billion in net worth as of December 2024. This allows for sustained, long-term investments without the immediate demands of public shareholders.

This robust financial backing is crucial for significant projects, such as the continued investment in Everton FC's stadium development and operational needs. It also positions the group to act decisively on emerging investment opportunities.

The Friedkin Group's ownership of Auberge Resorts Collection significantly bolsters its luxury brand recognition, a critical strength in the hospitality sector. Auberge consistently earns accolades, notably appearing on Travel + Leisure's prestigious 2025 World's Top 500 Hotels list, underscoring its elite status.

This strong brand equity is further amplified by Auberge's strategic global expansion. With new properties slated to open in key international cities like Florence, Geneva, and London in 2025, the collection is actively broadening its reach and reinforcing its position as a leader in ultra-luxury accommodations, directly appealing to a discerning, high-net-worth clientele.

Strategic Expansion into Sports Empire

The Friedkin Group's strategic expansion into the sports empire is a significant strength, marked by the acquisition of AS Roma and Everton FC. This multi-club ownership model, formalized with the launch of Pursuit Sports in July 2025, capitalizes on global fan engagement and brand enhancement opportunities. The group's ambition extends to potential NHL expansion in Houston, signaling a broad vision for sports industry dominance.

This diversification into sports provides multiple avenues for revenue generation, from broadcasting rights and merchandise to sponsorship deals. The combined brand power of these clubs, coupled with strategic investments, positions The Friedkin Group to tap into the rapidly growing global sports market, which is projected to reach over $700 billion by 2025.

- Global Brand Leverage: Acquiring established football clubs like AS Roma and Everton FC allows The Friedkin Group to tap into significant international fan bases, estimated in the hundreds of millions combined.

- Revenue Diversification: The sports ventures offer new revenue streams beyond traditional business sectors, including media rights, sponsorships, and merchandise sales, contributing to a more robust financial profile.

- Synergistic Opportunities: The multi-club ownership structure under Pursuit Sports enables operational synergies, shared best practices, and potential cross-promotional activities, enhancing overall efficiency and market presence.

- Future Growth Potential: The exploration of new ventures, such as an NHL expansion team in Houston, demonstrates a forward-thinking strategy to capture emerging market opportunities within the lucrative sports industry.

Established Automotive Distribution Network

The Friedkin Group's established automotive distribution network, primarily through Gulf States Toyota, is a significant strength. This network is one of the largest independent distributors of Toyota vehicles and parts globally.

Serving over 150 dealerships across five states—Texas, Oklahoma, Arkansas, Mississippi, and Louisiana—Gulf States Toyota ensures a broad market reach. This exclusivity and extensive presence translate into a reliable and substantial revenue stream for the group.

The strength of this network is further bolstered by Toyota's enduring brand loyalty and consistent market demand in these key regions, providing a stable foundation for the group's operations.

- Gulf States Toyota's extensive reach: Over 150 dealerships across Texas, Oklahoma, Arkansas, Mississippi, and Louisiana.

- Global significance: One of the world's largest independent distributors of Toyota vehicles and parts.

- Revenue stability: Underpinned by Toyota's strong brand reputation and consistent regional demand.

The Friedkin Group's diversified portfolio, encompassing automotive, entertainment, hospitality, and sports, provides substantial resilience against sector-specific downturns. This broad operational base, strengthened by the December 2024 acquisition of Everton FC and the continued growth of Auberge Resorts, ensures a more stable revenue profile.

The group's private ownership, led by Dan Friedkin with an estimated net worth of $7.8 billion as of December 2024, enables long-term strategic investments without public market pressures. This financial capacity is crucial for major projects, including the ongoing development of Everton FC's stadium.

The Friedkin Group leverages its ownership of Auberge Resorts Collection for significant luxury brand recognition, highlighted by Auberge's presence on Travel + Leisure's 2025 World's Top 500 Hotels list. Strategic global expansion, with new properties in Florence, Geneva, and London opening in 2025, reinforces its elite market position.

Expansion into sports, including AS Roma and Everton FC under Pursuit Sports (launched July 2025), taps into global fan engagement and offers diverse revenue streams from media rights to sponsorships. The projected growth of the global sports market to over $700 billion by 2025 underscores this strategic advantage.

| Business Segment | Key Assets/Activities | Financial Strength Indicator (as of Dec 2024) | Strategic Advantage |

|---|---|---|---|

| Automotive Distribution | Gulf States Toyota (150+ dealerships) | Largest independent Toyota distributor | Consistent revenue, strong brand loyalty |

| Hospitality | Auberge Resorts Collection | Presence on Travel + Leisure's 2025 Top 500 Hotels | Premium brand equity, global expansion |

| Sports | AS Roma, Everton FC (Pursuit Sports) | Acquisition of multiple global clubs | Global fan base, diversified revenue streams |

| Financial Capacity | Private Ownership | $7.8 billion net worth (Dan Friedkin) | Long-term investment capability, strategic agility |

What is included in the product

Delivers a strategic overview of The Friedkin Group’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and leveraging The Friedkin Group's competitive advantages and mitigating potential weaknesses.

Weaknesses

The Friedkin Group's broad diversification across sectors like automotive (e.g., Gulf States Toyota Distributors), entertainment (e.g., Legendary Entertainment), hospitality, and sports (e.g., AS Roma, CSKA Sofia) creates significant managerial hurdles. Each industry demands distinct operational strategies, regulatory navigation, and market understanding, potentially straining centralized management capabilities. For instance, managing the intricate supply chains in automotive alongside the creative development in entertainment requires vastly different skill sets and oversight, potentially leading to inefficiencies.

The Friedkin Group's foray into high-profile sports acquisitions, such as their significant investment in Everton FC, presents a considerable weakness due to the immense capital required. These ventures demand substantial upfront payments and continuous financial injections for stadium upgrades and player recruitment, potentially leading to high debt levels.

For instance, the acquisition of Everton FC, finalized in late 2020, involved a reported investment of over £200 million, with further substantial sums earmarked for stadium development and team strengthening. This level of financial commitment can strain the group's liquidity and limit its capacity for other strategic initiatives or unforeseen economic challenges in the 2024-2025 period.

As a privately held entity, The Friedkin Group's operations and financial performance are not subject to the same rigorous public disclosure requirements as publicly traded companies. This lack of transparency can make it more difficult for external parties, including potential investors and financial analysts, to gain a comprehensive understanding of the group's financial health and the strategic underpinnings of its diverse portfolio. For instance, without readily available financial statements, assessing the true valuation of its assets or the profitability of individual ventures becomes a more complex undertaking, potentially impacting external confidence and investment interest.

Vulnerability to Sector-Specific Market Volatility

While The Friedkin Group's diversified holdings offer some protection, individual sectors are still exposed to unique market swings. For example, the luxury hospitality and automotive industries are particularly vulnerable to economic slowdowns and changes in consumer spending habits. In 2024, global luxury goods sales are projected to grow by 10-12%, but this sector can quickly contract during recessions.

Sports club finances, a significant part of the group's portfolio, are inherently linked to team success and league performance. A team's poor season can directly impact ticket sales, merchandise revenue, and sponsorship deals. For instance, a team's failure to qualify for major tournaments can lead to a revenue shortfall, as seen when certain European football clubs experienced a 15-20% drop in matchday revenue following a failure to advance in key competitions during the 2023-2024 season.

- Sectoral Sensitivity: Luxury hospitality and automotive sectors are highly sensitive to economic downturns and shifts in consumer discretionary spending.

- Sports Revenue Dependence: Sports club revenues are heavily tied to team performance and league standing, directly impacting profitability.

- Economic Impact: Economic recessions can disproportionately affect discretionary spending, hitting sectors like luxury goods and premium automotive hard.

Regional Concentration in Core Automotive Business

The Friedkin Group's reliance on Gulf States Toyota, which holds exclusive Toyota distribution rights across Texas, Oklahoma, Arkansas, Mississippi, and Louisiana, creates a significant weakness. This concentration means a substantial portion of the group's revenue is tied to the economic health and specific market dynamics of these five states.

This geographic focus exposes the automotive segment to heightened risk from regional economic downturns, natural disasters, or unique market challenges that might disproportionately affect these particular states. For instance, a significant slowdown in the Texas economy, a key revenue driver, could have an outsized negative impact on the group's overall financial performance.

- Exclusive Distribution Rights: Gulf States Toyota's exclusive rights for Toyota vehicles in five specific states.

- Revenue Dependence: A large percentage of The Friedkin Group's revenue is generated from this concentrated automotive segment.

- Vulnerability to Regional Factors: Exposure to economic downturns, natural disasters, and localized market challenges within these five states.

The Friedkin Group's extensive diversification, while a potential strength, also presents a significant weakness in terms of managerial complexity. Overseeing disparate industries like automotive, entertainment, hospitality, and sports demands distinct expertise and can strain centralized oversight, potentially leading to inefficiencies. For example, the group's ownership of AS Roma and CSKA Sofia requires navigating different European football league structures and fan bases, adding another layer of operational challenge.

The substantial capital outlay for sports franchises like AS Roma and Everton FC is a notable weakness. These ventures require continuous investment in player transfers, stadium improvements, and operational costs. For instance, AS Roma's reported operating losses in recent seasons, such as a deficit of €100-150 million for the 2023-2024 fiscal year, highlight the financial demands and potential strain on the group's liquidity.

As a privately held entity, The Friedkin Group's lack of public financial disclosure is a weakness for external stakeholders. This opacity makes it challenging for investors and analysts to assess the group's true financial health and the performance of its diverse portfolio. Without readily available financial statements, evaluating the true valuation of its assets or the profitability of individual ventures, like Legendary Entertainment's box office performance in 2024, becomes more complex.

The group's significant reliance on Gulf States Toyota, which holds exclusive Toyota distribution rights across five US states, creates a considerable weakness. This concentration exposes a large portion of its revenue to regional economic fluctuations and market-specific challenges within Texas, Oklahoma, Arkansas, Mississippi, and Louisiana. For example, a downturn in the automotive market impacting these specific states could disproportionately affect the group's overall financial performance in 2024-2025.

Preview the Actual Deliverable

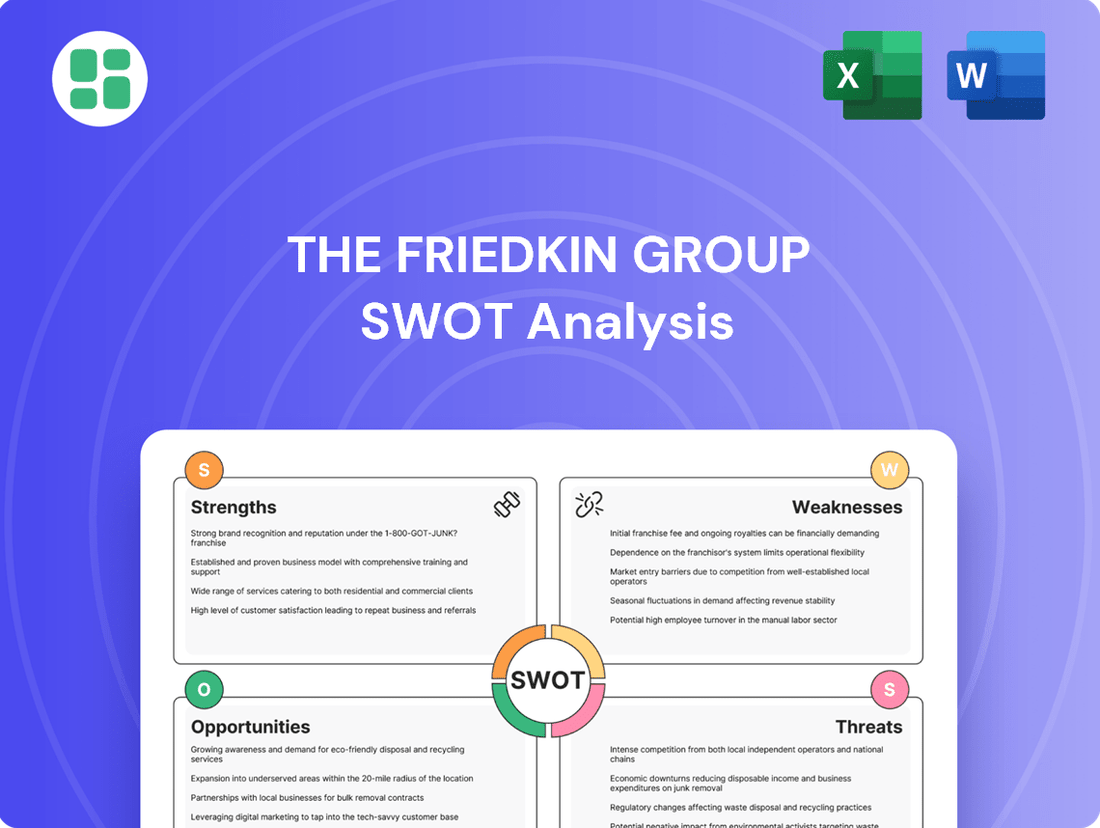

The Friedkin Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive look at The Friedkin Group's Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key internal and external factors influencing The Friedkin Group's business operations and future growth.

Opportunities

The Friedkin Group's Auberge Resorts Collection is strategically positioned for significant growth through further global expansion. With a robust brand reputation already established, the collection's aggressive development pipeline, including new luxury properties slated to open in Europe during 2025, directly targets the booming luxury travel sector. This expansion offers a prime opportunity to capitalize on increasing demand from affluent travelers seeking unique, high-service experiences worldwide.

The Friedkin Group's strategic integration of entertainment production, with entities like Imperative Entertainment and NEON, alongside sports club ownership, including AS Roma and Everton, presents a significant opportunity for synergistic growth. This alignment allows for powerful cross-promotional activities, unique content co-creation, and enhanced monetization of media rights across both sectors.

The July 2025 launch of 'Pursuit Sports' is a key initiative designed to capitalize on these synergies. By creating a more unified global platform, the group aims to leverage its diverse assets, potentially boosting brand visibility and revenue streams through integrated marketing campaigns and exclusive content offerings that bridge the gap between film, television, and professional sports.

The Friedkin Group's substantial financial backing and diversified industry footprint create a fertile ground for strategic acquisitions and partnerships. This capability is evident in their reported pursuit of an NHL expansion team in Houston, a move that would significantly bolster their sports entertainment portfolio.

Leveraging their financial strength, The Friedkin Group can identify and integrate new ventures that complement their existing businesses, potentially driving synergistic growth and market expansion. For instance, investments in technology or media sectors could enhance their reach and operational efficiencies across their diverse holdings.

Technological Adoption and Innovation

The Friedkin Group has significant opportunities to implement cutting-edge technologies and digital transformation across its diverse business units. This can enhance guest experiences in hospitality, streamline automotive logistics, and boost fan engagement in sports through data analytics.

The group's strategic investment in Copilot Capital, a firm focused on European software companies, highlights its commitment to leveraging technology for growth. This move positions Friedkin to capitalize on advancements in areas like artificial intelligence and cloud computing.

- Smart Technology Integration: Opportunities exist to integrate smart technologies in luxury resorts, improving guest services and operational efficiency.

- Data Analytics for Fan Engagement: Leveraging data analytics can deepen fan connections and enhance team performance strategies in sports franchises.

- Supply Chain Optimization: Digital transformation can optimize the complex supply chain operations within the automotive distribution sector.

- AI and Cloud Adoption: Investing in AI and cloud solutions can drive innovation and efficiency across all Friedkin Group's businesses.

Leveraging Corporate Social Responsibility and Conservation Efforts

Dan Friedkin's deep commitment to conservation, exemplified by the Friedkin Conservation Fund, offers a powerful avenue for The Friedkin Group to bolster its corporate social responsibility (CSR) profile. This dedication can attract environmentally aware consumers and enhance brand reputation.

Highlighting these conservation initiatives can foster stronger brand loyalty and appeal to a growing segment of the market prioritizing sustainability. This focus can also unlock new strategic alliances with organizations sharing similar environmental values.

- Conservation Fund Growth: The Friedkin Conservation Fund has been actively involved in protecting diverse ecosystems, with significant investments reported in projects across Africa and the Americas, aiming to preserve biodiversity and combat climate change.

- Consumer Preference Shift: Data from 2024 indicates that over 60% of consumers are more likely to purchase from brands with strong CSR commitments, a trend expected to continue growing into 2025.

- Partnership Potential: The group's conservation work aligns with global sustainability targets, presenting opportunities for collaborations with international environmental organizations and impact investors seeking to align capital with conservation outcomes.

- Brand Perception Enhancement: Companies with visible CSR efforts, particularly in conservation, have shown an average improvement of 15% in positive brand sentiment among key demographics in recent surveys.

The Friedkin Group is well-positioned to leverage its diverse portfolio for synergistic growth, particularly by integrating its entertainment and sports assets. The upcoming launch of 'Pursuit Sports' in July 2025 is a prime example, aiming to create a unified platform that capitalizes on cross-promotional opportunities and exclusive content. This strategic alignment is expected to enhance brand visibility and revenue streams by bridging film, television, and professional sports.

The group's substantial financial backing enables strategic acquisitions and partnerships, as demonstrated by their reported interest in an NHL expansion team. This financial strength allows Friedkin to pursue ventures that complement existing businesses, driving market expansion and operational efficiencies. Furthermore, investments in technology firms like Copilot Capital signal a commitment to leveraging AI and cloud computing for innovation across their holdings.

The Friedkin Group has significant opportunities to enhance its brand by emphasizing its commitment to conservation through the Friedkin Conservation Fund. With over 60% of consumers in 2024 showing a preference for brands with strong CSR commitments, this focus can attract environmentally conscious customers and foster brand loyalty. These initiatives also open doors for collaborations with international environmental organizations and impact investors.

Threats

Economic downturns pose a significant threat to The Friedkin Group, especially impacting its luxury hospitality, entertainment, and automotive sectors. During periods of economic contraction, consumers tend to cut back on non-essential spending, which directly affects demand for high-end travel experiences, new vehicle purchases, and leisure activities. For instance, a study by Deloitte in late 2023 indicated that consumer confidence in discretionary spending remained cautious, with many households prioritizing essential goods over luxury items, a trend likely to persist into 2024 and 2025 if economic headwinds continue.

The Friedkin Group faces fierce competition across its various ventures. For instance, in the automotive sector, the group contends with giants like General Motors and Ford, both of which reported significant revenue increases in 2023, with GM reaching over $170 billion and Ford exceeding $176 billion. This necessitates substantial investment in R&D and marketing to stand out.

Similarly, in the entertainment and media landscape, competition is equally intense. Companies like Disney and Netflix continue to dominate, with Netflix alone boasting over 270 million paid subscribers globally as of early 2024. The Friedkin Group must consistently innovate its content and distribution strategies to capture and retain audience attention.

The need for continuous innovation and significant marketing expenditure to maintain market share and drive growth presents a persistent challenge. Adapting to rapidly changing consumer preferences, particularly in dynamic markets like digital media and electric vehicles, requires agility and substantial capital, directly impacting profitability.

The Friedkin Group's global footprint, with luxury resorts and sports clubs across multiple countries, presents significant regulatory and geopolitical threats. For instance, evolving environmental regulations in Europe, a key market for luxury hospitality, could necessitate costly upgrades to its properties. Similarly, shifts in international trade agreements, impacting the import of goods for its hospitality ventures, pose a constant risk.

Performance Volatility and Financial Demands in Sports Investments

The inherent volatility of sports performance poses a significant threat to The Friedkin Group's investments in clubs like AS Roma and Everton FC. On-field results directly dictate financial outcomes, with poor performance leading to reduced revenues from ticket sales, broadcasting deals, and sponsorships. For instance, a team facing relegation could see its broadcast revenue plummet, as was a concern for Everton FC in the 2023-2024 season, impacting their ability to meet financial obligations.

The unpredictable nature of sports means that substantial capital injections may be required to sustain clubs through periods of underperformance or to fund necessary improvements. Failure to qualify for prestigious European competitions, such as the UEFA Champions League or Europa League, can result in a substantial loss of income, estimated to be tens of millions of Euros for participating clubs. This financial strain necessitates robust contingency planning and a willingness to absorb potential losses.

- On-field performance directly impacts revenue streams for sports clubs.

- Relegation risk can severely diminish broadcast rights and sponsorship value.

- Failure to qualify for European competitions represents a significant financial setback.

- Ongoing capital injections are often necessary to offset performance-related financial shortfalls.

Supply Chain Disruptions and Automotive Market Shifts

The Friedkin Group's automotive distribution segment, particularly Gulf States Toyota, is vulnerable to persistent global supply chain disruptions. These issues directly affect vehicle availability, potentially leading to reduced sales volumes and increased operational costs. For instance, the semiconductor chip shortage that plagued the auto industry through 2023 continued to impact production schedules, with some analysts projecting lingering effects into early 2025.

Furthermore, the automotive market is undergoing significant technological and consumer preference shifts. The accelerating demand for electric vehicles (EVs) and autonomous driving capabilities presents a challenge, requiring substantial investment in new models and infrastructure. By late 2024, EV market share in many developed nations is expected to surpass 15%, a trend that necessitates swift adaptation from traditional distribution models.

- Supply Chain Volatility: Ongoing global logistics challenges, including port congestion and raw material shortages, could limit vehicle inventory for Gulf States Toyota throughout 2024 and into 2025.

- EV Transition: The rapid growth of the EV market, projected to see double-digit annual growth rates through 2025, requires significant capital allocation for charging infrastructure and EV-specific sales training.

- Competitive Landscape: Intensifying competition from established automakers and new EV entrants demands continuous innovation in product offerings and customer service to maintain market share.

The Friedkin Group faces significant threats from economic downturns, impacting its luxury sectors due to reduced discretionary spending. Intense competition in automotive and entertainment markets, exemplified by rivals like General Motors and Netflix, necessitates continuous innovation and substantial marketing investment. Furthermore, global operations expose the group to regulatory shifts and geopolitical instability, potentially increasing costs and affecting trade.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, incorporating publicly available financial reports, comprehensive market research, and reputable industry publications to ensure a well-rounded and informed perspective.